Following up on last weeks overview:

Last week was exciting, marked with exploding pagers and a historic 50 bps cut by the Fed (first rate cut in 4 years!) Markets ramped higher (not without a nasty whipsaw on FOMC day) with all indices finishing higher on the week. Despite the excitement, VIX and VIX futures had a tepid reaction to the overall bullishness. Inflation continues to slow (even if we have to cut the basket down to just Costco hotdogs) and ‘goldilocks’ data keeps rolling in.

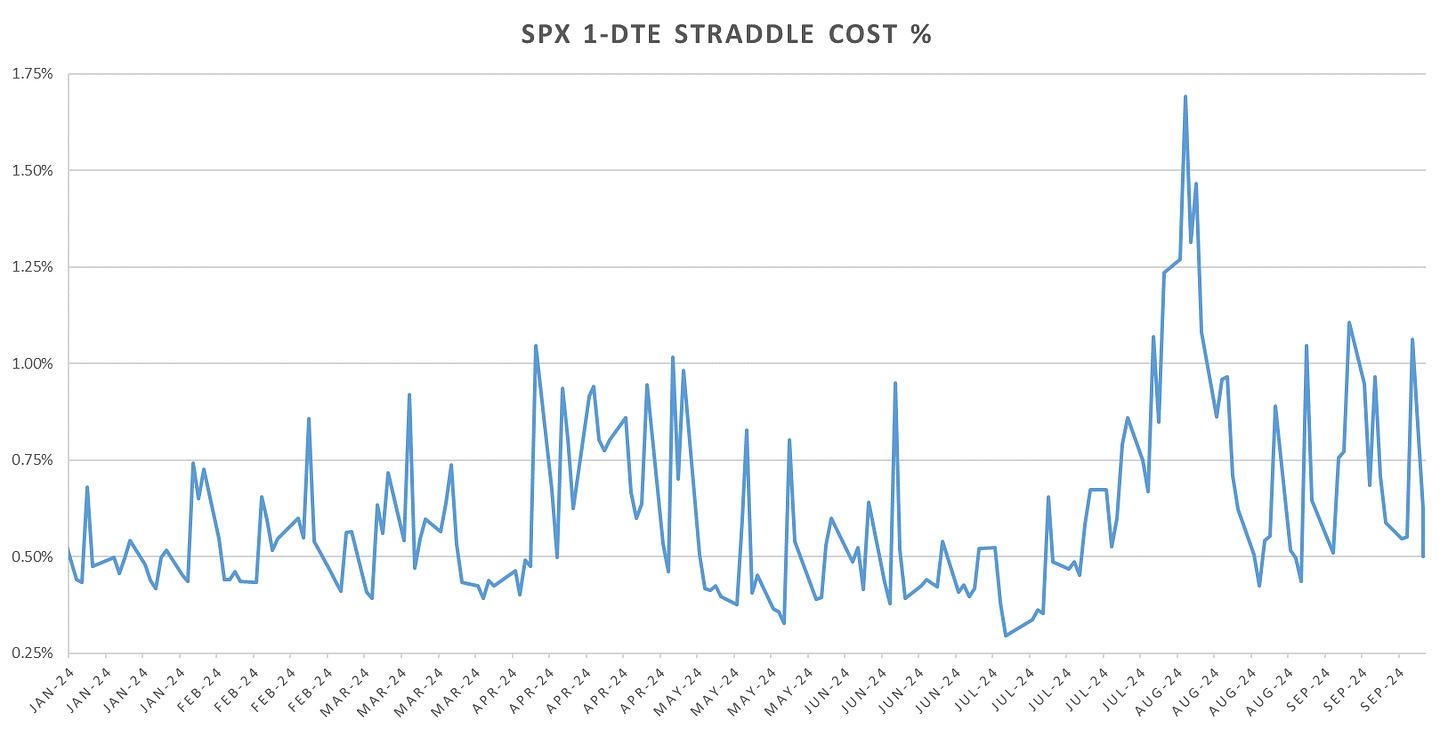

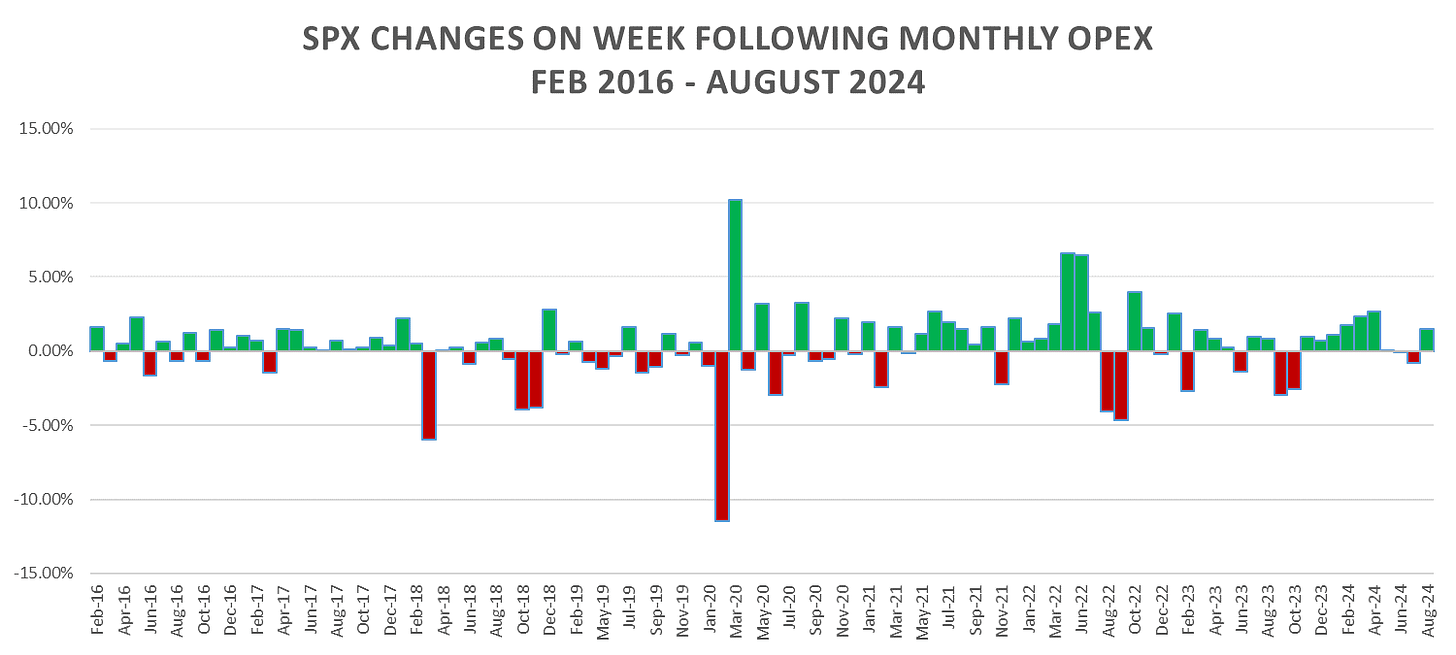

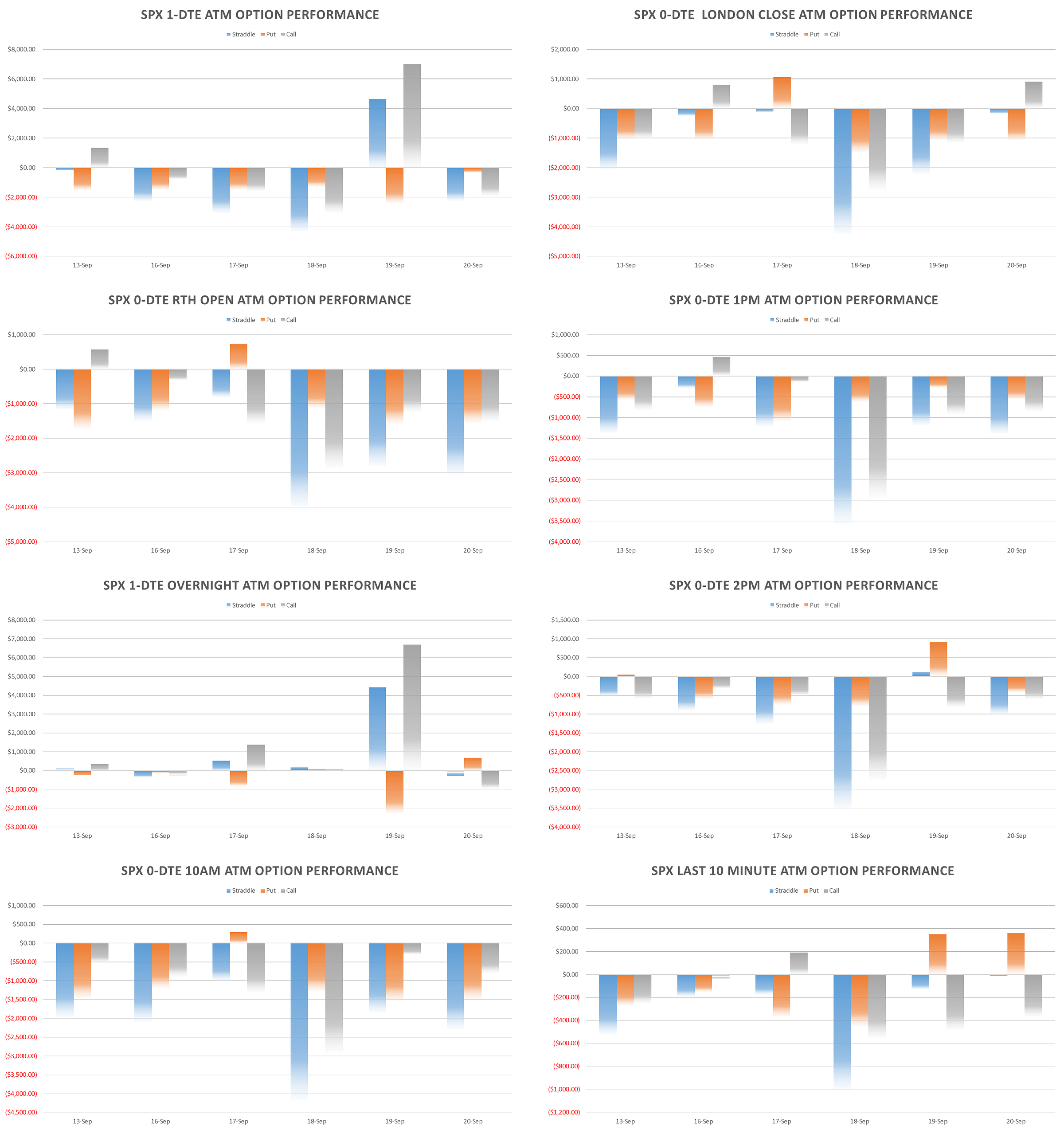

1-DTE SPX Straddles ended the week with a 50 bps weekend straddle, back to near ytd lows. Eyes are now on the election headlines, with October implied vol still showing wider than avg expected ranges. We are still in a seasonally weak period for equities, however, the post OpEx seasonality remains rather bullish:

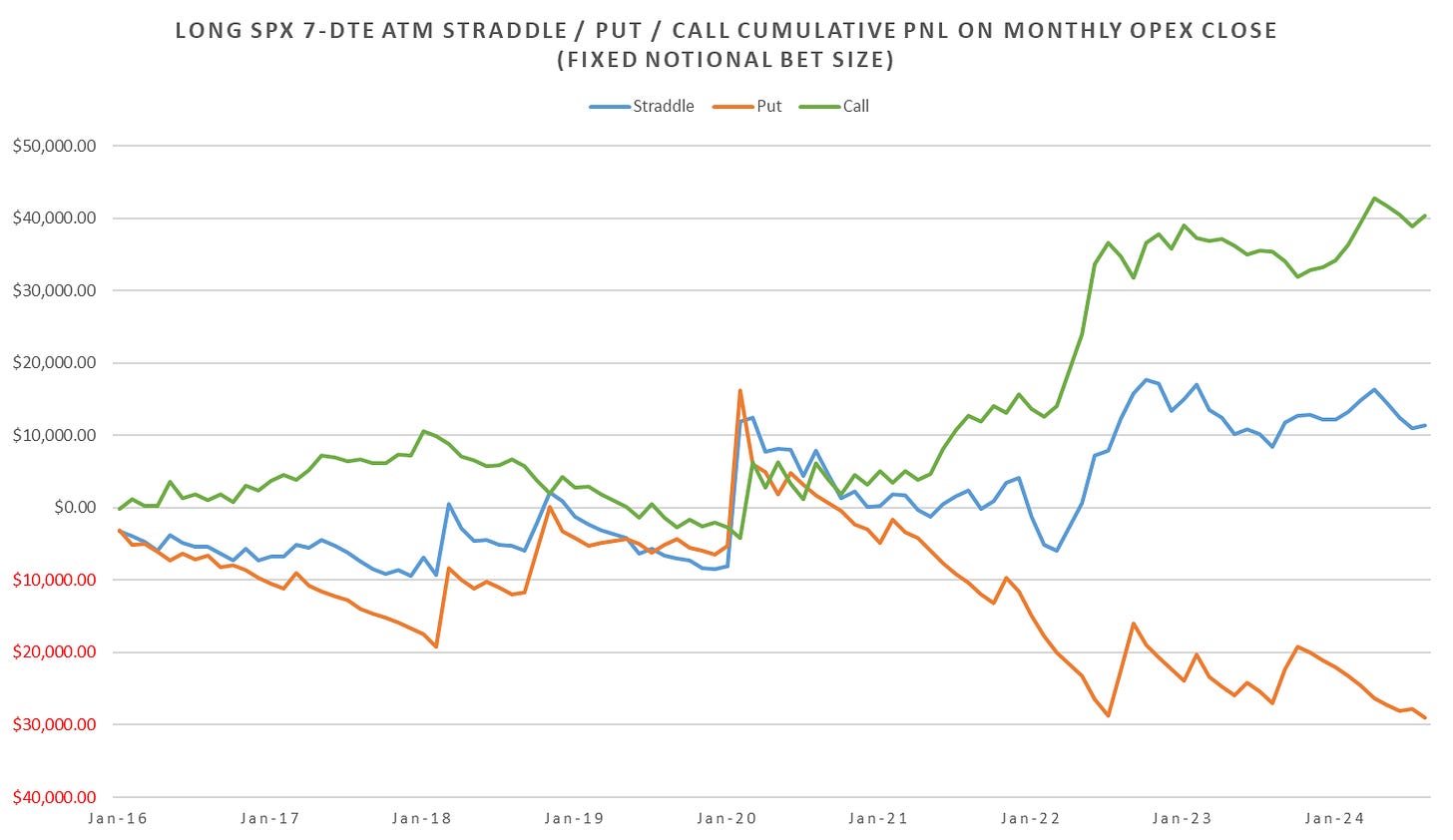

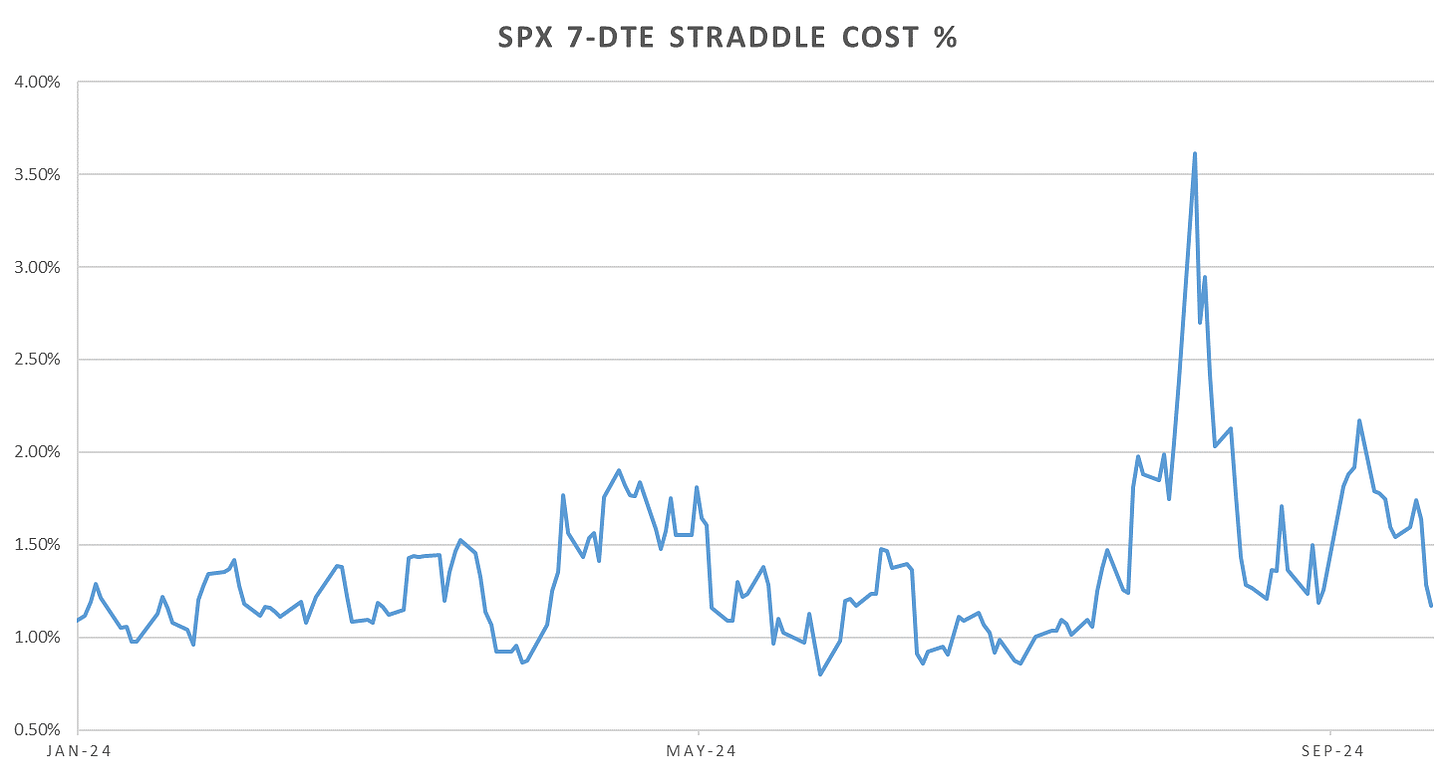

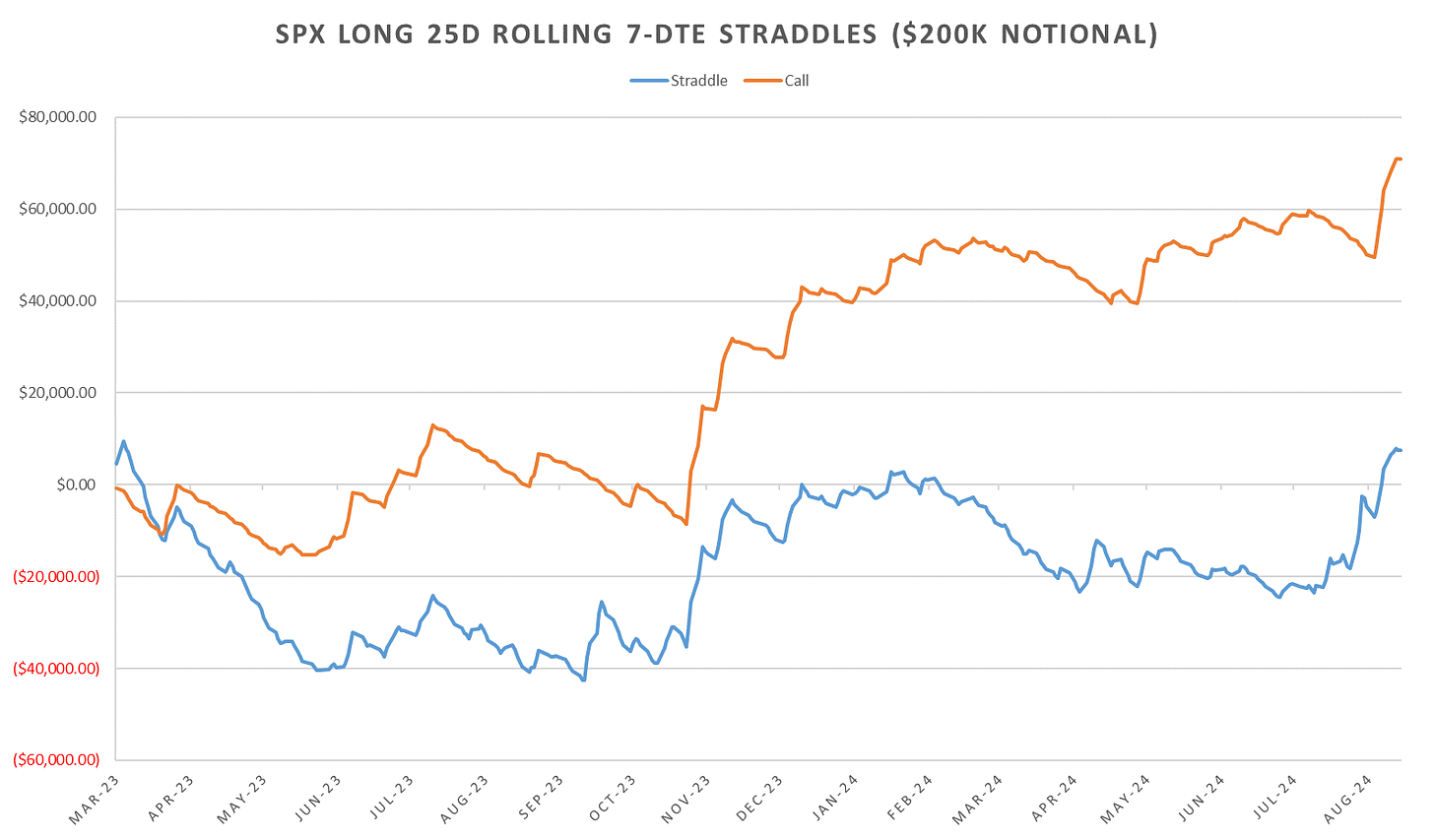

Weekly straddles are back to pre-August vol spike levels, trading just over 1% for next Friday. Looking back at the last few years, for both weekly & daily vol, ‘cheap’ straddles have been a great buy (in contrast to any sort of event or data premium.)

