Market Overview - April 6th 2025

S&P Index Options & Volatility

Following up on last weeks overview:

Will avoid obvious commentary as there is plenty circulating at the moment, things look dire. Unlike other spikes I’ve seen, this one stands out as it seems like the people in charge of the government are actually… cheering this drop (albeit more nervously after the flush last night.) Fed did not offer any calm on Friday (closed door meetings scheduled for this week.)

There was a sense of “nothing ever happens” going into Wed announcement and immediately after, VX30 beta to SPX was very stable, not showing any signs of stress, until Friday when everyone realized there is not going to be a so called “Trump Put”.

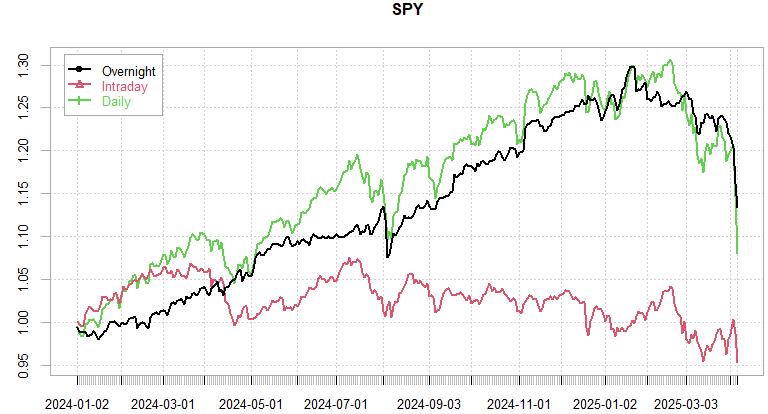

As mentioned before, the risk-off environment (looking at vol) has been on since Jan/Feb. The lack of sharp immediate downside means people got a chance to de-risk in a relatively calm manner over the last few months.

There will be incredibly sharp moves here (overnight liquidation candles for 50-100pts we saw already) and right now SPX bouncing 450+ pts in 30 mins on Trump potentially pushing back deadlines just to give back 200+ pts in minutes…

