Following up on last weeks overview:

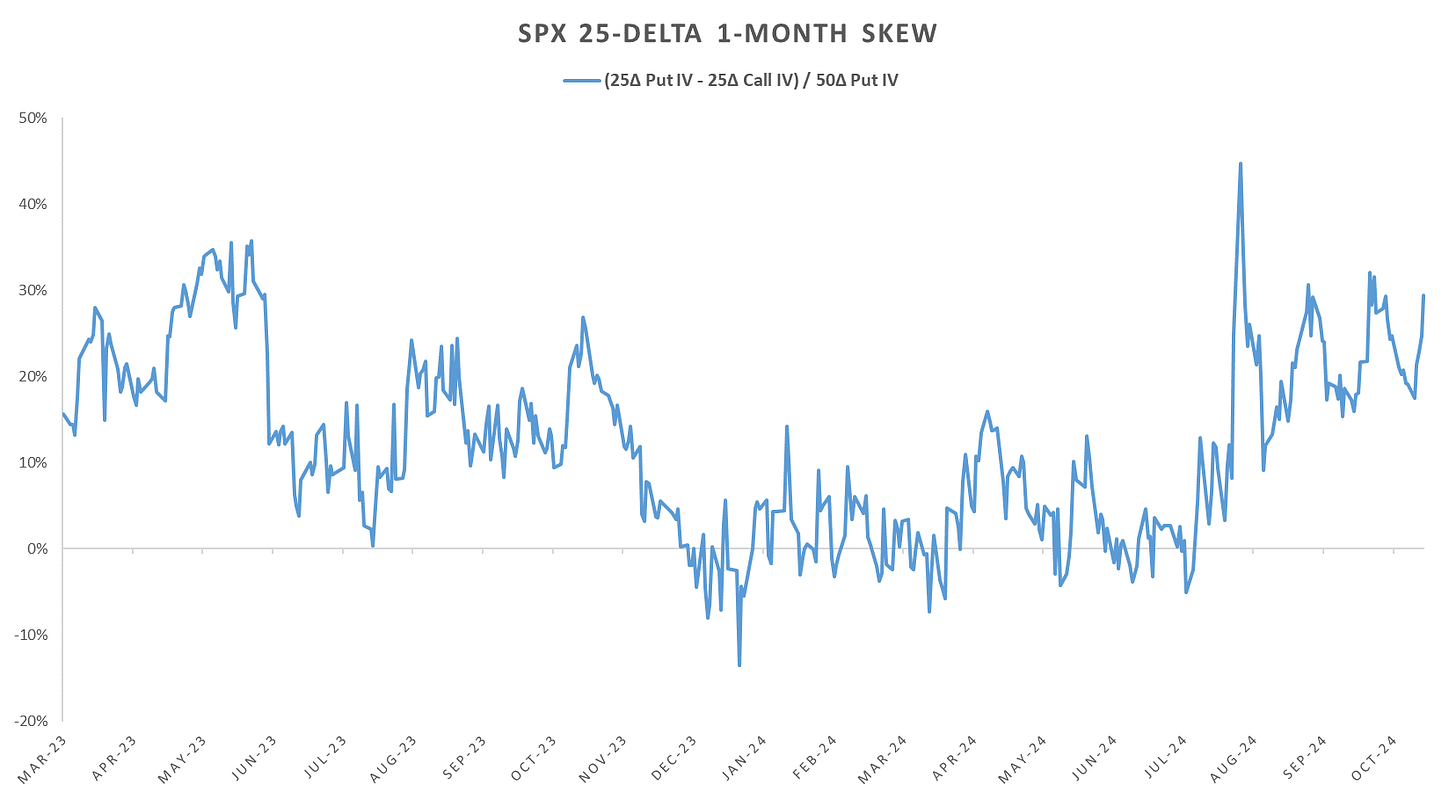

SPX finished the week ~1% down into Friday last week, mostly on the back of Middle East headlines going into the weekend. NDX closed near the highs with DJX & RUT going on a 5 day losing streak. MAG7 remained the vestige of strength throughout the week. Implied vol closed higher on the week mainly through SPX put skew being bid into potential Middle East escalation. VIX carries ~4.5pts of geopol risk premium into Friday (although given the current globex action, that should be back to 3.5 or lower by Monday open…)

