Market Overview - October 6th 2024

S&P Index Options & Volatility

Following up on last weeks overview:

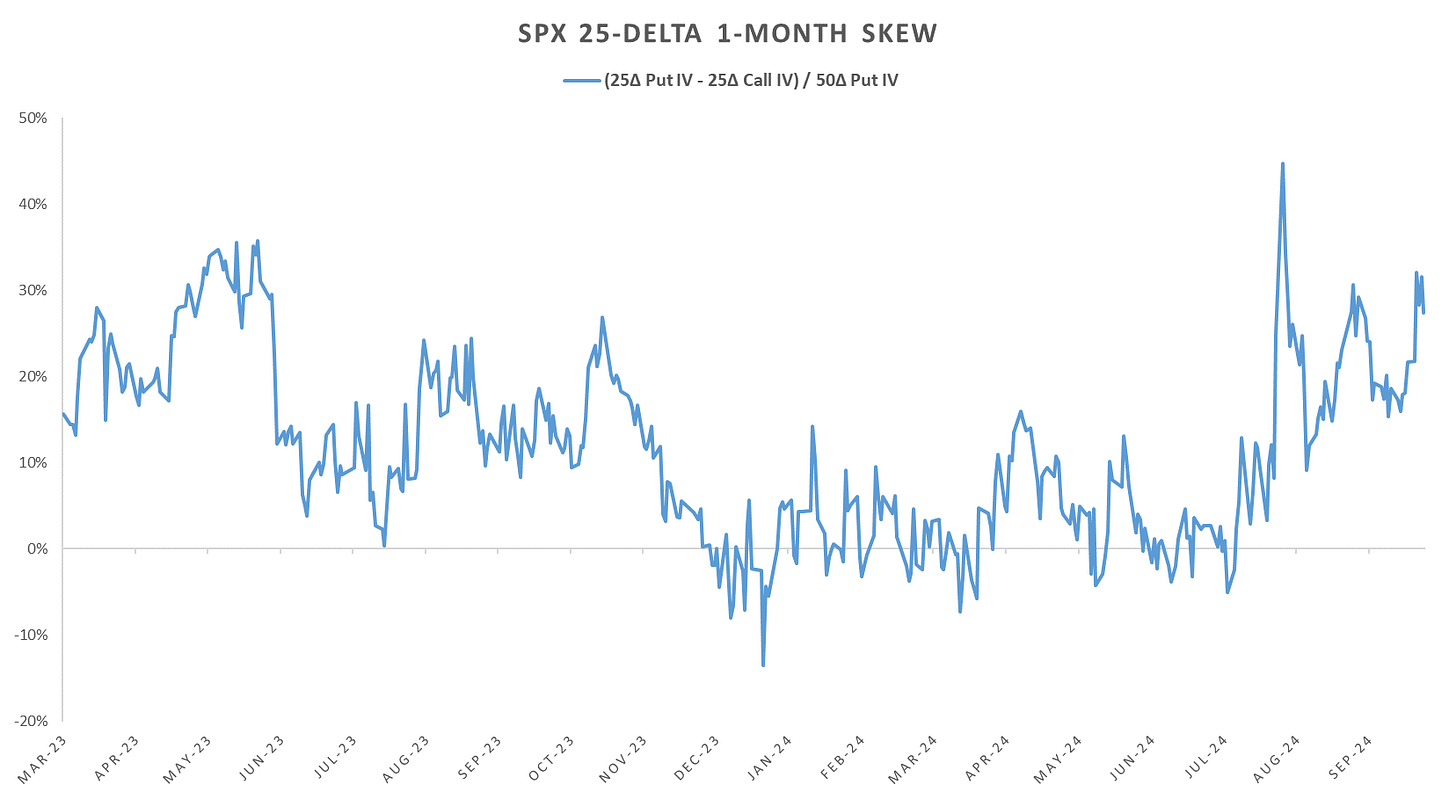

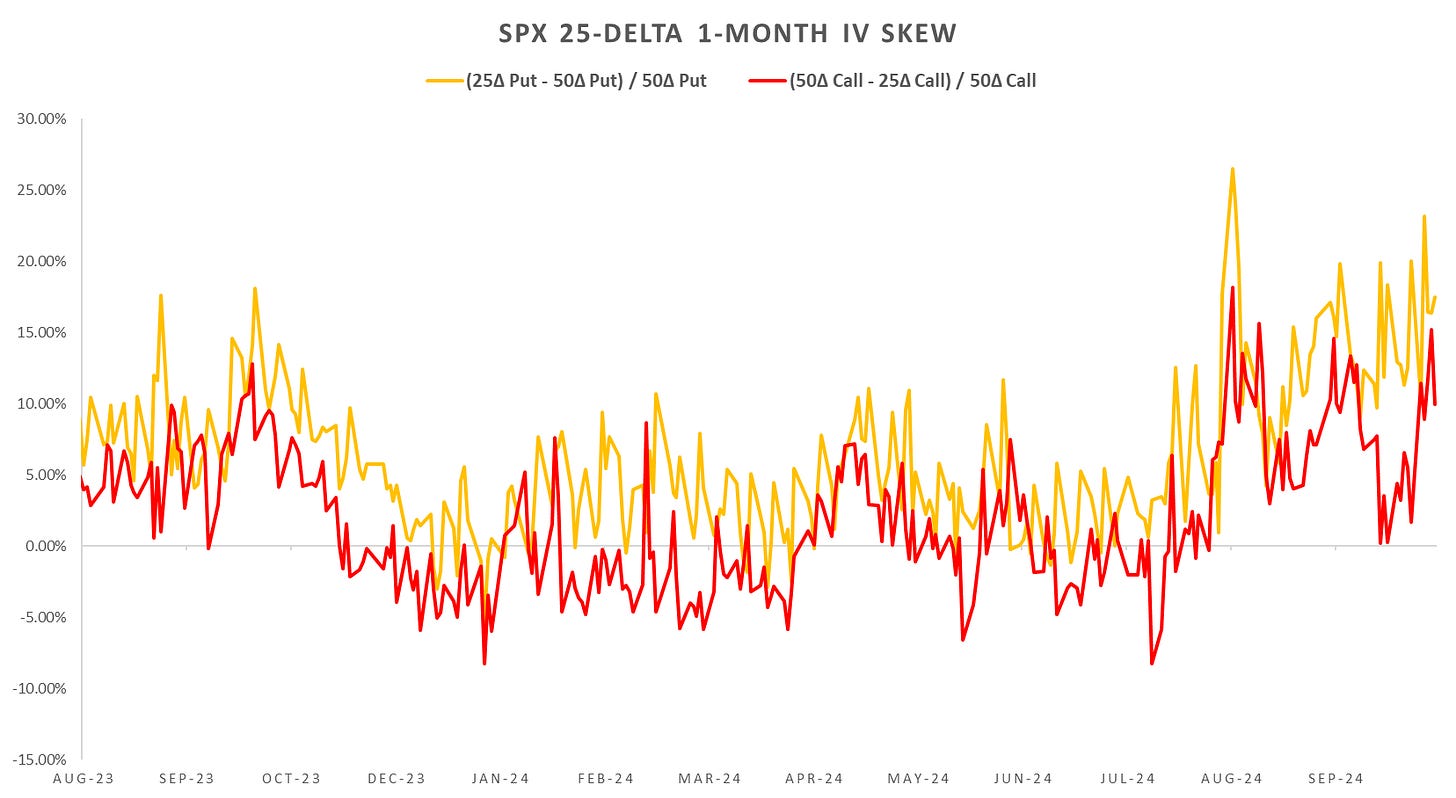

Another week where SPX managed to close few bps higher w/w. Despite the flat performance, ivol telling a different story. Skew remains bid, in addition to downside, upside for 30 days out is now being bid as well. Divergence in implied/realized vols leading to short option structures performing incredibly well vs short implied vol through VIX Futures (VIX & VXF both up on the week.) We’ve got CPI data on Thursday to look forward to as well as a barrage of Fed speakers. With markets going into the seasonally volatile period, the gap between implied/realized should narrow, although I really just don’t see how rvol picks up enough to compensate the wild premiums, especially given how everyone is already positioned for increased rvol…

