Following up on last weeks overview:

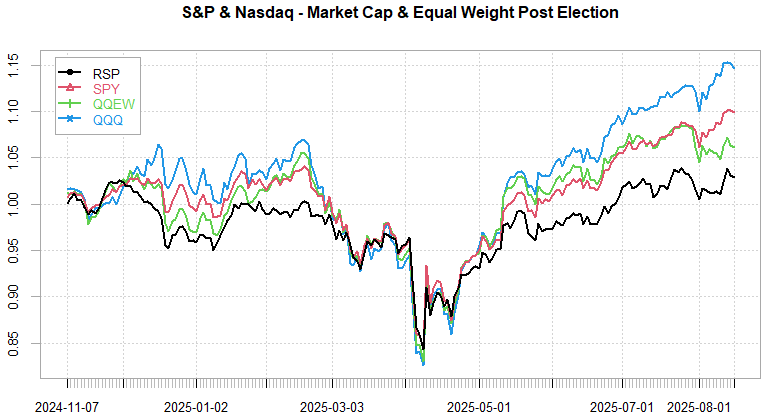

Another ATH hit late last week. CPI above target somehow still exceptionally bullish as its not rising fast enough to cause concerns. Overall, last week confirming ‘soft landing’ with rate cuts still expected in the next Fed meeting. Jackson Hole on Friday should be a good prelude to what we see in September from the Fed. So far, markets remain blissfully calm.

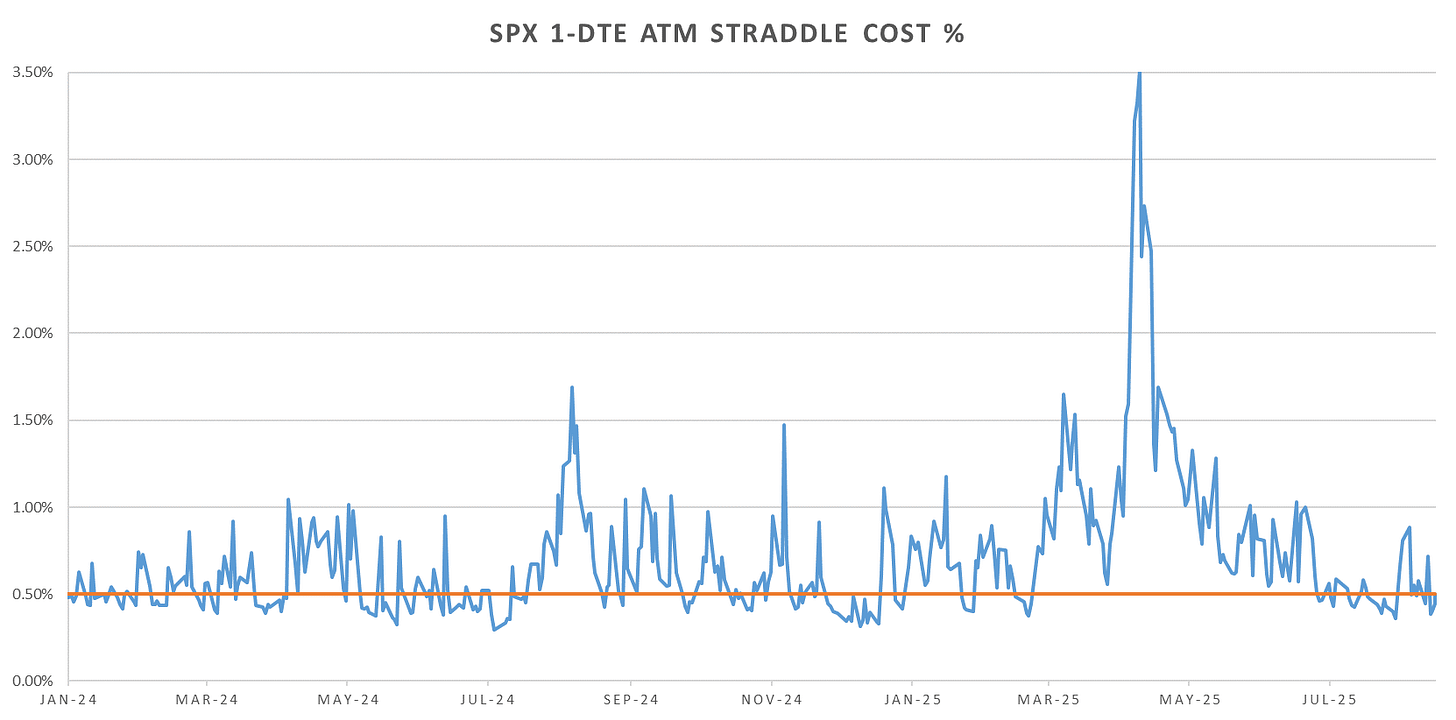

Weekend straddle went out 50bps flat on Friday, slightly elevated due to Ukr/Rus war summit in Alaska.