Outside of the post FOMC (overnight) rally, despite expectations, market has barely moved on a cl-cl basis last week as is evident from the massive premium burn on option structures (more below.)

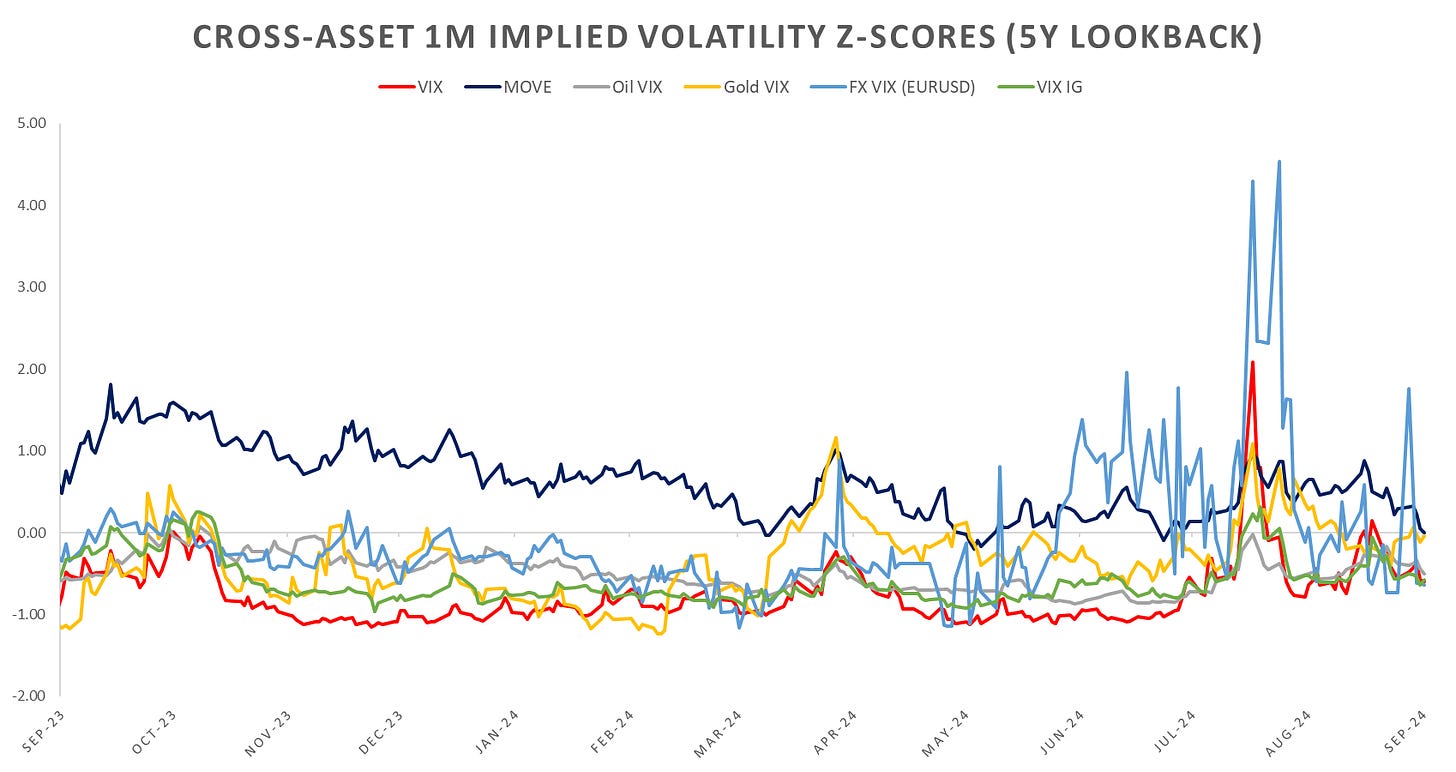

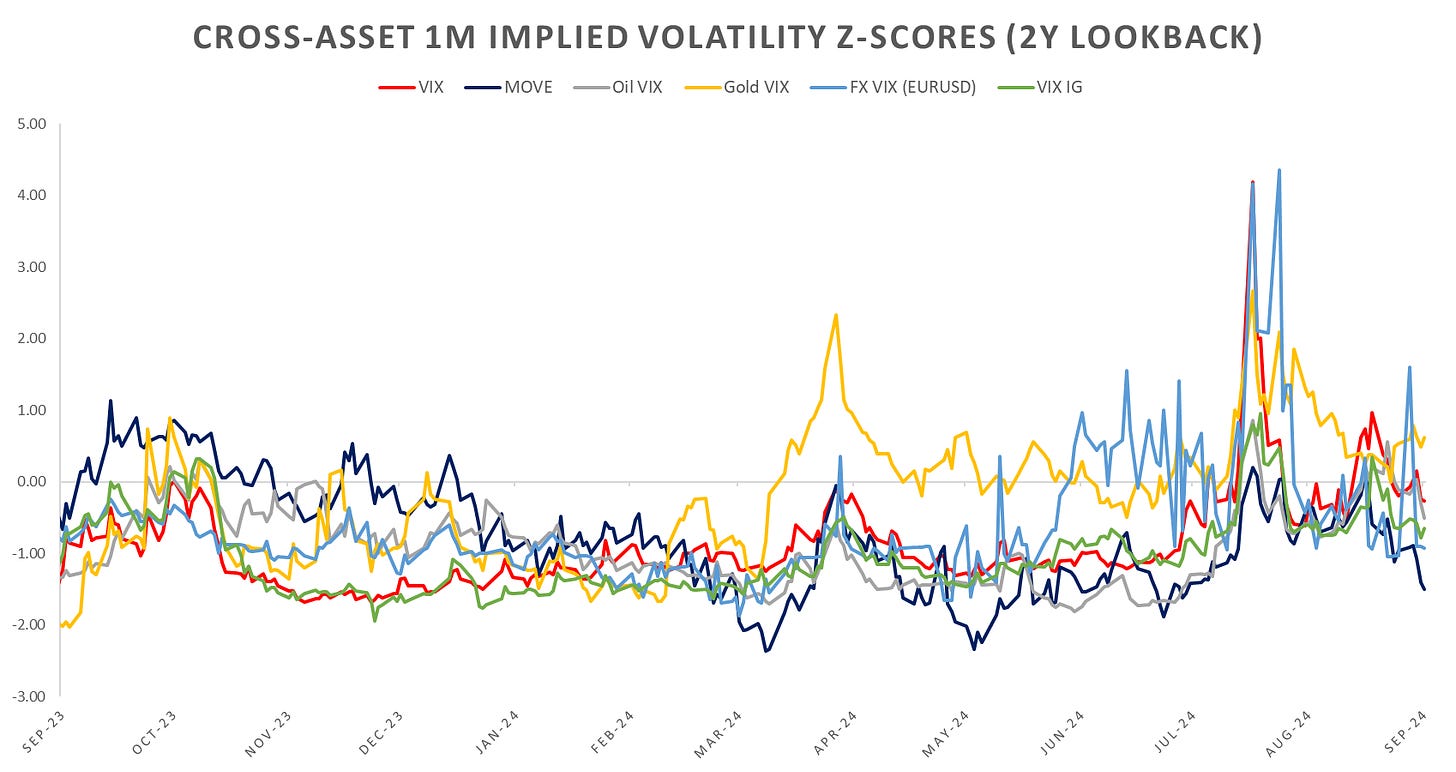

Cross-asset implied vols dropped back below their 2Y & 5Y averages. With the FOMC uncertainty behind us and implied vols coming off, tailwinds should take assets higher for the next week or two.