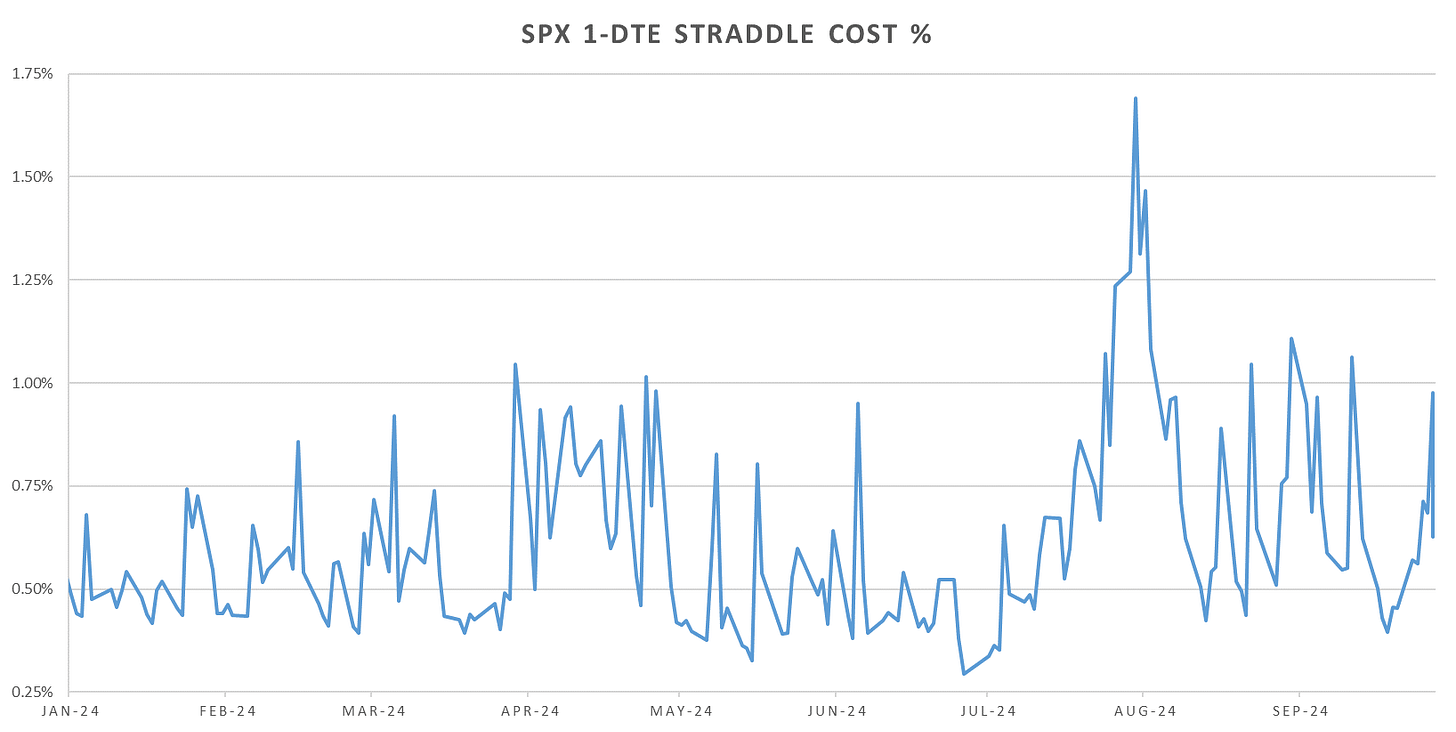

Interesting pattern coming up in 1-DTE vols, all the movement is expected on event days only… Outside event/data days, implieds trading at summer lows levels.

30-Day skew now trading 90th+ percentile over 1 year, with call skew picking up in addition to put skew (last week noticeable divergence with call skew lower / put skew higher.)

