Market Overview - June 2nd 2025

S&P Index Options & Volatility

Following up on last weeks overview:

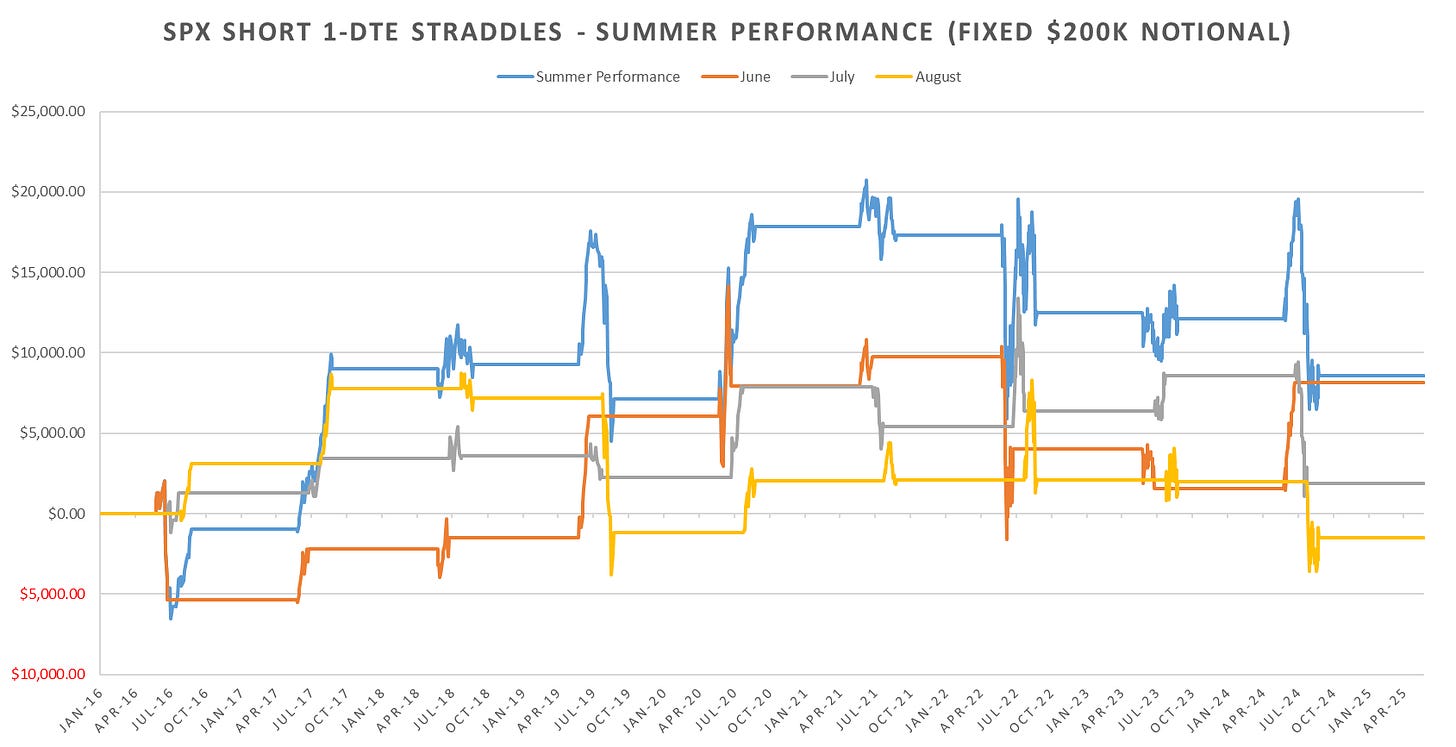

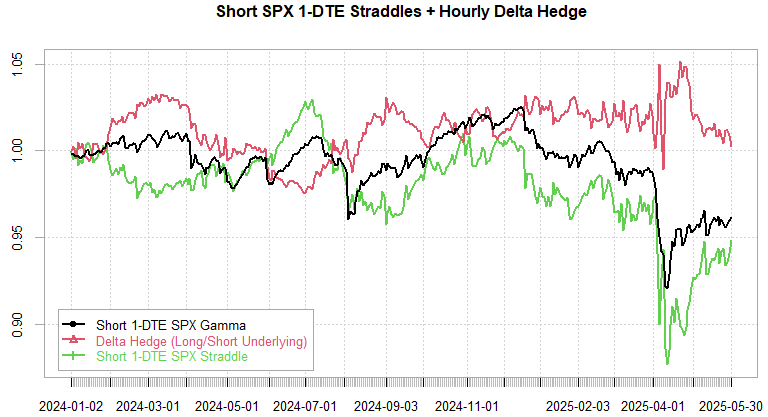

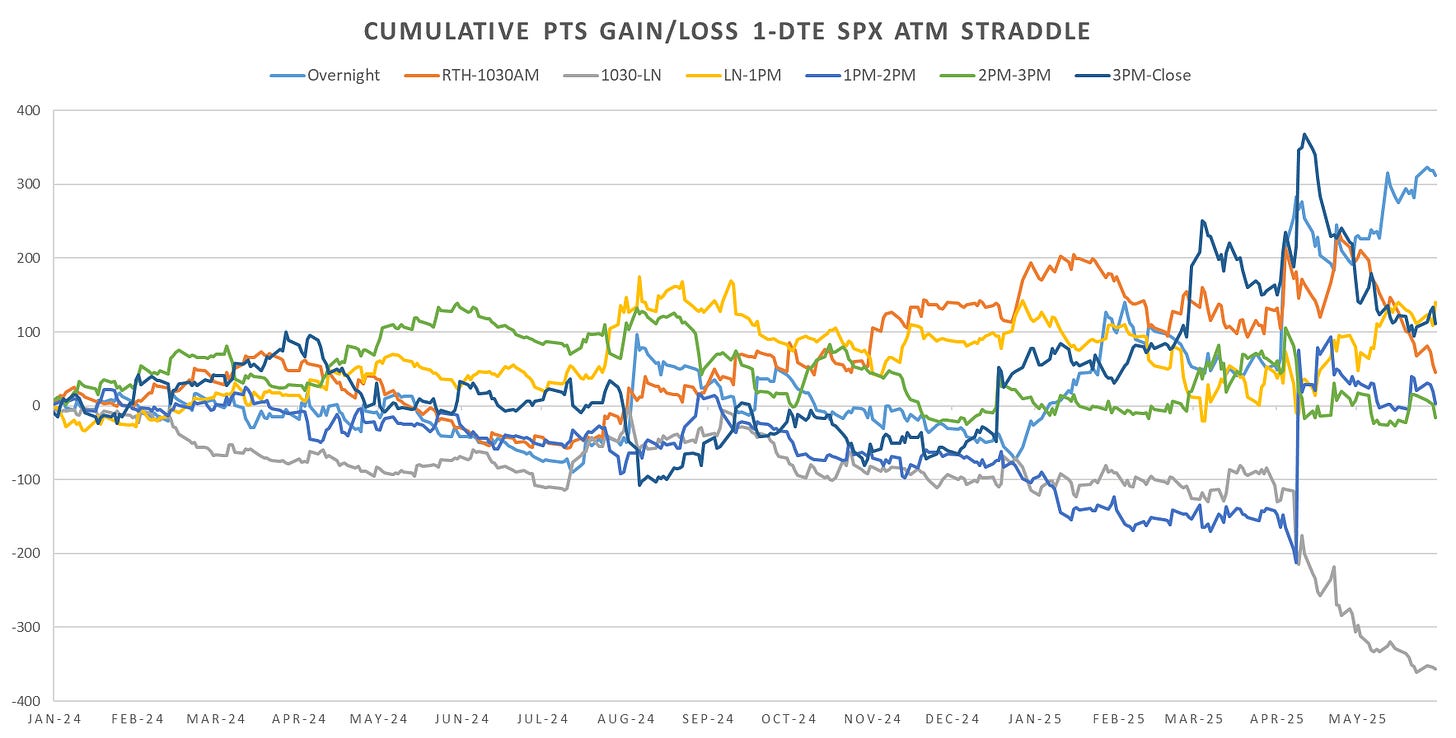

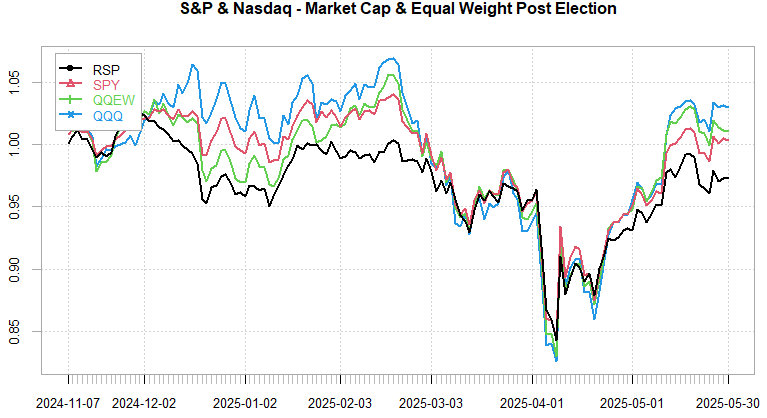

SPX now ~2 full weeks unchanged from the initial China tariff cut on May 12th. We’ve had a number of other headlines but SPX has been glued to 5900 level despite any gap up/down overnight price action. Earnings season concluded now with above average % beat on the initial guidance. As