Following up on last weeks overview:

SPX ended last week on a 7-day winning streak. The size and speed of this bounce is amongst the sharpest in the last 20 years when looking at historical data. Volatility / liquidity cycle does entail outsized moves in both directions, but the move last week and a half caught a lot of people by surprise (including me.)

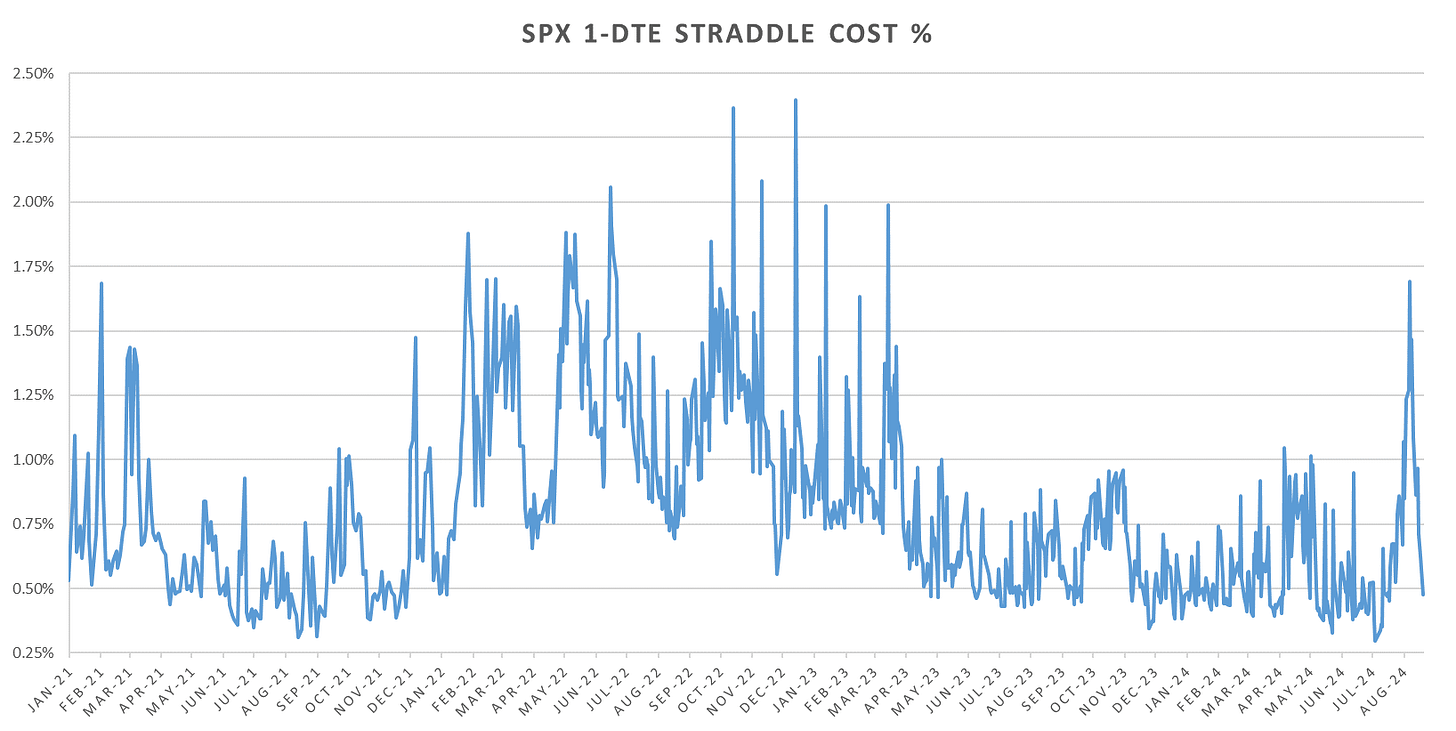

We managed to cover the entirety of 2022 highs & land at near 20 year lows for the 1-7 DTE straddles…

This week, no significant data releases except Wed FOMC minutes and the Friday Jackson Hole Powell speech. Given where vols closed Friday, not alot of risk anticipated…

Cross-asset vols back below their 2Y & 5Y average… Even FX is back to pre ‘event’ levels.

