Following up on last weeks overview:

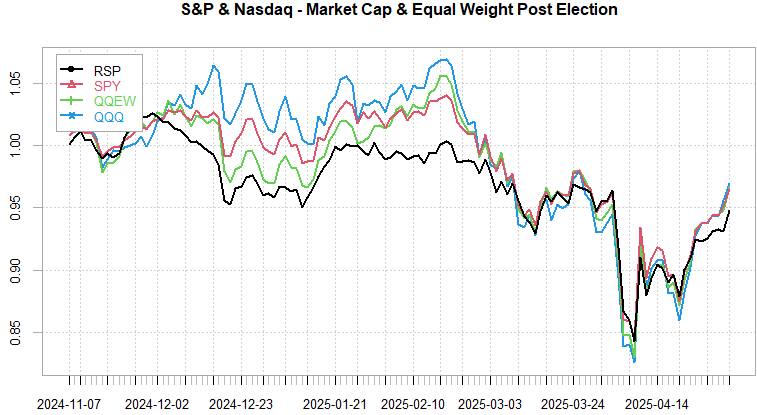

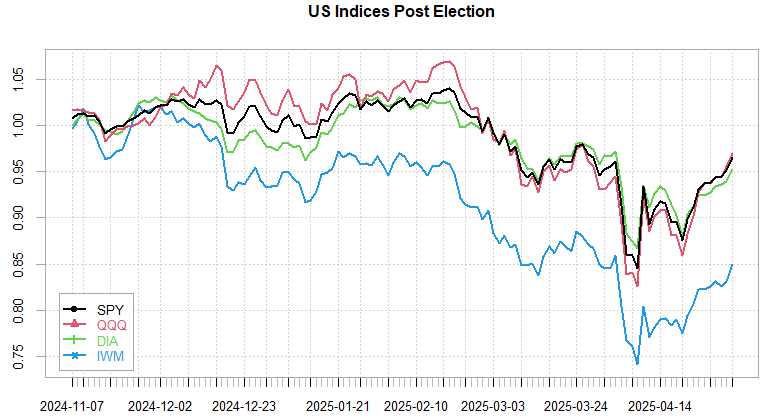

S&P now up ~17-18% from the panic lows in early April, just 8% shy of making new ATH. In the meantime, uncertainty around tariff outcomes (or even the final tariff levels) has not been cleared. VIX index is back ~20, with entire term structure trading ~22 a year out. This is typical for elevated uncertainty but without any ‘crash’ behavior. Short dated volatility is down to ~avg 2024 levels, with the ‘beach ball’ price action intraday coming back in a big way. Highlight of the week should be the Wed FOMC meeting, with little trading action before the FOMC press conference. Overall trading volumes dropped off sharply last couple of weeks as markets continue to be in wait & see mode.