we enter summer June usually sees lower than average volatility up until end of month / July & August where things usually get heated again (at least over last 10 years June on average best performing month for short SPX 1-DTE straddles with August the choppiest):

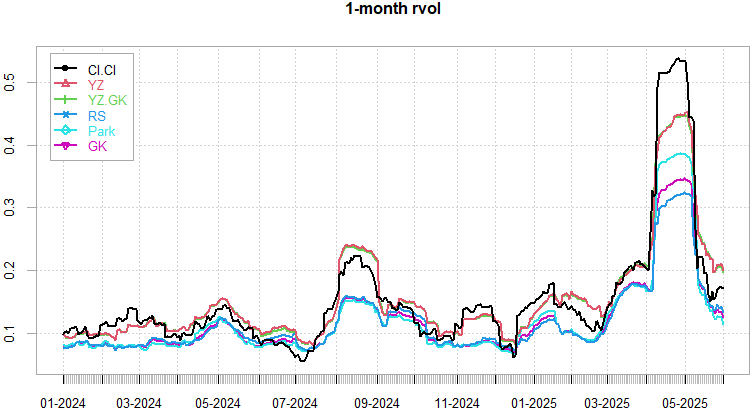

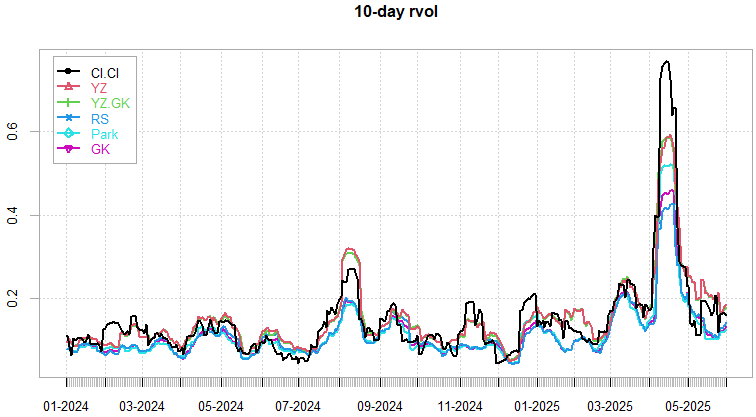

Relatively quiet week data wise with the usual employment data coming out Thursday / Friday. Overall can feel vols dropping off gradually, especially intraday once the overnight headlines get digested.

