Previous overview:

Its been a rather uneventful few weeks… All measures of vol and risk hitting ATL; correlations both implied & realized at 20 year lows, dispersion at highest levels since 2000, cross-asset vols all trending to decade lows…

Source: CBOE

Shorting 1-DTE straddles would be on a 16 !!! day winning streak if it wasn’t for that random ramp on Monday 17th June, with ~180 SPX points of premium pocketed relative to flat index price performance…

Looking back on the past decade, we are firmly at 2017 type payoffs for shorting rvol (2017 did not have 1-DTE for every day expiries so I can assume we would be at similar levels of 10-20 day short straddle win streaks):

What IS interesting is that despite collapsing rvols, short VX performance lagging hard compared to 2017:

YTD SVXY with -1x leverage:

In 2017, performance was DOUBLE ytd… Full year 2017 performance below:

Problem is index composition relative to 2017 has changed quite a bit with majority of the weights now in high implied vol tech names, so despite record low implied correlations, we simply cannot push implieds down to 10 as main component vols remain well above those of 2017 levels.

Realized Volatility Overview

S&P went nowhere last few weeks, both intraday and overnight cl-cl moves were tiny.

1 month cl-cl vols falling off a cliff into lowest levels of the last 2 decades:

10 day not far behind…

We ARE seeing an uptick in intraday vols, but the dips / ramps get mean reverted towards the close…

In terms of variance ratios, strong spikes last few weeks as cl-cl vol dies and intraday vol still trades somewhat decent ranges (up to 100 bps ranges this week.) Historically, the relationship has reached the lower end of the range, so sensible to expect pickup in cl-cl moves relative to intraday (some trending action… but when given next week is a ‘holiday’ week.)

