Following up on last weeks overview:

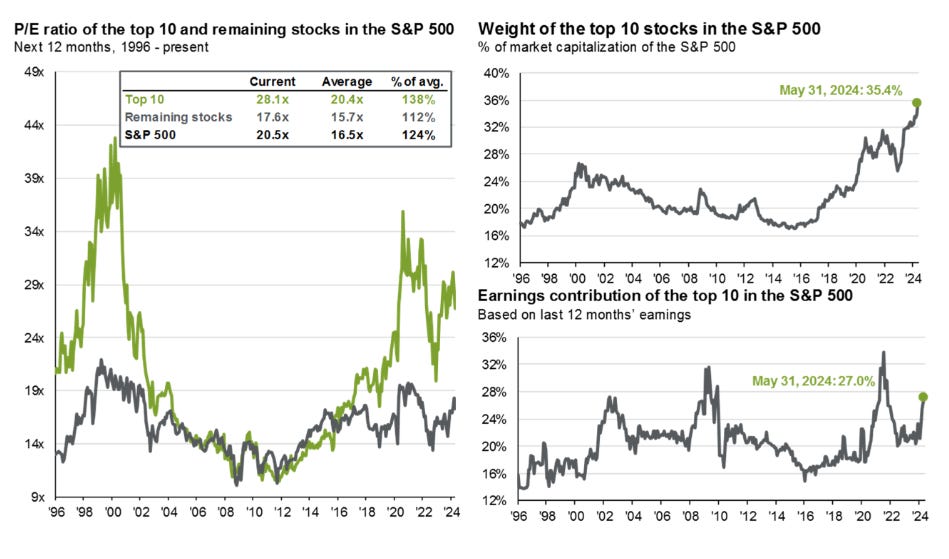

Market squeezed out a slight gain this week with SPX up ~1.2%, with equal weight index down ~.90%. Advance led by the usual suspects, with MAG7 making a new high in terms of index weights:

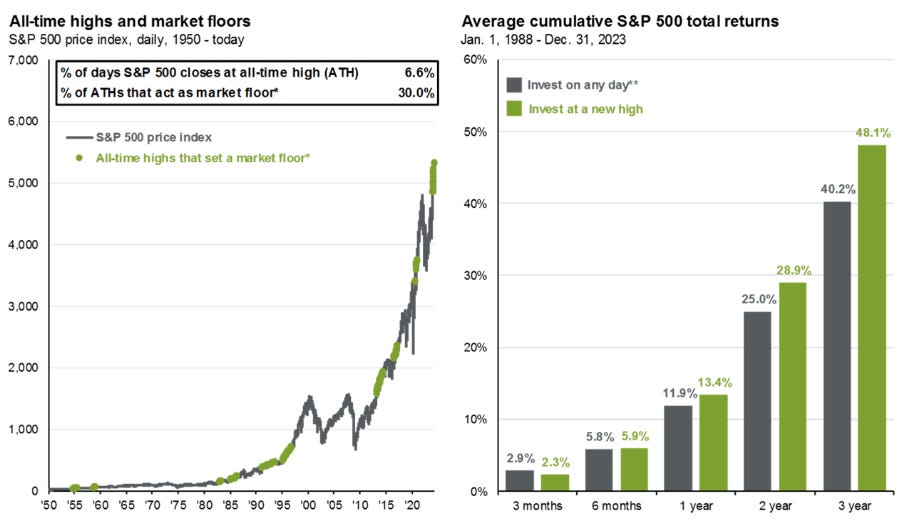

JPM was nice enough to remind us that shorting highs is, frankly, a fruitless endeavor on any time horizon, especially anything beyond 6 months…

… and that being in the right asset class / factor is more important than manager selection…

As markets await the FOMC meeting on Wednesday, nothing much is really happening in terms of movement. VX front month down half a point over the week as wave of rate cuts globally suggests Fed will likely cave again and cut or be extremely dovish this Wed too. Summer seasonality has not yet established itself (likely after FOMC) with implied vols holding so far and realized vol having a small bump last 2 weeks.

