Market Overview - September 29th 2024

S&P Index Options & Volatility

Following up on last weeks overview:

Another extremely quiet week in the markets. Price action remains diametrically opposite to expectations of elevated volatility during the worst two week stretch of the year. The ‘quiet’ trading action got marred by geopolitical risk headlines heading into the weekend. The gap between implied/realized vol widened further, with 30-day skew steepening into the weekend. US stocks largely ignored the wild reversal in Japanese Nikkei on Friday after news of the new incoming PM who is likely to support higher interest rates & higher capital gains tax. With quarter end expiration on Monday, indices should start moving again as we head into the pre-election October (in addition to 2nd half of September, most volatile month of the year.)

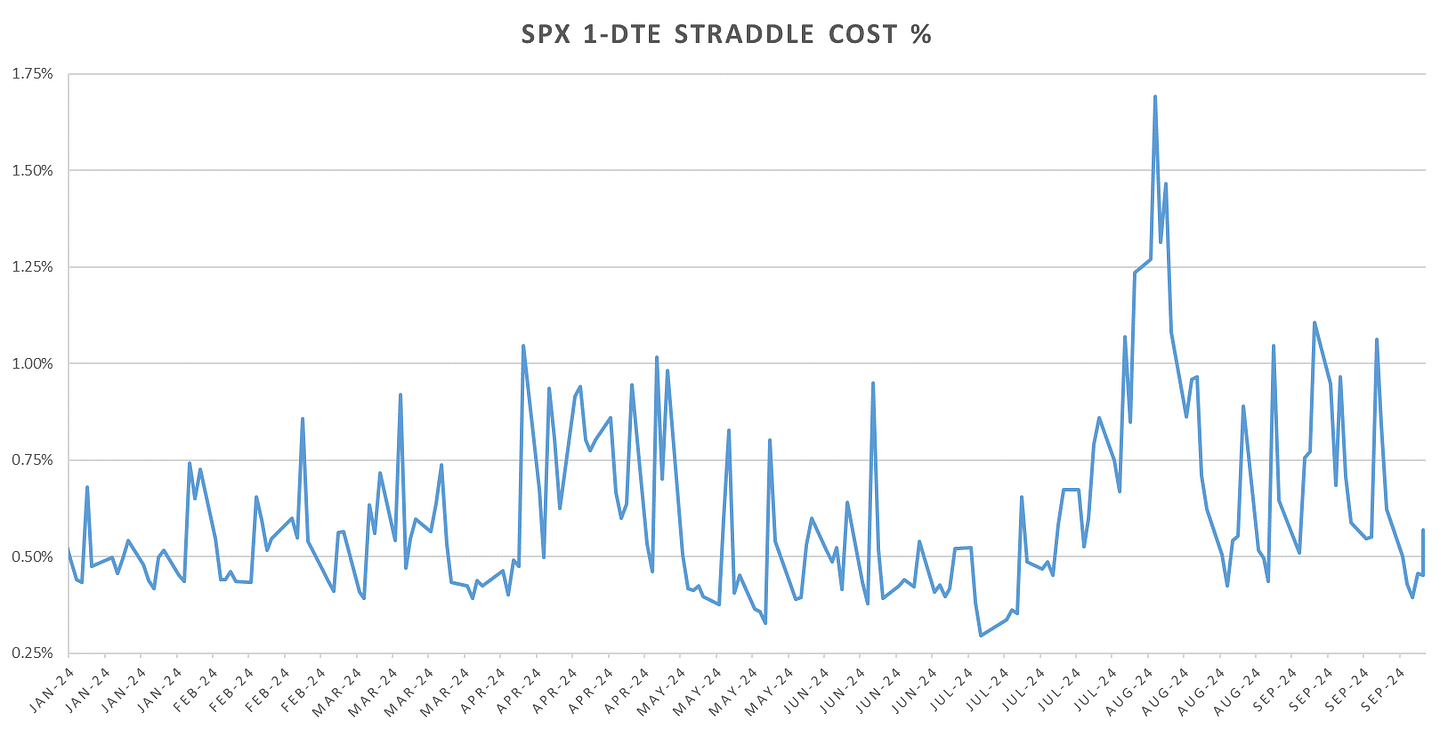

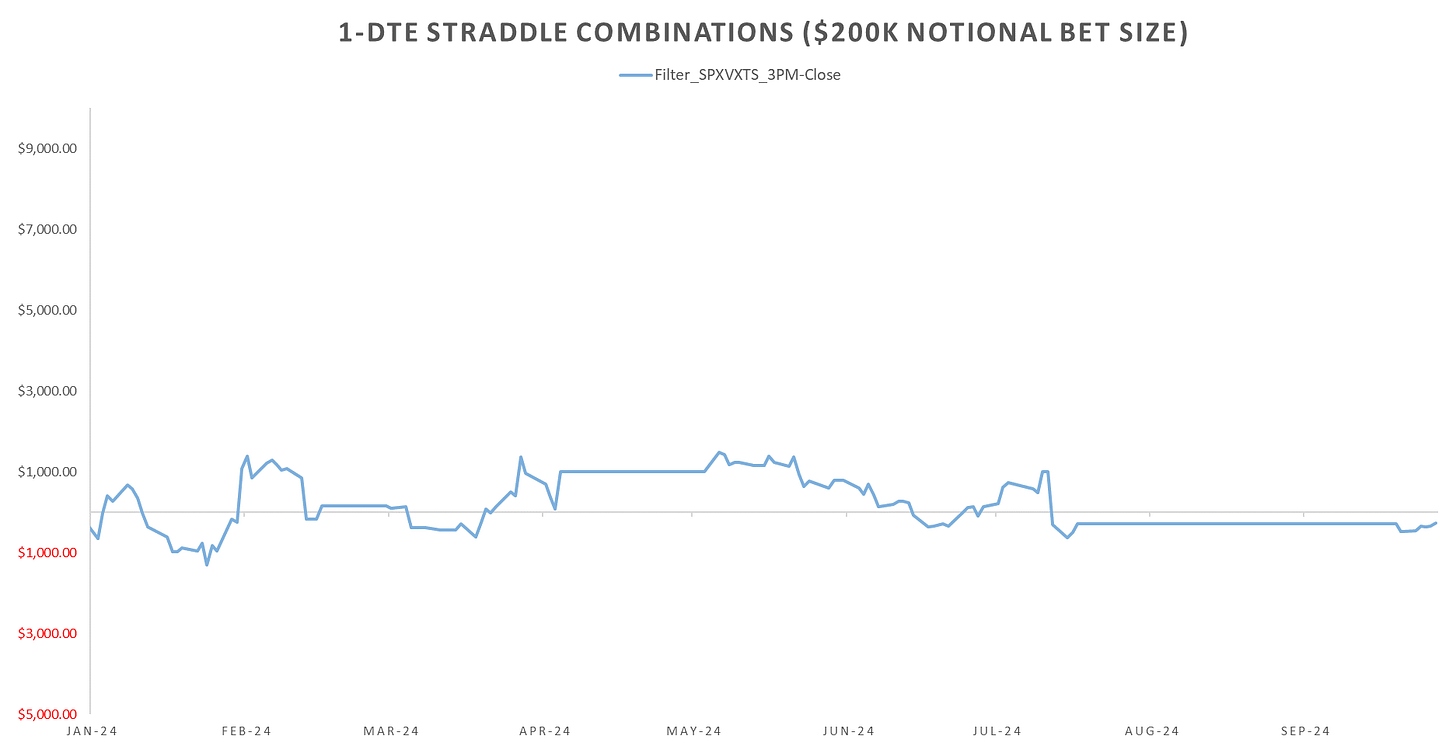

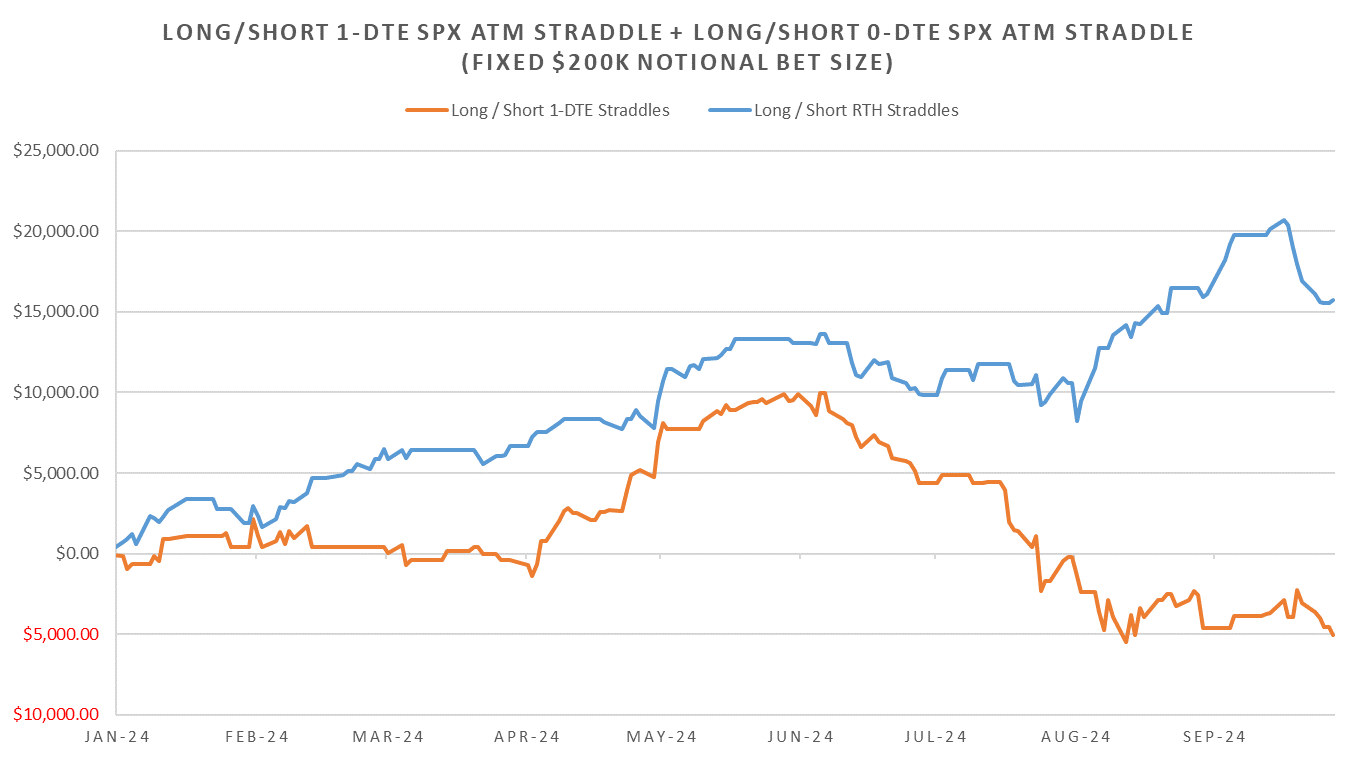

1-DTE Straddles briefly traded at around summer lows before going into the weekend at ~60bps on elevated geopol risk. Monday is also eom & eoq day so expecting a decent shot at long eod premium (will post the EoM trade overview on Monday.)

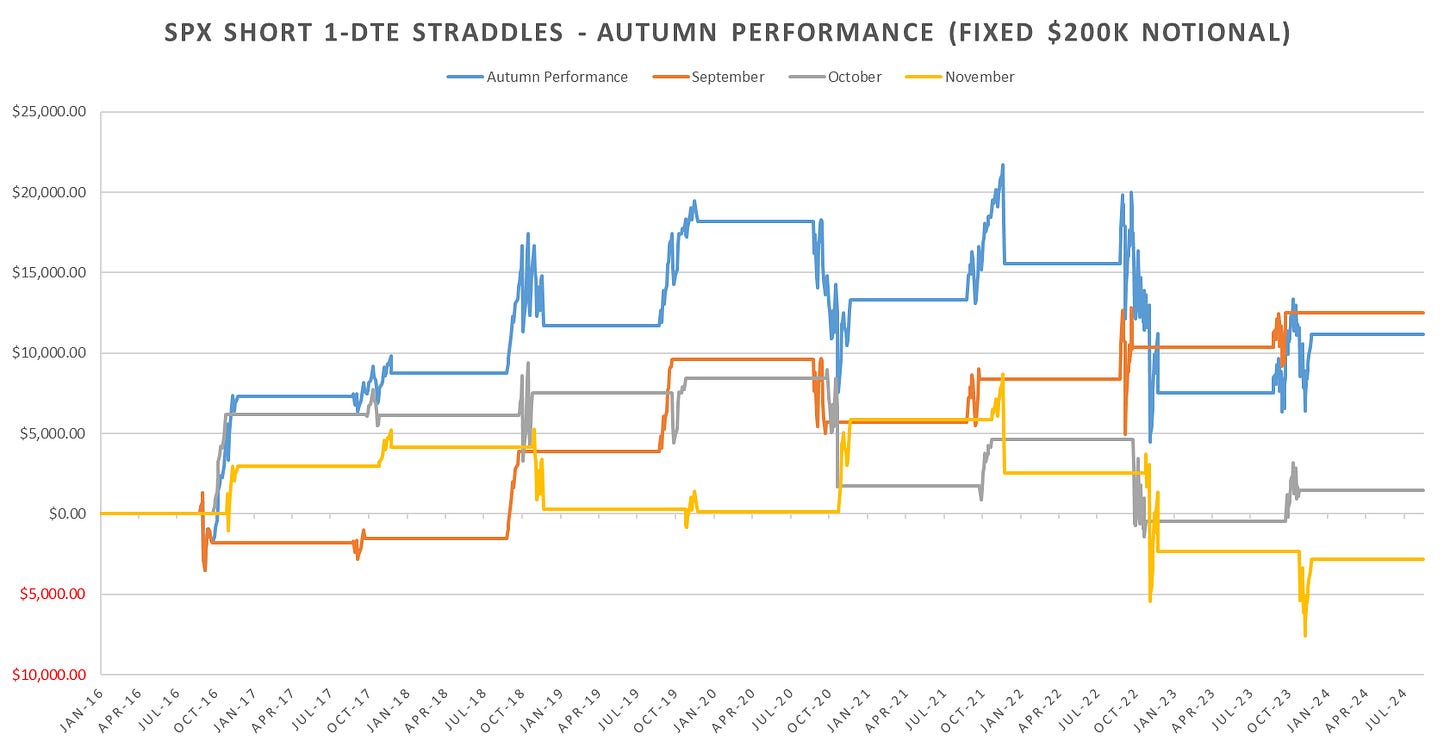

Looking at Autumn seasonality, we’ve passed the best part of the performance for short straddles, with Oct/Nov alot more rocky, especially given election headlines.

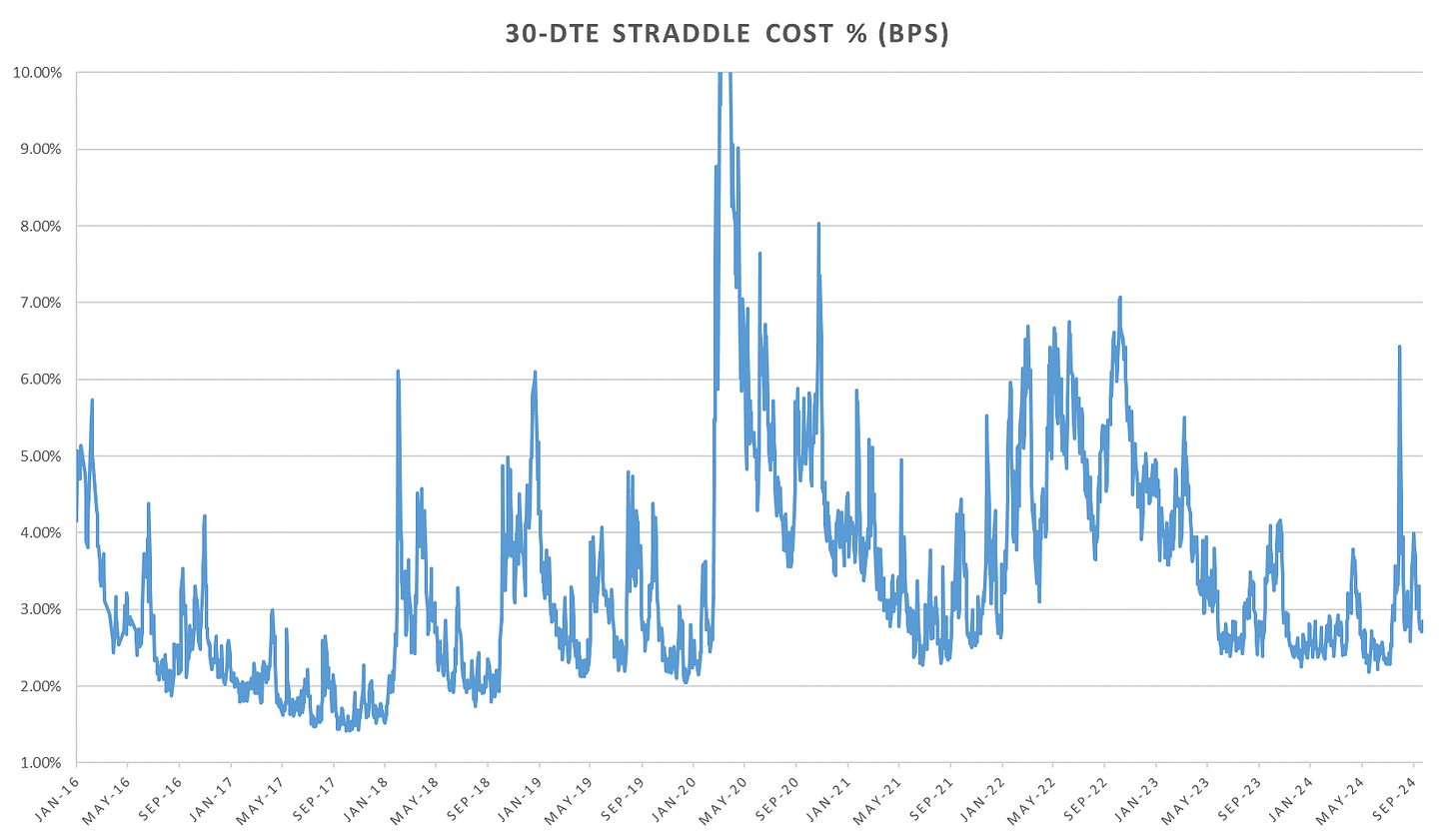

30-DTE straddles not quite covering the election yet but not following the short dated vol lower, holding ~August post BoJ lows.