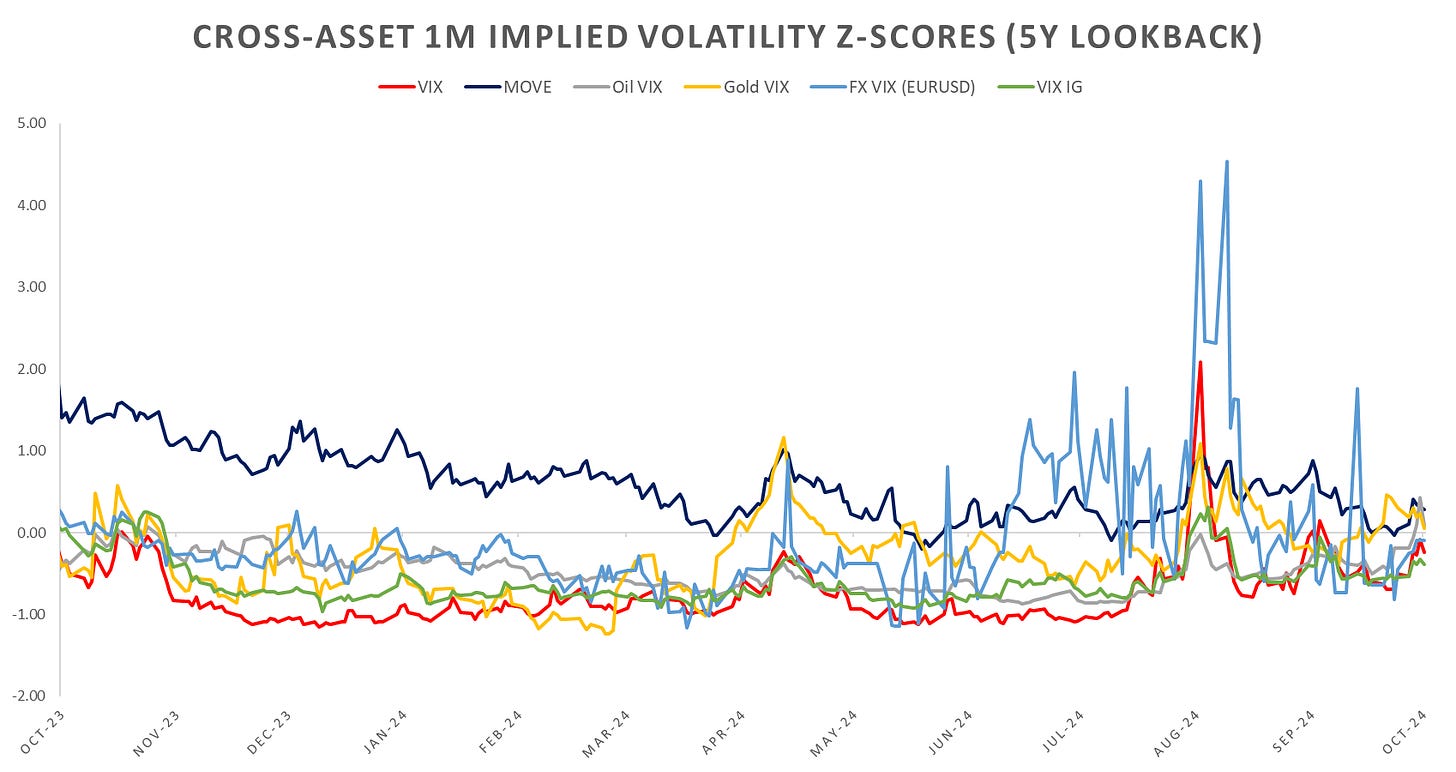

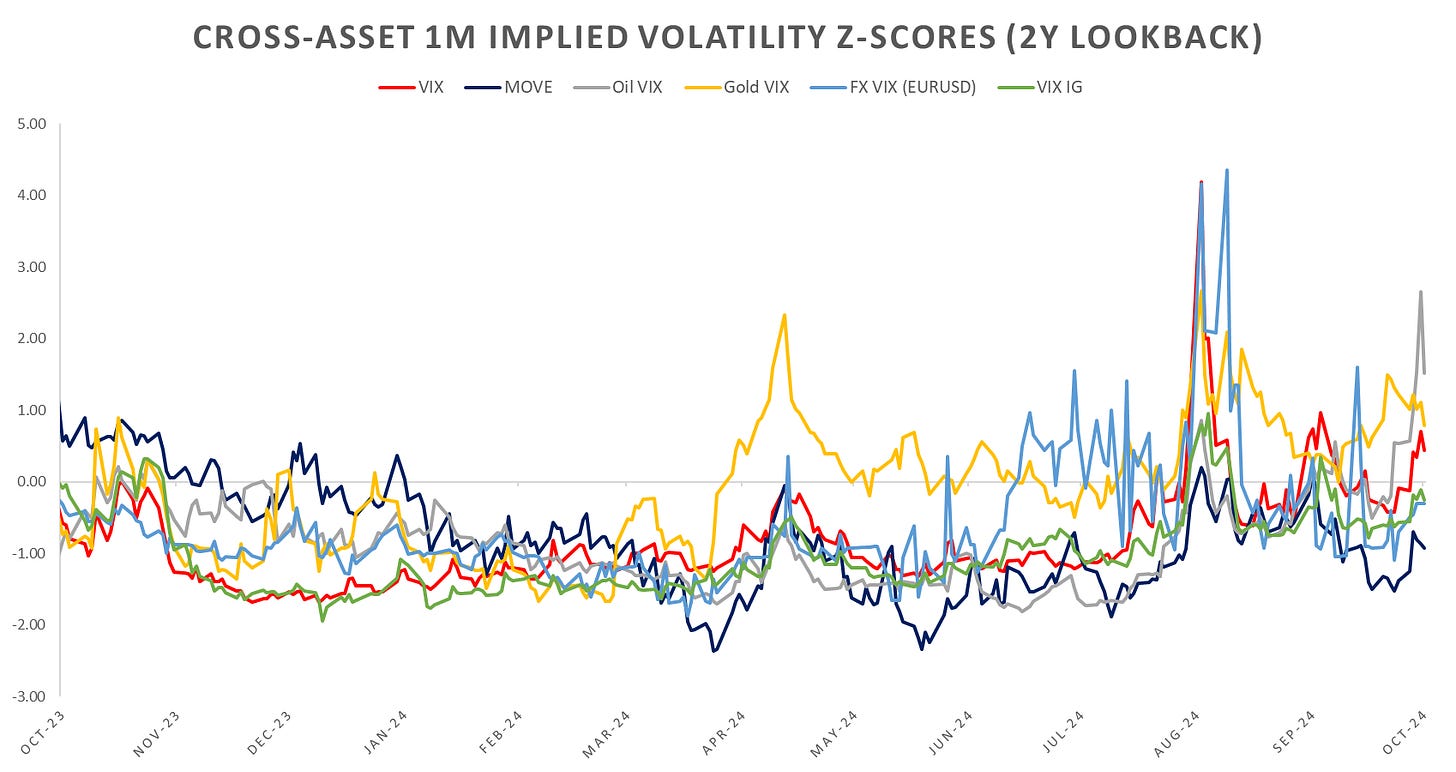

Looking at cross-asset ivols, oil, equities & gold leading, with bond ivol relatively cheapest. During the 2022 start of the Russian-Ukrainian war, oil was slow to react, rallying only a week later on confirmation.

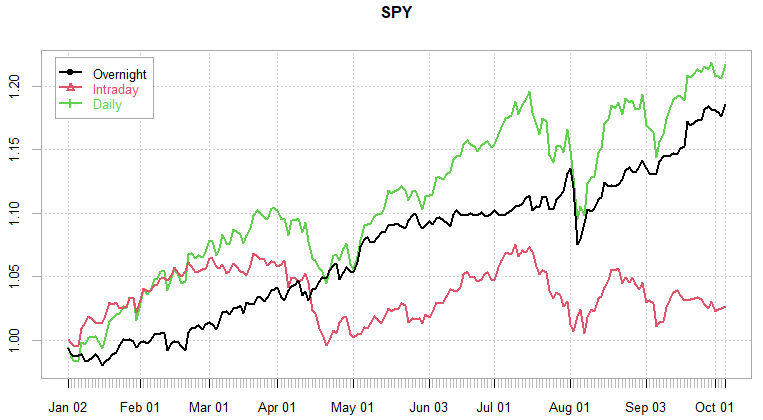

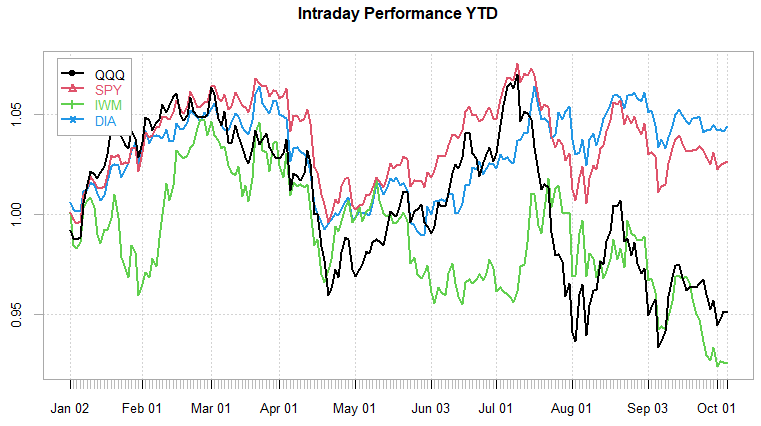

Looking at intraday price action, from the following posts:

and the newest post:

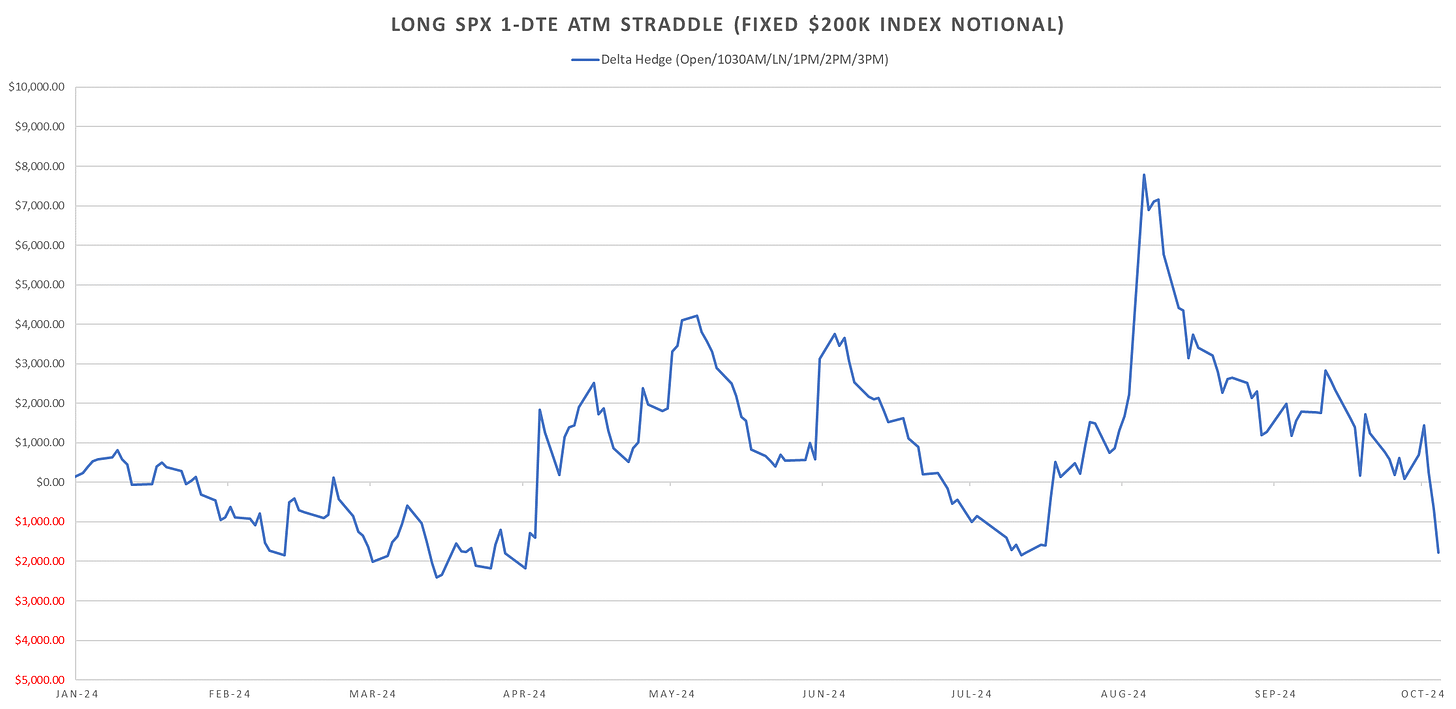

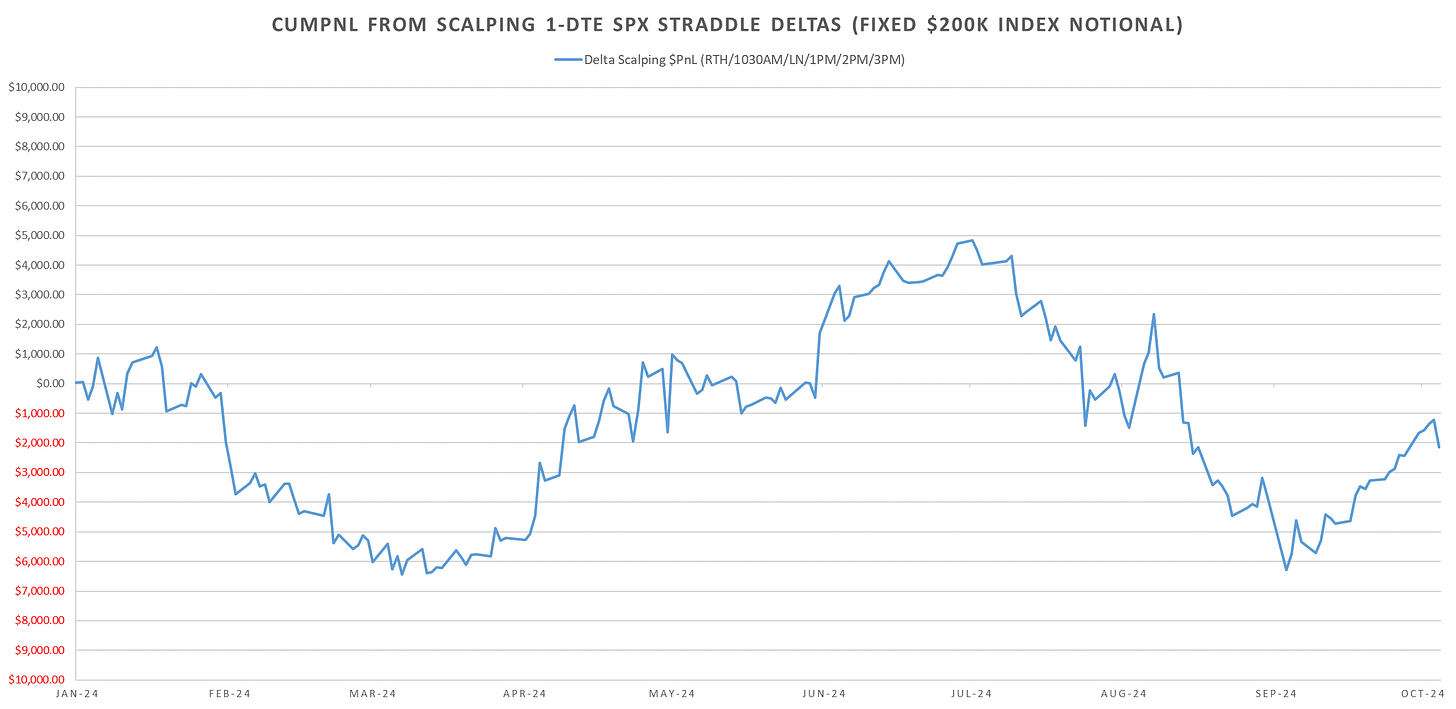

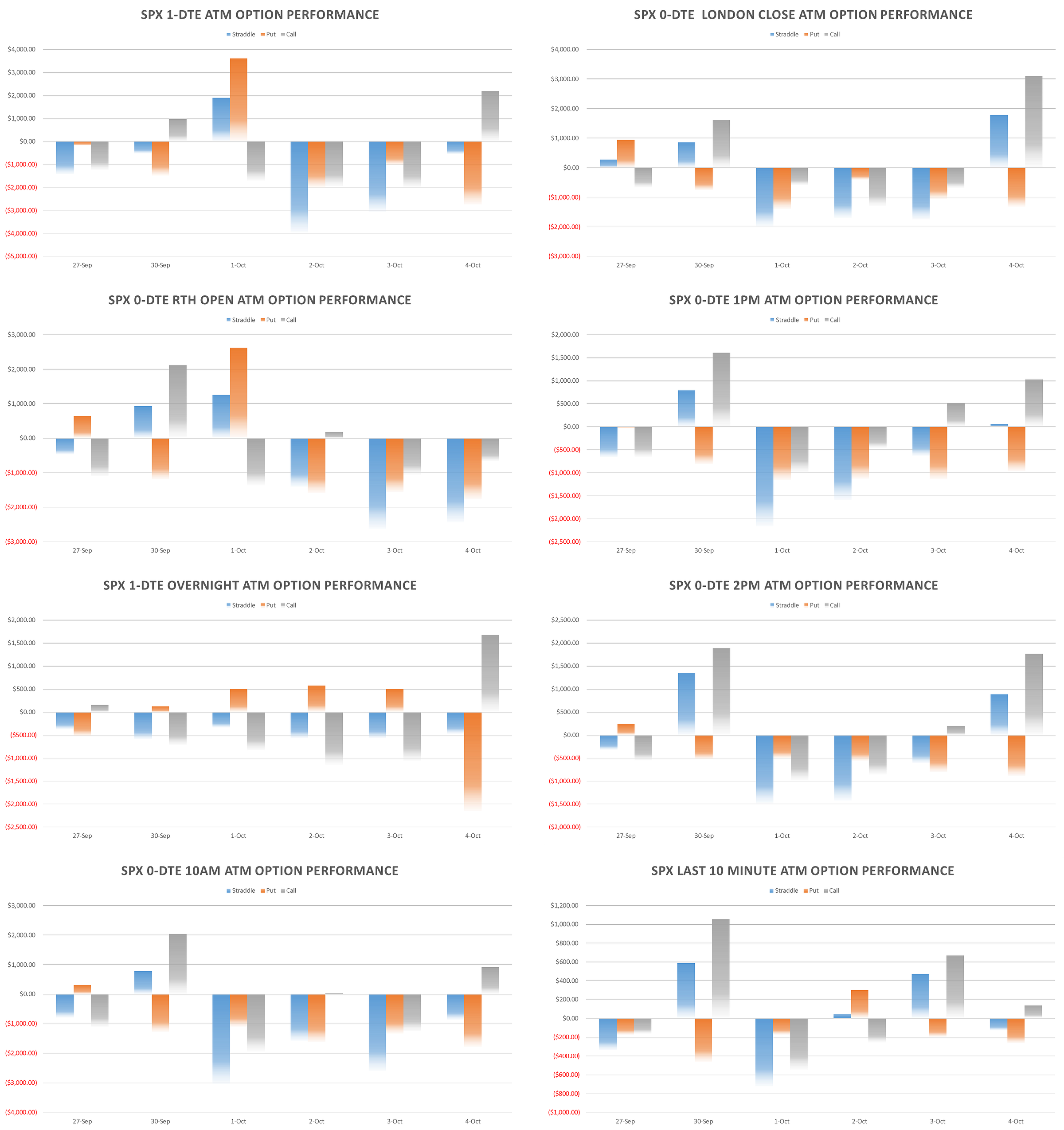

Long short-dated gamma had one of the worst weeks this year, the massive implied/realized gap killing long straddles, with lower rvol not enough to make up for it by scalping deltas intraday (although decent mean reversion intraday last week, except Friday.)