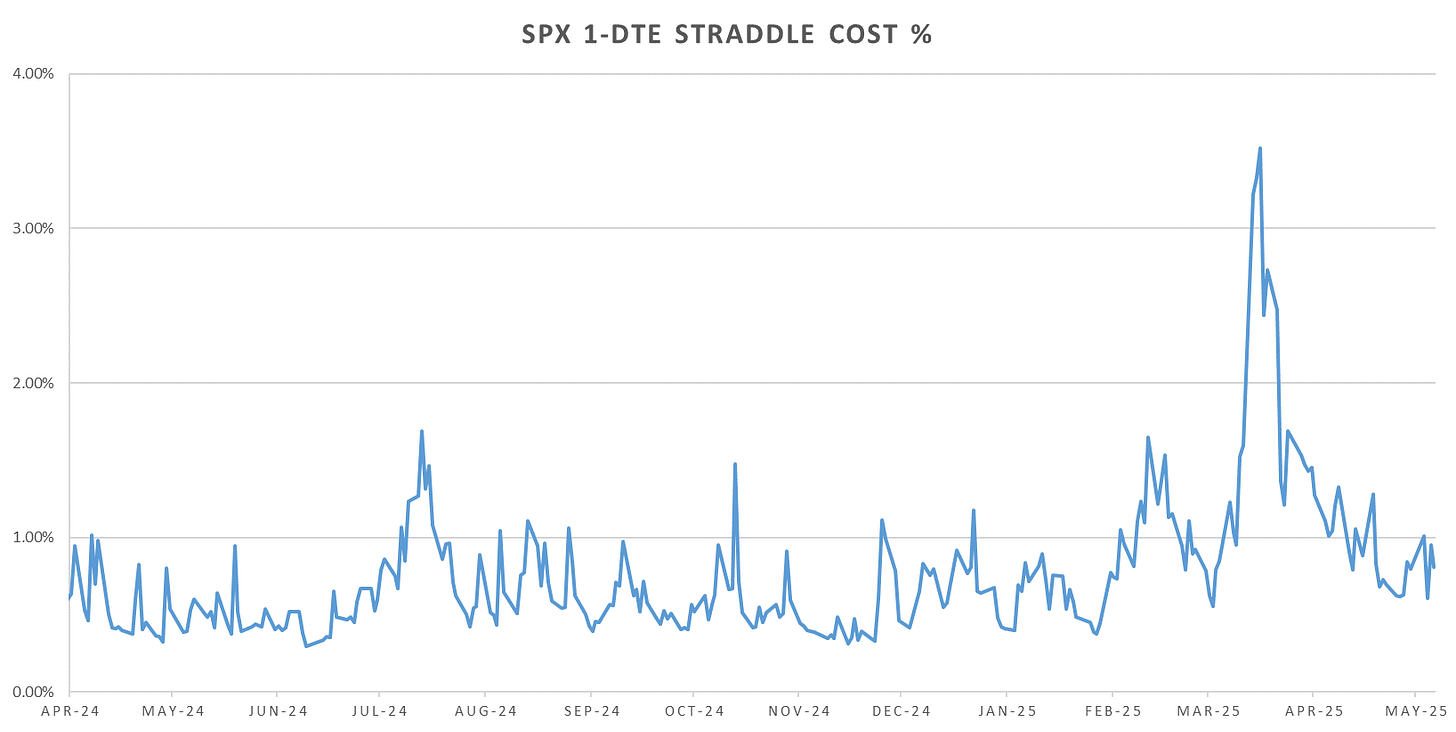

We are back to sub 1% weekend straddles on SPX as well, even the wild news out of Ukr/Rus over the weekend can barely nudge SPX 10-20bps during Globex…

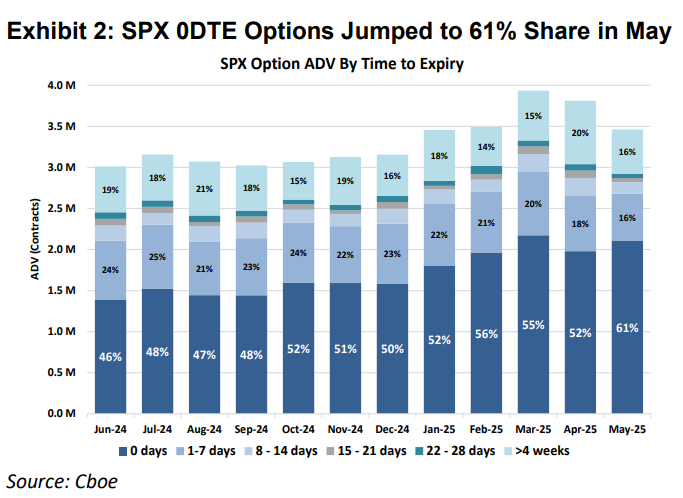

0-DTE share of the market continues to grow, now more popular than ever!