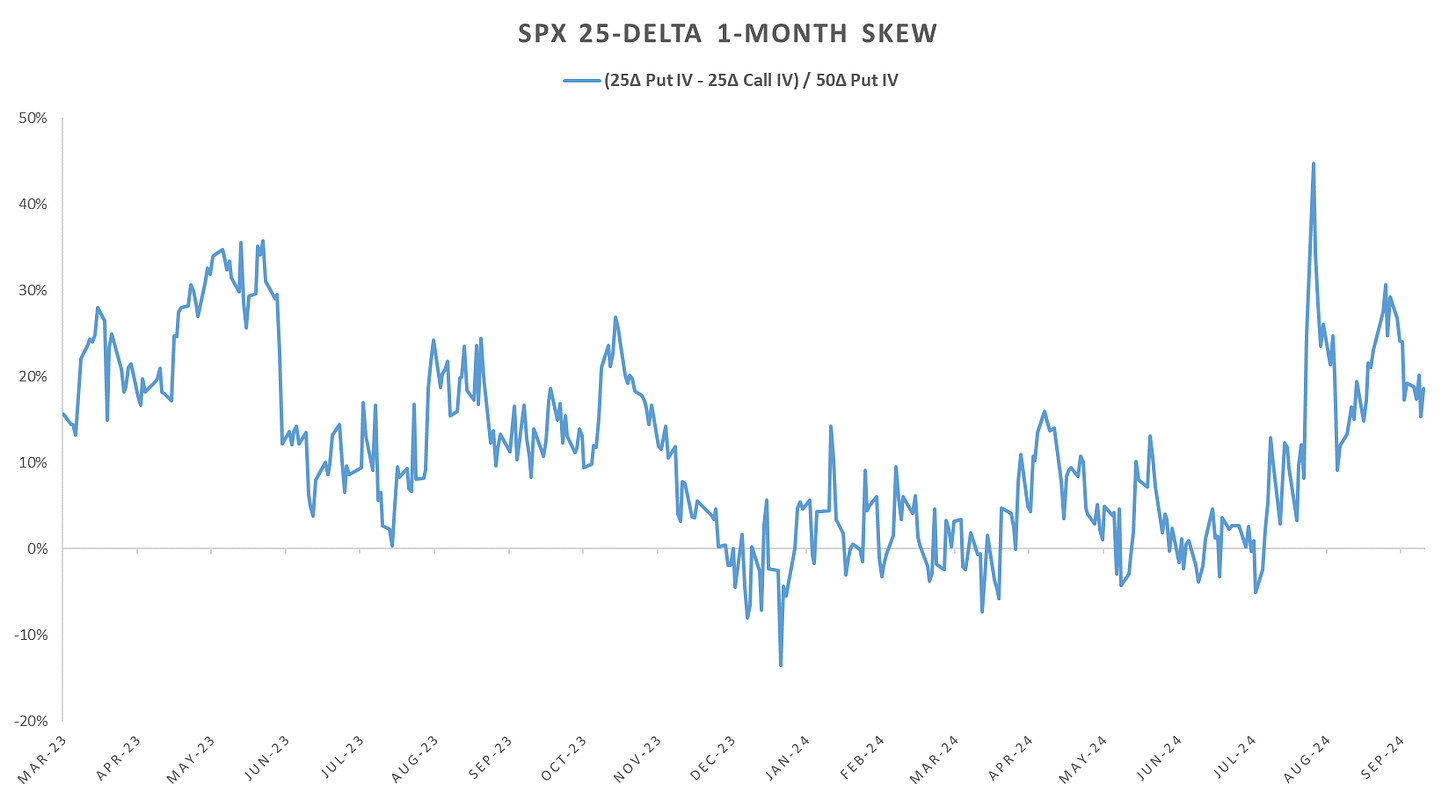

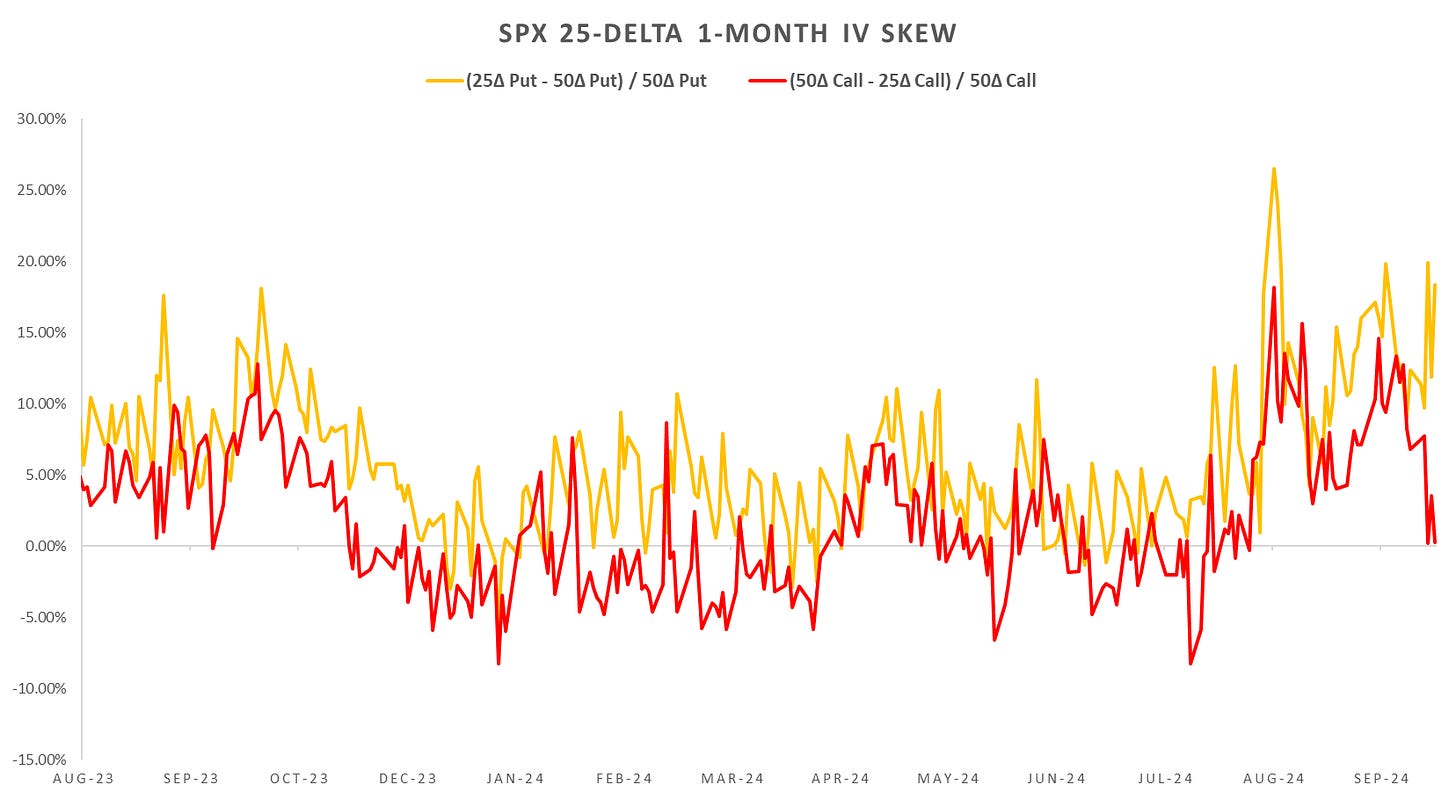

Notable divergence in skew last week, with call skew flat & put skew still strong (relatively cheap calls.) With explosive upside moves that we’ve seen this year and correlations notably higher on the back of rate cuts, upside vol is probably once again too cheap. Risk reversals or delta-hedged 25d 7/30-dte calls look like a decent play here to maintain some downside cushion.

Looking at intraday price action, from the following posts:

and the newest post:

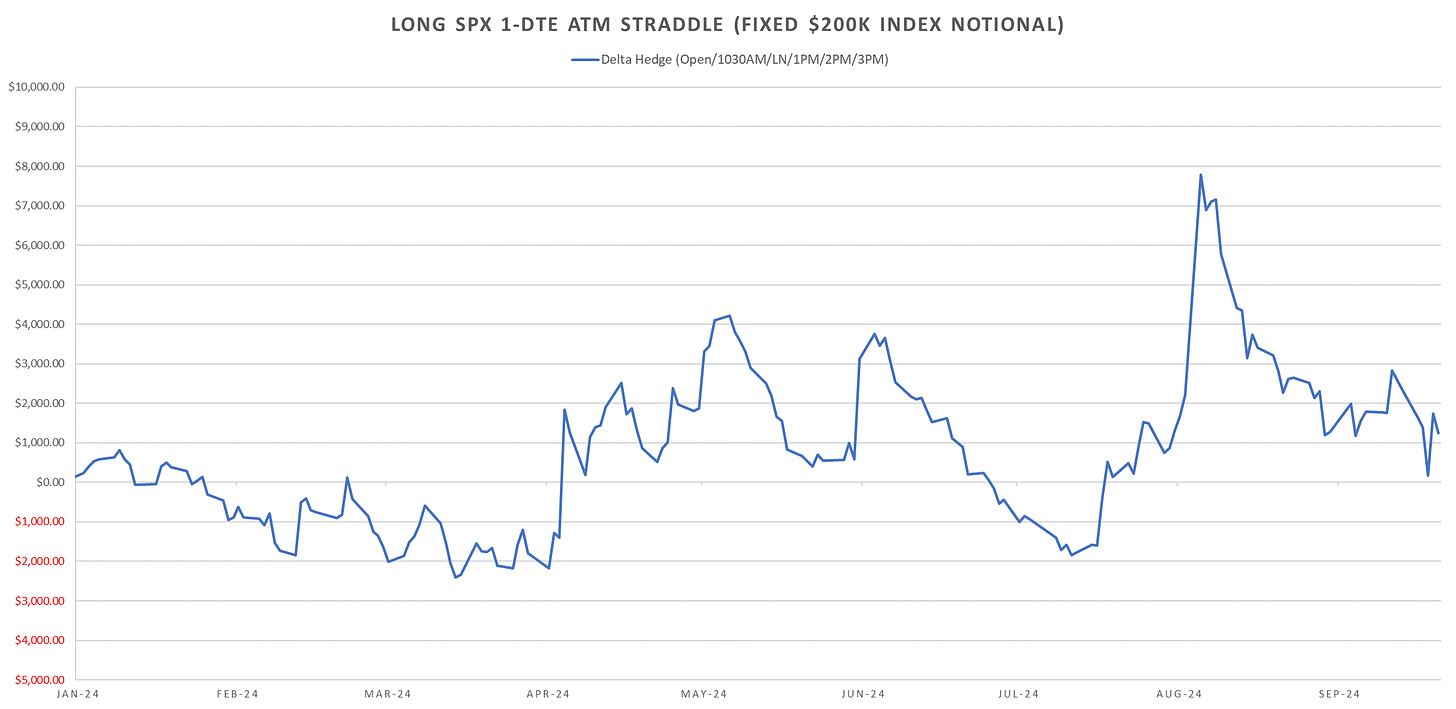

Long short-dated gamma down big last week (outside of Thursday massive gap higher.) Last week was filled with event premiums & data releases, with the market closing near flat for almost all of the days, straddles got destroyed.

