Market Overview - May 19th 2025

S&P Index Options & Volatility

Following up on last weeks overview:

SPX now trading 1100+ pts higher from April lows. Last 4 weeks all closed green with market barely having a single day of retrace. While the market remains cautious on a longer term horizon (3M+) short dated panic chasing through calls is in full force. Last weak saw realized correlations drop substantially, leading to drop in implied & realized vols. Large cap tech started to outperform again with small caps / dow lagging. The US credit rating downgrade by Moody’s soured the mood on Sunday open, however, market quickly retraced the entire drop and briefly traded green on the day… We see vol up / spot up once again as participants are forced to chase the rally higher while at the same time still hedging downside through longer dated options.

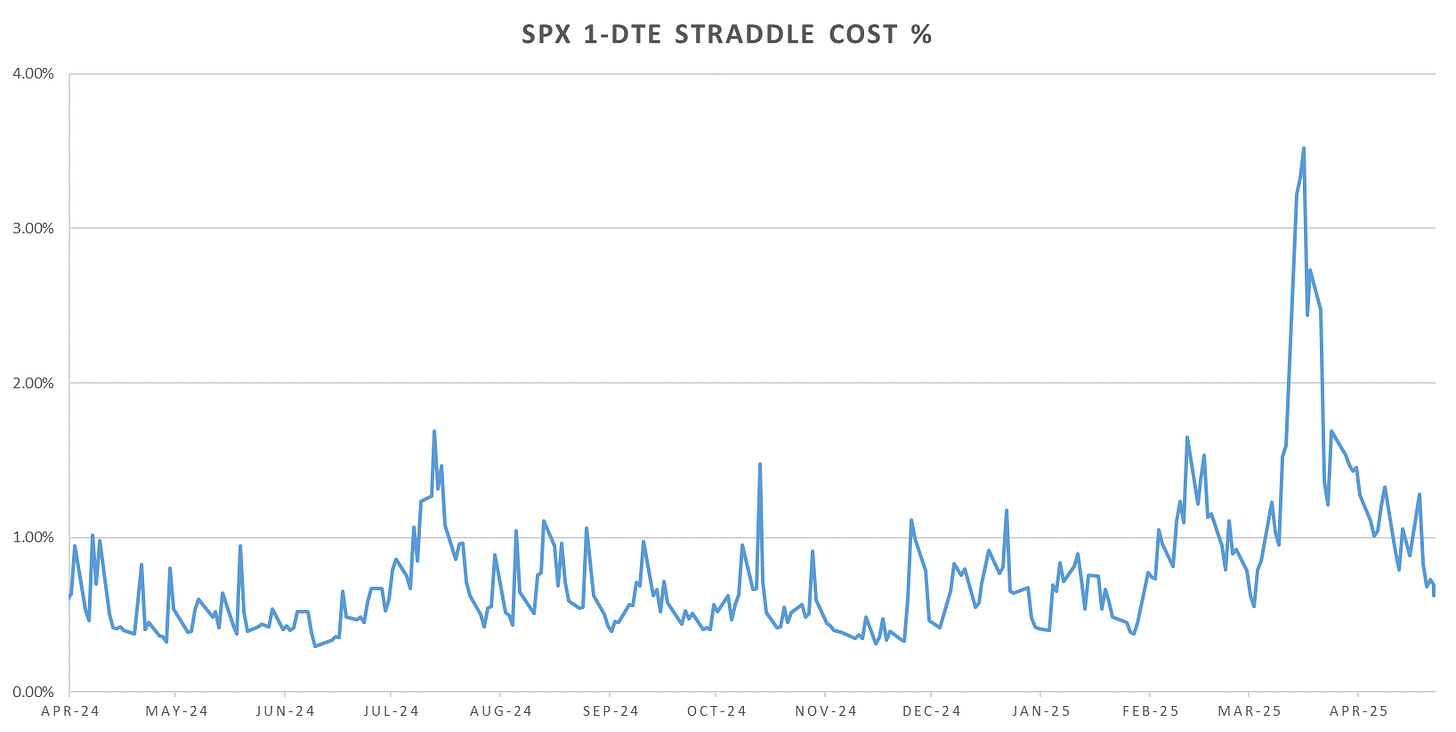

1-DTE vols dropped back to near 2024 lows (just before the Moody downgrade hit with 10 mins left in Fridays AH futures session…) These short term troughs all throughout last year were a decent opportunity to buy short dated vols as markets continue to get hit with headlines that break the brief periods of vol stupor.