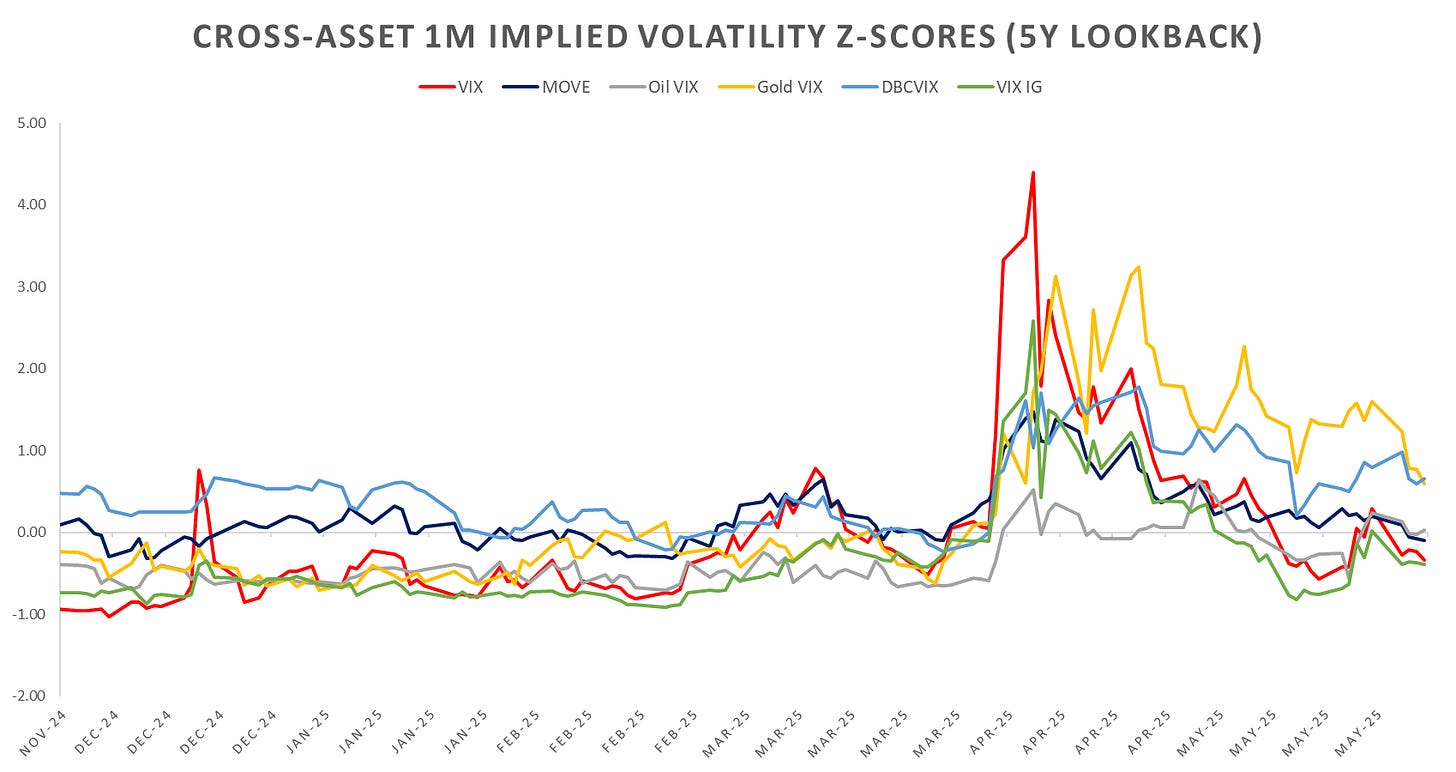

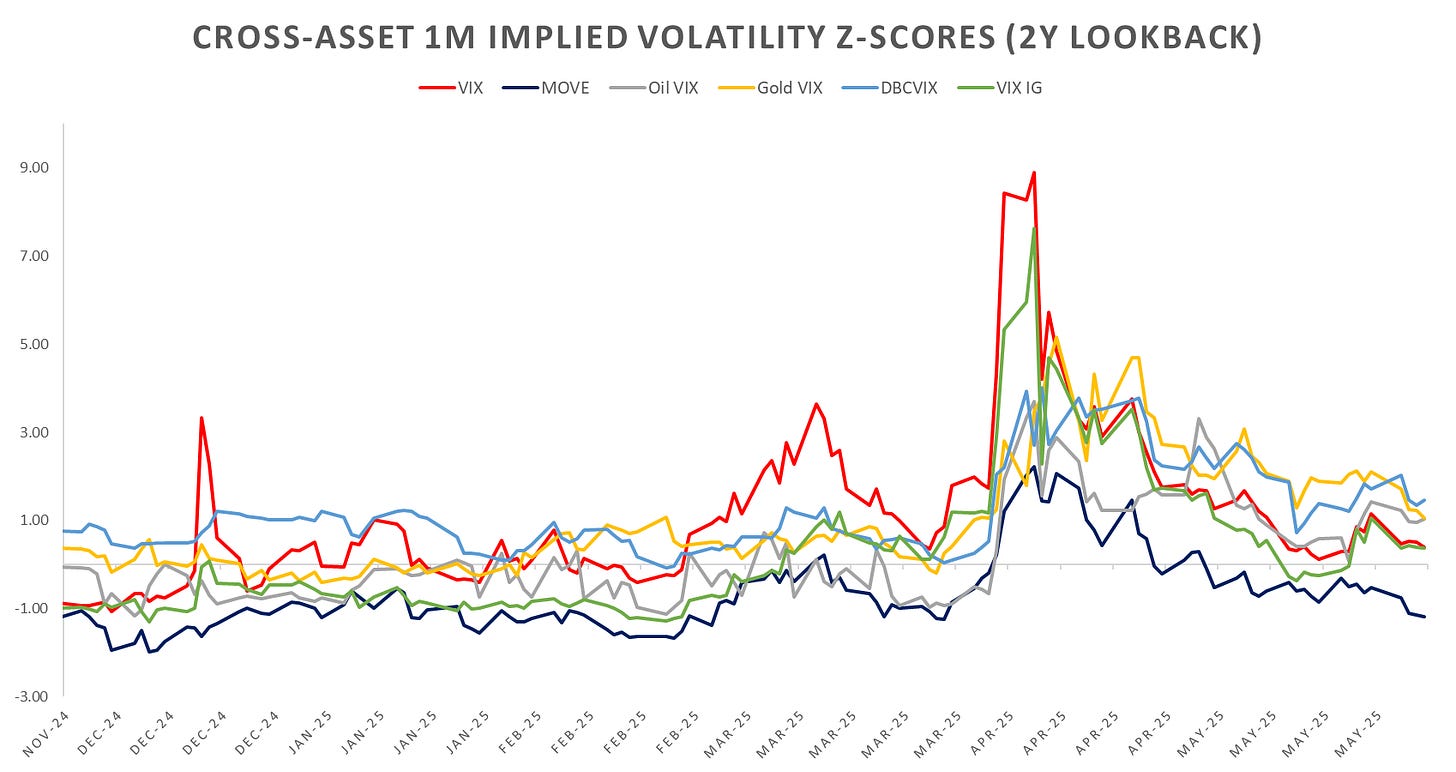

Cross-asset implied vols down across the board last week, although Gold surged Monday morning on renewed geopolitical concerns after the Ukrainian strike on Russian nuclear bombers over the weekend (just writing this out feels ridiculous and the fact that market was barely down 10bps with vols now red across the board speaks on some incredible complacency…)