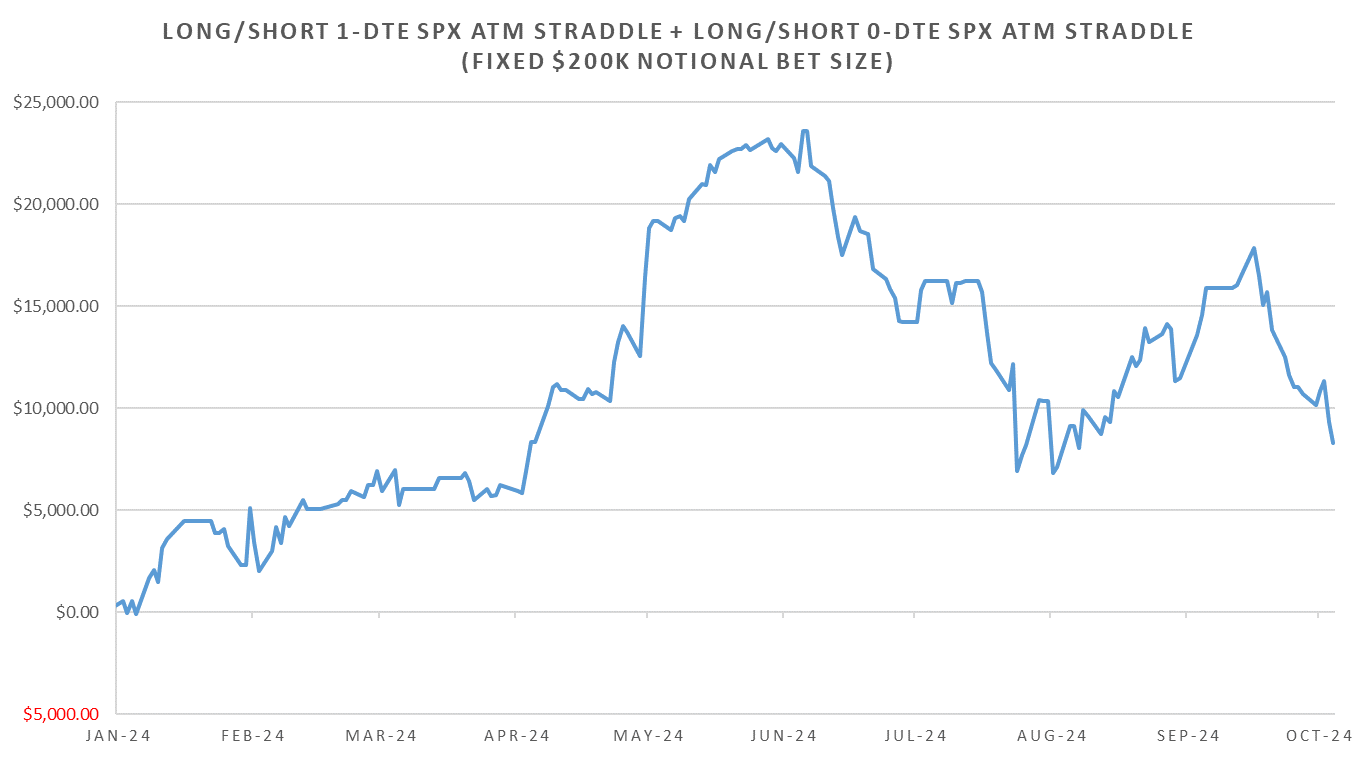

Overall long gamma now finally down on the year, up until this week its been one of the best ytd equivalent periods in the last 8 for long short-dated SPX gamma. The drop-off in rvol to summer levels last 3 weeks really killing any long vol performance this year has had up till now.

