Market Overview - May 26th 2025

S&P Index Options & Volatility

Following up on last weeks overview:

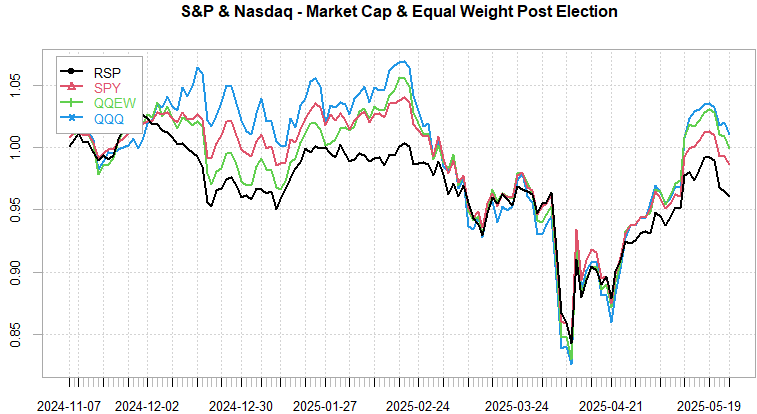

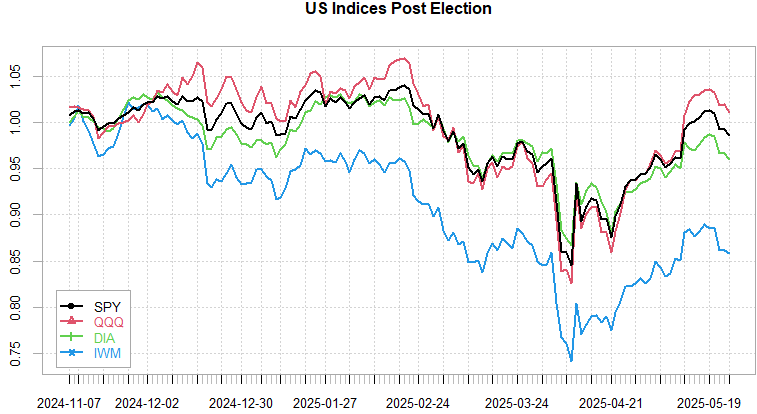

Market finally had a small pullback last week, S&P 500 sold off nearly 4% from the peak of the rally into end of week. VIX traded back towards 25 purely on spike in implied correlations after European tariff headlines (already smoothed over after weekend “talks going well” headlines…) We have a relatively light week in terms of data, GDP / PCE Thursday/Friday and in terms of earnings NVDA reporting after close on Wednesday. That’s around 11% of NDX & ~6% of SPX market cap reporting on Wed with related knock-on effects on rest of AI stocks. Can clearly see market shifting to higher implied correlation regime (reflecting more systematic risk vs idiosyncratic) as SPX is just few % off ATH yet we see VIX putting in a higher floor (with single stock implied volatility [VIXEQ] EQUAL to Feb / Mar lows, meaning this higher ivol floor is purely due to higher implied correlations, not higher single stock vol.

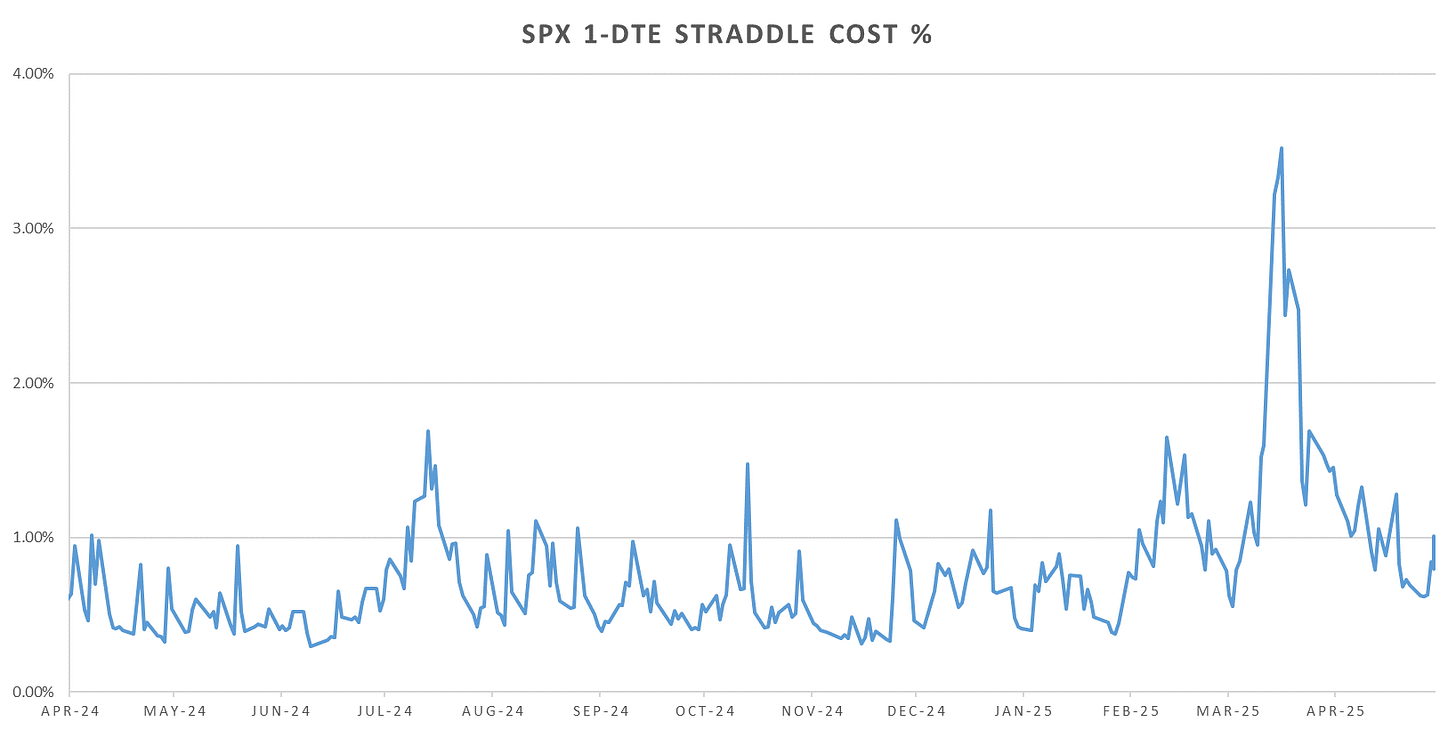

1-DTE SPX Straddles briefly traded lower just to end up back above 1% for the long weekend after the European tariffs headlines.

