Following up on last weeks overview:

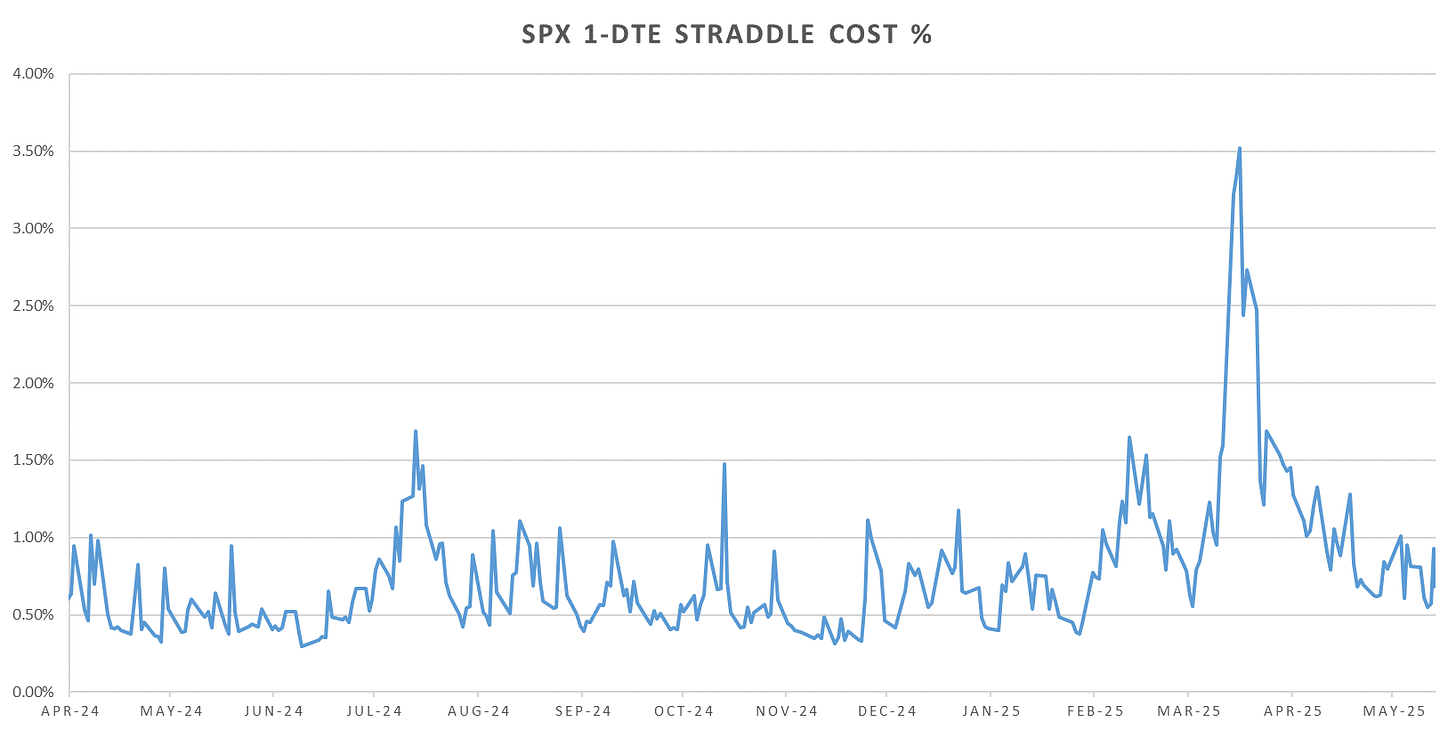

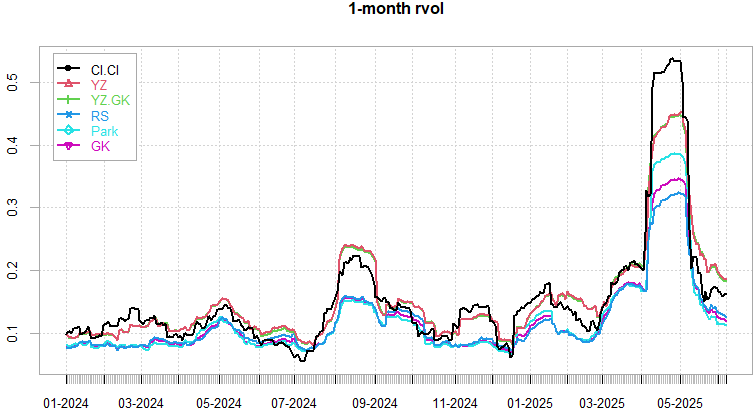

SPX managed to close last week at 6000 flat, new peak for the rally from April lows. Markets quickly shrugged off all the Musk/Trump drama on Thursday (despite alarming allegations thrown out…) VIX closed in the 16’s with single stock volatility dropping to its lowest levels so far in 2025 (implied correlations still above early May lows.) *Feels* like summer lull is in full swing, from the last post, this early June period is seasonally the strongest period for shorting rvol as markets wait for new catalysts to emerge. The main event of this week is the CPI on Wednesday (although CPI day straddles have been priced well below 1% last year or so except for Mar/Apr…)

