Following up on last weeks overview:

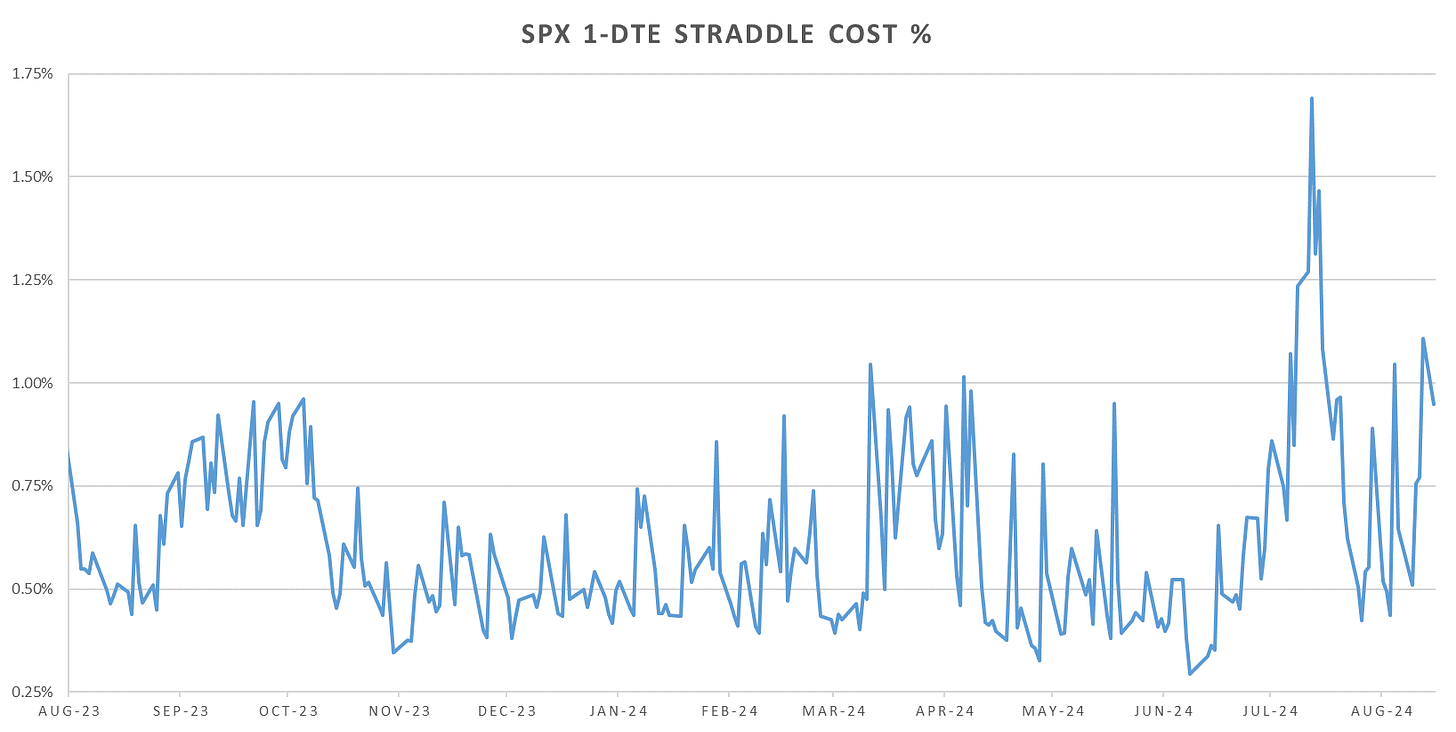

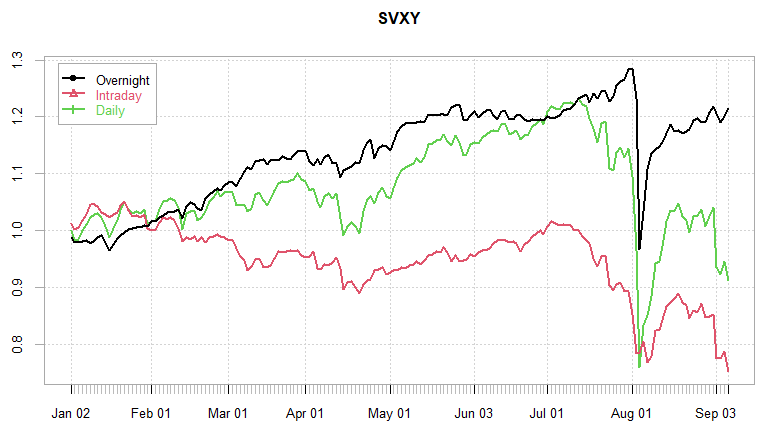

Labor week ended up being anything but quiet. 1-DTE straddles for Tuesday traded ~50bps at the end of August, cheapest level since July (and post BoJ crash in August.)