Massive week for earnings with majority of MAG7 reporting by eow. TSLA had a stellar few days post earnings (probably bid with Trump odds climbing as well.) Check out ListDer Research latest post for the earnings preview & straddle pricings for this week.

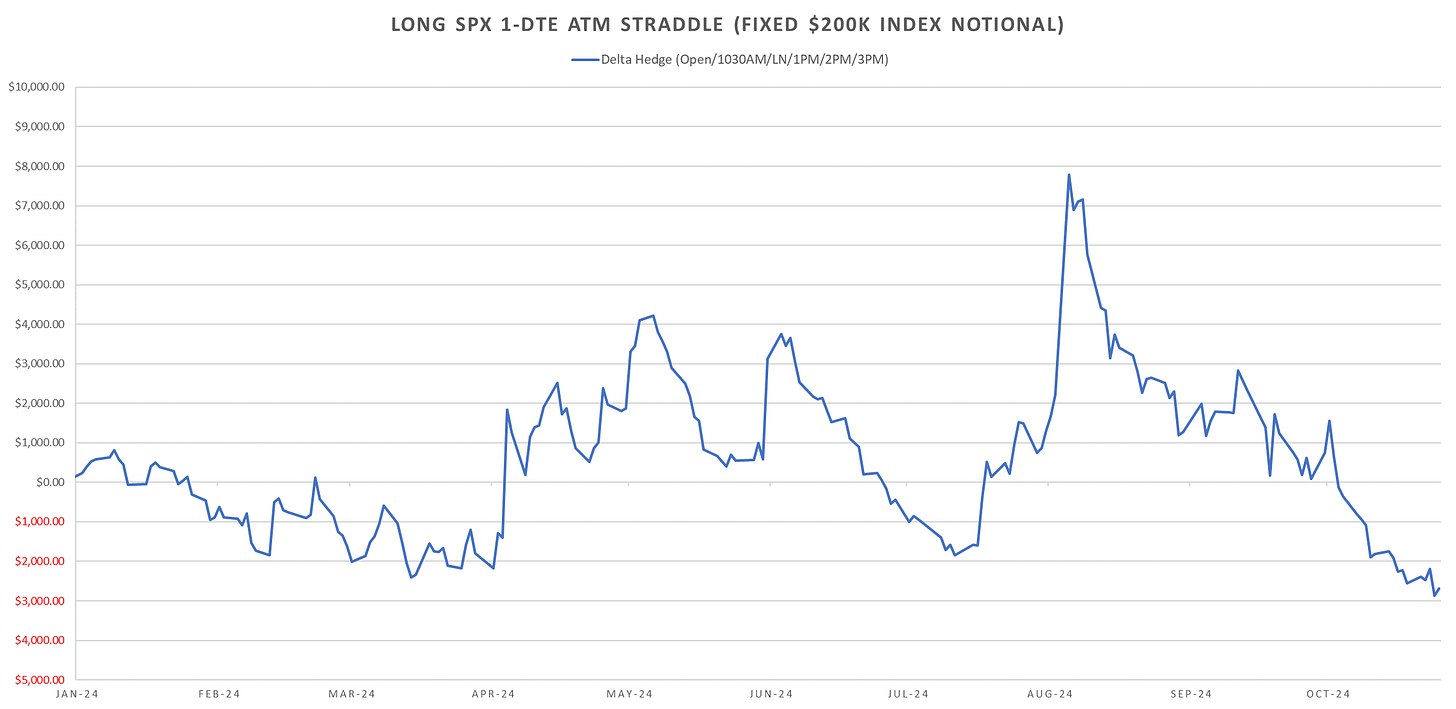

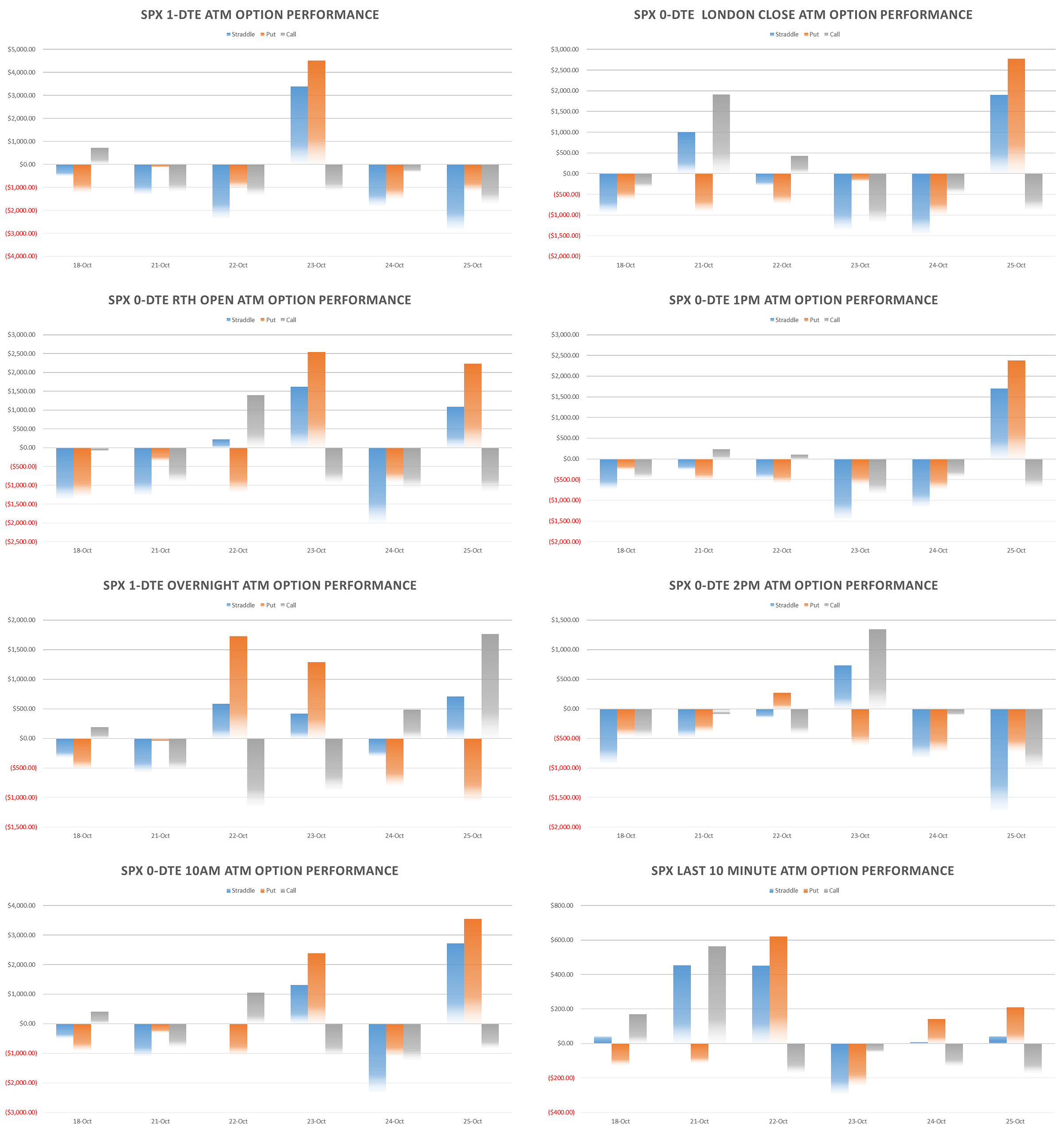

SPX 1-DTE Straddles trading higher into the weekend but overall still nowhere near the highs. Rvol contracting into elections with higher than avg dispersion (low realized single stock corr) so far.

