Following up on last weeks overview:

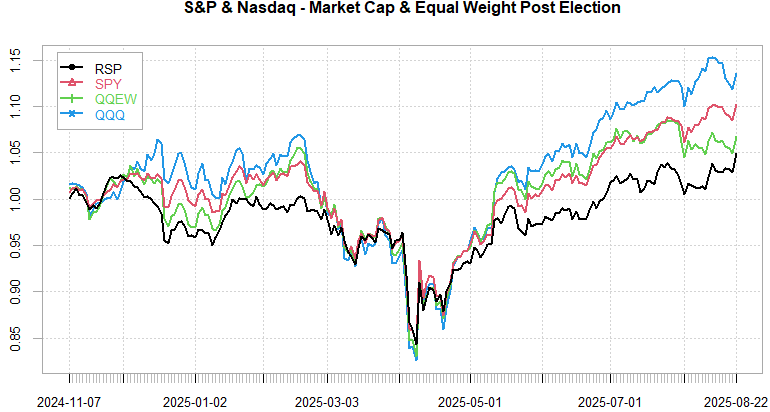

Indices ramped back to highs after what looks like absence of severely hawkish tones from Powell on Friday, erasing 5 days of grind lower in about 5 minutes. Rate cut odds for Sep FOMC now above 85%, unfortunately at the cost of ignoring the inflation mandate… This week starts off slow but Thursday / Friday we get another slew of economic data. Wed after market close we get NVDA earnings, with NVDA alone being 7%+ of SPX weight & 14%+ of NDX weights the pricing of earnings move for 1-DTE straddles is higher than almost any data release.