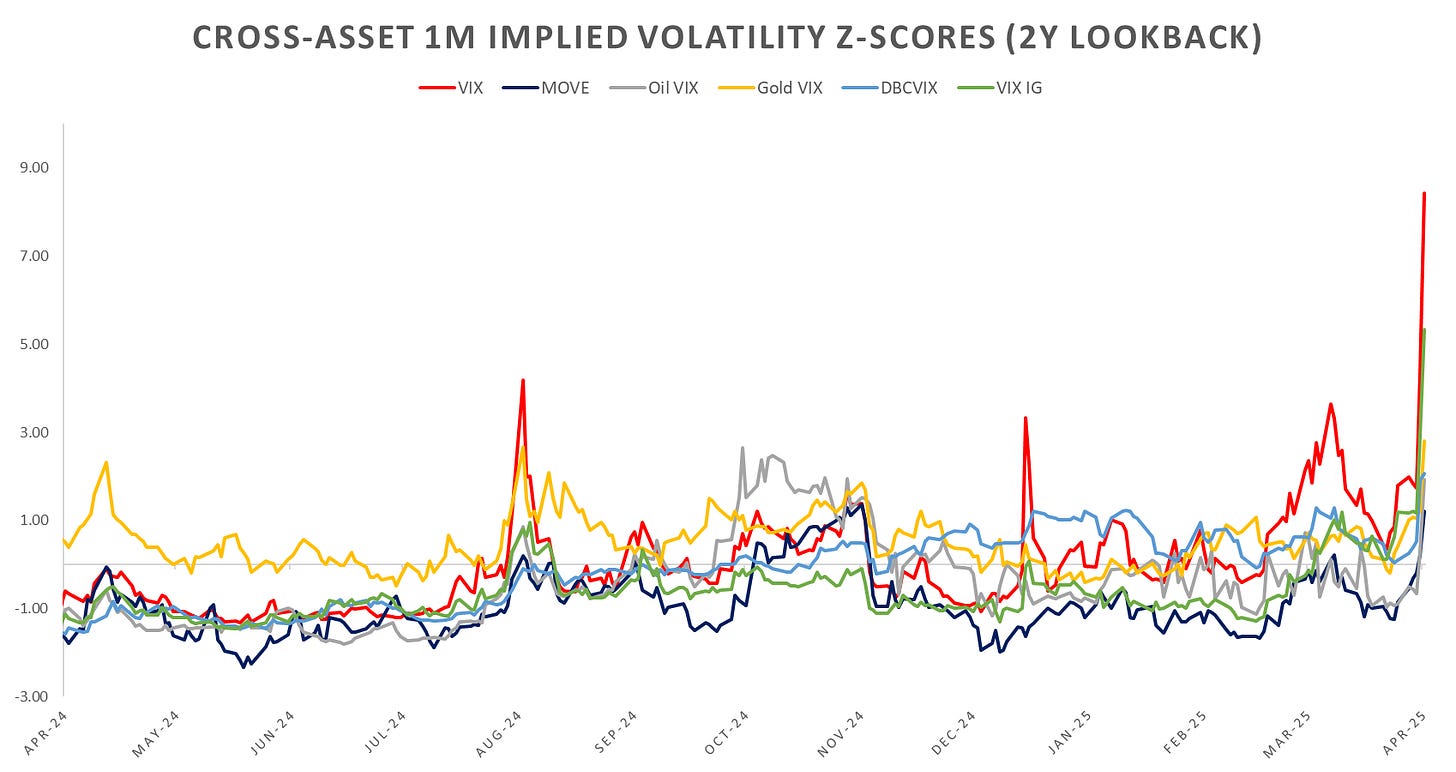

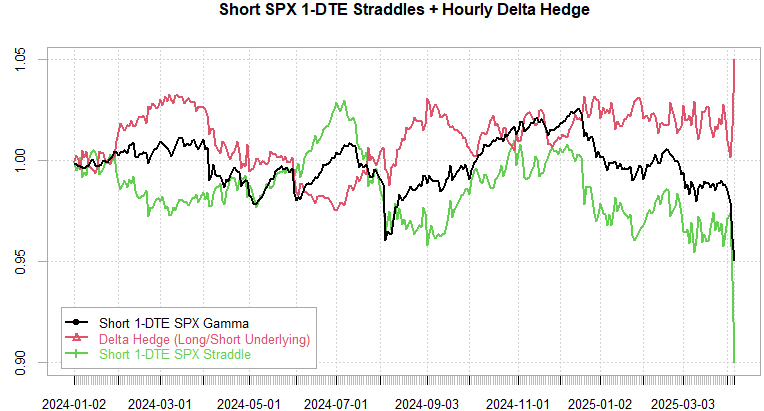

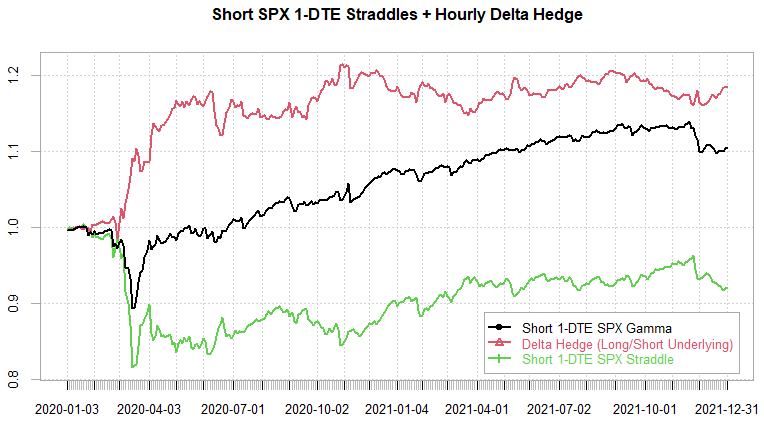

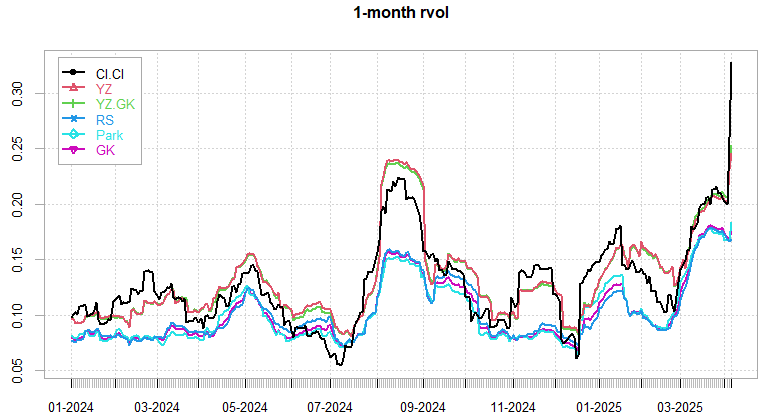

The reflexive nature of vol → liquidity → vol means we will be seeing these moves until things calm down (it won’t be a day or two as this is VERY large vol spike that will linger in lookbacks for months.) After large events like this we also inevitably see serious damage to existing short premium strategies, 2020 saw left tail rich for ~2.5 years well into 2022 correction before it got sold again, Feb 2018 was shorter ~ few months but that was also a technical event that quickly resolved.