Oil & Gold leading cross-asset vols higher, again, geopol risk was main thing on the newsfeed late Friday. The tepid response from Israel & lack of any response from Iran following the strikes suggest we will likely only see any decisive action post US elections… Similar situation with the Ukraine/Russia war.

Put skew, once again, steepened, with demand for calls marginally higher on the week as well. Any downside in the indices, however, remains purely hypothetical as SPX is set for one of the best YTD performance paths in 20 years (more than half coming from NVDA.)

Looking at intraday price action, from the following posts:

and the more recent:

Intraday gamma pnl continues to collapse even with 1-dte straddles hitting ytd lows in terms of vol this week. Delta scalping pnl picked up but not nearly enough to make up for straddle losses.

Looking at intraday straddle cross-section, morning US session still sees some vol, with markets largely fading everything by eod (gains & losses):

YTD, shorting 1-DTE SPX Straddles up only ~27pts. Overall a strange year for short premium strategies… Realized volatility overall seemed low, but the pricing was record lows too and the frequent tails (both right and left) on correlation spikes just killing short straddle trades.

Hedge funds struggling this year unless long biased… Attached the Q3 HF Industry Overview from Aurum.

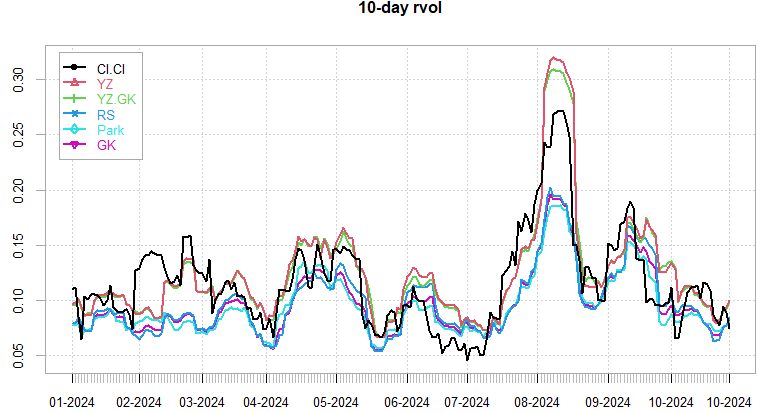

Realized Volatility Overview

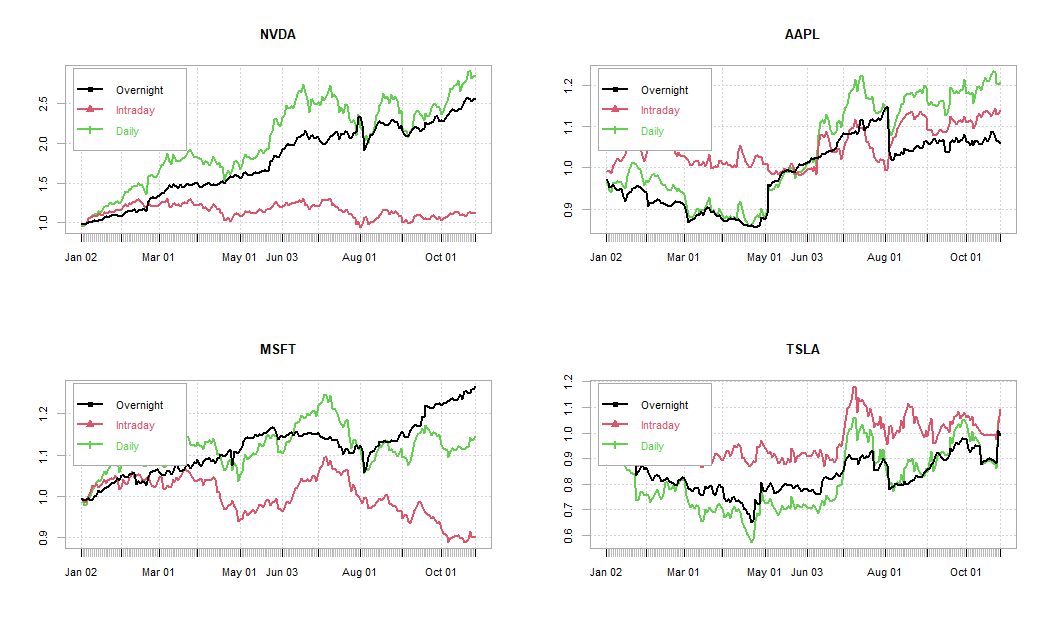

Market continues to go absolutely nowhere during US session, overnight performance ~ flat over the last week.

QQQ hitting new highs last week for overnight performance, remains relatively strongest performer ytd.

SPY returns by day of week still showing over half the returns ytd came overnight into Thursday as unemployment took over focus from inflation.