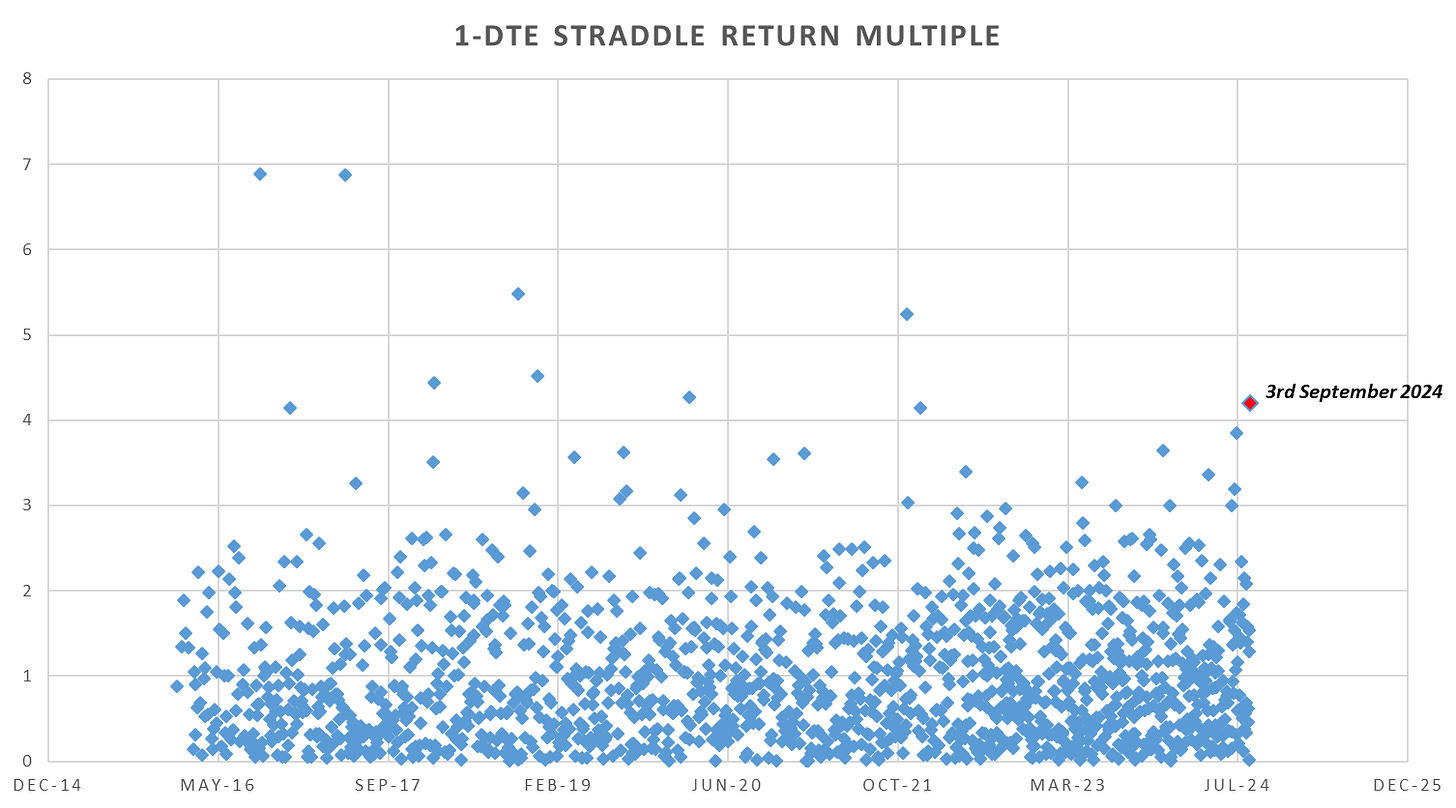

That was by far the largest mispricing since 2021 for 1-DTE straddles. Driven primarily by rotation as defensive sectors finished positive on the day. NVDA lost 10% (wiping out the mkt cap of 1.5x MCD 0.00%↑ or 1x NFLX 0.00%↑ ) . The rotation theme keeps playing out as market positions itself for softness and *gasp* possibility of a recession (although who can possibly tell now, with all the data ‘revisions’ we might as well already be in one…)

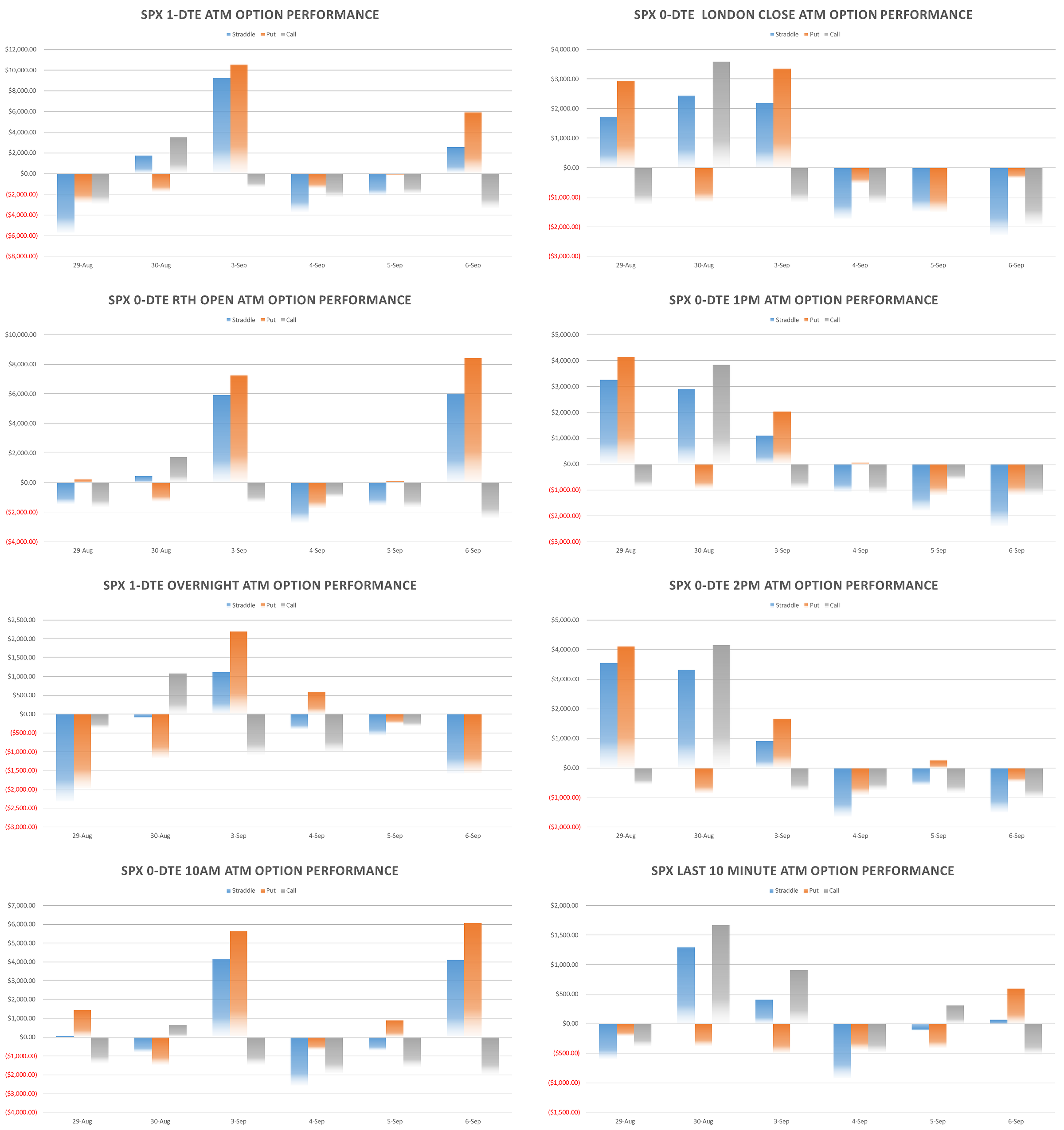

Daily straddles are back to 2024 highs, with markets skipping the usually quiet Labor Day week and going right for the action. Equity implied vol rallied sharply last week, VIX spent majority of the week above 20 once again, albeit the reaction to the worst week since March 2023 was alot more tame than early August (as mentioned last week, skew never got sold so market was already decently hedged with demand for upside & downside convexity strong in the last 3-4 weeks.)