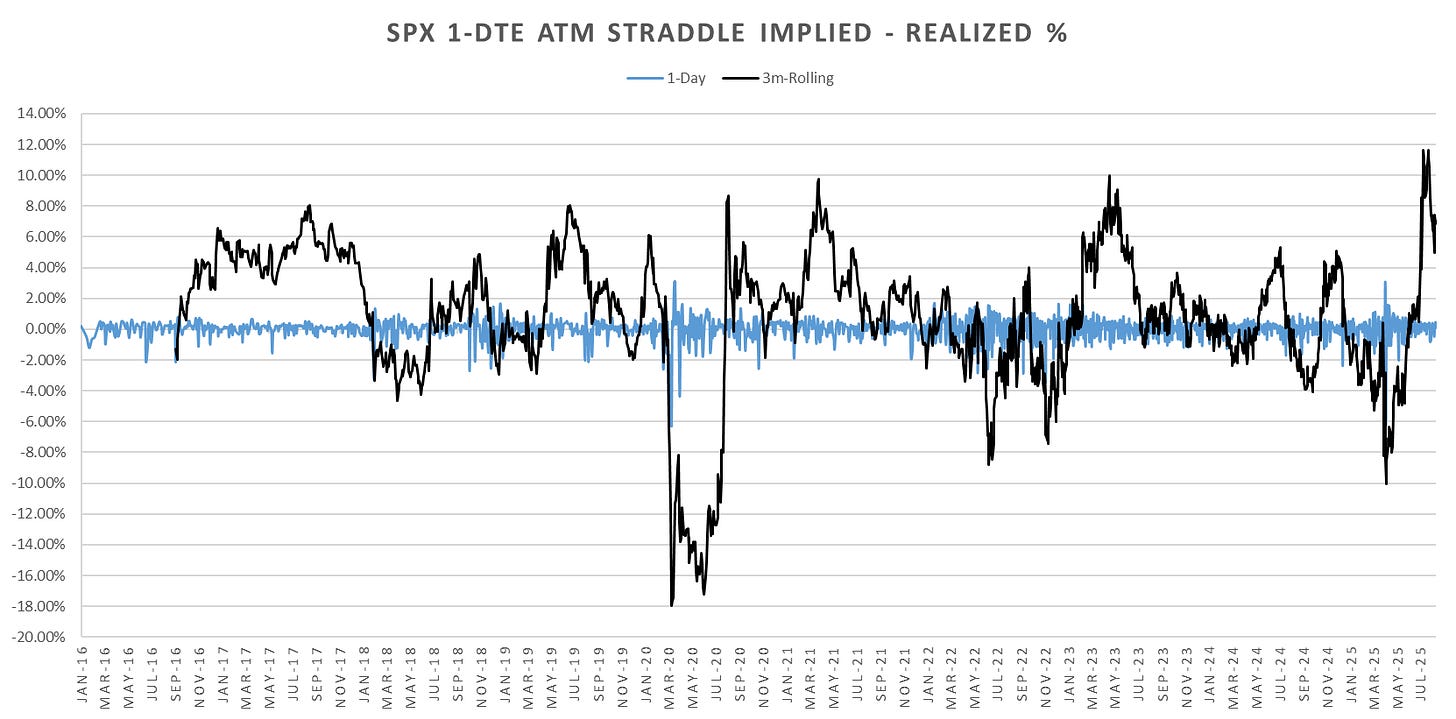

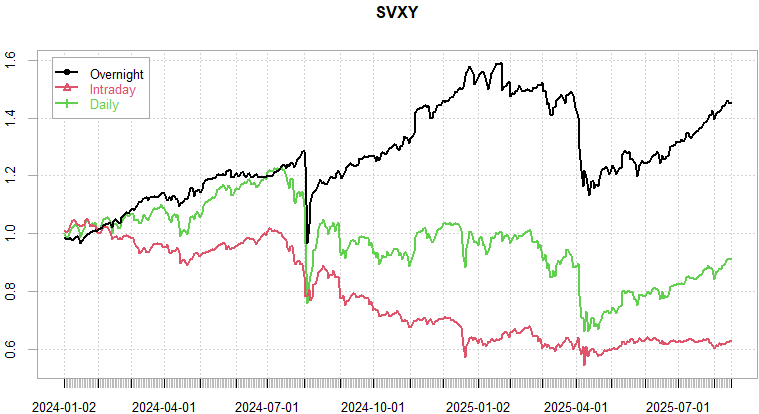

Short dated short vol performance getting extremely stretched here, 3m rolling performance sat at 10 year highs before the small drop early August.