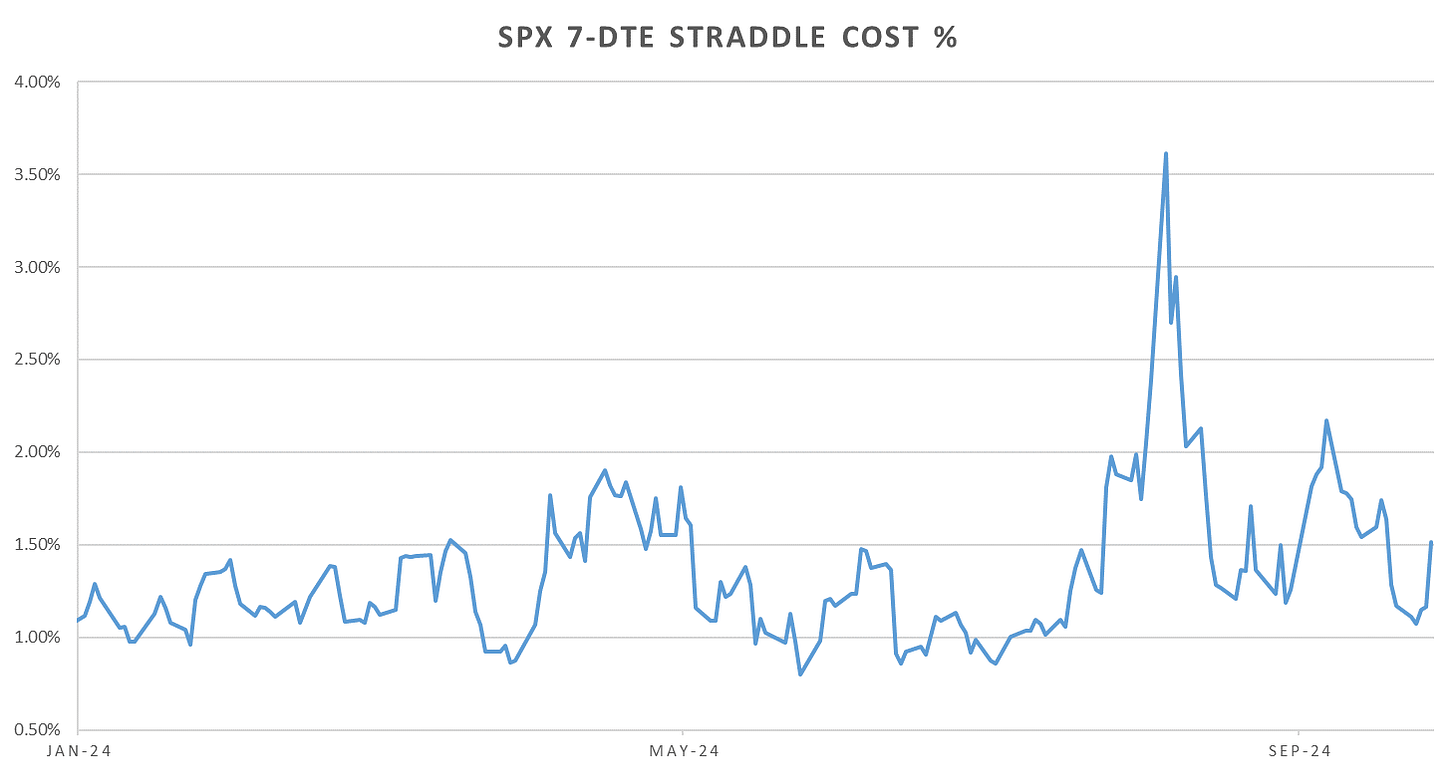

Weekly straddles also back up, driven mainly by the Friday Oct 4th premium for NFP & unemployment data (almost 40bps jump for 7-DTE straddle covering Friday from Thursday.)