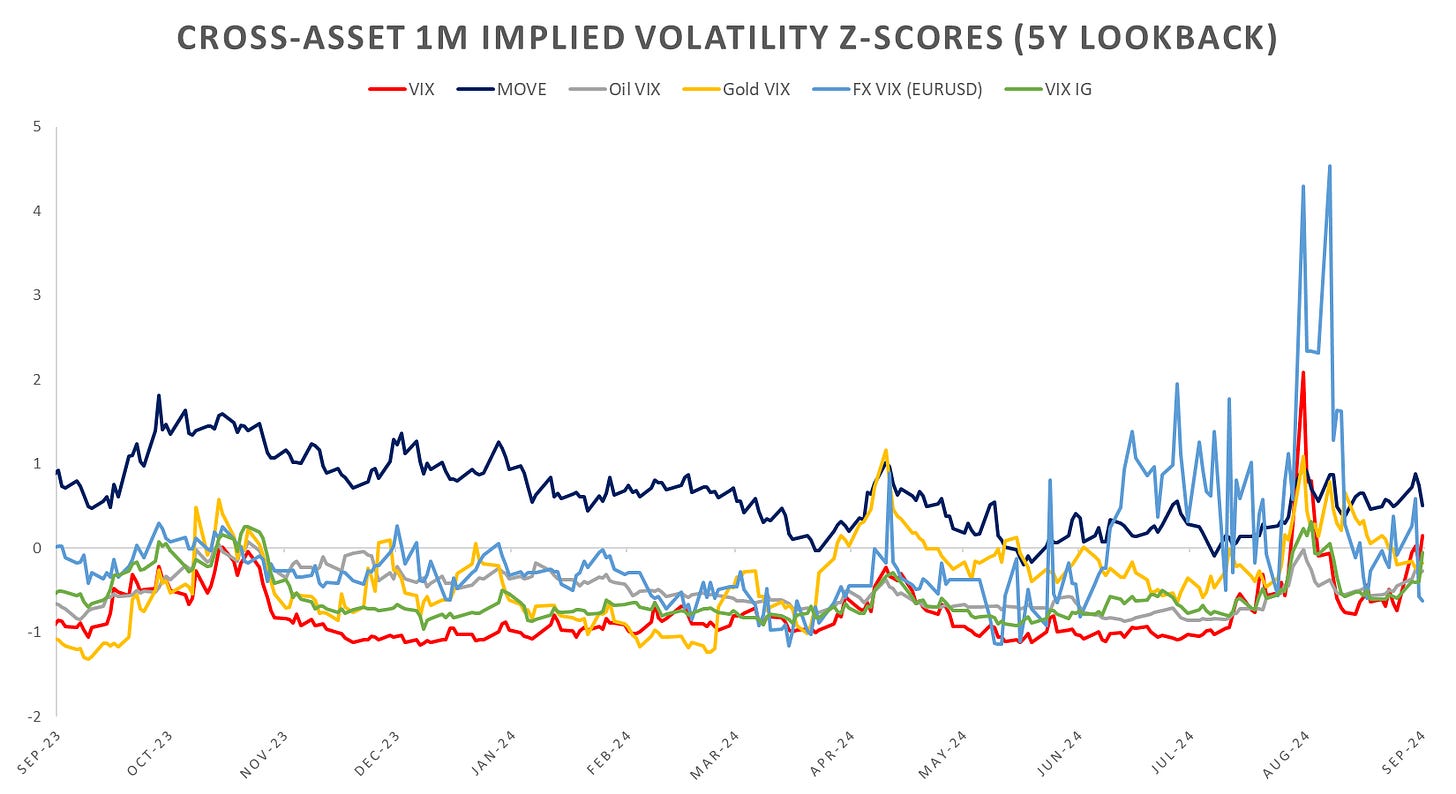

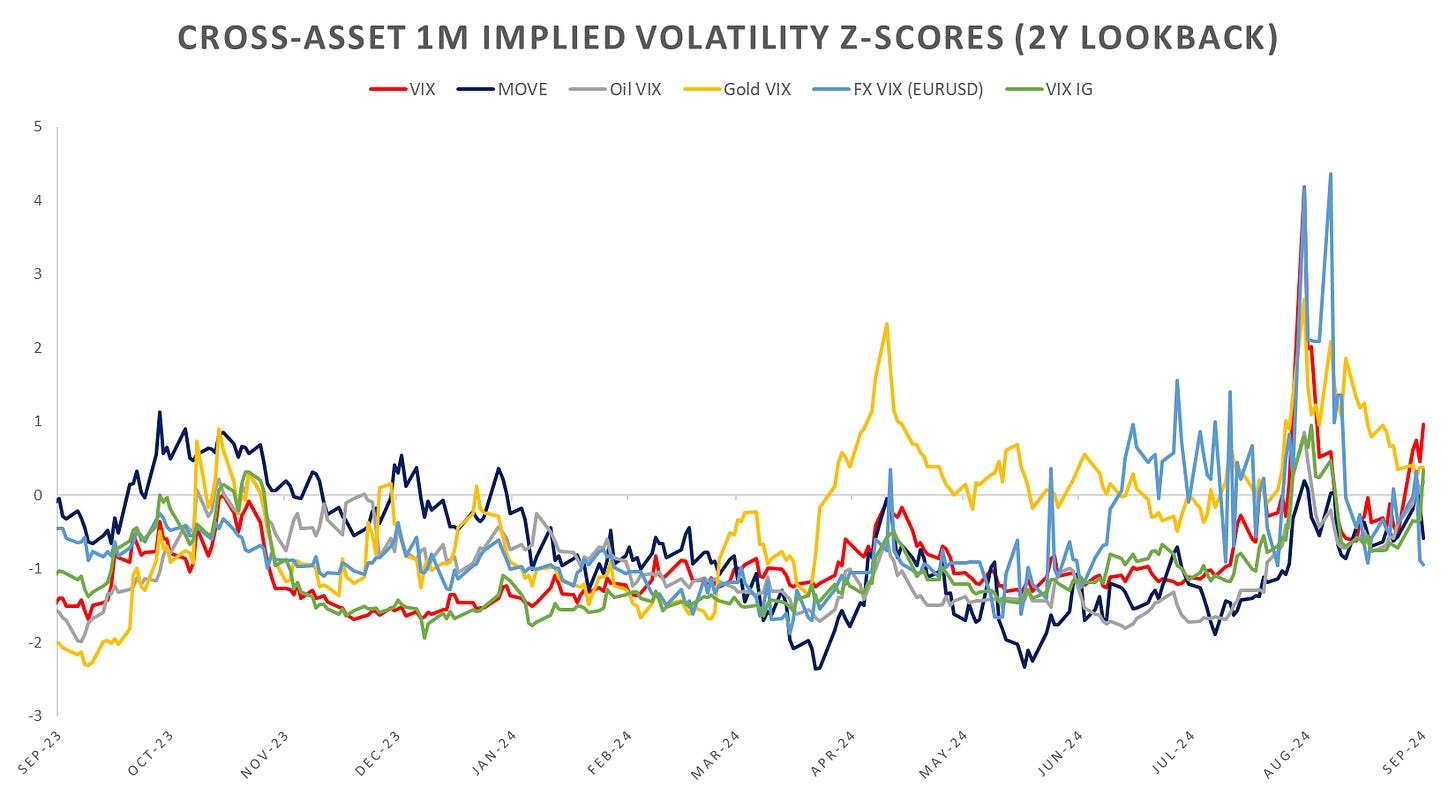

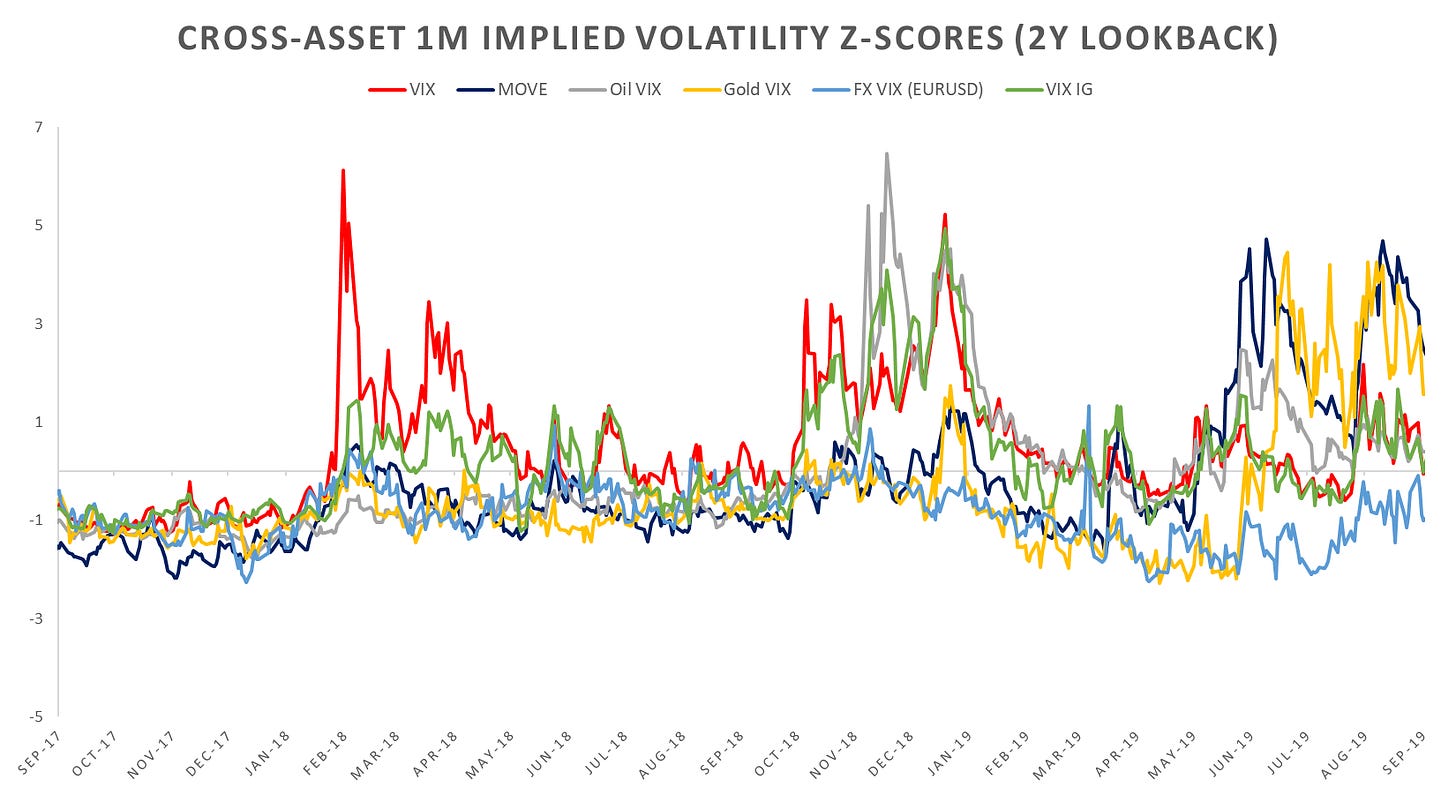

Cross-Asset vols paint an interesting picture. Looks like equity vol is in the driving seat as of the end of last week, with bond, fx & oil vol lower. First time in a while equity vol leads.

Have to go back to 2018 to see the same picture. Note back then Fed was on their ‘return to normalcy’ policy and were hiking instead of cutting, although return to normalcy now would most definitely be a cutting cycle… 2019 cuts also coincided with cross-asset vols blowing out although equities at the time did not have that much of a spike relative to other assets. The common denominator here is really that ‘changes’ bring with themselves rebalancing flows and thus unwinding of crowded positions from the previous market ‘state’. Until Fed changes stance to ‘do nothing’ cross-asset vols tend to remain closer to the ‘median’ values rather than ‘modes’.

