Following up on last weeks overview:

This week we saw a number of increasing divergences, within US markets, the equal weight / market cap weighted indices and globally the V2X-VIX spread continue to widen on EU political theatre.

European VIX Future / VX Future front month jumped to highest levels in a decade.

Within US markets, tech rally once again beating everything else ytd…

… as implied correlations drop to all time lows:

Realized Volatility Overview

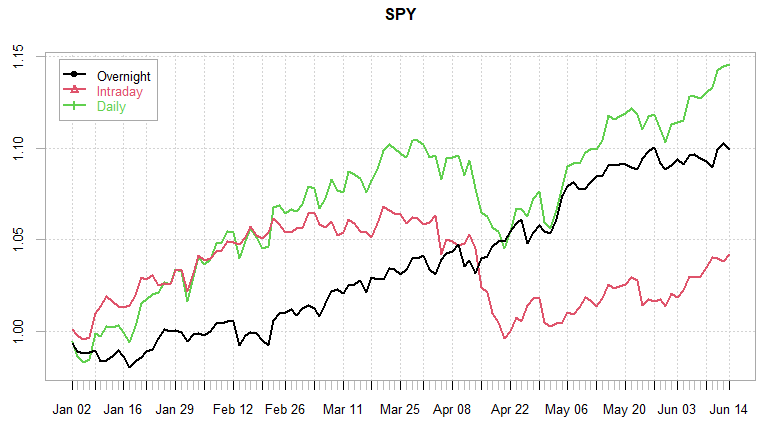

SPY closed Friday at a new ATH as intraday gains picked up on falling inflation and what looks like dovish Powell…

Some divergences within realized vol estimators as cl-cl volatility remains subdued but with decent intraday ranges (dips get bot, rips got sold.) Outside of jumps on data, markets made absolutely no progress and closed flat going into FOMC and the following Thursday/Friday.

The pick-up in intraday mean reversion firing off long straddle signals for the time being (all long straddle bets went horribly wrong this week though.) As outlined in previous post on the Variance Ratio:

The pickup in mean reversion generally followed by a trending break in either direction, lets see if this OpEx week delivers (historically quite a bearish week…)

Free posts on monthly OpEx effect:

When VIXpiration is prior to monthly OpEx:

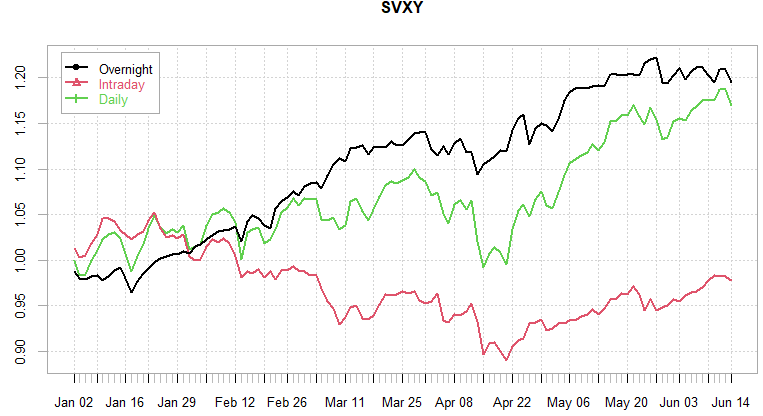

For VIX Futures, despite collapsing rvol, European jitters led to a spike in implieds towards eow, not enough to put a meaningful dent in ytd performance, however as we will point out lower in the post, VX carry remains a tricky trade this year…