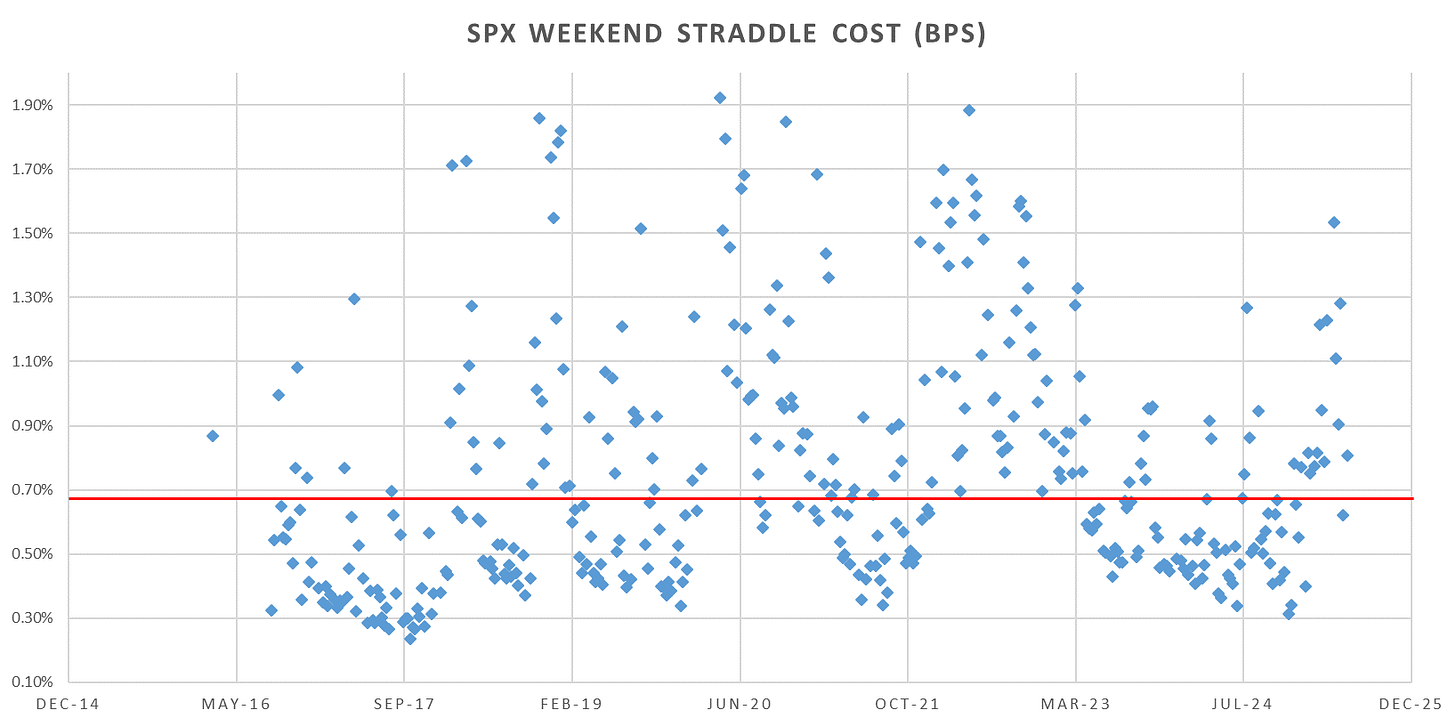

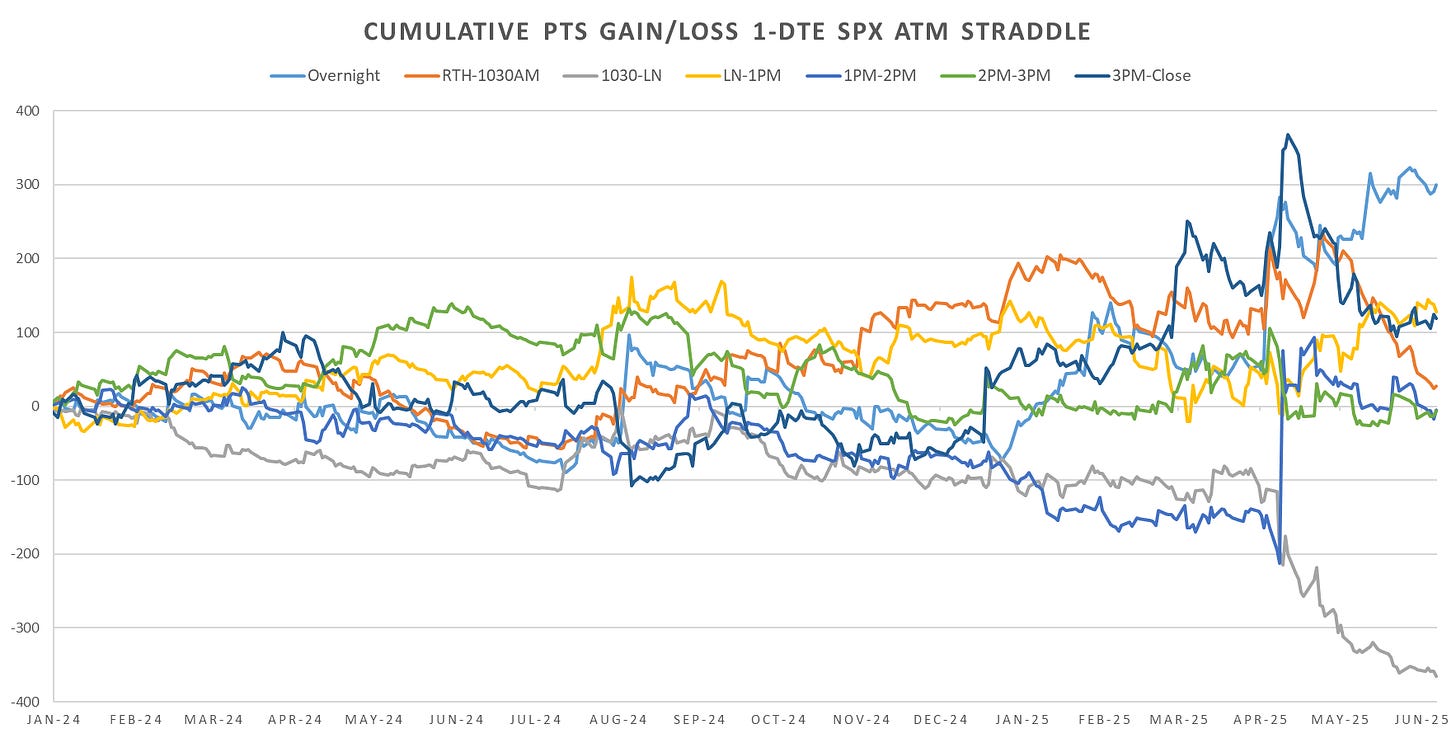

Latest weekend straddle back to only ~70 bps. Majority of the risk we saw last few months, especially regarding tariff news was weekend gap driven:

