Following up on last weeks overview:

From Monday lows to Friday, SPX rallied ~8.5% last week. A stark shift in character for the market. Implied volatility lower across the board… SPX briefly traded above the pre-tariff levels early Monday morning, now sold ~80pts lower from peak. After last weeks lack of econ data releases, this week has got plenty! Earnings for Apple, Amazon, Microsoft and Meta on Wed/Thu (that’s ~19-19.5% of S&P 500 total market cap reporting on Wed/Thu), plenty of econ data with GDP on Wed and other job related data coming late in the week.

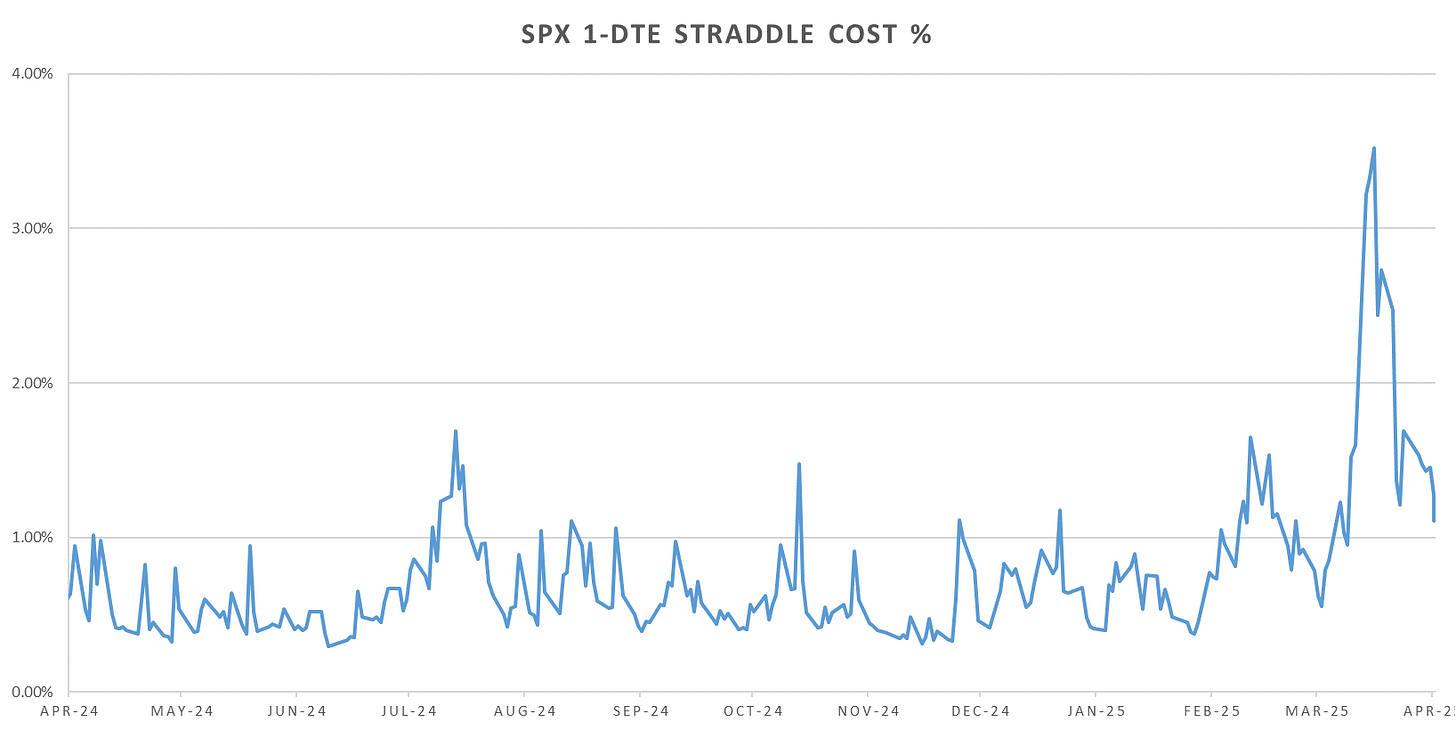

Lots of action for this week, just in time for SPX straddles to drop back to ~1% daily cost, the higher end of the ‘bullish’ regime but feels like a bargain given intraday vol is still high and short short-dated gamma performance has been lagging lately as SPX rebounded (so we are moving just as sharp to the upside, for stability need to see overall vol come in.)

Cross asset vols lower across the board with bonds lowest on a 2Y lookback. Gold remains well bid on upside call buys (macro ‘doom’ hedge.)

1M SPX skew flatter, mainly due to tails being sold, not much enthusiasm in calls yet.

CBOE highlights the convexity premium (defined as VIX - ATM implied) retraced very fast. Tariff announcement and the size of tariffs caught people off-guard, that seems to be out now as the administration is ‘managing’ the impact on markets on a daily basis through constant supportive headlines (no matter how far-fetched or simply ‘untrue’ they are…) China denied having any meetings with the US side & rest of world is taking a ‘wait and see’ approach as well.

Looking at intraday price action:

Short dated gamma ended up being cheap last week as markets ripped to the upside (8.5% move from Monday lows to Friday… upside vol still vol…) This remains a heavy headline driven market, with Trump having the power to send us 300pts lower or higher in a single session based on a single tweet…

10:30am - London Close mean reversion continues to dominate. Can see eod momentum fade a bit last week. Still a major run since start of year.

