Following up on last weeks overview:

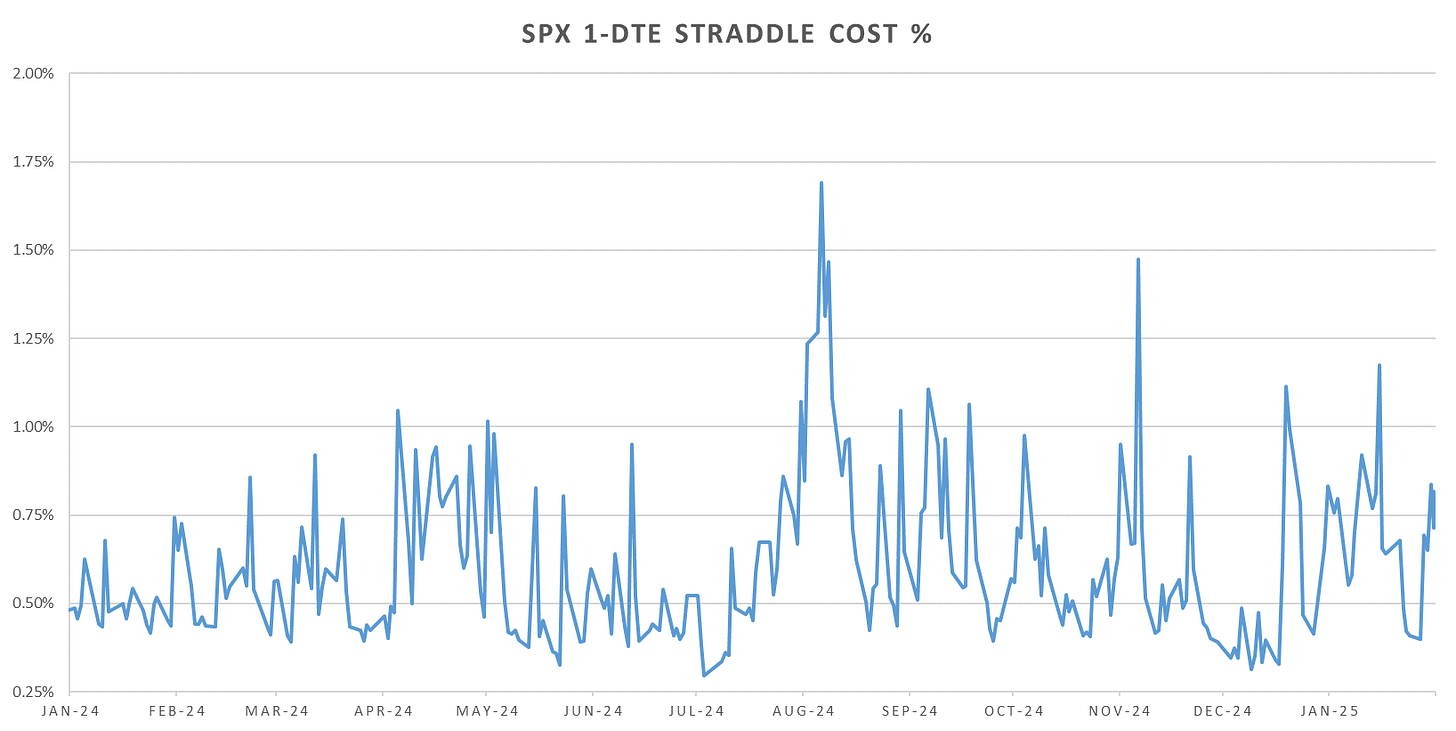

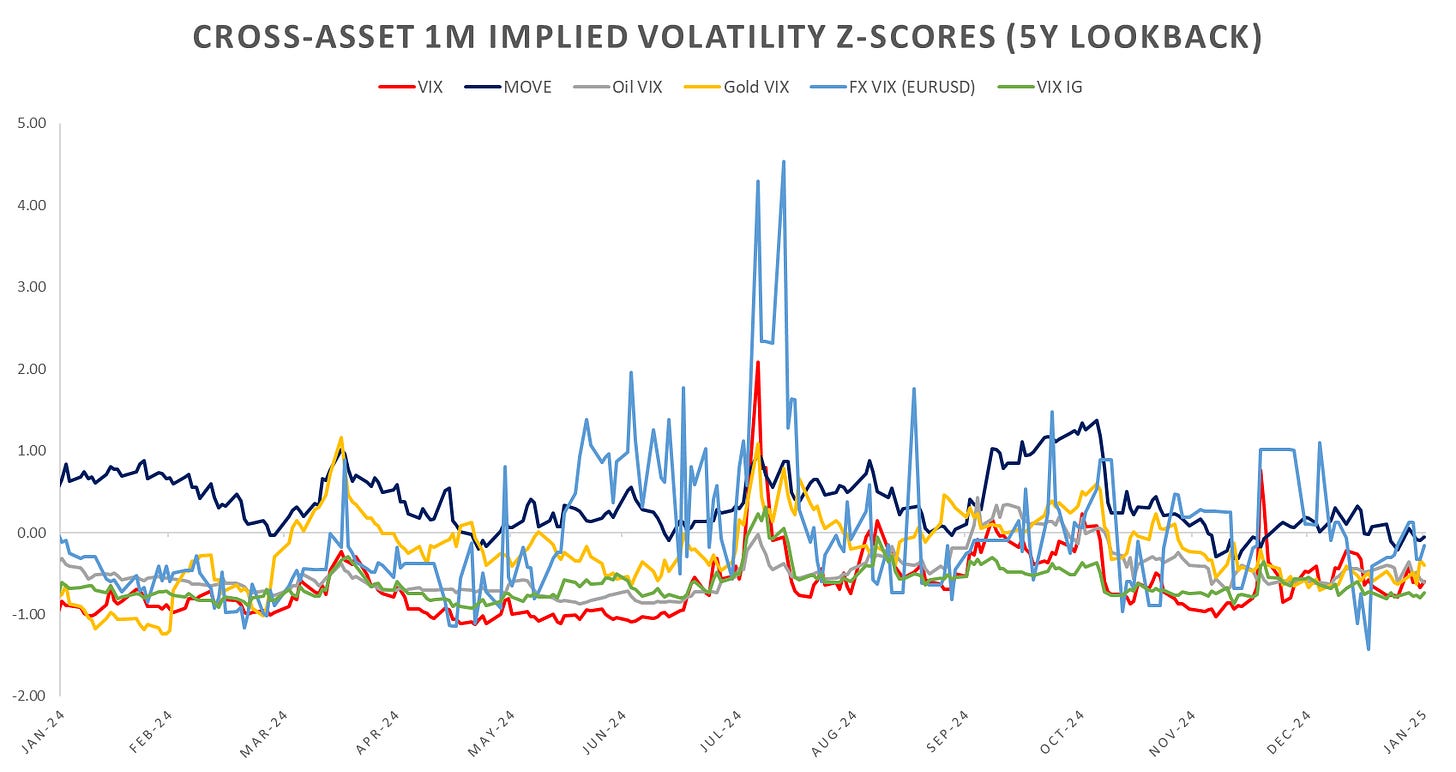

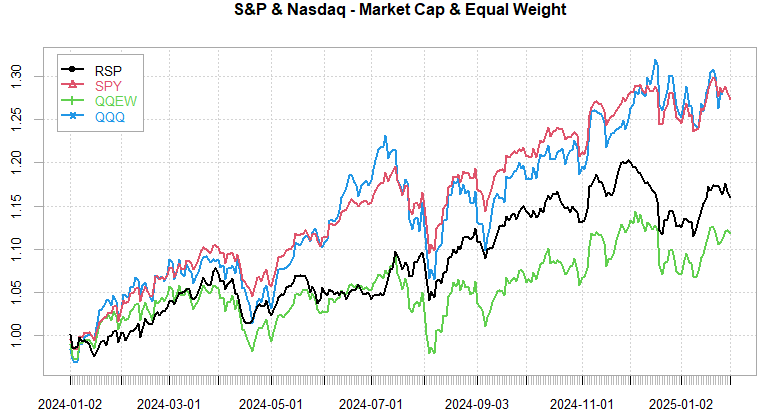

Trade Wars ^tm are back in full swing, Canada/Mexico tariff tango & now China imposing 15% tariffs on US coal & lng exports leaves us with wild whipsaws on indices. General consensus is we are back to 2018/2019 headline trading. Main difference being implied correlations are now significantly lower (1m at ~10% avg vs 35%+ in 2018 after trade war started.) Majority of SPX index gains now are also coming purely from Mag7 and the AI theme. It should be noted despite all the headlines SPX is largely still stuck within few % of ATH.