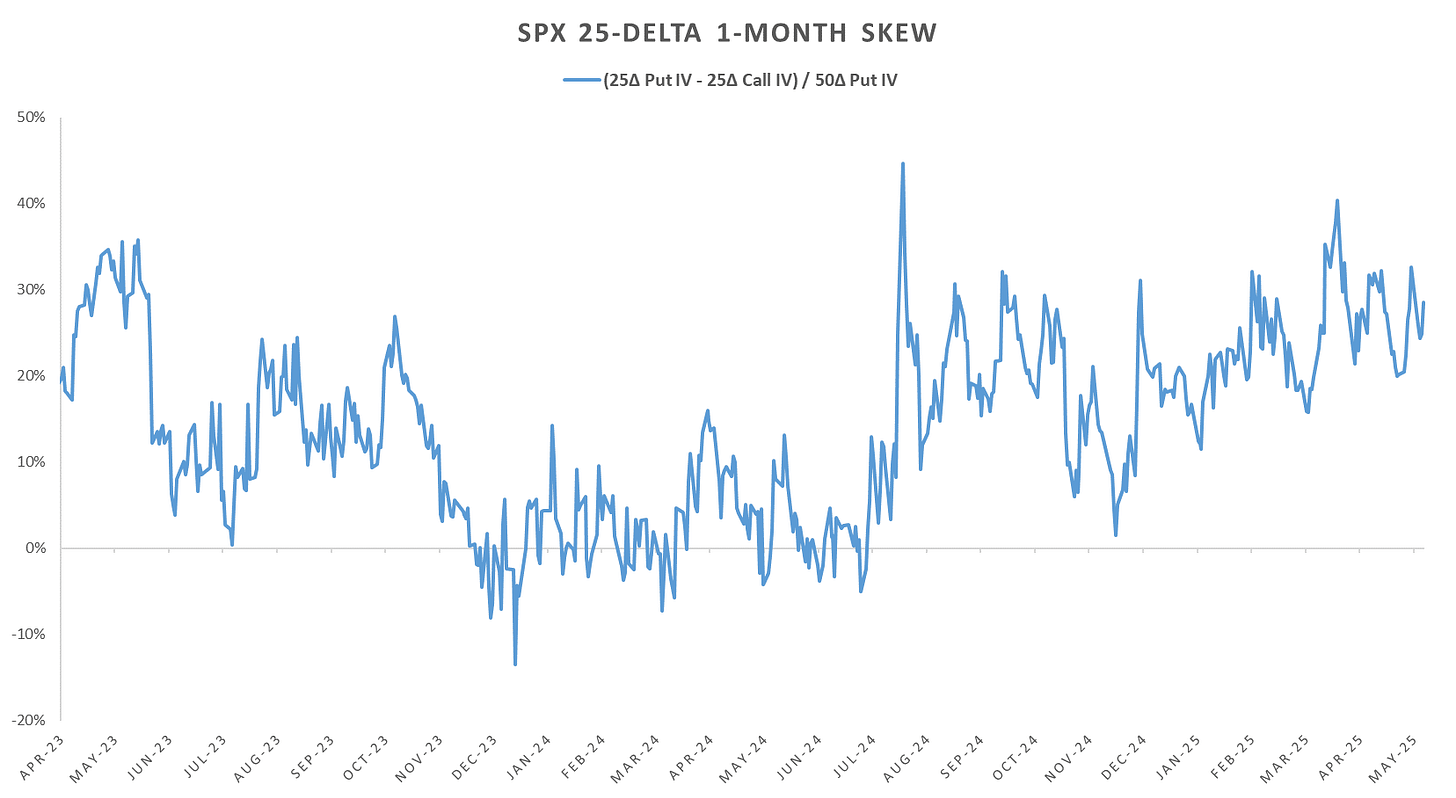

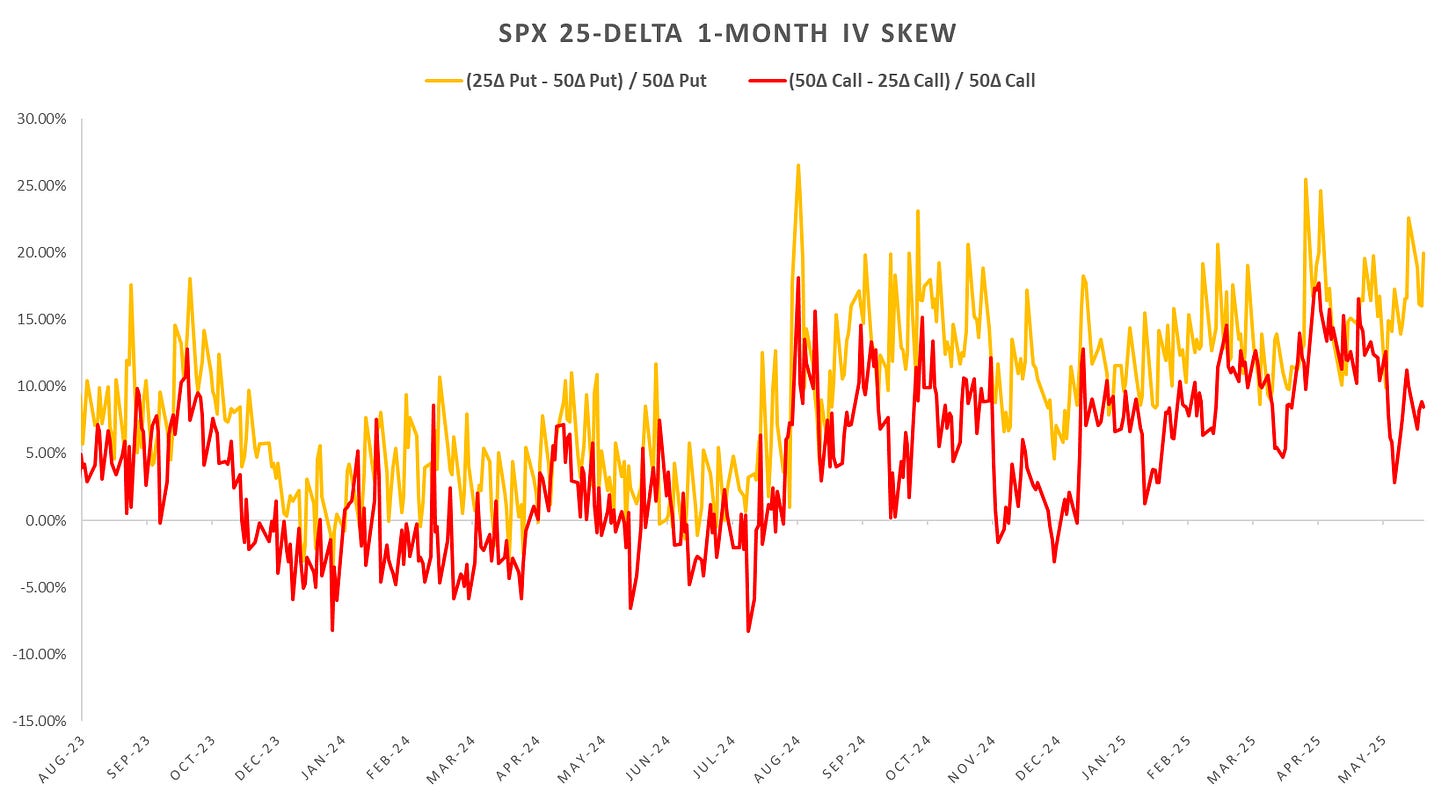

SPX put skew continues to trade top %-ile up till now, the moving component mostly call side. Panic grab for calls we saw a week ago larger over.

Looking at intraday price action:

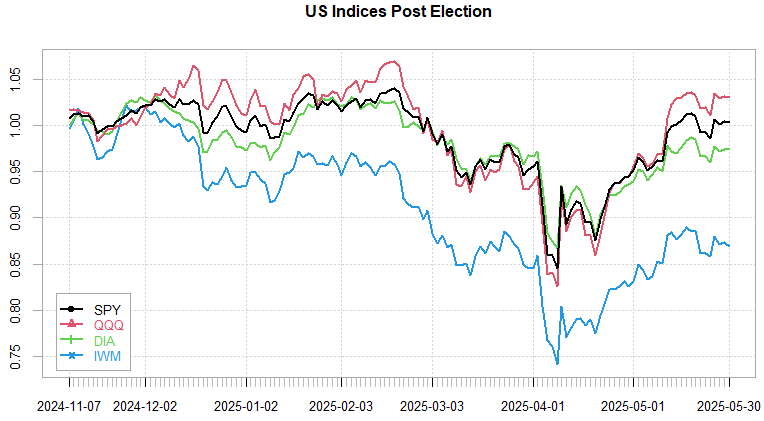

Short 1-DTE SPX delta hedged straddles (hourly) flat since early May despite SPX being stuck in a range. We still have alot of overnight moves but they largely get retraced for low cl-cl vol.

