Following up on last weeks overview:

Markets ended up closing higher than the tariff announcement week, traders got bombarded with headlines on possible tariff pause once long end yields started blowing out. Despite the possible tariff pause, yields closed the week near highs, erasing all the bond gains.

Over the weekend we once again saw bullish headlines on tariff exemptions, almost immediately walked back a day later with Trump now saying no exemptions were announced on Friday….

Needless to say this is a complete circus, no plan was outlined, nobody understands what the goal is (are we negotiating tariffs, if so then are we just foregoing all the manufacturing jobs that were promised?!)

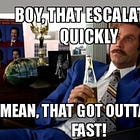

Weekend straddle managed to drop from 3.5% last weekend to ~2.4% for tomorrow, IG weekend markets had us gap up nearly 3% up, now likely erasing the entire drop and possibly opening lower after Trumps clarification on exemptions…

This entire ‘tantrum’ had SPX dipping ~21% from ATH. While large, this is something that happens every few years regardless (think 2018 rate hike correction when Powell refused to cut rates.)

Given the context now, this feels like a much larger shift in macro than a late rate cut…

At the same time this drop was completely engineered by the current administration, the data *was* solid (ofc going forward, the uncertainty this policy shift created is likely to slow growth substantially.)

We saw one of the most brutal rallies on Wednesday, nearly 10% intraday in a couple of hours on a possible de-escalation of the trade war. In the end all we getting is nonsensical volatility (sourced from ones Twitter account…) destroying performance. The usual sources of jump risk during other periods of volatility (Federal Reserve) did their best to smooth out their impact, this time we have an individual who is seemingly enjoying the havoc his statements are causing at absolutely random times of the day/night…