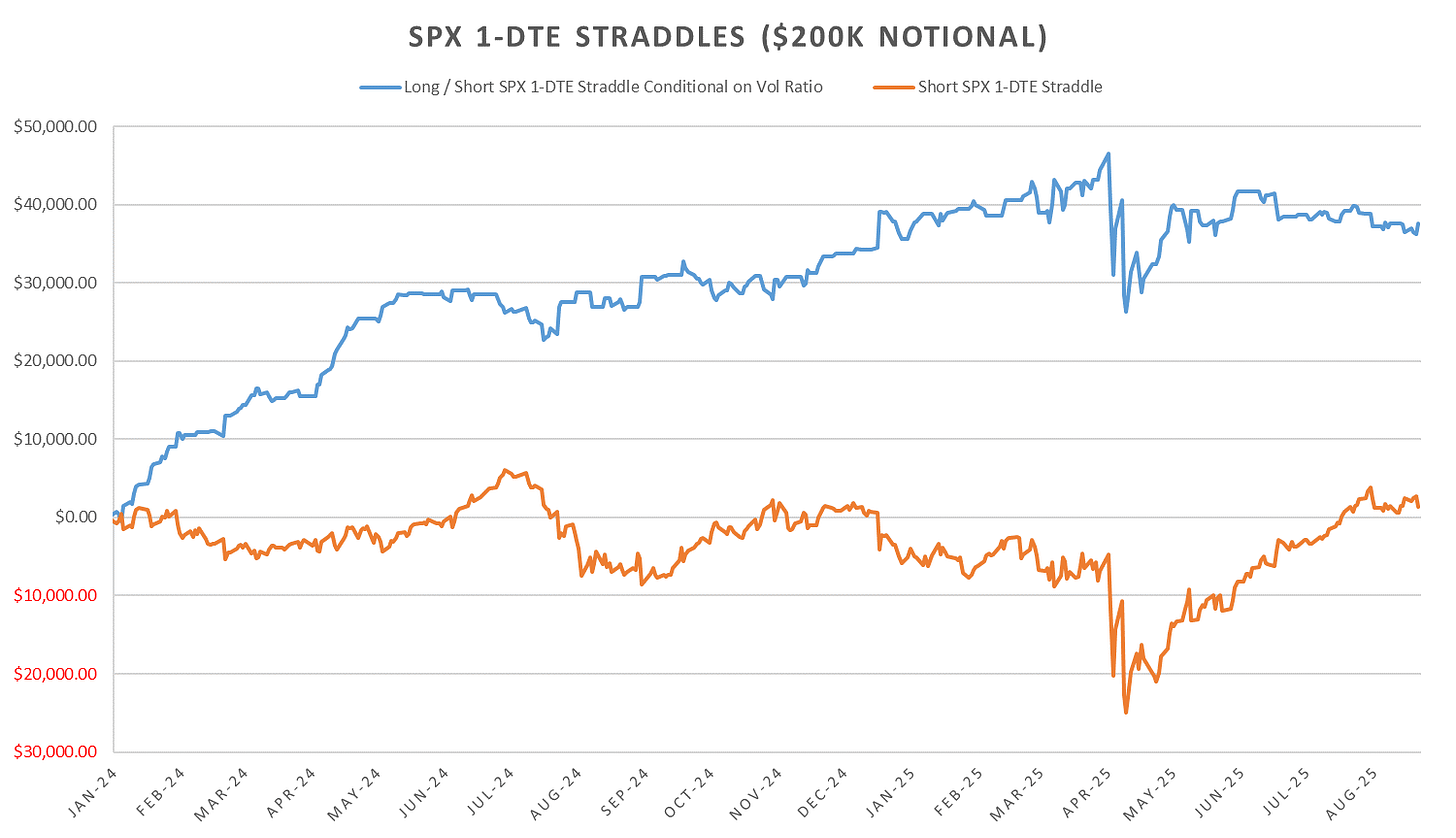

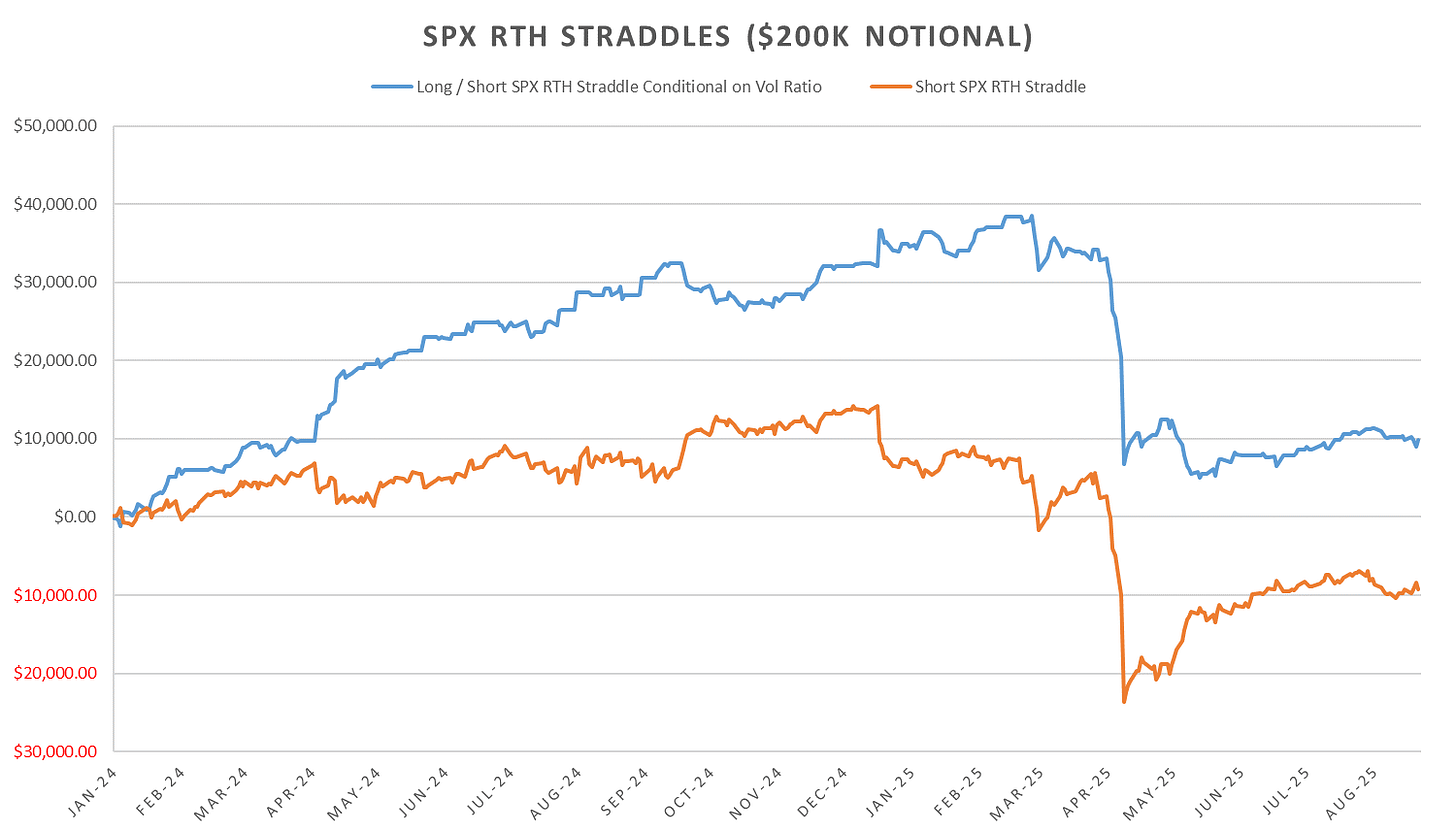

Last week SPX straddles priced ~90bps for Jackson Hole, ended up being slightly cheap. We continue to trade sub 1% 1-DTE straddles since May. Rolling VRP getting thinner throughout the last month as premiums compressed to historic lows.

Cross Asset implied vols down to lows after Jackson Hole. All cross asset vols firmly below their 5Y & 2Y averages.

