Delta Hedged SPX 1-DTE Straddles

Part II - Conditional performance based on VRP, IV / RV buckets, Taleb Ratio (trend / mean reversion)

Continuing from Part I:

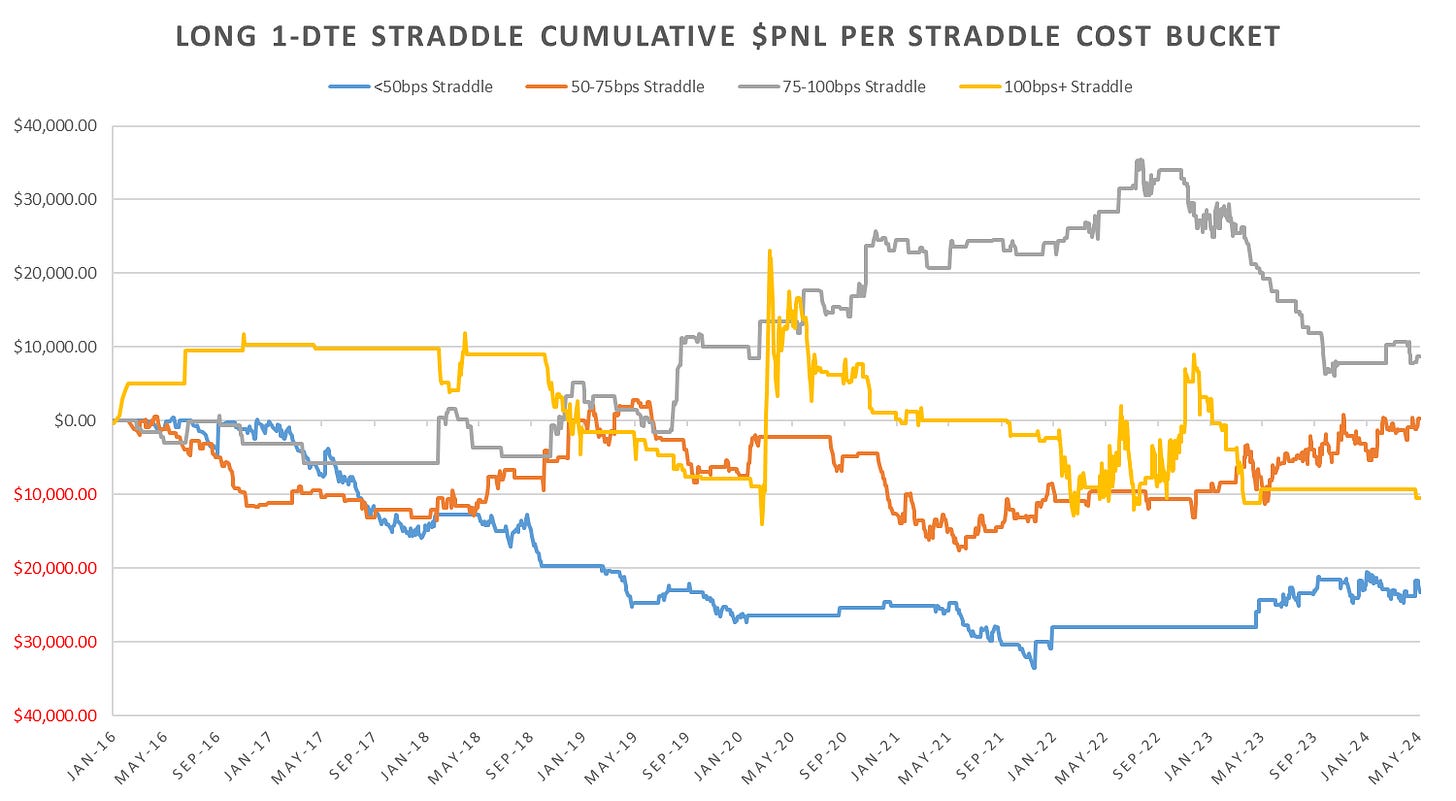

Performance Conditional on Straddle Cost

In order to further explore conditional performance, we split the 1-DTE straddle cost over 4 buckets:

<50bps

50-75bps

75-100bps

100bps+

Each bucket covers roughly 32% / 28% / 18% / 21% of overall data set.

Overall picture lines up with what we see in event days, last year and a half buying event premium a losing proposition as data fails to disappoint enough for event premium to be worthwhile. We can also note the weaker persistence of ‘cheap’ 1 day vols, as buying <50bps and 50-75bps straddles avoids bleeding out compared to 2016-2019 periods.

Looking at the daily discrete hourly delta hedging pnl per straddle cost bucket, we see, last 1.5 years, some mean reversion intraday in higher cost straddles, with least mean reversion in the 50-75bps bucket.

Performance Conditional on VRP

VRP defined as the difference between Straddle Entry IV annualized minus 10-day annualized rvol (Cl.cl, YZ estimators). Positive VRP when Entry IV > Rvol, negative if Entry IV < Rvol.

Keep reading with a 7-day free trial

Subscribe to Vol Vibes to keep reading this post and get 7 days of free access to the full post archives.