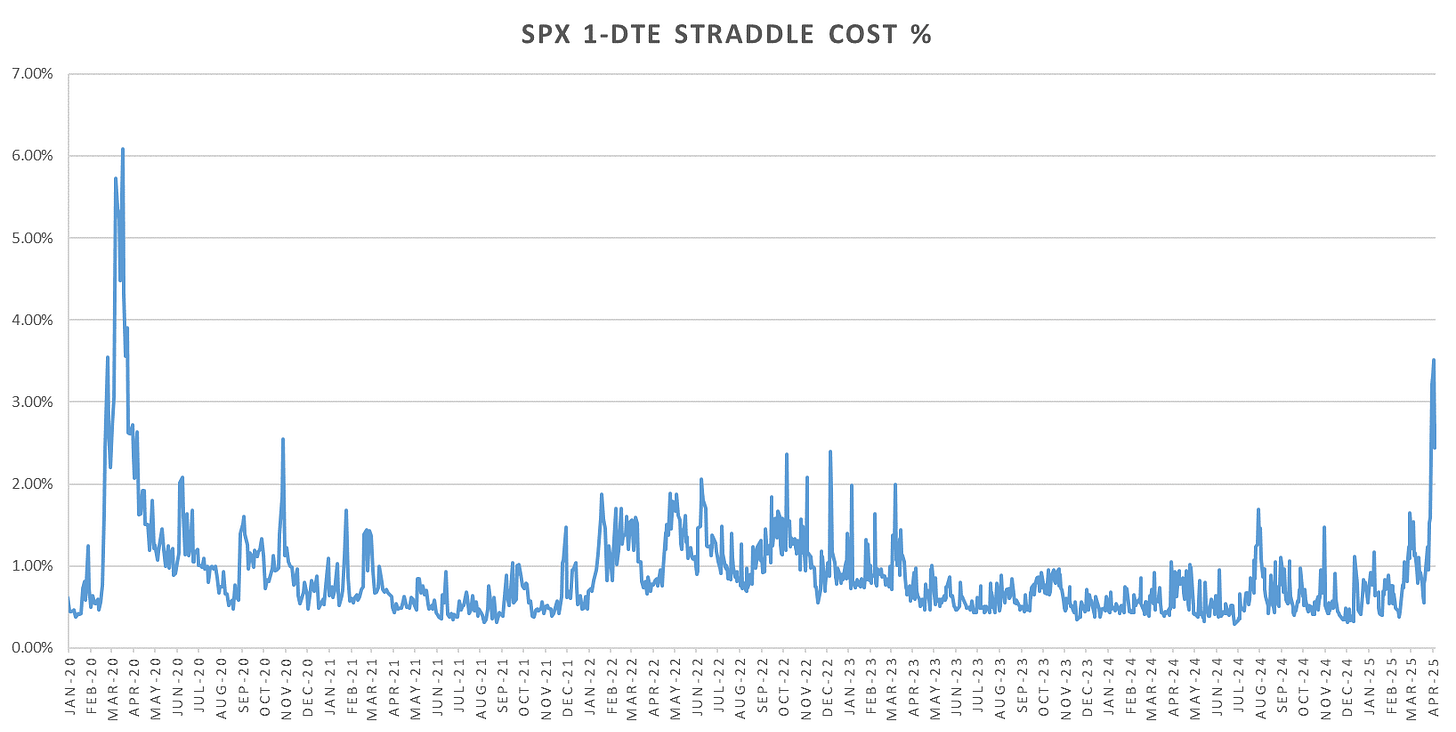

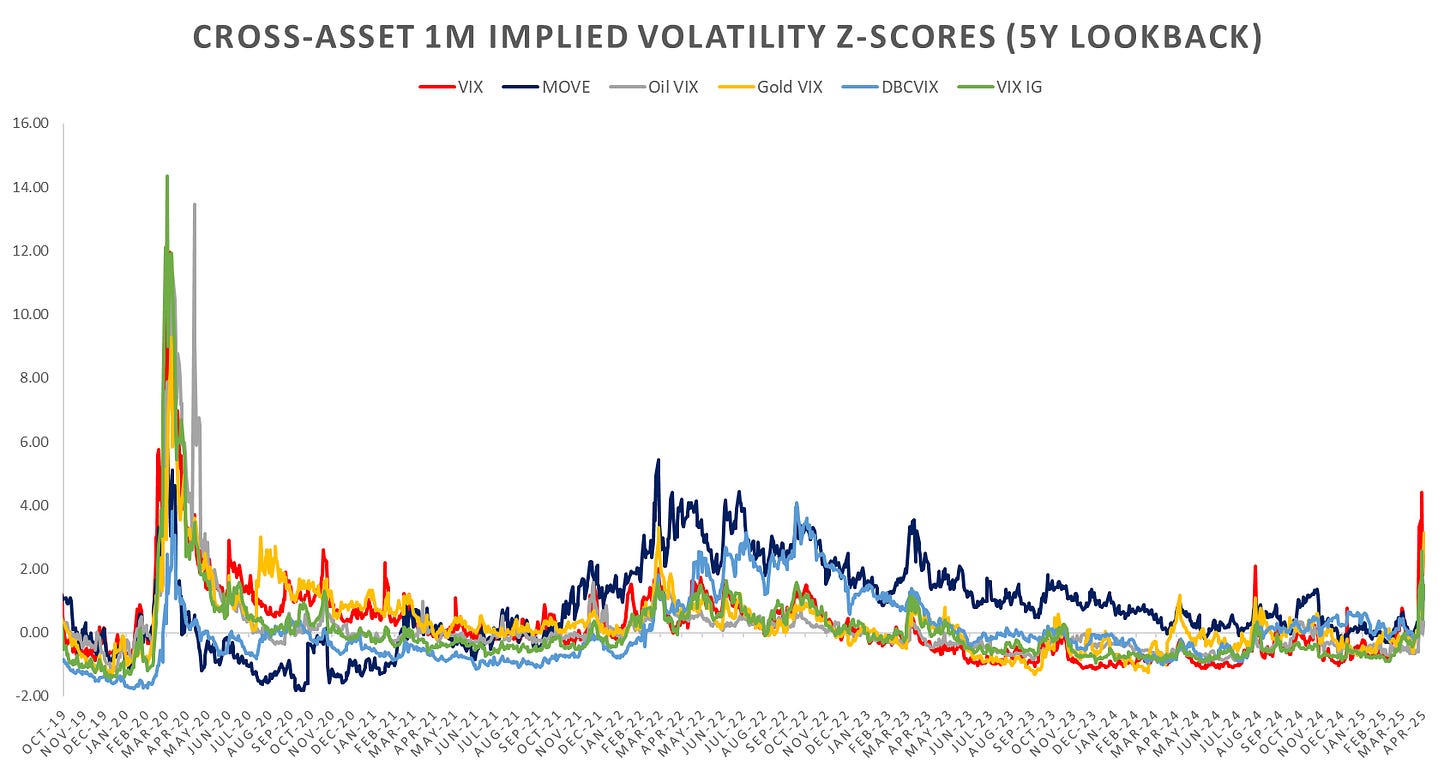

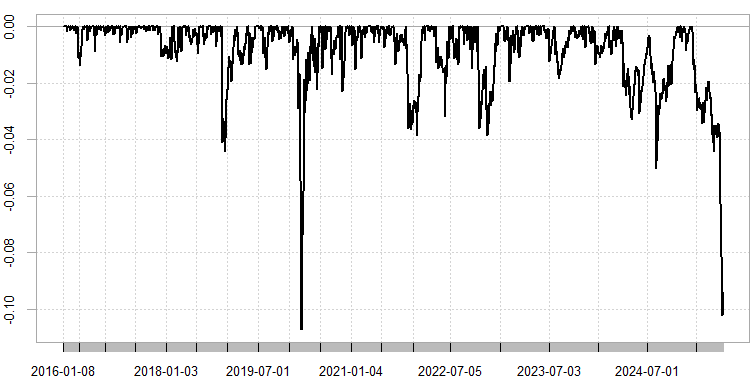

Zooming out on the cross-asset implied vols, *almost* as big of a shock as covid on the 2-year lookback.