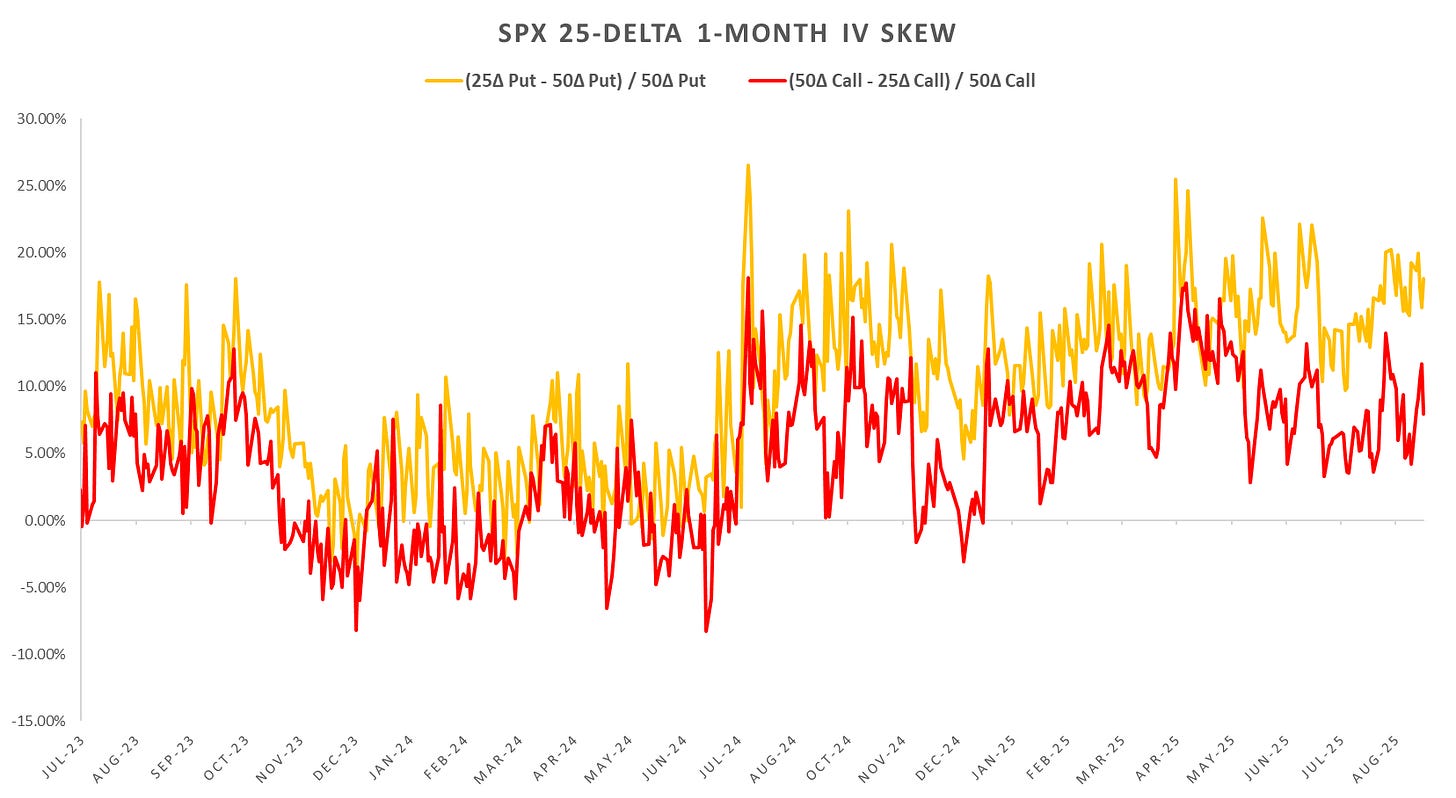

Despite the large upswing on Friday, 30d skew remained steep. Put skew barely budged on the news and remains steeper w/w.