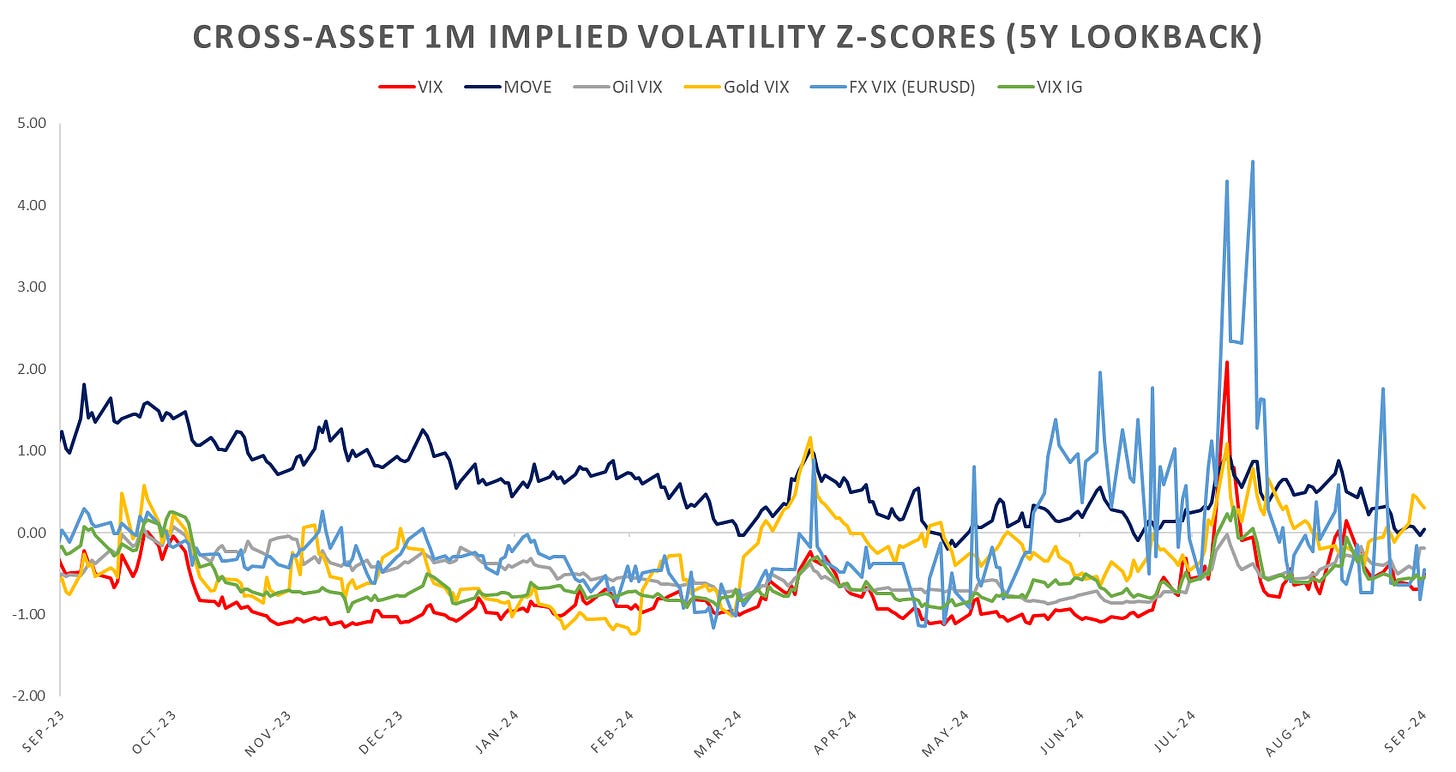

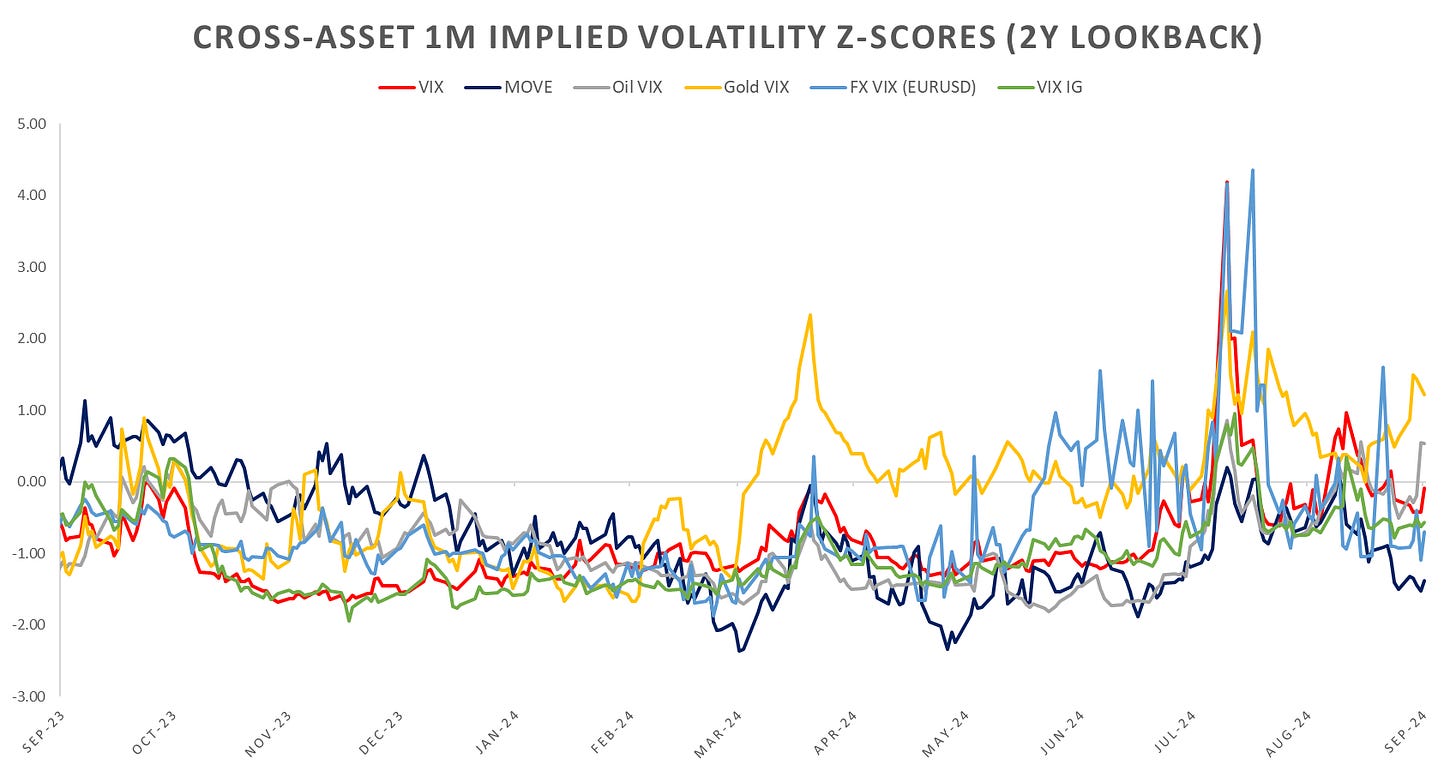

In terms of cross-asset vol, MOVE back down to summer lows after the 50bps cut, gold & oil having the biggest jump w/w as Middle East continues to be in the spotlight.

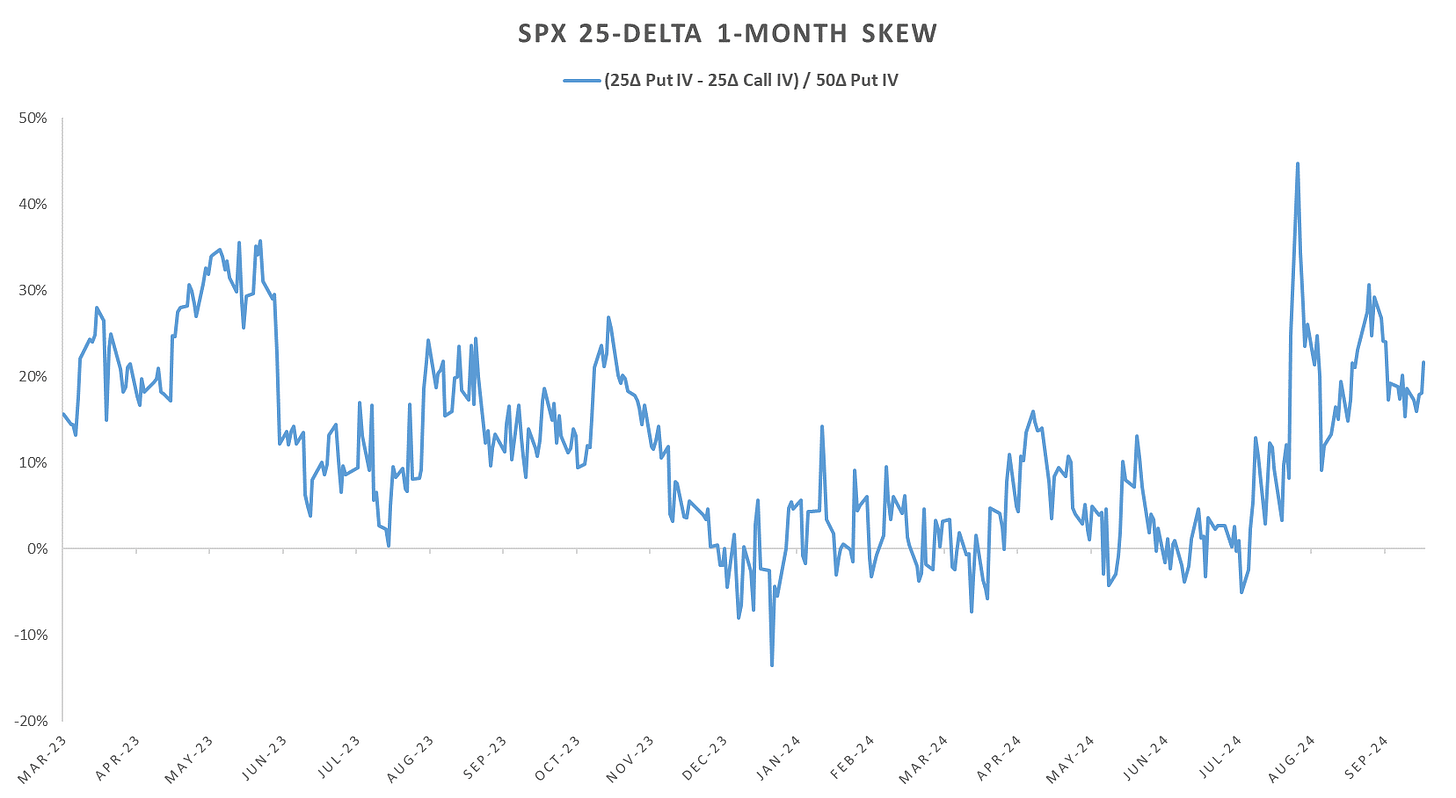

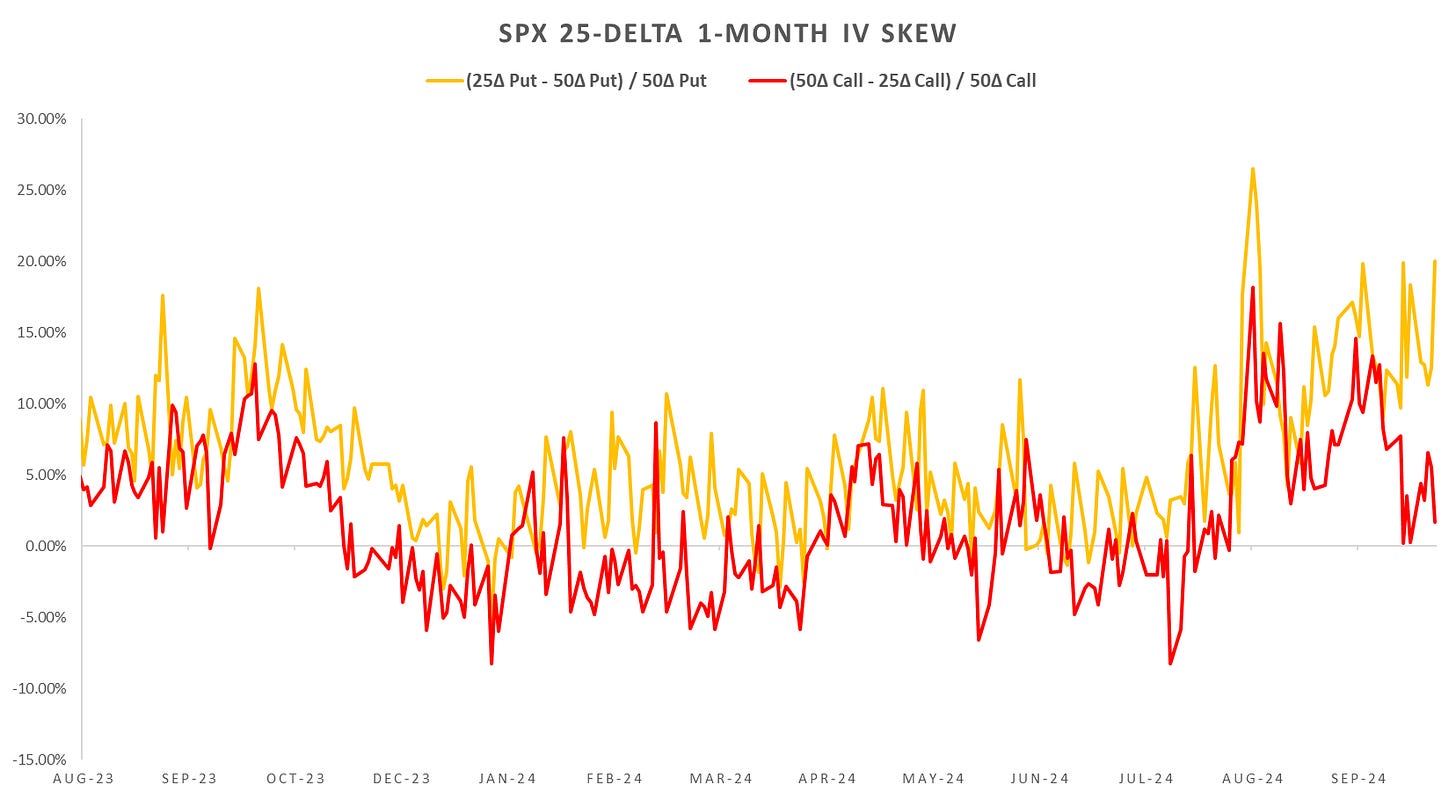

SPX skew continues to steepen, with upside skew flat & downside skew well bid (almost back to August highs.) Elevated downside skew should keep VIX in check on a relatively mild 3-4% downside move, so should not see panic moves like we’ve seen in August. Expect weaker VX beta relative to SPX moves to the downside, with ~flat VIX/VX on upside moves.