10:30am to London Close falling off a cliff since April. Every single overnight / opening move we’ve had gets retraced in a monotonous way into London close. Overnight straddle performance back to peak (almost straight line since Jan 2025.)

Realized Volatility Overview

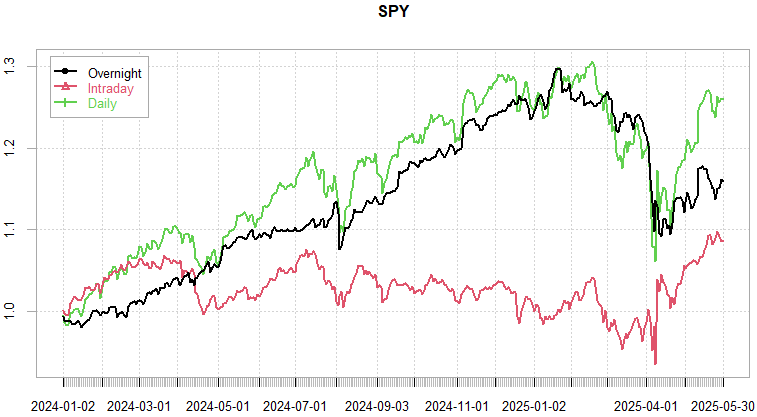

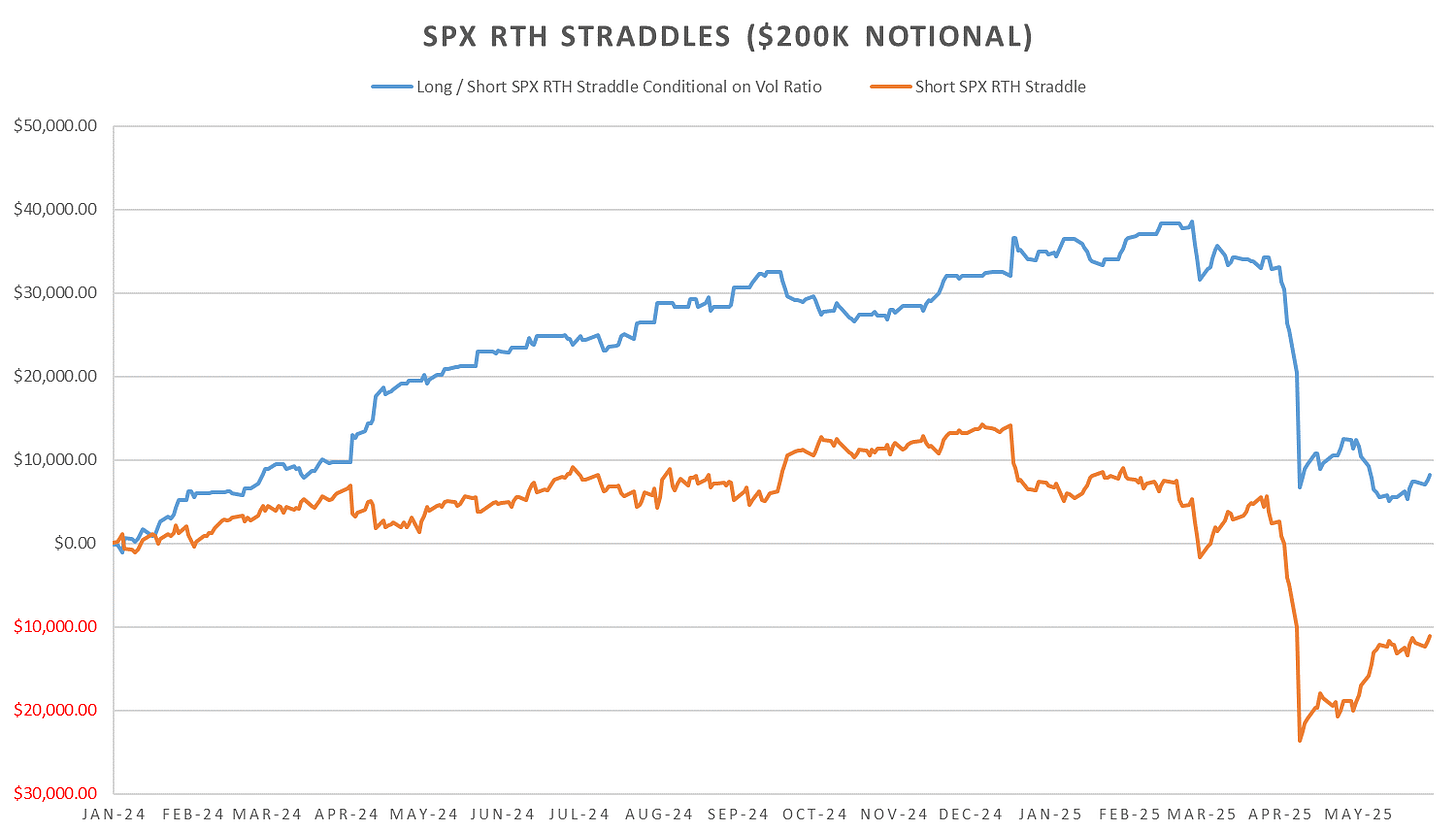

US RTH strength continues, almost entirety of the ramp since April lows happened during the US RTH session.

Can see the divergence between intraday range based vol estimators and the estimators that account for overnight gaps. Intraday vol now back to average levels for 2024.

Single stock equity vol (VIXEQ) making new post Tariff lows along with dispersion after earnings season concluded. Implied correlations still above early May lows albeit VIX able to drop below 20 (although given the skew any weakness in market should spike us back to 20-25.)

VIX-Futures have been trading ~20 with entire term structure up to 2026 trading within 2pt range. This shape in line with uncertainty surrounding tariffs and general macro environment.

