Following up on last weeks overview:

Happy Easter to those that celebrate!

Going into econ data-light week we’ve had volatility retreat substantially from recent highs. Tariff news became less sensational after the bond scare, back to the ‘trade deal going well’ mantra. With the initial panic spike over, not likely to see vol explode on mediocre index downside, however, we generally saw indices retest the initial lows or make new lows on a lower implied vol level historically. Powell offered no comfort last week, with markets selling off after Powell explicitly stated stagflation is the main concern for early rate cuts.

1-DTE SPX straddle cost dropped substantially last week, back to the Feb/Mar peak even for the weekend. With the vol term structure retreating from extreme backwardation, ‘flattish’ term structure still the classic sign of uncertainty…

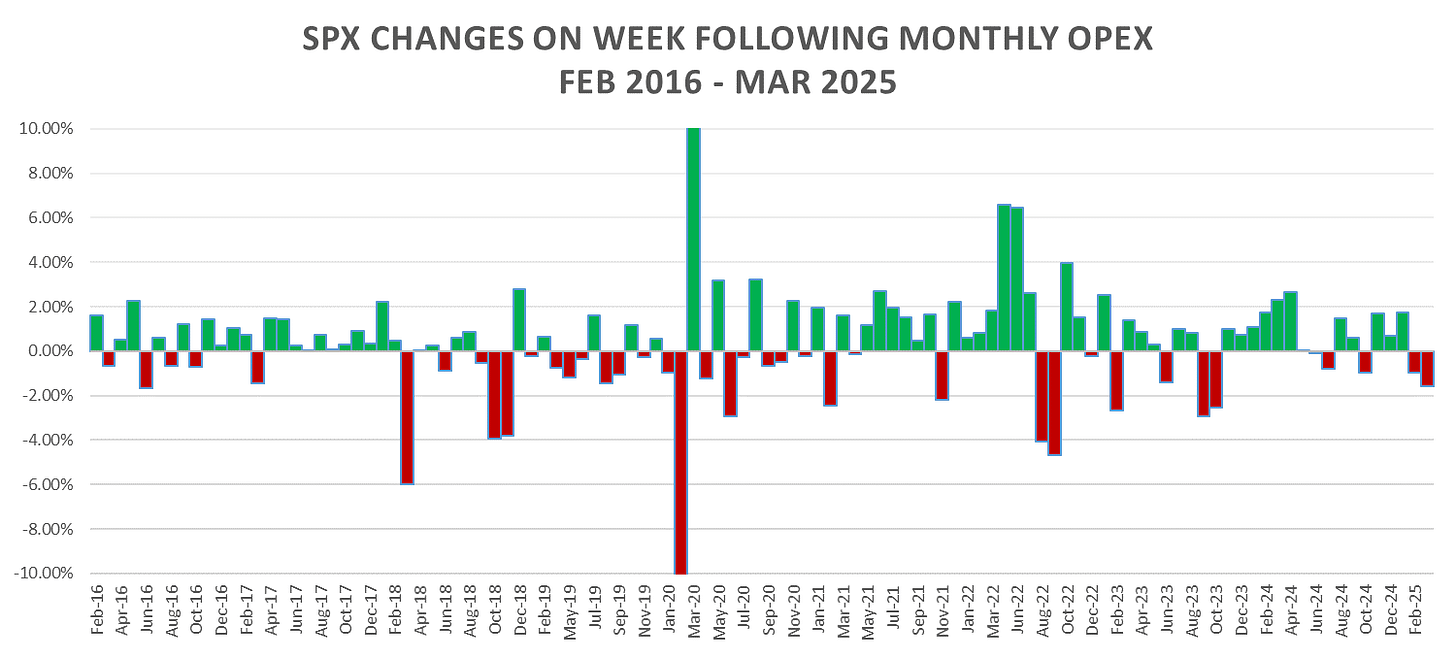

Post OpEx could see vol return as in 2018, people were hedged going into the tariff news, but lack of quick resolution that markets were hoping for could send us lower before large cap earnings kick off.

Gold implied vols stickiest so far but overall implieds lower across the board last week.

1-month SPX skew slightly lower into eow, nowhere near complacent though.

