Follow up to the previous post on using the variance ratio to trade long/short 1(0)-DTE straddles on SPX:

In the previous post we use the Yang Zhang - Close to Close variance ratio to trade long/short ATM straddles on SPX. After some discussions, it became apparent that the main driver behind the profitability of the VarRatio for long straddles was mainly the ‘fast’ over ‘slow’ ratio crossover. Essentially a crossover system for different vol averages. Now it does seem to produce fairly decent performance, however, not exactly what we were looking for…

The goal was to compare intraday vol estimates to daily vol estimates to isolate when you would want to buy(short) the daily straddle and hedge by shorting(buying) the intraday straddle.

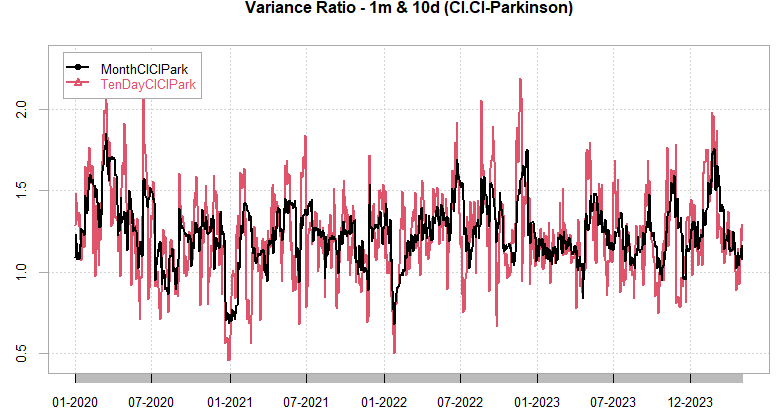

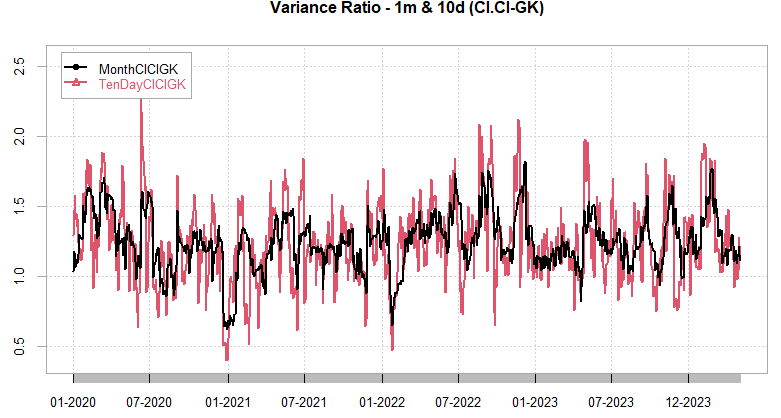

The logical way to compare intraday vol to daily vol would be to use vol estimators that purely look at various intraday vol dynamics (Parkinson, GK):

Parkinson and GK roughly similar when comparing to close-close but lets see if there is any significant improvement when we fit the ratio to long/short straddles.

Breaking down 1 DTE Straddles into long/short trades:

Keep reading with a 7-day free trial

Subscribe to Vol Vibes to keep reading this post and get 7 days of free access to the full post archives.