Following up on last weeks overview:

SPX closed Friday at a fresh new ATH along with Dow & Russell 2000. Market cap weighted NDX still off July highs, however, equal weight QQQ (QQEW) made new highs on Monday before closing the week slightly lower. Realized volatility continued to collapse last week with 1m & 10d rvols dropping to YTD lows. Equity Implied volatility (VIX) continues to trade well above realized, with Middle East tensions & elections keeping tails well bid.

Looking at shorter dated vol, 1-day SPX straddles went into the weekend at ~40bps:

Some of the cheapest straddles ytd, especially for a weekend trade. Elections tend to have rvol collapse going into the event, with rvol picking up on the week of the elections. We will start to see some of the MAG7 earnings come out next few weeks, with TSLA 0.00%↑ & AMZN 0.00%↑ reporting on Wednesday & Thursday this week.

SPX put skew & call skew eased last week, with call skew falling off more after the ramp higher into new ATH’s. Adding to elevated skew & higher implied vols are the sharp moves in realized correlations between index constituents. Sharp narrative swings impact traditional cross-asset correlations, jumping between ‘booming’ economy with positive equity/commodity correlations to ‘recession’ risk where higher commodity prices are hindering equity performance. Earnings seasons usually see a jump in realized dispersion as company specific news should contribute more to single stock variance relative to index, however, with the macro & geopol risk backdrop, we are seeing wild jumps inside the index correlation space.

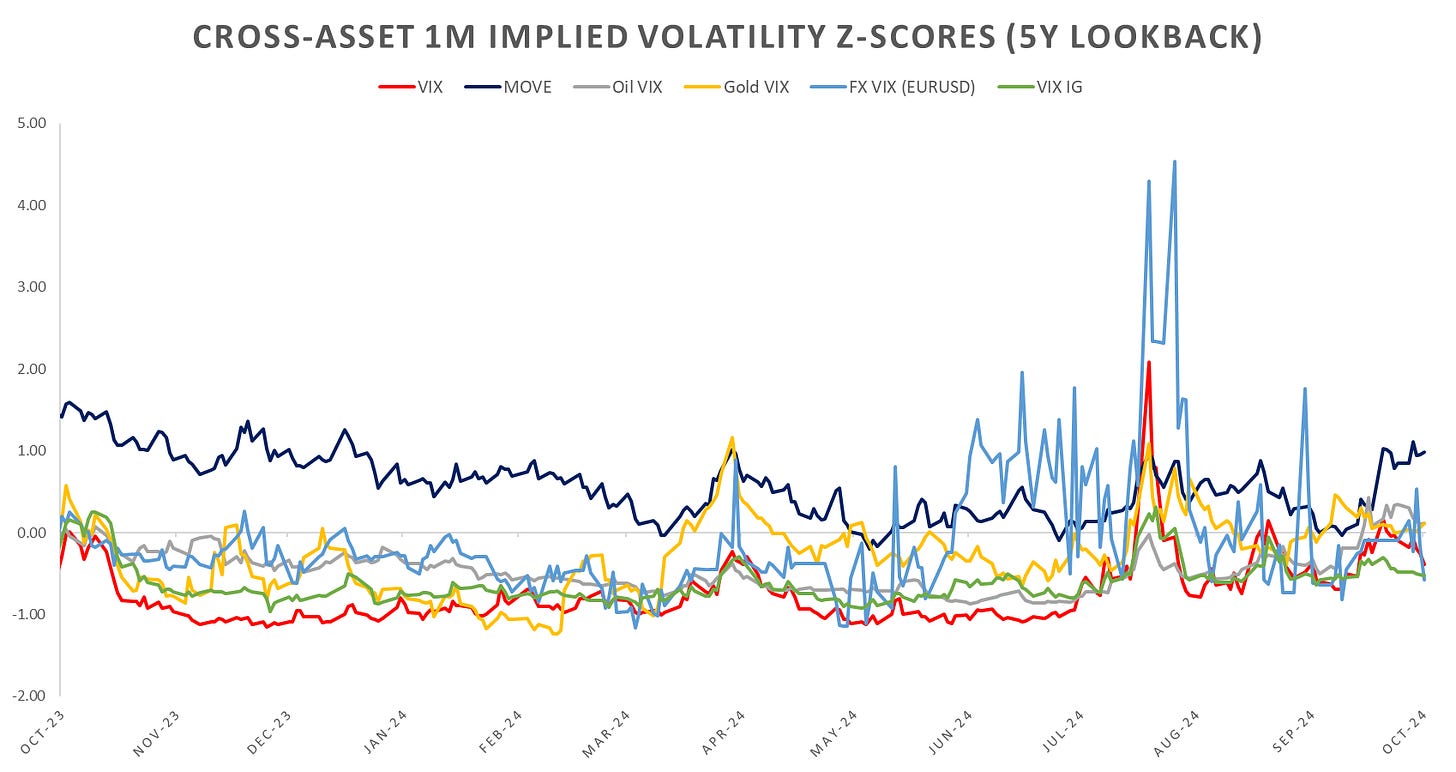

Nervousness around the Middle East can be seen when looking at the cross-asset iv charts. Oil & Gold now leading, with overall cross-asset implied vols elevated.