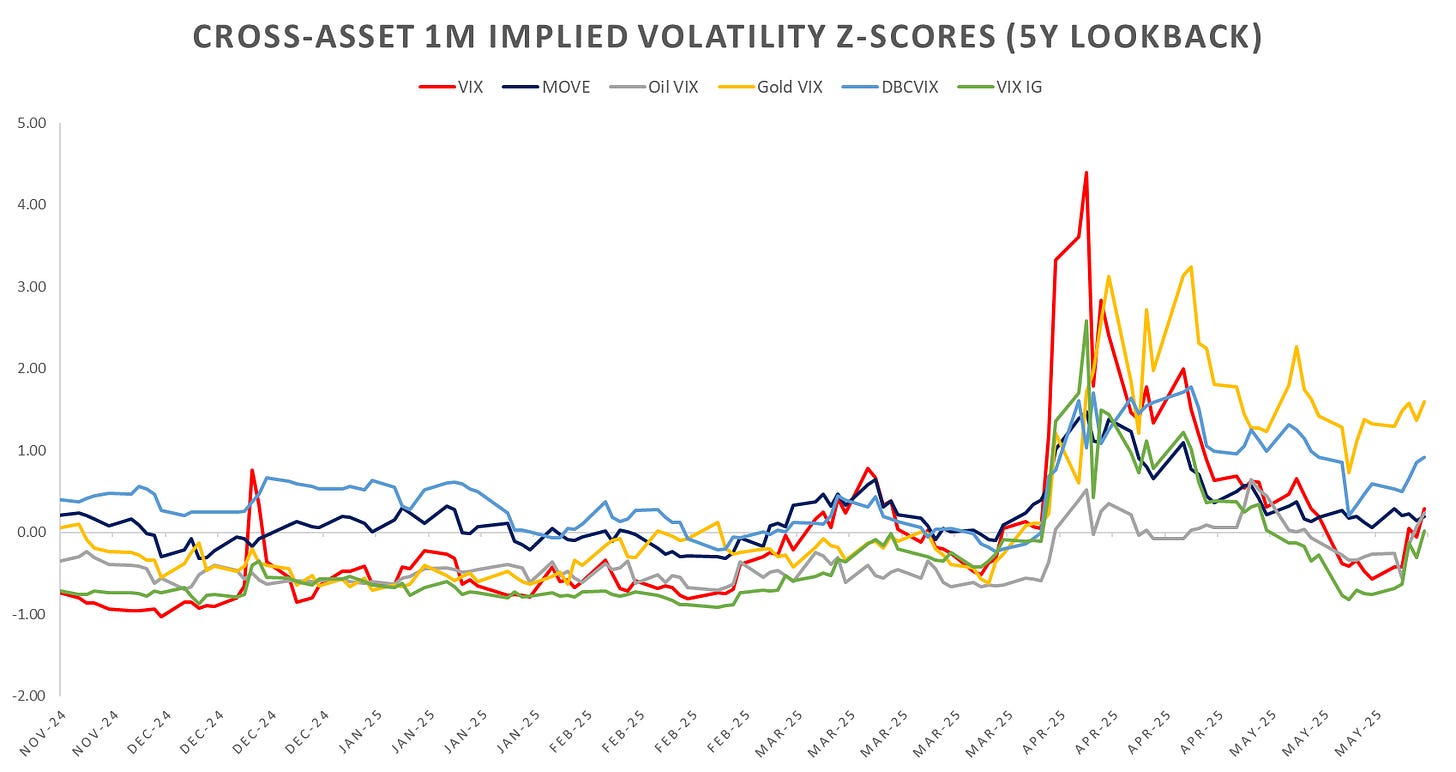

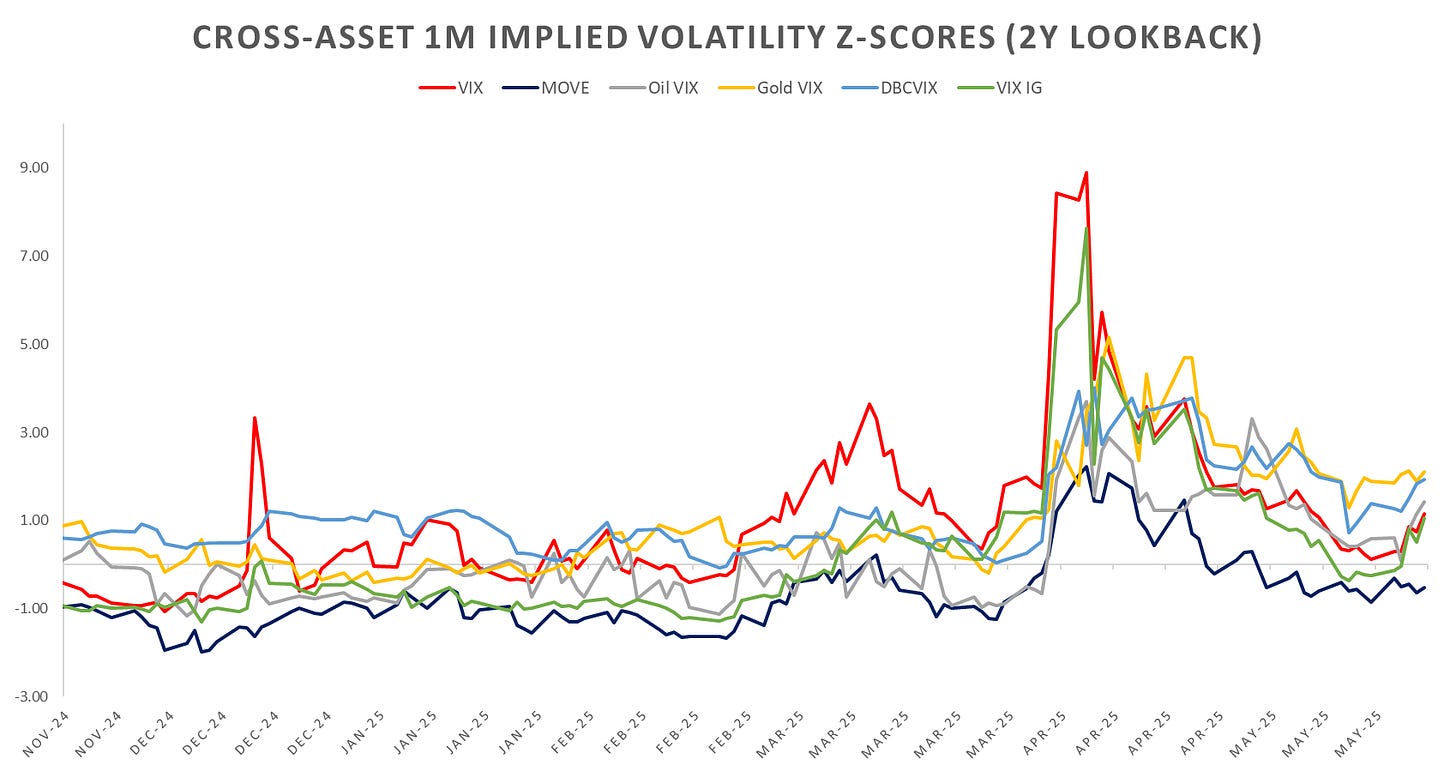

Cross-asset vols higher into eow across the board on another tariff scare. Even with the gap up in equities this morning VIX still remains above 20 for now. Gold relative highest on 2Y & 5Y lookbacks. Equity vol really lagging ‘macro’ vol (Gold & FX), equity vol did catchup into eow a bit (again, the large drop in equity index implied vols was due to dispersion picking up last 2 weeks & correlations dropping.)