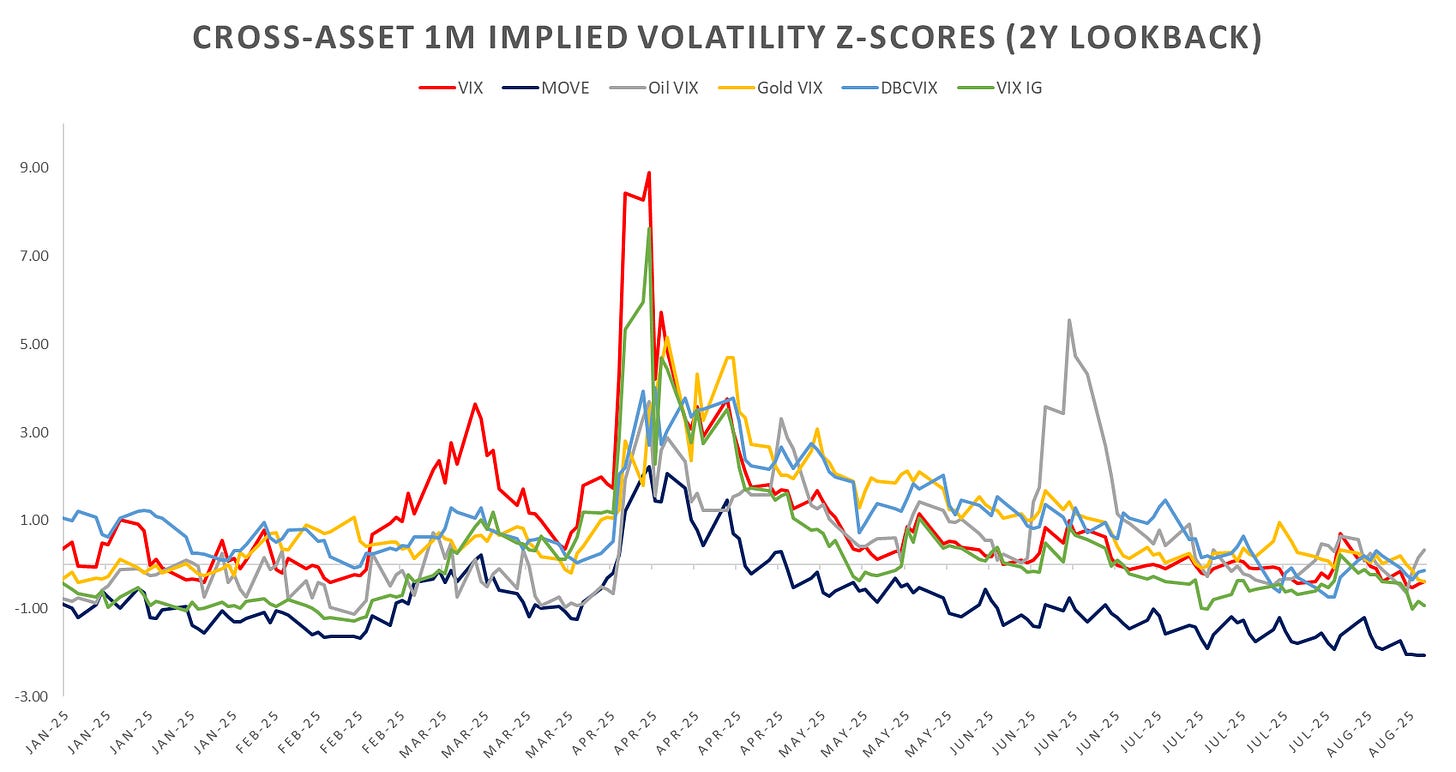

Cross asset vols mixed last week. Oil implied vols slightly higher to end the week in anticipation of ‘something’ happening post Alaska summit.