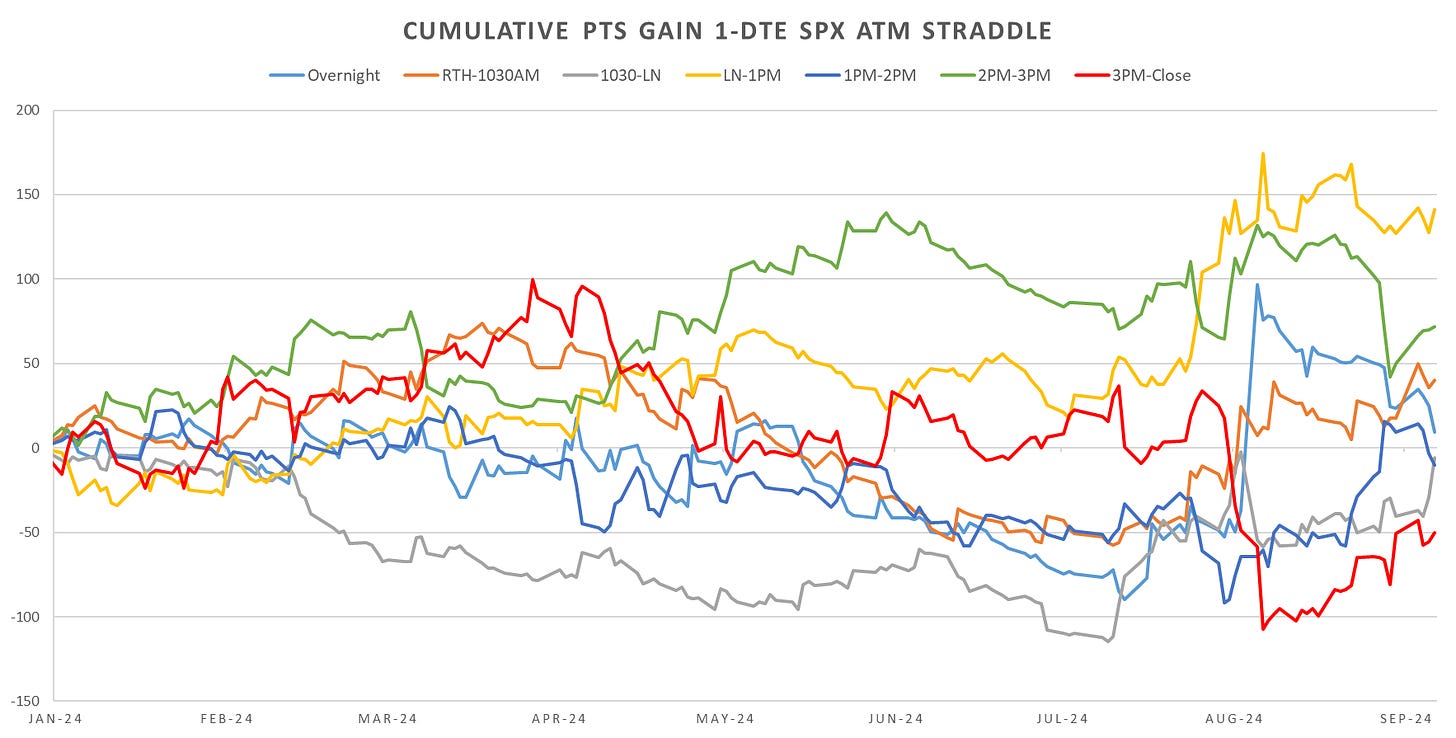

Looking at intraday price action, from the following posts:

