Market Overview - October 13th 2024

S&P Index Options & Volatility

Following up on last weeks overview:

Equities continue to march higher on the soft (no) landing tune. Equal weight S&P & Nasdaq ($RSP & $QQEW) both closed at new ATH on Friday. Broad based rally with 75% of NDX & SPX stocks closing above their 50MA’s. Despite the exceedingly bullish price action, implied vol still elevated for the election. VX/SPX beta dropped sharply this week as VX largely ignored almost a 100pt rise in SPX.

When looking at very near term vols, 1-DTE SPX straddles now trading at the lower end of YTD range (~47bps for weekend straddle.)

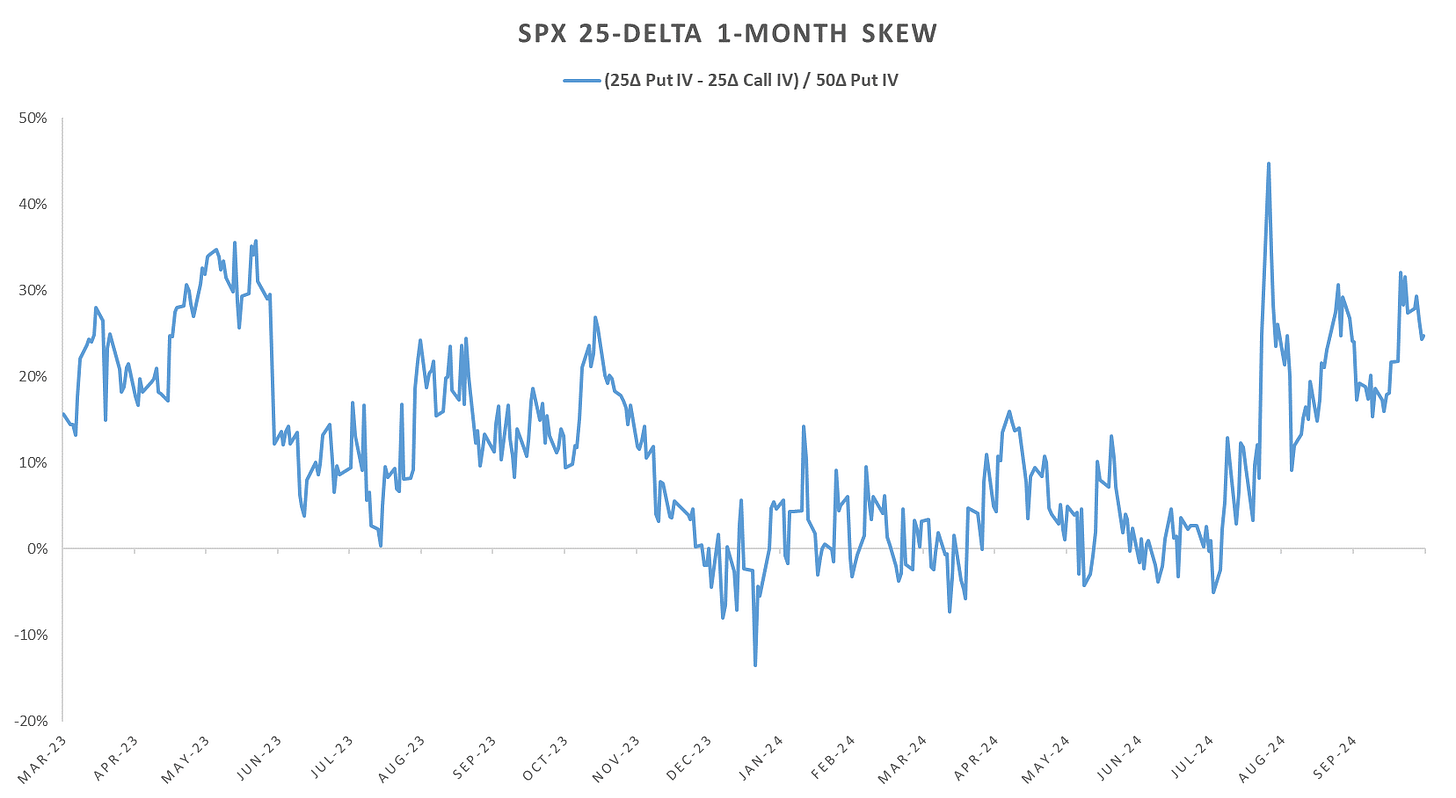

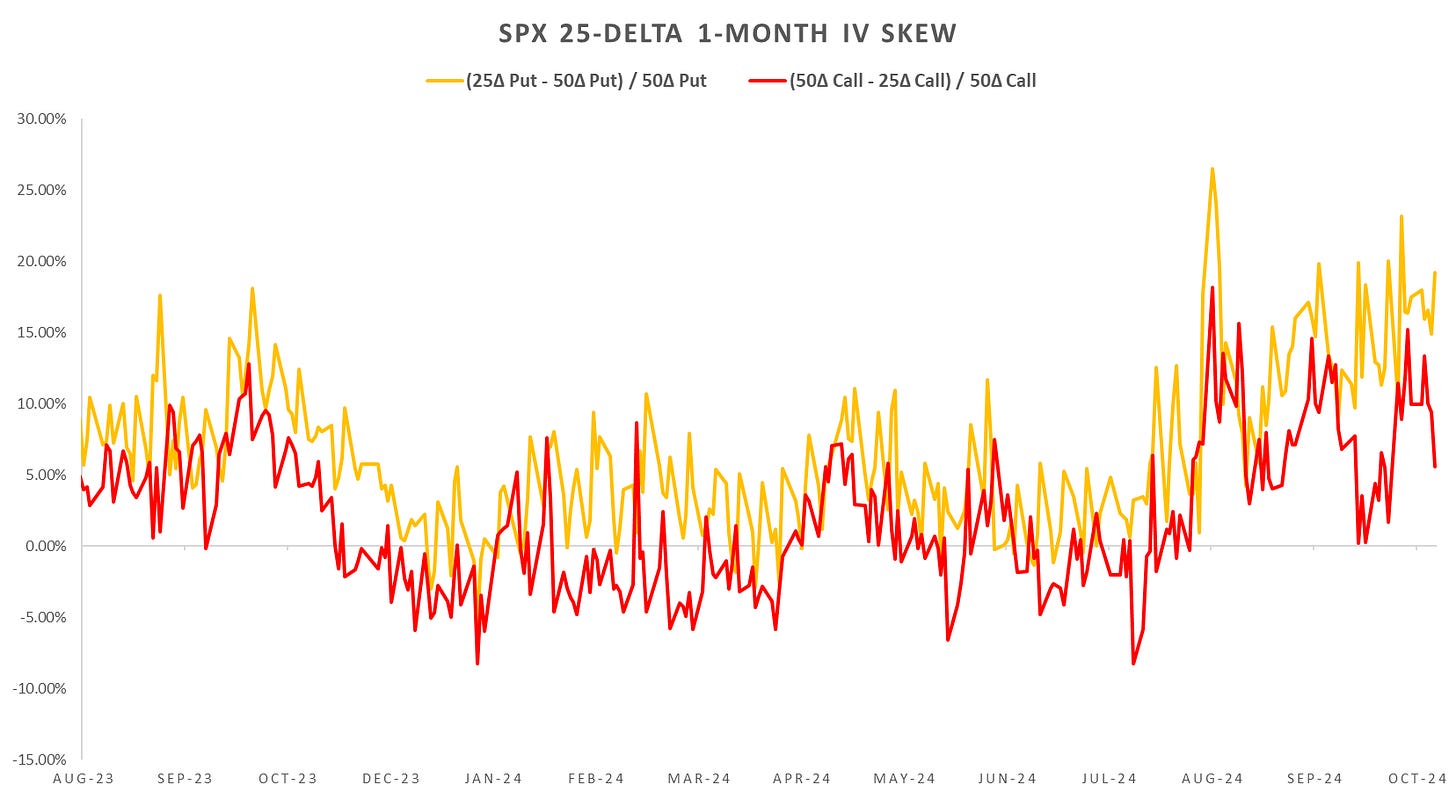

In terms of SPX skew, calls not as bid into eow, put skew almost back to ytd highs.

Oil, Bond & Equity implied vols moving last few weeks. Market walked back some of the rate cut expectations following strong economic data reports. It is also looking more likely that regardless of which candidate gets elected, spending is only going to increase, with risk of economy running hot resurfacing again.