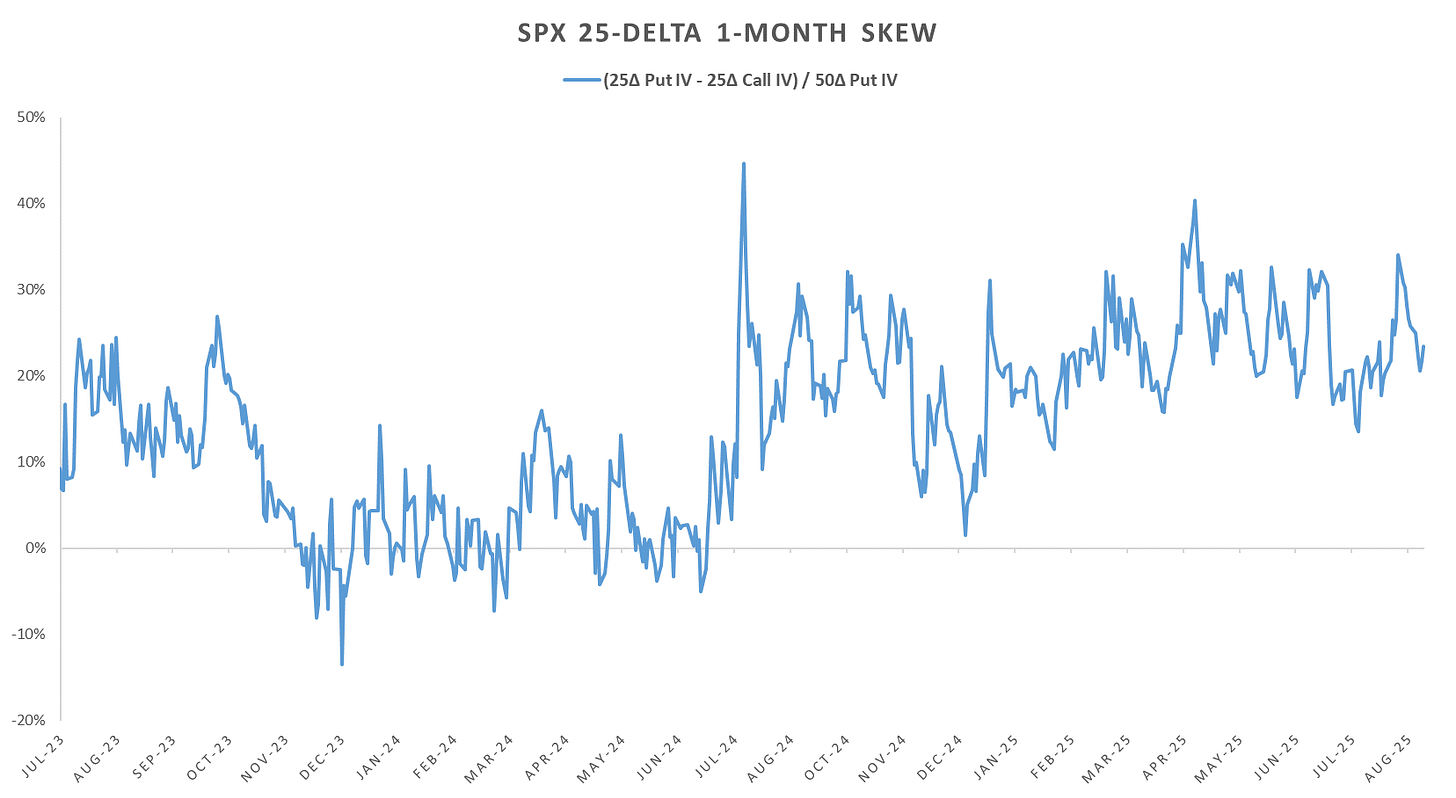

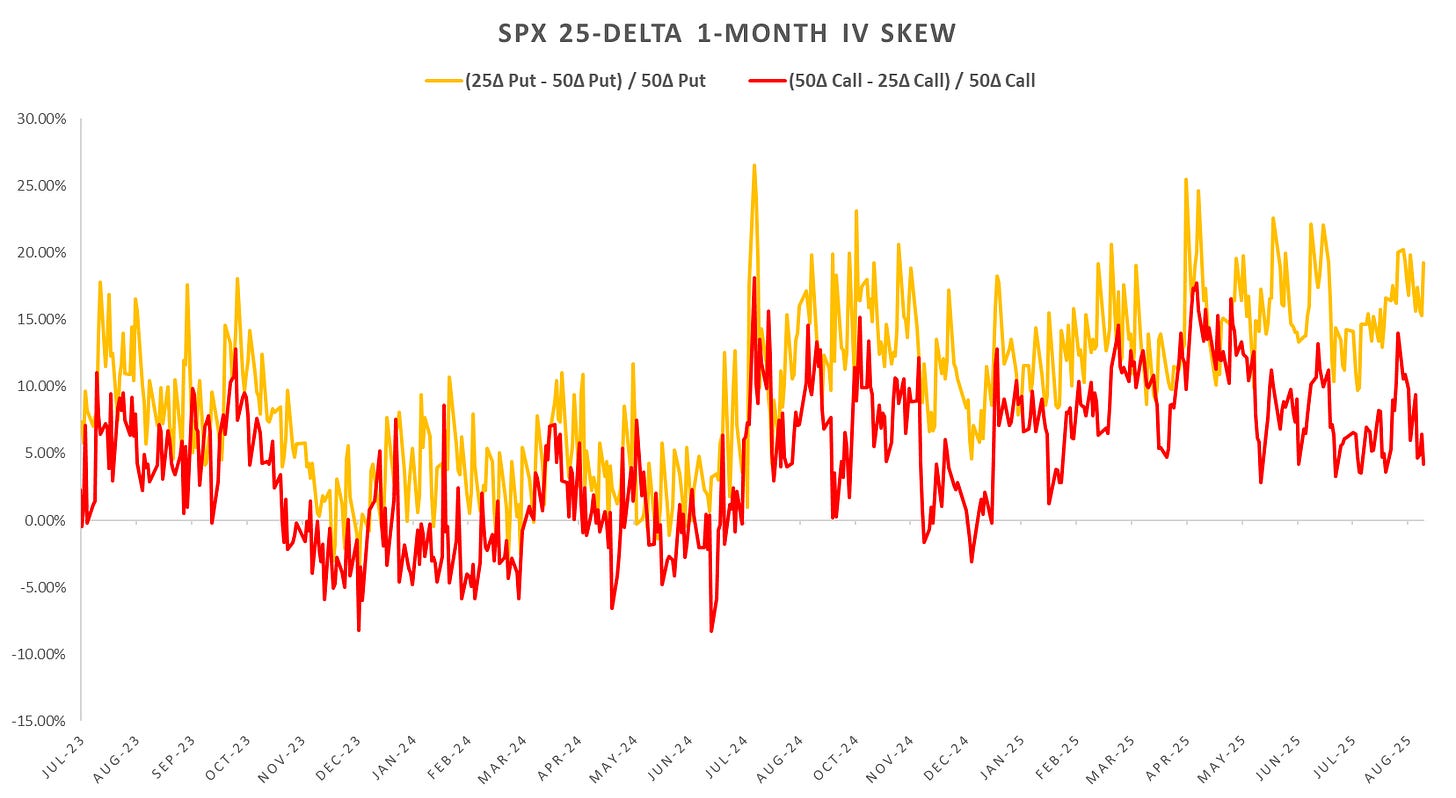

1m 25 delta skew flatter on the back of flatter call skew. Put skew remains bid as was the case throughout this rally.