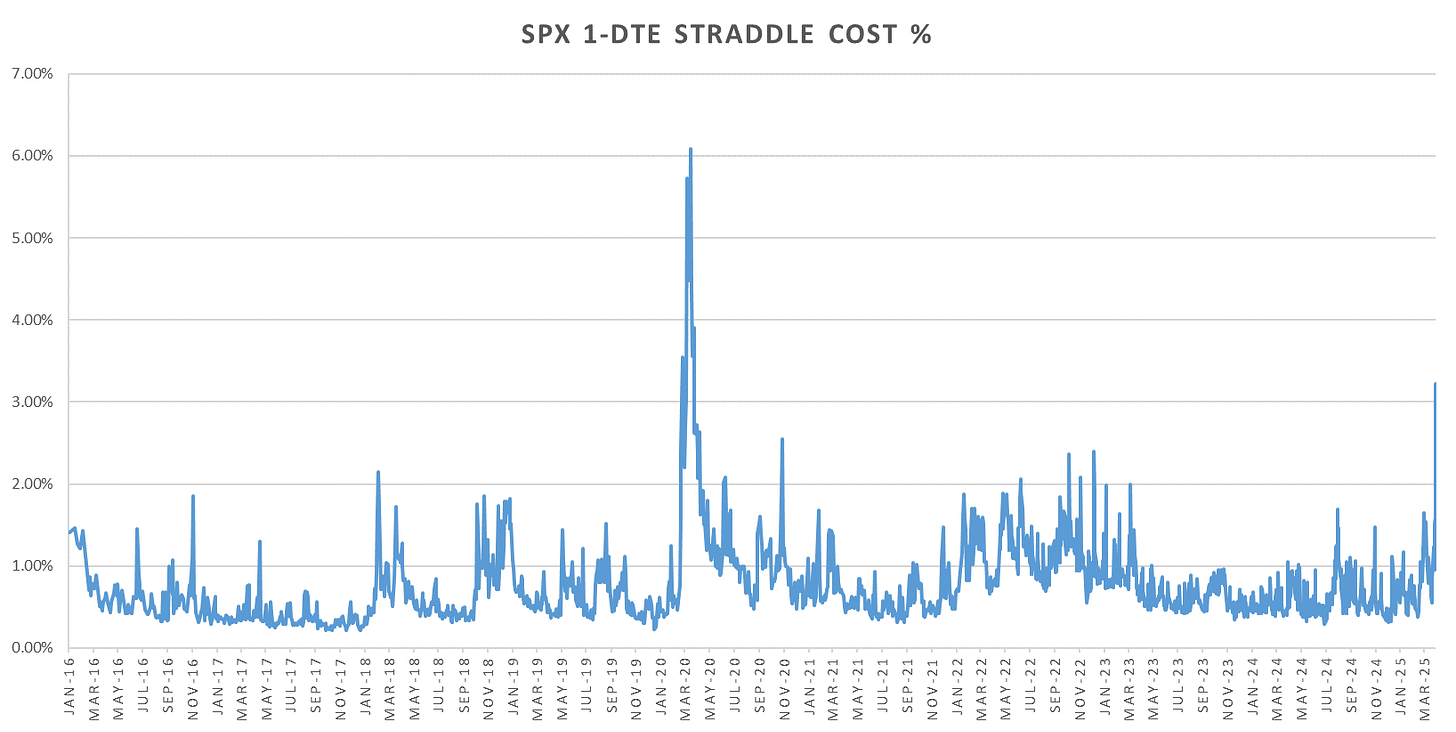

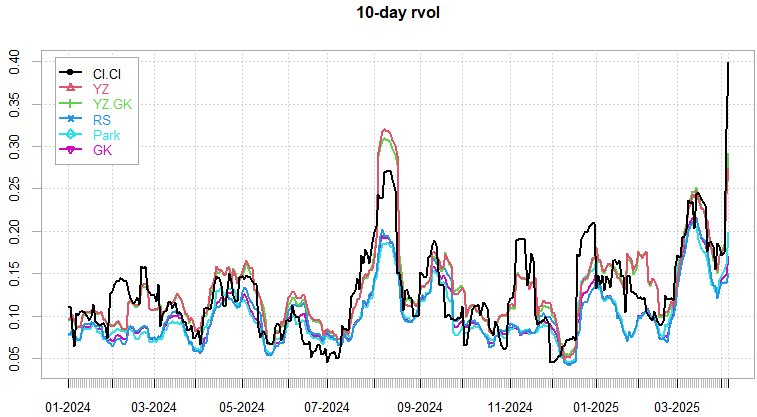

We’re firmly back to Covid levels of 1-DTE straddles, ATM RTH straddle was trading ~4.1% this morning, crash levels.

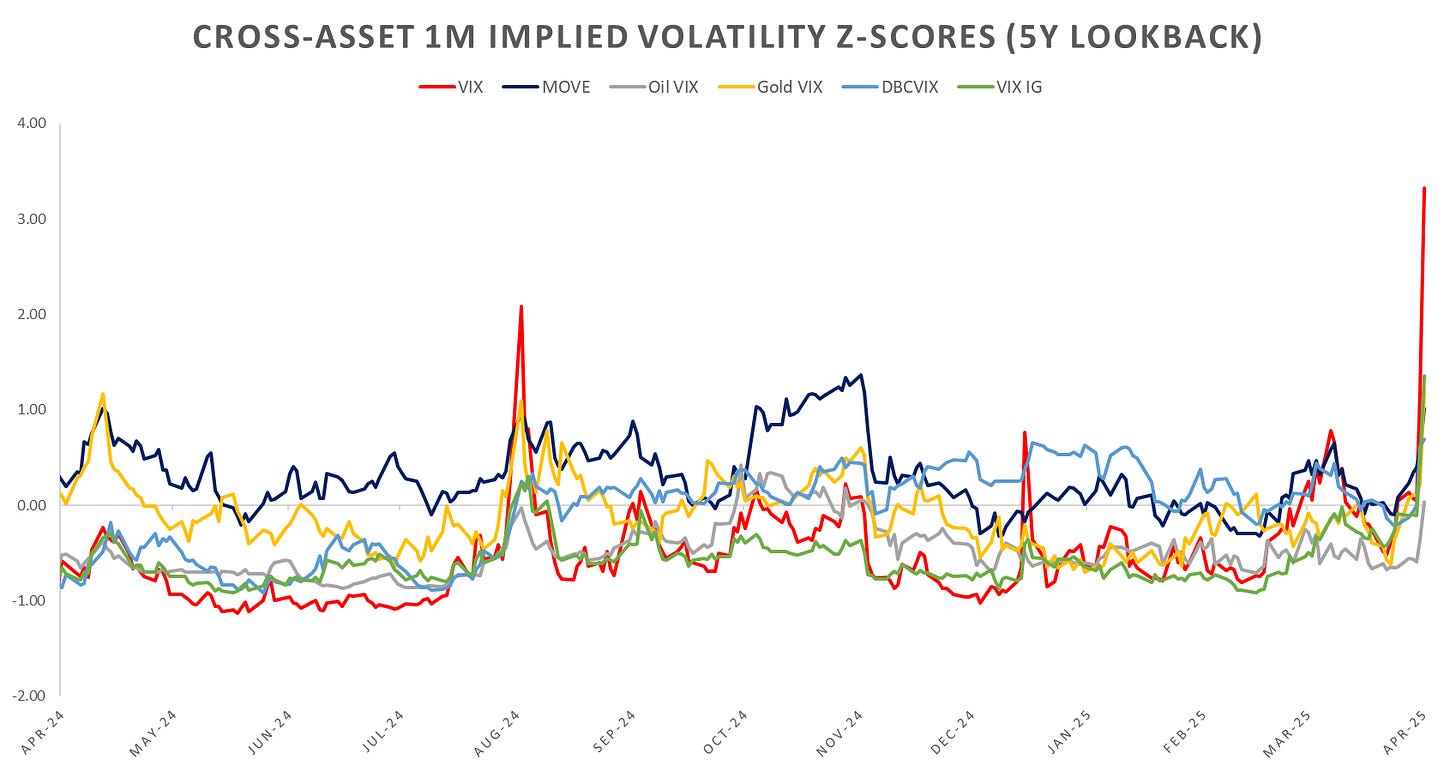

Cross-asset vols all higher, equity leading, oil cheapest… biggest shock since Covid, as mentioned this will linger in risk models for a while.