While SPX finished the week slightly higher, the main move once again was the Thursday gap up to the upside, moving slightly above the 7-DTE straddle breakeven before giving it back in the RTH session. Delta-Hedged 7-DTE Calls slightly up on the week, driven by delta scalps in the RTH session.

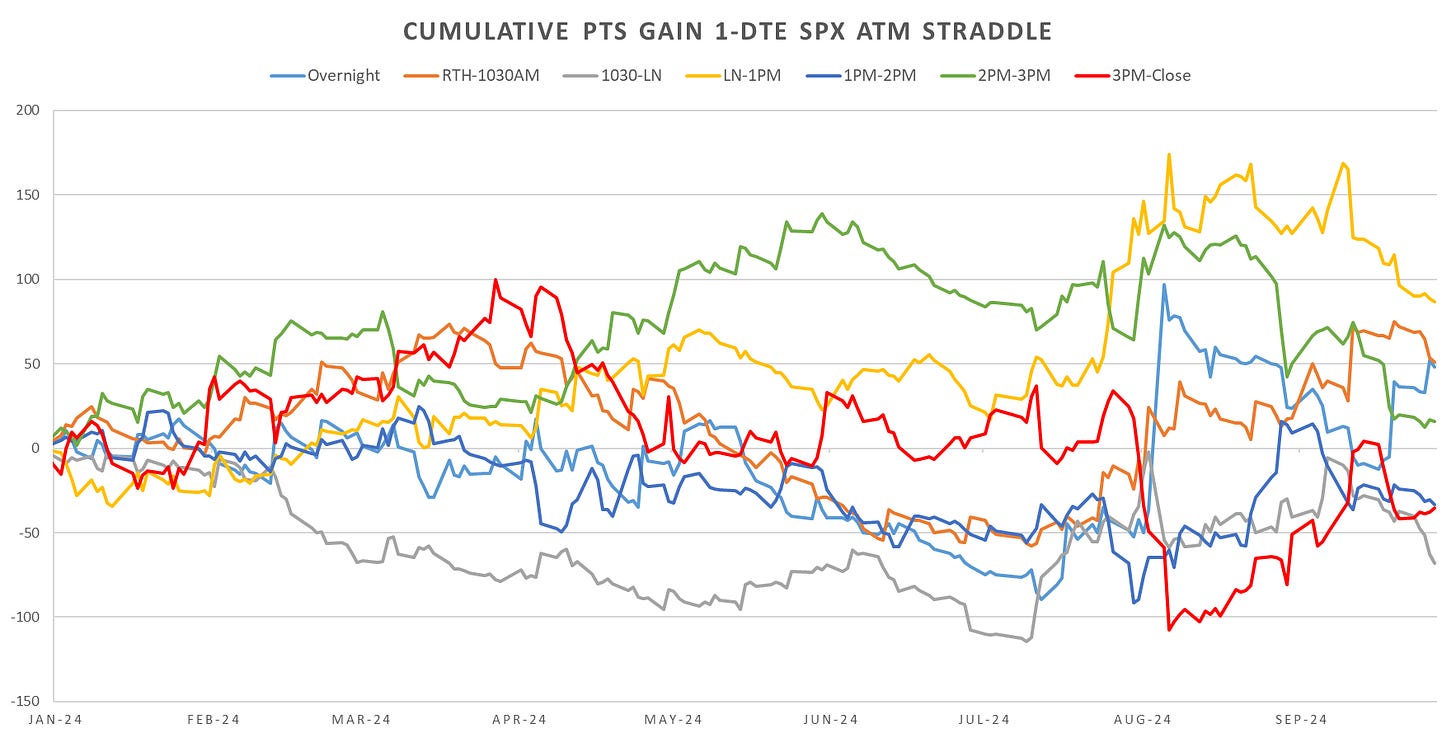

Looking at intraday price action, from the following posts:

and the newest post:

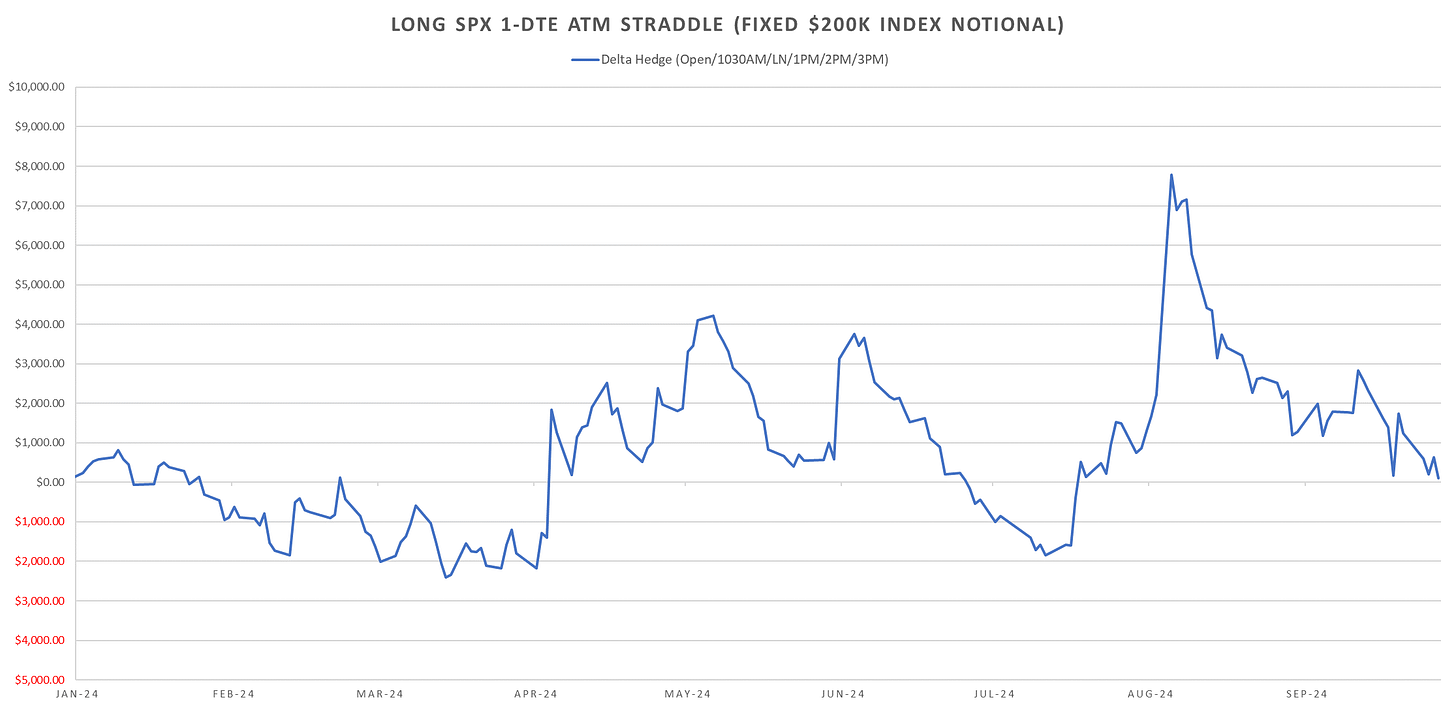

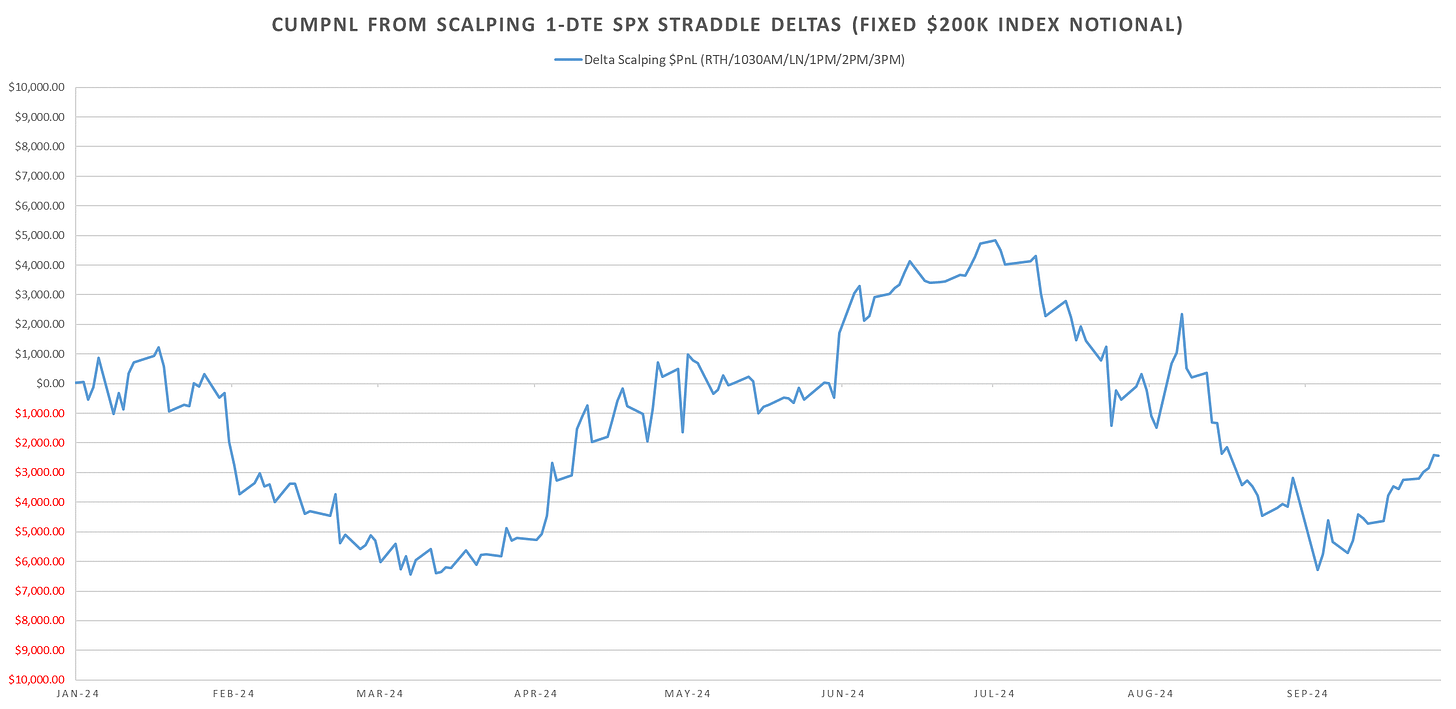

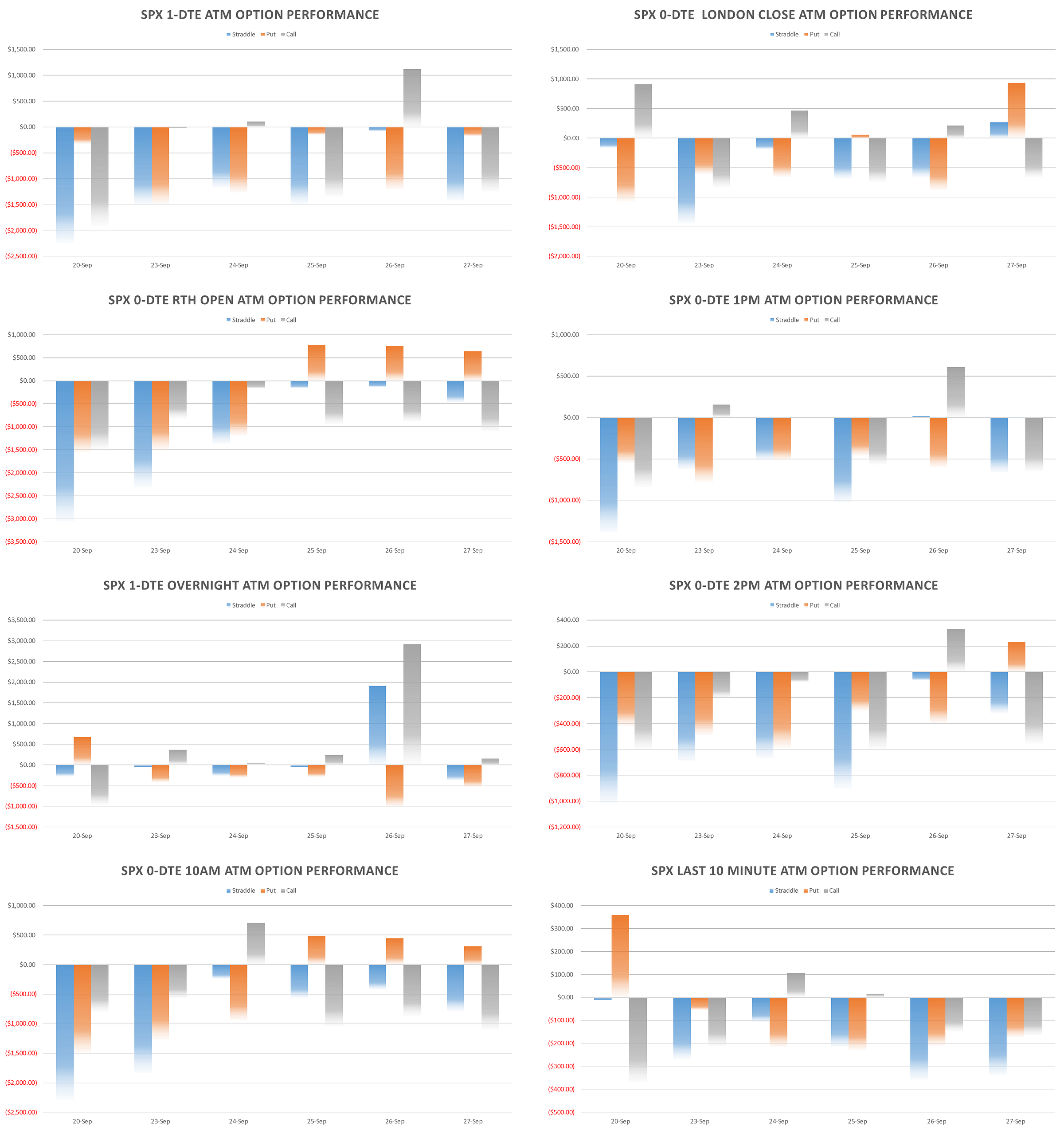

Long short-dated gamma down once again this week even with straddles trading near June/July lows.

Majority of the moves were reserved for first few hours of the trading day, with SPX largely flat into eod, resulting in no opportunity to scalp enough deltas to offset theta decay. In summary, gap up → scalp deltas back to flat → grind sideways into close…

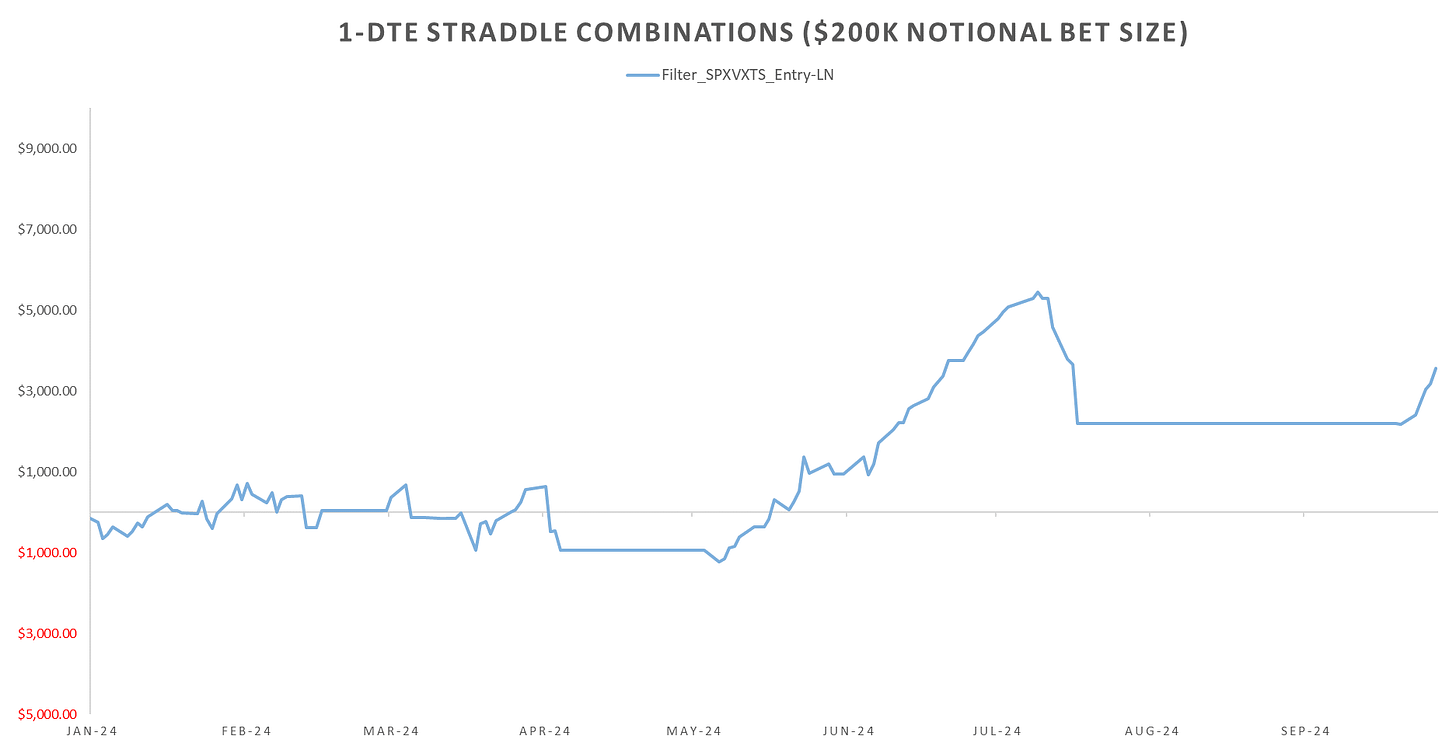

Outside of the overnight moves & the RTH-1030AM mean reversion straddles just kept bleeding. In the last post I mentioned that filtering the short 1-DTE Straddle till London Close trade by SPXVXTS shape filtered out a lot of the downside. This week ~1400$ pnl on $200k notional bet size (~70 bps).

