Following up on last weeks overview:

SPX continued to rally & closed Friday less than 1% from new highs. Notably, NDX is lagging SPX on the way up as rate cuts keep favoring small caps. Jackson Hole proved to be (at least in the short-term) purely a premium burn event, although I do expect possibly a delayed reaction early this week as rate cut narrative potentially moves towards elevated recession risk.

As

posted in his latest note, SPX sold off in the 2nd half of July as markets started leaning towards a 50bp cut in Sep.Source: (https://substack.com/@russellrhoads/p-148082333)

This week saw wild swings in straddle pricing, on Monday, we almost saw 1-DTE vol drop back to June lows. That was a wild overreaction from the recently bought optionality, given straddles repriced higher as we progressed through the week and closed Friday off lows despite SPX closing at highs.

In terms of cross-asset vols, gold & bonds remain above their 5Y lookbacks:

2Y lookbacks showed cross-asset vols closing at ~ average across the board and well off summer lows:

Short term implied & realized correlations remain bid, indicating no return to summer lows, so expect vol to remain firm on further upside moves on indices.

Earlier this year I posted a summary of summer seasonality for straddle performance:

“Overall shorting June/July/August 1-DTE straddles net positive over the last 10 years (pre 2022 data has gaps due to 1-DTE expirations not being available for every day of the week), however, gains given back quite often towards end of July/August, with a number of years peaking ~mid July.”

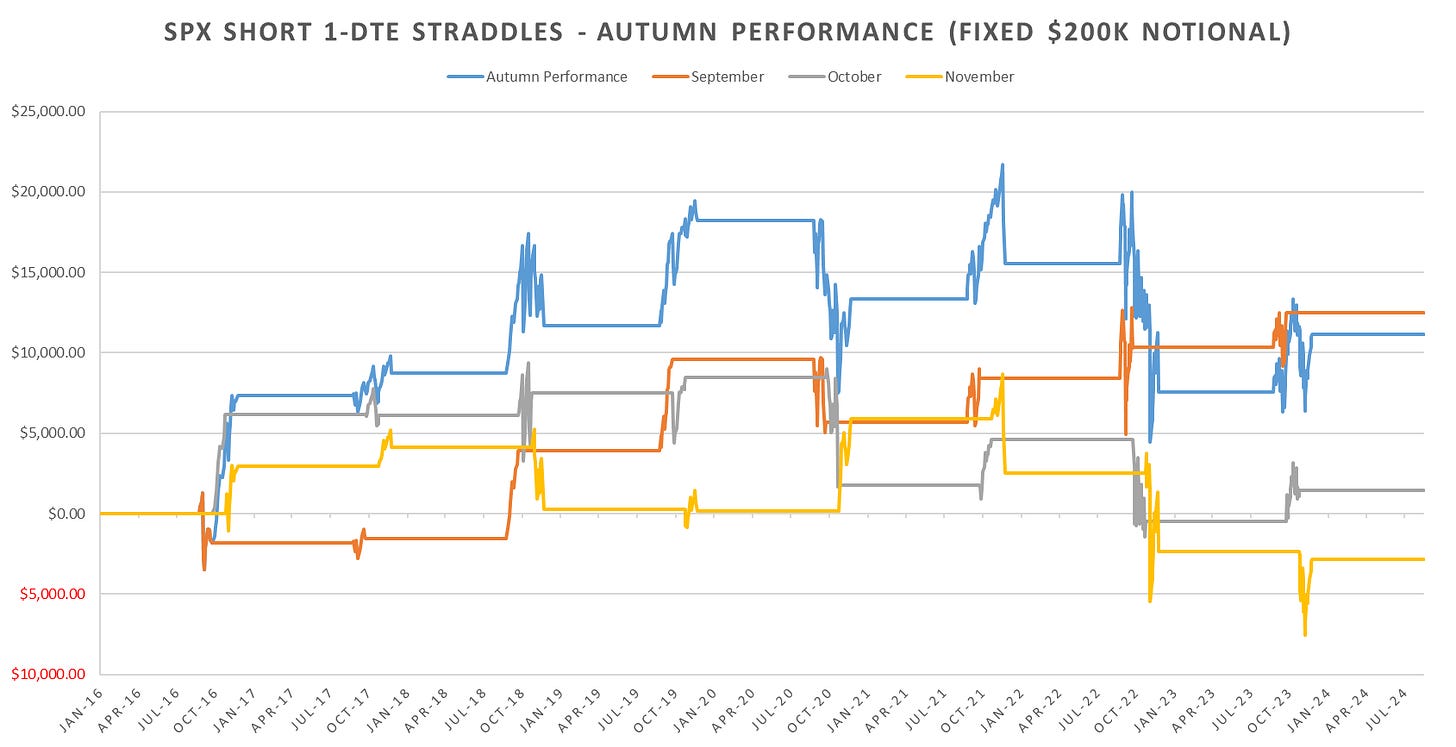

For continuity, below is the summary for Autumn performance since 2016. Looks like September still gets that bit of summer vol doldrums overhang, with vol picking up towards Oct/Nov past few years.