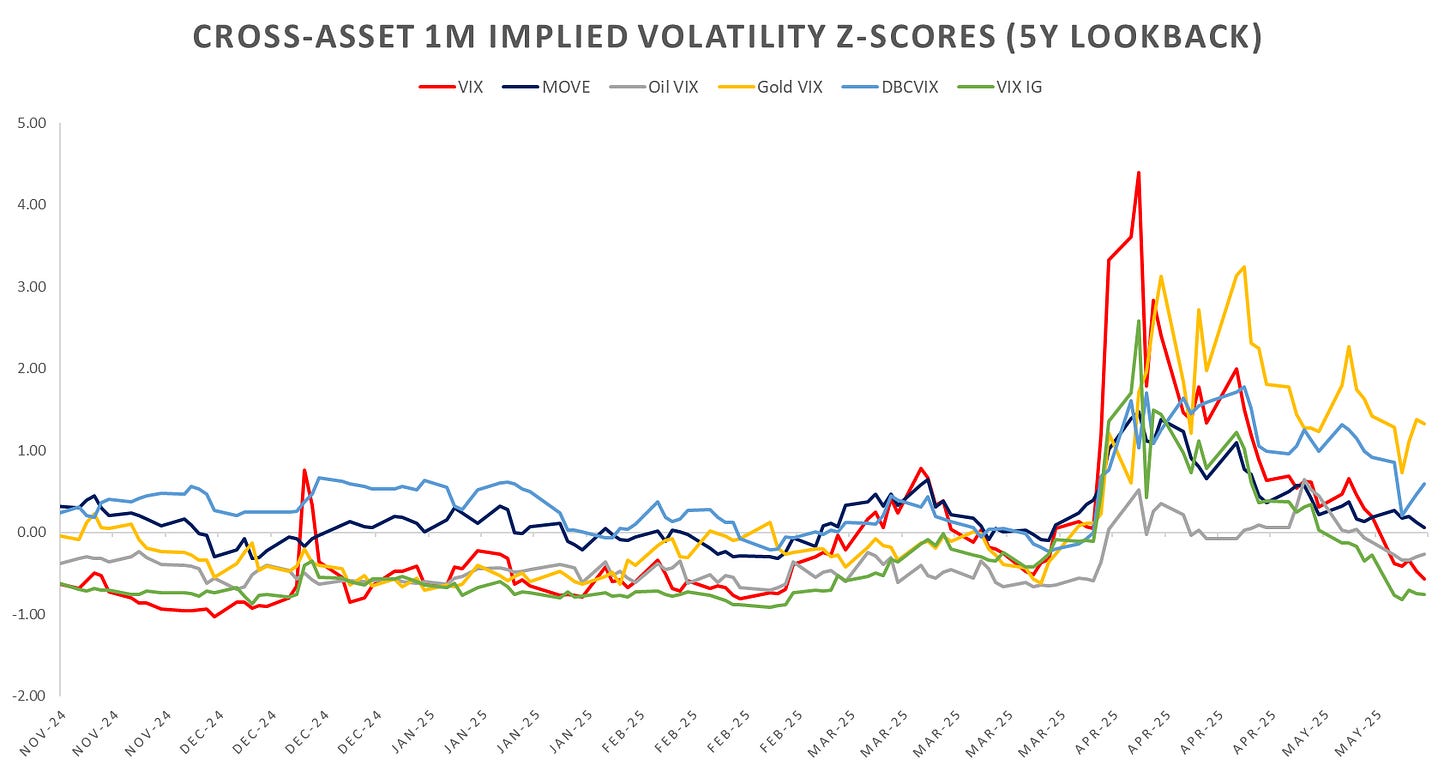

Cross-asset vols all lower on the week, equity & investment grade credit lowest, gold / fx highest.