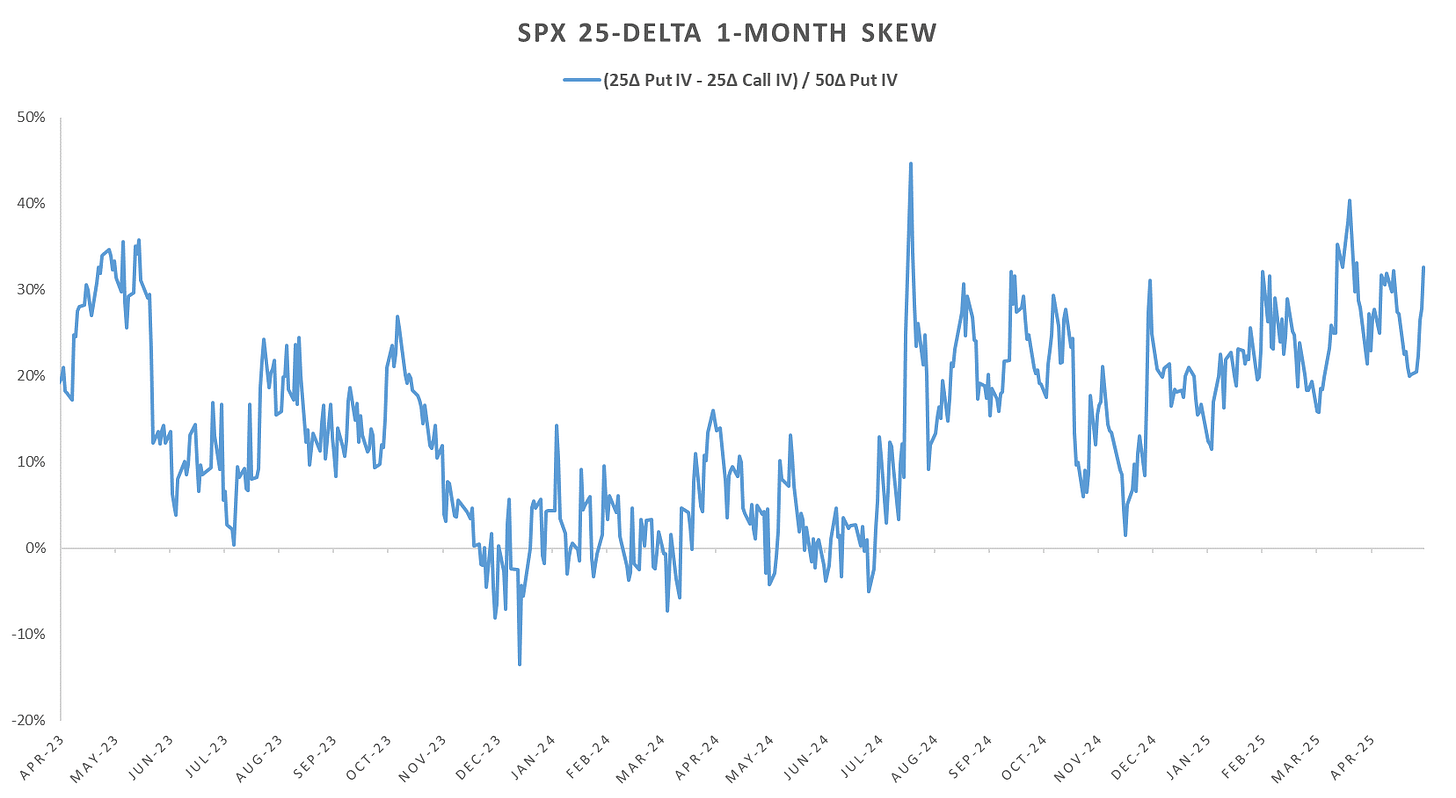

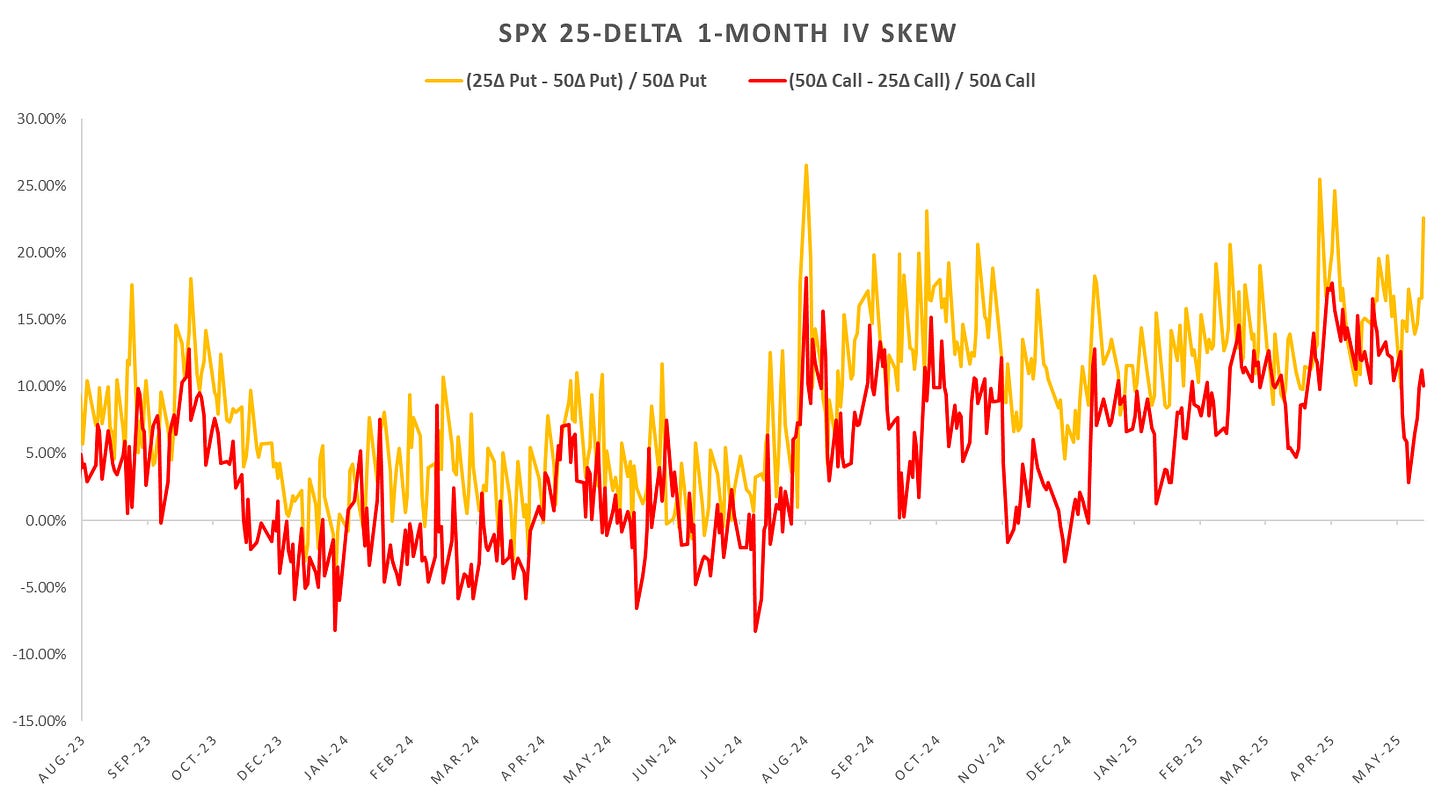

Skew steepened heavily into the weekend, call euphoria dropped off after 5-day losing streak last week.

Looking at intraday price action:

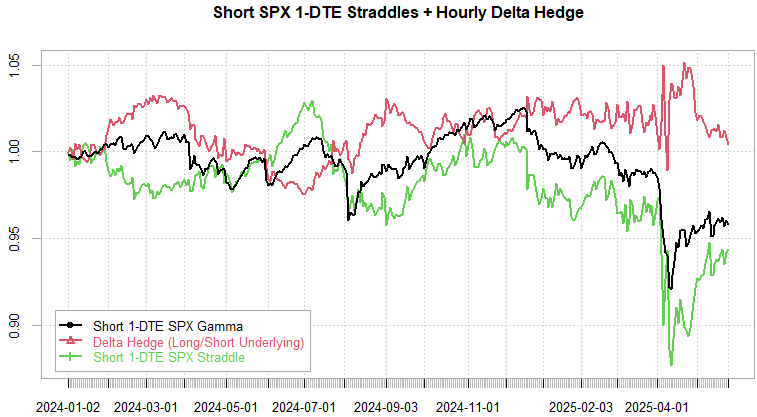

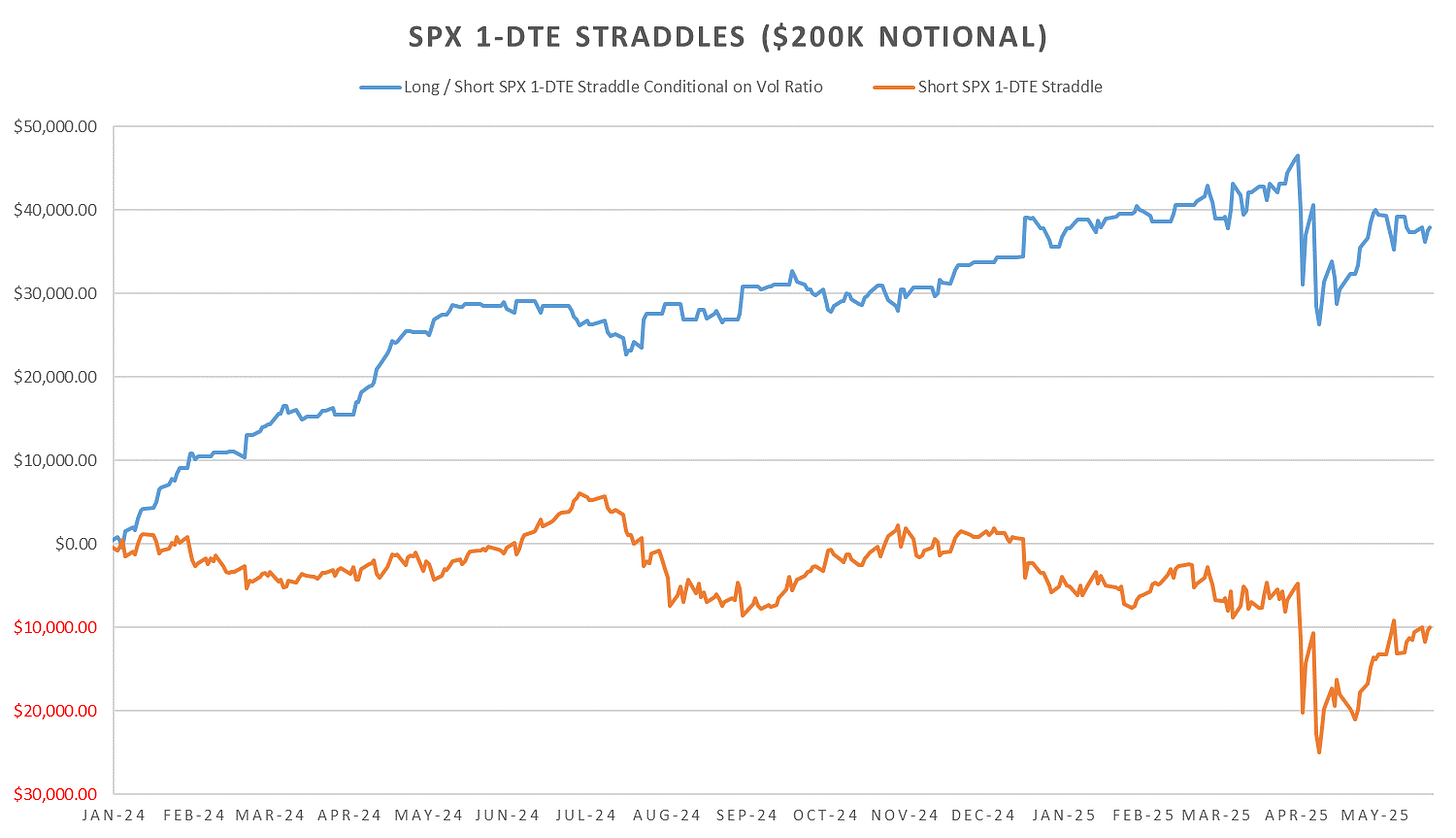

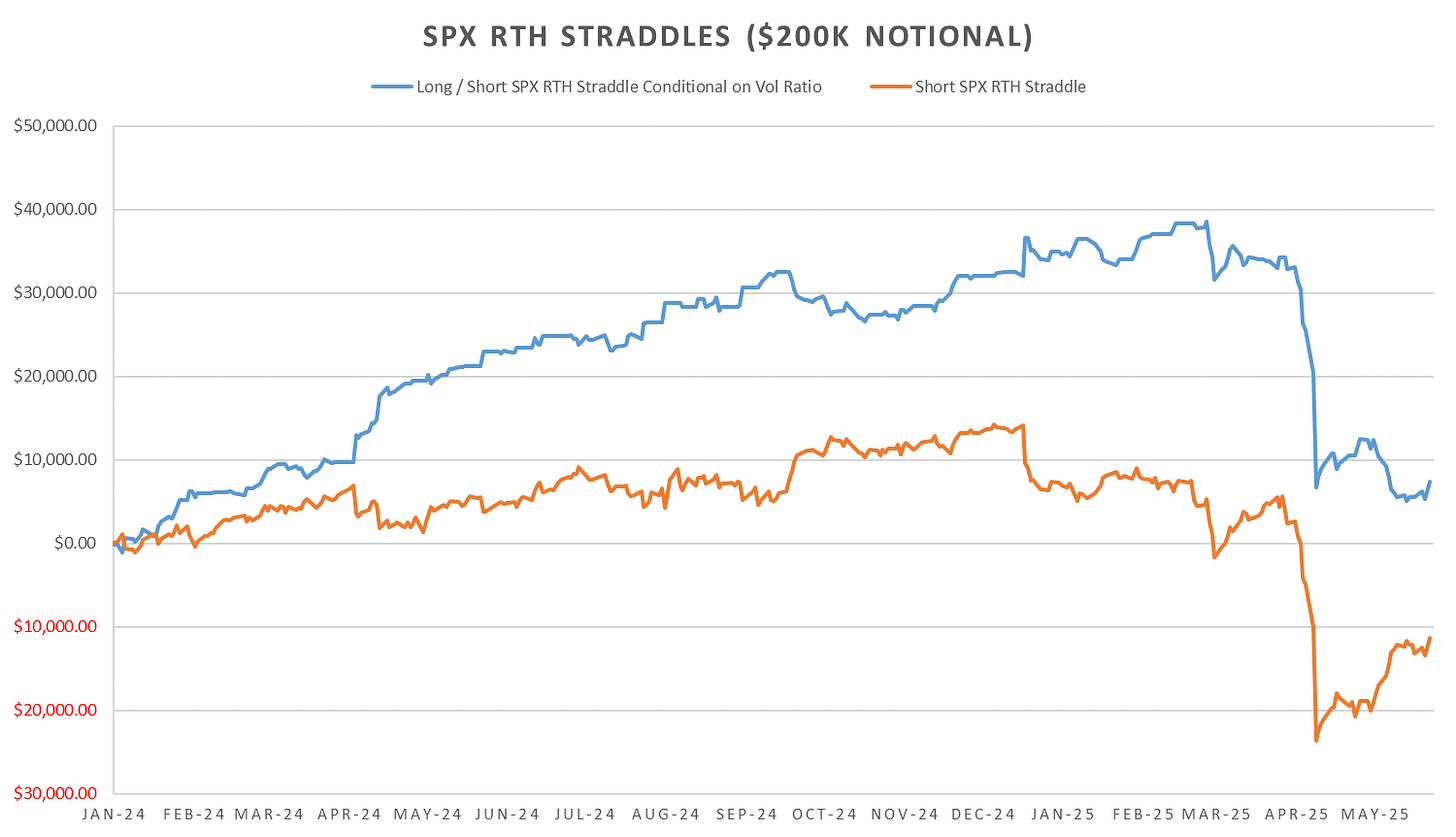

With 1-DTE implieds dropping heavily last week can see short 1-DTE gamma flattened / lower into eow. 4-5th straight week of losses on the delta hedging part of the pnl breakdown, markets just