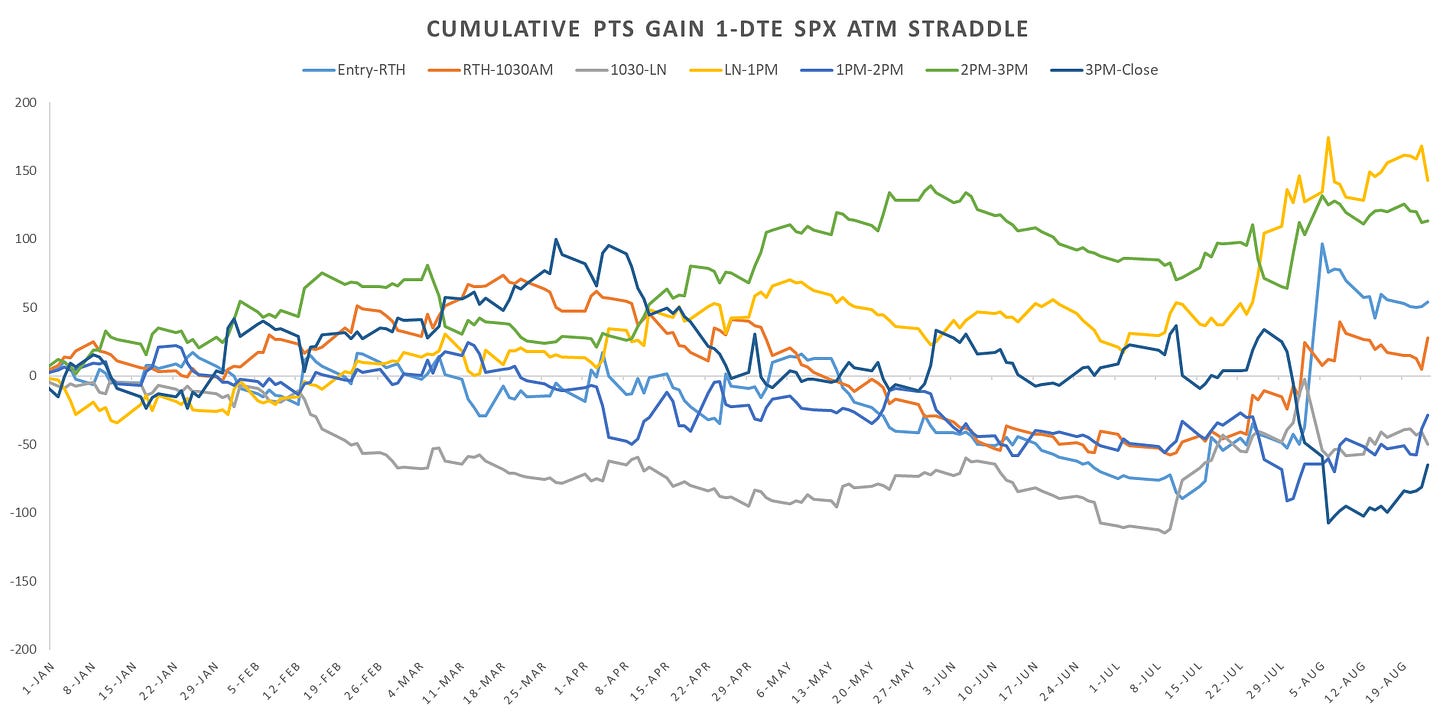

Looking at intraday behavior, from the following post:

Scalping intraday straddles not doing that great last week, largely last 2 weeks we had very few opportunities to scalp deltas intraday as markets trended through the entire day. Some small pickup towards eow, however, markets still closing at daily highs/lows without an opportunity to scalp anything…

The only period with positive mean reversion pnl continues to be ~10-1030am to London close:

We’ve got Nvidia reporting after close on Wednesday, so far, earnings results by MAG7 only fueled the rotation trade into equal weight indices. With very little data coming out before Wednesday, I expect rvol to drop early in the week, with Thu/Fri rvol picking up as we go into EOM with expectations of a retrace of the last 2-3 week rally.