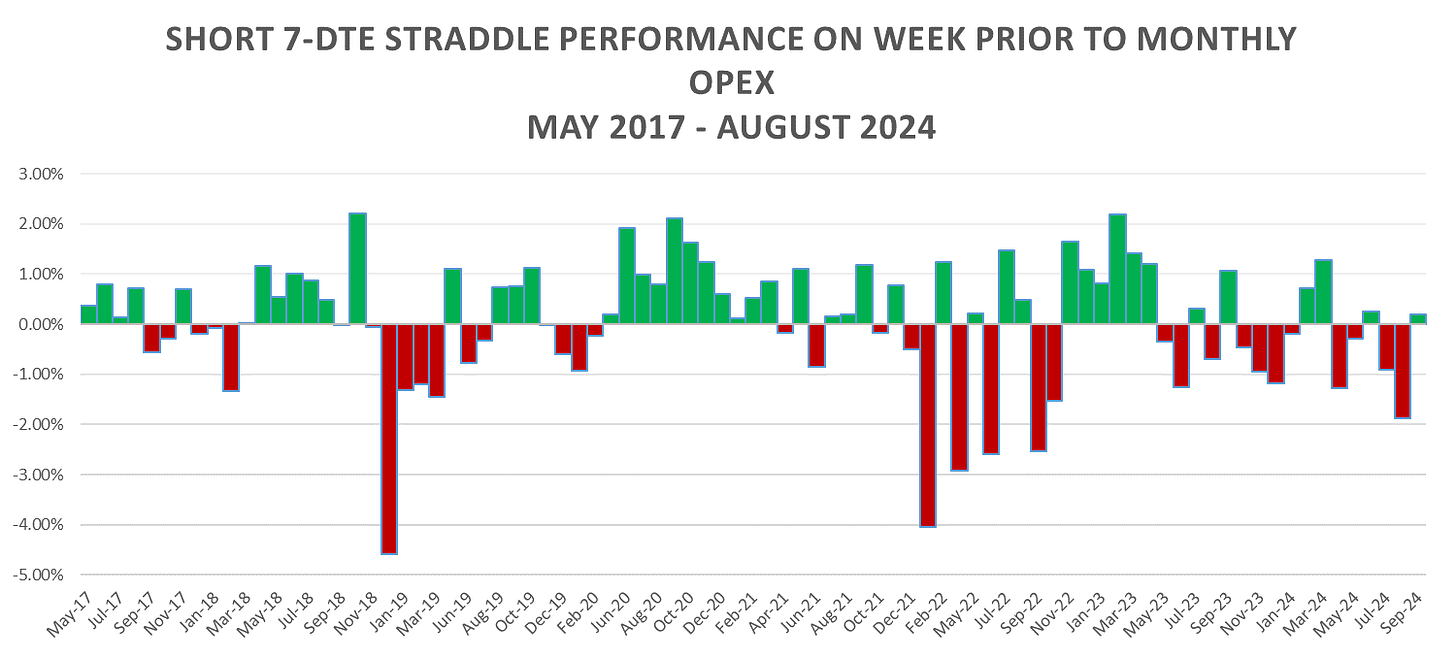

We are going into OpEx week, historically, some decent volatility in the 8 year sample with decent moves in both directions

Short SPX 7-DTE Straddles net lost ~5% during OpEx week since May 2023.

Looking at intraday price action, from the following posts:

and

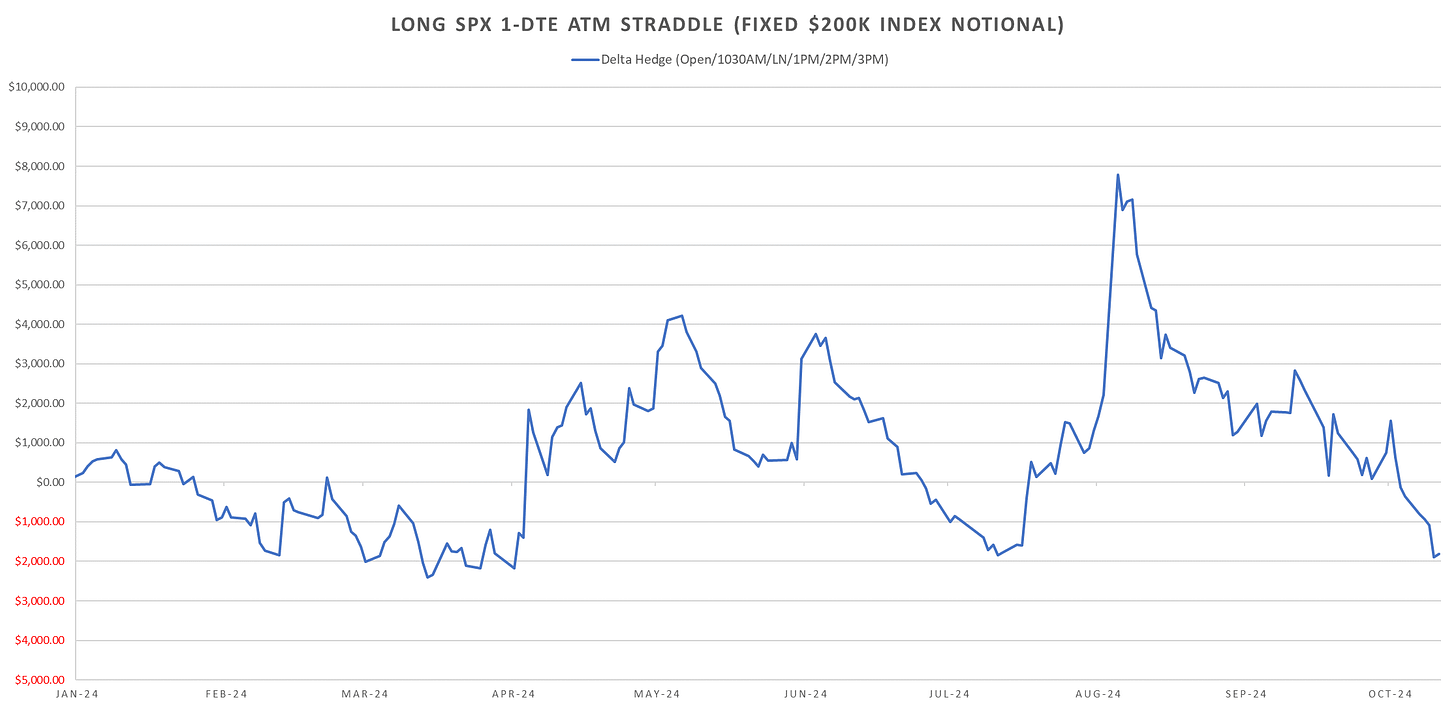

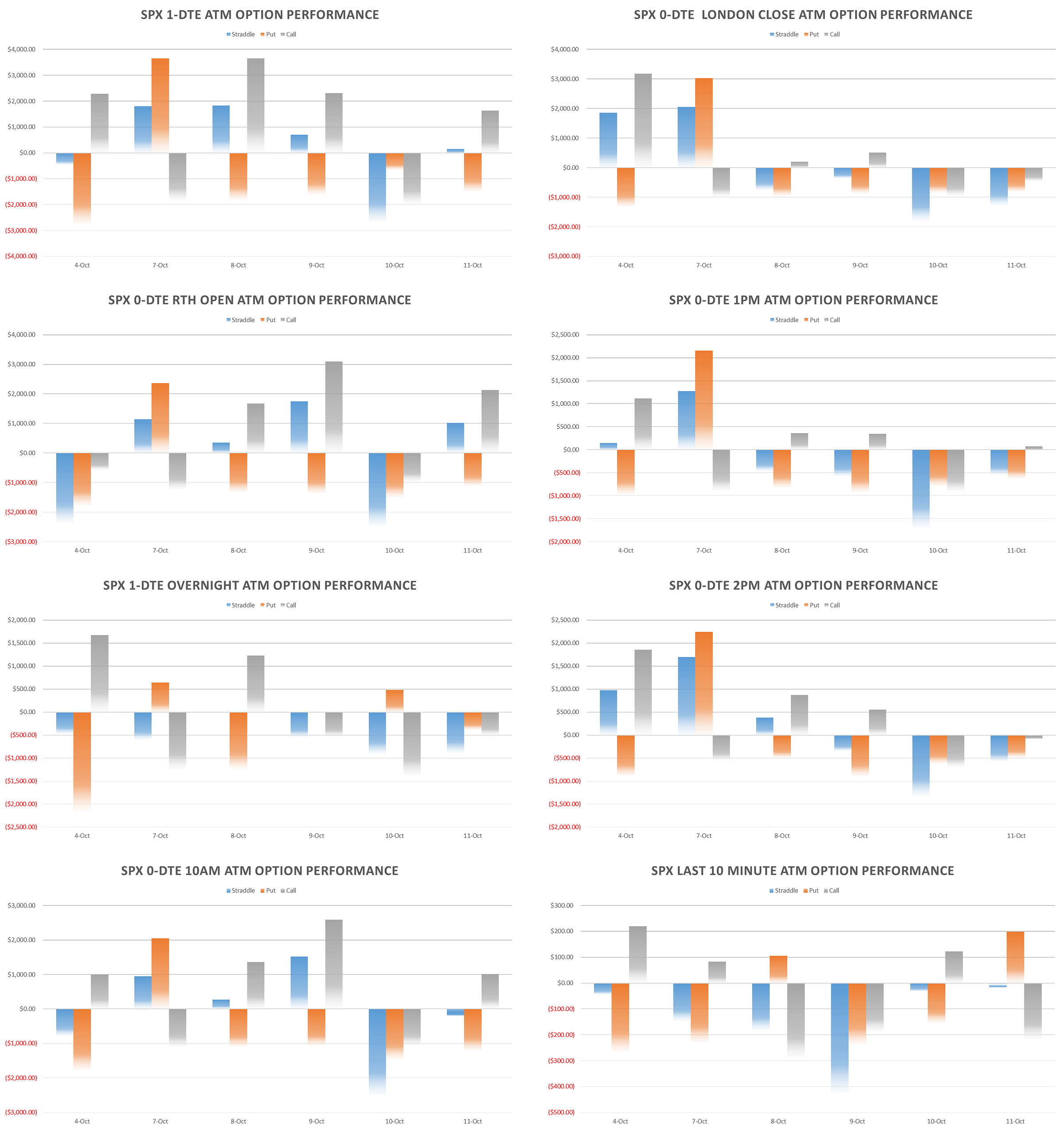

Long 1-DTE gamma bleeding since August jump. Last 3-4 weeks, initially the straddles were overpriced and now looks like intraday vol died completely with very weak trend from open till close.

Intraday straddle cross section showing 10:30-London Close still the strongest mean reversion period intraday YTD. Although all periods taking a hit last few weeks as we are back to realizing sub 10 rvol.

With Q3 Earnings Season kicking off, make sure to check out

for the earnings straddle trades!For a look at how to take advantage of the elevated index implied vol going into the election as well as see the overall performance of long/short SPX delta hedged daily/weekly straddles, check out the newest post:

Realized Volatility Overview

Early weakness after SPX open almost all week, grind higher overnight and into US session close. ~18% of the entire gain YTD from the globex session, sub 5% intraday.

Bit of a jump back above 10 for 10-day rvol following almost 100pt jump in SPX last week.

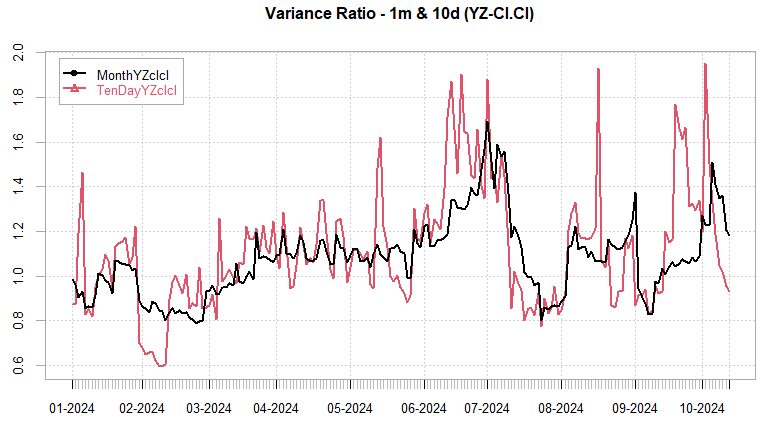

VarRatio’s normalized following the follow through on upside last week. Intraday action likely to remain range bound.

For realized volatility & vix futures performance around election years, check out this post from early September.

VIX Futures not dropping all for now, all the demand is coming in during US RTH session.

SPX ATM Straddle Performance

Mixed results last week, long 1-DTE straddles on SPX winning 4/5 days. Overnight long straddles 5/5 red. As we’ve dropped back to ytd lows in short dated straddle implieds, getting harder and harder to convincingly sell these wafer thin premiums, especially with SPX somewhat stretched short term, with numerous vol catalysts still in the air.

Variance Ratio Conditional Performance

From the following post:

Stayed mostly in cash last week for the 1-DTE legs, short RTH session straddles. For Monday, short 1-DTE straddle from Friday close & short the RTH straddle at US session open.

VX Carry & SPX Overlay

From the following post:

VX system triggered exit at open last Monday, has not traded since. Oct contract almost done, Nov not interesting as a short for now. Given how low realized vol is, would not be surprised if we are sitting back at 10-12 VIX by early Dec.

Have a good week!