With single stock volatility near top quarter percentiles over the last 20 years, correlations are near 30 year lows. For indices to have any meaningful correction, something has to move the AI basket lower.

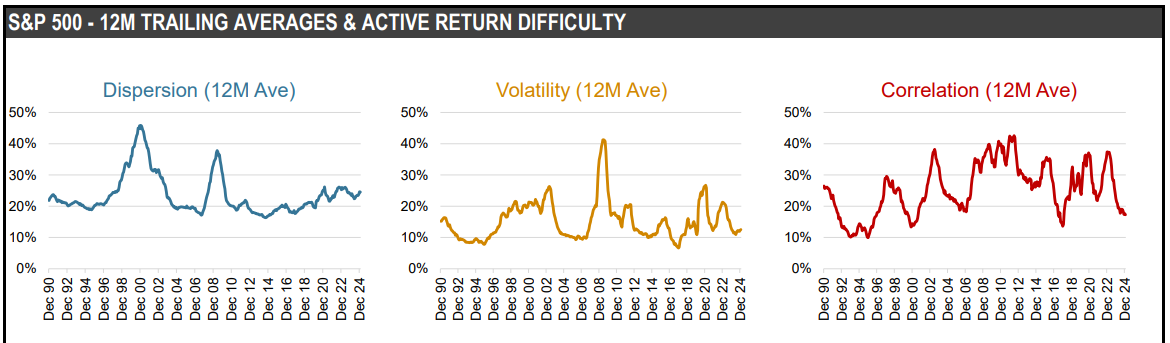

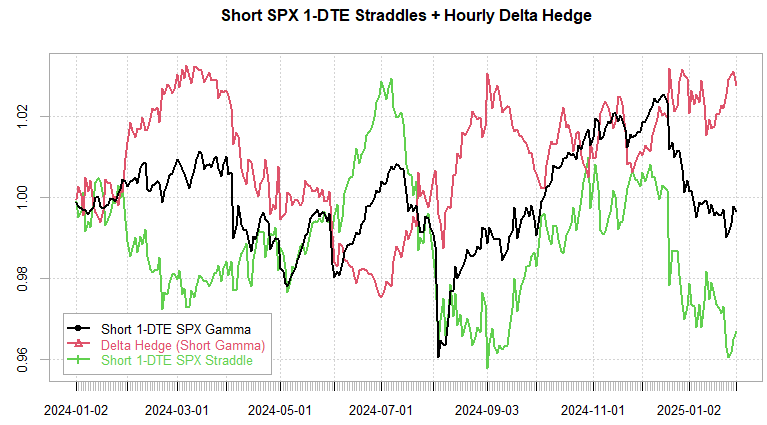

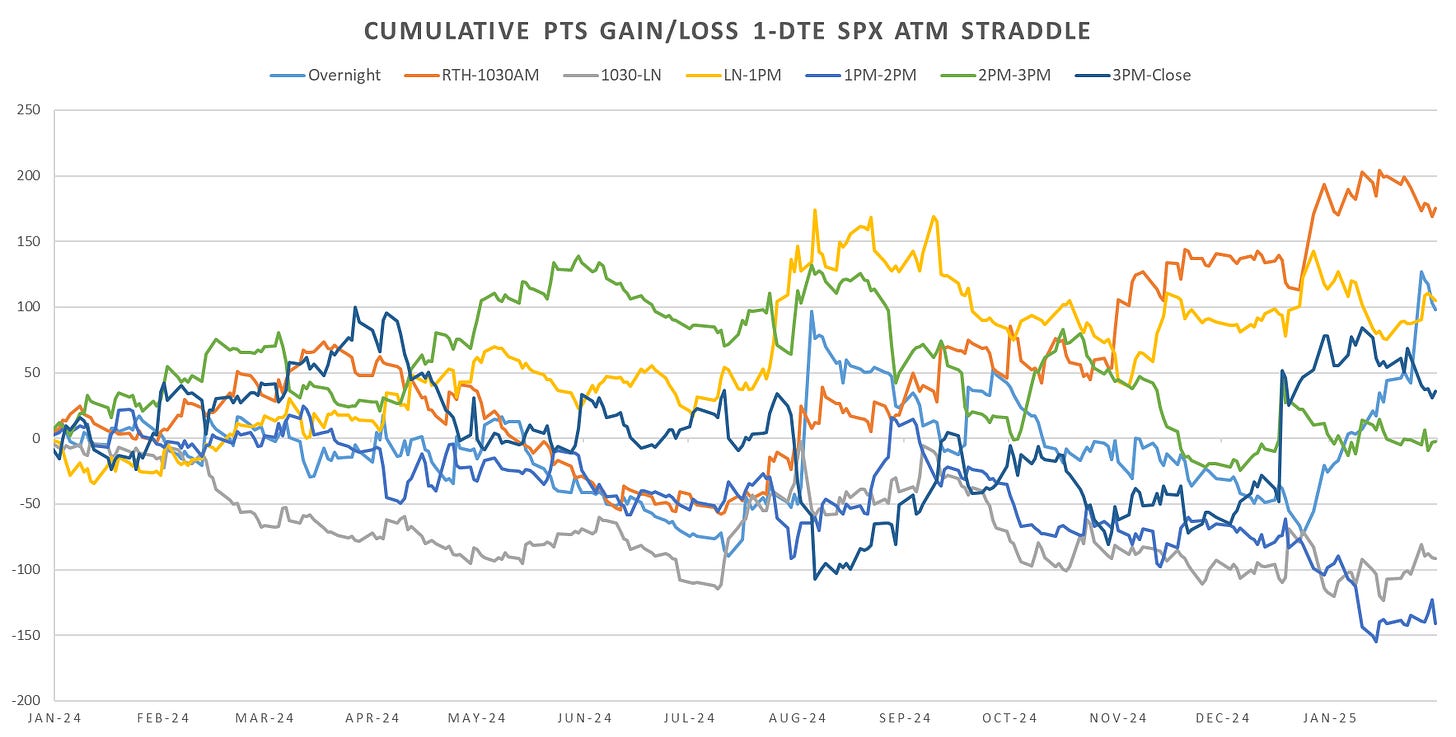