As we enter the post-OpEx week, historically quite bullish, have not seen any large downside since Sep/Oct 2023.

7-DTE straddles from Friday trading ~100bps. Some of the cheapest levels not seen since April / June.

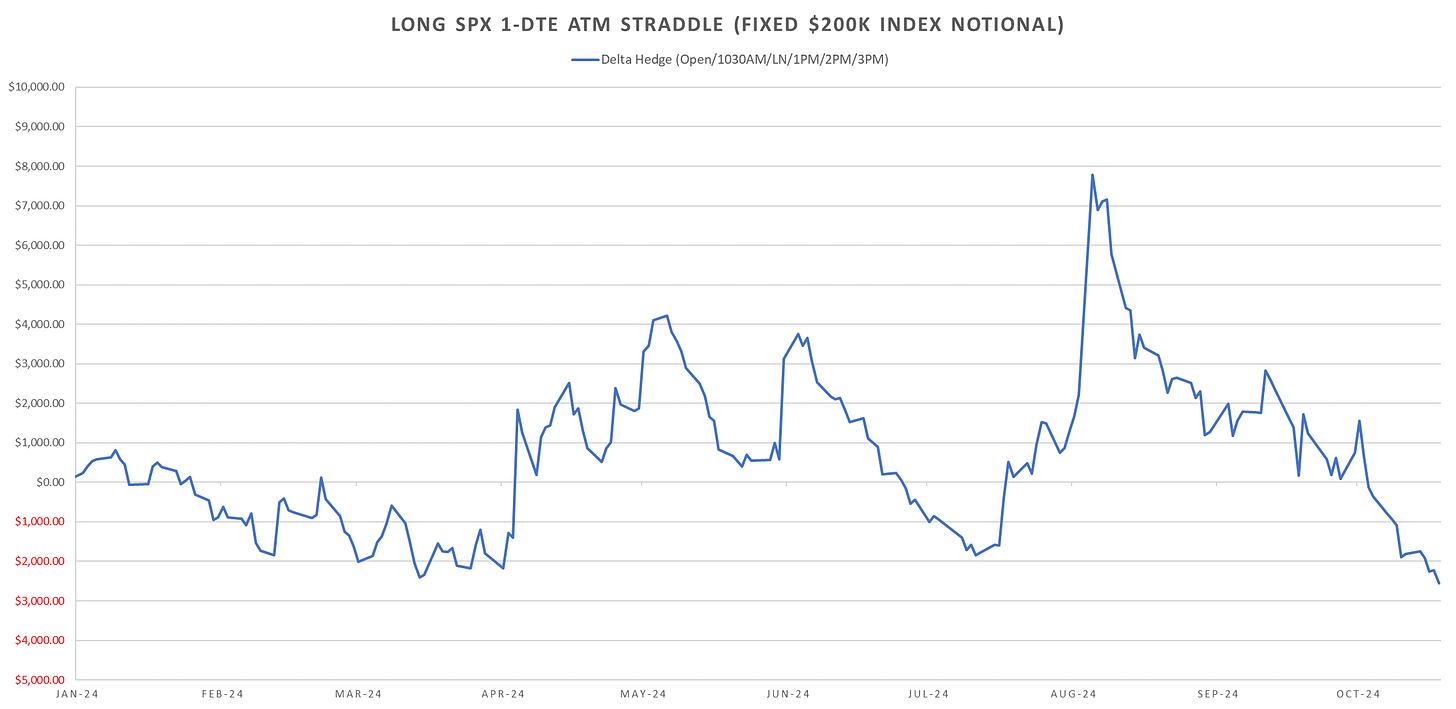

Despite short dated (<7-DTE) implieds dropping to record lows once again, short dated gamma is still not managing to perform, making new YTD lows. I think there will be a window next few weeks to scalp some decent moves going into the election and immediately after.