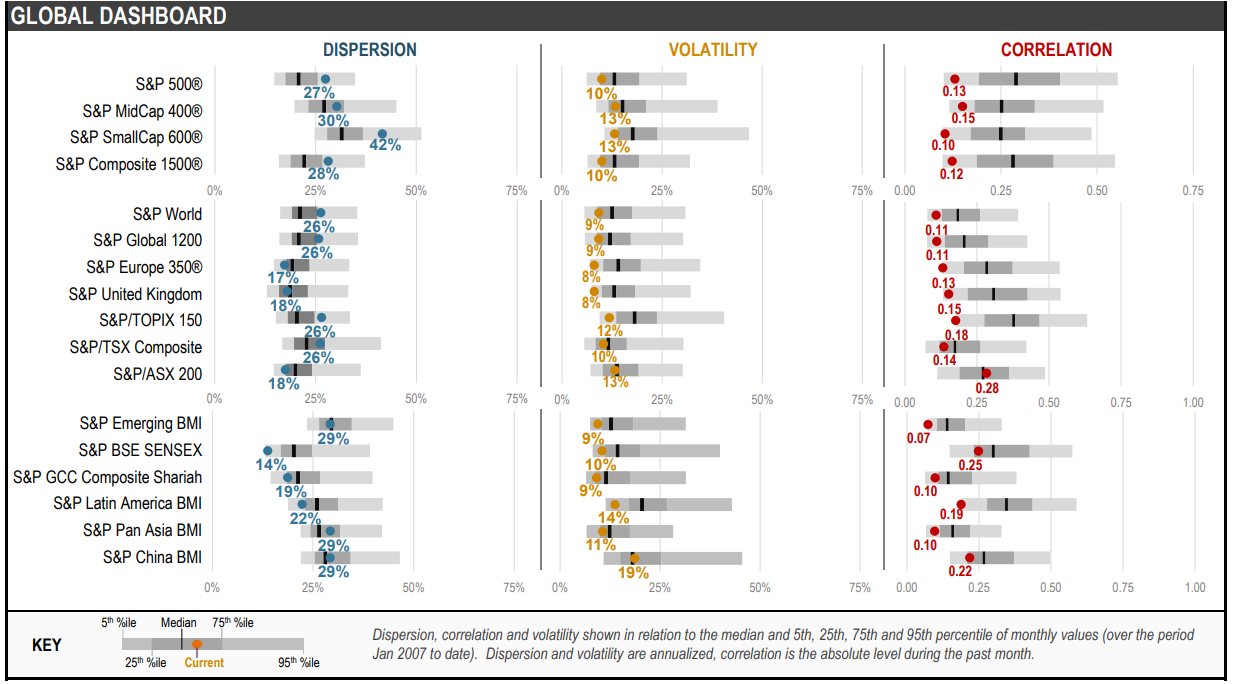

Record low correlations continue to suppress index vol, story of the last 1.5 years, with either MAG7 (in large cap indices) or now the ‘meme’ frenzy (in mid-caps and small-caps) contributing to above average dispersion:

Correlations are hitting lows globally, not just in US, dragging vols lower in Europe & rest of world.

Realized Volatility Overview

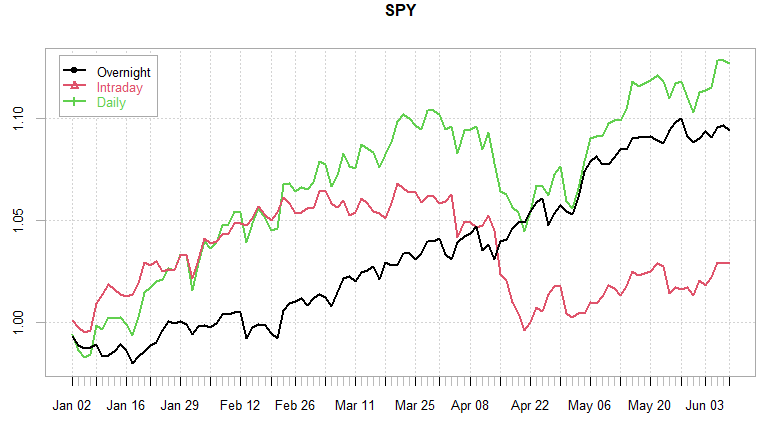

S&P made new ytd & overall ATH this week, overnight/intraday performance continues to move in tandem (albeit the overnight sharpe still 3.7+ ytd vs < 1 for intraday.)

1 month realized vols firmly sub 10 with intraday range based estimators sitting at decade lows. ‘Faster’ 10 day rvols picked up a bit last week and half but indices closed flat throughout the week on eod mean reversion.

Once again, not much divergence between overnight / intraday vol this week but the intraday ranges are getting wider relative to cl-cl with mean reversion intraday, implying, at least historically, a likely breakout/breakdown move coming, hence the long straddle bias this week and going into next week (more in the VarRatio section.)

RTH VX moves caught up with overnight drift lower last few weeks. Short vx ETPs, however, red ytd for the RTH session…

SPX ATM Straddle Performance

1-Day straddles down a whopping 48pts this week total, thats including a big 36pt win on Wednesday…

RTH ATM Straddles down ~22pts on the week, while avoiding holding through the overnight bleed, still, eod rallies/drops pinned index flat almost every day this week.

Holding straddles overnight down ~9pts on the week (even with the decent sized moves on data, the premium was simply way too large…)

Holding straddles in the first half of the day all loses, however, from 1pm onwards, straddles closed green almost every day.

1pm straddles up ~23pts and 2pm straddles up ~15pts on the week.

Buying EOD straddles managing to not bleed for close to 4 years now…

As mentioned in previous posts, for some reason straddles tend to perform closer to eow… at least half way into Friday (Fridays afternoon been dead for a while…)

Variance Ratio Conditional Performance

From the following post:

Long / Short 1-(0) DTE Straddles briefly made ytd high but gave up gains into eow as kept trading either long 1-dte or 0-dte… While positions were up intraday almost every day, the mean reversion towards eod hit hard this week. YTD the sizing is ~4 XSP contracts using a $200k index notional bet size (will add vega weighted position sizing in a follow up post to the original VarRatio post.) Signals continue to show a long straddle bias going into next week. Main trigger for long positions coming from the intraday mean reversion relative to cl-cl move.

Have a good week!

Will post Part II for the delta hedged 1-dte straddles post Sunday / Monday (part I:)

After that will look at the weekly/monthly delta hedged straddle performance with various delta hedging timings.