NVDA driving over half the gains ytd in indices overall… (and its all overnight.)

Looking at SPY realized vol:

Without geopol risk, ~15 implied vols for the elections, which is roughly in line with realized vol in the previous 4 election periods as outlined in:

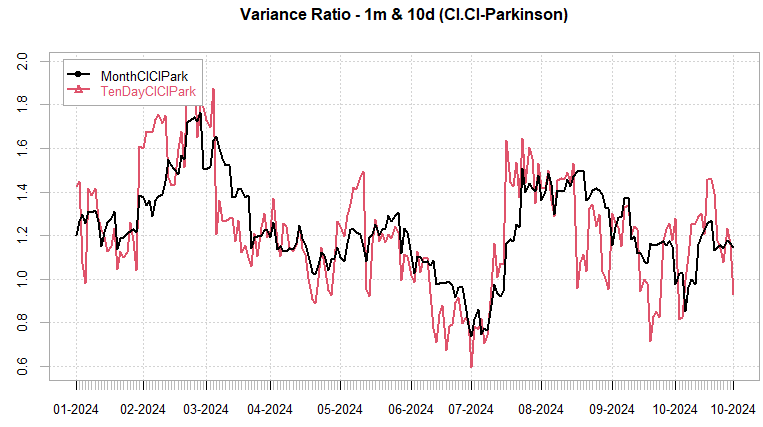

Nothing crazy going on with variance ratios based on intraday price dynamics. Bit larger than avg mean reversion but nothing extreme.

The gap between overnight VX30 & intraday VX30 continues to widen, since July, -1x VIX Futures down nearly 50% during intraday session (that’s excluding the overnight drop during BoJ August crash.)

SPX ATM Straddle Performance

1PM SPX long straddles massive losing streak, saved only by Friday afternoon headline fears. Post EU close market dead into eod lately. Quite a change from overall pattern last 3-4 years as highlighted in other posts. Not as much chasing into eod as we had in 2022 & early 2023.

Variance Ratio Conditional Performance

From the following post:

Some recovery last week, shorted 1-DTE straddles all week until Friday, 1-DTE leg went into Monday long (will also long RTH open straddle.) RTH leg last week flipped between long/short/cash all week, closed with a long Monday RTH open straddle trade.

VX Carry & SPX Overlay

From the following post:

No trades since start of Oct in VX. SPX Overlay traded couple of straddle but net losers by close. Not picking up the difference between term structure inversion in current environment vs when SPX actually dropping. Mainly event & geopol premium in VIX/VX right now. Overall flat for the year… one of the worst 10 month performances in 10 years, hoping for magic to happen post elections into Jan to catch up!

Have a good week!