Finally breaking the highs...

SPX 1-dte options

Shorting straddles had a rough 10 year run, despite periods of calm, frequent vol spikes left strategies that consistently sell premium largely flat over the past 6-7 year… until now…

Short 1-DTE straddles finally broke out last few weeks, hitting new highs…

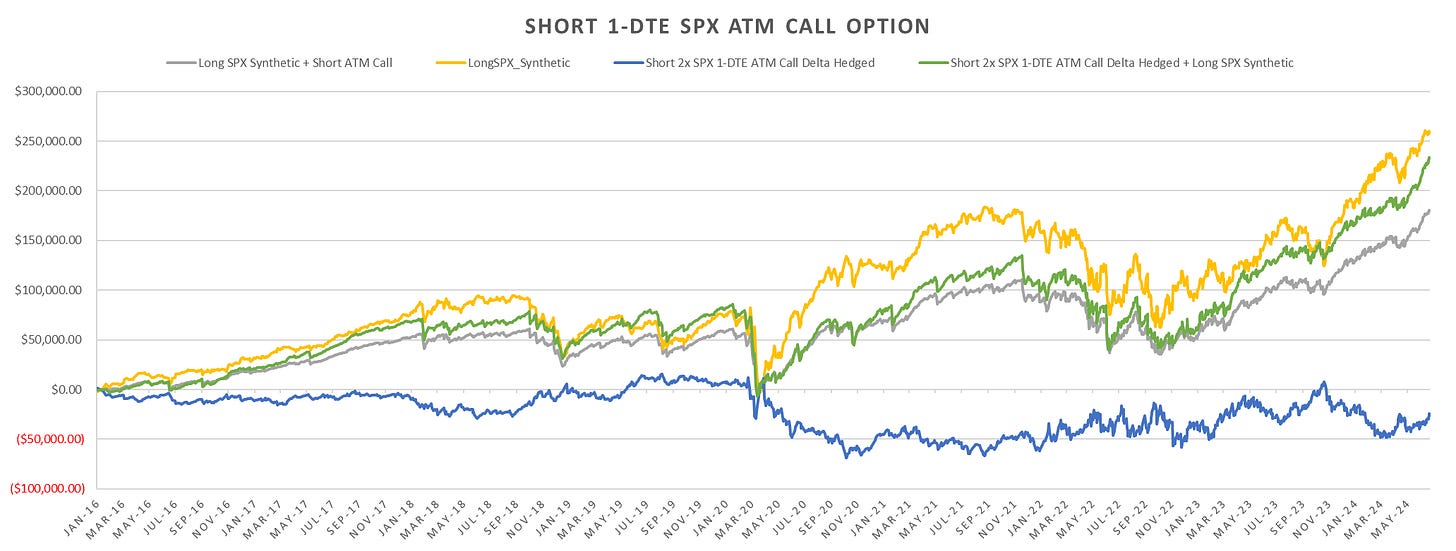

Performance relative to SPX synthetic long (short put / long call) for days with 1-DTE straddle expiries available is underperforming hard.

Shorting calls a disaster unless delta hedged at inception… As an overlay, underperformed significantly, without any meaningful risk mitigation…

Long puts vs delta hedged long puts:

Delta hedged 1-dte puts managing to outperform slightly for last few years as the upside gamma manages to perform (2016-2019 underperformed massively though…

Lastly, as we’ve covered the intraday straddle dynamics in:

and

Cutting the straddles a tad early produces some very decent pnls throughout the past decade (short till london close data up to 10th of May 2024, but its been doing extremely well since then as well, will update later)…