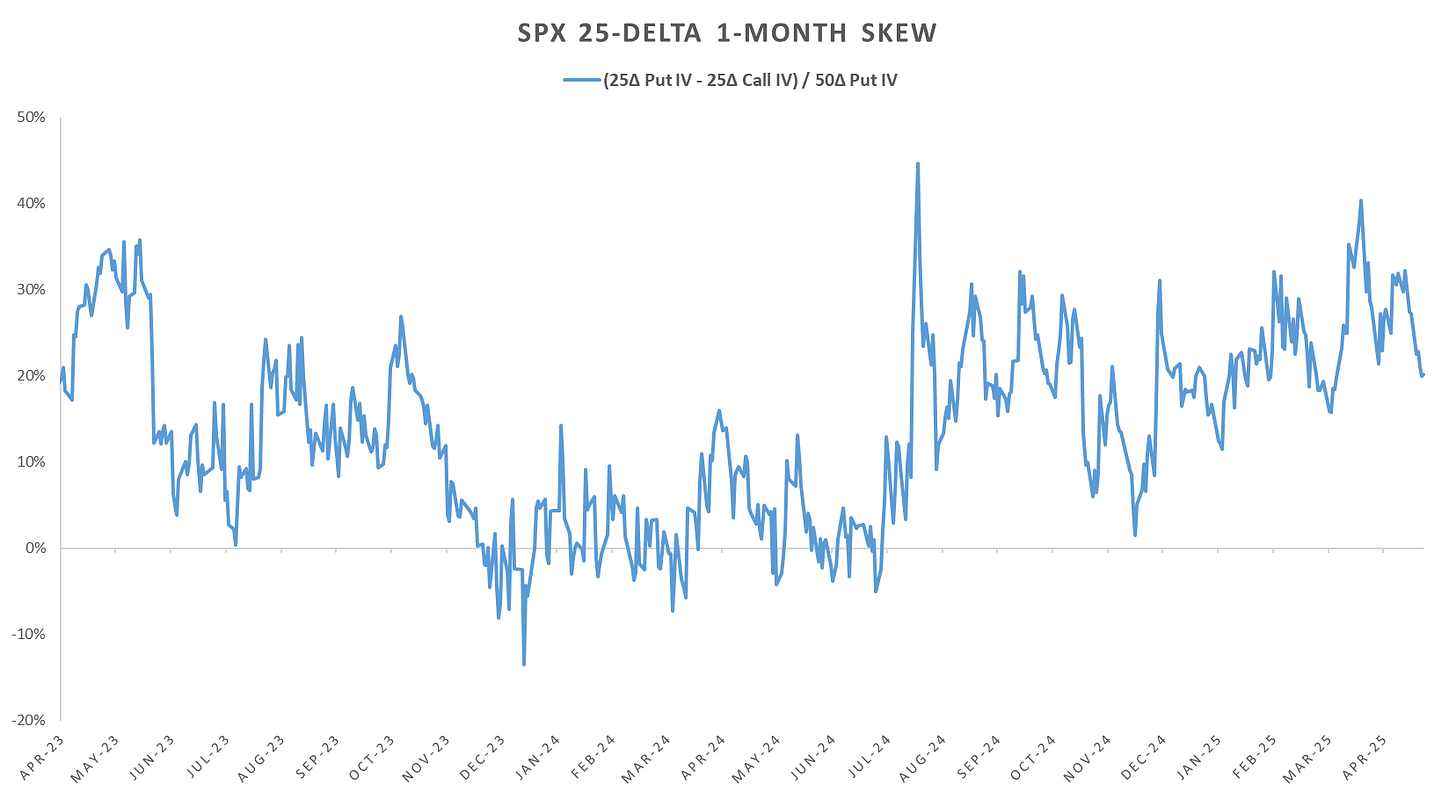

Can see the call chase with put skew steepening at the same time. Less pronounced for longer dated skew.