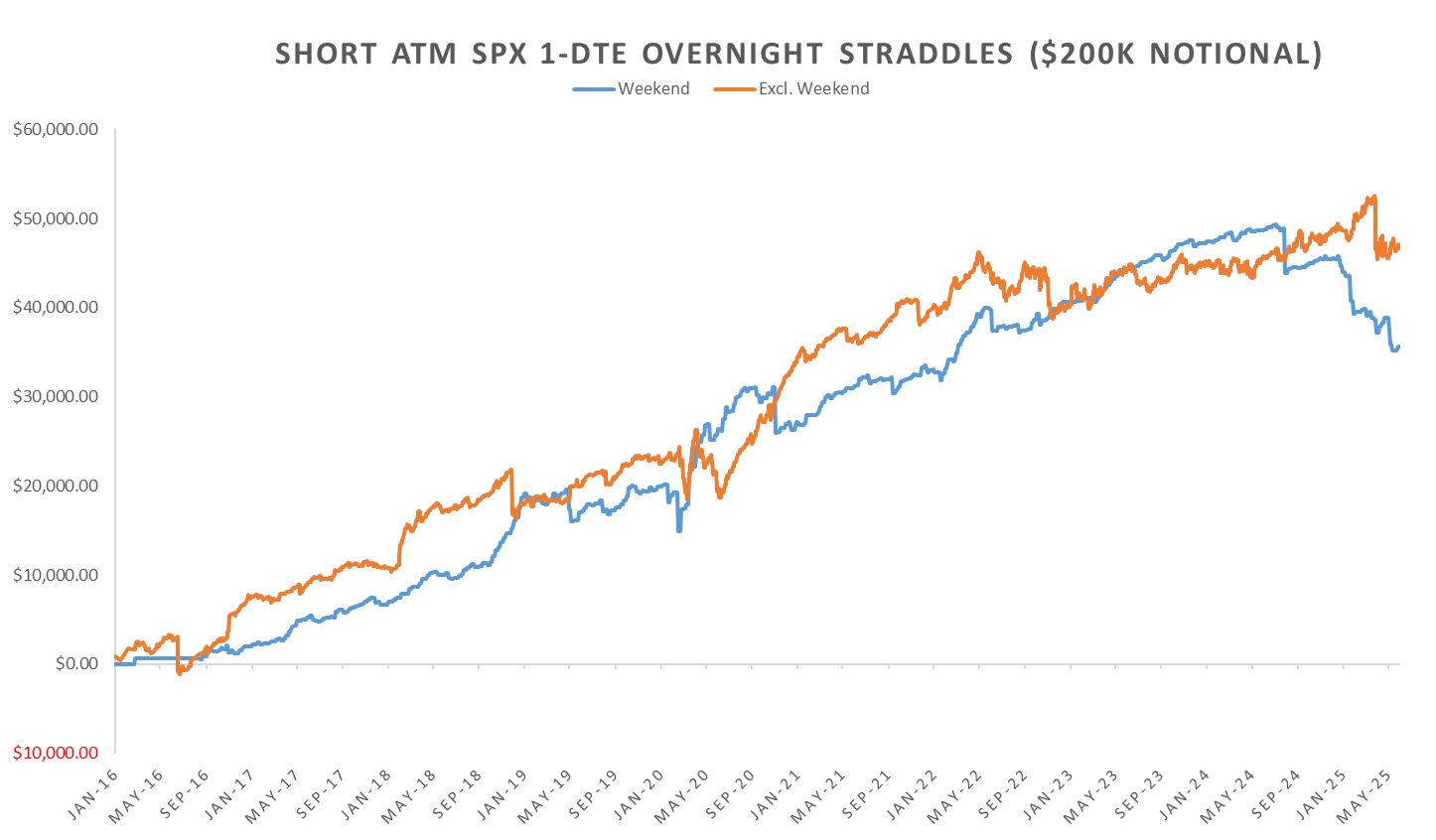

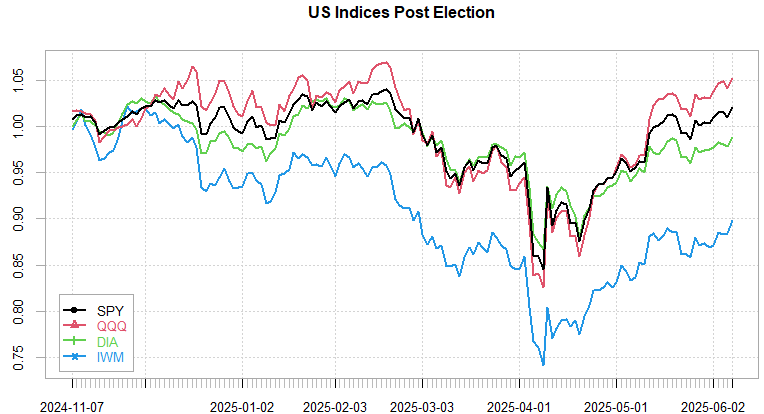

The weekend short overnight straddle trade was ~ equivalent to the premium earned over the other 4 days of the week up until Aug 2024.