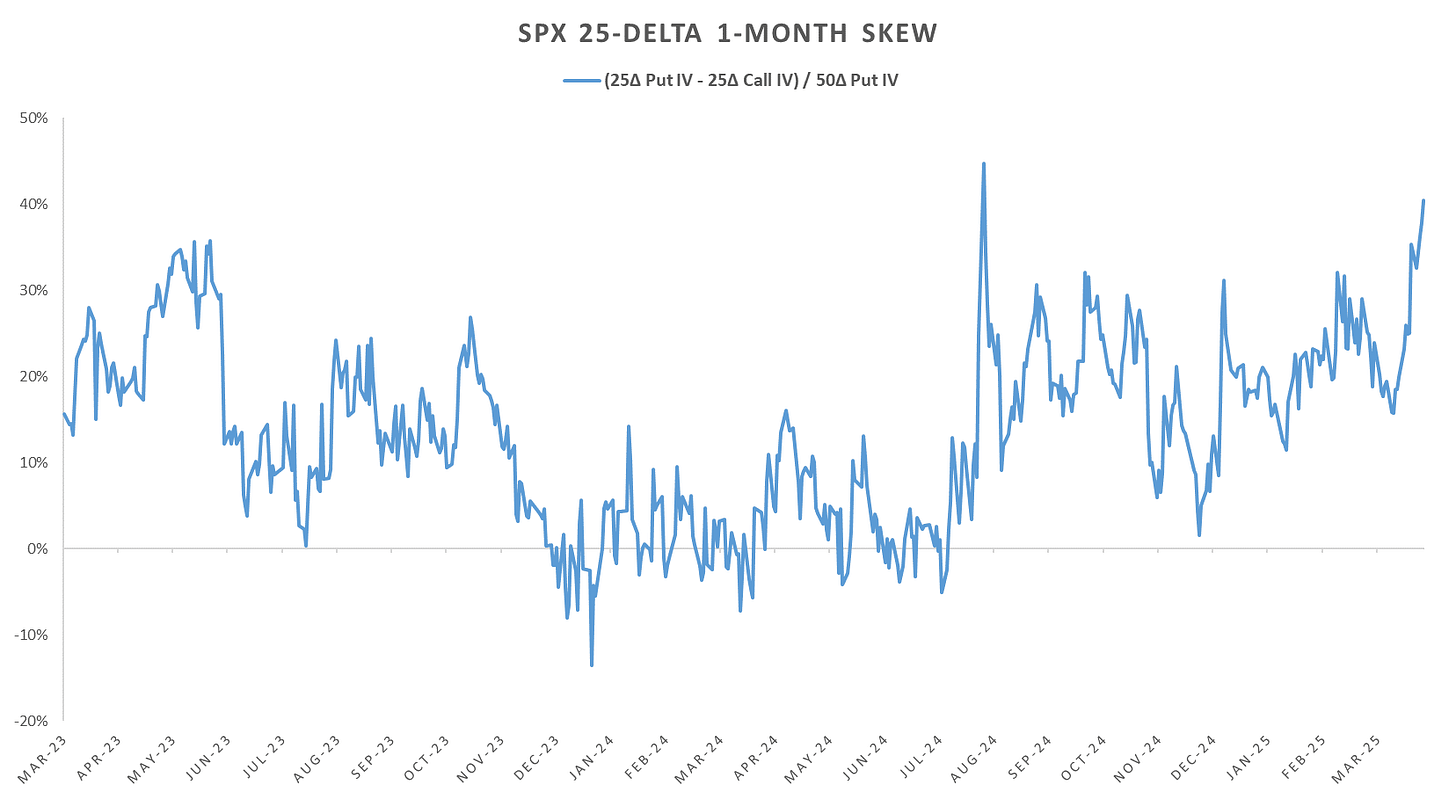

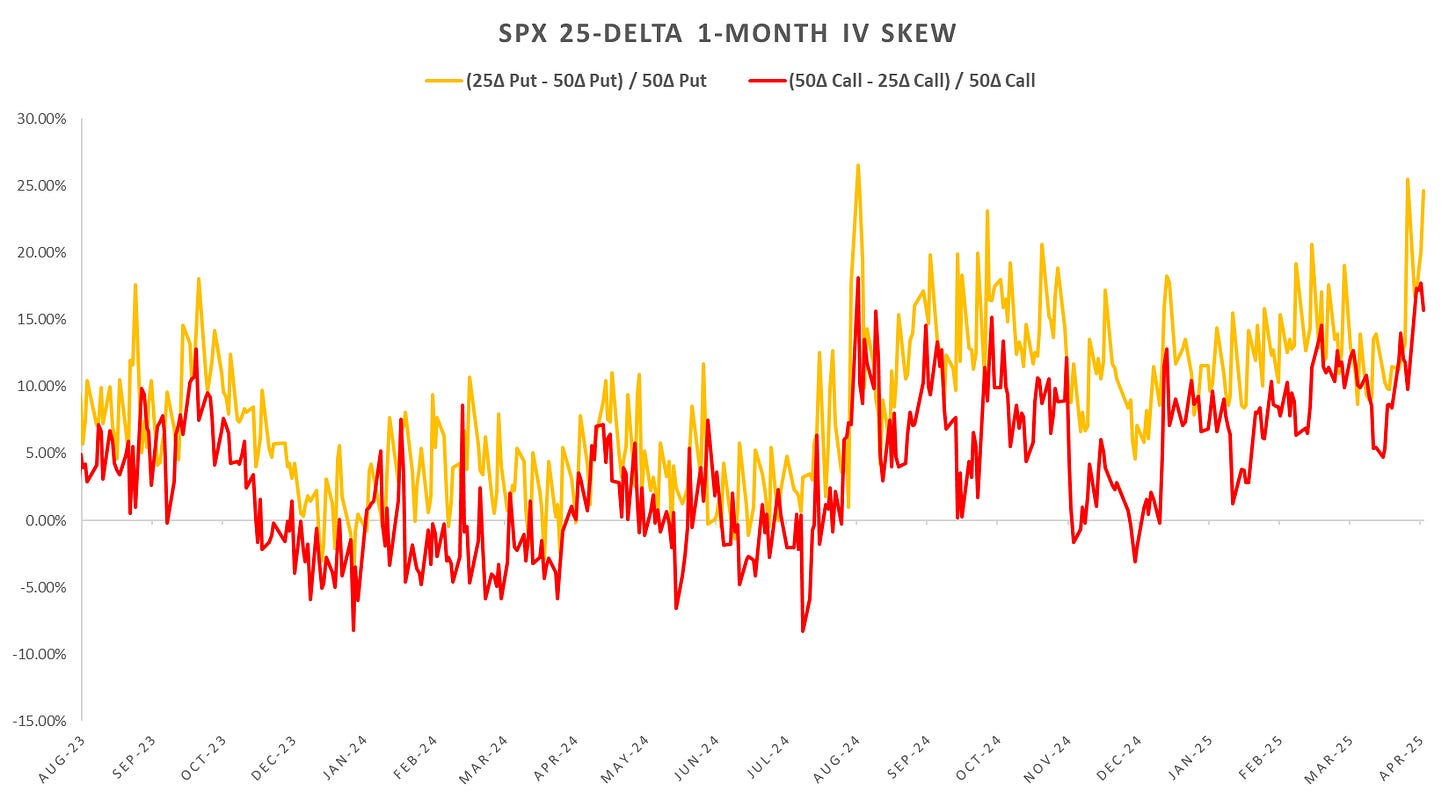

1m skew closed Friday steepest since BoJ crash.