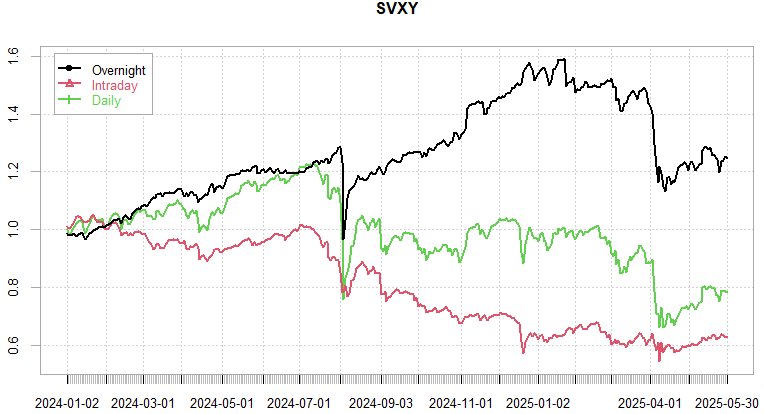

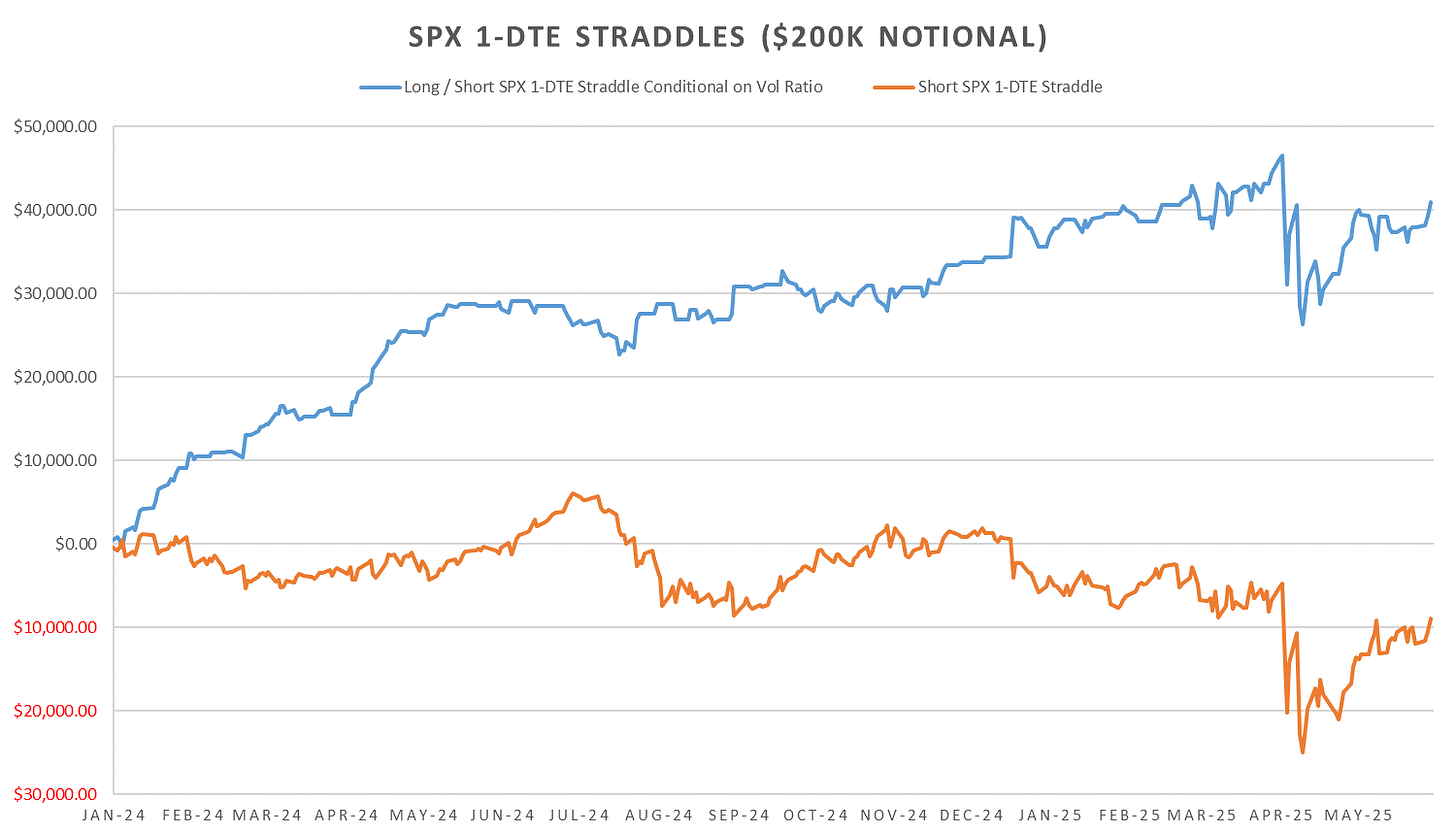

SPX ATM Straddle Performance

SPX 1(0)-DTE Straddles showing clear patterns of positive overnight performance for long straddle positions & . SPX Straddles opened at US RTH session open down ~67 pts over the past 6 trading days, overnight straddles up 20pts. Biggest losers are straddles opened at London Close (11:30am), down 93pts over 6 trading days.

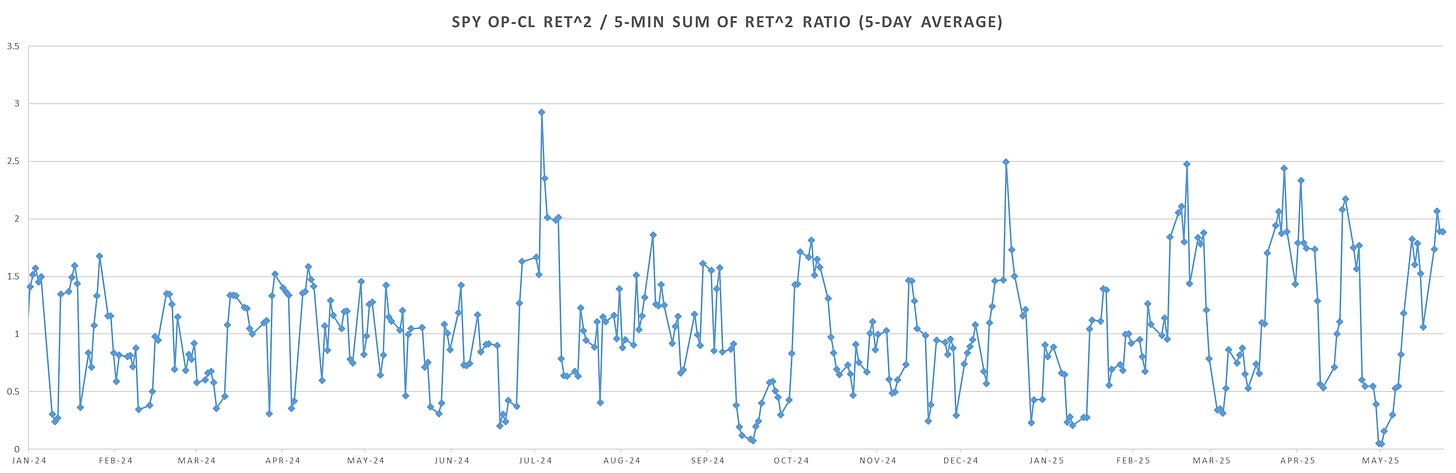

Intraday Variance Ratio

From the following post:

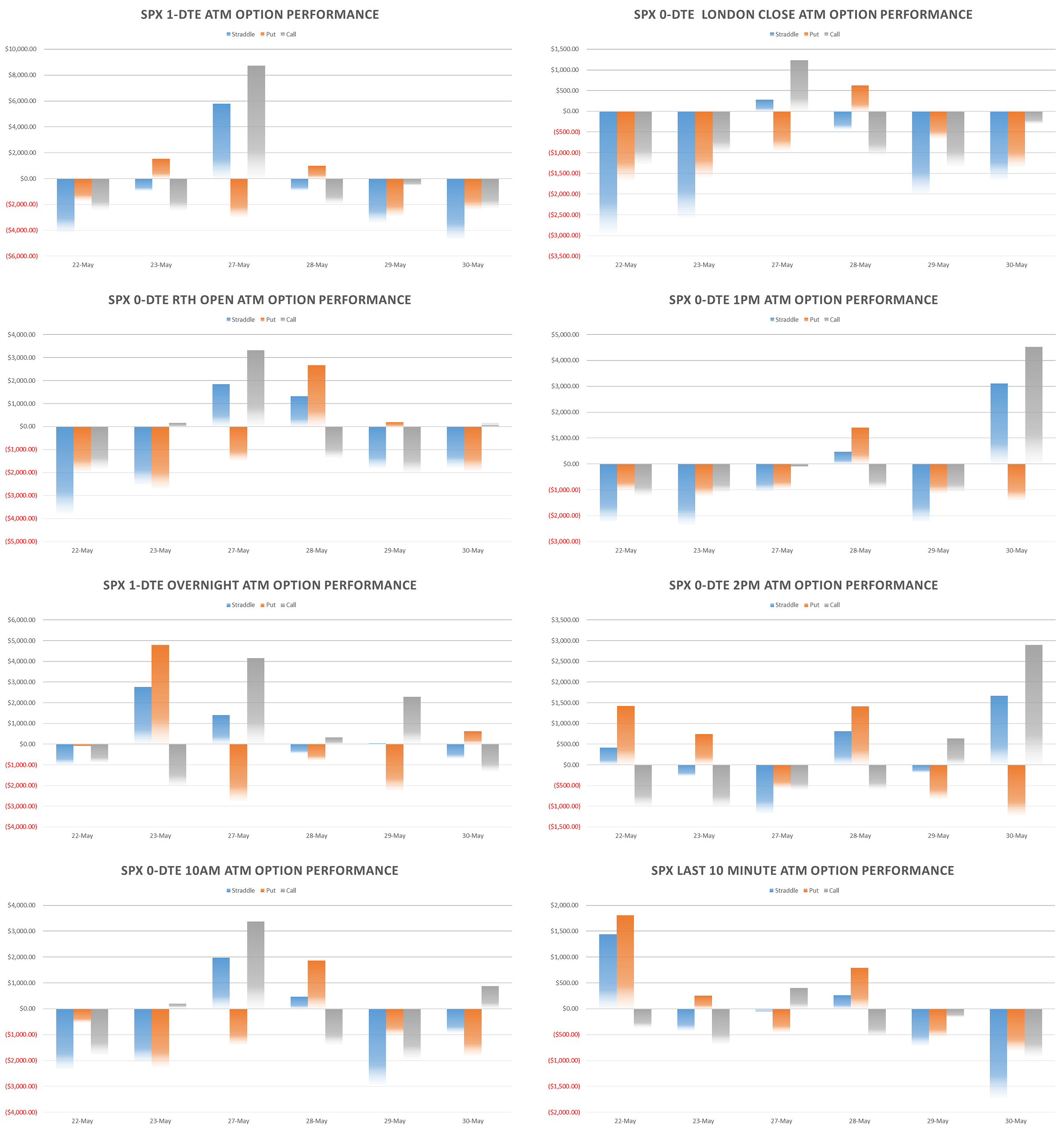

Looking at the ratio of 5 min variance to op-cl variance we see strong trend intraday. All dips/rips overnight bought in uniform fashion throughout the day.

Fading extremes in intraday trend/mean reversion for 1-DTE straddles shows pnl recover almost back to pre tariff panic highs. As previously mentioned fading extremes works well when markets are largely calm, biggest losses come during periods of extreme vol in one direction.

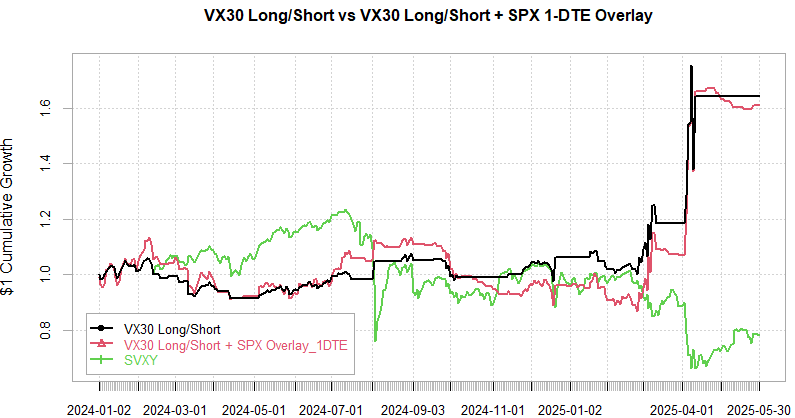

VX Carry & SPX Overlay

From the following post:

June VX closing in a 10pt range for 4 days in a row now. June VX still higher than the 19.3 low we’ve seen after the initial China tariff rollback mid May. After long break now short from RTH open on Monday ~20.2. June relatively quiet month so maybe we DO get a couple of points settle into 18 for June expiration. Ofc the whipsaw possibility is high with SPX back to nearly 6k and Trump having the need to get rid of his new assigned TACO acronym… Nevertheless first short in a while so lets see how it goes… Term structure not great and carry is thin here so any upswing in vx larger than few % will likely trigger a fast exit.

Have a great week!