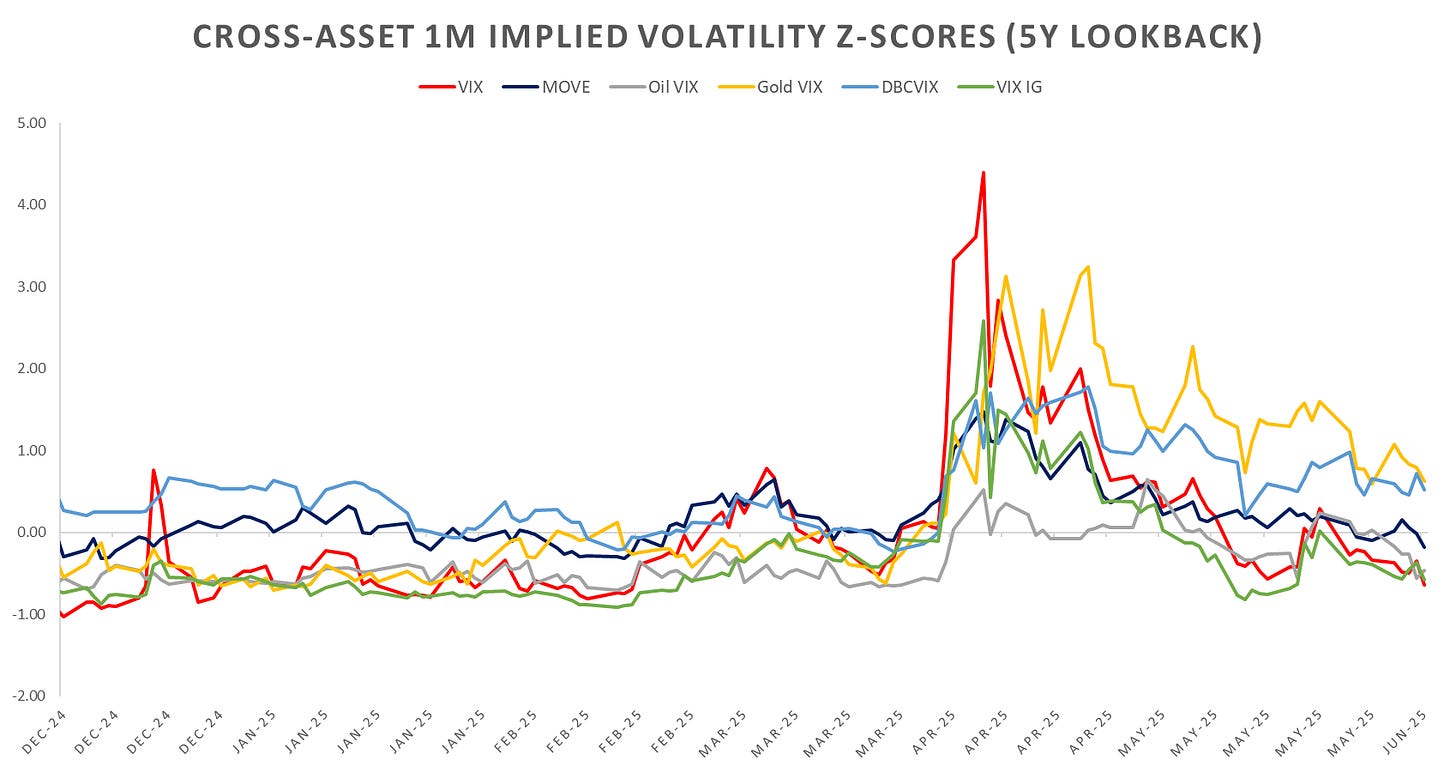

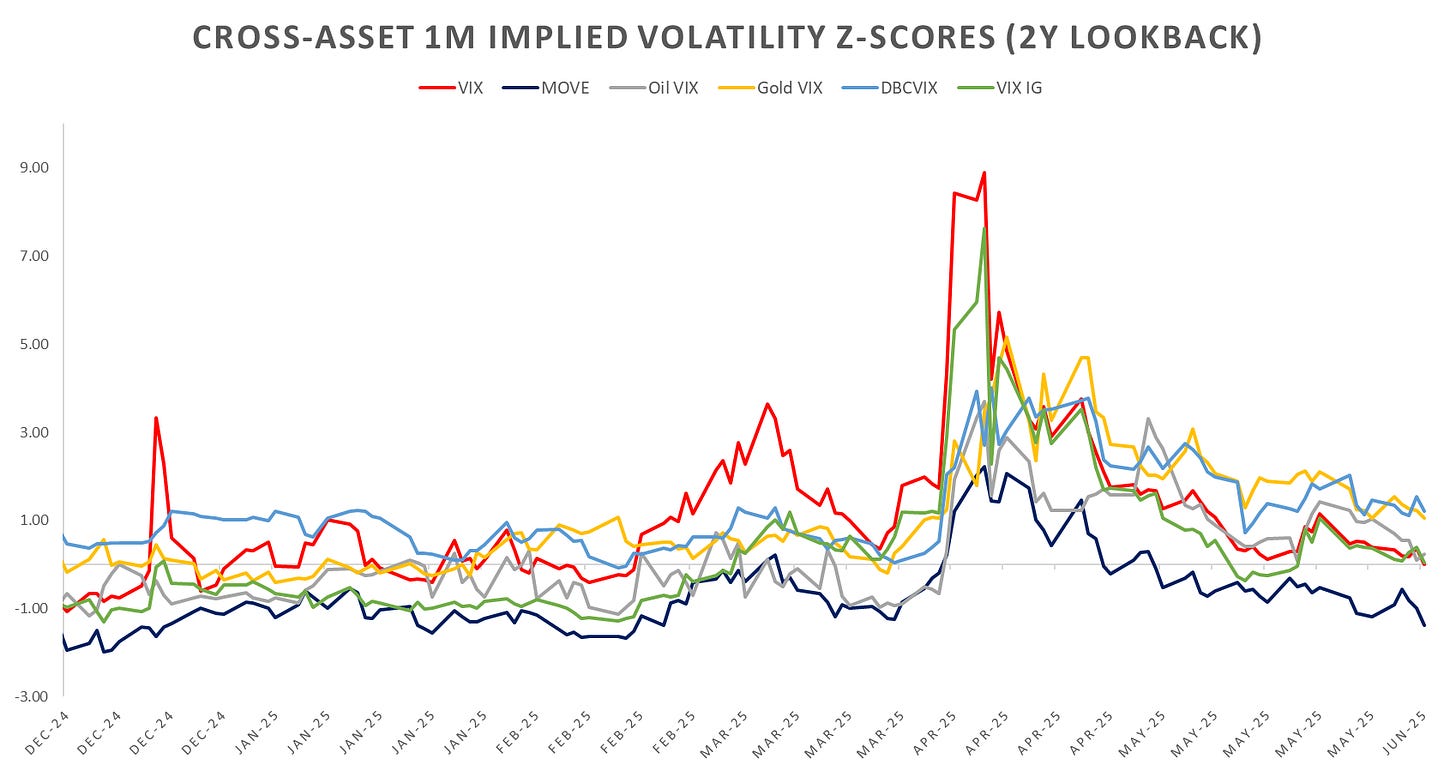

Looking at cross-asset 30d implied vols, once again lower across the board last week. 5Y lookbacks back to ~avg for equities, bonds, investment grade credit & oil. Gold & FX remain stubborn.