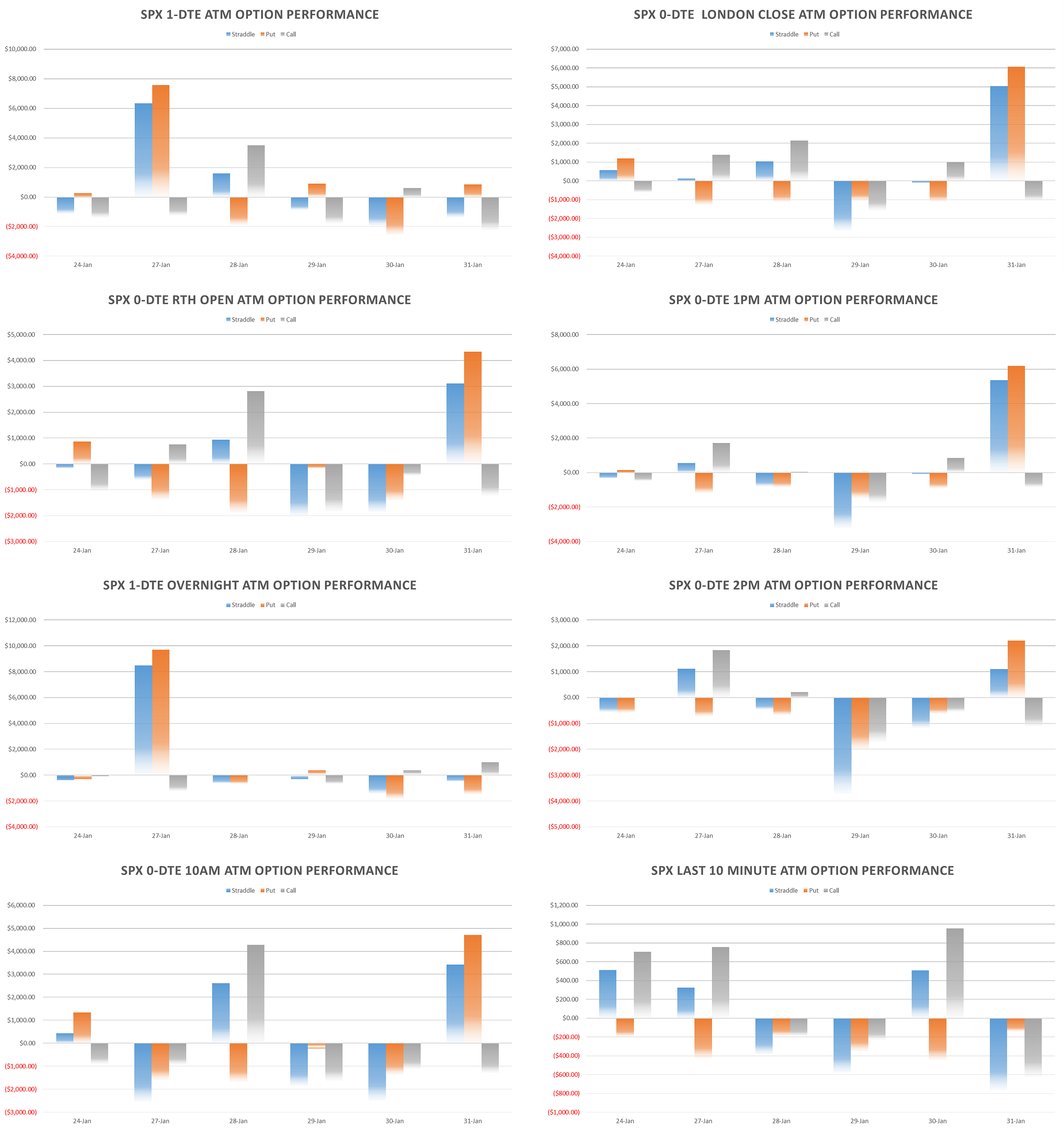

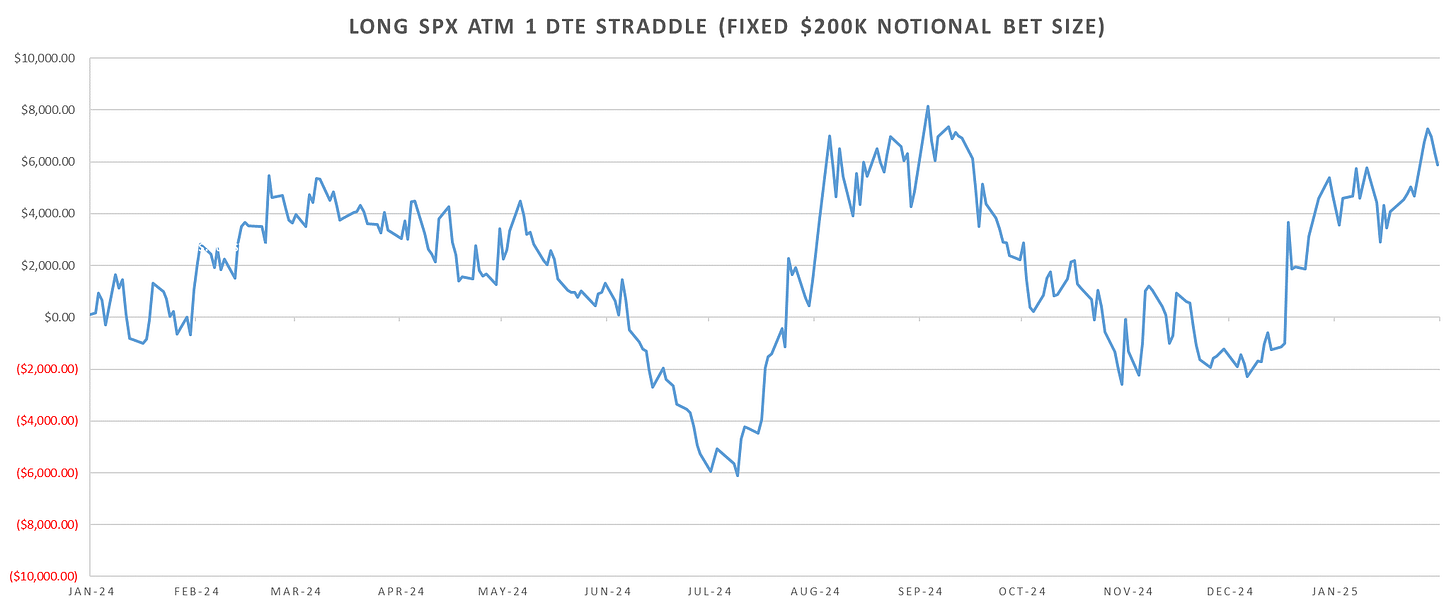

1-day implied vols climbed higher towards the end of the week, however, as will be evident lower in the post, outside the overnight moves on headlines, intraday & short dated SPX straddles have struggled to breakeven majority of the time.

