Following up on last weeks market overview:

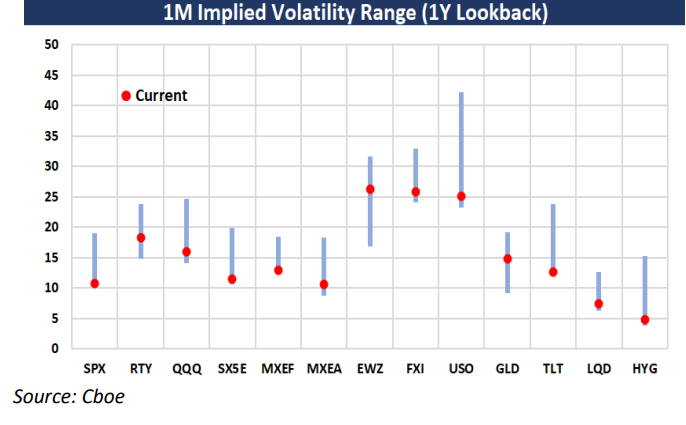

Another week of volatility getting slaughtered across asset classes:

CPI data coming in below expectations ended up being the final nail in the coffin for both implied and realized vol.

Top 10 index weight components continuing the march higher to new ytd highs:

Despite volatility dropping to near 20 year lows, CBOE $GAMMA index (Weekly delta-hedged straddles) keeps holding, implying that on a weekly timeframe we keep realizing decent sized moves:

Lets take a look at how SPX index options performed this week, as well as take a look at how the various systems discussed in previous posts have fared with the collapse in vol:

Realized Volatility Overview

Almost perfect performance from SPX overnight YTD, with RTH catching up last week, didn’t even blink at the April correction…

Slower vols catching up from last week, with intraday vol estimators making YTD lows into Friday close. The brief collapse in intraday vol relative to 1-day vols made the long 1-day straddle short RTH 0-dte straddle trades a decent winner this week (more in the Variance Ratio section):

SPX ATM Straddle Performance

Outside of the CPI outperformance, daily straddles losers all week.

RTH Straddles held up mid week but Fridays (17th and 10th of May) big down days.

Overnight calls net up on the week, with straddles bleeding every night (post CPI crush was brutal even with a <5 sec 23pt candle higher after the print…)

Intraday straddles all showed net breakeven towards buying after London Close, net up on the week (mainly carried on eod rally into and post CPI.)

Variance Ratio Conditional Performance

From my previous posts on variance ratios and intraday / interday volatility:

Updated performance YTD:

This week 2 tiny losses on tuesday & thursday but decent wins mon/wed/fri. A nice mix of long/short trades for both 1-dte and 0-dte straddles this week. Some of the short trades do overlap, Monday was short 1-dte AND short 0-dte straddle, Wed long 1-dte AND long 0-dte straddles. Overall, continues to capture intraday/daily movement incredibly well…

