Following up on last weeks overview:

Last week of the summer closed relatively flat, with decent whipsaws after NVDA earnings / Friday data release. As we head into the short Labor Day week, this should be the last ‘break’ before eventful autumn months start. While on the surface indices look to have recovered, when looking at implied & realized volatility, we can see some decent ‘nervousness’ in the coming months.

1-DTE straddles had a wild ride this week, going into the 3-day weekend just above 50 bps. As mentioned in the last weekly overview, the first week of September covering labor day tends to be the last spot to hedge for the upcoming months.

Looking at 1-month skew on SPX, can see some put love for the next month with call skew largely unchanged in the last few weeks.

had a nice chart in his recent post outlining the various VIX regimes of the last year. Despite equities recovering, VIX downside momentum stalled, with downside protection being bought.Looking at cross-asset vols, some interesting dynamics playing out last few weeks. 5Y lookbacks showing equity vol well below every other asset at the moment.

Perhaps equities got a little too buoyant into month end here…

Looking at intraday price action last week, from the following post:

Despite almost perfect mean reversion ‘regime’ last few weeks, event premium vols last couple of weeks are very hard to beat on the long side. Thursday’s large win from intraday deltas completely overshadowed by the almost 1% straddle closing at 0 for the day.

YTD, best performing period remains after London Close till ~ 3pm, this is slightly out of ordinary relative to last 4 year trends when majority of moves happened towards the close.

I expect the current early day vol period to end, instead switching back to eod vol for the election period.

Realized Volatility Overview

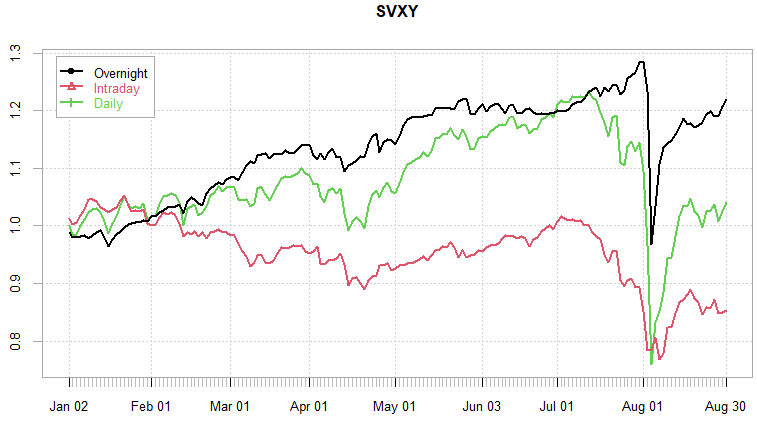

S&P made a new ytd high for overnight performance last week. All the downside coming intraday once again…

The swift recovery in SPX left 1-month rvols sitting near highs for entire month, rarely do we realize just as much vol on the upside as downside but looks like we are in a ‘new paradigm’ with this market… 10-day vols bottomed ~ 10, no surprise implied can’t follow through on the downside as we keep realizing above 10 in the last few weeks.

We are starting to see range based vol pick up relative to cl-cl, historically, long straddles for a trend-like move have positive expectancy here, especially for RTH moves.

Similar to S&P, VX futures keep popping up intraday. Overnight performance almost back to ytd highs. Flattish term structure not really conducive to taking major risk on vol collapse here…

Election Seasonality

Short overview of rvol behavior around the last 3 US elections:

2020

2016

2012

Going back to 2004, majority of risk during the US election period comes at the end of the US trading session. While not exactly large vol spikes, more whipsaw type action with frequent reversals should be expected. Given the sizable premiums in VX, inverse vol etps tend to weather this period well.