Realized Volatility Overview

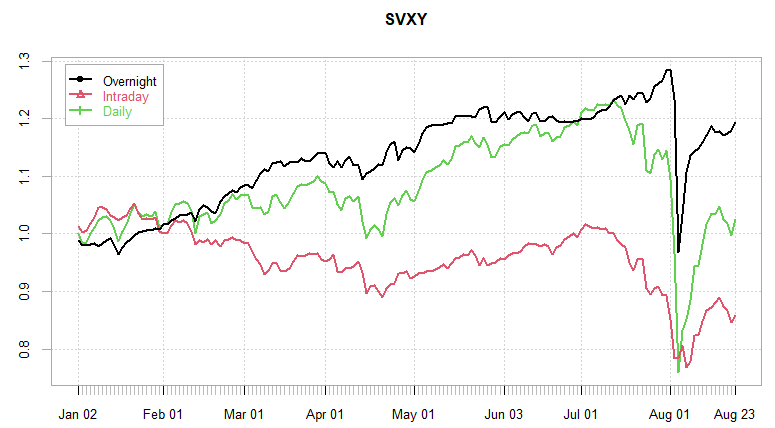

Overnight performance closed at YTD highs on Friday, RTH performance still lagging…

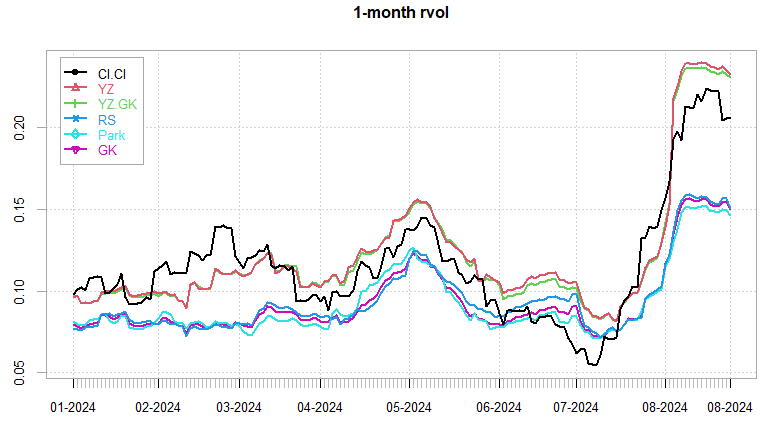

1-month rvol still has significant down & up moves in its lookback window, with 10-day vols back to ~10-14.

Range based vol estimators moving in tandem with cl-cl as we have seen very little intraday two-way action. One directional flow all day, every day….

Vol ETP’s suffered greatly from the vol drag post Aug 5th spike. While beneficial for the short VXX/UVXY/UVIX holders, buy & hold inverse vol etp traders will take time to recover… Upside for short vol etp holders is that the election premium bump is still there in the Oct contract & the Nov/Dec contracts also have a nice premium built in for a juicy eoy run.

SPX ATM Straddle Performance

Net 1-DTE straddles managed to finish the week up, driven by the way oversold Monday vol. Thursday/Friday net straddle wins despite elevated premium for Jackson Hole & jobs data. Outside of the early data moves, buying straddles after London Close net losers up until the close where last 10 minute straddles saw some decent moves. Even on Thursday market managed to move ~8pts between London Close and US close despite large swings.

Variance Ratio Conditional Performance

From the following post:

Var Ratio system continues to recover, almost back to late July levels. 1-DTE leg flipped to cash on Monday close from long 1-dte straddles and later traded short 1-dte straddles on Wed/Fri. The intraday leg, opposite to 1-DTE leg flipped from short intraday straddles to now some long trades, capturing some of the moves this week. the RTH leg YTD doing MUCH better… RTH leg spent 39 days long & 63 days short the RTH open 0-DTE straddle YTD. For Monday, RTH leg in cash, 1-DTE leg going short 1-DTE straddle from Friday close.

VX Carry & SPX Overlay

From the following post:

VX system had a few trades last week, SPX Overlay had long straddle trades on for Thursday/Friday. The system also flipped short Oct VX ~18.5 around London Close on Friday. Both the core system & the overlay system hitting ytd highs, however, this is probably on the lower end of ytd performances in the last ~14 years and its already end of August… Can only hope for a nice short vol run post elections…

Have a good week!