Looking at intraday price action:

Delta hedged 1-DTE SPX straddles ~ flat over last few weeks as last Mondays upside move well above implieds but rest of week recovered with market largely pinned. As we see today, cl-cl moves small but overall vol still in line with 18-20 implieds as GS notes liquidity is still low which results in large intraday swing.

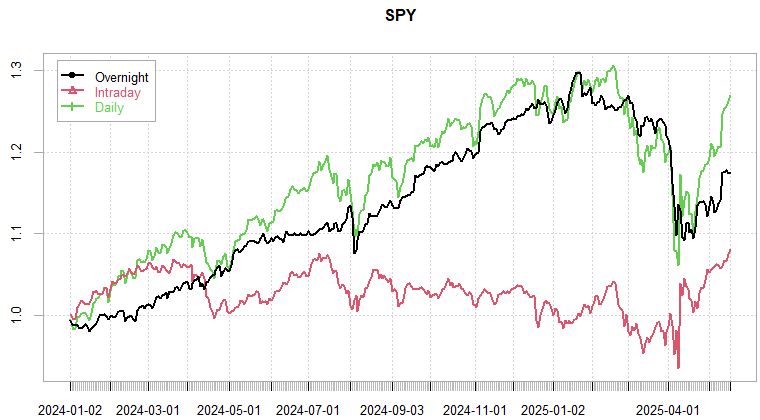

Overnight component of the 1-DTE straddles now the best performing period over the last year and a half. 10:30am - London Close best performing mean reversion period by a wide margin. EoD momentum dropped off along with cl-cl vol.

Realized Volatility Overview

US RTH session performance very solid throughout the ‘crash’ and still going. Market just barely off ATH…

Short dated range based vol measures (high-low) down to near 2024 lows… Looking at overnight moves rvols even for 10d still above 20. Outside the overnight gaps market back trading near 10 vols.

Can see quite clearly dispersion pick up after the China deal progress announcement over last weekend. This is a large contributor to declining ivols/rvols as intraday moves offset each other even as single stock vol refuses to decline.

VX30 drifting overnight/intraday, can see intraday moves largely flat / slightly positive towards eow despite the SPX rally.

SPX ATM Straddle Performance

1-DTE straddles net up 63pts over the last week due to the weekend gap. After Monday SPX straddles opened throughout the day net losers across the board.

Intraday Variance Ratio

From the following post:

After record mean reversion intraday we had a few trending trading days thursday / friday with current ratio stuck in middle of the range. Overall recovered nicely after the April drop. Currently flat into Monday and likely next few days.

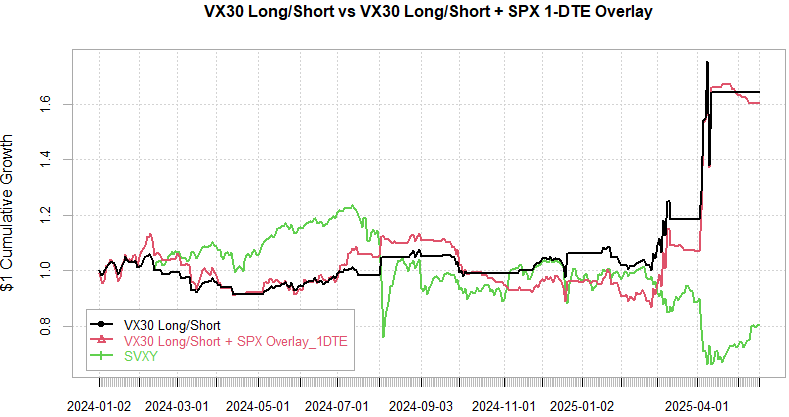

VX Carry & SPX Overlay

From the following post:

Still cash throughout last week but likely to trigger short VX June tmrw morning unless some sudden jump in short dated vols on a headline (just in time to get whipsawed cause this rally is getting a bit ridiculous.) Good thing is that exit should be quick given entire term structure is still relatively flat & with skew steepening I reckon there will be decent reaction to SPX downside in VIX-Futures.

Have a great week!