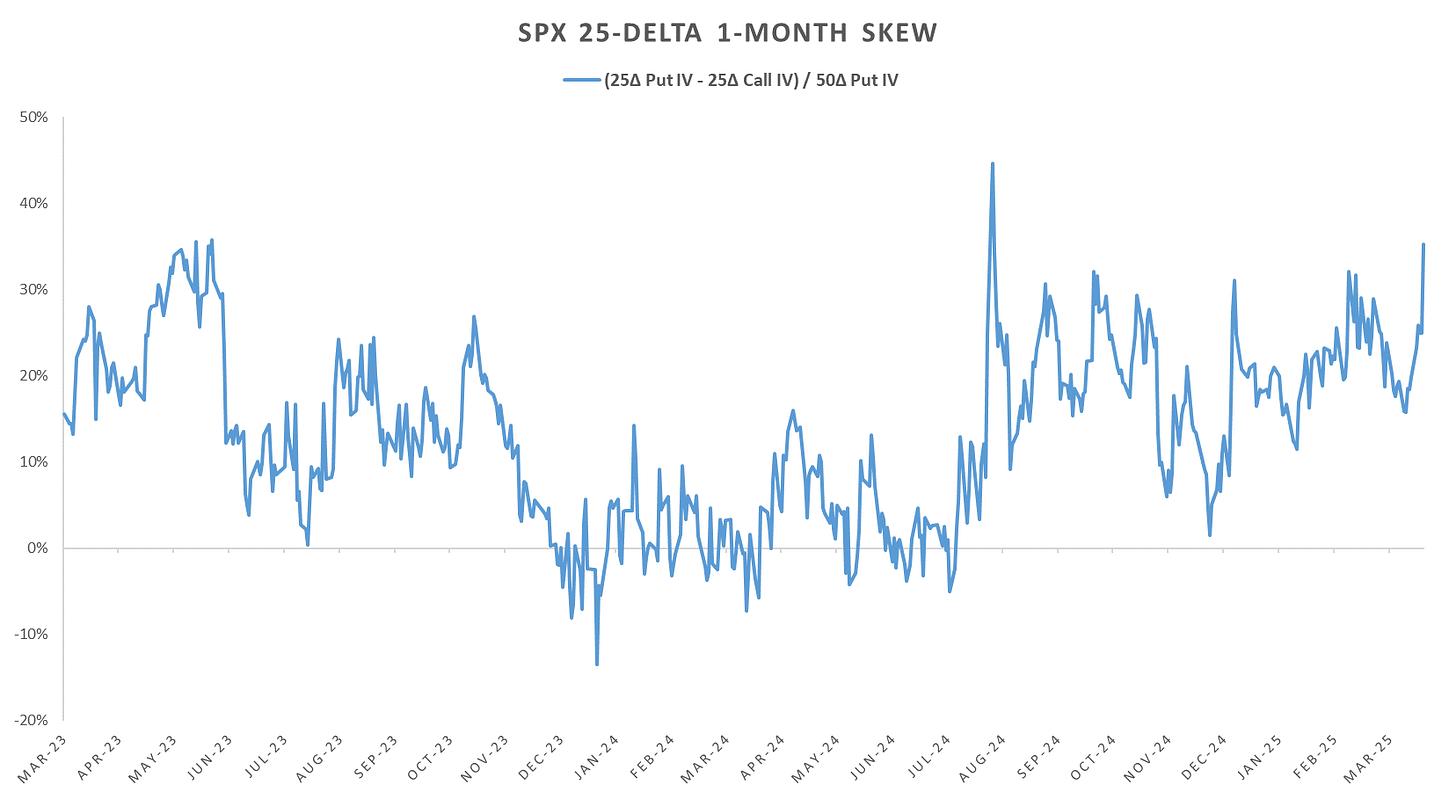

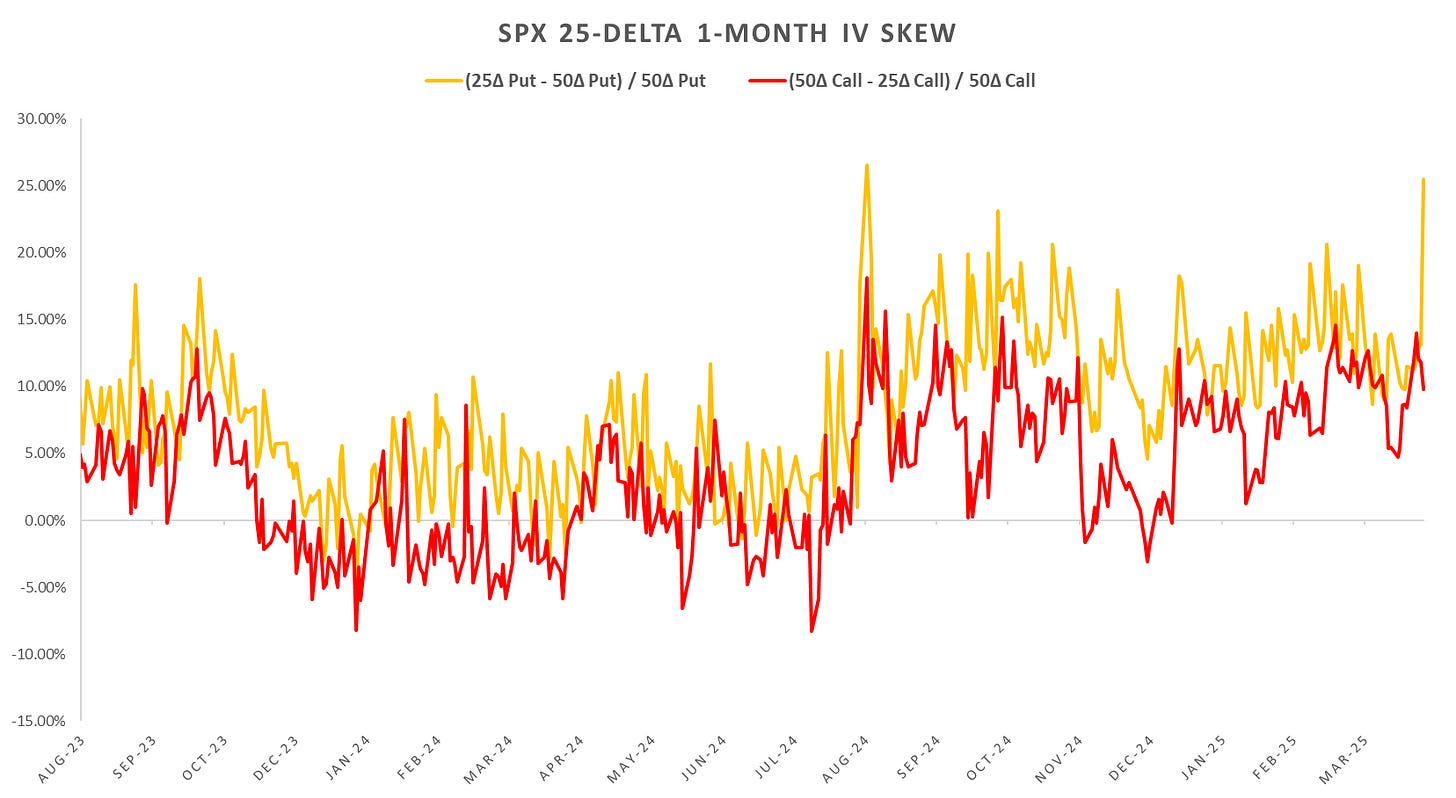

Skew actually not blowing out to August levels on Friday (this morning, however was proper panic so went higher.)

