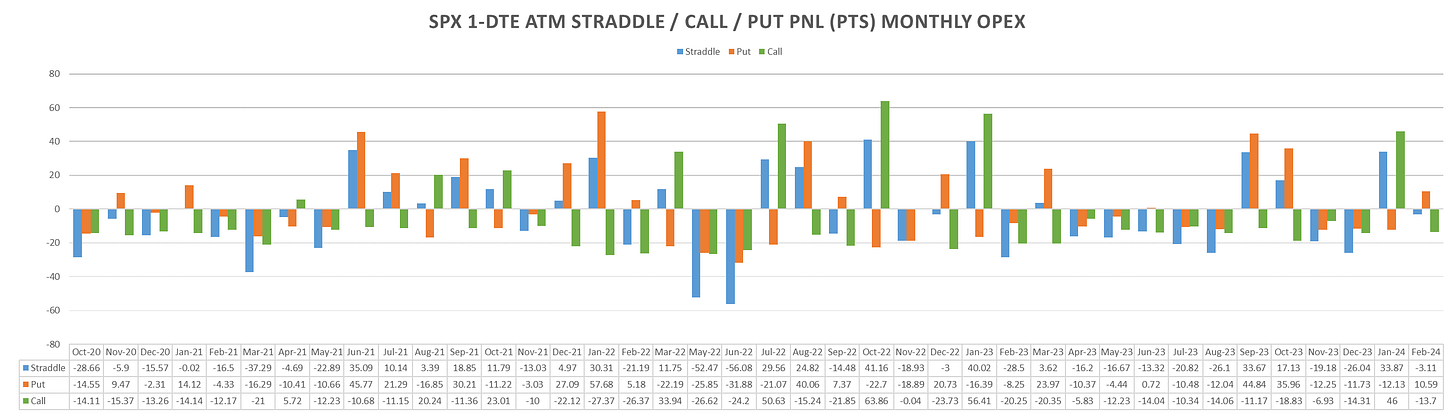

As we wrap up week no.20 of indices grinding higher with no end in sight, lets take a look at some stats surrounding the monthly (quarterly) option expiry and if we can expect any significant changes to how markets are expected to behave. Currently, pricing for Fridays options looks to be completely in line with historical avg (~58bps for Fridays ATM SPX Straddle.)

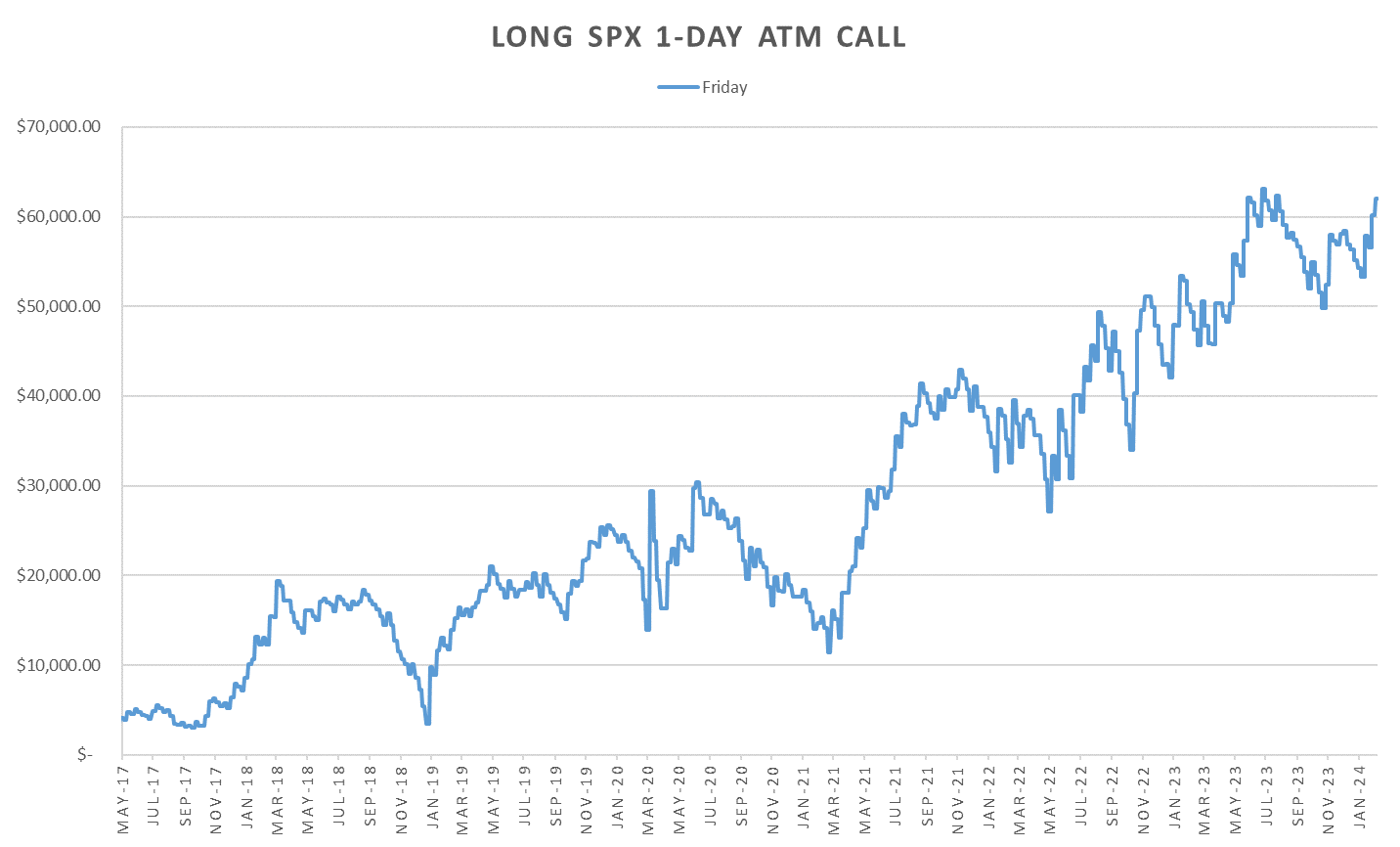

Couple of things stand out, Fridays index ramps have been with us through thick and thin, however, seem to lag on monthly index option expiries (n=~100). Puts are not displaying the best performance either (despite staying positive over ~8yrs of data.) Overall, would not expect any fireworks, rather drippy price action after RTH open.

For a deeper look at intraday option performance as well as weekly options data surrounding monthly/quarterly option expirations, make sure to check the follow up post to this overview!