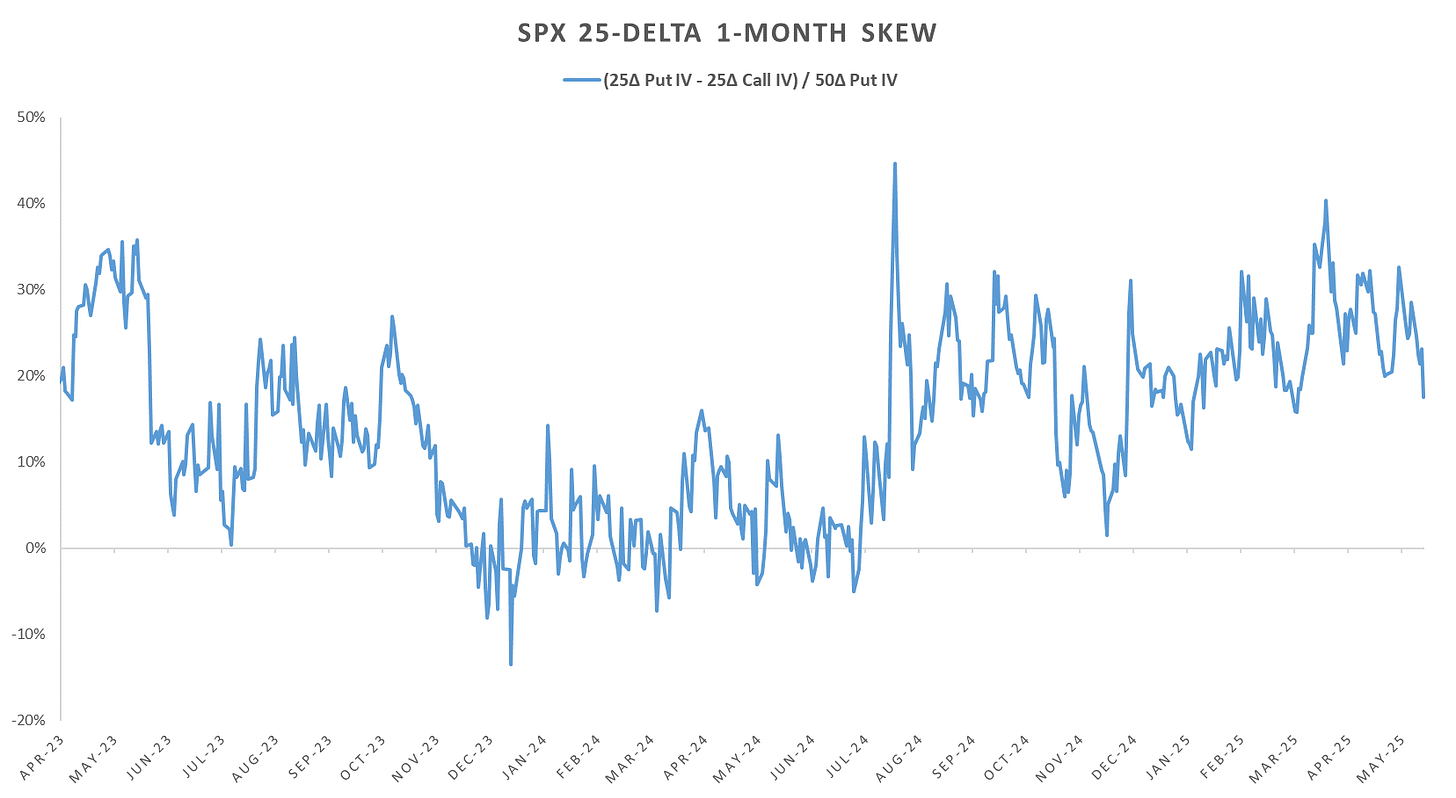

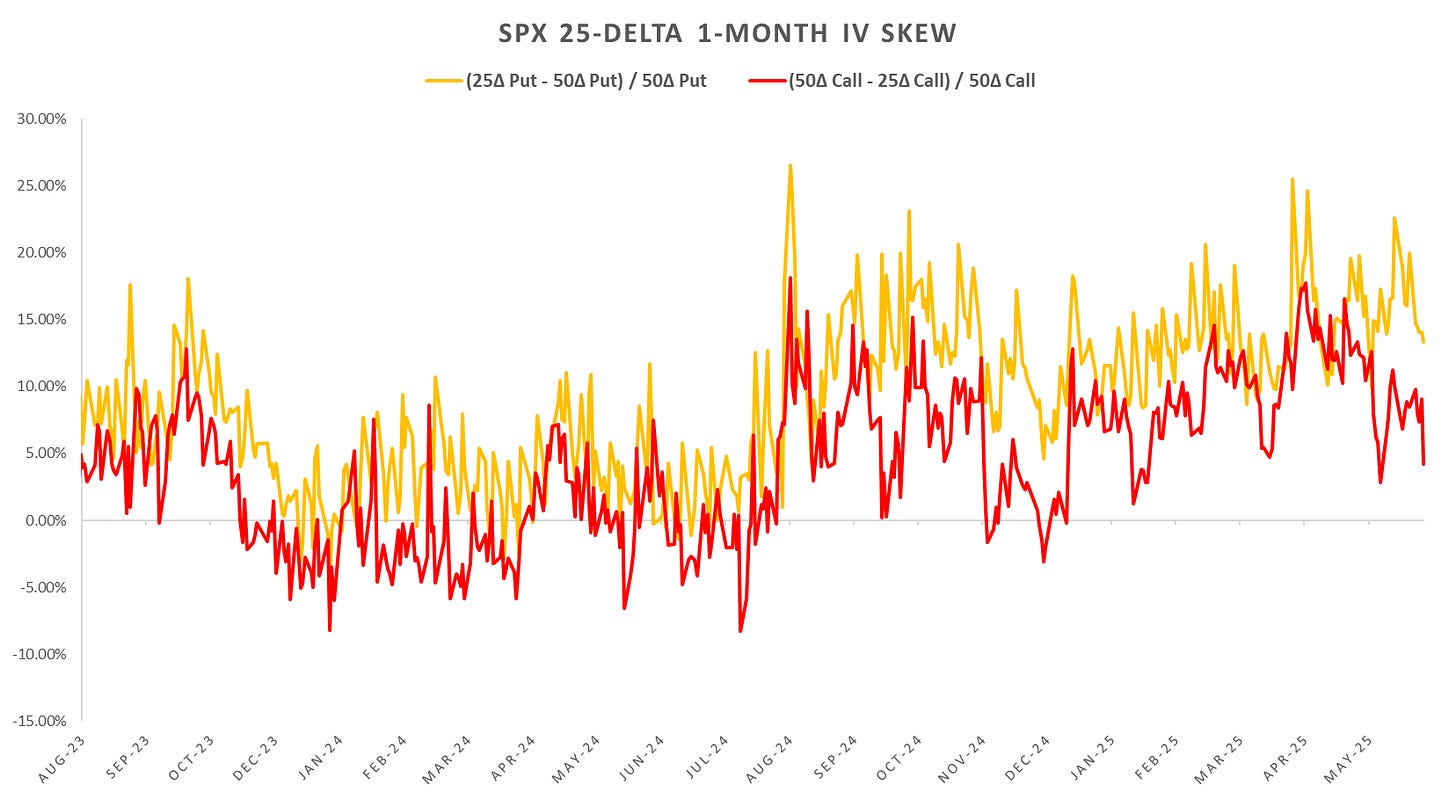

Finally see 1m 25d skew flatten back to March levels. Notably, put skew remains in the same range after the Aug 2024 episode, even during the Decemeber / Jan 2025 rally remained bid.

Looking at intraday price action:

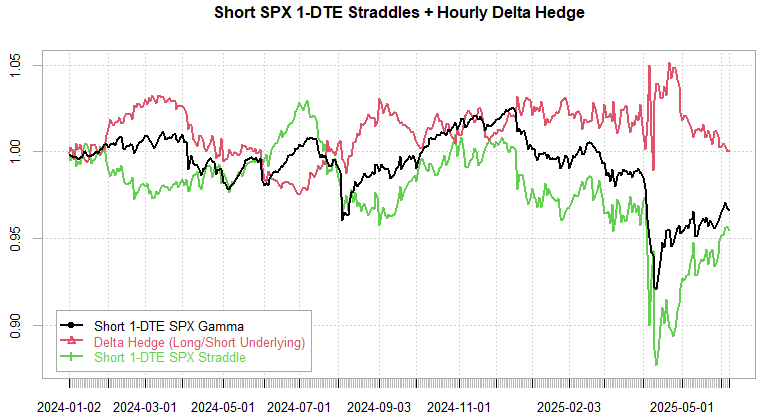

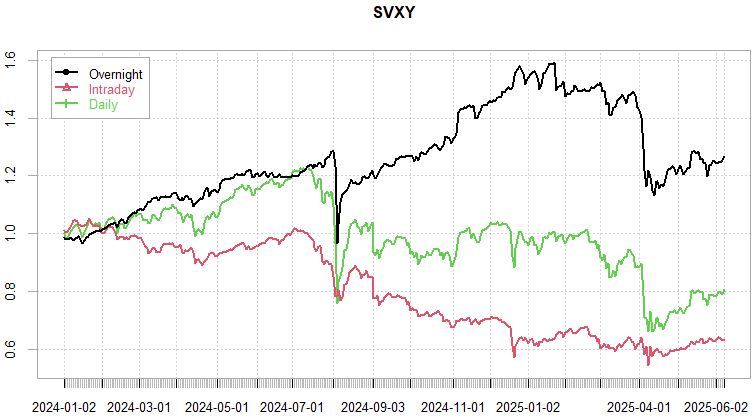

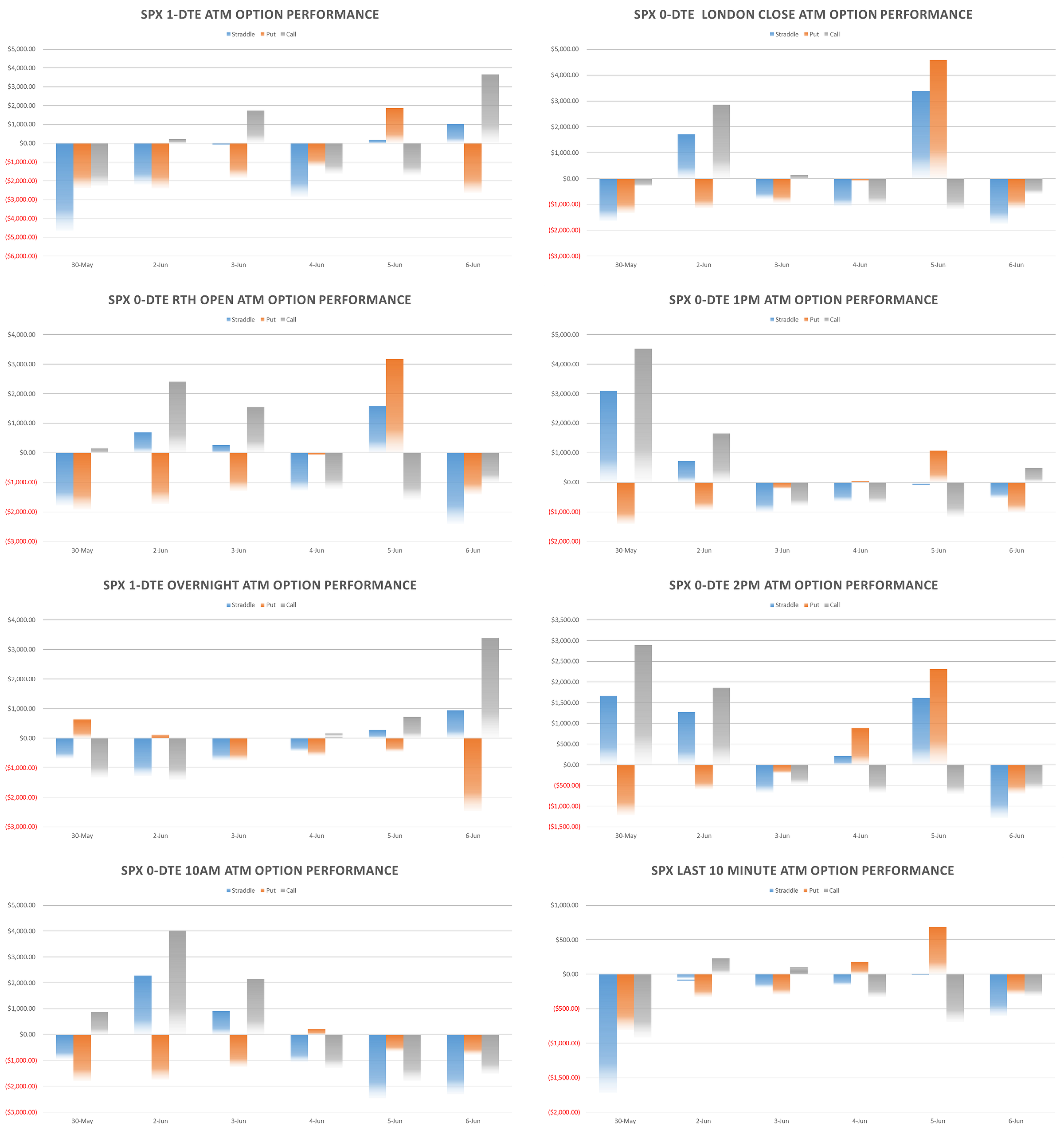

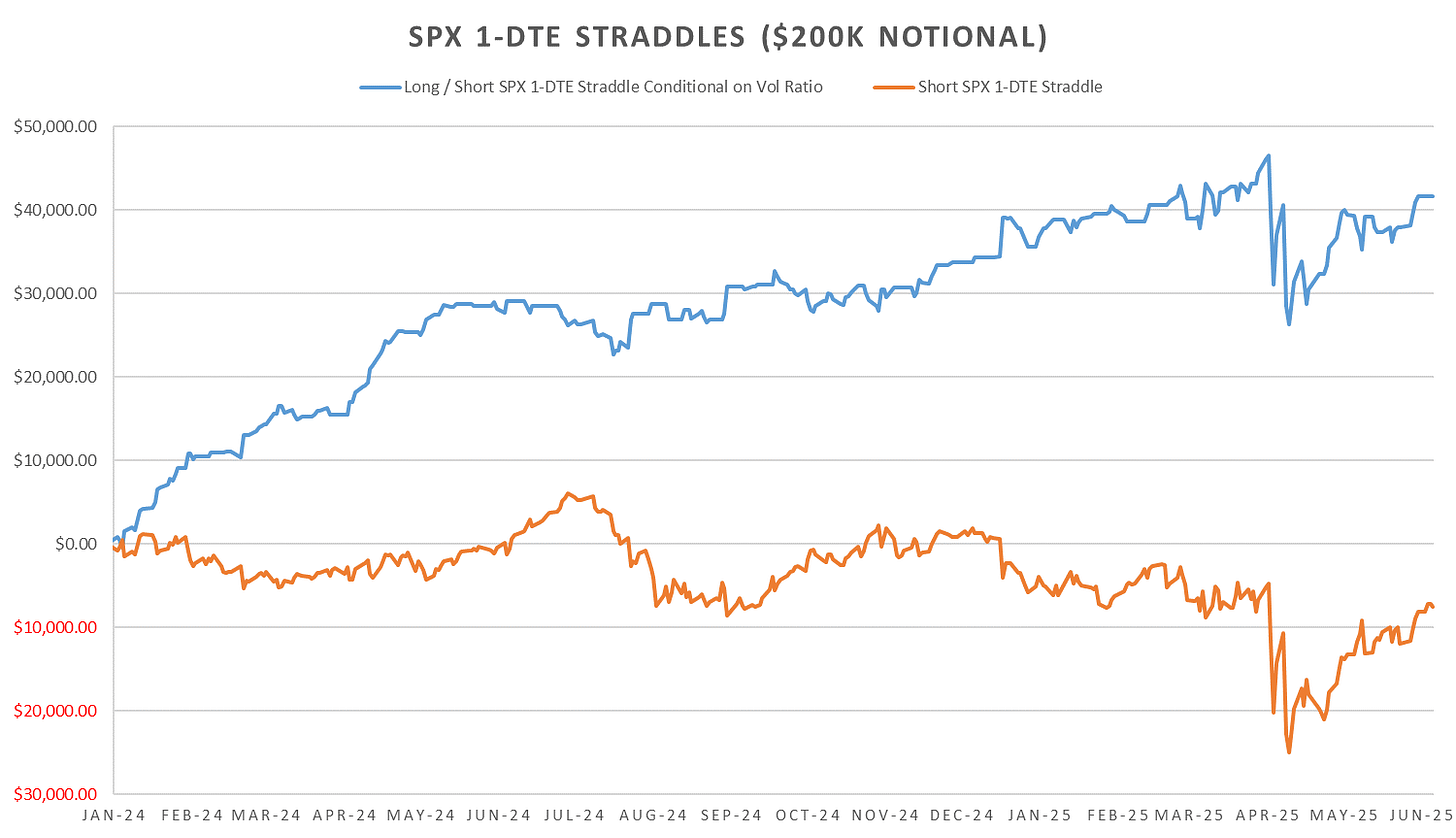

Shorting 1-DTE SPX straddles did well last week, putting it new highs as indices still remained largely pinned throughout the week. Delta hedge component net drag since April lows as SPX remains choppy intraday while closing ~flat on a cl-cl basis.