Looking at intraday price action:

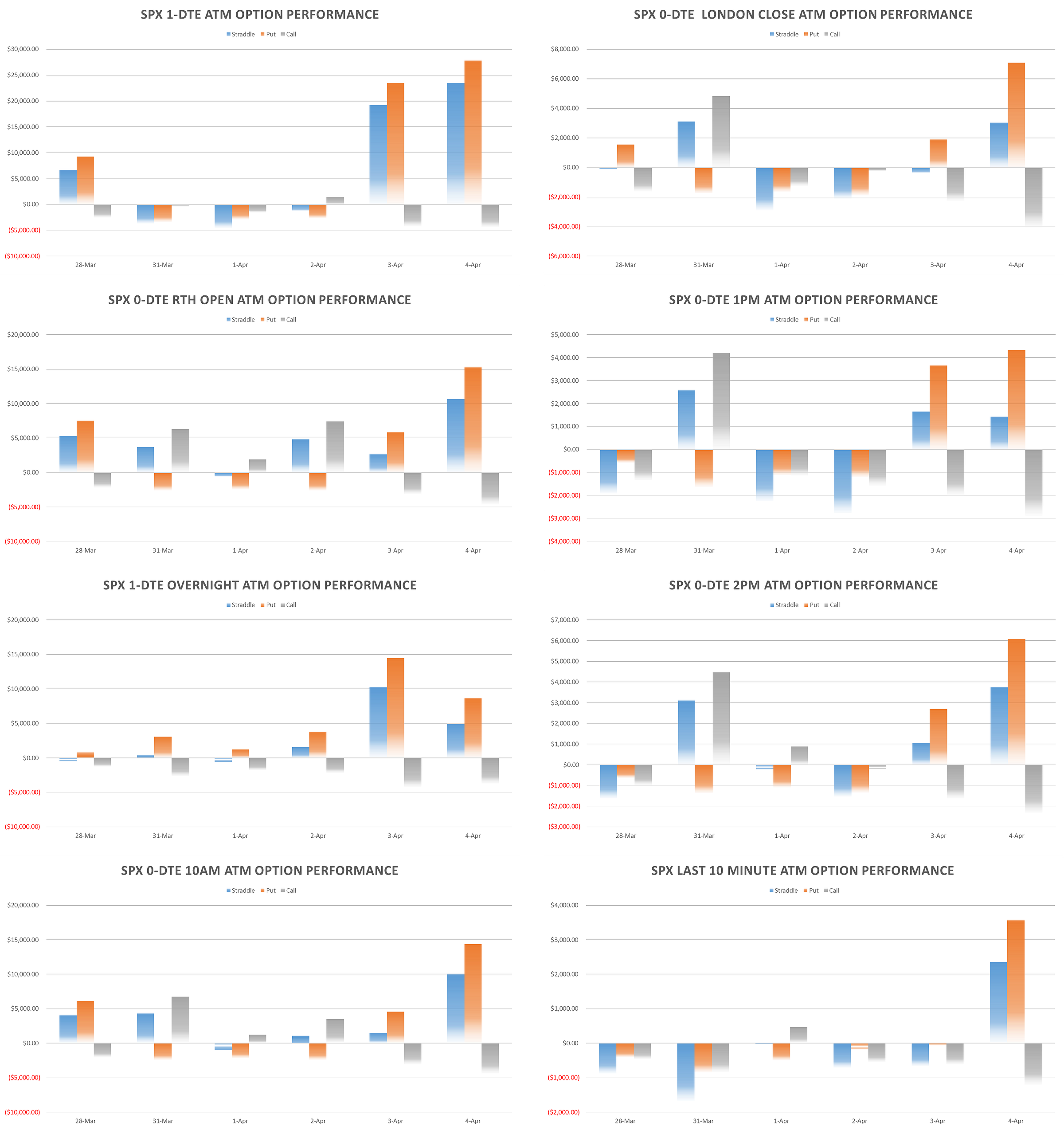

1-DTE Straddles were oddly tame up until Friday. Tariff day straddles we’re trading ~150 bps and even Thursday after the announcement we saw ~160bps straddle… The real risk came on Friday close with a 320bps weekend straddle, doubling in a day from already elevated levels. Realized vol was severely underpriced going into end of last week…