and the newest post

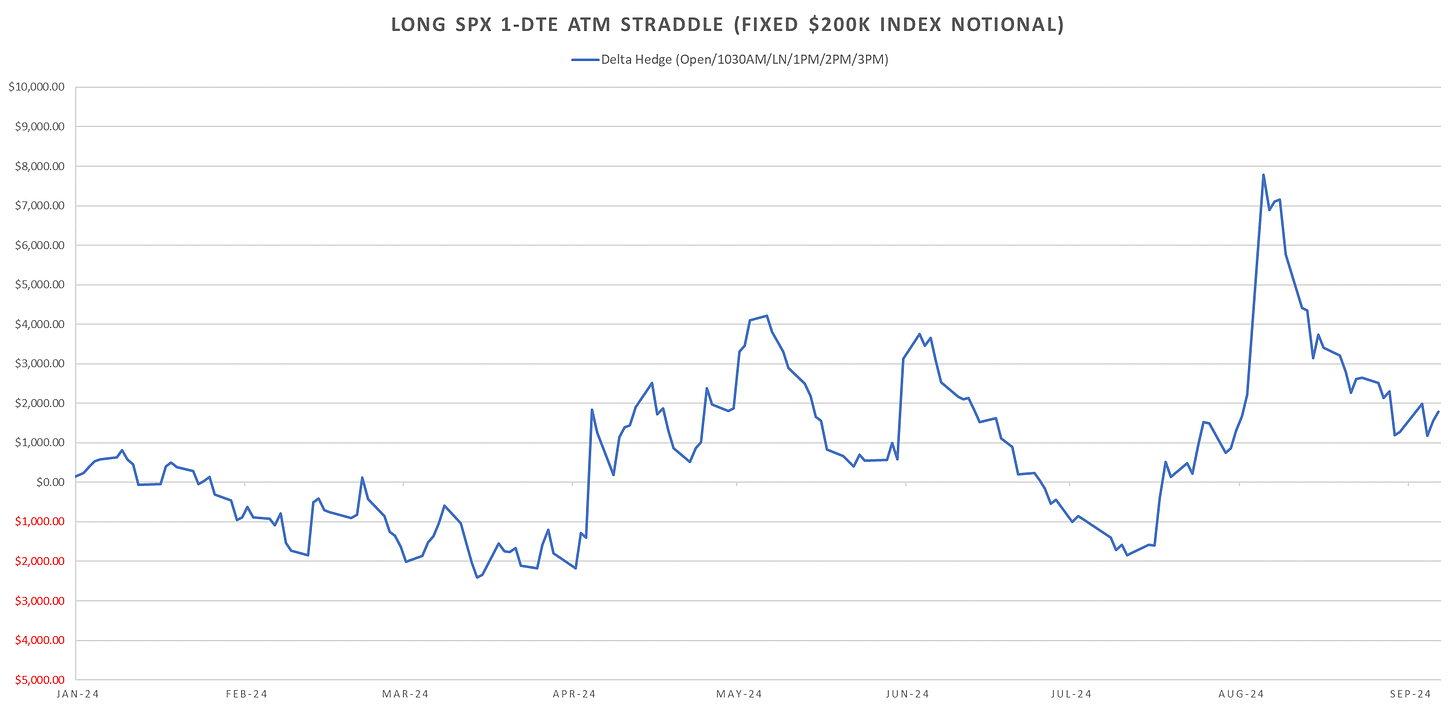

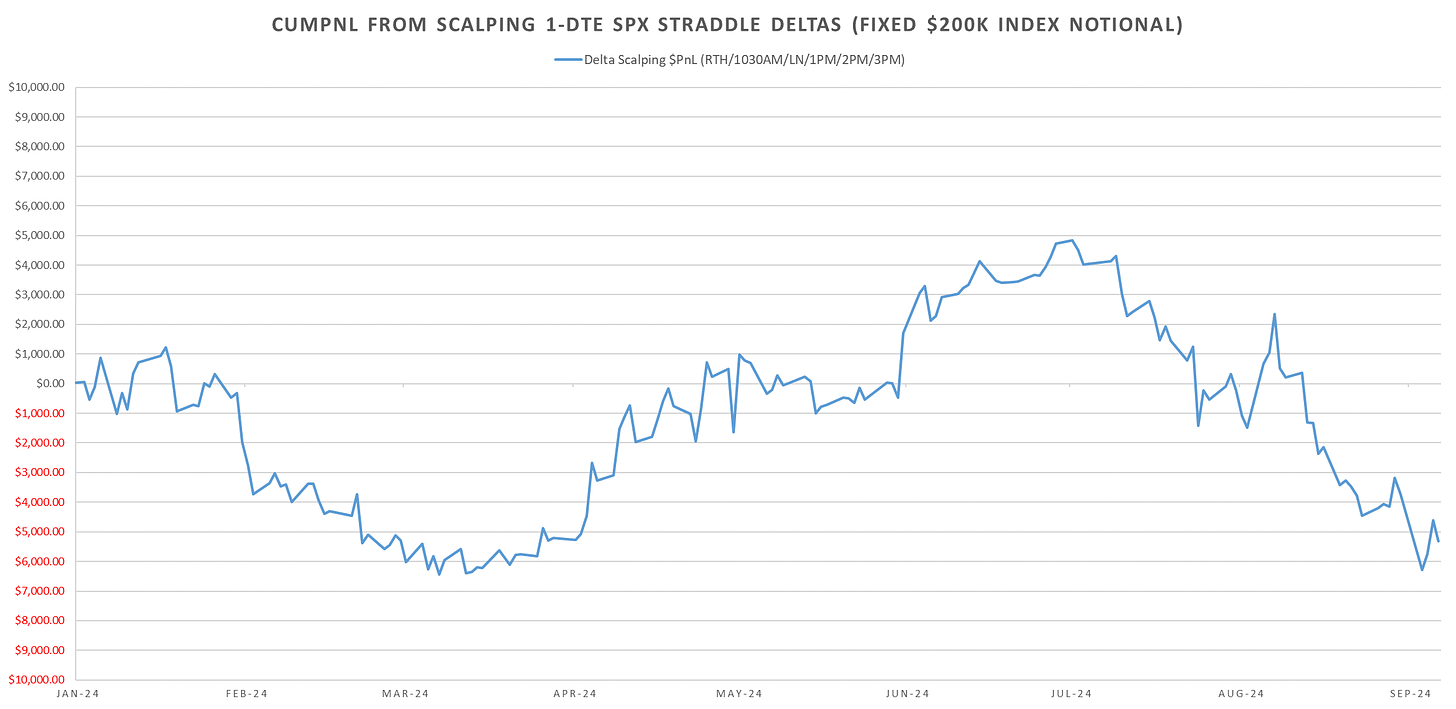

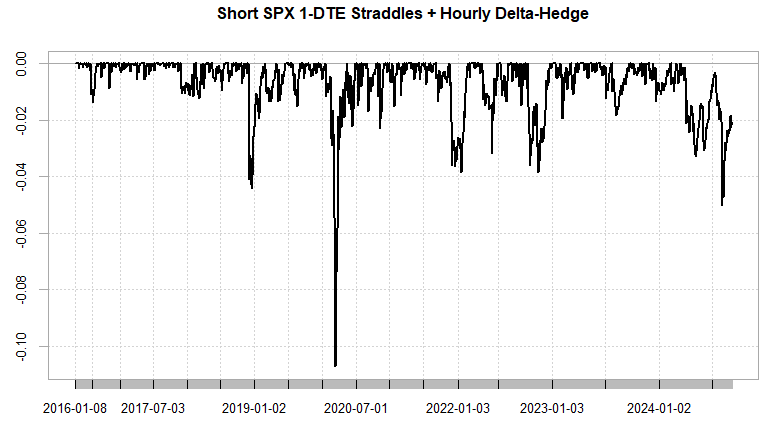

Despite the large moves last week, long gamma barely paid as moves were largely one directional throughout the trading day and with vol quickly adjusting to higher levels, long delta-hedged 1-dte straddles (delta-hedged hourly) barely up on the week…

Note the difference in pnls with the August drop, without large intraday swings or implied significantly underpricing rvol, path dependency playing a key element in short gamma trades. Even the Friday almost 2% drop on SPX was barely positive as event premium was over 1% & entire move one-directional.

As gamma pnl is dependent on both implied/realized & path, in previous posts I highlighted how the current market is having the least amount of intraday mean reversion in the last 20 years. With peak gamma being ATM and majority of the rvol occurring near the first hour or so of the day, the short gamma trade is hit early, with gamma exposure decreasing as SPX moves away from the previous days ATM strikes. Before June, as rvol was mainly imbalanced towards the close of the day, short gamma kept performing well, less so now that rvol flipping to the am session. In addition to market path, June/July saw record lows in 1-dte ATM ivols, touching 2017 & 2004 levels, exacerbating the short gamma losses.