The streak of mean reversion between 10:30am and London Close remains, with overnight gains largest contributor since Jan 2025.

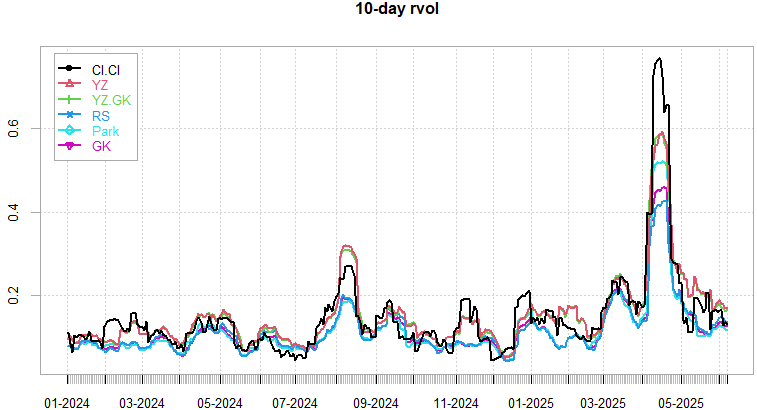

Realized Volatility Overview

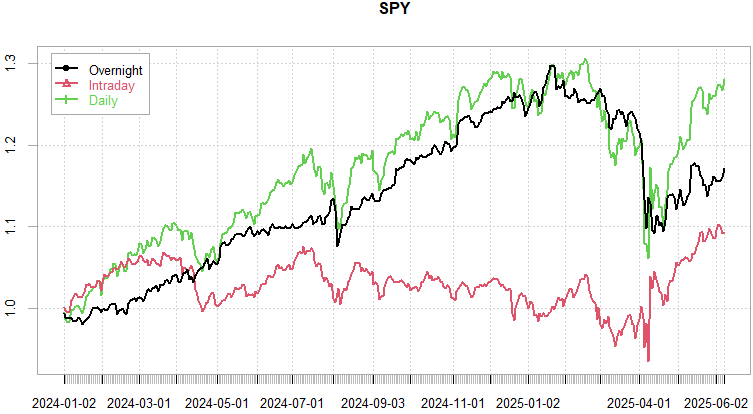

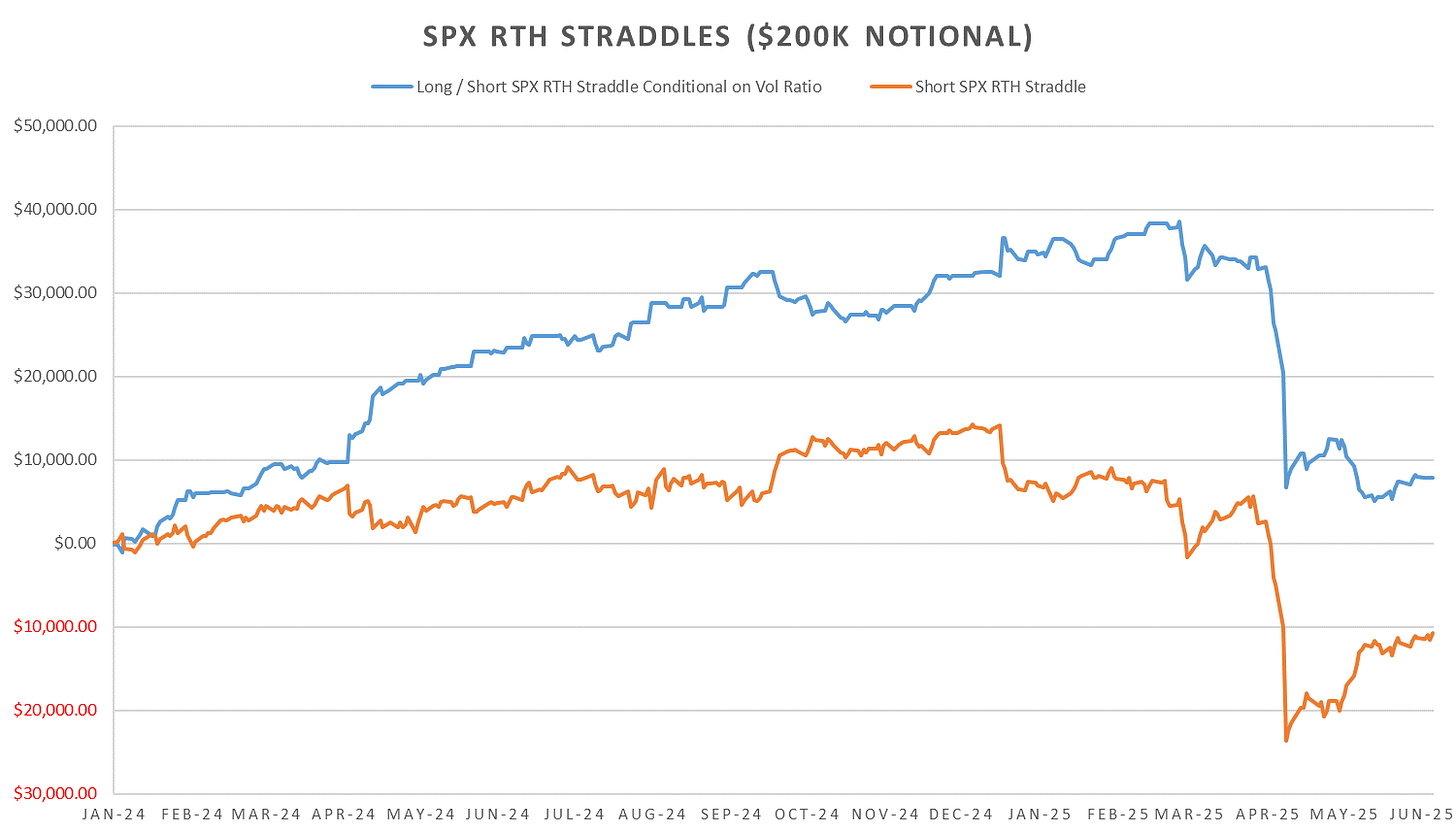

US RTH session strength is not dwindling, outperforming heavily the Globex session.