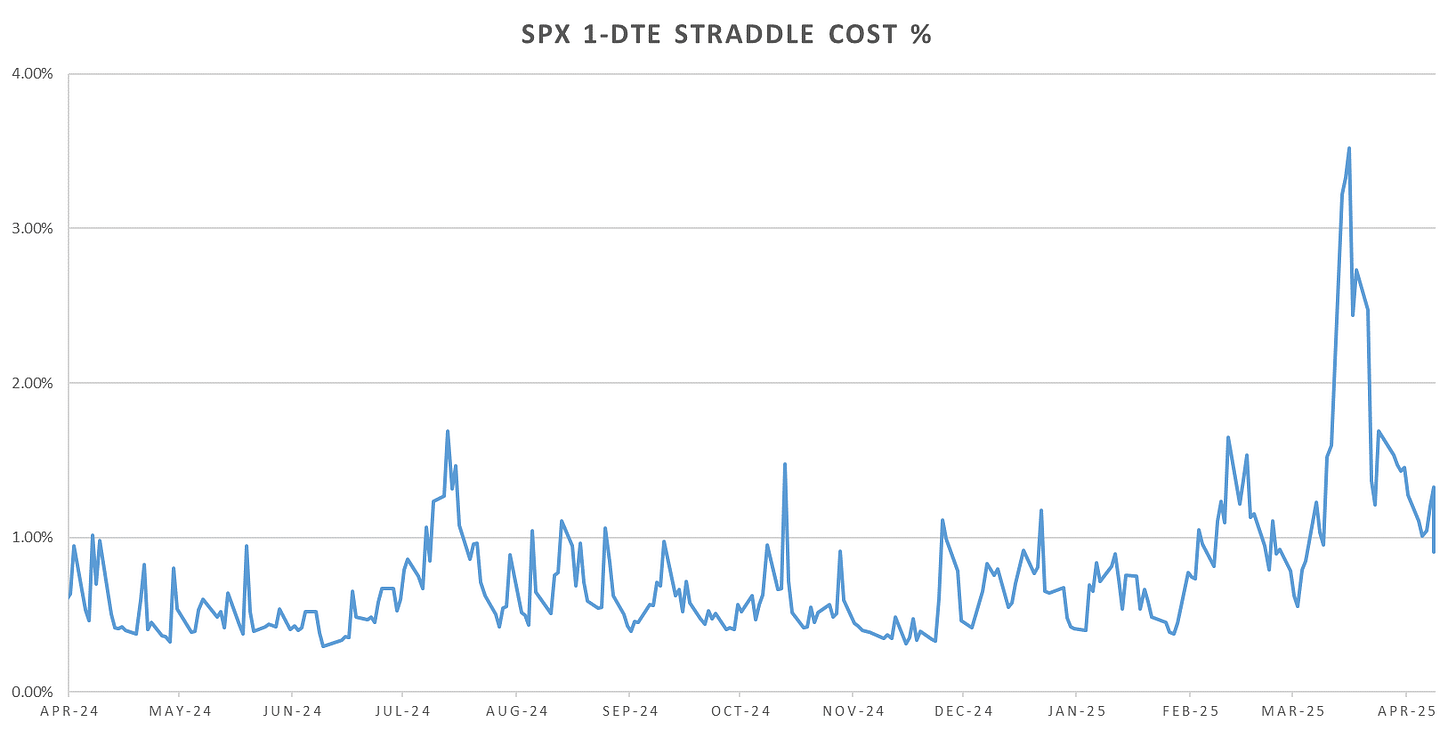

1-DTE SPX Straddles back below 100bps even for the weekend as we face what looks like complete ‘headline exhaustion’…

Cross-asset vols lower across the board, FX & Gold highest on 2Y & 5Y lookbacks. Bond vol now below average over 2Y lookback. Oil sticks out from cross asset vols last week, with implied vols trading higher despite equities & bonds calmness.

25D SPX Skew steepened last week. No upside chase through call, instead see divergence with put skew steeper but call skew flat.

Looking at intraday price action:

Short 1-DTE SPX straddles up a couple of % last week, delta hedged short straddles, however, relatively flat as indices still choppy intraday with large recoveries throughout the day.

Intraday mean reversion strongest 10:30am - London Close as has been the theme for the past 5 years. We also see eod momentum drop off as overall rvol collapses.

Realized Volatility Overview

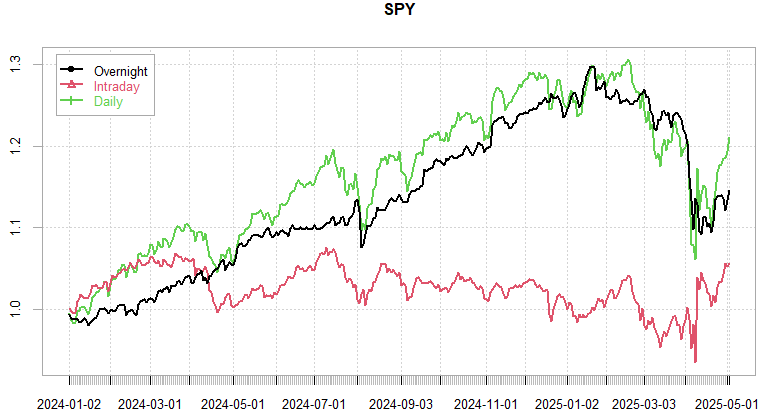

Strong US RTH session performance last couple of weeks. All overnight drops get bought during the US session.

