Market Overview - July 7th 2024

S&P Index Options & Volatility

Previous week:

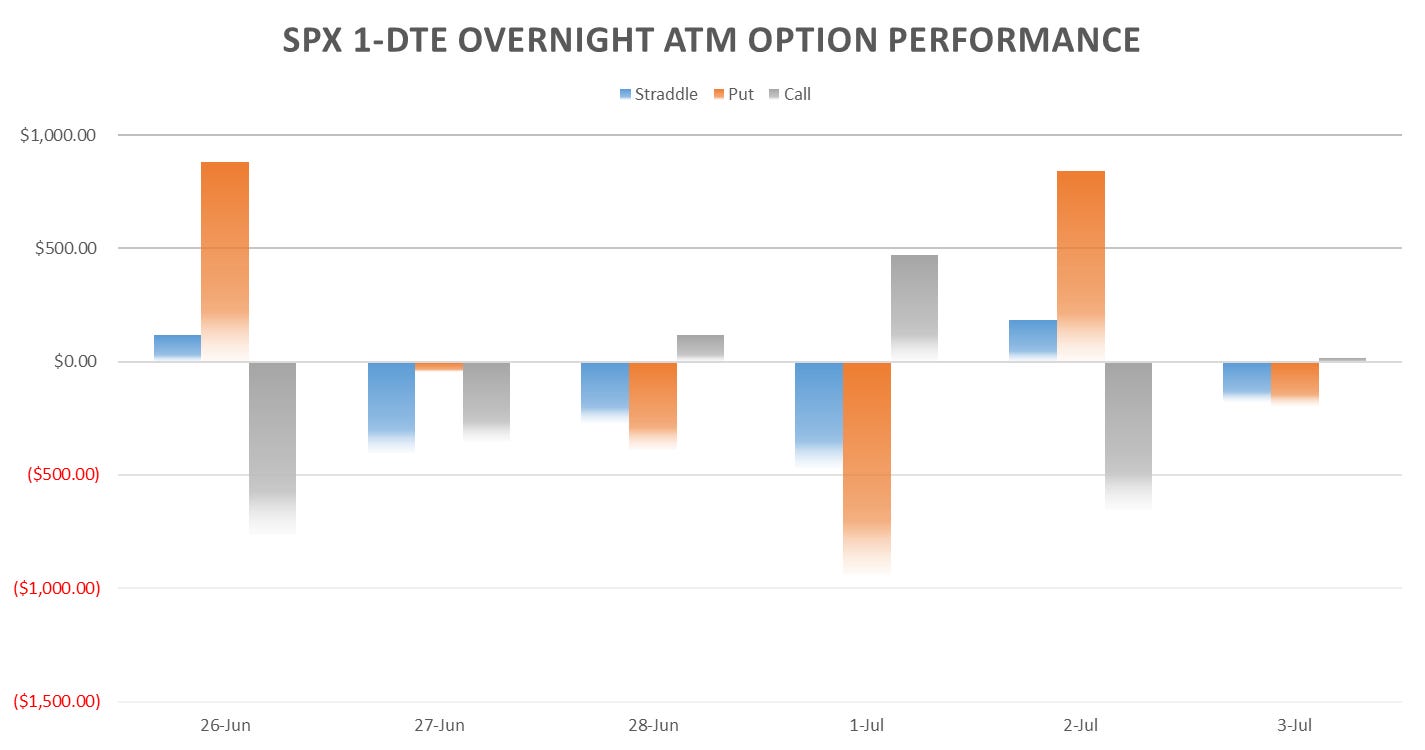

SPX largely continues with the summer doldrums, hitting new highs with declining breadth. The holiday week had little surprises as SPX grinded higher over the course of the week with 1-dte straddles underpricing the ramp towards end of week.

As mentioned in our posts last week, selling straddles had impressive performance since May. Systematically selling 1-DTE straddles hit a new ATH since 2016 (after a hectic 5 years.)

As we approach the half way point of the summer, decided to have a look how shorting straddles over the course of the summer did during the last 10 years. On Friday, the weekend straddle dropped to one of the cheapest levels in the last 10 years (~ 30 bps.)

Realized vol did drop to record low levels, but still, such thin premiums are quite a rare sight. Given seasonality, had a look at how 1-DTE straddles tend to perform over the course of the summer. Overall shorting June/July/August 1-DTE straddles net positive over the last 10 years (pre 2022 data has gaps due to 1-DTE expirations not being available for every day of the week), however, gains given back quite often towards end of July/August, with a number of years peaking ~mid July.

