VIX-piration

Weekly option performance post VIX-piration

After our first real *correction* in 6 months (SPX off ~4.2% high to low tick so far) noticed a few comments surrounding OpEx flows. Theory is option overwriting programs have calls expiring otm now so no bullish flows into opex.

Vixpiration tomorrow morning speculated to be start of weakness. This would be a change in character given entire rally happened pretty much Thursday/Friday for the last 6 months.

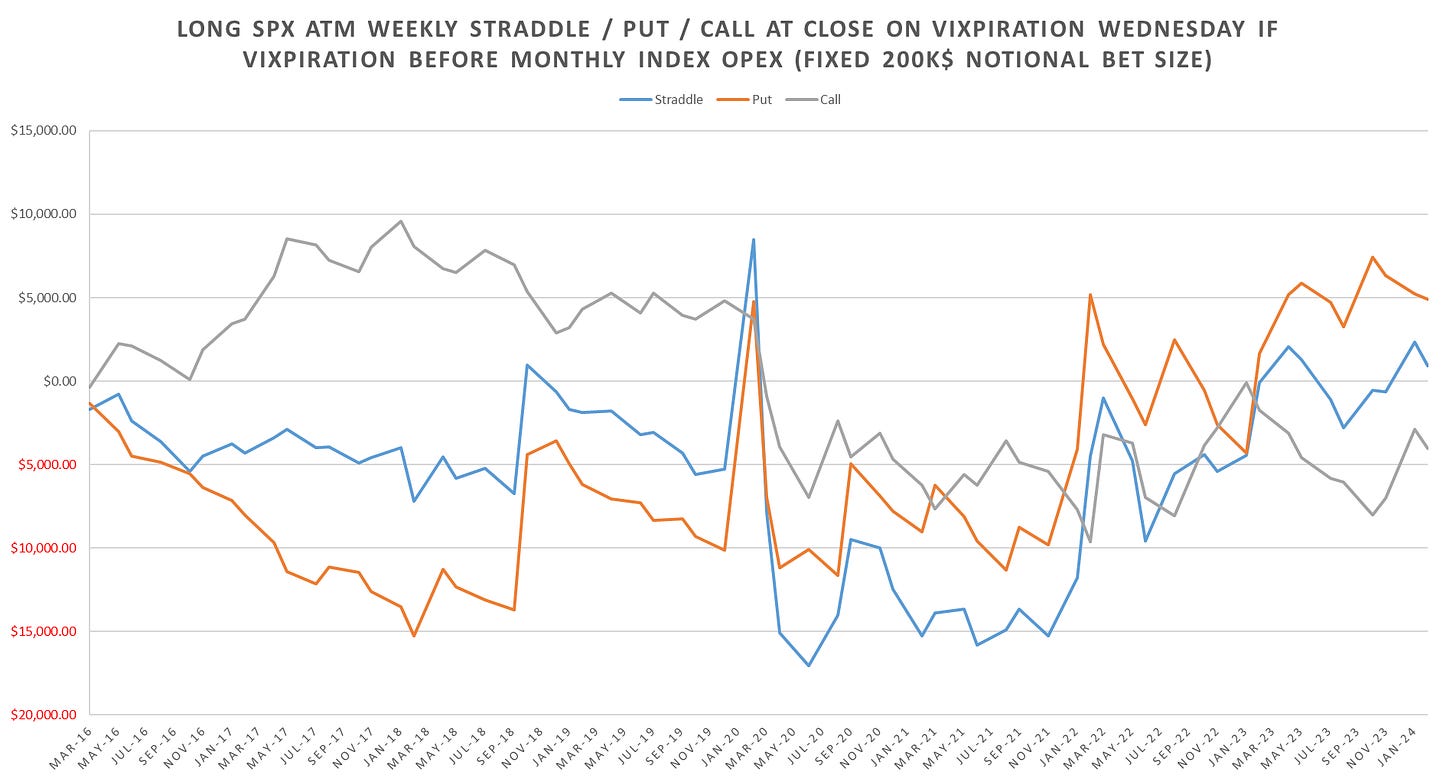

Going long a 1 week SPX ATM Straddle/Put/Call on Vixpiration Wed close, puts look to be delivering on avg better than expected pnl (fixed notional bet size performance on chart.)

Further filtered by Vixpirations that are before not after monthly index opex:

SPX weekly option performance of week going into monthly index opex:

Performance of buying 1 week out option structures on close of monthly index opex:

Putting the SPX OpEx performance + SPX Vixpiration performance together we see opex generally bullish, when Vixpiration happens prior to monthly index opex, buying 1 week out spx atm puts on vixpiration day close worse than overall vixpiration day sample.