SPX ATM Straddle Performance

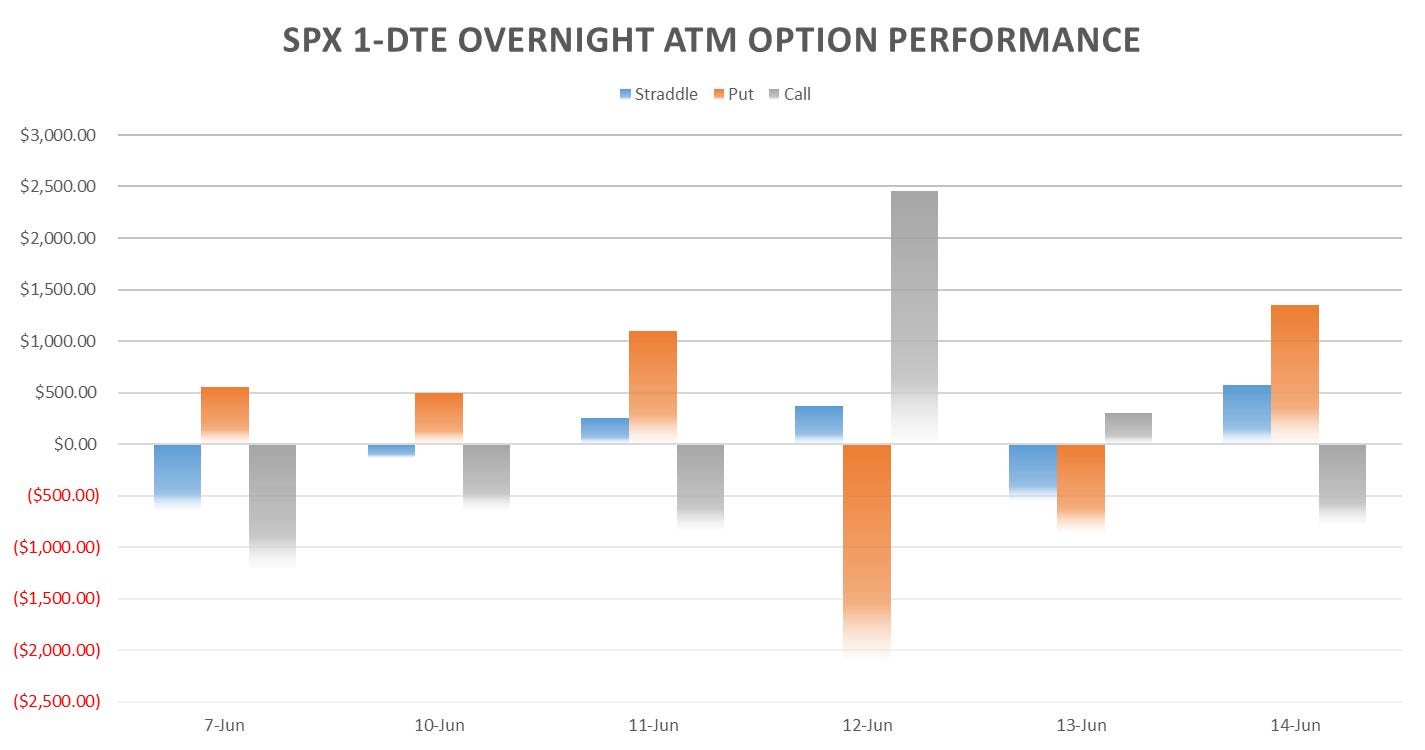

1-Day Straddles down 60pts this week (90pts counting last Friday), largest weekly loss in a while… Rich event premiums all week led to almost every single leg losing!