The 3PM-Close pnl still ~ flat YTD.

More details on this in:

Realized Volatility Overview

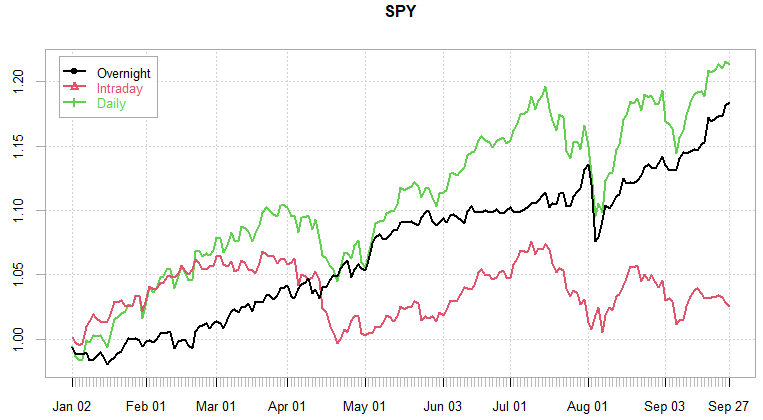

SPY remains net red for September during the RTH session… up almost 5% during the overnight session, same pattern as almost entire year. Almost 4+ sharpe for overnight performance YTD, one of the best years so far for overnight performance.

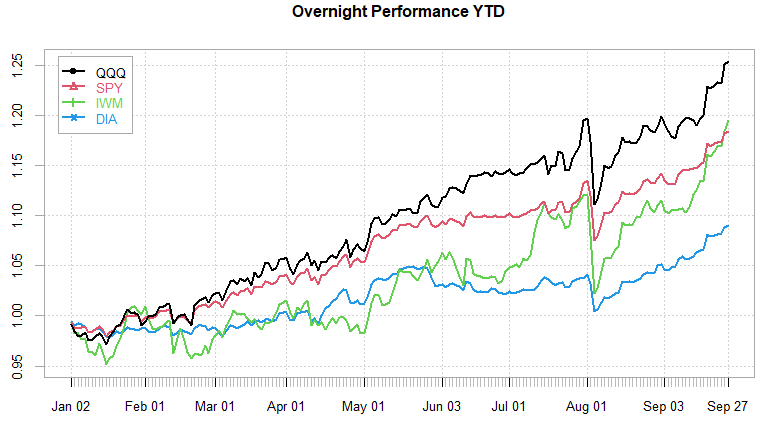

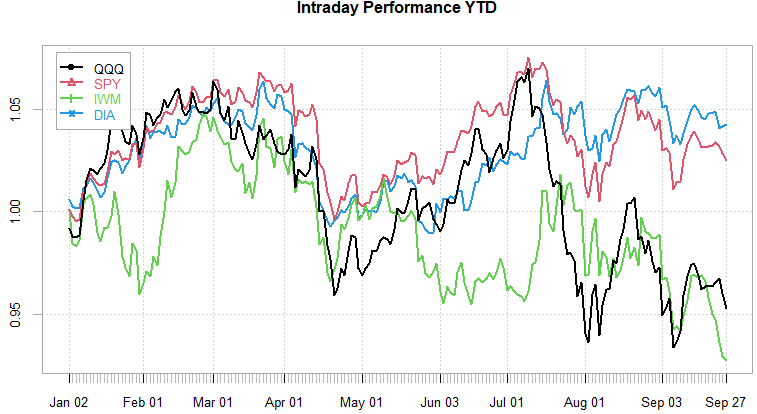

Out of the major indices, QQQ leading the overnight perf, DIA leading the intraday perf.

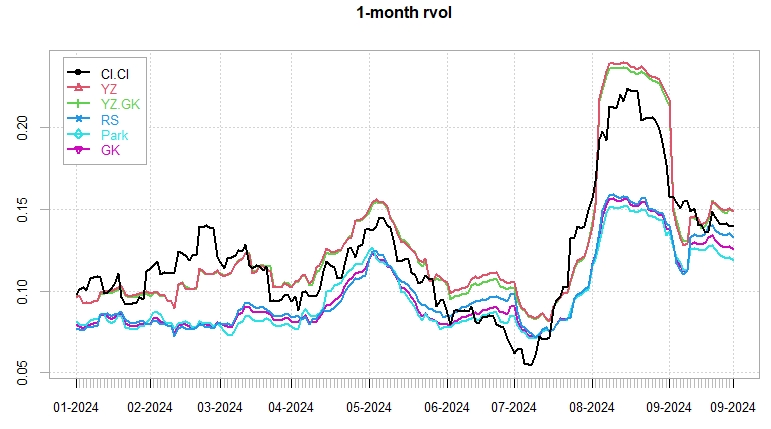

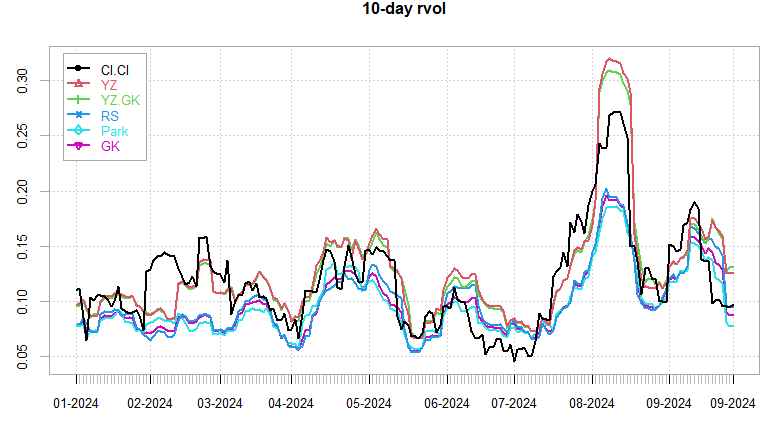

10-day rvol dipped below 10 once again on most measures. YZ holding closer to 15 as it takes into account the overnight moves. 1-month rvol circling around long term average here.

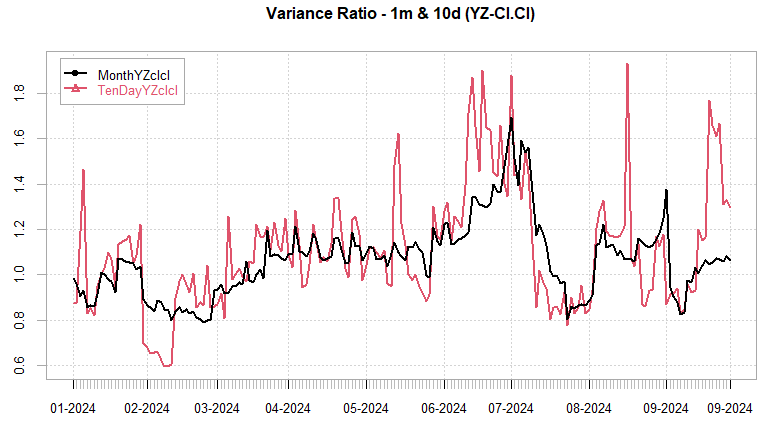

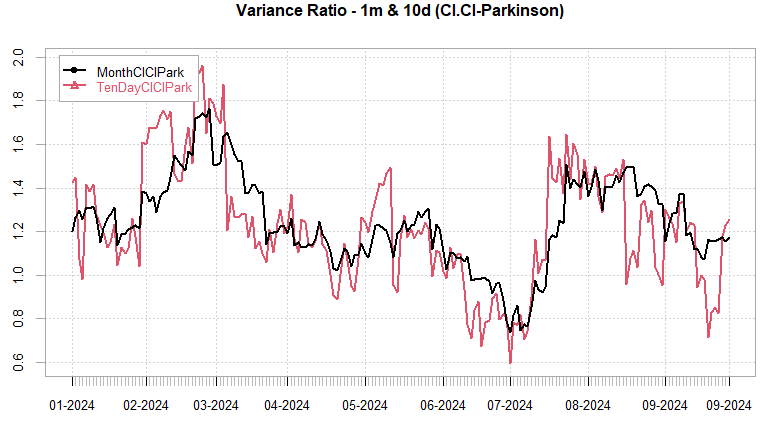

Variance Ratios have normalized as the more efficient rvol measures have caught down to the cl-cl measure. As of Thursday close, flipped expectations from intraday trend to intraday mean reversion but with larger cl-cl moves. Logic behind this is high mean reversion on a cl-cl basis but with large ranges, historically, tends to lead to range expansion & good long 1-DTE straddle performance going forward.