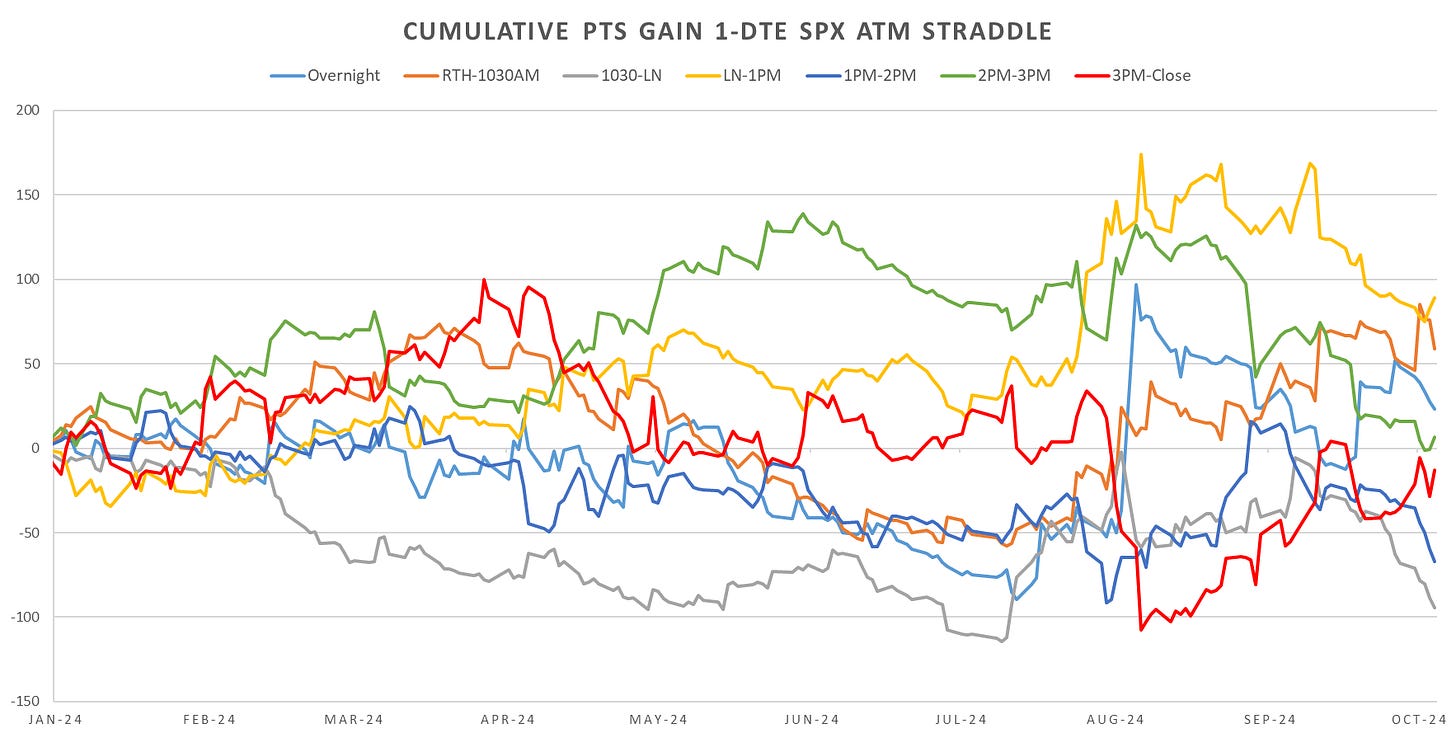

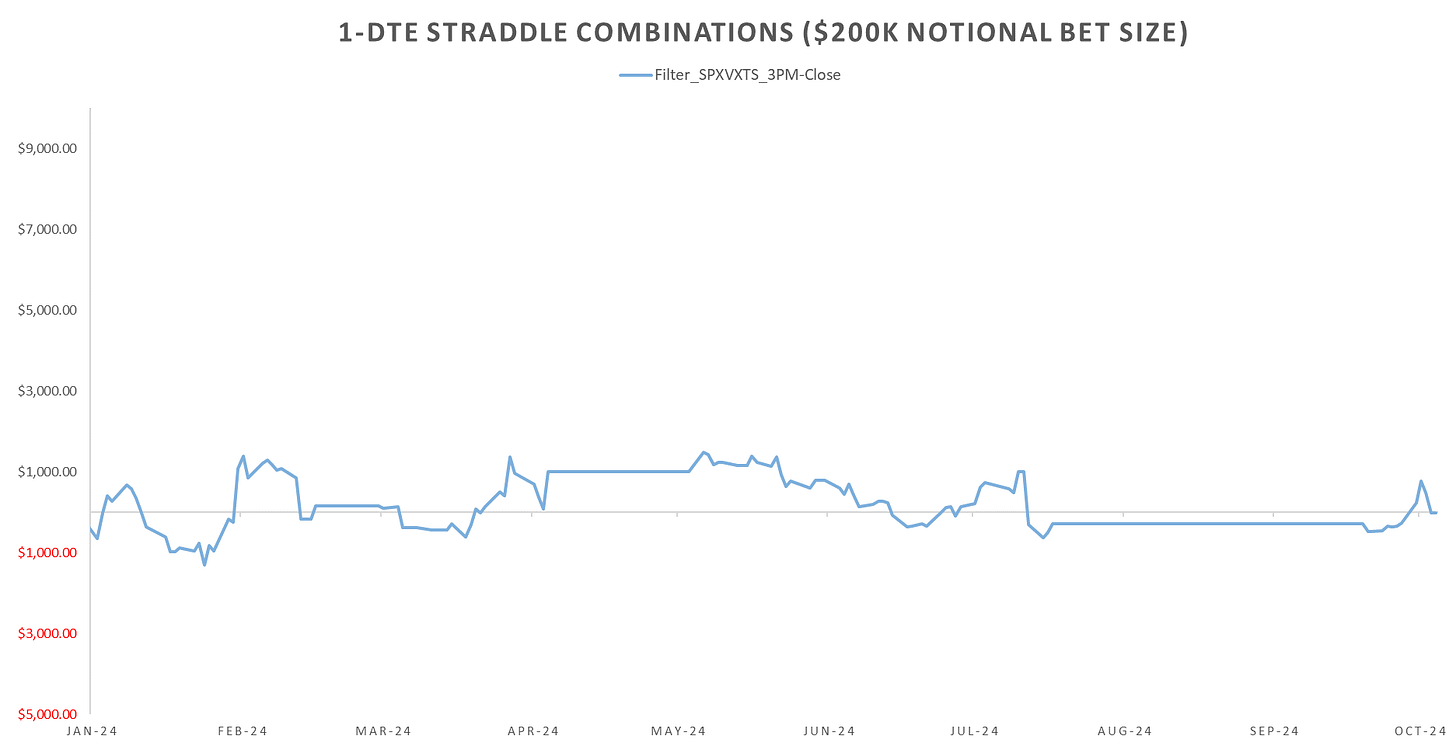

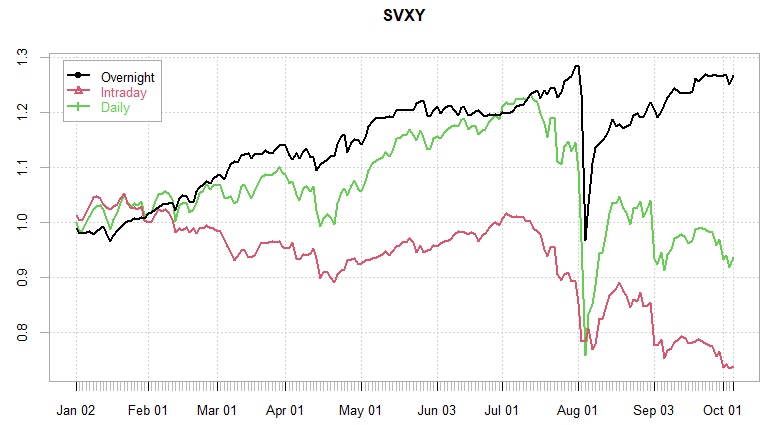

Intraday straddle cross-section ranked by YTD performance, 10:30AM to London Close worst performance (mean reversion to flat on the day), followed by 1pm-2pm time period. Surprisingly, overnight straddles net UP on the year, mainly due to the August spike. A lot of vol risk concentrated outside US RTH session lately, with China/BoJ/Israel news mainly hitting overnight. Structurally, overnight / intraday performance differentials for vol & underlying still remain one of my (not only mine) biggest head scratchers…

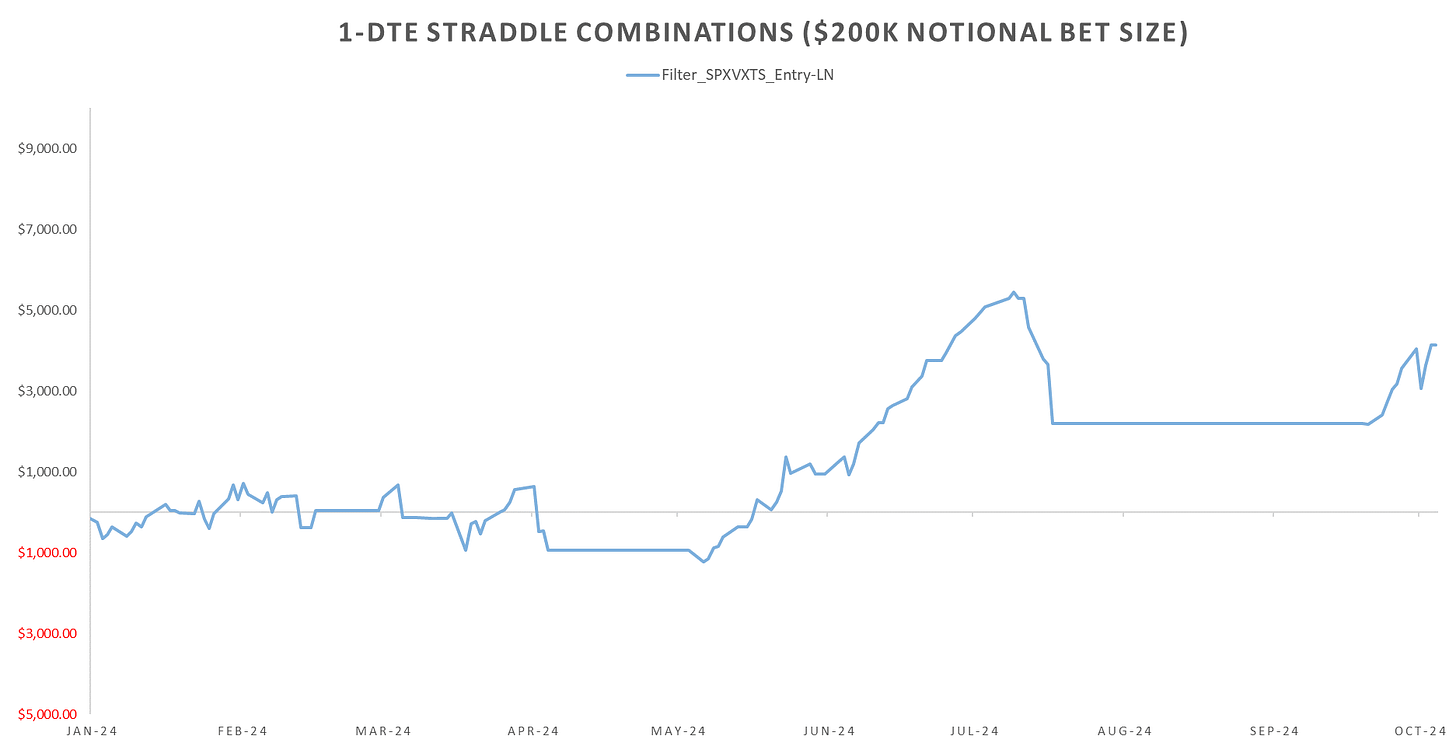

Shorting 1-DTE Straddle till London Close continued to perform well based on SPVXSTR shape filter, although eod perf not impressive last week. More details on this in:

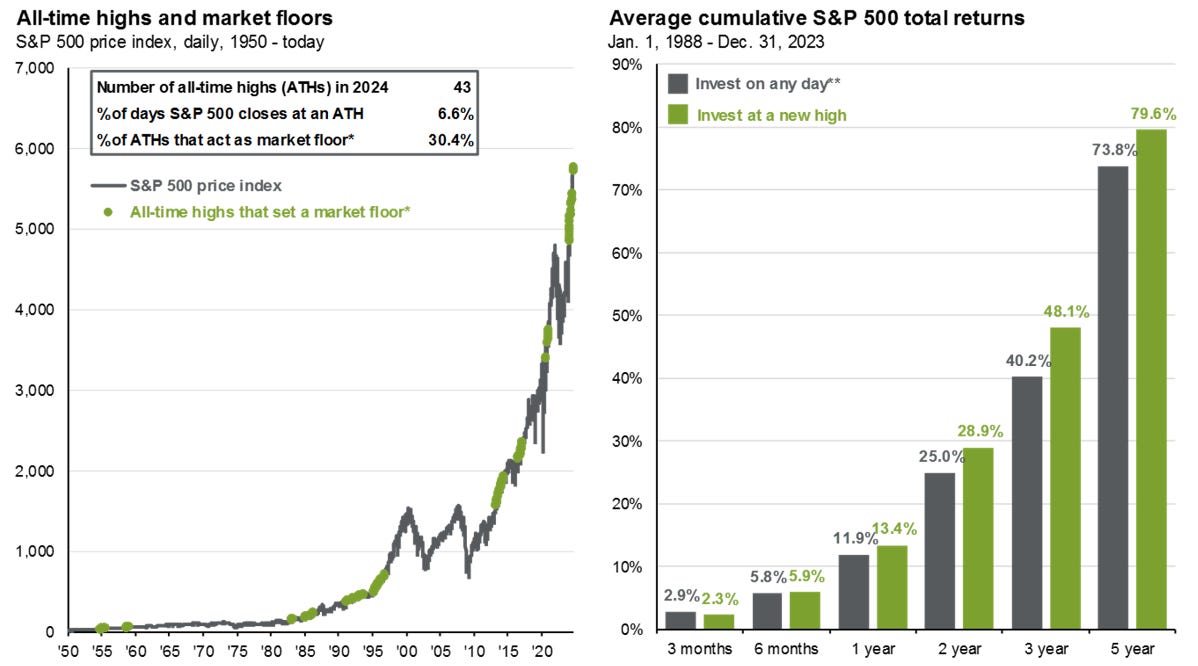

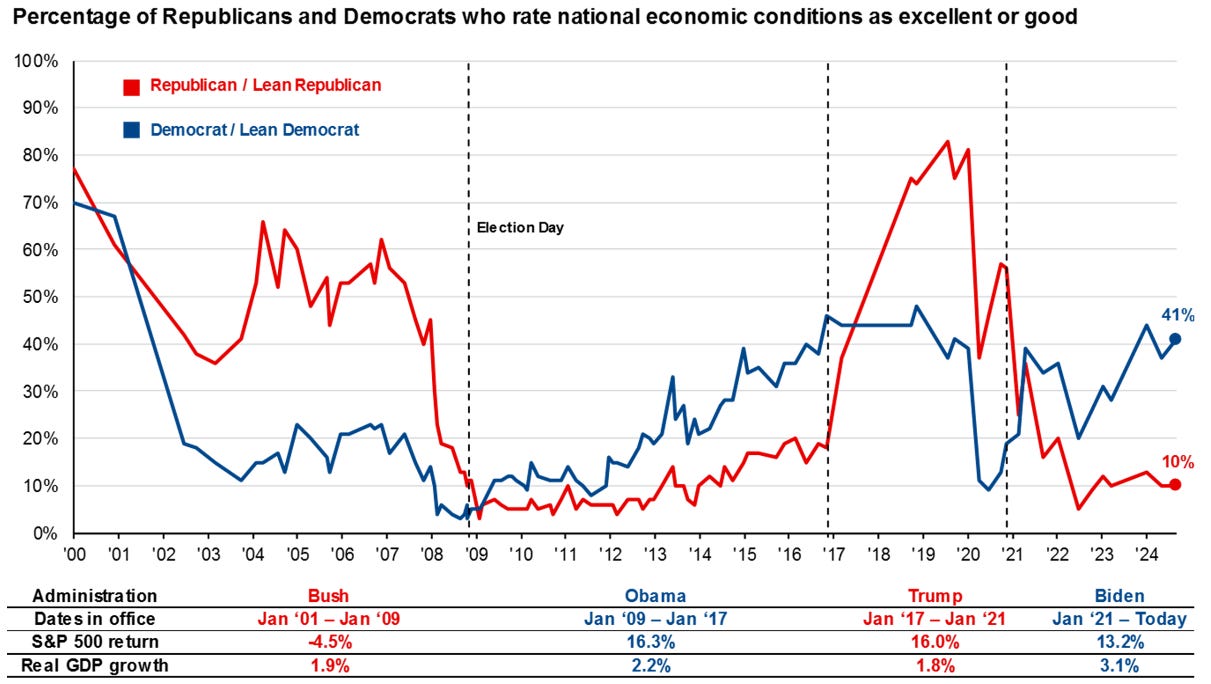

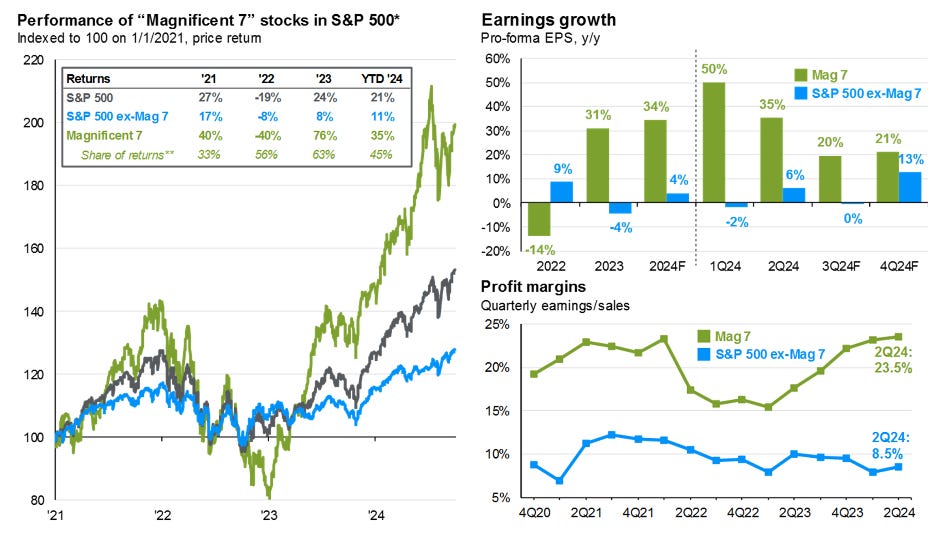

A couple of interesting charts from the JPM Guide to the Markets:

As we near the highs once again, right before the election, in 2016 we rallied right after and never looked back.

Republicans seem to be the more volatile bunch…

Mag7 continues to take the lion share in S&P 500 performance, almost entirety of the earnings growth coming from the 7 tech stocks.

Realized Volatility Overview

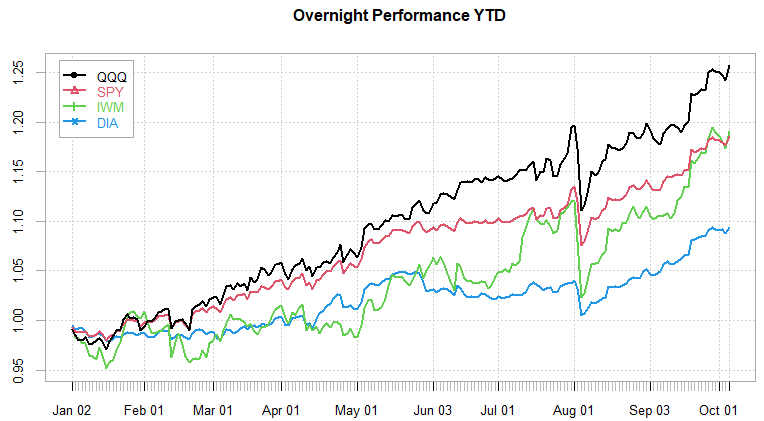

New YTD highs in overnight performance as of Friday. RTH performance flat/negative for the 4 major indices since start of the year…

QQQ leading the overnight performance by almost 8%, DIA lowest overnight/intraday performance ratio. Will do a post this week on the historical intraday/overnight volatility ratio and see if there’s any predictive power for the overnight/intraday return pattern (and implications for long/short options.)

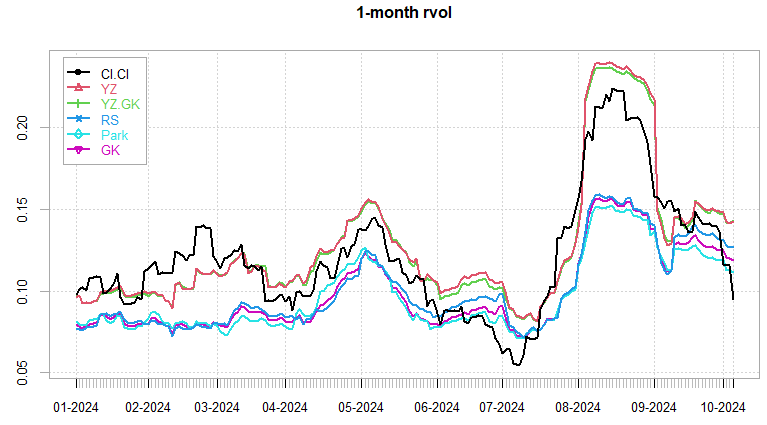

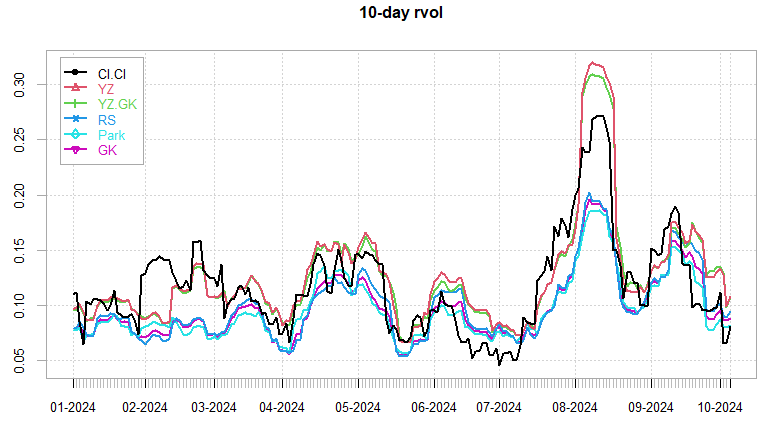

10-day rvol back to summer lows here, even the monthly cl-cl vol sub 10 at this point… NOT what you’d expect from seasonality here, especially given the wild implied/realized gap.