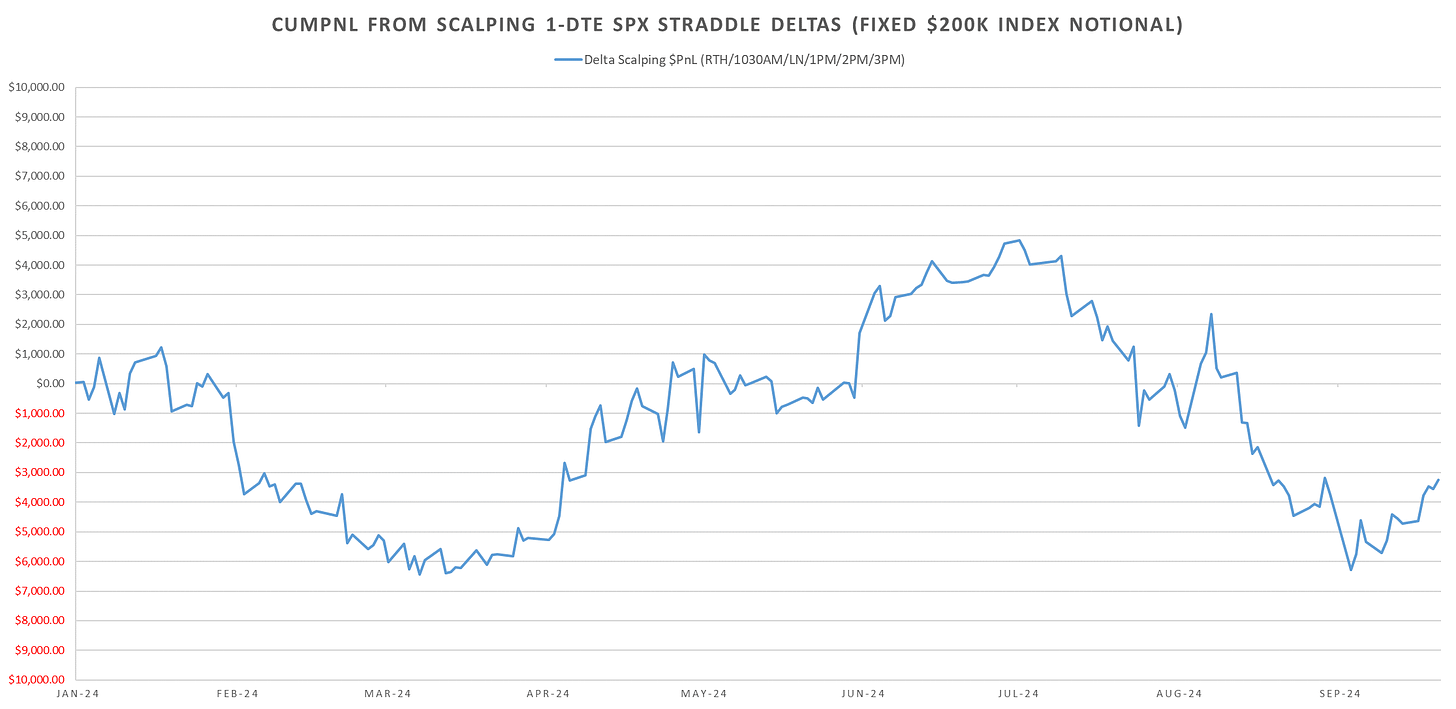

Scalping deltas intraday did well last week as we traded wider ranges with relatively flat closes. Expectations are, however, for a trending move going forward (more in Var Ratio section.)