For further explanation, see:

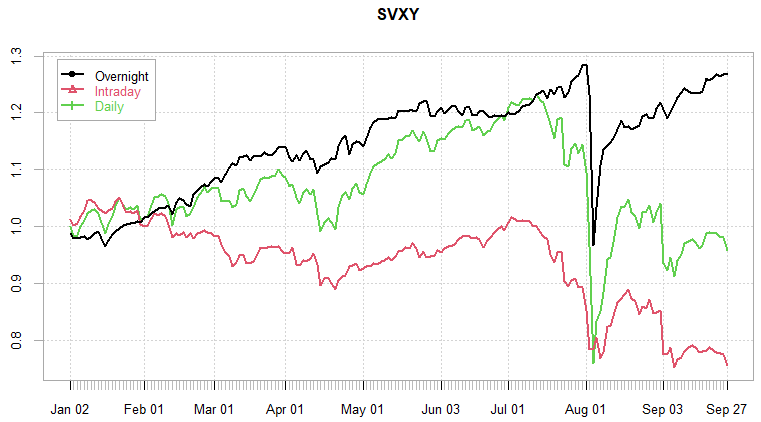

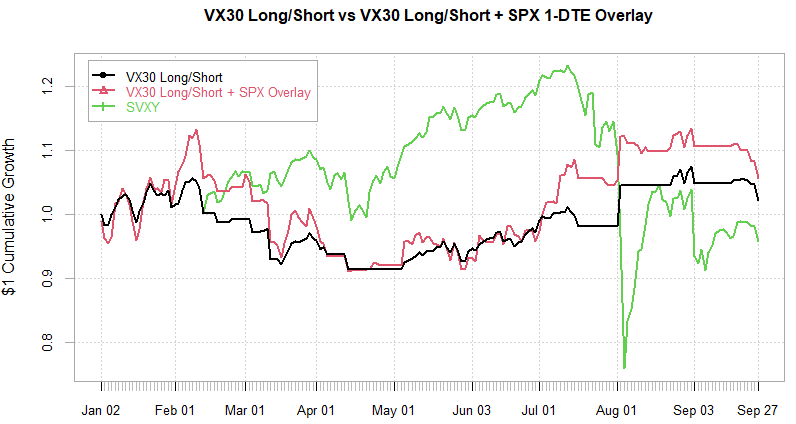

Shorting VIX futures during RTH made new lows for the year on Friday… Overnight performance back to pre August drop highs (almost 50% YTD for -1x Index as SVXY is -0.5x). We have a VX term structure almost 1 year out trading at 18+ once again. This provides quite a bit of cushion for buy & hold short VX carry trade even without any conditioning.

SPX ATM Straddle Performance

Once again, this week was dreadful for any long premium strategies. Unlike last week, even Thursday ended up inside the straddle breakeven. Only positive long premium trade this week was long the overnight straddle (purely due to the Thursday ramp.)

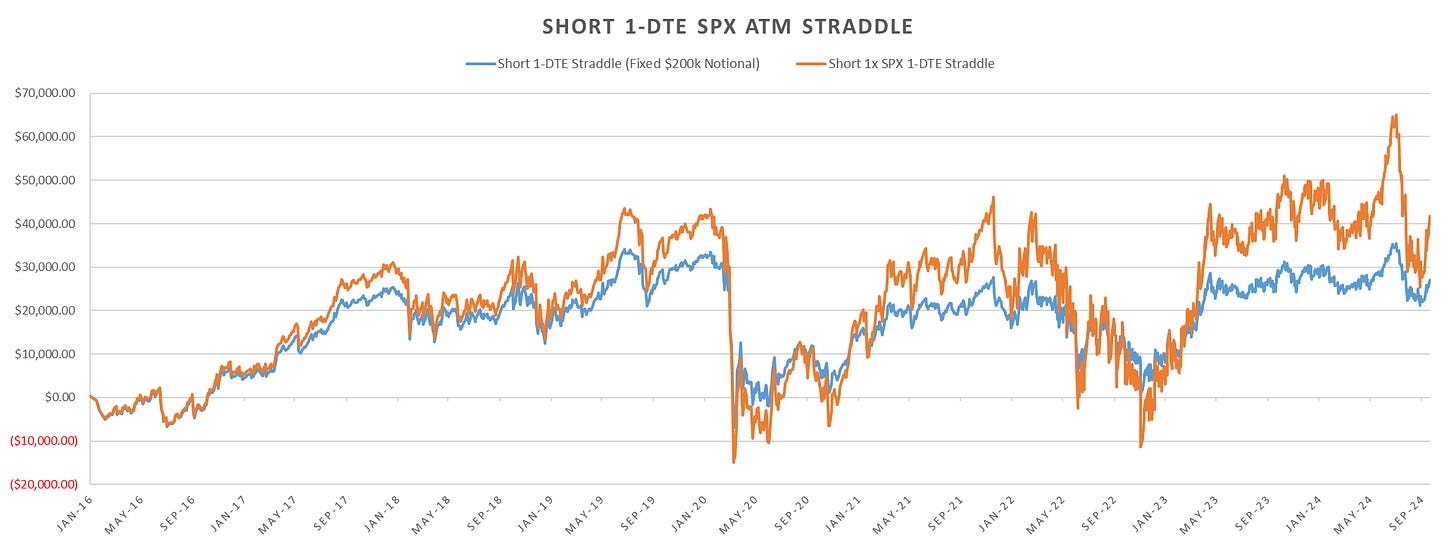

Rolling short 1-DTE straddles coming back a bit last few weeks but largely shorting 1-DTE SPX straddles ~flat since Jan 2023… almost 2 years of no short net premium gains.

Variance Ratio Conditional Performance

From the following post:

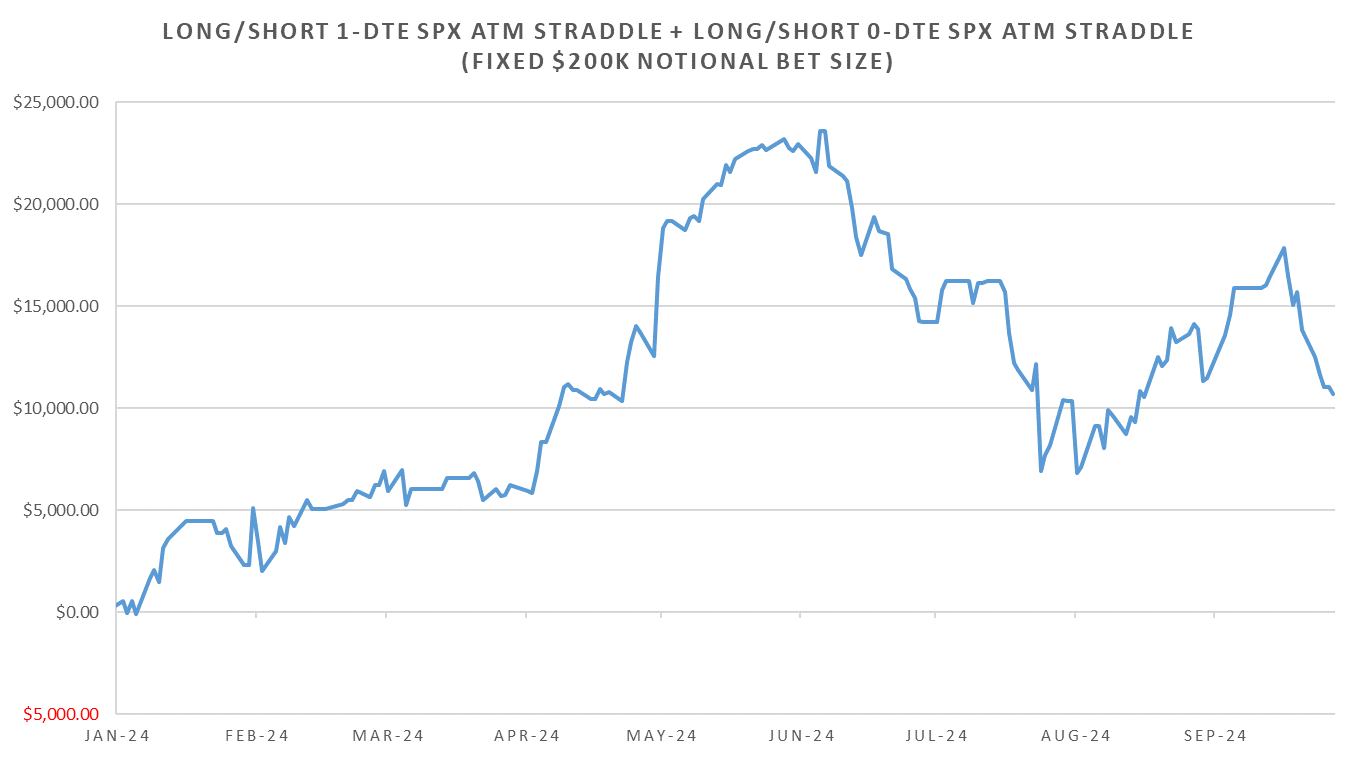

Rough two weeks with a long straddle bias… Last time got stuck with long straddle bias was in June for entire month until flipped short just to get whipsawed.

This time around the RTH leg of the trade switched to short RTH straddles on Thursday. 1-DTE leg still long 1-DTE straddles for Monday (short RTH & long 1-DTE.)

VX Carry & SPX Overlay

From the following post:

Despite large VIX/VX basis, steepening skew taking VX up with it. Add to that geopol headlines into the weekend + rolling into the near election expirations for VIX calculations and shorting VX got hit into eow. SPX Overlay leaning into calls last week, unfortunately, best case was cutting the calls after the overnight moves instead of holding till close. System got hit twice, loss on long calls + loss on short VX. Still, kept same exposure for Monday, given no major news over weekend + eom/eoq close today, calls probably decent bet along with some vol coming out to start the week (hide in big tech for election uncertainty trade coming?).

Have a good week!