mean revert the overnight / early morning moves without any follow through…

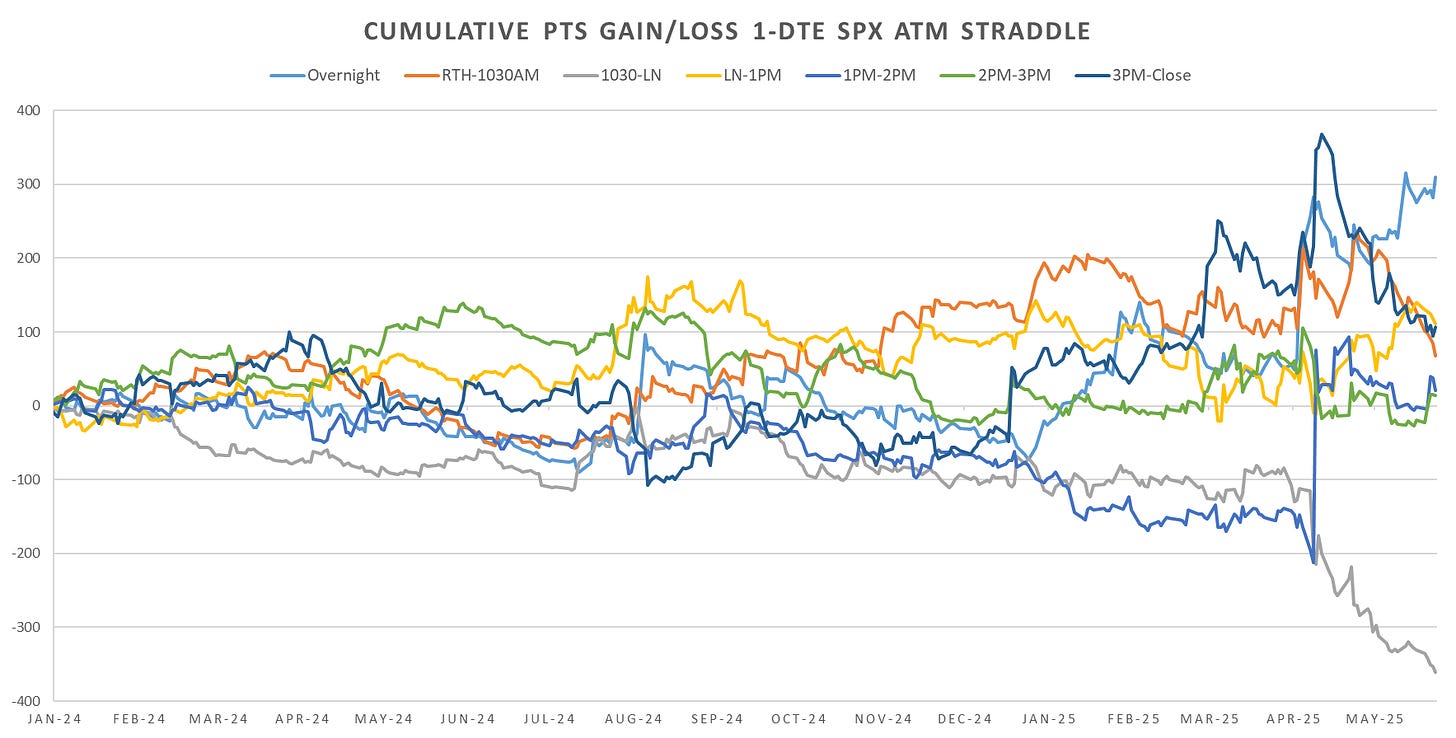

Looking at the cross section, overnight period largest contributor to long straddles PnL YTD, up ~ 400 pts. 10:30AM - London Close ~250pts down (fades overnight + first hour moves into london close.)