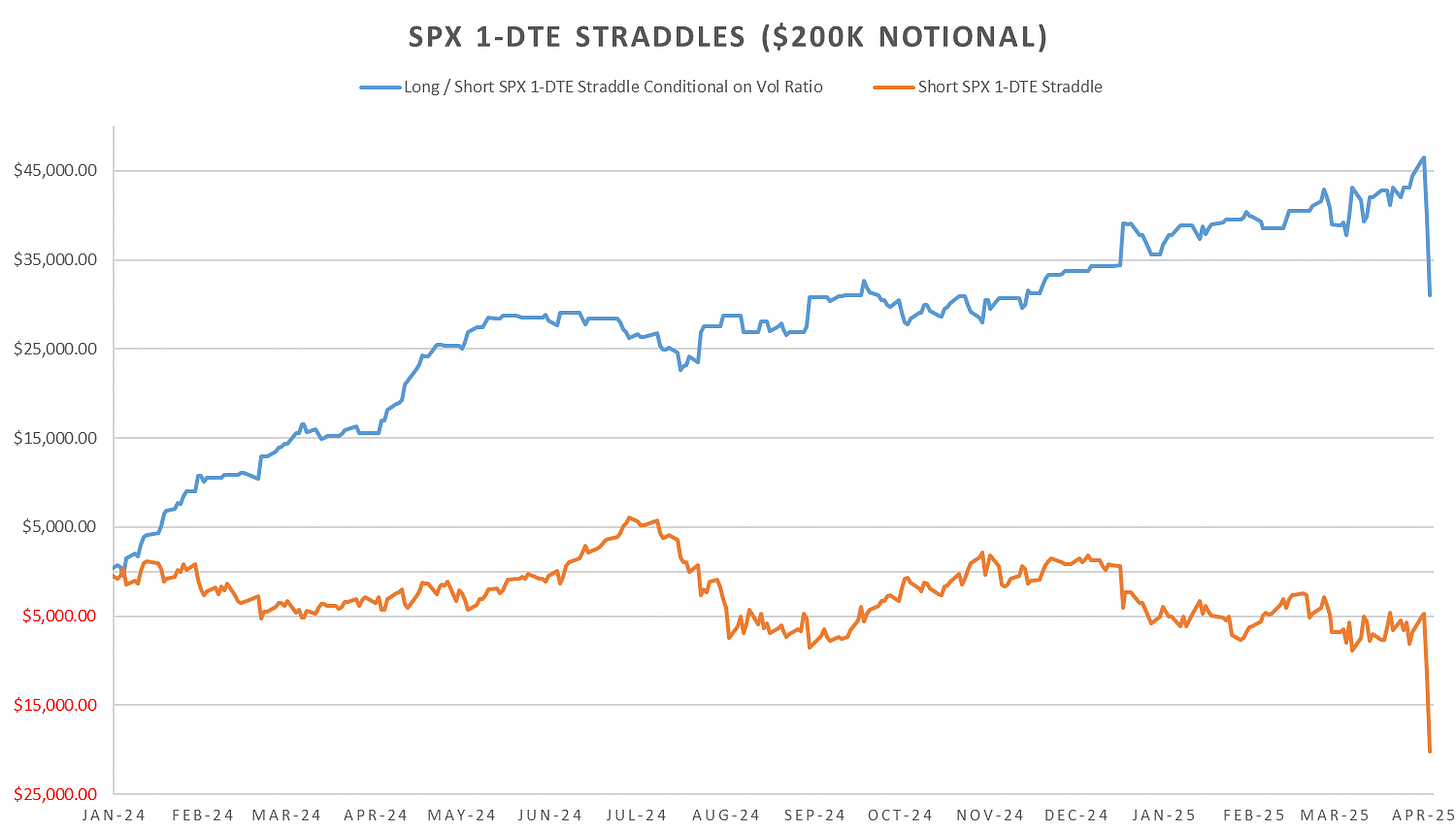

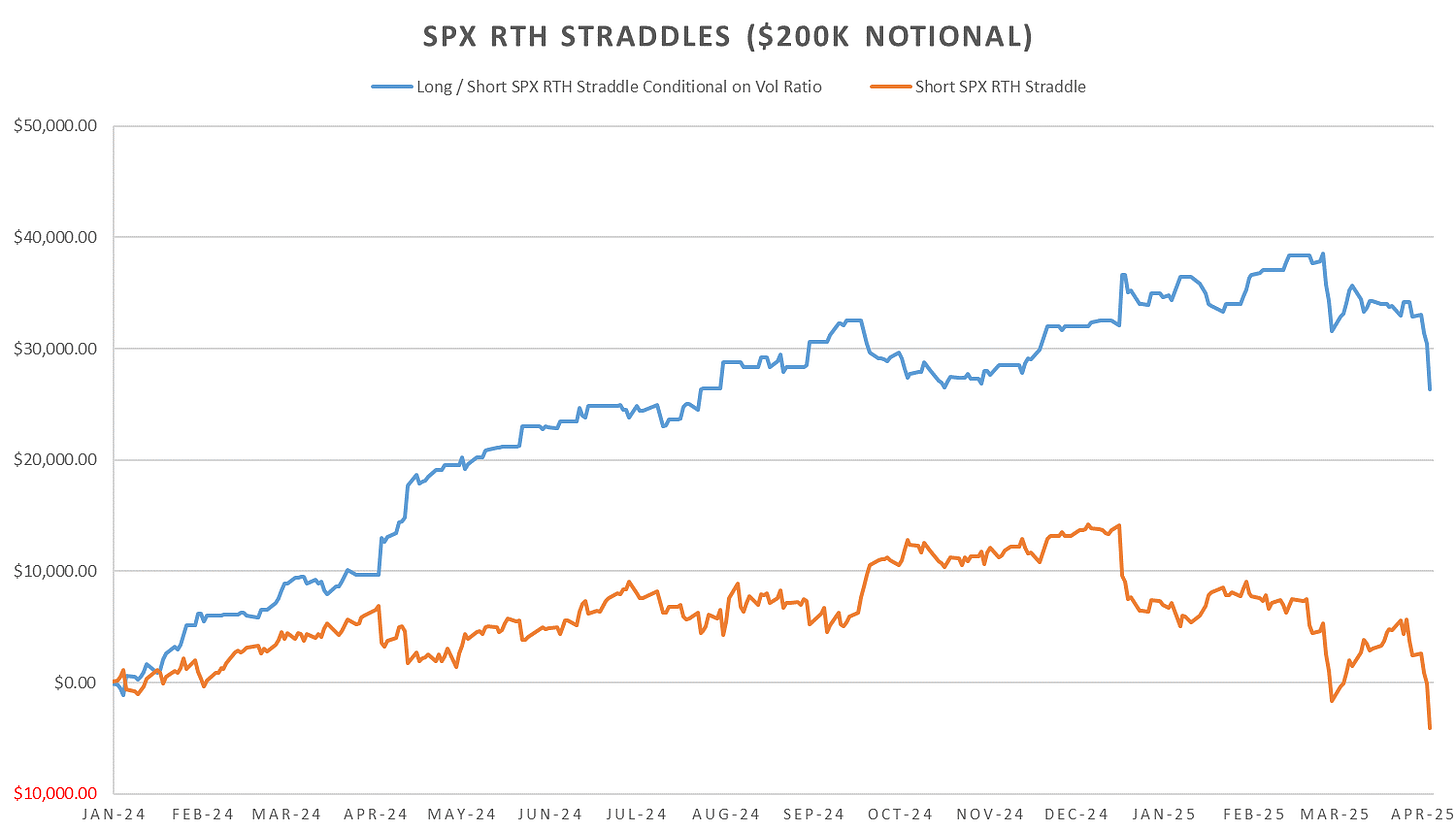

The upside is both 2020 and Aug 2024 events saw short 1-dte delta-hedged straddles perform exceptionally well following the risk events. I think we are now at that point again where shorting 1-dte straddles and delta hedging intraday should do very well next few months.

