VIX Futures & Volatility ETPs

Position sizing for systematic volatility selling, descriptive statistics & basis predictive properties

First in a series of posts on the VIX complex (ETP’s, VX Futures & Options).

2024 has been a horrible year for Vol ETP’s, especially considering the SPX performance (up 20%+). In this post I will cover the reason behind the lag in performance for vol etps, why buy & hold is not the best approach for short vol etp trading and look at some stats for perhaps the most common ‘feature’ of the short vx trade - the basis (VIX - VX1 or VX30).

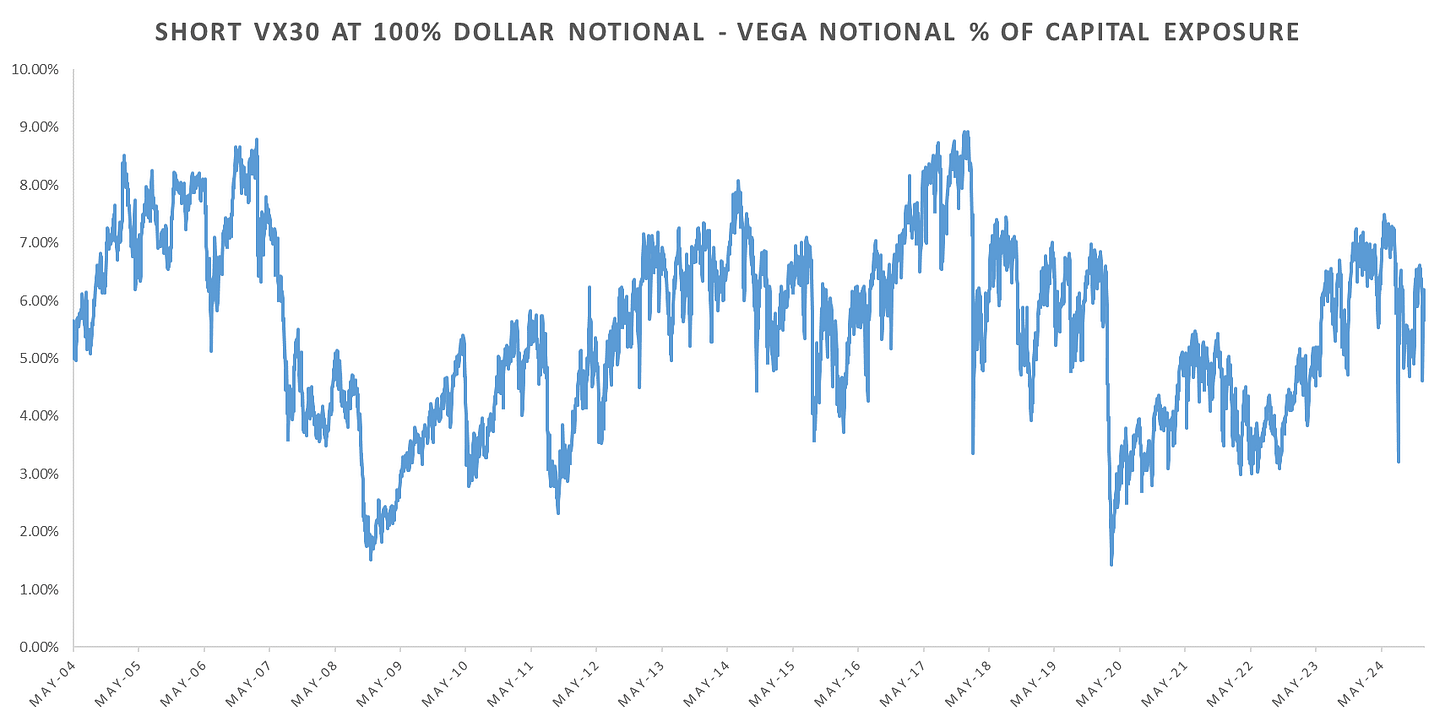

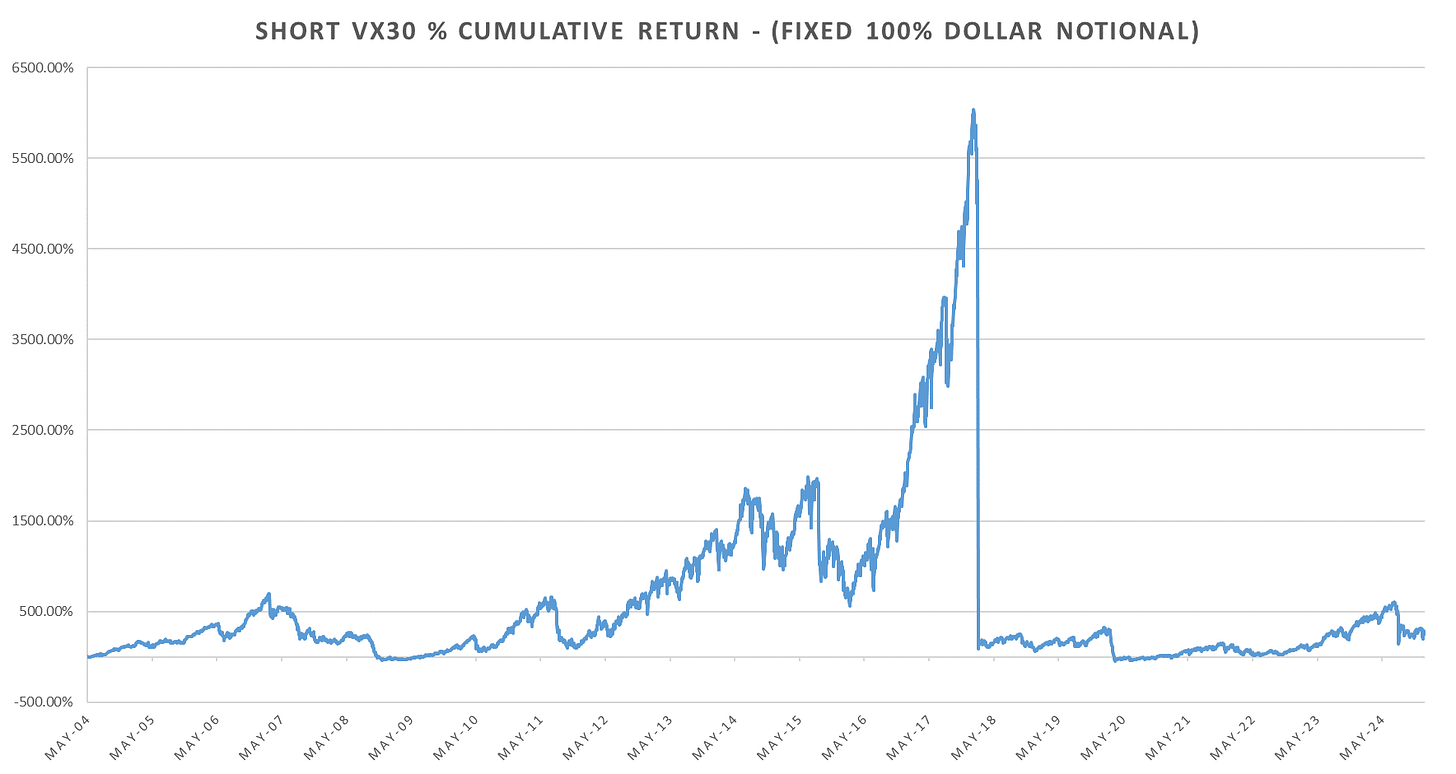

Chart: Short -1x VX30 performance derived from weighted VX1 & VX2 series (100% Dollar Notional position sizing)

The problem with volatility products that makes them lackluster for buy & hold trading (if you don’t believe the prospectus that clearly states it) is that they size to 100% dollar notional, meaning that whatever the AUM of the ETP’s, they are long either 50% (SVXY) or 100% of the AUM in the weighted 30-day synthetic future. The dollar notional is just $1000 * VIX Futures price ($100 for VXM). Vega notional is always $1000 * # of contracts short/long.

As AUM of these products fluctuates, while the dollar notional exposure remains the same, the vega notional exposure fluctuates significantly. Worst part is that vega notional exposure as % of capital ends up being largest just when VIX Futures prices are lowest, and lowest when VIX Futures dollar notional is highest (you are short the least vol when its expensive and short the most when its cheap.)

This dynamic leads to familiar pattern we’ve seen in the -1x products:

Position Sizing

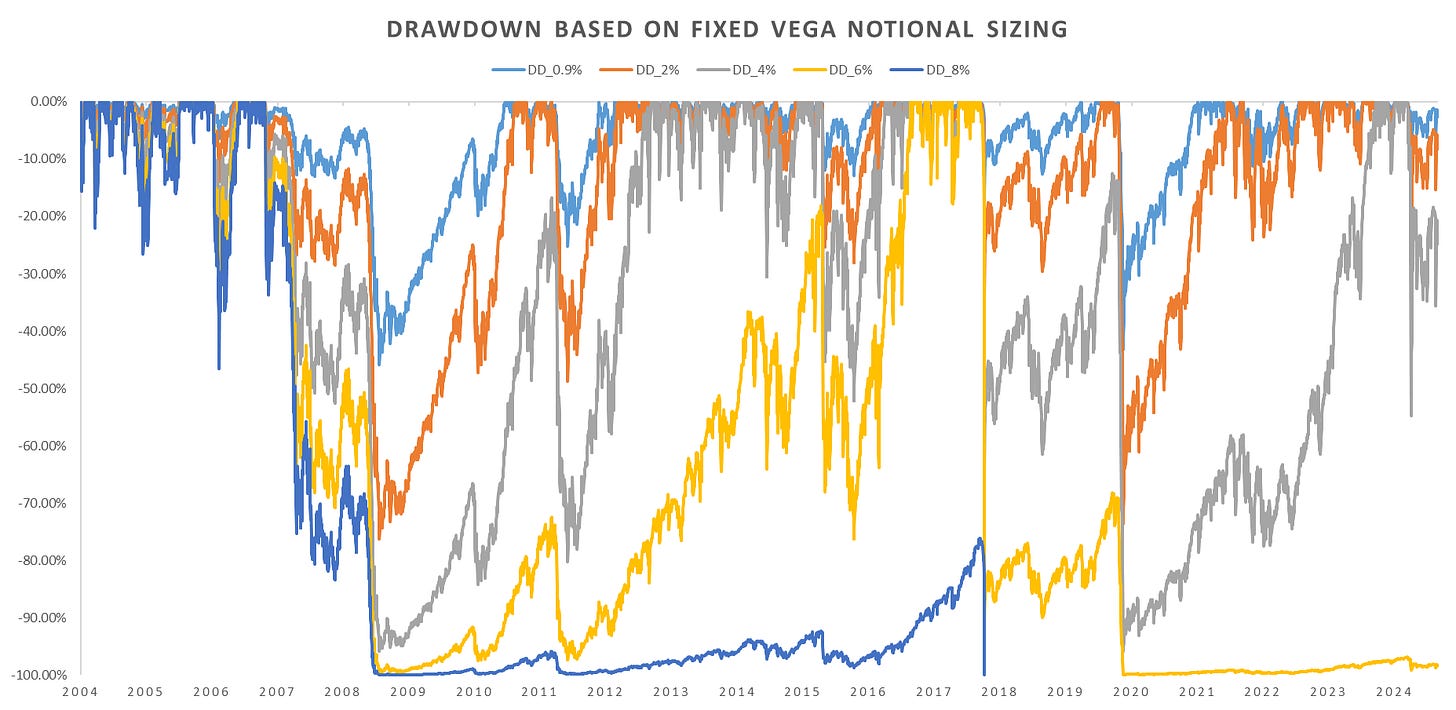

The frequency of large single-day moves in VIX futures keeps increasing (we’ve seen 2 in 2024 alone.)

Using a fixed vega notional as % of capital position sizing, we can see that anything above 6% would not survive the 2018 spike and barely survive 2008 (a $1m portfolio would be down to 3 VXM Futures at the bottom, if VXM existed…) Even a 0.9% vega notional sizing position would be down ~50%.

A 0.9% vega notional position sizing nets ~8% for systematic VX30 short and ~10% for a VX1 short (held from contract roll to the night before expiration.)

Using a fixed vega notional position sizing proved to still be profitable in 2024 (and 2022 for comparison) with VX30 short outperforming VX1 short.

Since 2004, short VX1 now outperforming the contango filter (short VX1 only if VIX<VX1.)

Shorting VX1 instead of VX30 saw wild run in outperformance from 2019 to 2021, much like in the period after 2008. Uncertainty keeping the 30d+ vols bid but the near term contract is free to roll off into spot.

VIX Futures Basis

The basic assumption behind the short VX trade is that the futures ‘roll down’ the term structure towards spot VIX, which represents a premium that can be harvested.

The following paper tests this hypothesis based on data from 2006 to 2011:

https://www.efmaefm.org/0efmameetings/efma%20annual%20meetings/2013-Reading/papers/VIX%20paper_EFMA.pdf

I’ve extended this analysis a few times before, in late 2018 and just now with data up until end of 2024.

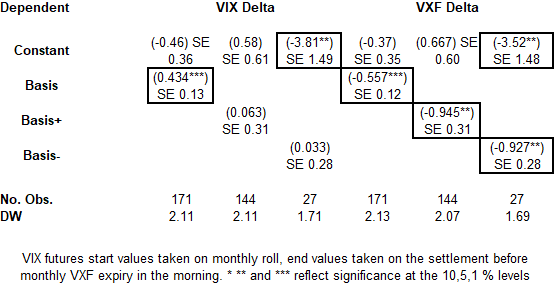

The 2006 - 2011 results from the paper:

Tldr; the basis (VX1-VIX) represents a fairly good predictor for the front month VX future. A large positive basis (VIX nicely below VX1) is likely to lead to VX1 dropping by ~80% of the basis size. This remains true when filtering by only positive and negative (VIX > VX1) basis. Meanwhile the basis does nothing for the forward spot VIX returns (can see its likely to go up by some % of the basis but with a large error.)

2004 - 2018 data:

By 2018, few things have changed, spot VIX became likely to cover a larger share of the basis, however, short VX performance was still strong (smaller pt changes but then VIX Futures largely returned to lower values in 2016-2017 and even after the 2018 blowup.) The basis still explains roughly 10% of the variation in price for VX.

2004 - Dec 31, 2024 data:

Between 2018 and 2024, we saw quite a bit of change in the market. VIX spot over the entire data sample is eating away at over half the basis over the next month, the basis became even less of a factor for forward VX returns as it now explains just over 1.5% of the variation in VIX Futures price.

VIX futures continue to deliver roughly the same average performance when sized properly, however, the basis predictive power has been dropping gradually since 2018. Instead of premium, the basis now much better forecasts spot VIX changes.

As always, do not hesitate to reach out, this is the first post on VIX Futures / ETP’s this year, I will be posting more on VIX options / futures in the coming weeks!

Have a great start to 2025!

isn't the underperformance of VIX ETN in 2024 due to, in large part, the fact that VX futures were in backwardation a lot of time after the August crash?