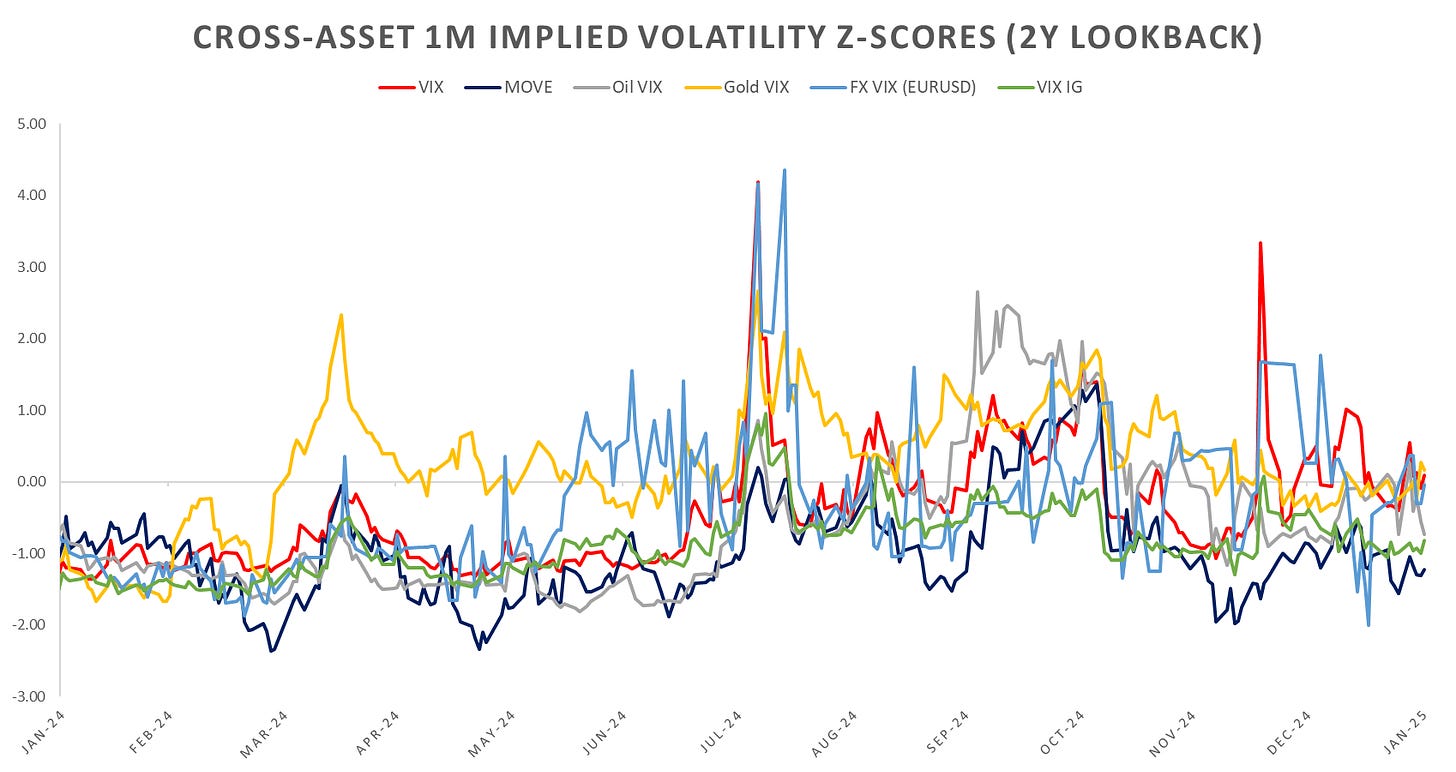

~Avg implied vols across assets over the last 2 years, equity vol leading last week on the Deepseek news. Likely overtaken by FX vols after the tariff headlines this week.