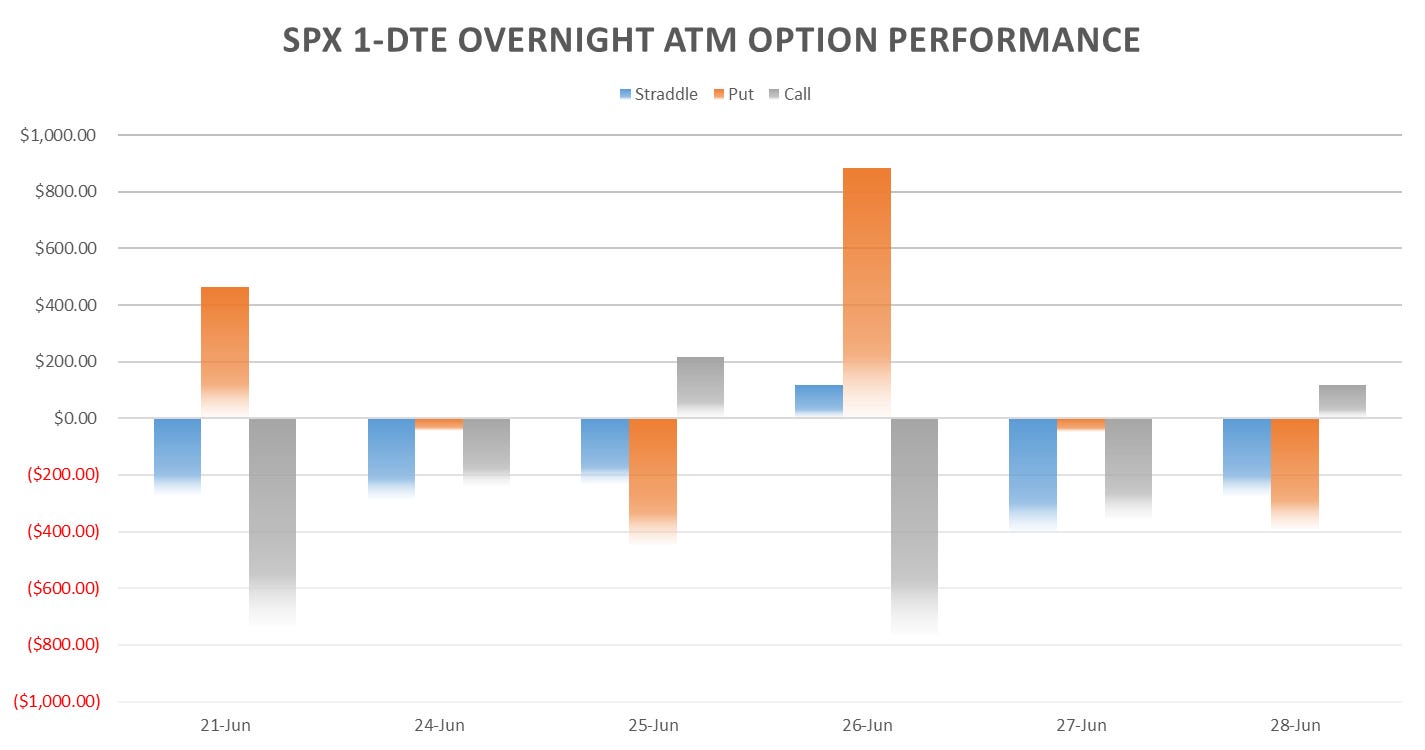

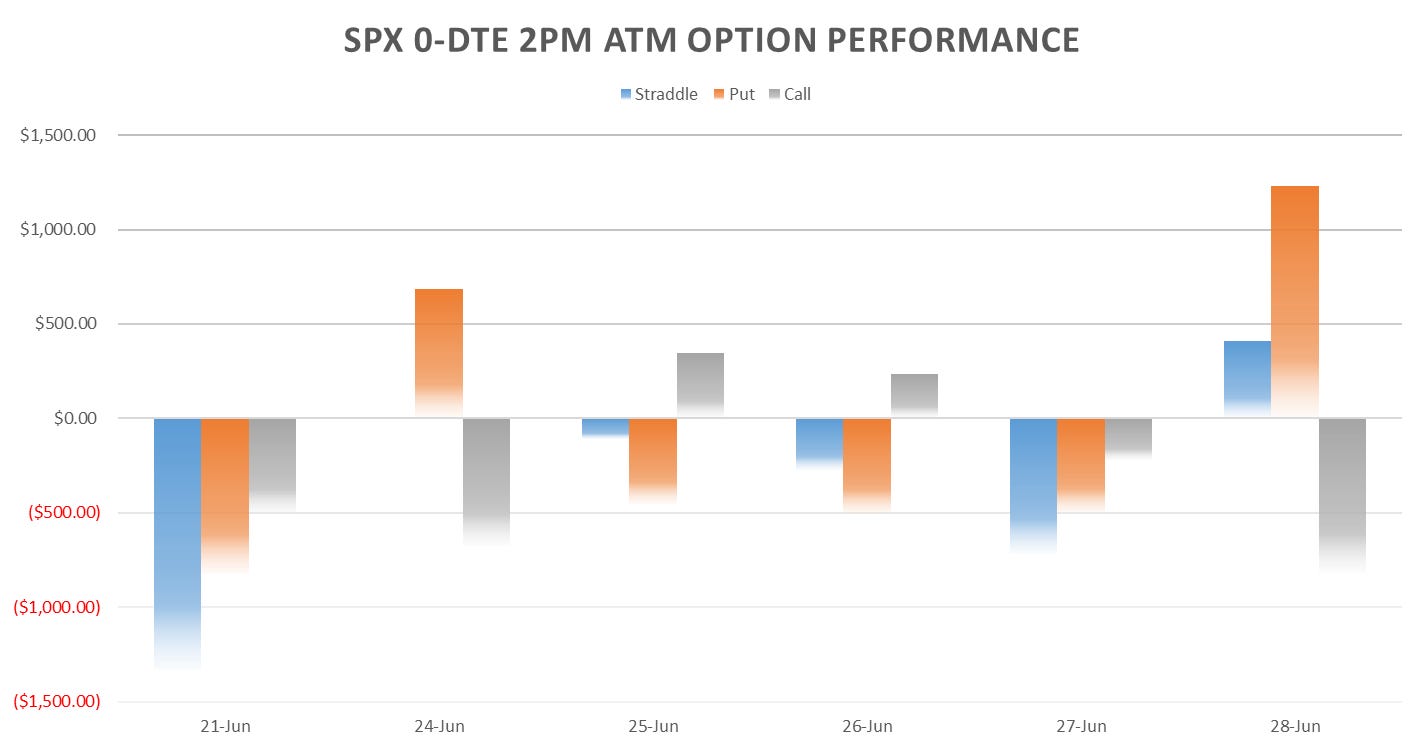

SPX ATM Straddle Performance

As mentioned before, 1-DTE straddles lost all week, ~70pts collected with SPX completely flat w/w.

RTH straddles not much better, down ~54 pts w/w…

Overnight straddles down ~13pts w/w, couple of down moves that paid well putting overnights puts up ~4pts w/w.

10am straddles down only 13pts w/w. Premiums were low this week on avg, so the decay between RTH open and last hour or so was small (peaking ~1pm or London Close.)

London Close straddles up 13pts on the week on 2 reversals intraday from a bullish overnight + morning session.

Buying atm straddles at 1 & 2 pm also net losers…

What has been having a good time is buying last 10 min straddles:

YTD:

Variance Ratio Conditional Performance

From the following post:

The long / short 1-0 DTE straddles conditional on the varratio having a big retracement last few weeks… Positioning was long 1-0 DTE straddles on account of narrowing cl-cl moves against uptick in intraday vol. This price action usually precipitates a trending break in either direction (at least historically) but the last few weeks have been completely pinned…