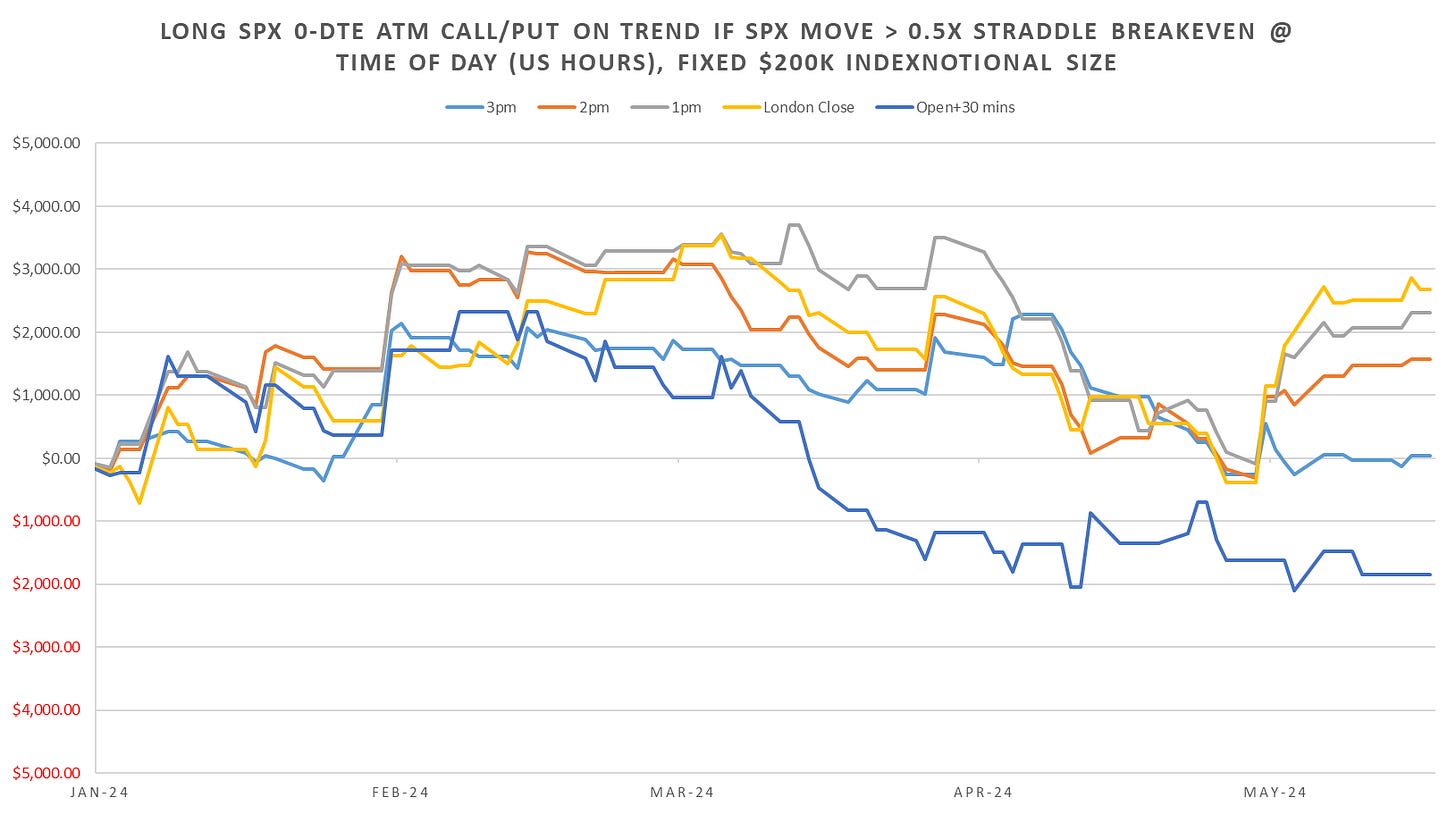

0-DTE Momentum / Mean Reversion

From the following post:

A mixed bag this week, with momentum won on CPI day, Thursday decent sized win from mean reversion intraday…

Overall, YTD no distinct pattern on intraday momentum/mean reversion in line with conclusions from main post. Mean reversion not working intraday and momentum too weak to beat premiums…

VX Carry & SPX Overlay

From the following posts:

*Strong cope* Lagging inverse ETP’s badly YTD, but can’t expect to outperform a pure raging short-vol trade if managing risk… Should add absolute returns during the summer but really need SOME risk to materialize towards elections to outperform passive inverse etp trade… Overlay helping slightly, however, de-risking into CPI on VX30 shorts and calls bleeding thursday/friday on lack of follow through really hurt…

Something I’m watching for this summer, with correlations & volatility dropping down to lows again, you’d expect a grind up in the index. What I am looking to see is if we are going to realize substantial jumpy upside like in 2023 where dispersion was above average (and the SPX long option overlay worked quite well. in addition to short VX) OR if we are back to 2021, 2017 grind up scenario where calls unlikely to work with index flattish / slow grind up. The post earnings drop in dispersion kinda makes it feel like this’ll be the 2021/2017 type index action…