Over the weekend some pointed out the growth in leveraged ETP’s and their impact on eod momentum when they have to rebalance & the subsequent frontrunning that occurs. Looking through the straddle cross section, we do see a major pick up in 2020 & then at the end of 2024. Effect looks to be most pronounced once we hit higher overall volatility levels. Very strong in 2022, flattish in 2023-2024 as rvol really came in, and ytd back to being very strong.

See following posts on for full breakdown:

Realized Volatility Overview

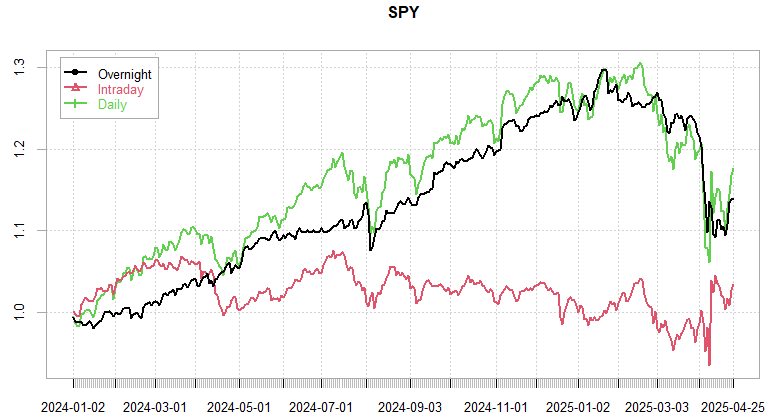

S&P back to being up ~20% since 2024 start. Much better US RTH session performance since the Tariff announcement.

10-day rvol measures down significantly from the peak panic levels we’ve seen early April. While lower, intraday range based vol still ~2-3x the ‘safe’ levels we usually see.

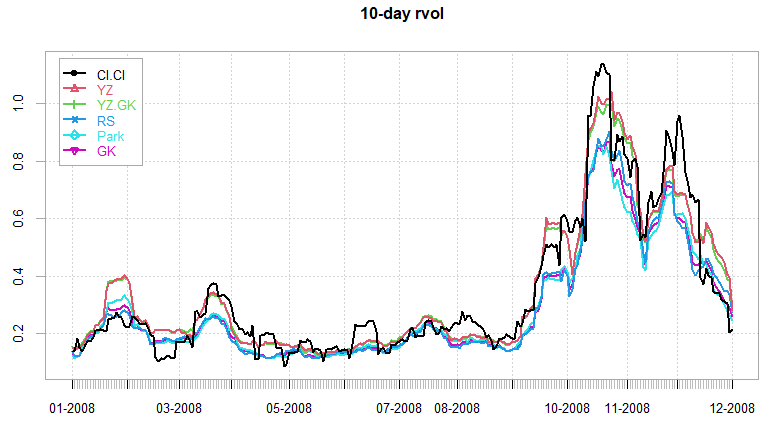

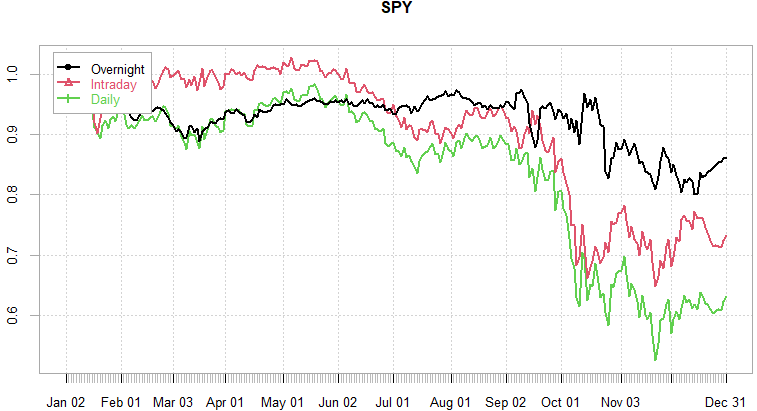

Looking back, during large ‘macro’ shocks we see rvol bottom before markets take a meaningful move higher (instead of just violently chopping around):

2011 EU Debt crisis:

While less true over the last few episodes where we saw V-shaped recoveries, this feels more in line with the former ‘events…

Still see everything moving at corr=1 here. So don’t expect vol to come in until correlations drop again.

VIX Futures dropping overnight, ~flat intraday again. With markets rebounding, SVXY still stuck in range. As mentioned before alot of the vol mean reversion was already baked in and trading underlying market much better r/r than shorting long vol ETPs immediately after vol spike.

SPX ATM Straddle Performance

1-DTE Straddle net up ~100pts on the week, post 1pm straddles down ~100pts. Mostly early day rallies following by sideways grind. Same as last week, feels like recent ‘puke’ in tails and drop in ATM vols is a buying opportunity in the short term.

Intraday Variance Ratio

From the following post:

Extremely trendy few days last week (mon/tue/thu), ratio back to extreme trend, favors short straddles at least mon/tue before market likely to move next.

Small rebound so far, but if panic is over, should return to ‘usual’ dynamic of mean reverting extremes in trend/mean reversion.

VX Carry & SPX Overlay

From the following post:

Still cash signals for the VX model since the roll. With rvol of VXK dropping substantially over the rolling window, now again closer to long VXK than short. Just need some sort of downside momentum in SPX and likely to trigger another long VX trade. Historically model gives back some of the pnl from the long side in the coming months due to whipsaws so bracing for that!

As always, don’t hesitate to reach out if you have any questions / suggestions!

Have a great week!