Looking at intraday price action, from the following posts:

and the more recent post:

One way train from the Aug spike, short SPX 1-DTE intraday d/hedged straddles now red on the year, looks like 9th red year in a row unless we get some serious panic next few months… (just under 50 trading days left in 2024!… minus few weeks for the holiday trading and pretty much 30 ‘real’ trading days left)

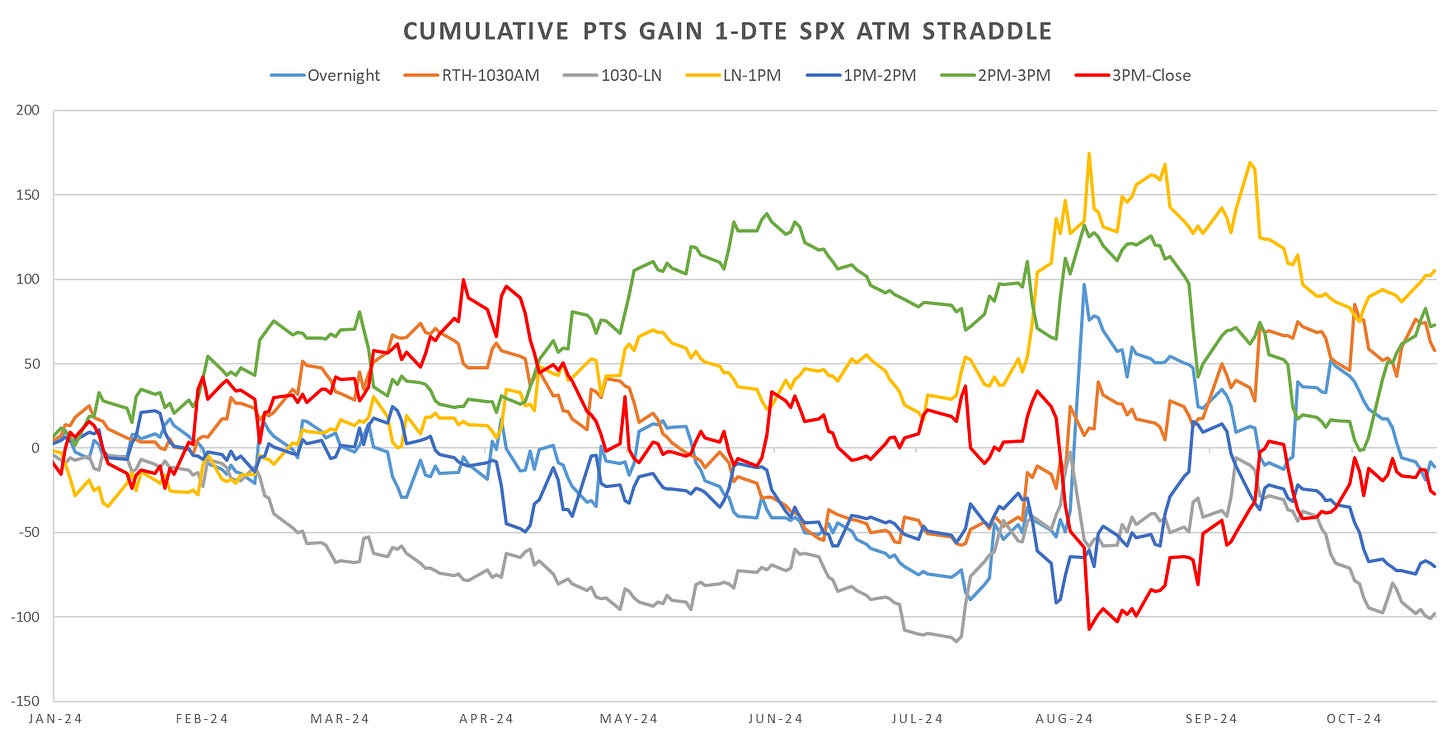

Looking at the 1-DTE straddle cross-section, London close to 1PM, best performing period YTD for holding long intraday, followed by RTH-1030am & 2pm-3pm. Overnight short straddles mainly killed in the Aug BoJ drop, STILL red YTD though.

Realized Volatility Overview

Another new high for the overnight SPY trade, RTH trade down on the week… 20% out of the 24% ytd in SPX came overnight…

1-month & 10-day SPX rvols back to sub 10 across all measures. Intraday range based vol estimators at ytd lows. Overall action mainly overnight, with indices flat through the US session post London Close.

Nothing noteworthy in terms of divergences between rvol measures. Indices are getting some follow through in terms of cl-cl changes. Also looked at the Taleb Ratio, previously mentioned in:

Should average ~1-1.1 for ‘efficient’ price action. 'Trending’ behavior implies < 1, mean reverting behavior > 1. Mentioned in previous posts ~July how 2021 onwards had incredibly ‘trendy’ intraday price action when compared to the last 20 years. We had some short lived periods of excessive mean reversion but lately back to pure ‘trend’ intraday. Will go over the various implications of this in future posts.

So far in 2024, intraday trend persistence remains sticky, directional follow through from the overnight session and from the am into pm sessions.