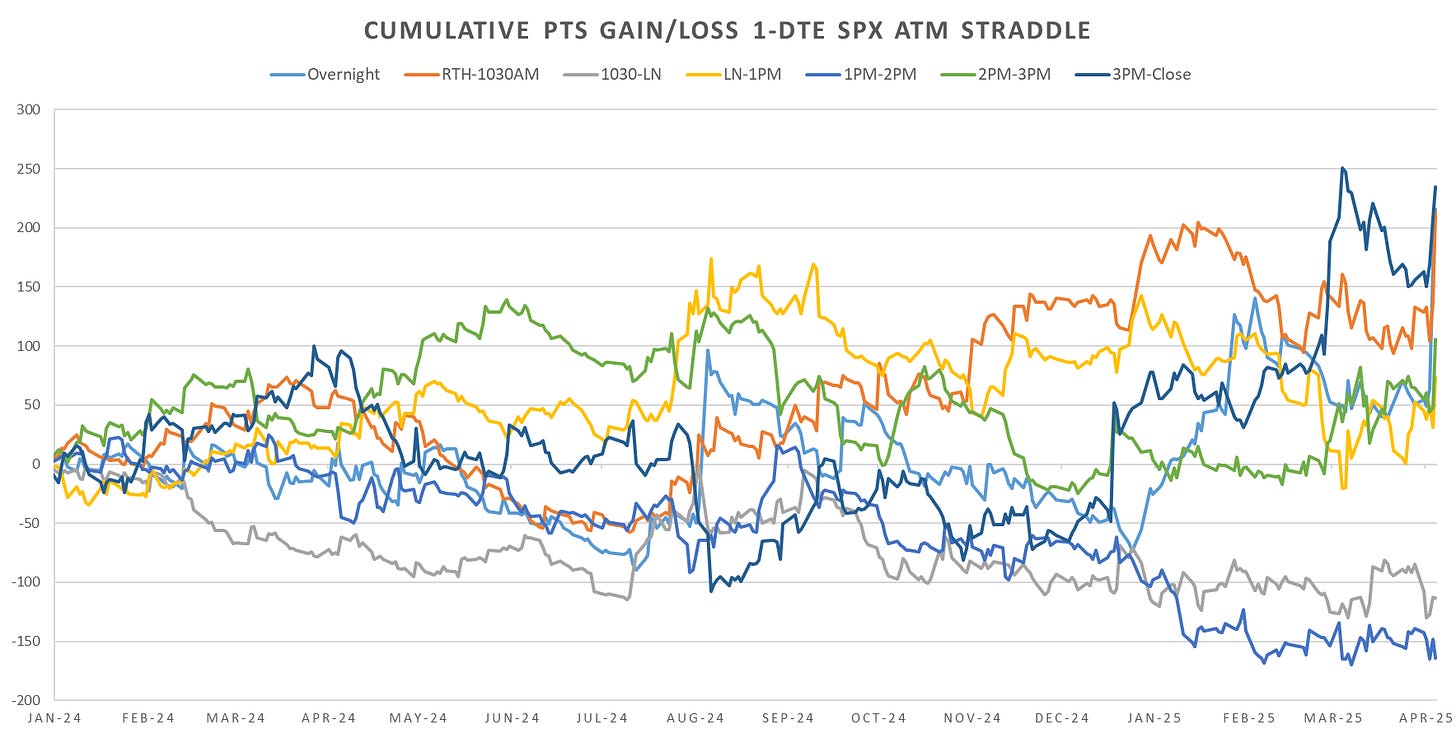

Eod momentum returned by Friday last week, as mentioned in:

When volatility expands (realized way more than was anticipated), momentum into close is the default bet, from the post, best performance for momentum on large straddle breakeven beats (move up to X-time of day, larger than straddle implied for the day.)

Realized Volatility Overview

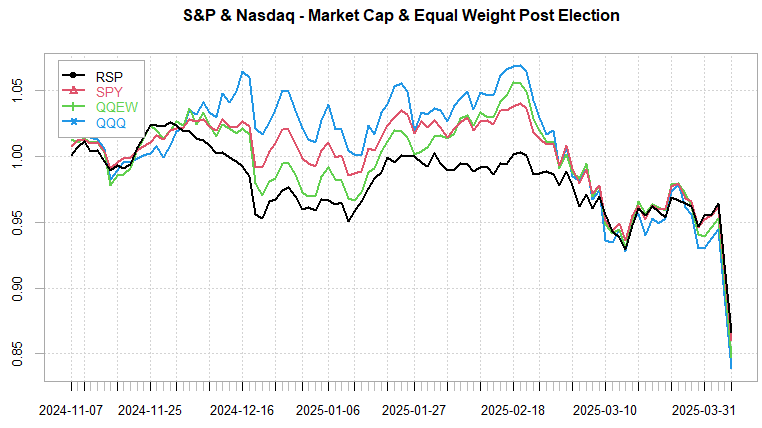

SPX briefly touched unchanged since start of 2024 on Sunday open, putting us at a 3.5 year return of 0 and single digit growth since pre 2020.

Rvols looked like putting in a top last week, Wed night / Thurs blowout instead. Major spike in rvols, this will have much longer impact on risk models than smaller spikes → crash conditions in place. There really is no cap on how high implieds can go in middle of a crash as people are getting liquidated / forced to hedge.

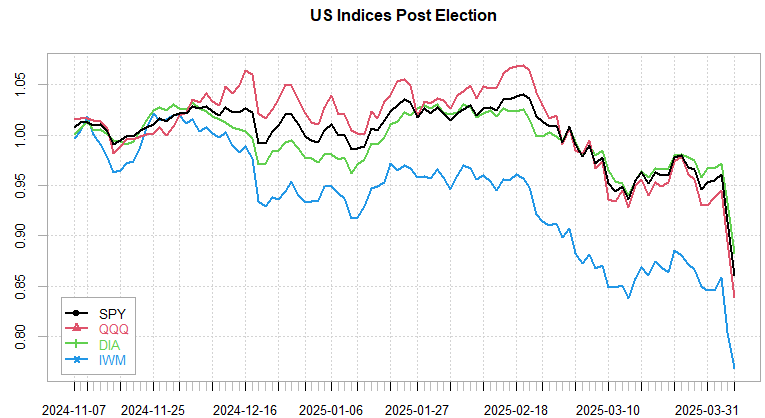

Corr=1 across the board as everything sold. Small caps worst off, now back to 2020 levels.

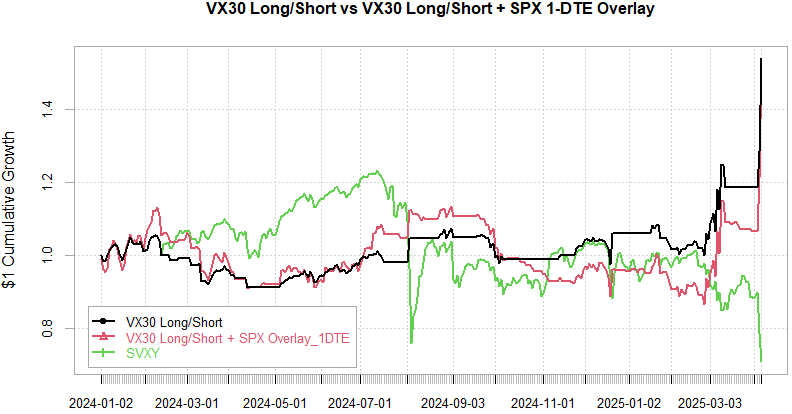

VIX-Futures underreaction to early last weeks drops in SPX, Friday & Monday blowing out. We’ve seen curve inversion since early Feb so strategies that take curve shape into account have been de-risked for a while (see VX Carry & SPX Overlay section.)