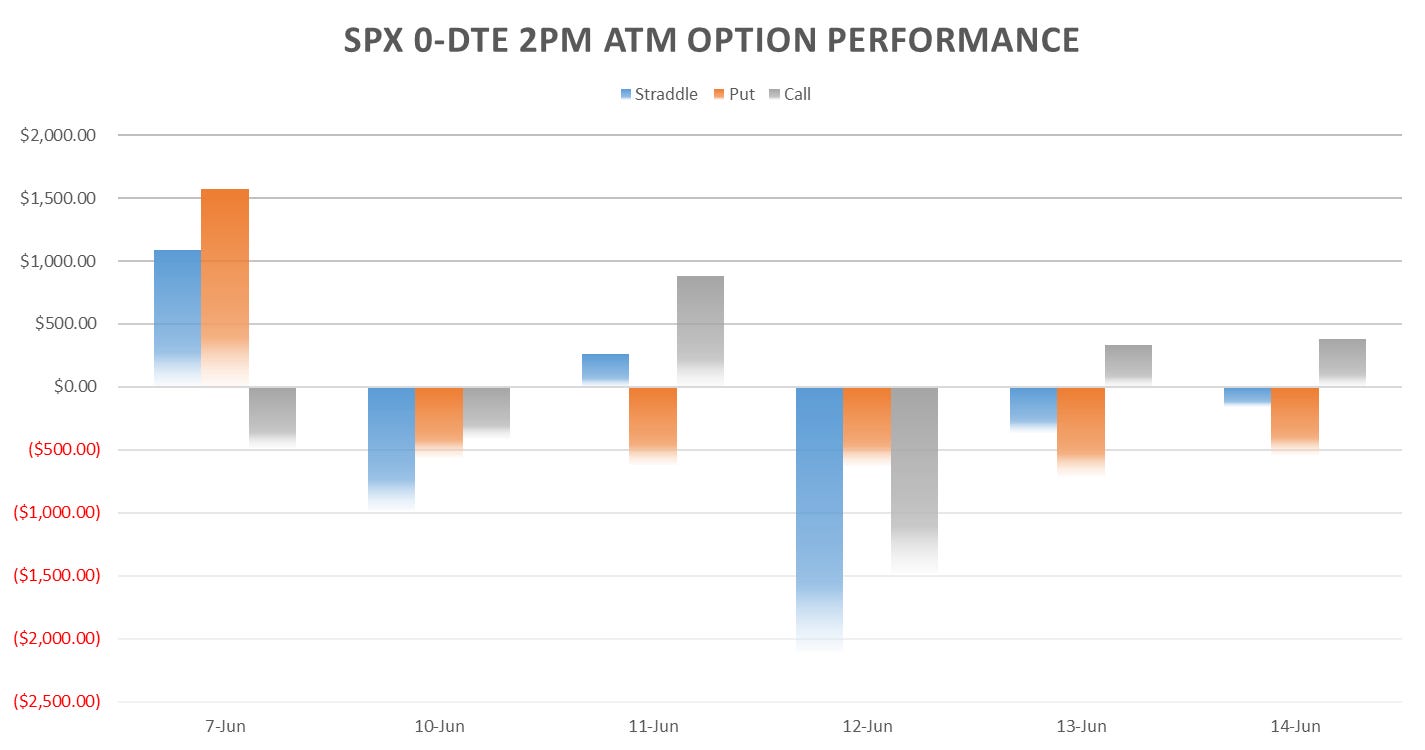

RTH straddles not doing that much better, down 46pts on the week but Monday/Tuesday small wins…

For once overnight straddles net up 5pts on the week (put leg winning overnight on data announcements) however, markets bounced right back up all week…

Intraday straddles also down across the board… only meaningful movement was around data announcement and FOMC… markets completely flat outside of any events / data releases.

FOMC event premium ended up being way too rich this time around.

Variance Ratio Conditional Performance

From the following post:

First big down week this year for the long/short straddle system. Kept firing long straddle bets for intraday as well as some 1-day bets but indices just mean reverted entire overnight drops… STILL showing likelihood of breakout going into Monday and given its OpEx week (not the most bullish seasonality) perhaps a shot at recouping some of the loses.

VX Carry & SPX Overlay

From the following post:

VX carry still struggling… A couple of missed days leading to large divergence, still need an ‘event’ to outperform.. one way train for now…

Lets see how rest of year goes, have not had a decent ‘event’ for vol in a while…

Have a good week!