In terms of the straddle itself, since July, early am windows winners, 2pm onwards losers. Alot more dispersion intraday as well, Jan-Mar overall long straddles did well, after April intraday sessions almost ‘split’ between am/pm sessions.

I think last weeks equity reaction was largely overblown, probably due to shortened week + (clearly) unexpected weakness. CPI this week & FOMC next week will likely keep market steady into them. Despite general risk off triggers across trading systems, no long VX or outright short market trades as of yet… (then again shorting this mkt generally only worthwhile when there’s clear signs of liquidation… otherwise equities just somehow always levitate higher…)

Was talking to a trader over the weekend, he mentioned “this market always gives you the urge to sell calls”, yet looking at data, its probably the worst possible thing to do across any duration…

Realized Volatility Overview

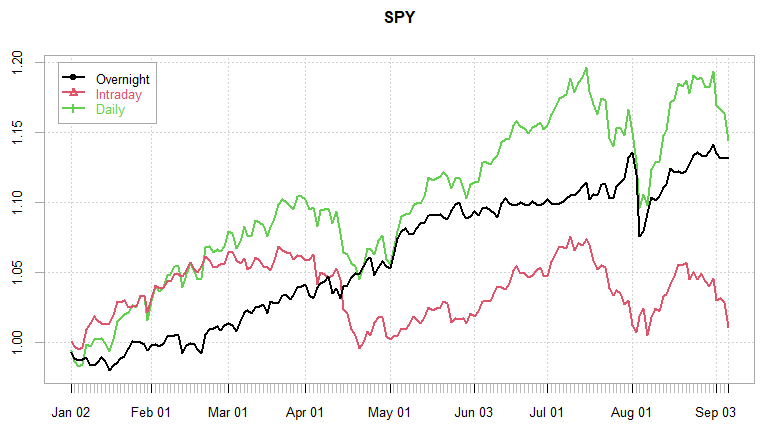

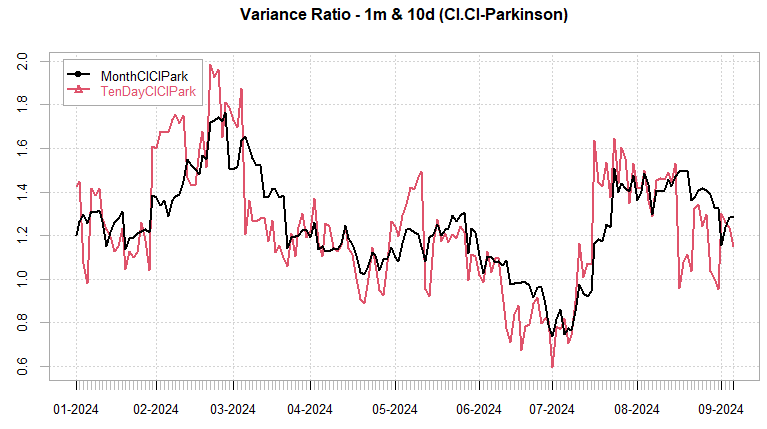

As was the case for majority of the year(s)… overnight risk is invisible with intraday SPY trading flat on the year…