After latest period of low rvol, looks like the realized skew is returning to ‘normal’, with vol on down days exceeding upside vol. Last year and a half, realized skew was most inverted since 2003.

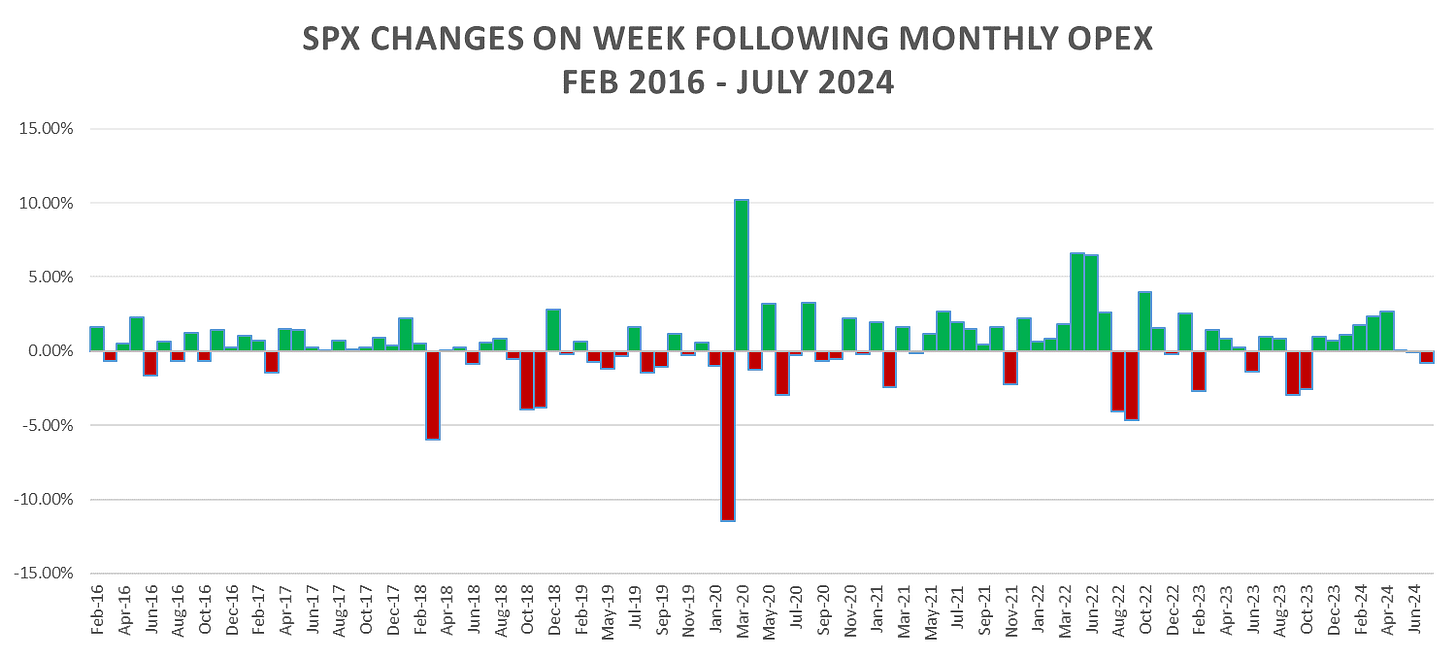

Post OpEx week generally bullish, however, majority of large downswings pre 2020 came after OpEx unclench.

In terms of intraday behavior, pnl from scalping 1-DTE straddles down last week, we largely moved in line with breakevens, however, its the lack of any mean reversion intraday that hurt pnl. Performance YTD continues to hold positive, one of the best years in the last decade for long short-dated SPX gamma:

Table showing short 1-dte straddle %PnL, delta hedged at various times intraday, for details, check out:

When looking at intraday behavior, we are experiencing the least amount of mean reversion intraday and for the shortest amount of time since end of the 90’s. (Taleb Ratio from other posts.)