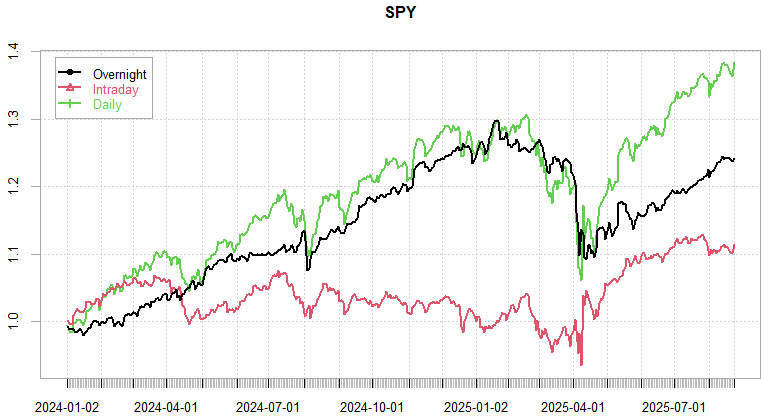

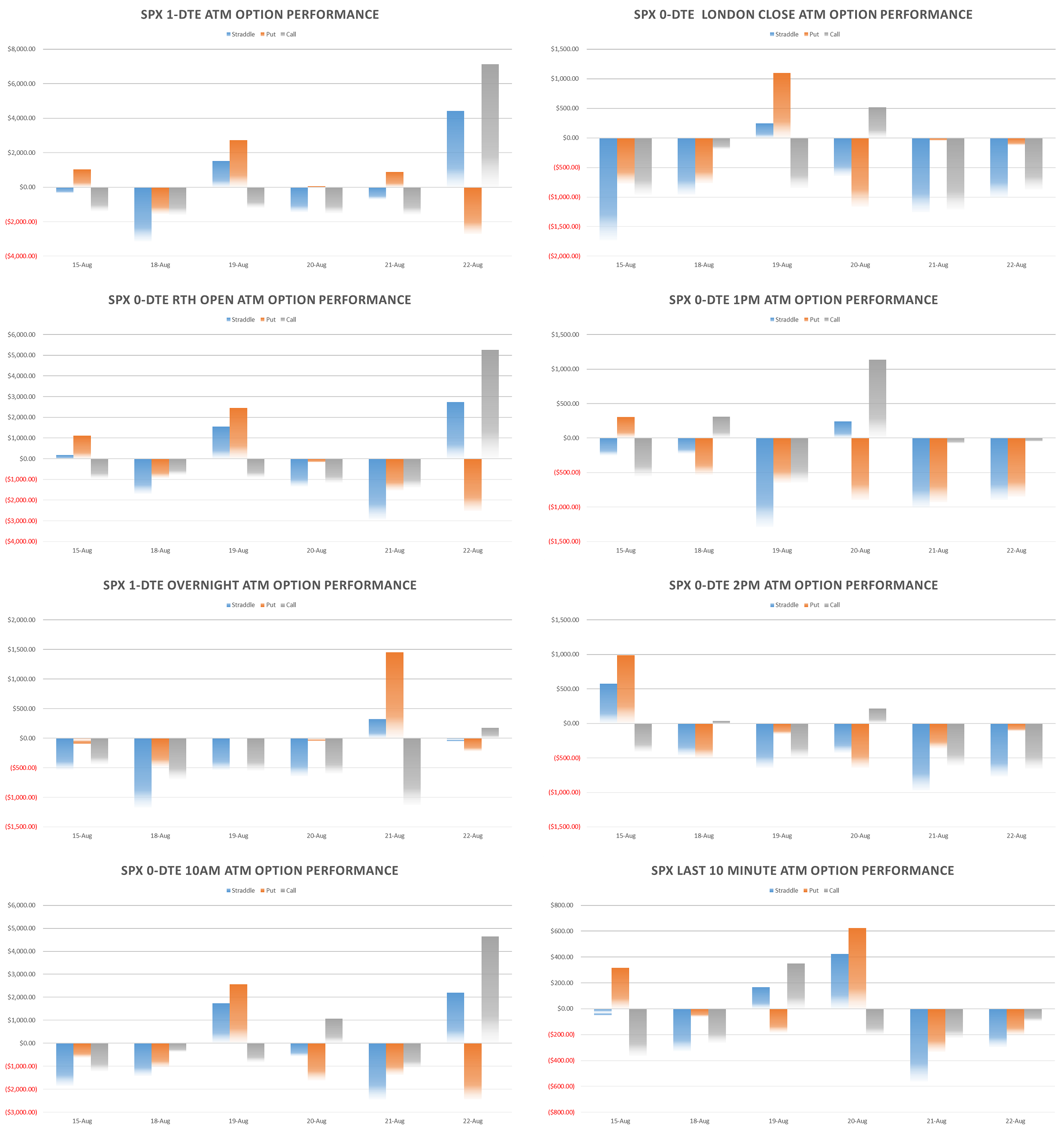

Looking at intraday price action:

Short delta hedged straddles down wed/thu/fri, but overall both unhedged & hedged 1-DTE straddles ~flat since mid July. The run from April lows puts the systematic short 1-DTE straddle pnl back to 10 year highs (from near 10 year lows in April), one of the strongest runs for short straddles in a decade.

Looking at the cross section, seeing pnls flatline across periods. Very thin premiums overall outside of data releases / events.

Realized Volatility Overview

Flat w/w with indices straight back to highs on Friday. We’ve stalled since late July, rallies 6400+ on SPX end up being sold.