Looking at intraday price action:

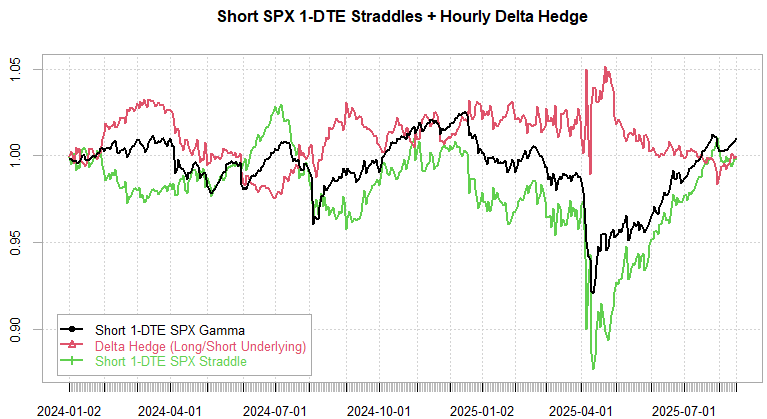

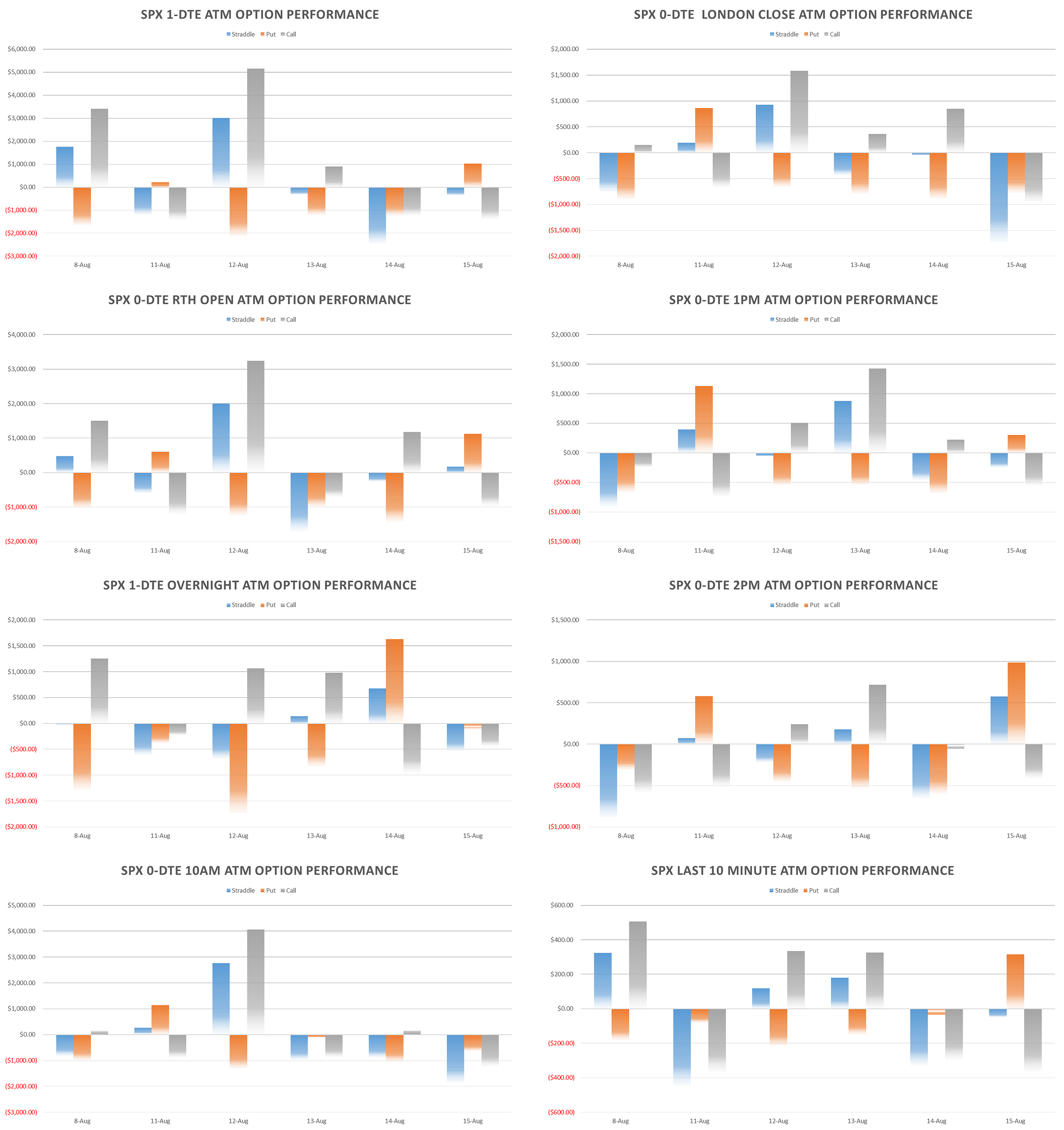

Elevated data release premiums last week nothing more than extra profits for risk premium sellers. Short delta hedged straddle pnl sitting at near highs of the rally again. Almost no big data releases this week except for Wed Fed meetings & Jackson Hole speech on Friday morning so straddles back to sub 50bps range (last few years not worth the squeeze shorting very cheap straddles.)

Cross section once again showing just more of the same since April lows, although we are now seeing short straddle pnl flatline since late July as we enter extreme low vol levels & choppy markets.