Mean reversion peaked August 6th, intraday trend since then… Rvol almost completely shifted to first half of the day, with weakest eod momentum since 2021.

In terms of positioning,

showed the share issuance on inverse vol ETP's skyrocketed after the drop, with what looks like everybody smashing the short vol button (and getting away with it again.)For broader indices & flows,

’s latest post:In summary, the dip was so fast, almost every single participant (with the exception of retail) ended up deleveraging into lows & buying some back last week. Given the size of the shock, I expect *less* enthusiasm on chasing this rally, especially with Jackson Hole & autumn seasonality with potential election headlines vol.

Realized Volatility Overview

S&P almost back to highs… intraday performance just under 5% for the year, majority of gains coming overnight.

1m rvols barely off highs here, with 10d dropping towards eow. Range based vol estimators still high as they’re catching two extra days with wide ranges & low cl-cl rvol.

VarRatio’s, historically, showing likelihood of trending moves coming… I am not sure if its the speed of this recovery messing with the ratio’s (even 10-day lookbacks apparently too slow now), and the trending move is the move we’ve seen last week or we will continue moving (possibly a sharp retrace?) Given the performance of straddles for low cost% buckets last few years, might not be a bad bet.

Very little bleed on cheap 1-DTE straddles last couple of years, majority of short straddle pnl coming from selling expensive event straddles…

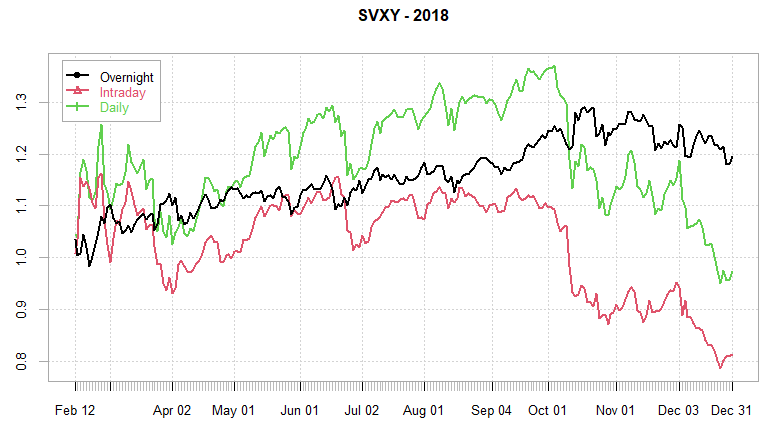

SVXY back to net positive on the year, with overnight performance continuing to trump intraday pnl (intraday trend down throughout the year…) Almost a 40% move from lows in SVXY, very reminiscent of 2018 Feb vol spike. Saw a sharp recovery back then too, with a retest coming ~ a month later.

SPX ATM Straddle Performance

1-DTE straddles net flat on the week, 2 big wins, 3 small losses.