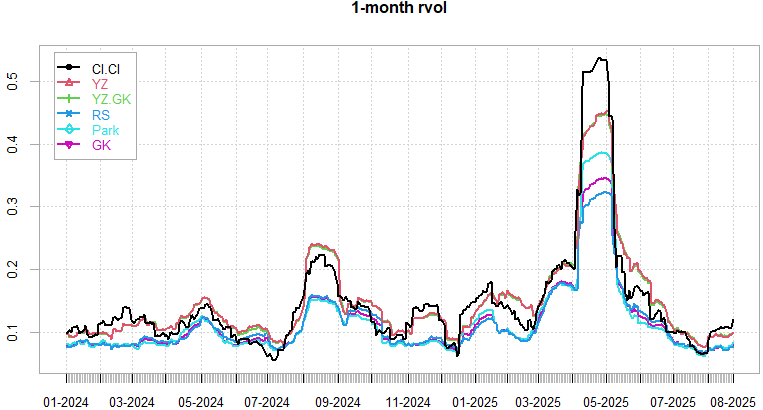

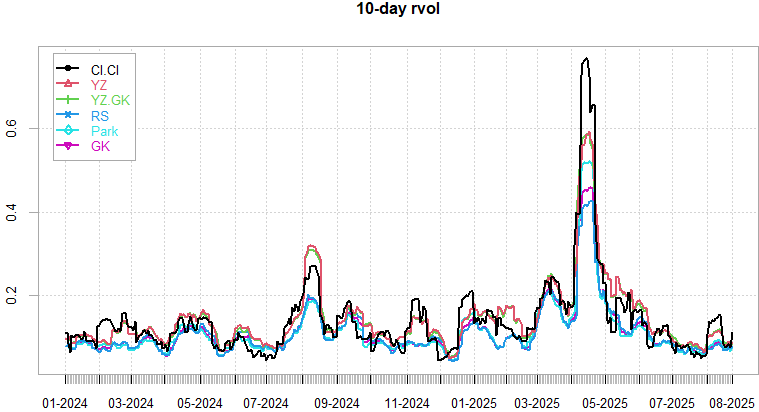

1m rvol rising since start of Aug, now above 10. 10d rvols also briefly spiking last few weeks but nothing major.

Small caps catching up in Aug, up nearly 10% since start of the month & most on Friday. 1m implied correlations got crushed on Friday, slammed below 10 from 15-16. Single stock vol (VIXEQ) continues to trade within 32-37 range since late May, with majority of the moves in VIX coming from drops/increases in implied correlations.

VIX Futures continue to show a ‘cleaner’ picture of overnight/intraday moves. RTH performance flat since mid May, all the drop in VX30 coming in overnight.

SPX ATM Straddle Performance

1-DTE straddles net positive over last 6 trading days by ~2.5pts. Straddles opened RTH and at any point during the day net red anywhere from 15 to ~50pts for London Close 0-DTE straddles.

Intraday Variance Ratio

From the following post:

Bias towards long straddles continues even after very ‘trendy’ Friday reaction to Jackson Hole speech. Feels like market is gearing up for a trendy move here as we’ve spent last 1.5 months in a range. Timing that is harder as there are no distinct catalysts until the FOMC meeting in mid Sep.

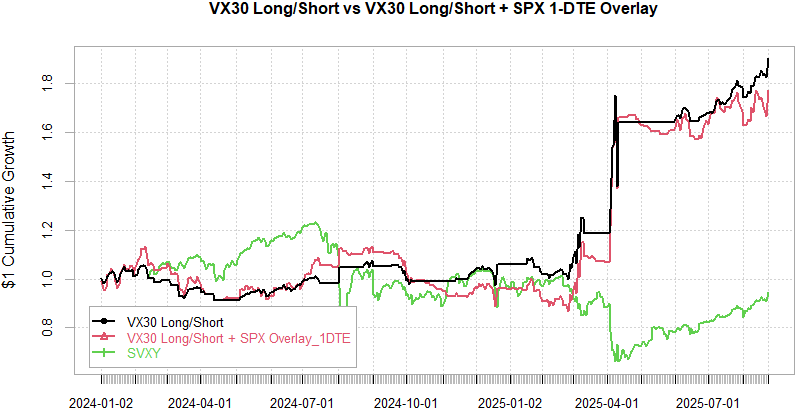

VX Carry & SPX Overlay

From the following post:

Short VX Sep signal continues to hold as term structure continues to be extremely steep. 2.5 spread between spot VIX & Sep contract along with nearly 5pt(!) spread between spot and Oct. Jackson Hole crushed Sep contract almost 2pts in a single day as Sep rate cut looks to be a ‘lock’. Scouting twitter over last month or so can see lots of tweets about buying ‘cheap’ VX exposure into autumn months. Well it ain’t cheap and there’s little reason to position long before markets at least manage to hold a 1% pullback… Given current term structure we will easily ‘eat’ a 2-4% pullback without VX blowing out so even with perfect timing there is no reason to position long VX against such a massive headwind.

As always don’t hesitate to reach out!

Have a great week!