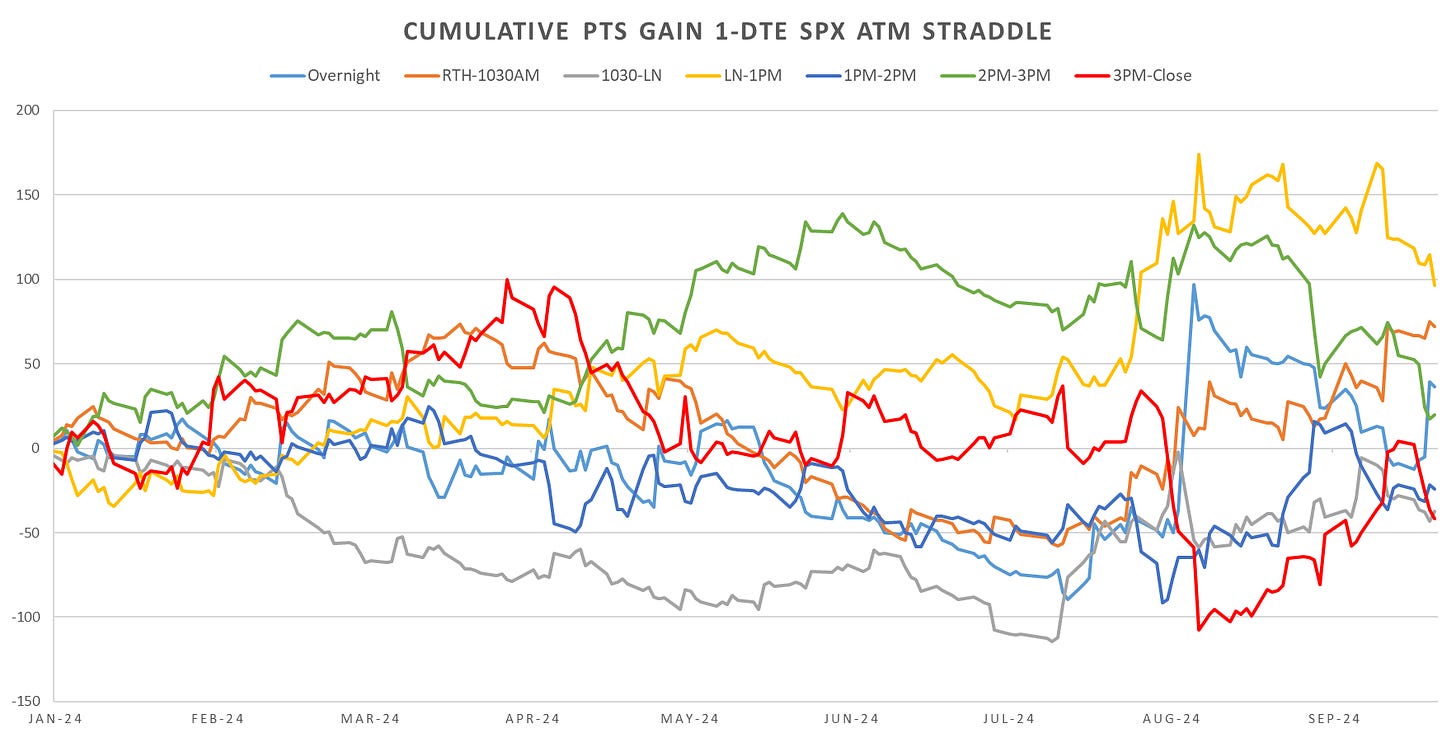

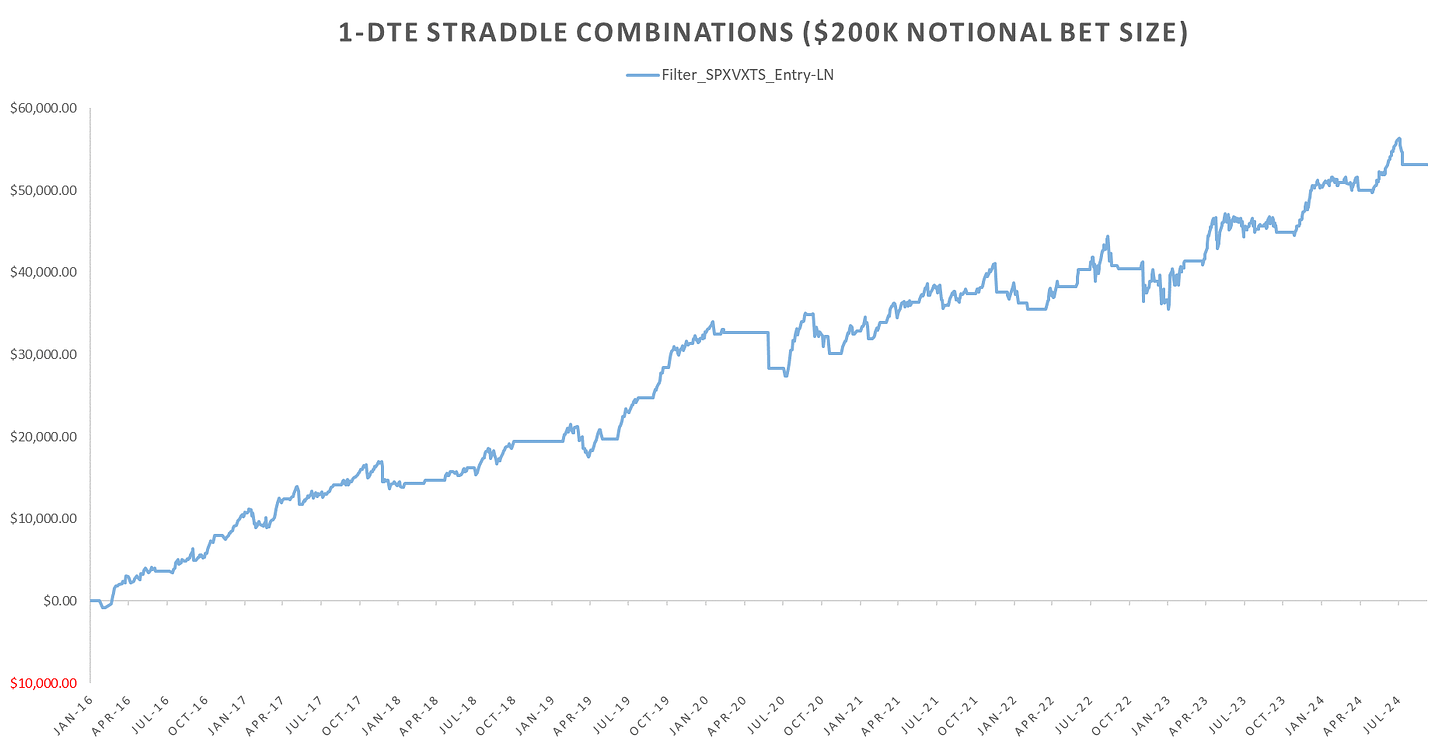

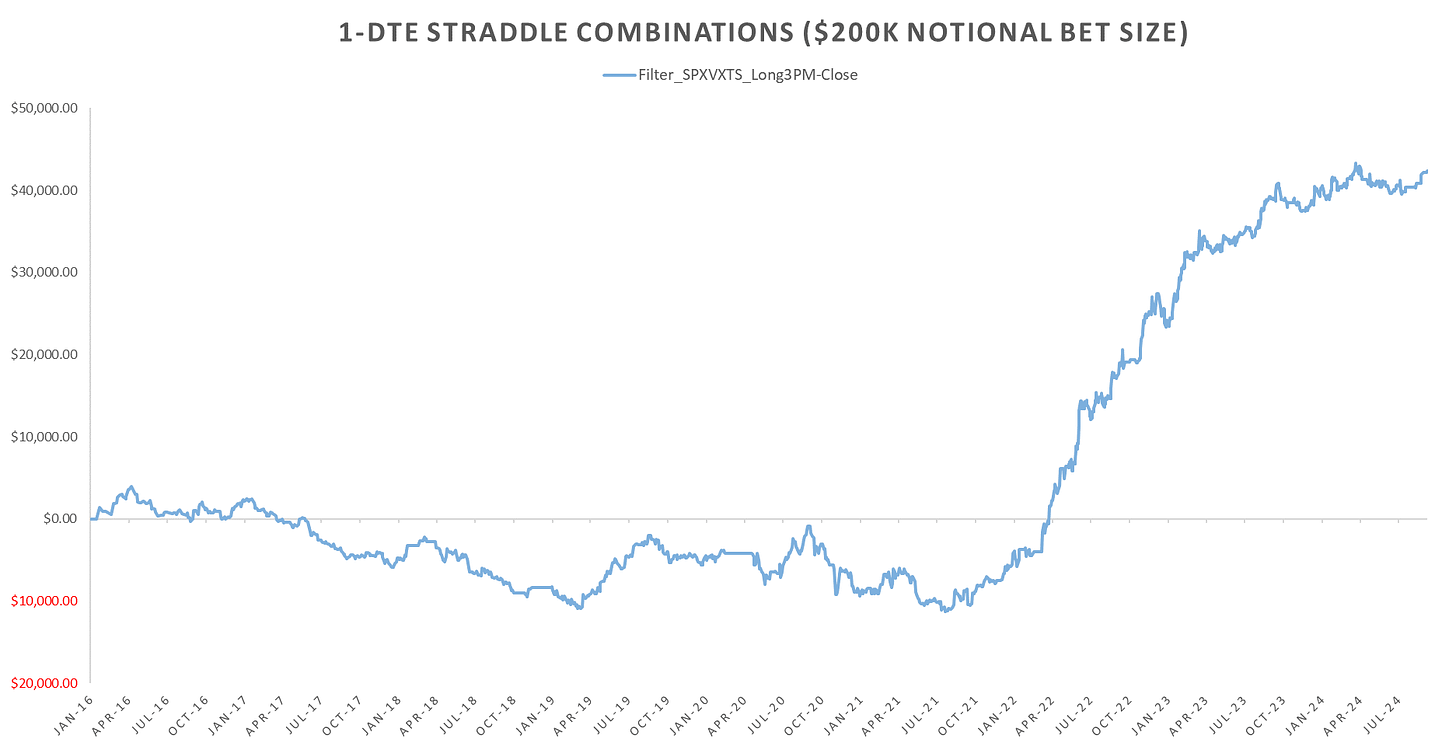

Looking at the 1-DTE Straddle cross-section, still seem to be in the similar mode from the August vol spike with the morning session rvol outperforming eod rvol. In the last weeks overview, I wrote that eod rvol was picking up but early morning vol was still high. After last week, SPX vol term structure back to ‘normal’ shape, looking at the last hour performance & early