Intraday mean reversion hitting extremes last week even beating the summer peak. Highly unlikely to persist (at least historically.)

Shorting VX overnight - flat. Intraday, skew steepening led to almost a 1.5 bump in VX, extremely annoying when compared against the collapse in rvol… Oct VX kept a relatively small premium, rest of term structure flat up until 2025 contracts.

SPX ATM Straddle Performance

More of the same once again this week… Premium destruction across the board. Overnight short straddles (excl. Thursdays) on a 12 day win streak. Dips get bought all week. Relatively template intraday price action, early day weakness, dip buying in the afternoon.

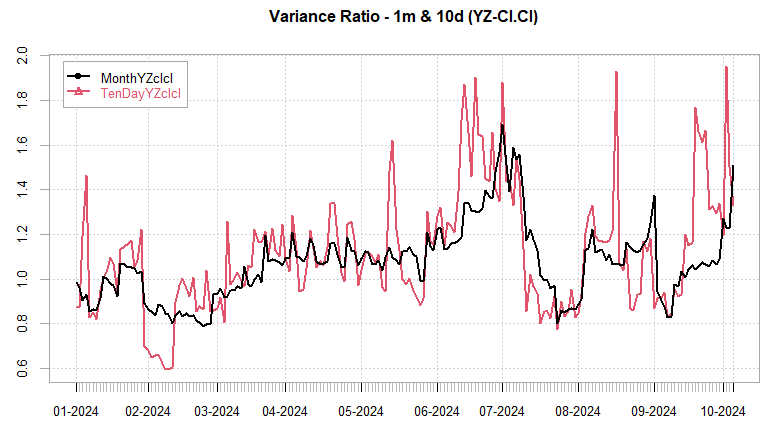

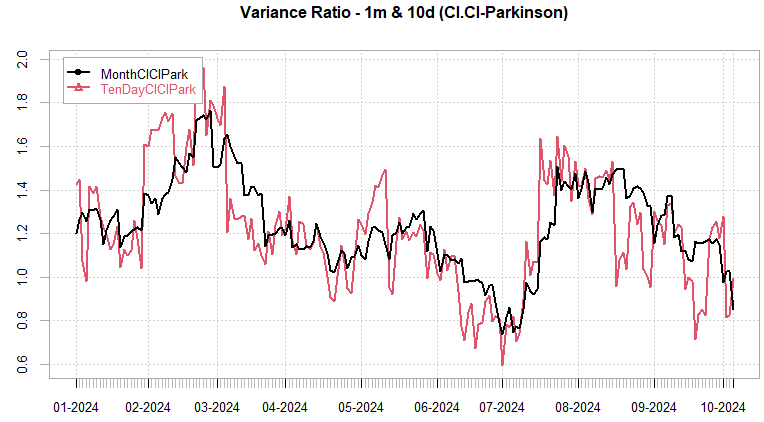

Variance Ratio Conditional Performance

From the following post:

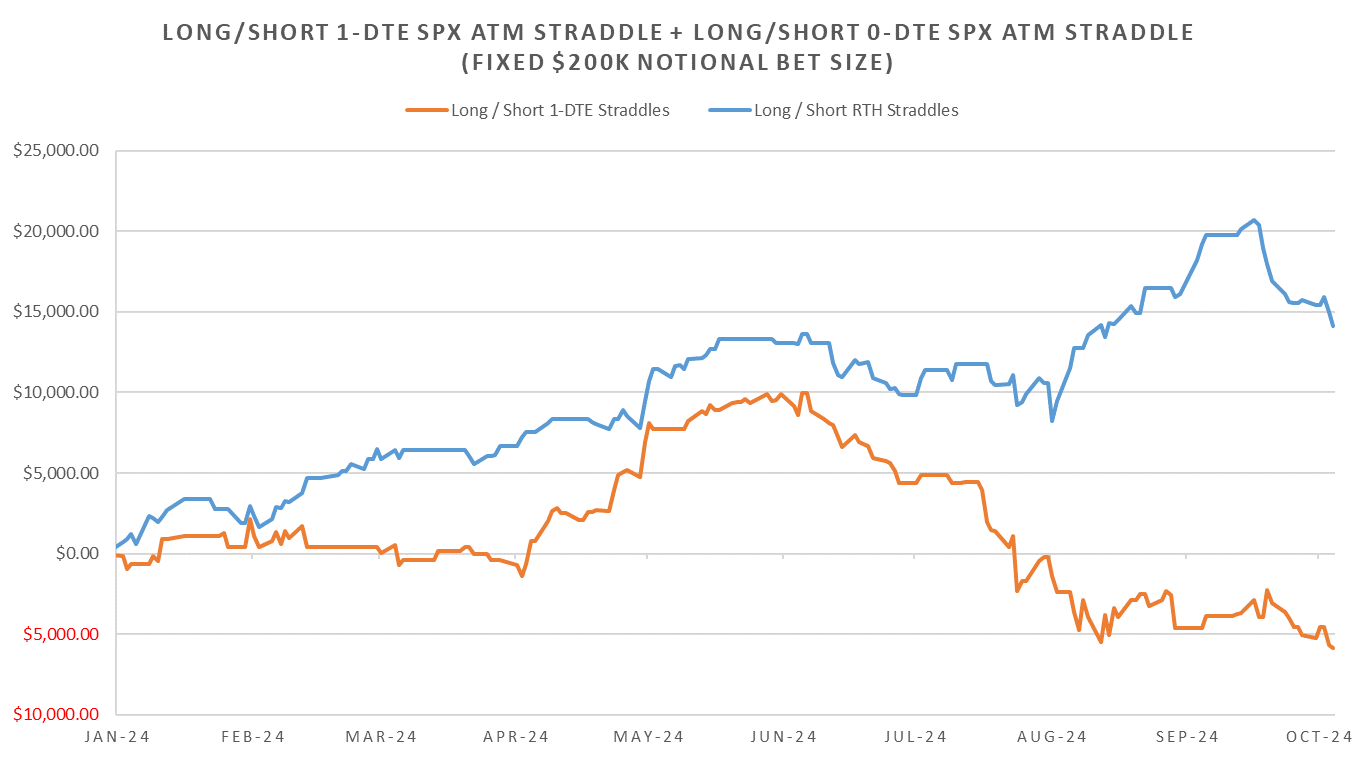

Bias for rvol to pick up here killing performance. Going into Monday with cash signals for the RTH leg and the 1-DTE leg as VarRatio’s fade off extremes.

So far still within expected DD range, RTH leg continues to outperform the 1-DTE leg, especially on long straddle biased trades.

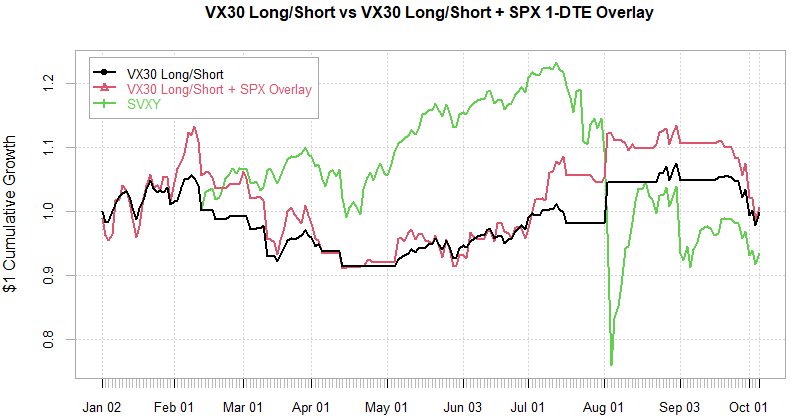

VX Carry & SPX Overlay

From the following post:

Back to flat on the year as of Friday. Horrible year for the VX carry, signals remain short VX Oct, flat rest of term structure. Without substantial increase in rvol of vol, risk not picking up and exits not triggered. Very thin edge here as we are likely to remain with a flat term structure up until elections. Will do an update post on the SPX Overlay, found a better way to express the SPX rvol bias relative to SPVXSTR filter.

Have a good week!