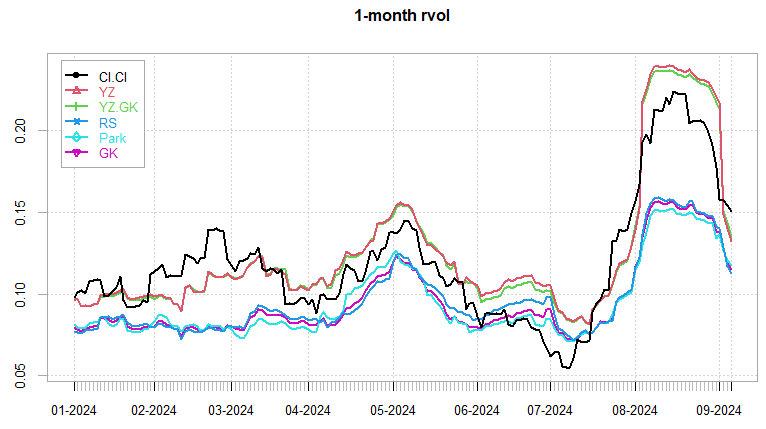

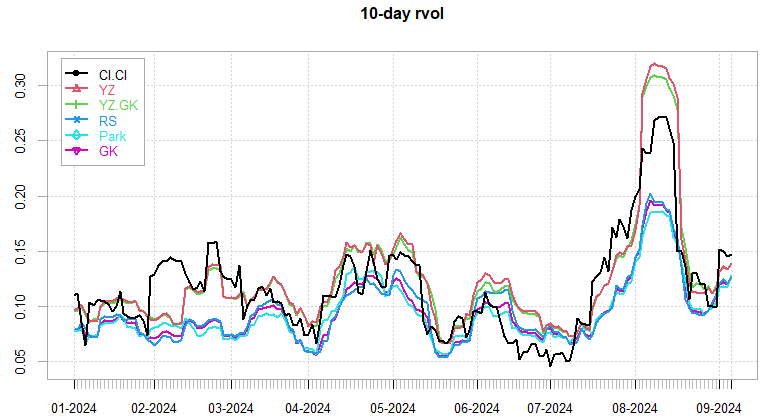

Entire August 1m rvol managed to hold up as we rallied almost as fast as we’ve dropped. Only recently 1m rvols managed to drop back towards 15, just as implied spiked again. VIX ~15-17 remains fair given rvol, with 1m implieds trading at a decent premium now.

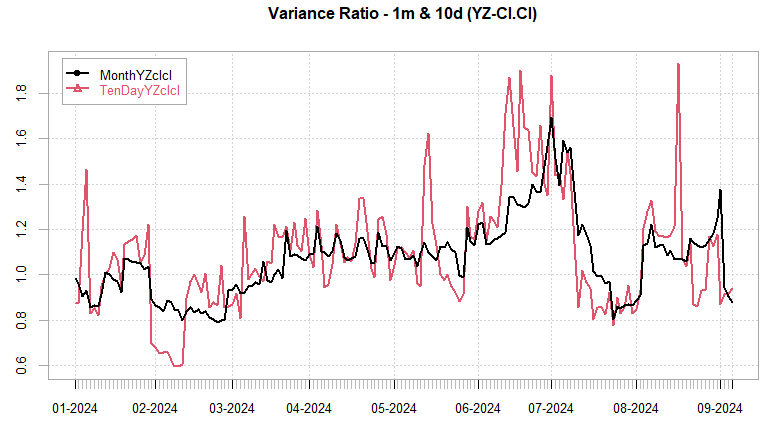

From last post: “We are starting to see range based vol pick up relative to cl-cl, historically, long straddles for a trend-like move have positive expectancy here, especially for RTH moves.”

I remain impressed with the VarRatio’s consistency in forecasting forward trend/mean reversion behavior intraday (see VarRatio section). Largely no edge here into next week. Probably decently wide ranges with some mean reversion (in line with vol term structure inversion and elevated implieds.)

VIX Futures overnight remain oblivious to RTH session woes. Worst week since March 2023 for equities yet overnight short VX up on the week…

SPX ATM Straddle Performance

To summarize, 1-DTE straddles done well (thanks to the unexpected Tuesday drop mainly, Friday move largely priced in.) Post London Close short straddles winners every day last week. Data releases *look* to be playing central role here. FOMC should clarify path expectations and how concerned they are with the slowdown going into October. After that central theme is election & the subsequent *fingers crossed* vol crush into year end.

Variance Ratio Conditional Performance

From the following post:

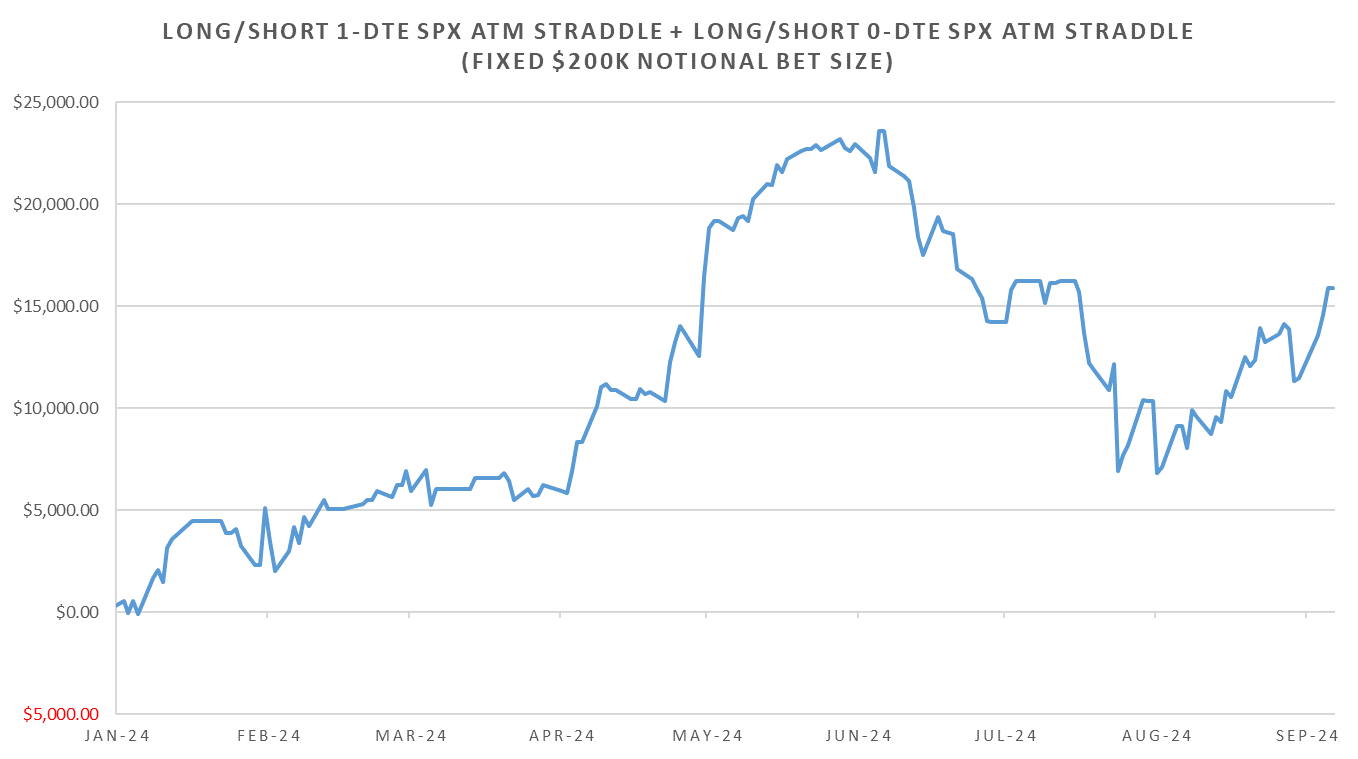

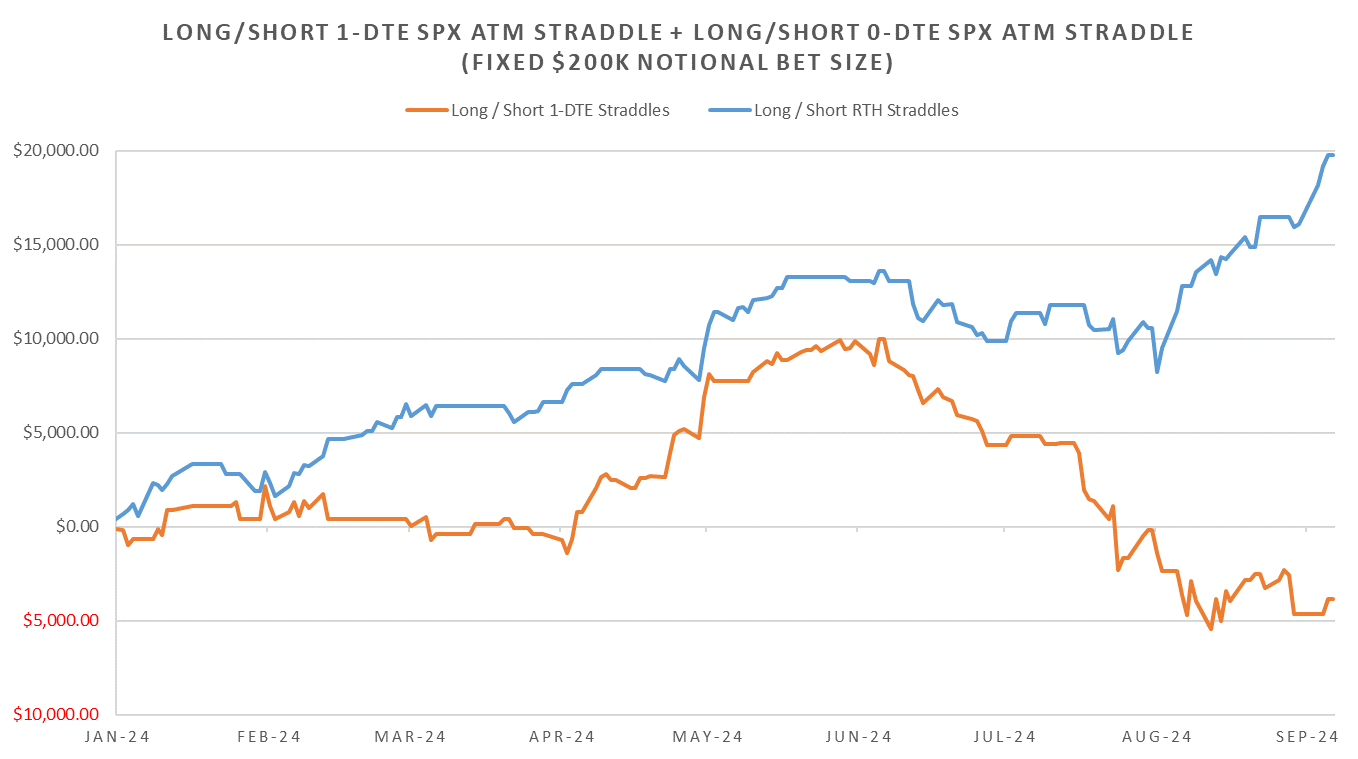

Big win last week, systems went into Tuesday long the RTH straddles, short the 1-DTE & RTH straddles for Thu. Fri remained in cash with no positions and no positions for upcoming Monday either.

Divergence between the 1-DTE leg and the RTH leg continues. Difference in range based vs close-close estimators looks to be pronounced this year. For details check the main post. Unlevered performance ~8-9% ytd so far (~17% avg annual between 2017/2023).

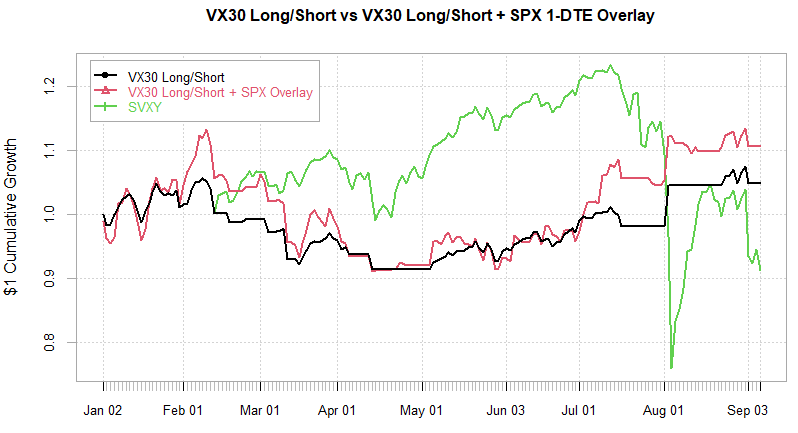

VX Carry & SPX Overlay

From the following post:

Not a lot of action from the overlay or the VX systems. Short VX Oct closed at Tuesday open ~18.35 from 18.5 (Aug 23rd entry.) Had some nice pnl on it but sudden drop on Tuesday kicked it out fast. SPX Overlay no triggers for a while now, possibly early this week if vol calms down a bit will get a long straddle trigger. Generally, nowhere near short vol for the front month contract since July 17th… One of the longer stretches without any short vol triggers. I will chalk that up to the amazing run we’re gonna have post election, lol.

Have a good week!

Morning