SPX Intraday Trends

Intraday index price dynamics & option performance update

Last few months SPX intraday price dynamics experienced a fairly large ‘flip’ between volatility in the morning session & in the afternoon session. For almost 3 and a half years the general dynamic was acceleration of the price into the close in the direction of the underlying move. As of late, between end of April to June this dynamic has slowed and from ~July sharply reversed. Majority of the vol is now observed over the first 1.5hrs of the trading session, with eod moves largely muted.

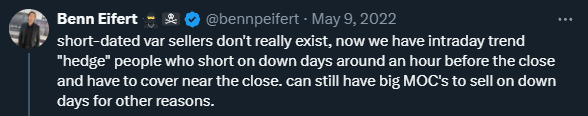

The reasoning behind this ‘flip’ could be attributed to many factors, but guessing the exact catalyst of intraday flows would be largely futile. We’ve had multiple ‘risk’ factors over the last few months, which had some impact on the overnight performance & the US econ data releases with the immediate reaction in the US am session. In this post we will look at the intraday SPX trends over the last 9 years, intraday straddle performance, delta-hedging & gamma pnl from 1-(0) DTE SPX options.

This post will refer to data previously posted in:

and

SPX Intraday Hourly Data

Keep reading with a 7-day free trial

Subscribe to Vol Vibes to keep reading this post and get 7 days of free access to the full post archives.