Cl-cl vol & intraday ranges breaking lower with estimators that account for overnight vol still closer to 20. Entering the seasonally quiet period so outside headlines / data points likely won’t see much movement till eom.

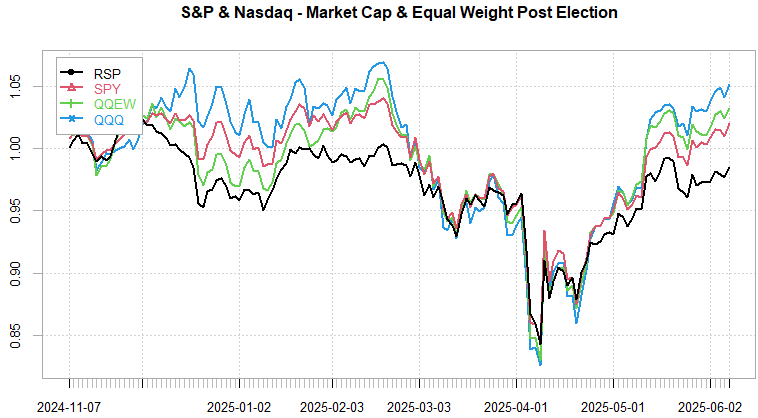

Tech leading the rally, almost back to ATH with small caps lagging (barely above ‘liberation day’.) Correlations continue to drop putting pressure on implied vols.

VX30 slowly dropping, little to show for overnight moves, steady grind lower intraday. Term structure steepening in the front with back end completely flat a year out as expected. Decent chunk of ‘carry’ into June expiration if VIX managed to hold ~16 handle.

SPX ATM Straddle Performance

Short straddles overall big winner across the board last 6 trading days. Only 2pm straddles net positive as we had the large thursday drop following Trump/Musk drama on Twitter.

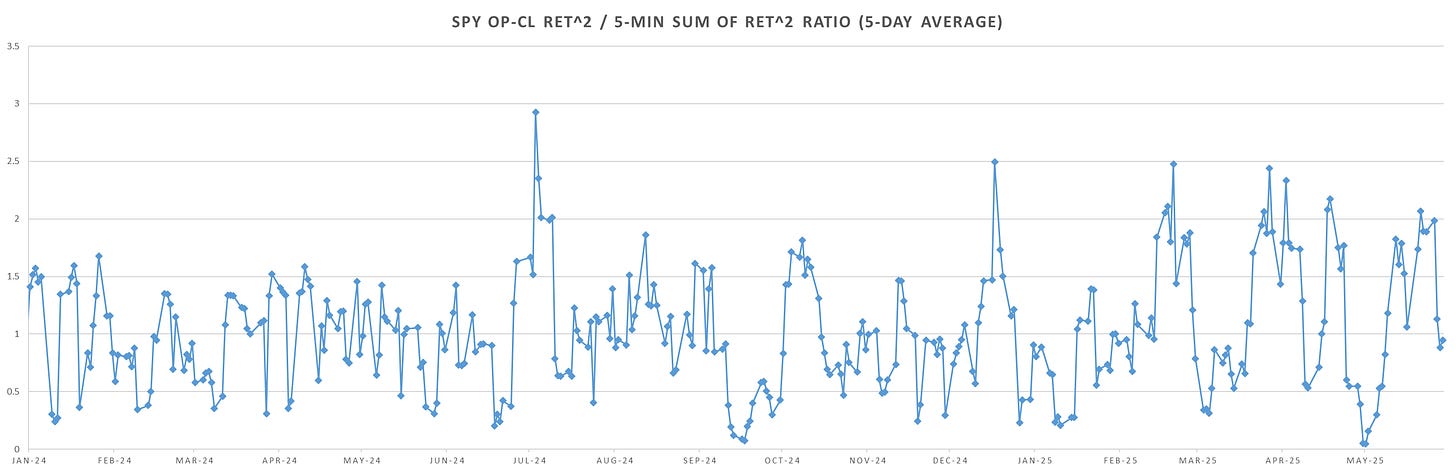

Intraday Variance Ratio

From the following post:

~Average chop last several days, no extremes to trigger new trades. Large divergence between the 1-DTE and US RTH session straddles. Majority of the vol we get now happens overnight, with very thing RTH session VRP.

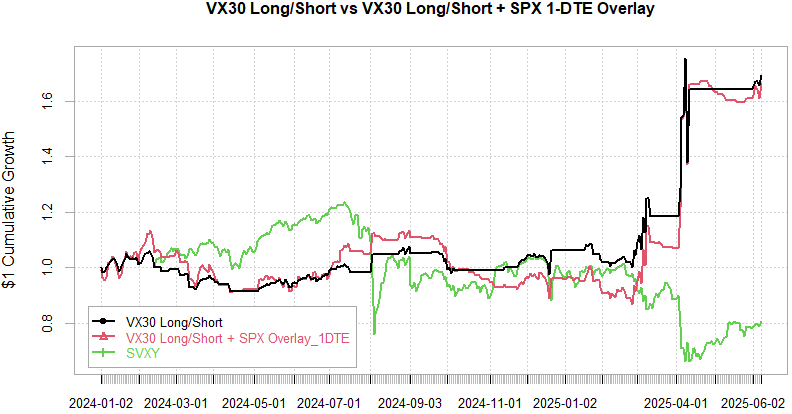

VX Carry & SPX Overlay

From the following post:

Short VX June position held from Monday last week, up almost 2pts on the trade before the Musk/Trump drama broke out. Still keeping the short into this week as term structure much steeper now & seeing almost all vol metrics ease into end of last week. VX reactions have become muted to SPX drops as we saw SPX put skew ease back to March levels on Friday. Still 6 months to go to end the year so anything can happen (Aug/Sep 2020 come to mind) but so far making up for lackluster 2024…

As always, don’t hesitate to reach out!

Have a great week!