SPX ATM Straddle Performance

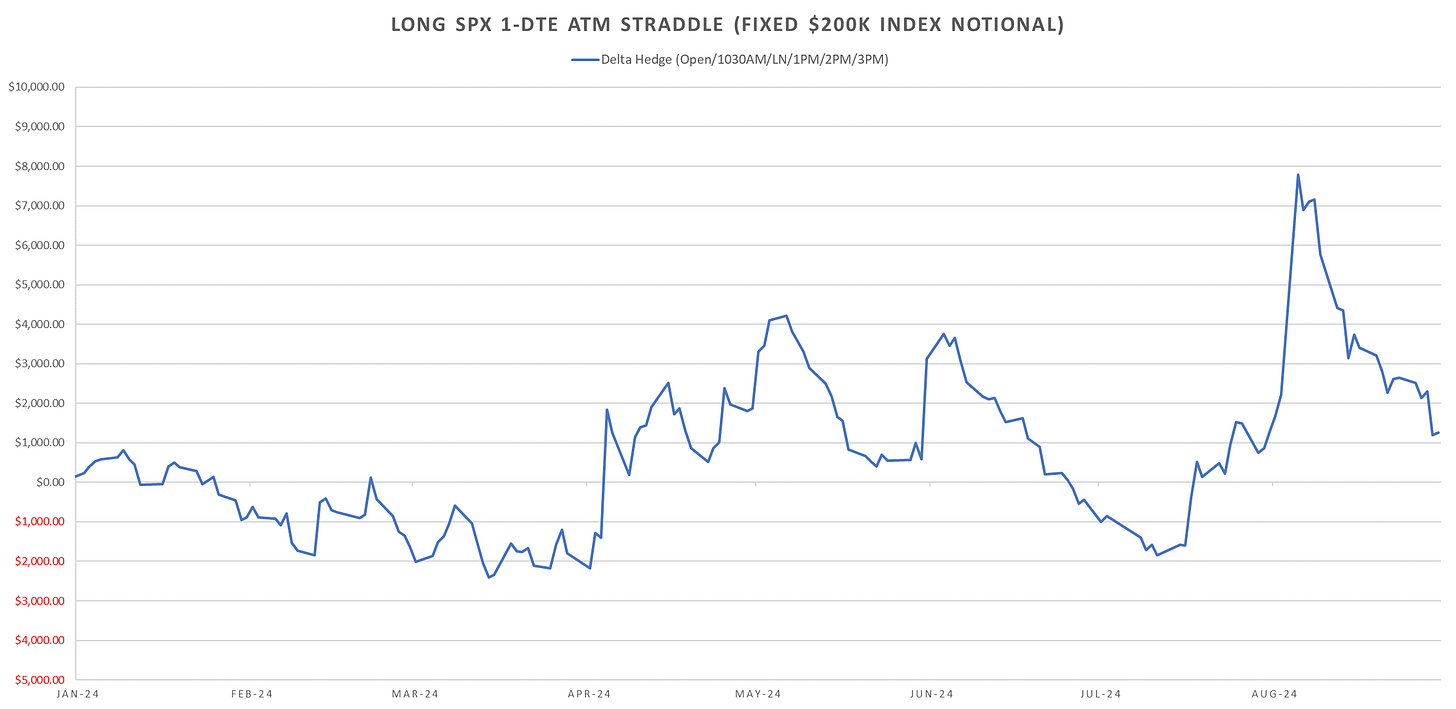

Net 1-DTE straddle posted a big loss last week, driven by thursday flat close on large event premium. The last 10 min of the month trade worked quite well, returning more than double the premium of the straddle. Outside eom, last 10 mins have been massive losers last 2 weeks. Otherwise a very mixed week, market *feels* nervous and realizes decent ranges despite being back at near ATH.

Variance Ratio Conditional Performance

From the following post:

Systems flipped long straddles into Thursday, getting hit with a completely flat close relative to Wednesday after the early morning rally given back. Both systems leaning towards range expansion from here, into Tuesday, 1-DTE leg in cash, 0-DTE leg long the straddle at RTH market open. The RTH leg continues to outperform YTD… One of the problems with 1-DTE positions is the horrific pnl of long straddles for the overnight globex session. By the time market opens straddles are down anywhere from 5 to 30% (on event days). Overwhelming majority of the time the opening print is also higher than the closing price resulting in a ‘gap up’ with vol lower type of action.

VX Carry & SPX Overlay

From the following post:

VX30 system made new ytd highs, beating the previous Feb peak. Driven mainly by the VX Oct short from last Friday as mentioned in the previous post. SPX Overlay lost on a long straddle position on Monday, no overlay triggers rest of week. Front month VX remains flat relative to spot, with vol of vol picking up substantially, little edge to carry the short vol here in the front. The Oct contract has some nice premium built in but I doubt it gets below 17 in the next few weeks. Main expectations still remain for the post elections vol drop to make up for the lackluster year.

Have a good week!