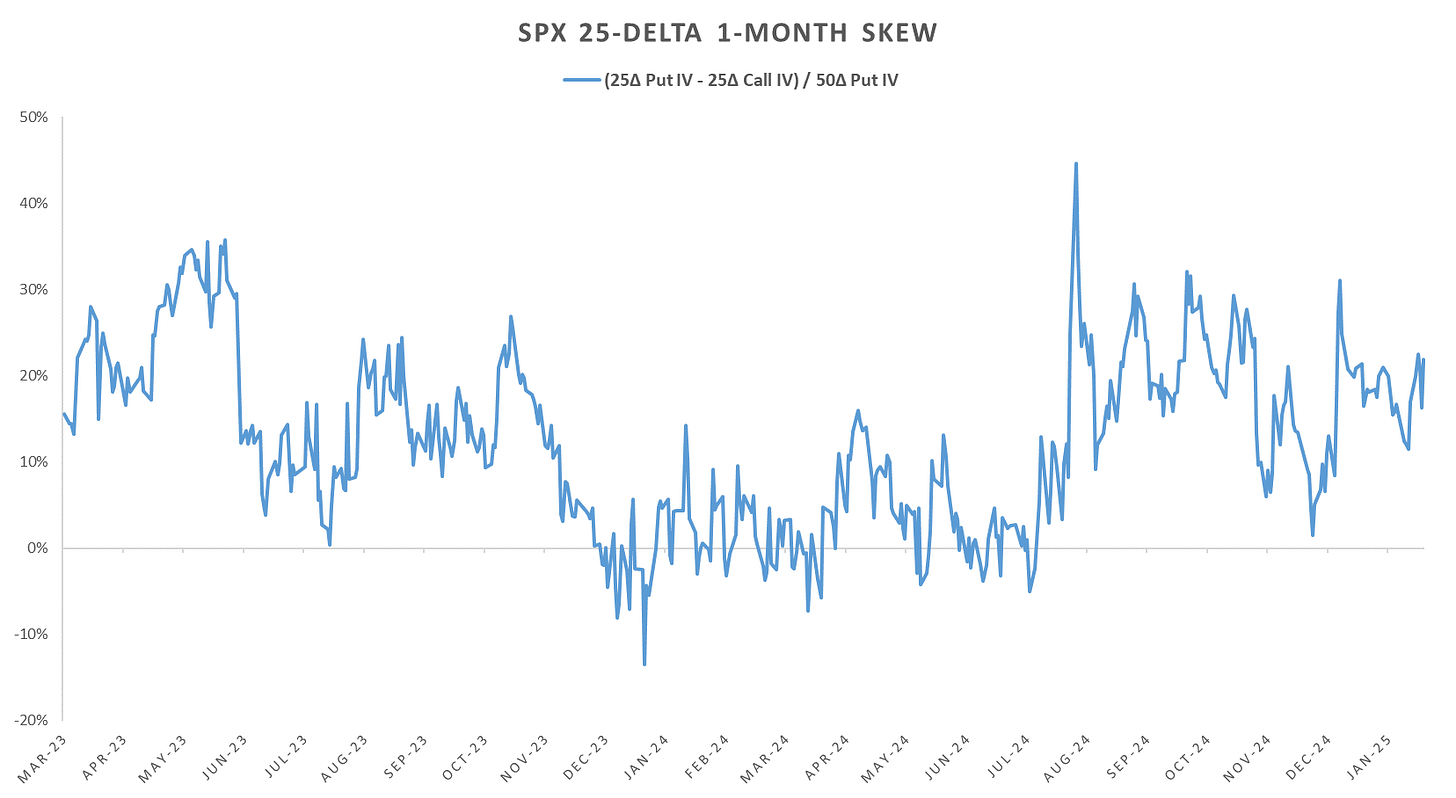

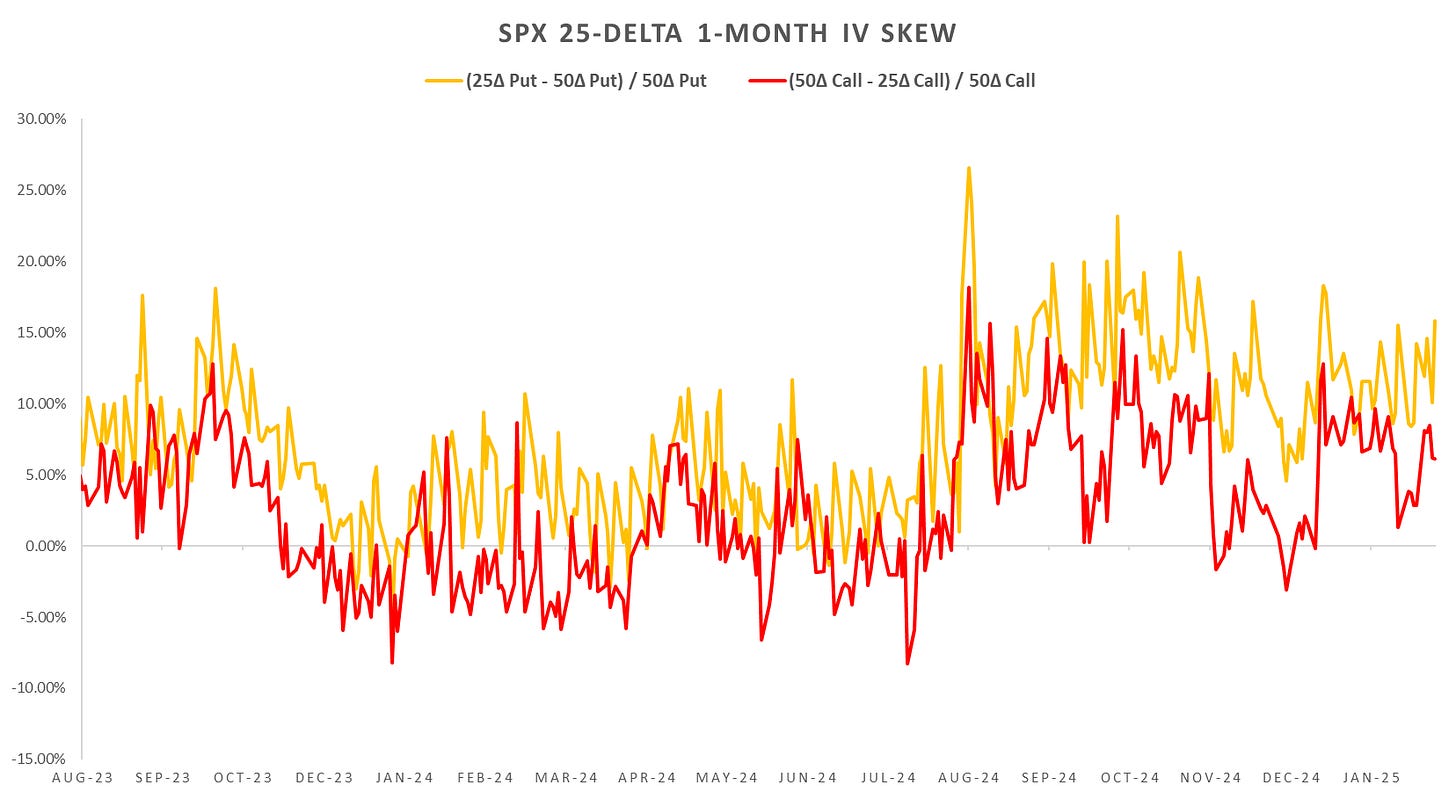

Looking at SPX skew, 1m put skew steepest since Dec 18th FOMC drop. Has not eased since July dispersion blowout.

Looking at intraday price action:

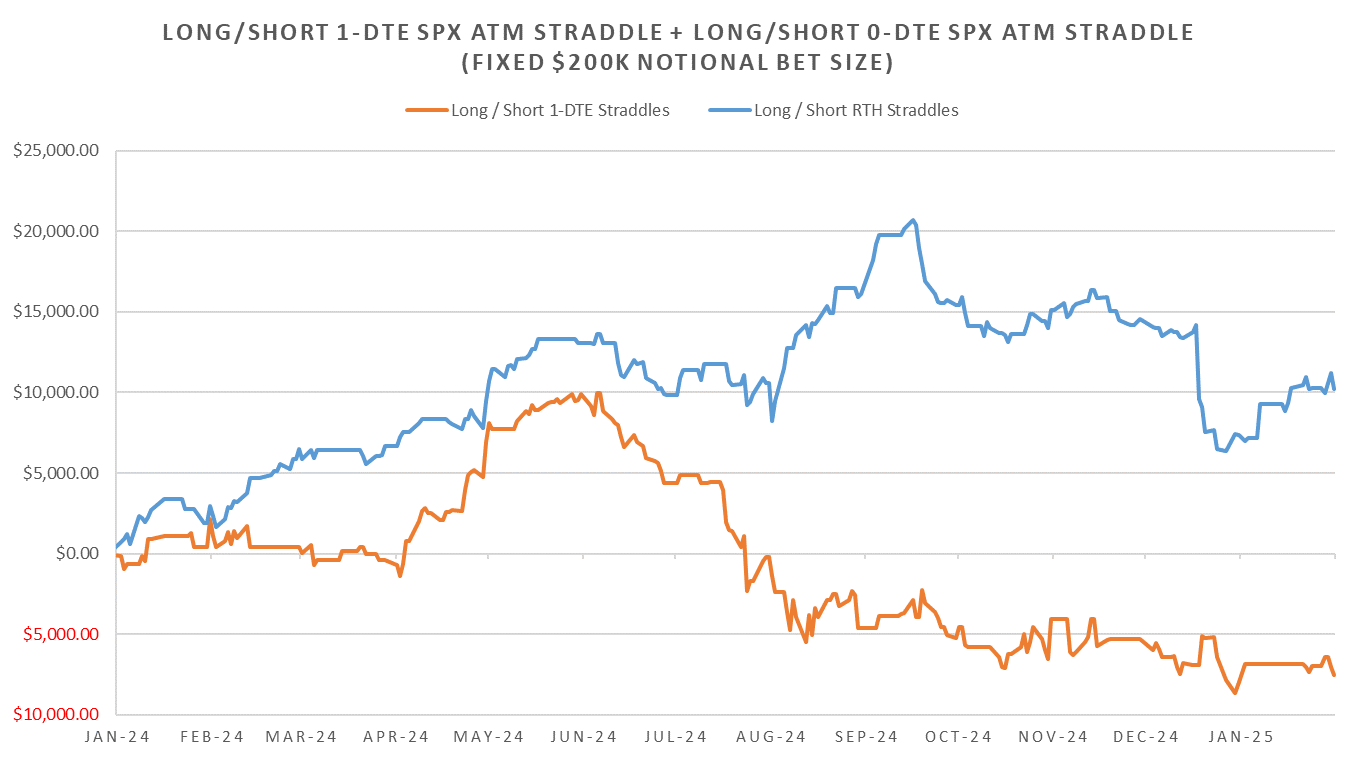

Short delta hedged 1-dte straddles performance suffered again last week on the NVDA drop on Monday, however, the trade recovered everything by Friday close. Intraday trend pnl (long underlying with short 1-dte straddle deltas as position sizing) sitting at 1 year highs.

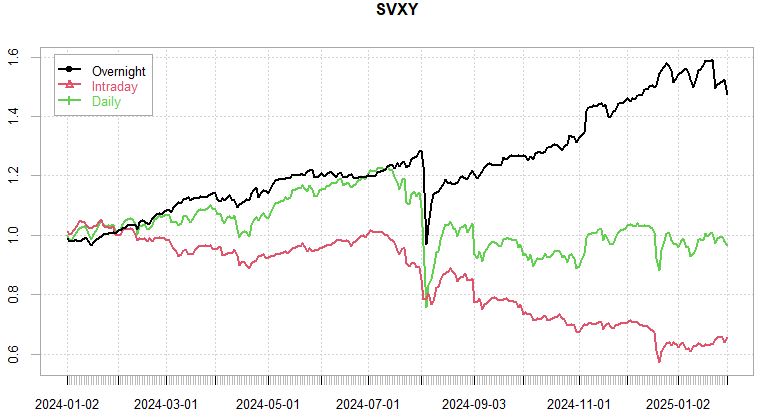

Overnight quickly becoming the best performing period for 1-dte straddles. RTH open to 10:30am still holding up since July on strong follow through of the overnight action. 10:30-LN & 1pm-2pm most stable mean reversion / short straddle performance periods.

