Trading 0-1 DTE's for directional exposure

Single factor SPX Option Overlay

After a few conversations on Twitter about trading 0-1 DTE’s directionally as well as looking at overall straddle performance since 2016 (where straddles over the period have barely decayed on a constant exposure rolling basis) I decided to take a look at how to possibly trade 0-1 DTE’s directionally or as an overlay to an existing system.

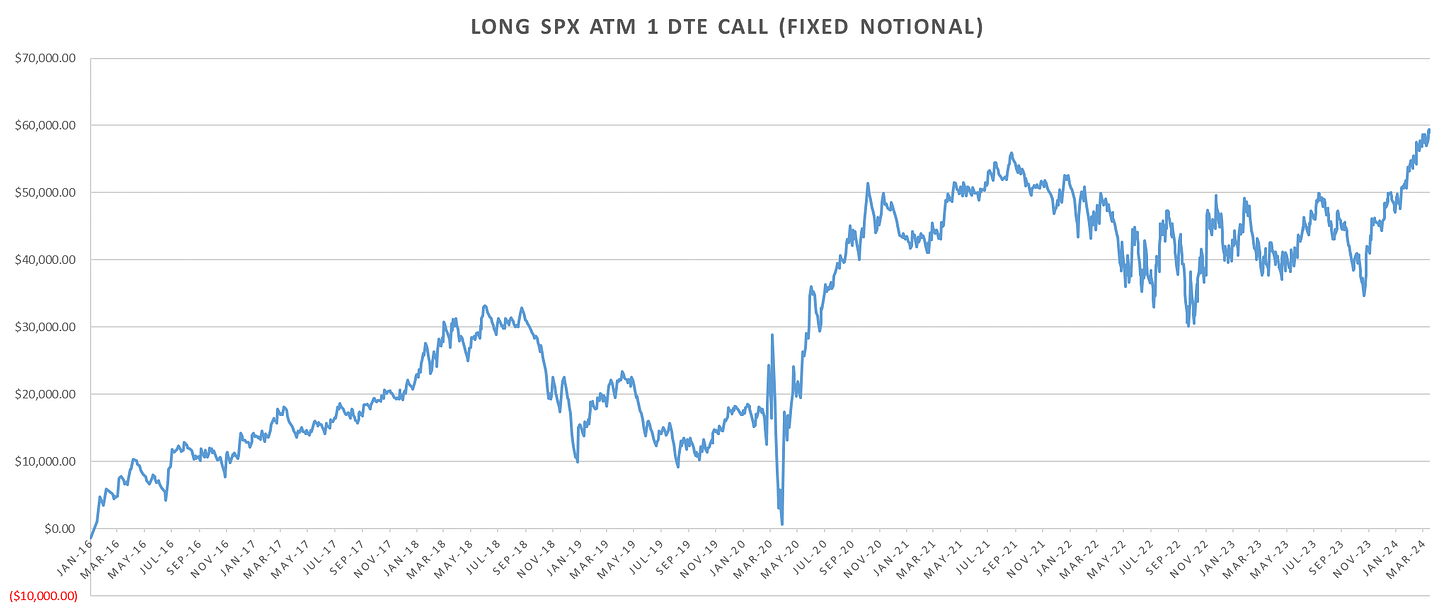

First of all, lets look at how SPX ATM straddles/puts/calls performed since 2016 on a 200k$ fixed notional bet size:

Frankly, given how ‘eventful’ last 8 years have been, straddles/puts/calls hold up quite well over the entire period. Outside of the post-Covid vol decay and post 2022 Fed ‘Pivot’ 1-DTE vols have been fair to cheap if we look at how little decay is going on.

There’s plenty of speculation to indulge in when it comes to ‘why’ vols have been priced low enough for long premium strategies to hold up this well… but fact is they have so lets look at how we can possibly take advantage of this strong, persistent market directionality through long-only option bets.

One of my favorite go-to market vibe check indicators is the SPX vol term structure shape. Simple concept,

Upward sloping term structure (near term vols < further out vols) = business as usual market, slow grind higher (flattish) spx, low vol of vol, weak mean reversion.

Flat term structure = uncertainty, common after violent short term event moves, could be yellow light for a regime shift

Inverted term structure = panic, serious event premium, violent moves

Now that we’ve outlined the basic idea behind what the term structure might indicate, lets set up rough guidelines on which option structure would probably be optimal for each ‘regime’.

Straddles - flattish term structure (pre-event, recovering after initial violent move (we don’t know if there will be continuation or bounce.))

Calls - upward sloping term structure (business as usual, best when term structure moving from flat to ‘normal’ (adjust term structure shape for rolling upvol))

Puts - term structure inversion, rare but surprisingly high win rate

Keep reading with a 7-day free trial

Subscribe to Vol Vibes to keep reading this post and get 7 days of free access to the full post archives.