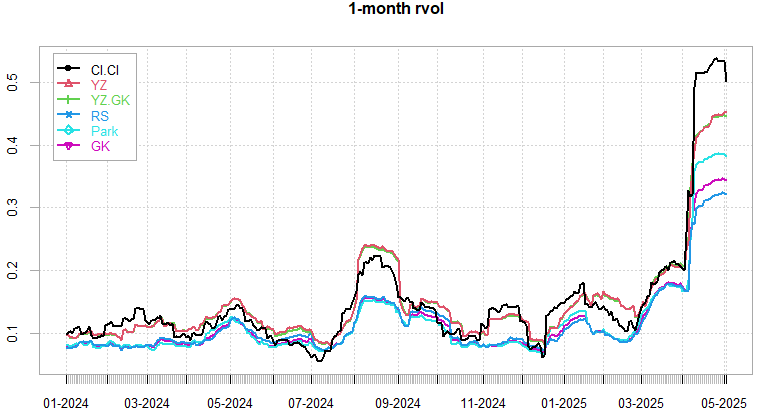

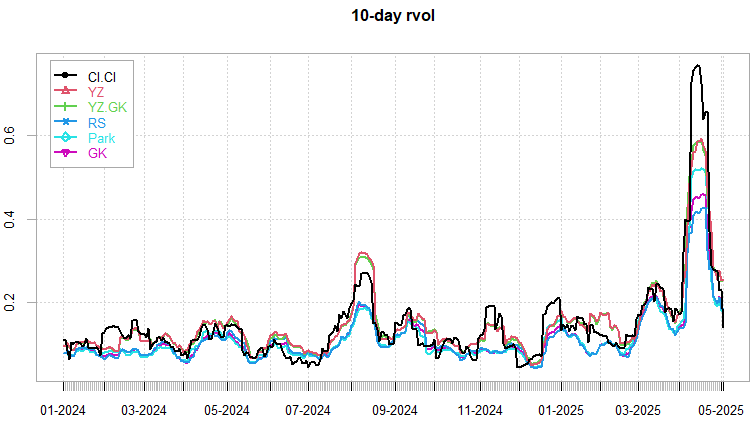

Shorter frequency rvol measures down to ~average 2024 levels. Cl-cl rvol leading to the downside with more efficient estimators taking account of the overnight price action & intraday range slightly stickier (but still lower.)

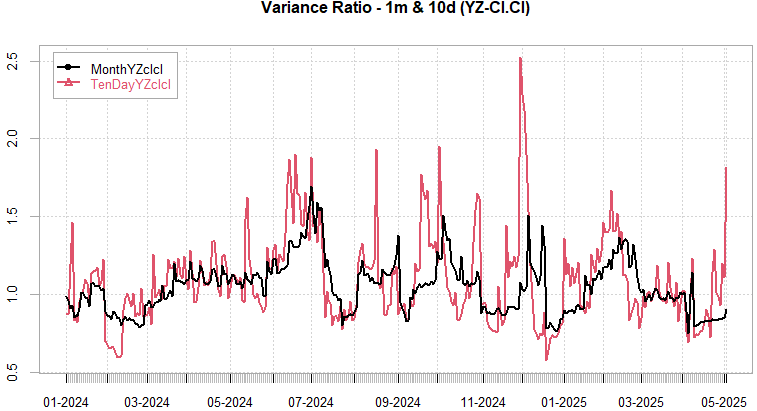

Can see this divergence between cl-cl volatility & intraday volatility on the YZ-cl.cl variance ratio. Just looking at the close-close changes paints a much ‘calmer’ picture than intraday volatility measures. Trading volume still remain low & we have not really seen any major *new* negative news come out to test how the market deals with strong downside volume.

Correlations remain higher than average although we did start seeing *some* dispersion come through last week (mainly on the back of earnings releases.)

With S&P ~18% higher, SVXY just barely above the levels we saw on Apr 9th, as mentioned the mean reversion was largely baked into the term structure of VIX Futures.

SPX ATM Straddle Performance

Markets going on a 9-day winning streak, unsurprisingly 1-DTE SPX puts have lost ~200pts over the last 6 trading days. Overnight straddles net up ~3pts in the same time period. ATM Straddles opened after London close and the last 10 mins all up from 4-24pts over last week. The EOM straddle performed well, however, clearly market adjusting to the EOM effect with last 10 min straddles going for double the cost of straddles on the 29th of Apr & 1st of May…

Intraday Variance Ratio

From the following post:

Heavy mean reversion last few days, favors range expansion into this week. Markets keep bouncing nicely between low/high intraday variance.

1-DTE Straddle almost entirely recovered the losses from the early April drop, currently on a 6-day win streak (flipped from short straddles last week into long Friday & long into this week.)

VX Carry & SPX Overlay

From the following post:

Still sitting in cash. Term structure completely flat for longer dated VIX futures, vol of vol collapsed, term structure inverted (spot > vx1) for over 26 trading days now. This entire drop had incessant dip buying up until the liquidations hit on Monday in early April. All fear & negative outcomes getting discounted… Still remains close to triggering a long VX trade again than short, we are just 1 Trump tweet away from a waterfall…

As always, don’t hesitate to reach out if you have any questions / suggestions!

Have a great week!

Your intraday volatility ratio looks really useful. Is the (op-cl) ret^2 numerator using 1 minute data (and the denominator also one minute but summed over 5 mins?) Thanks -- Frank (NYC)