Realized Volatility Overview

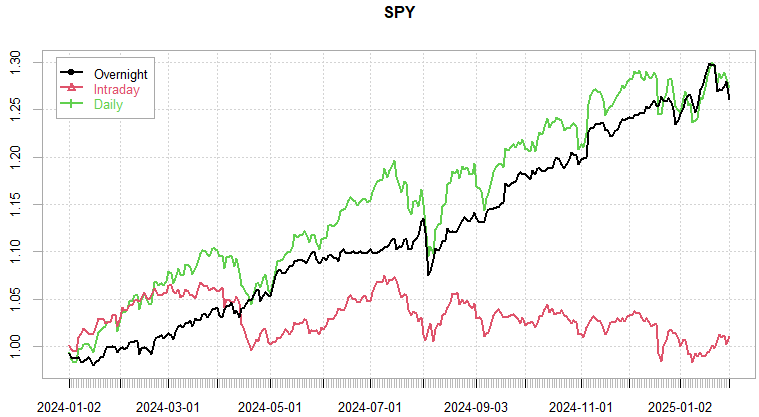

Rough few weeks for overnight longs, RTH performance back above 0 since 2024. Nothing major broke yet, S&P largely range bound with every dip vigorously bought.

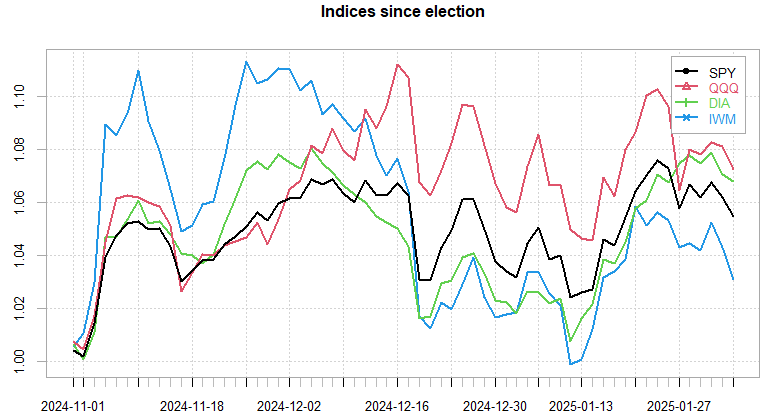

IWM was most excited for Trump presidency, now closest to giving up all the gains since election. All about the megacaps & AI…

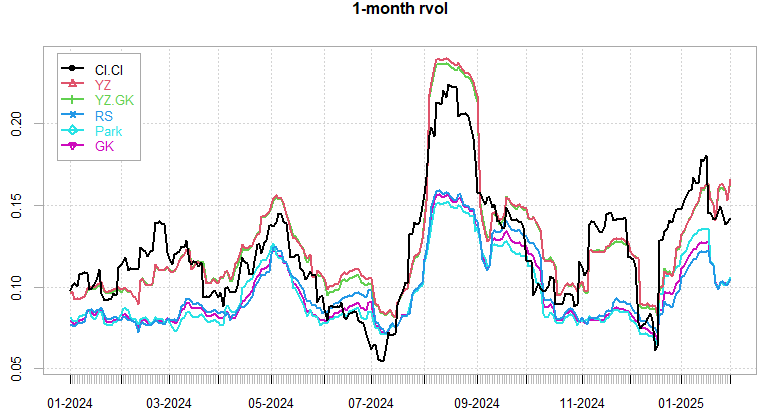

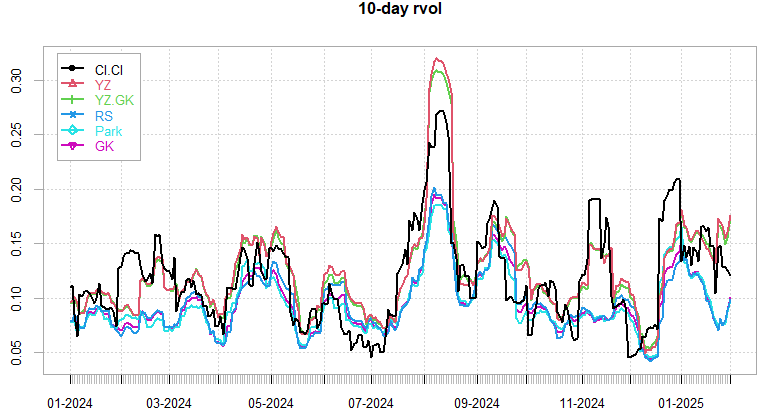

Finally some divergences between volatility measures, intraday range based volatility dropped back below 10, with cl-cl vols almost double that.

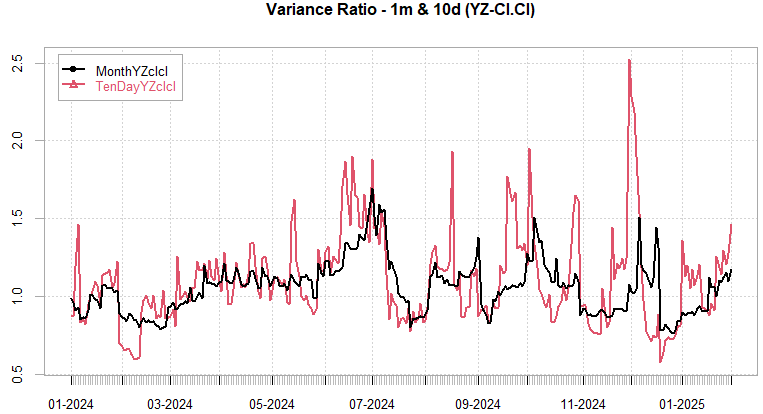

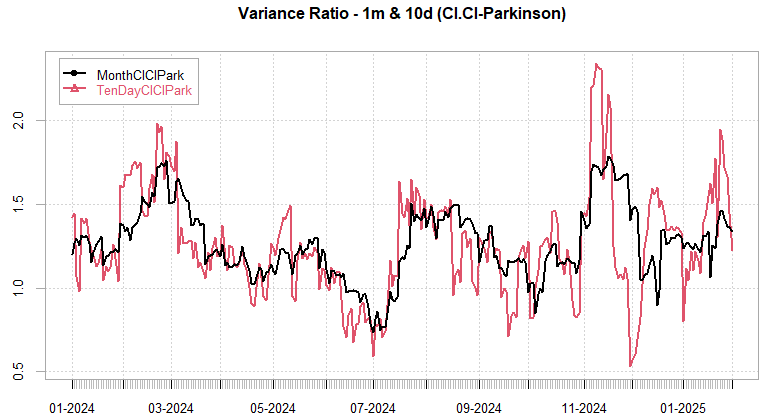

Bias is now to see some follow through in terms of direction over the next few days/weeks after long period of mean reverting overnight moves.