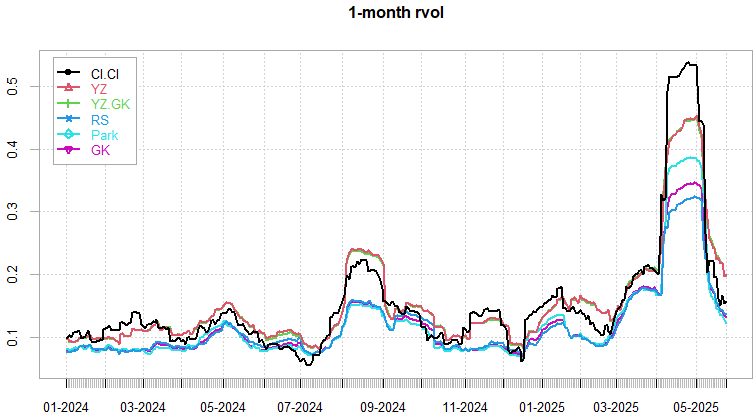

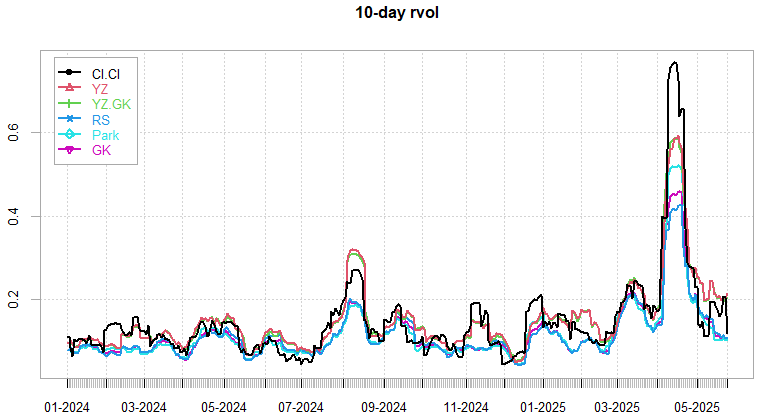

Realized Volatility Overview

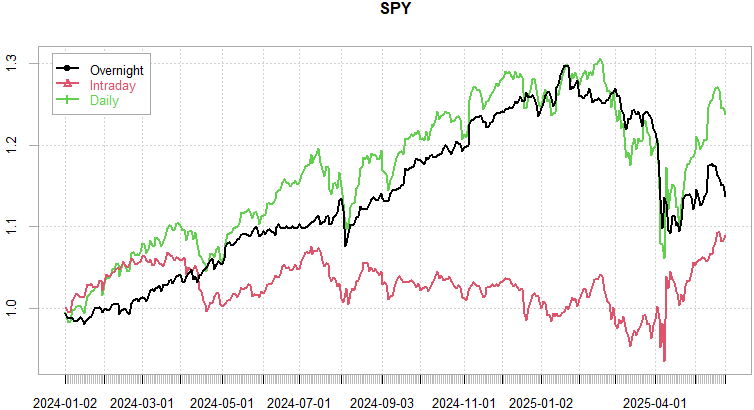

US RTH session almost vertical higher from April 3rd lows… Overnight session largely flat since the tariff announcement.

Range based vol estimators barely had any jumps last week, YZ estimator still above 20 since it accounts for the overnight moves.

After dispersion picked up last few weeks we saw a linear move lower across equities on tariff headlines into eow. I still don’t see how ivols move substantially lower considering any time market is up it gives Trump room to be aggressive on tariffs…

VIX-Futures largely following SPX with the RTH session performance. Overnight bids in vol / drop in indices with RTH US session recovering the entire drop and then some…