Looking at intraday price action:

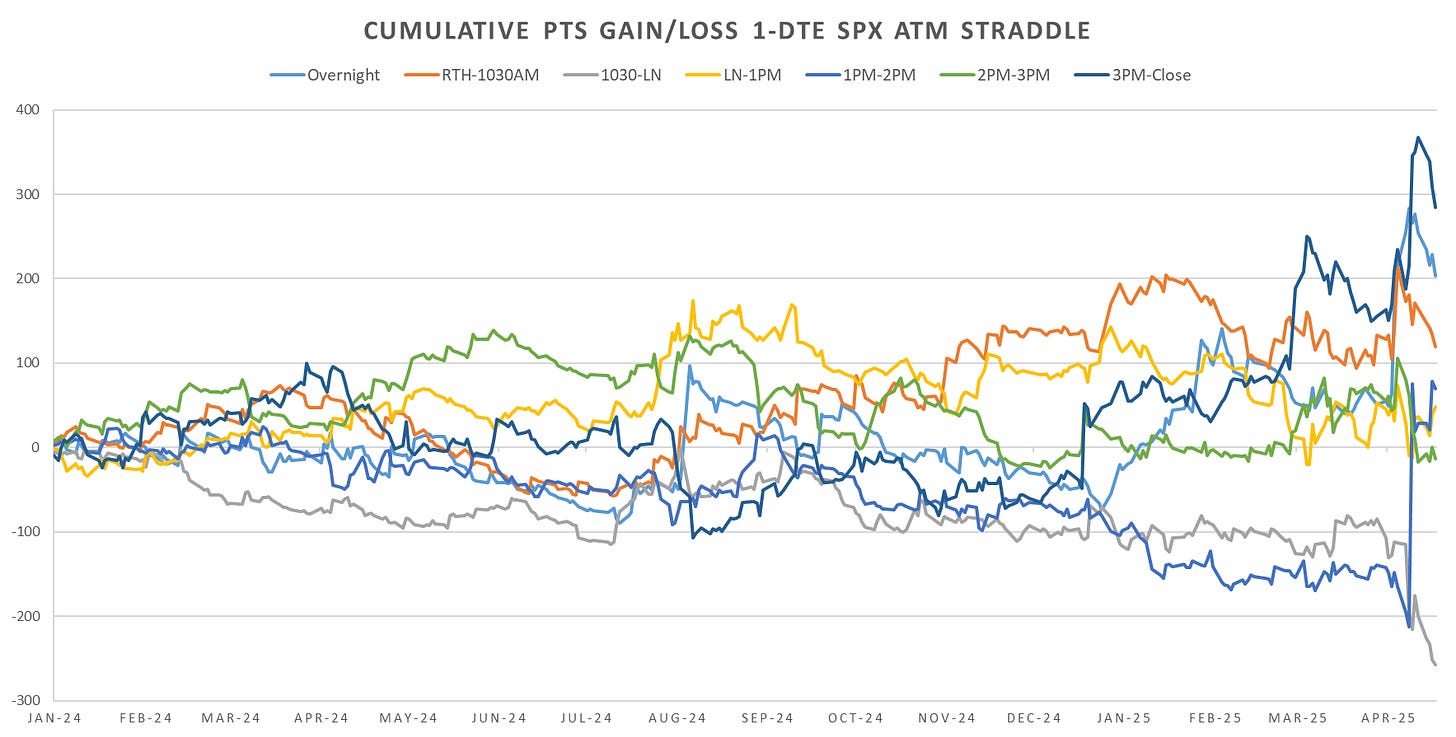

Short 1-DTE SPX delta hedged straddles recovered ~ half the losses from prior week. Still choppy price action intraday but vol overpriced significantly throughout the week.

Looking at the cross section for 1-DTE SPX straddles, eod momentum faded. 10:30am - London close now firmly in the lead for mean reversion since Jan 2024.

Realized Volatility Overview

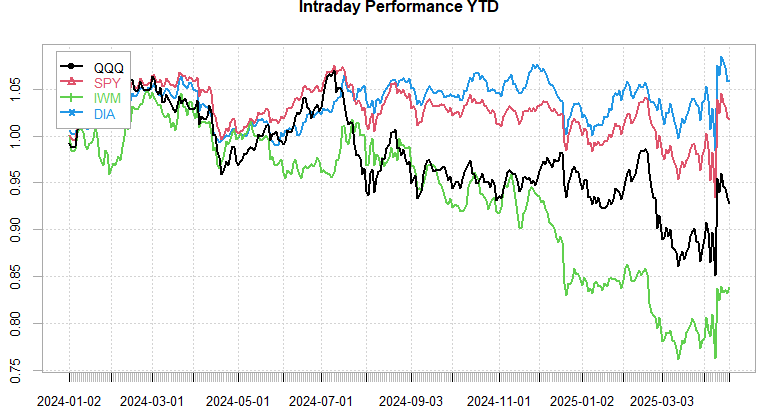

Flat week, RTH US session largely gave back the small overnight pops. Everyone waiting on next shoe to drop with tariffs.