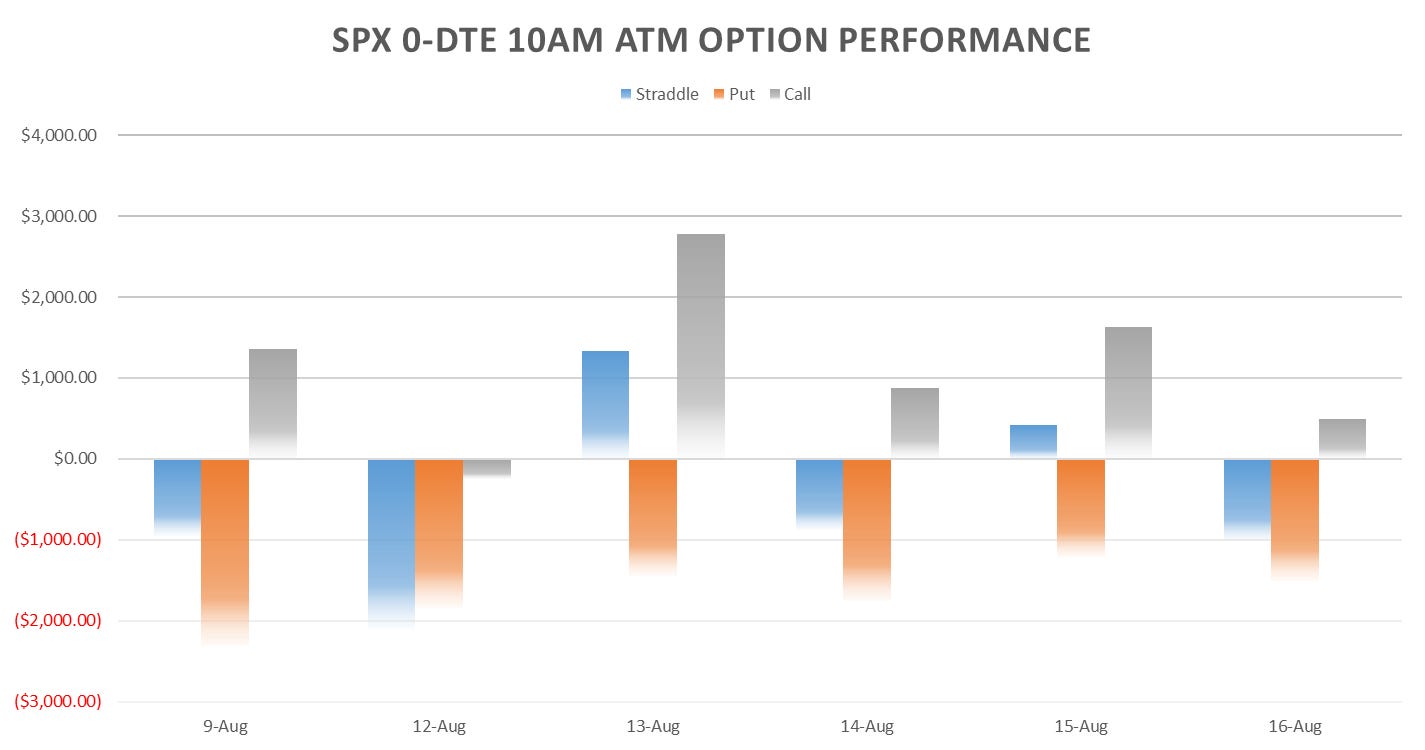

RTH open straddles down ~20pts last week, outside Tuesday never really moved enough.

Thursday reaction to data extremely positive, otherwise overnight straddles back to bleeding every day…

As mentioned, all the moves we got we’re largely overnight / early morning, with straddles after the first hour having progressively worse pnl…

1pm & 2pm straddles red every single day with both legs losing… haven’t seen that in a while….

Mentioned in the last post, the 3 week loss streak in eod calls finally over. Looks like some buying going on towards the close, albeit nothing impressive.

Variance Ratio Conditional Performance

From the following post:

*Some* recovery last week… although looks like this drop too fast for the system. Hopefully normalizes once we can further away from the event vol.

Overall, long/short rth straddles catching much better performance, largely leaning short last week with 1-dte smashing long trades all week… Went into Monday long RTH & 1-DTE straddles…

VX Carry & SPX Overlay

From the following post:

No trades from the VX system in a while, overlay gave some back from playing long straddles early last week, now both firmly in cash (at least until vol drop from lookbacks…) At least beating rolling short VX30 for now…

Have a good week!

Hi Michael,

Thanks for the informative post!

Trying to better understand this statement: "Went into Monday long RTH & 1-DTE straddles…". IIUC, this is talking about the Variance Ratio Conditional trade from the "Straddles and Variance Ratios" post.

The logic given there is: "Ratio’s used are Close-Close vol / Parkinson (GK). For Long 1-DTE Straddles, when ‘fast’ ratio <= ‘slow’ ratio, buy 1-dte straddles (>= for short 1-DTE)."

I tried computing these for Friday, and got 10-day ratio as around ~1.499 and 21-day ratio as ~1.485. In that case, strictly following the logic above would mean we would short the straddle on Monday morning.

It is possible I have completely misunderstood the strategy, or there is a bug in my calculations. Will be very useful to get your thoughts.