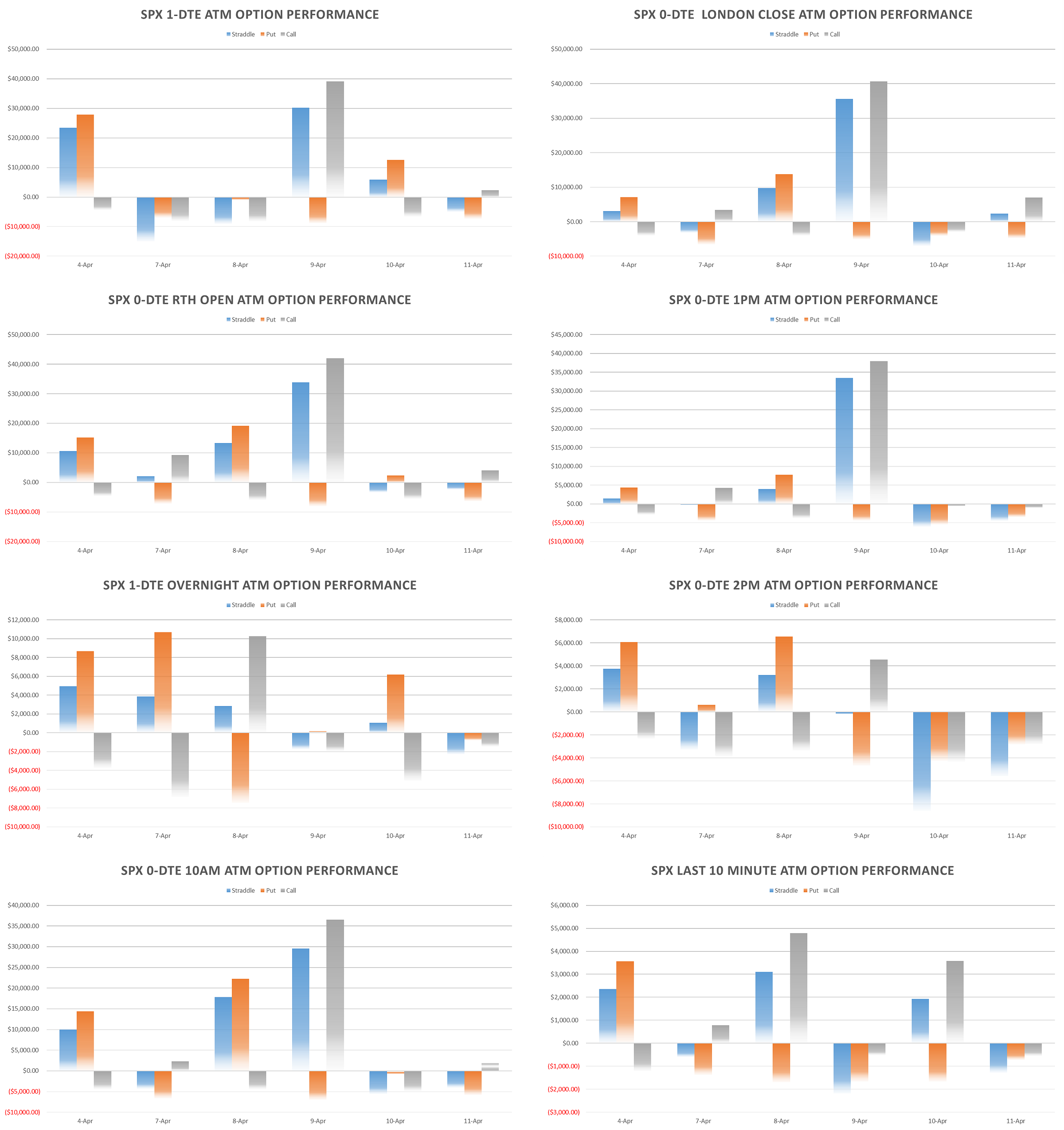

Looking at intraday price action:

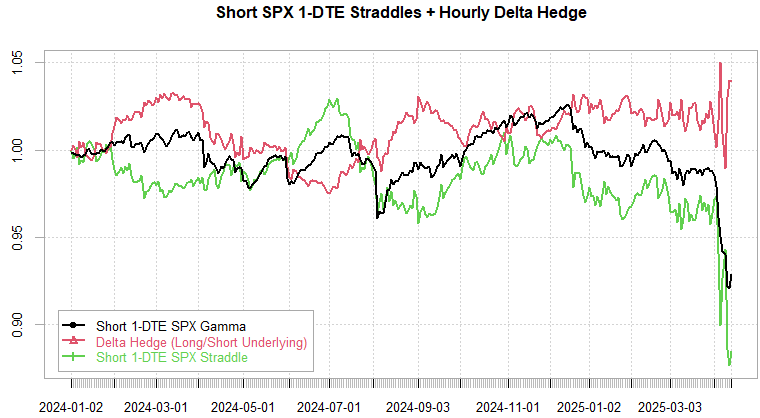

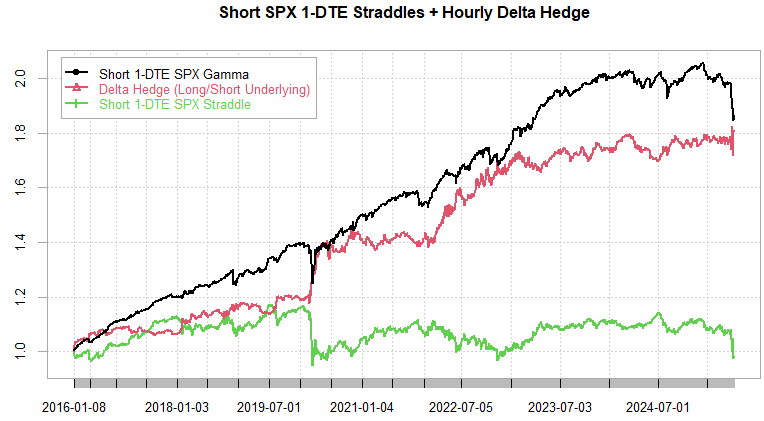

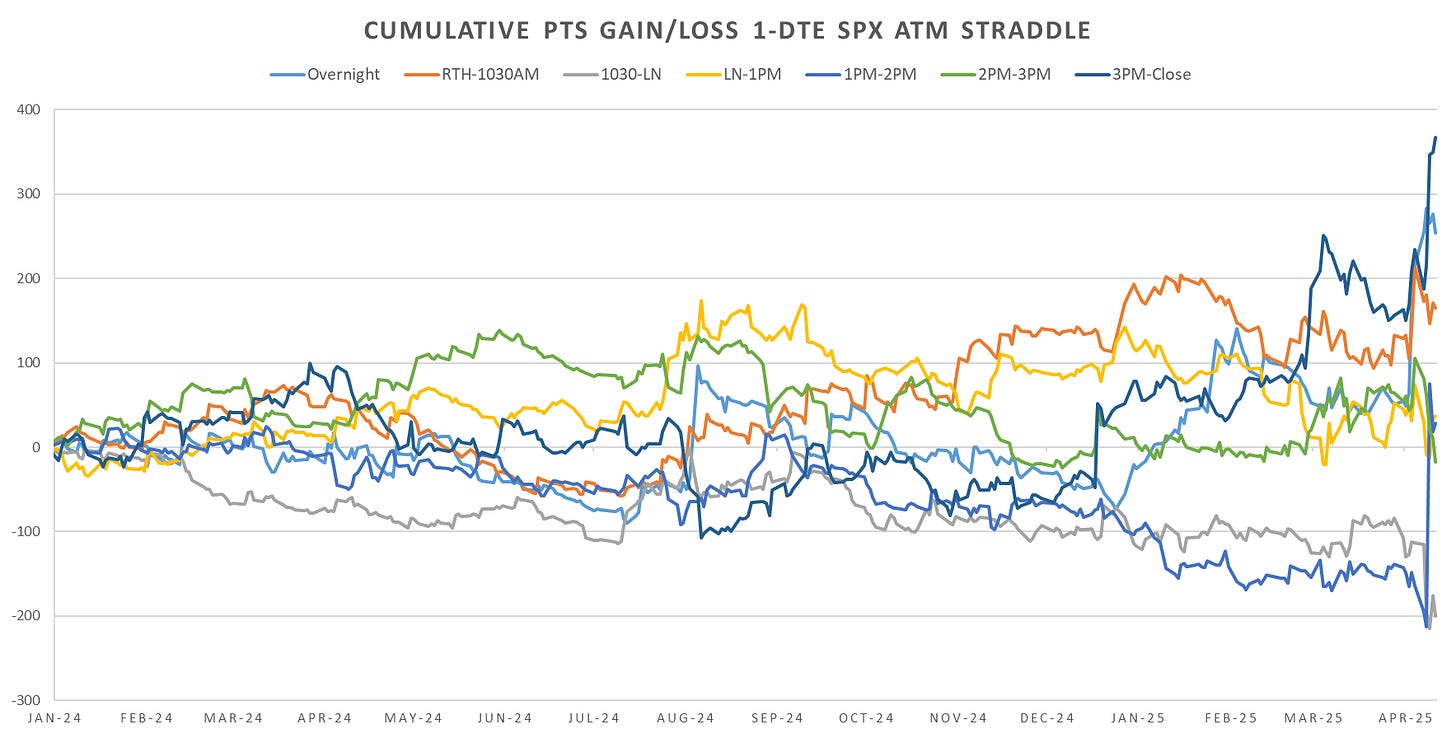

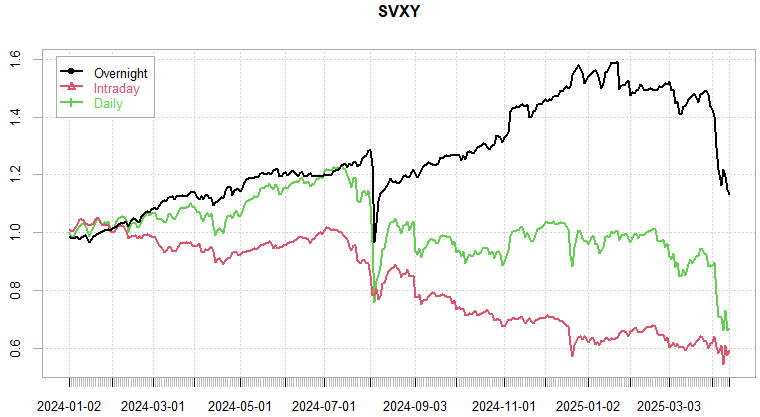

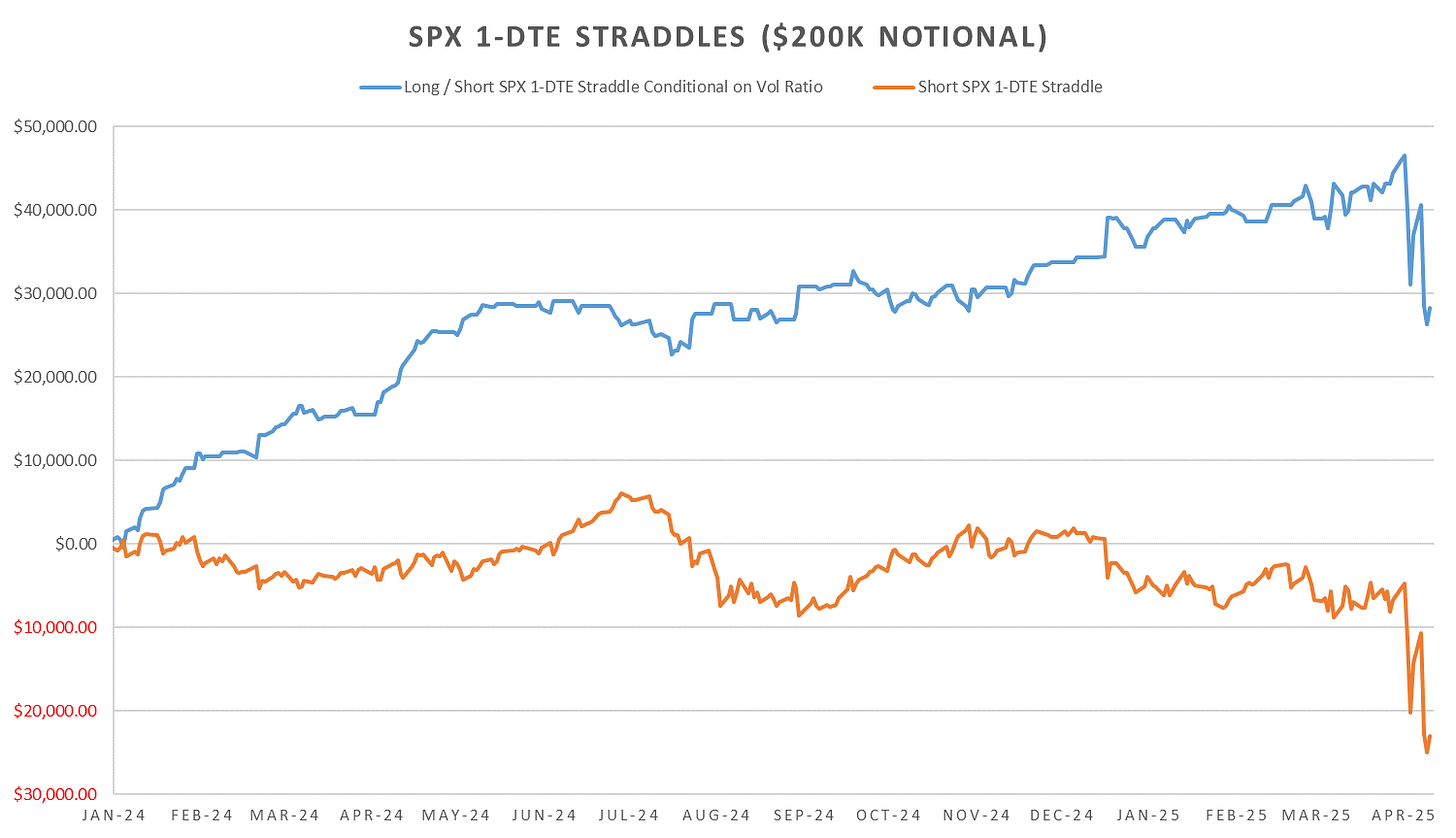

Short 1-DTE delta hedged SPX straddles had a 10-day(!) loss streak, that’s with implieds blowing out post announcement to near Covid levels… Friday first (tiny) positive win for short delta hedged straddles.