Starting to see some retracement in realized vol estimators, range based intraday vol higher still, cl-cl giving some back. As mentioned last time, still too fresh of a risk event, so expecting wider swings to continue next few weeks.

Implied correlations traded slightly lower last week, realized still remain high. Overall everything ~10% lower since election night, not that big of a correction tbh..

Dow holding up during US session, small caps decoupled from rest intraday from early Dec.

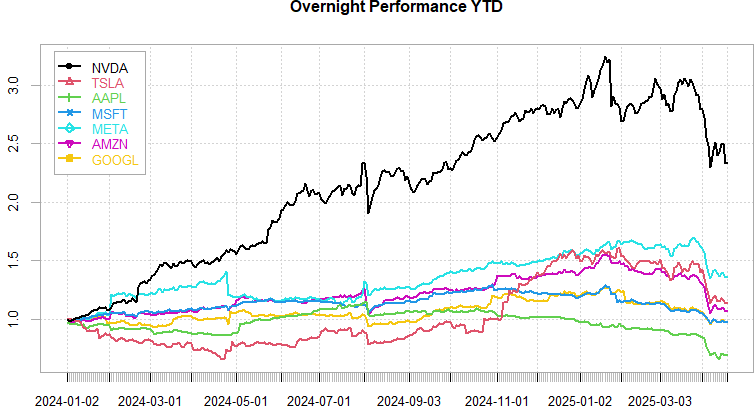

MAG7 performance:

Apple continues to be only component of MAG7 showing relative strength during US session.

Intraday / Overnight - Day of week breakdown:

The thursday overnight performance dropping sharply from 4+ sharpe last 1.5 years to near 0 since Jan.

VIX Futures largely going nowhere even with the SPX bounce. As mentioned in a couple of previous weekly posts, SPX can bounce but VX term structure already has heavy mean reversion ‘baked in’. VX May & VX June trading well below panic levels, given everything tariff related is still well up in the air, unlikely to see them substantially lower (see VX Carry section.)

SPX ATM Straddle Performance

Long RTH straddles red for 6 days in a row for ~154pts of premium lost. Generally see similar patterns in the previous years going into long easter weekend. Overall large premium burn week, both calls/puts burned, short dated implieds back to last months levels, cheap relative to the moves we saw just 10 days ago. Feels like 1(0)-DTE straddles fair / on the cheaper end here, especially given intraday ranges have barely contracted.

Intraday Variance Ratio

From the following post:

Lots of mean reversion last week intraday, bias now long straddles next few days. The largest drawdown came on Wed after the trump tariff pause tweet. That was one of the largest intraday swings in market history, coming from a single person in the white house…

The move also came during the ‘calmest’ part of the day where usually we don’t see any outsized moves (post London Close & before eod flows come in.)

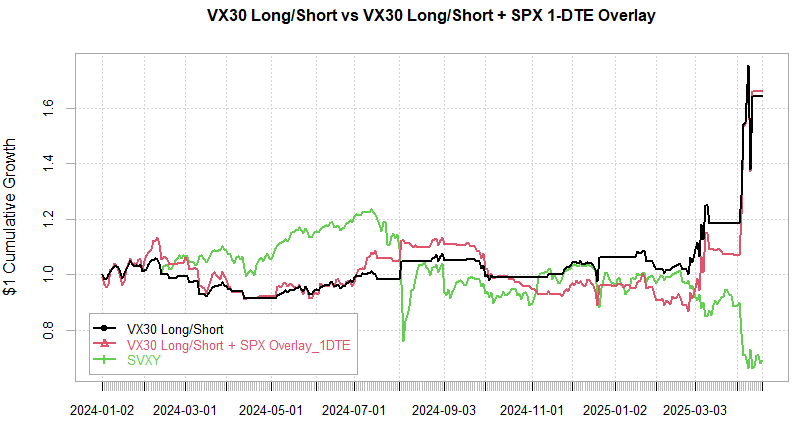

VX Carry & SPX Overlay

From the following post:

Still in cash from exit on the roll. Unlikely to see new positions trigger until the large vol of vol spike falls out of the lookback windows for the system. Don’t want to guess whether there will be a larger drop (after all, -10% on SPX still feels too small given the implications of the shift in macro…) For now its likely to be vicious chop without any significant grind lower in 30-day VX.

As always, don’t hesitate to reach out if you have any questions / suggestions!

Have a great week!