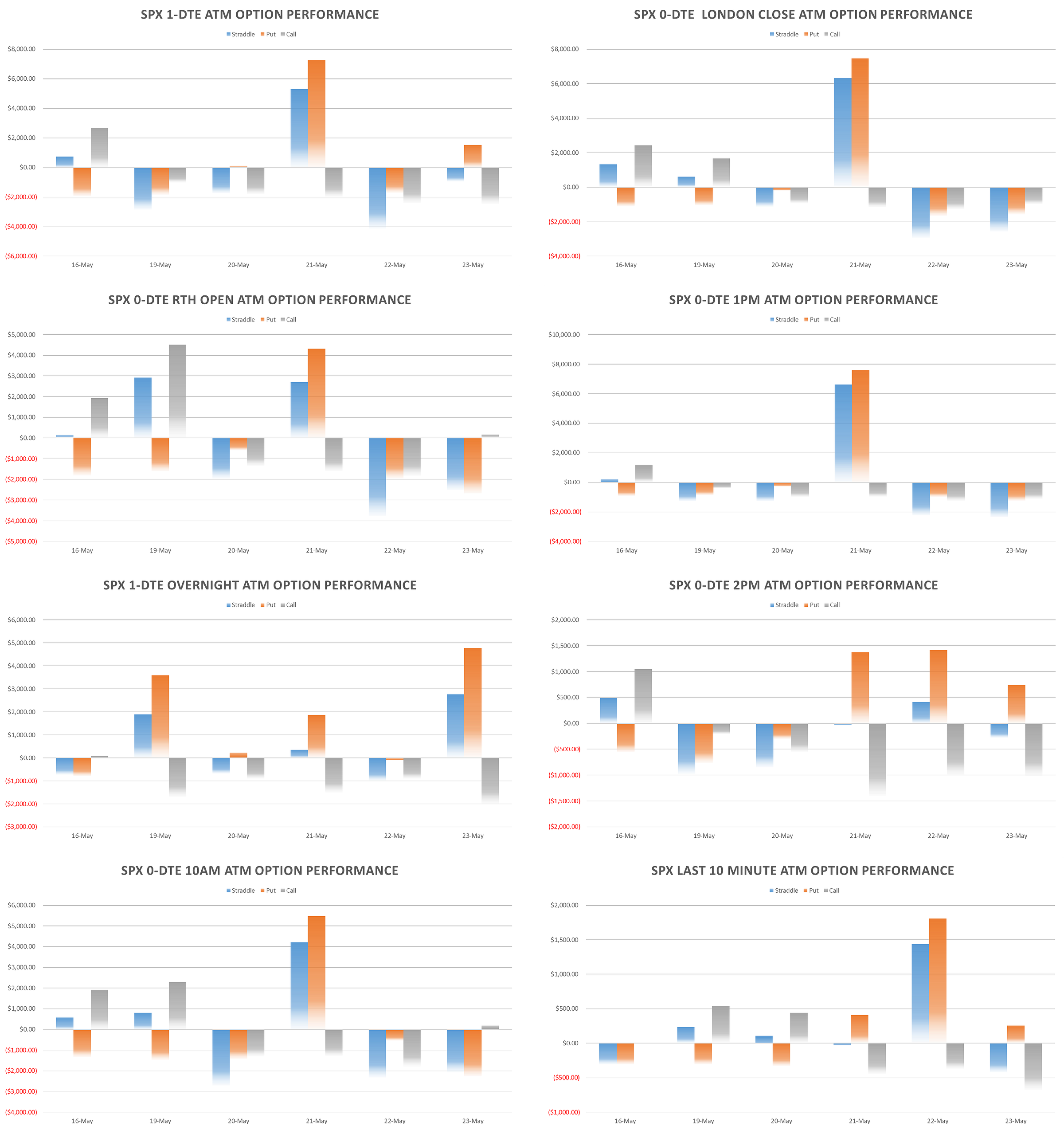

SPX ATM Straddle Performance

Apart from Wed drop paying out, straddles across the board lost money last week. 1-DTE calls lost money 5 days in a row as upside momentum stalled. Big win for last 10 min straddles on Thursday into close (EoM trade coming up this Friday.)

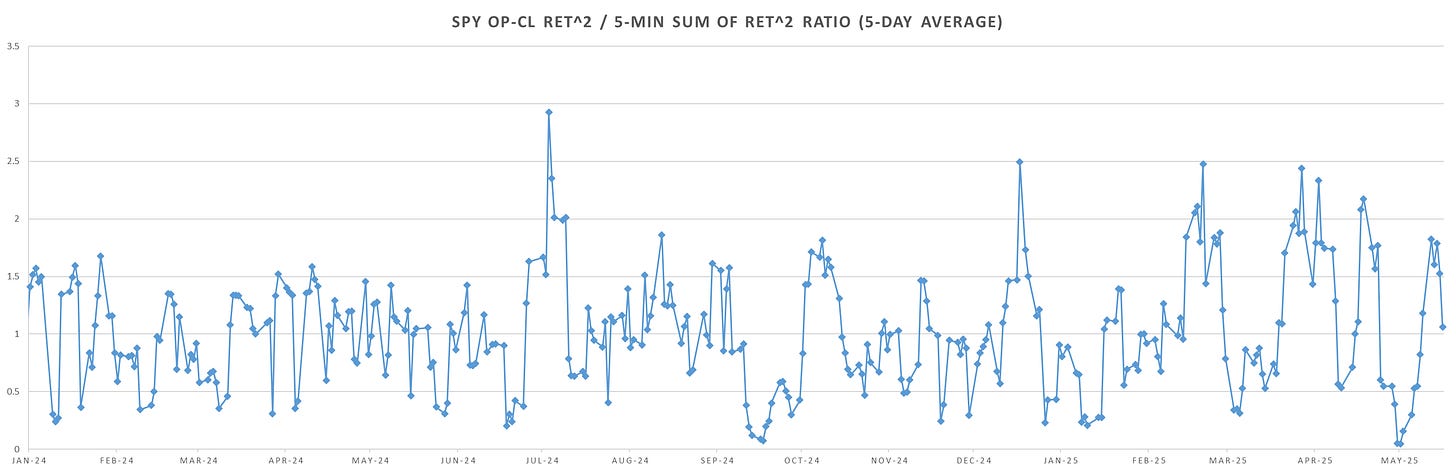

Intraday Variance Ratio

From the following post:

Few trendy days over last week but closing week in the mid range, flat into long weekend. Flat pnl last few weeks in line with overall short straddle performance, no extremes to fade so far.

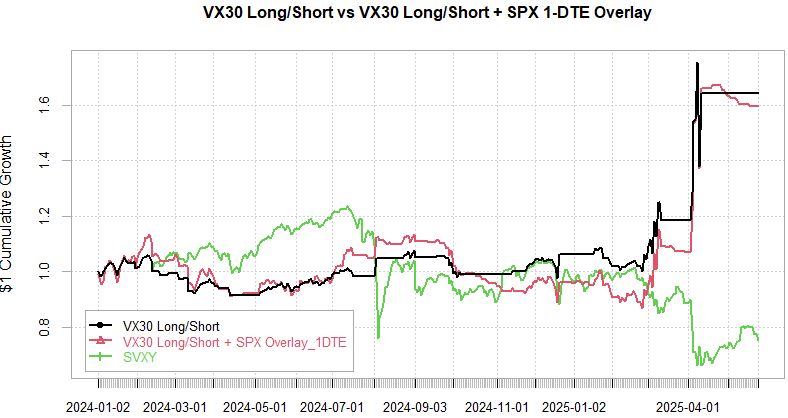

VX Carry & SPX Overlay

From the following post:

Term structure went out flat / slight backwardation in the front into the weekend… ofc the tweeter in chief walks everything back over the weekend and we see everyone puking hedges today… Still no strong bias here, its expected after a large vol episode but now nearly matching Covid in duration of no new trades triggered. I don’t really see us going substantially below 20 with trade drama still set to go on till July-Aug (and likely wayy longer). Problem is entire curve is flat around 21 now so there’s very little carry even if market goes nowhere (need either correlations back to lows, which would require trade drama to end or single stock vol to crater, which is also unlikely given the AI hype in tech stocks…) Not much to do here…

Have a great week!