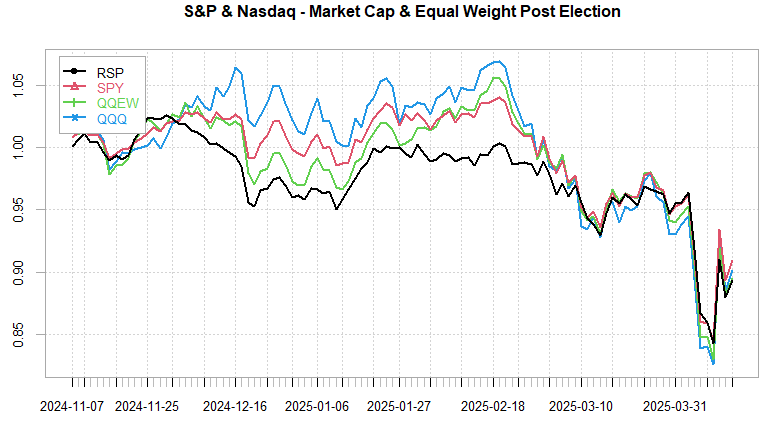

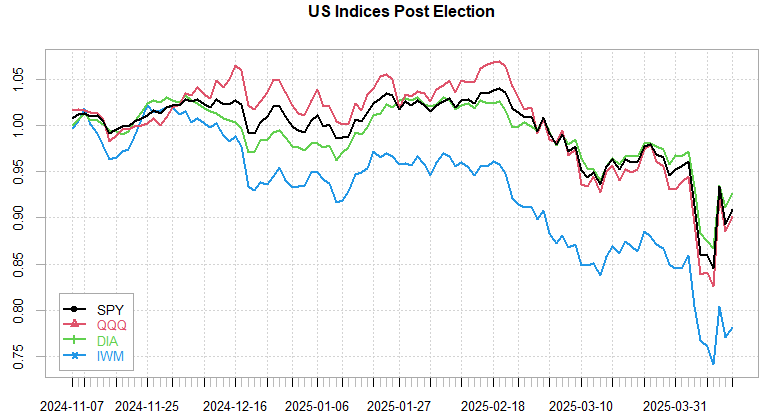

Zooming out on the damage done, now identical to the Covid drop… Markets were downplaying Trumps tariff rhetoric up until the ‘deer in the headlights’ moment. Can also see the damage to short premium started in Jan, never recovered even with markets making new highs earlier in the year…

Looking at the intraday cross-section, last hour momentum best performing period since Jan. Nasty spike on Wed intraday put the worst period (1PM-2PM) back to positive from 2024 start.

