Market Overview - May 12th 2025

S&P Index Options & Volatility

Following up on last weeks overview:

After the weekend tariff news SPX now less than 5% away from making a new ATH. While the details of what exactly is going on with tariffs (and what is now happening to all those promised jobs?!) remain elusive, the markets are giddy to rally above the ‘liberation day’ highs. Implied volatilities down across assets (after slight bump into weekend.) VIX now back below 20 with slight steepening to a ‘healthier’ looking VX term structure. Markets have CPI to look forward to Tuesday pre-market & a few other econ data releases throughout the week. Last weeks FOMC largely ended up being a non-event, with Powell hammering in the ‘data-dependant’ line again. Bond yields are now largely flat from start of year with 30-year yields now just 10bps shy of 5% mark (that triggered Trump to walk away from tough China talk.)

SPX 1-DTE straddles traded briefly to the highs of 2024 range, with a slight jump into the weekend China meeting. Markets moved well above the expected range, up 3%+ on the day with an hour left in the session.

Cross-asset vols choppy but lower across the board by end of week. Gold & FX relatively highest on 2Y & 5Y lookbacks.

Skew flattened, CBOE notes pickup in call activity as markets extend the rally:

Looking at intraday price action:

Short delta hedged 1-DTE SPX straddles extended the rally last week, still choppy price action intraday with decent vol but low cl-cl vol. Short 1-DTE SPX straddles almost recovering the entire drop from late March / early April.

10:30am - London Close mean reversion dominating last few weeks. End of day momentum faded as volatility retreated as well, see latest post for more on intraday momentum / mean reversion!

Realized Volatility Overview

Overnight session still choppy but US session smooth rallies higher. Will be interesting to see how SPX holds up in the US session after the trade deal news euphoria settles. After all we just went back to square 1 but with ALOT of volatility / uncertainty in between…

The bulk of early April rvol starting to drop out of lookback windows. Shorter dated rvols (cl-cl) almost back to 2024 lows… Estimators that account for ranges lagging a bit but thats the usual pattern on prior spikes as well (dips bot / rips sold as market stabilizes.)

Small caps is the ‘dog’ of the indices since elections… so much for small cap initial exuberance post elections.

SVXY recovery barely visible. Remember the embedded leverage due to the mechanics of these ETPs (targets 100% dollar notional vs fixed vega notional) means that the inverse vol ETP’s have much larger embedded leverage when VX futures are lower, deleveraging as VX spikes. So while you may be holding the same number of SVXY or VXX shares, the exposure is meaningfully different depending on VX level:

SPX ATM Straddle Performance

Short straddles performed exceptionally well last week regardless of intraday entry timing. Any jumps in premium due to events / data releases were burned throughout the week. We are starting to see interesting price action last 10 mins, with bulk of the moves being lower (unlike earlier when SPX was ~4800-5300 and last 10 mins we had large buying take place.)

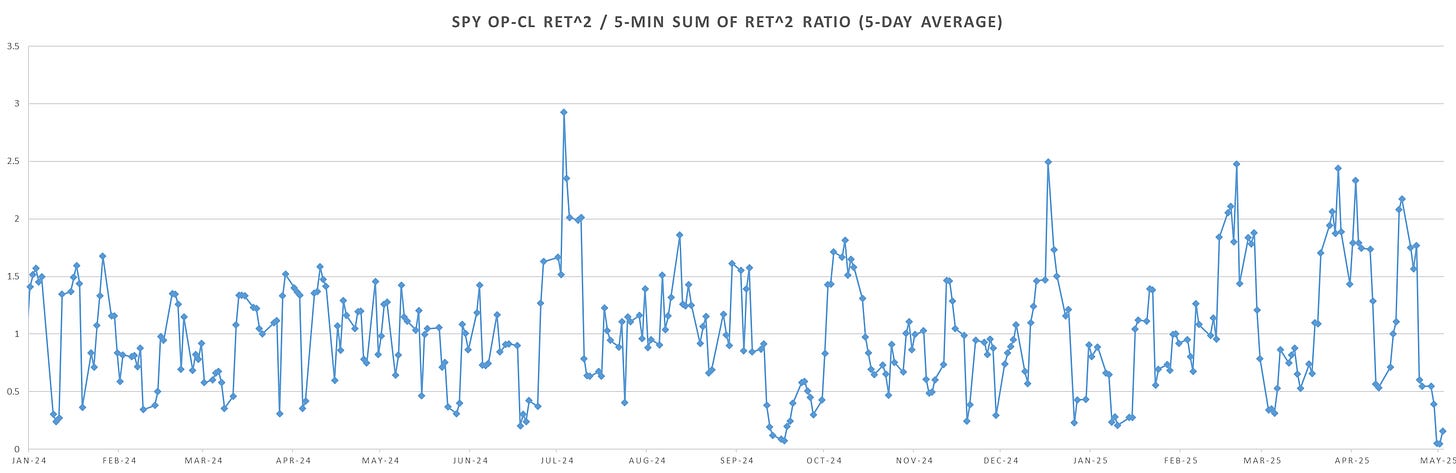

Intraday Variance Ratio

From the following post:

Very excessive mean reversion intraday last week. Ratio dropped to Sep lows. Straddles continued to play long throughout the week racking up a 5 day loss streak (saved by today’s jump higher in market.) Previously had an 8 day win streak almost recovering entire drawdown but given back some last week.

Weakness continues to be prolonged periods of vol / mean reversion. While not the ‘usual’ pattern to see lately as since 2018 we see markets quickly oscillate between flat / trend days, still get periods like last week where mean reversion lasts longer than expected (similar to follow through on vol early April.)

VX Carry & SPX Overlay

From the following post:

Still flat on the long/short VX carry system. We’re seeing some steepening now and with May VX coming off next week the June contract will be trading in a semi decent contango (rvol of vx has been muted last few weeks.) Likely to trigger short VX June if this can last few more days. There is a strong tendency to get whipsawed after large vol spikes like we’ve seen in April, reason being we likely sharply recover with systematic players triggering back in / re-leveraging on ‘bullish’ signals, just to see a second leg lower / retraces happening as markets overshoot to the upside… so bracing for hopefully ‘light’ whipsaws next few months!

As always, don’t hesitate to reach out if you have any questions / suggestions!

Have a great week!