Shorting 30-day VX Futures overnight new YTD highs into Friday close, RTH session barely a few bps off lows… Expectations still for a post election crush into Jan. With term structure still 18+ well into 2025, some nice meat on the bone there.

SPX ATM Straddle Performance

Some decent moves Monday/Tuesday last week, spent rest of week climbing back to Monday highs. Overall straddles net red across various intraday time frames. More overnight upside into Thursday key data releases. Outside of that indices really have not moved much.

Variance Ratio Conditional Performance

From the following post:

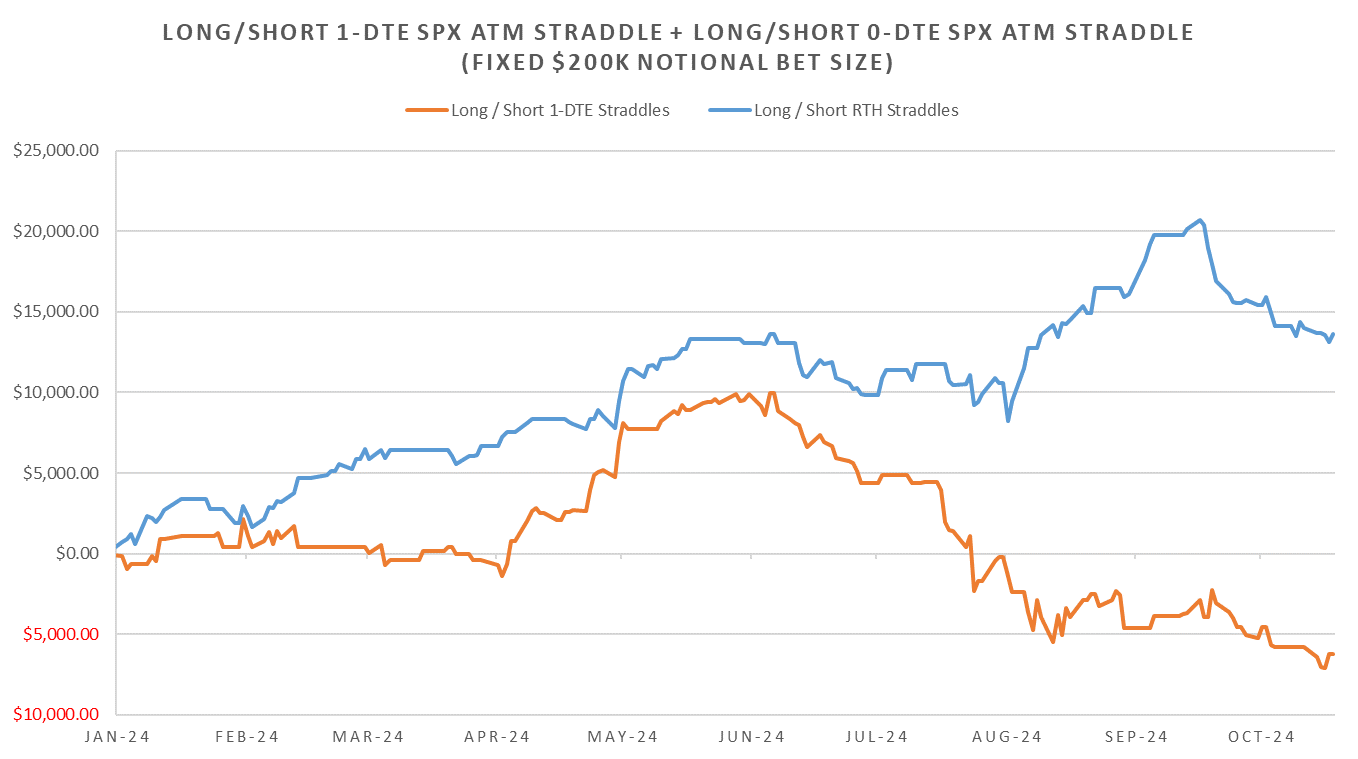

Positioning was between short and cash for straddles since Oct 4th. Not a single long straddle trigger for either the 1-DTE leg or the RTH leg. Relatively flat performance, very cheap premiums so tiny wins on the shorts that did win.

RTH performance still much better YTD than 1-DTE leg. Performance choppy since June. Frequent jumps in realized correlations means frequent flips between signals → lots of whipsaws. Should in theory have a more stable market profile post elections into start of next year.

VX Carry & SPX Overlay

From the following post:

No VX trades since the exit early Oct. Just a few SPX Overlay trades (long straddles.) Overall in waiting mode for the post election vol crush…

Have a good week!

Hadn't seen the Taleb ratio before. Very interesting. Thanks for sharing!