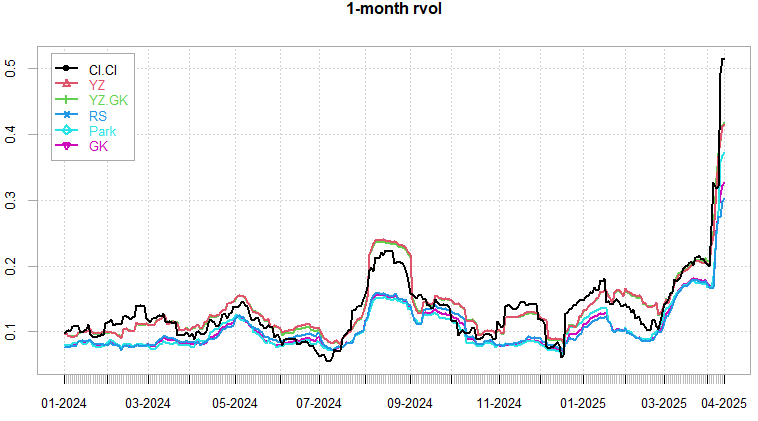

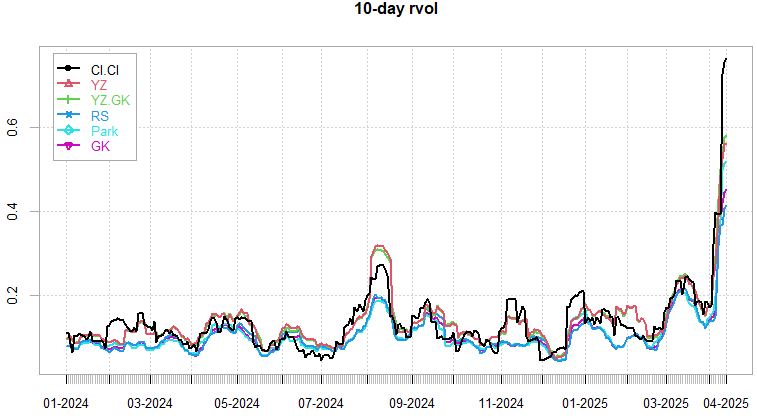

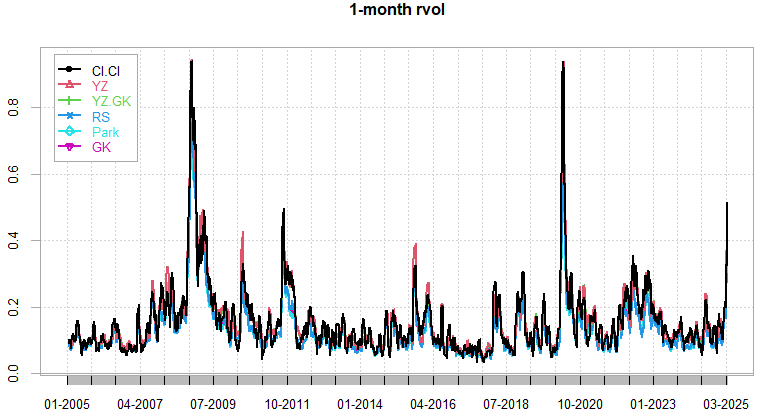

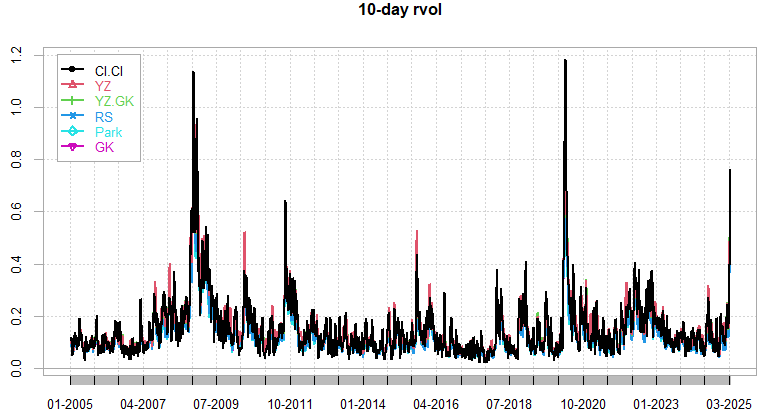

Realized Volatility Overview

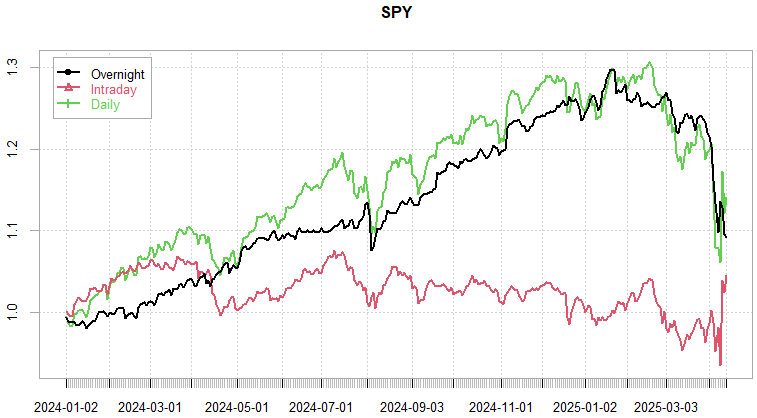

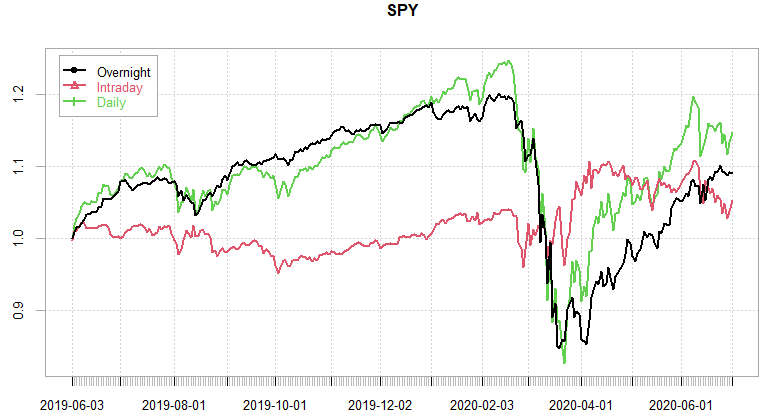

Much like Covid, we are seeing markets try to bounce intraday:

Still barely a year of gains given up on S&P…

Rvols still vertical… no sign of pulling back, pretty much still *in* the risk event.

Never a good sign when Covid is your point of reference for the rvols but its Covid & 2008 only that saw higher rvol in the last 20 years… wow!

Given the rvols, staggering that we are just 10% off from the election prices on indices… Shows just how much everyone got caught with their pants down…

VIX-Futures trailing realized by a mile here… 2nd & 3rd month VIX futures nowhere near levels we saw during Covid & 2008 implying markets think this episode of vol will be much shorter…