Source: CBOE

Globally, we are looking at single digit correlation & volatility figures now in the DM for the time being… Of course there’s still sizable premium for elections and I do think we see quite a bit of vol towards autumn (albeit the forward volatility is currently priced almost 4x trailing 1m rvol.)

Realized Volatility Overview

New highs for SPX, overnight SPX went nowhere since early May… I’ve outlined the PnL’s from cutting short straddles early in previous posts:

Collapsing cl-cl 1-month rvol with 10-day rvol holding firmly sub 10.

Variance Ratio’s spiking significantly as cl-cl and intraday vol estimators diverge. Two ways for this to correct, either we see a pickup in cl-cl vol (unlikely given mid summer seasonality with main event still few months out) OR we see intraday vol completely die out… Given that we are seeing non event 1-dte straddles now priced at 30bps we might be in for a few weeks of 2017 style rvol…

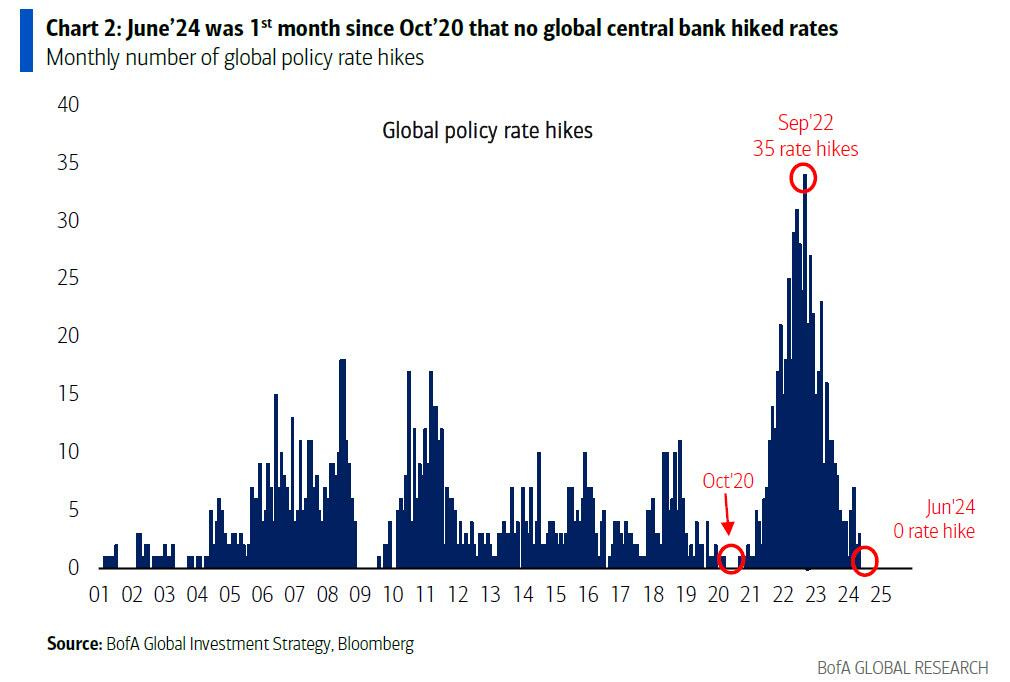

CB’s back on easing path too…

VX carry doing well as expected, 1m+ VX futures still have SOME meat on the bone with CPI & FOMC covered by July/Aug contracts.

Unless we see something outrageous in the numbers this week, there’s a good 10-20% roll over the next 30 days for Short Vol ETPs.

SPX ATM Straddle Performance

1-DTE Straddles barely squeezed out a win last week, Wed/Fri low volume ramps were a bit larger than expected…

Intraday straddles net winners last week.

Overnight performance flat for the index…

As mentioned before, the premiums got way too thin, moves after London Close almost 2x straddle breakeven.

Variance Ratio Conditional Performance

From the following post:

Small bounce for now after hitting some long RTH straddles following few weeks of getting nailed by collapsing cl-cl vols… during summer 2017, following similar spikes in Var Ratio’s, system flipped short 1-DTE into July as intraday vol collapsed after cl-cl vol (so far its been playing long side as intraday vol is somewhat still moving.) Ofc this is mainly a trend based model, with trades triggered on a roughly 2 week long/short bias before flipping.

Note: Performance using $200k index notional bet size