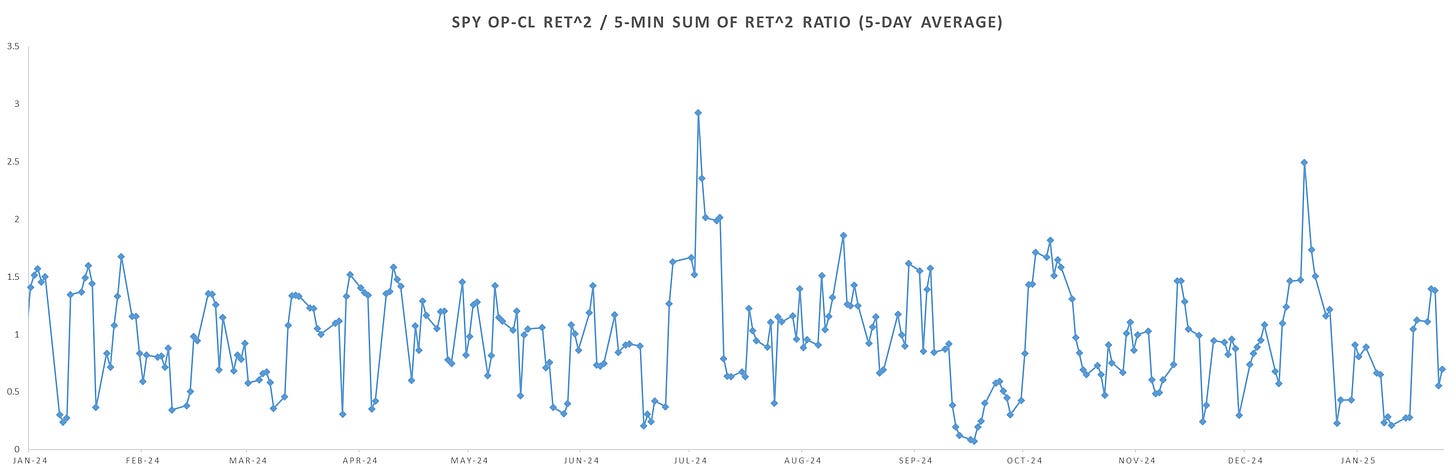

Intraday volatility ratio also shows increase in intraday mean reversion as of last week, no follow through on headlines.

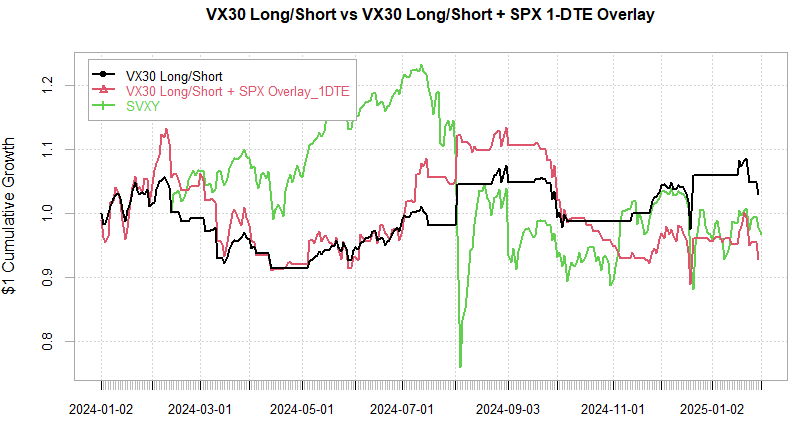

Short vol ETP’s choppy but going nowhere for few months now. Lots of whipsaws on the VX carry trades, looking back at 2018-2019, 2019 saw first 9 months of the year SVXY roughly flat…

SPX ATM Straddle Performance

Performance in overnight straddles purely from Monday gap down, outside of that, red by ~30pts next 4 days. Similar picture across other time periods. Violent moves but vol does not have any follow through, gap and camp. Selling straddles post headline moves winning last few weeks.