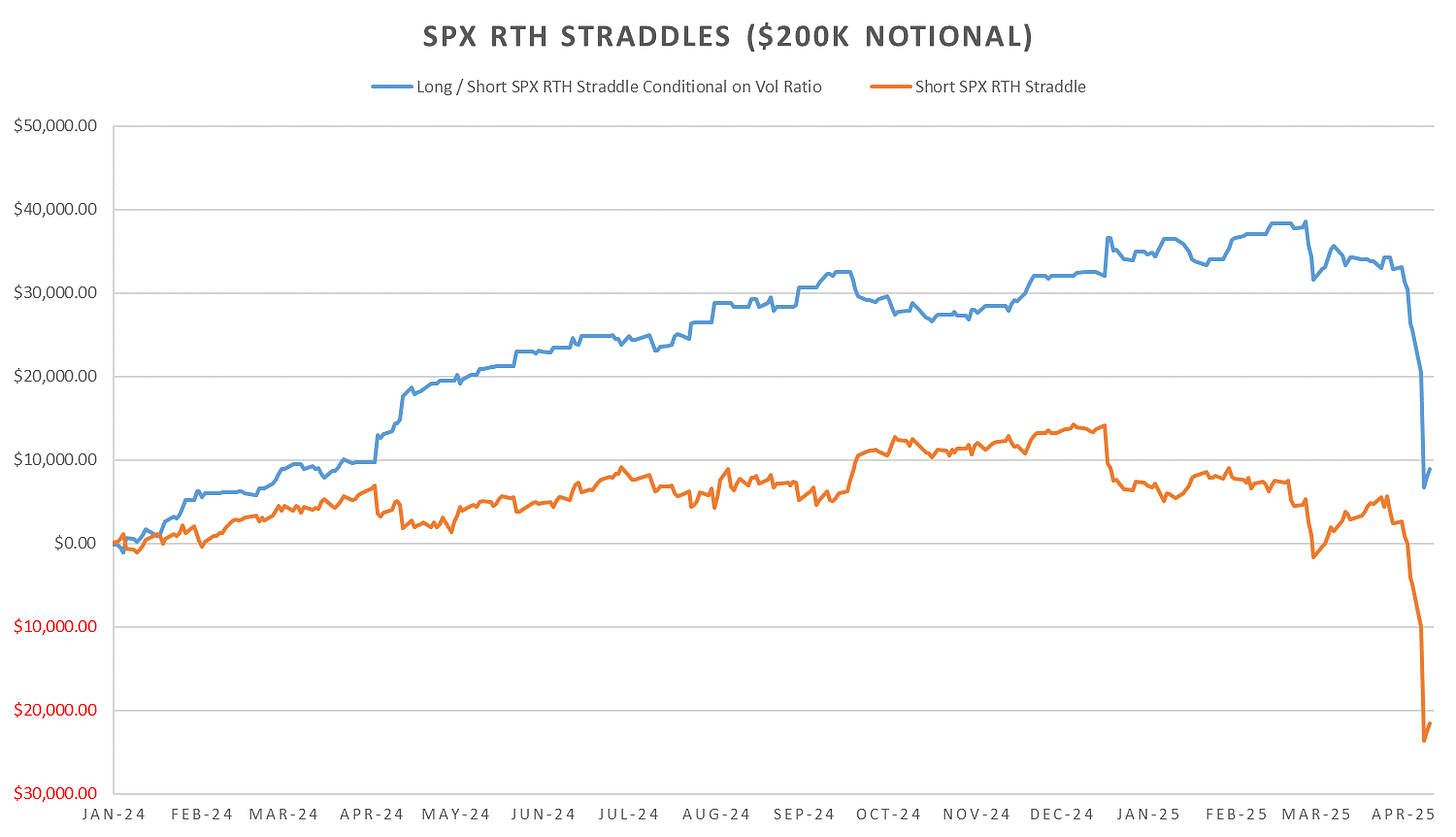

SPX ATM Straddle Performance

~300pts being long the 1-DTE straddles, ~540pts being long the RTH session 0-DTE straddles. Last 2 hrs straddles down ~105pts last 6 days.

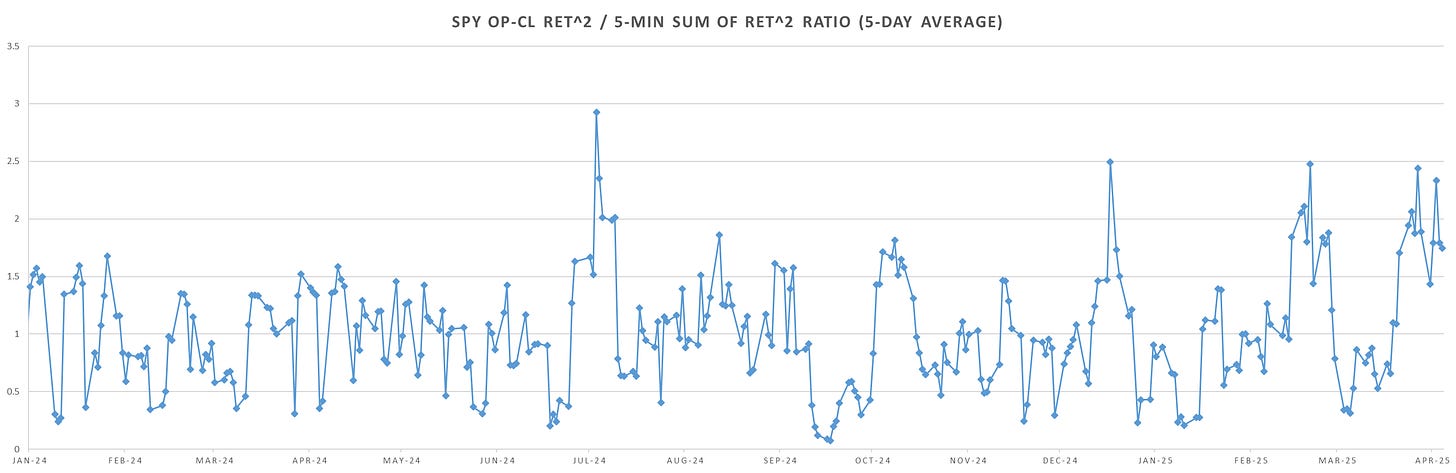

Intraday Variance Ratio

From the following post:

Still seeing strong intraday trend, Thursday heavy mean reversion.

Trying to mean revert the extreme trend we see not having a good time at all… RTH implieds especially poorly adjusting to last weeks chaos.

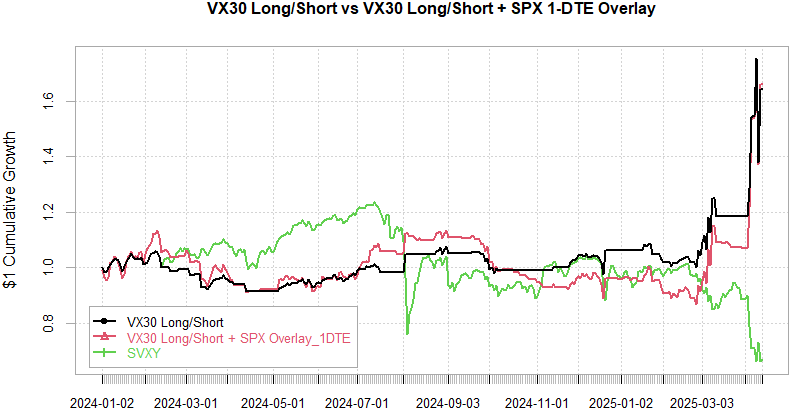

VX Carry & SPX Overlay

From the following post:

Back to cash on Thursday close, VX May contract trading substantially discounted, however, higher rvol of vol & still plenty of time to expiry, not very interesting to long/short May VX at the moment. So far markets seem to be bent on discounting the persistence of implieds here despite realized vols reaching 2008 & Covid levels…

First big win for a long VX trade since Covid. The term structure factor despite being lackluster for short VX trades (see:

killed it for the long VX trades into April. So far great performance into almost every *major* crisis we’ve had (Covid, 2018 XIV blowup and a few others.) Got whipsawed a few times on small vol spikes (then again who knows if its a short vol spike or not at the time) but that’s the price you pay for periods like now.

As always don’t hesitate to reach out if you have any questions!

Have a great week!