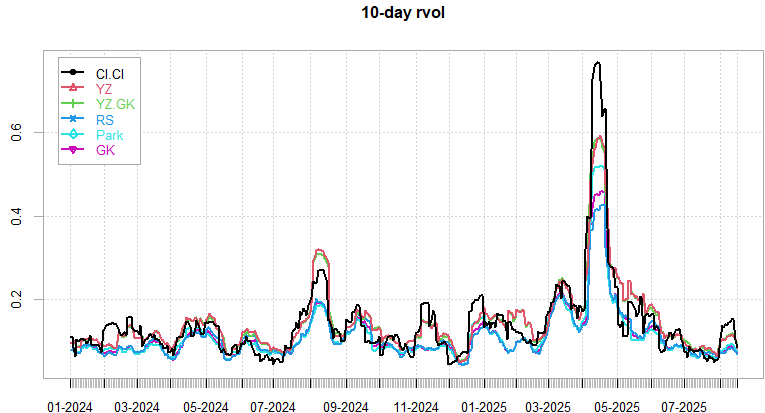

Realized Volatility Overview

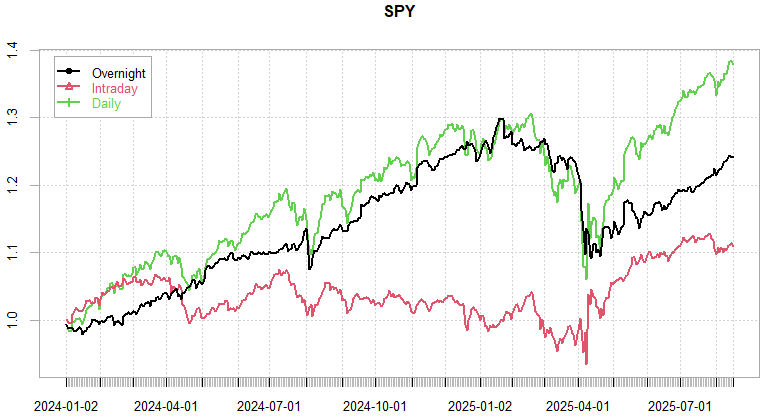

US RTH performance flat since June, led by overnight gains mostly once again.

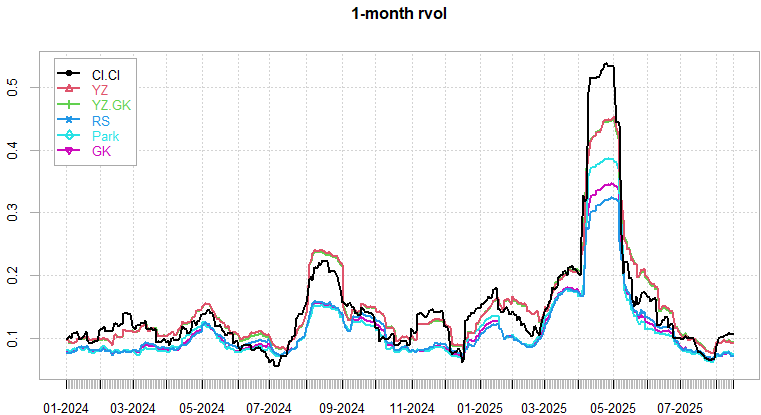

Realized vol measures all at lows, range based RTH measures lower as all vol coming from the data releases pre market or after hours on earnings releases.

VIX down to 14-15 on both single stock vol down to lows post earnings & correlations back to ~10%. Some weak rotation last week or so from tech into small caps on rate cut expectations.

The overnight/intraday performance difference way more pronounced in VX land, short vx ETP’s rallying entirely overnight since April with US RTH session largely flat/higher.