SPX ATM Straddle Performance

Astronomical #’s for long straddles thursday/friday. Drop mainly overnight, overnight puts green for 6 days in a row, 1PM opened short straddles net red for the week for ~12pts despite the downside. Straddles we’re relatively cheap going into Thursday/Friday even with known event. Clearly market caught blindsided by Trump’s unwavering push for tariffs even following large negative reaction by markets.

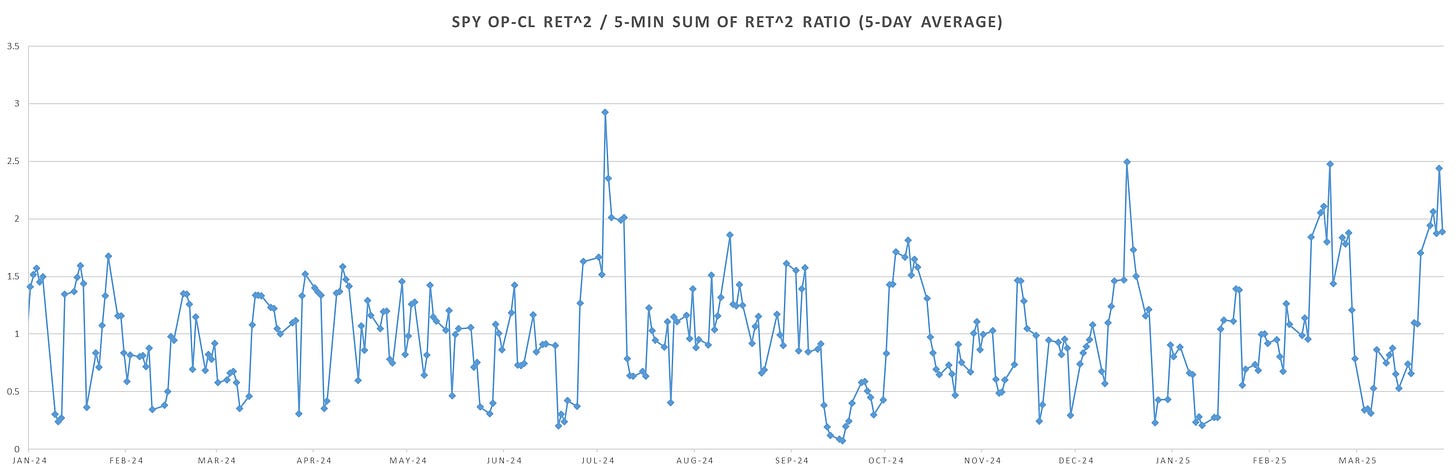

Intraday Variance Ratio

From the following post:

Strong trend Thursday / Friday intraday as you would expect during crashes. Unfortunately the great performance of last few years was primarily reliant on the mean reversion aspect of intraday trend / intraday mean reversion. Of course with mean reversion models that means being hit hard when things suddenly blow out as they did last week…

Wiped out all profits back to Nov (fixed bet size assumption.) Mean reversion still expected but its more about risk management now. Straddles very rich and vol will not keep up at this level so short straddles will payout again but damage is done…

VX Carry & SPX Overlay

From the following post:

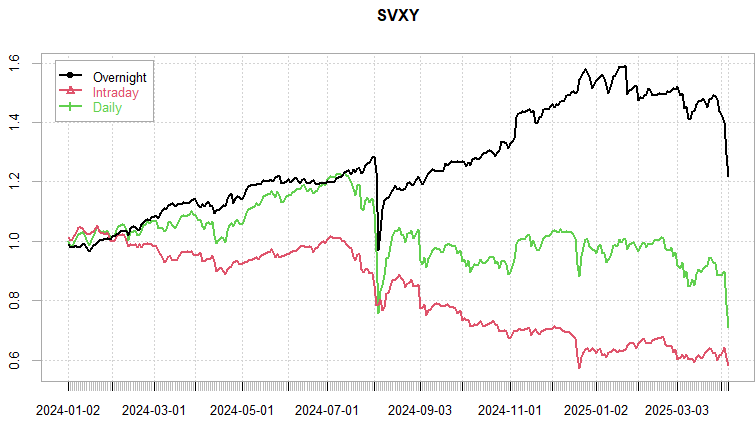

VX curve inversion factor delivering last few months. Long VX from Thursday open signal, remains long throughout Monday likely. Signals will switch to weighting VX May from VX April on Wed, but with the inversion being so high long signal likely to remain for May VX (unless some major news comes out and curve flattens - see main post for ways to smooth out signal.)

Lots of threads over weekend about shorting VX here through Vol ETPs. Essentially the ETP’s are shorting the constant 30-day weighted VX which is much lower (implied mean reversion baked into market.) The longer spot VIX remains up here, the natural ‘carry’ from VX is higher not lower (if you fix VIX at 55, VX will grind higher the closer the VX expiration to meet VIX at 55, with VX Apr currently at 33-35 thats a long way up for expiration in 7 trading days, the damage to vol etps will be massive just from the rise in VX without VIX having to continue going up or SPX dropping lower). Ofc VX carries alot of beta to SPX so it will go down on large bounces (as we’ve seen today already) but ‘historically’ timing the duration of this spike is not a smart thing to do, we can spend months with spot VIX 40s - 50s or higher like in 2008/2011 or during Covid… There will be plenty of upside in inverse vol ETP’s once vol tapers off a bit. You really do NOT need to time the precise top in vol to make very solid returns (spot VIX can drop ALOT with SPX bounce but the 30 day VX will have muted move lower, see Dec 2018 spike and following reaction in VX.) So there’s no point to time the top using inverse vol ETP’s as you don’t even get the same ‘juice’ as simply long ES (or MES) at much lower leverage than normal.

As always don’t hesitate to reach out if you have any questions!

Have a great week!

Nvm. I see it now!

The long/short 1dte straddle…what are the “vol ratio conditions” upon which the trade is based? Thank you.