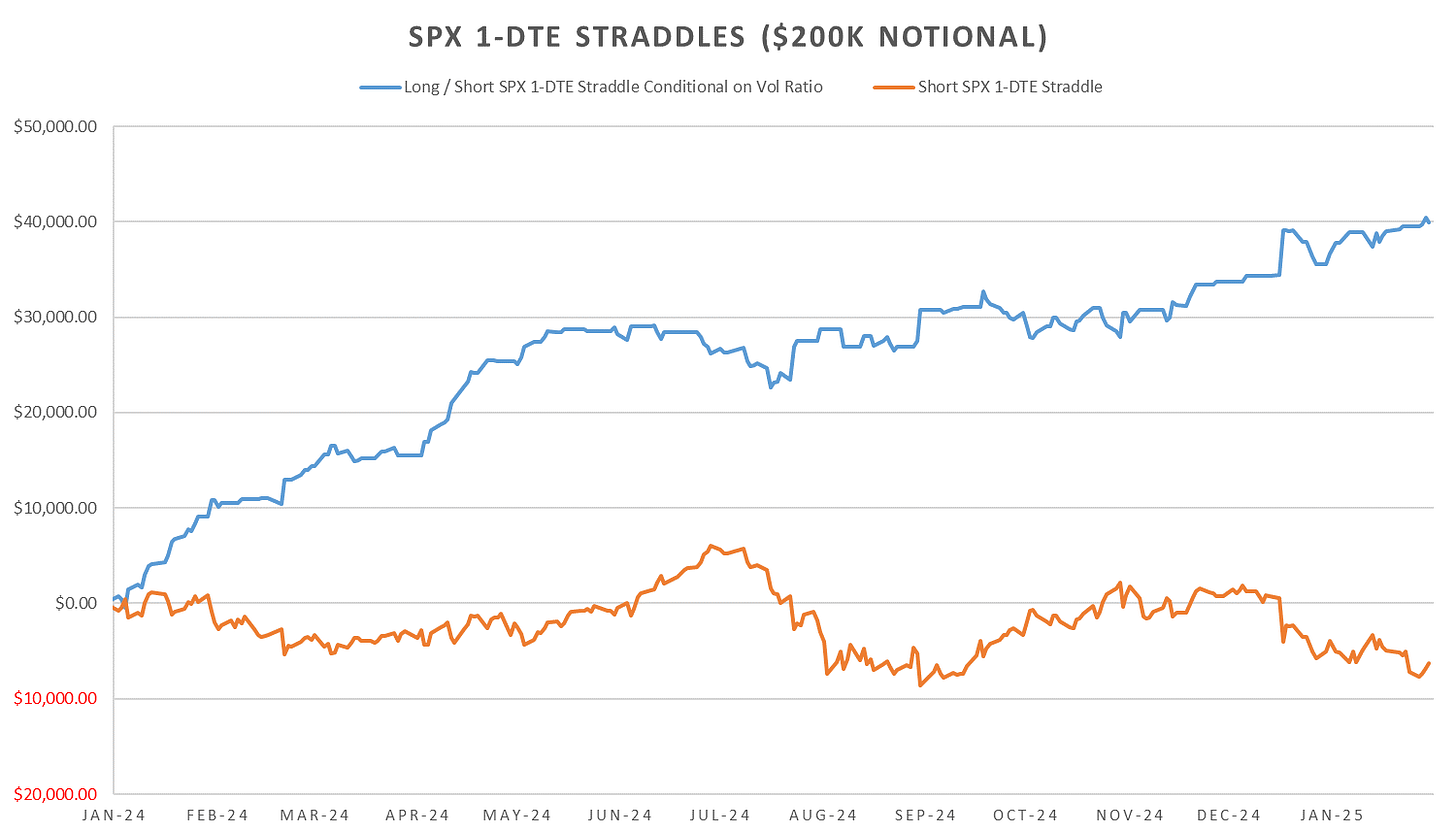

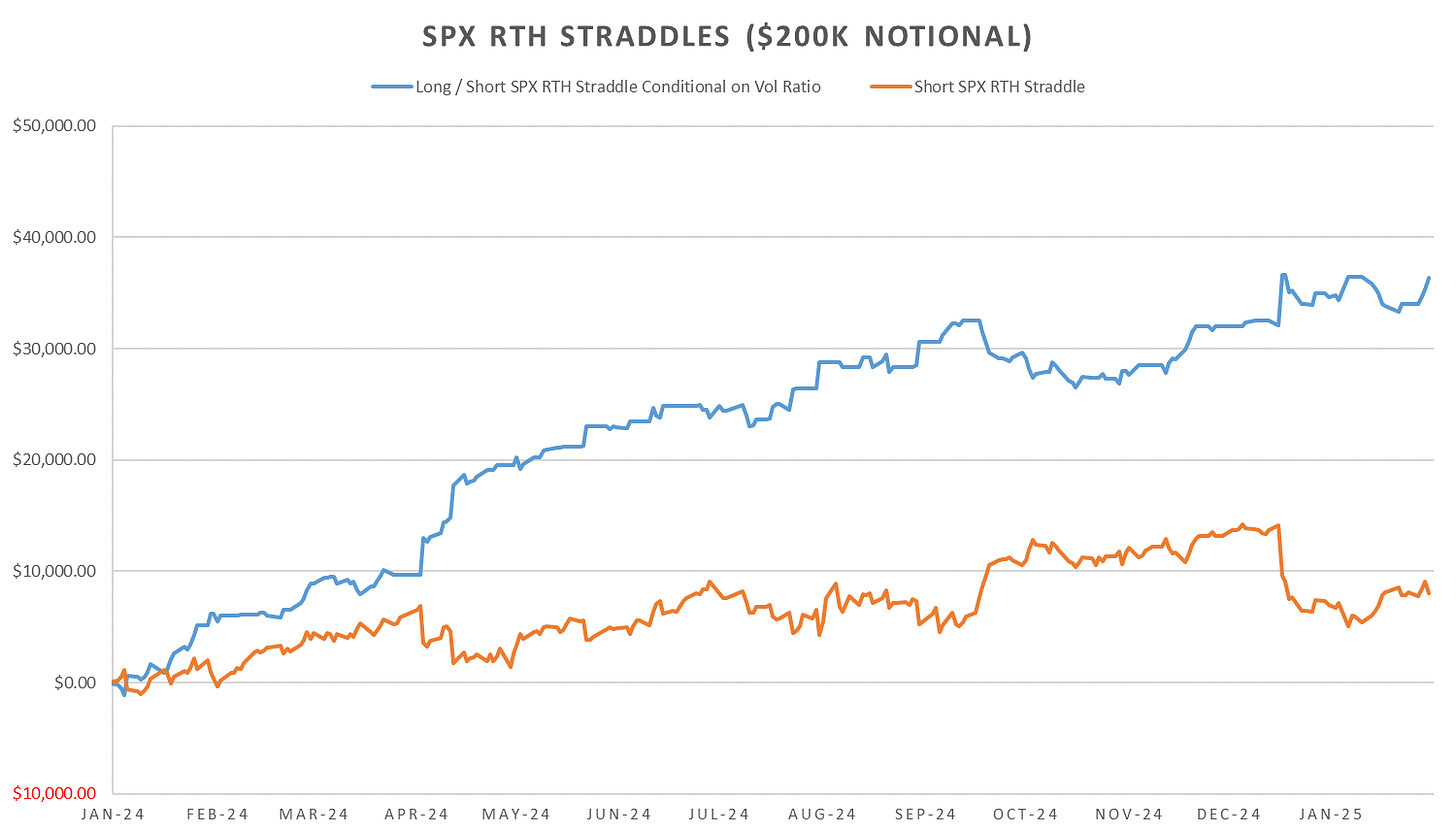

Variance Ratio Conditional Performance

From the following posts:

VarRatio filter:

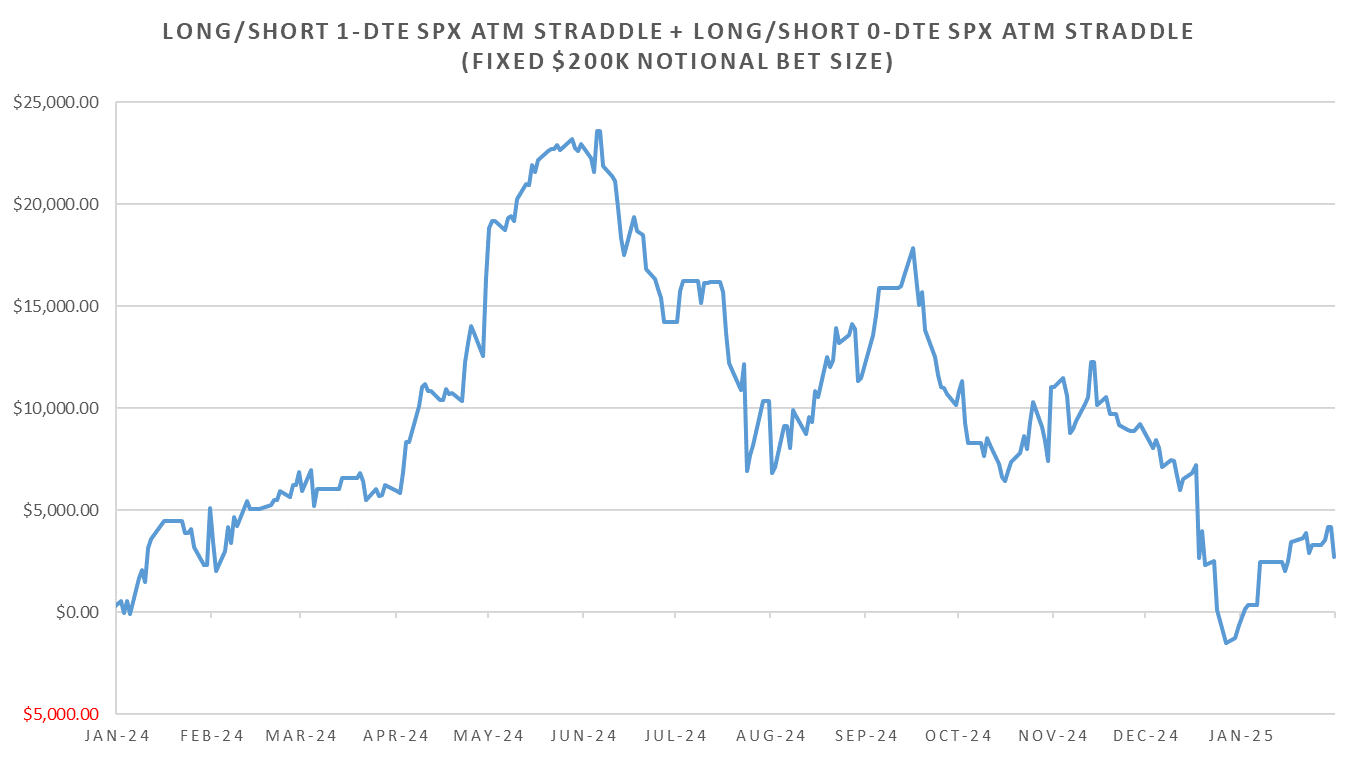

Long/Short 1-dte straddles keeps struggling as flat out long straddles performance is now positive since start of 2024.

5-min intraday volatility ratio filter:

Fading extremes in intraday mean reversion / trend continues to perform extremely well last few years.

VX Carry & SPX Overlay

From the following post:

Getting whipsawed hard on the weekend news cycle. Back to cash after Mondays drop. Couple of people messaged about the short VX trade into headlines and current environment. There is no silver bullet, position sizing & risk management through the painful periods (and there were / will be plenty), jumping the gun and calling tops on vol spikes (in size) is a recipe for disaster.

See following post for position sizing & drawdown expectations:

Have a great week!