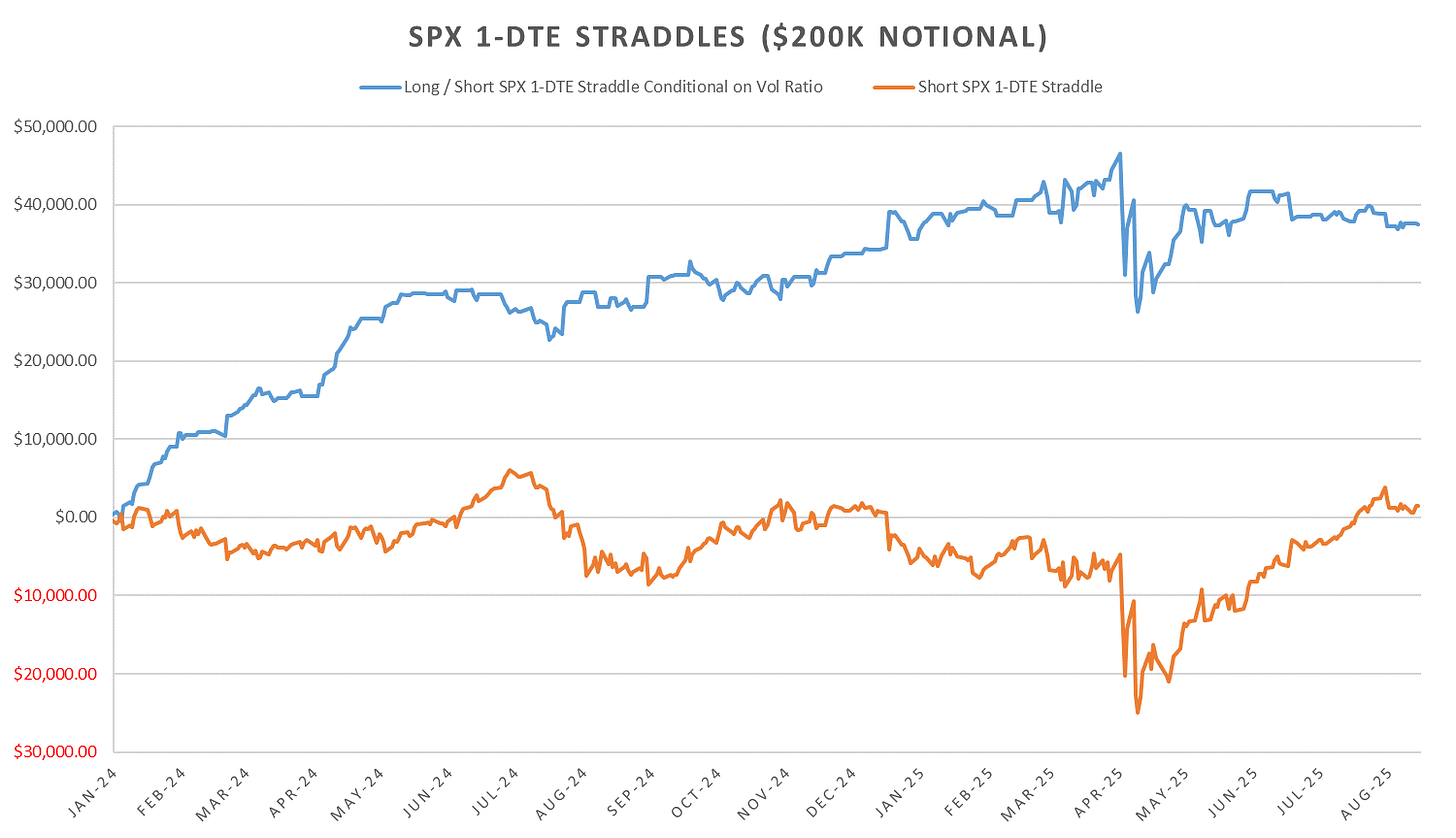

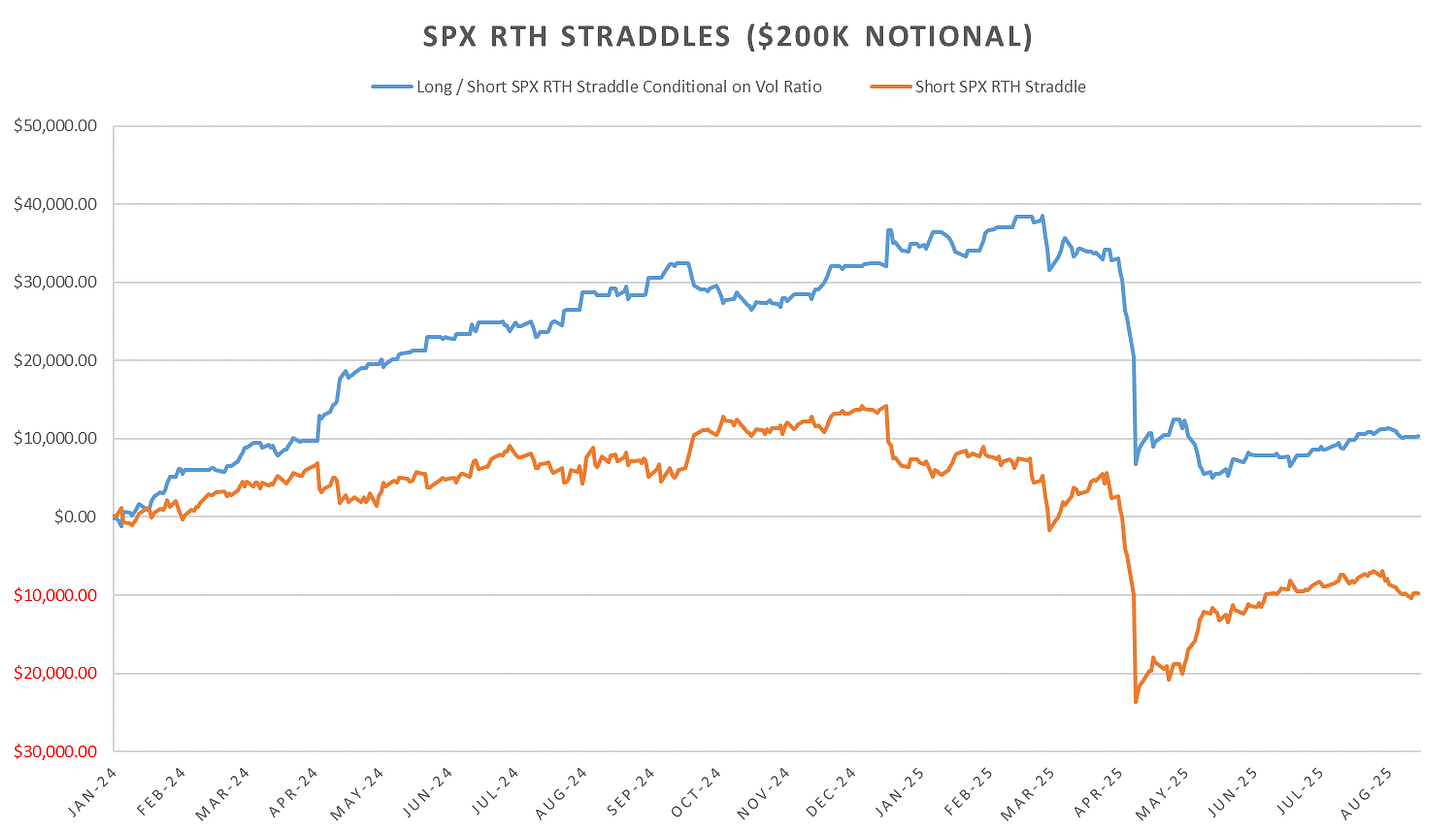

SPX ATM Straddle Performance

Both straddles opened at US RTH open & 1-DTE straddles from close net up over last 6 trading days (only few pts though.) Other straddles opened intraday ~flat. As mentioned, premium getting very thin here as the rally from April lows is becoming more and more extended.

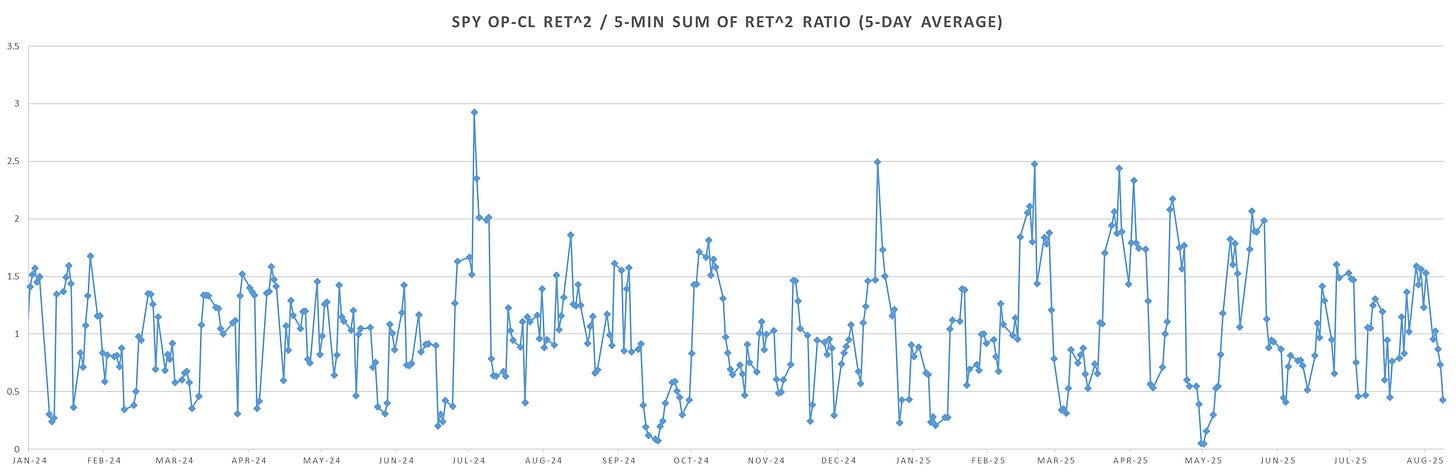

Intraday Variance Ratio

From the following post:

Hitting some extreme mean reversion measures on intraday price action last week. Bias now strongly towards long straddles into start of the week. Overall performance flattish as we had a very prolonged period of almost no extremes last several months, just a grind higher on low rvol.

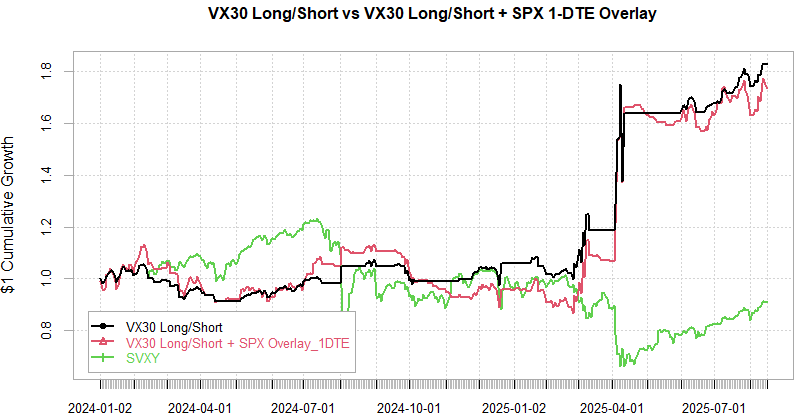

VX Carry & SPX Overlay

From the following post:

With a very steep curve the short VX signals keep holding through last week and into this week. Sep VX at a 3pt premium to spot & almost 5pt premium in Oct contract… thats a top %ile spread on a historical basis. Last post in Jan I highlighted how the VIX/VX basis has been explaining less and less of the VX variance to the point where we can expect VIX to rise a greater % of the basis (with the same standard error) than VX are expected to drop. Whether this still holds true is ofc impossible to know as this is mainly influenced by the behavior of VX term structure in the 2018-2024 period. So far this year the term structure factor has done extremely well capturing both upside in March/April and the roll down in VX last few months.

As always don’t hesitate to reach out!

Have a great week!