morning performance based on SPXVXTS filter, hoping the short am vol / long eod vol pattern returns.

More details on this in:

Realized Volatility Overview

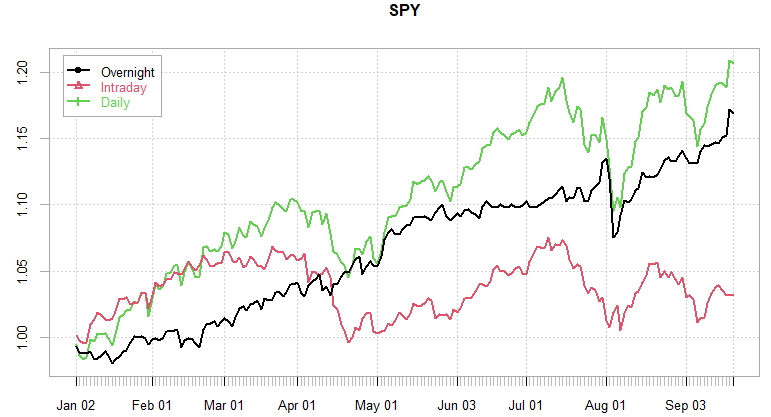

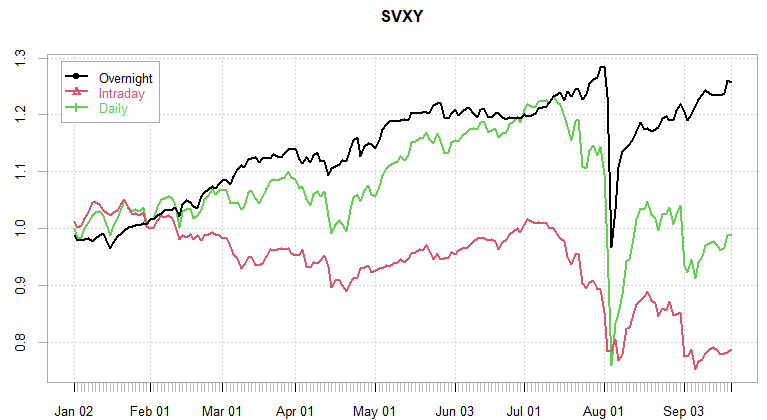

Another week where overnight performance dominates, extending the divergence between overnight/intraday returns to ~12% ytd. As mentioned, the overnight gap up on Thursday was the main move for the week with S&P closing unchanged on the rest of the days.

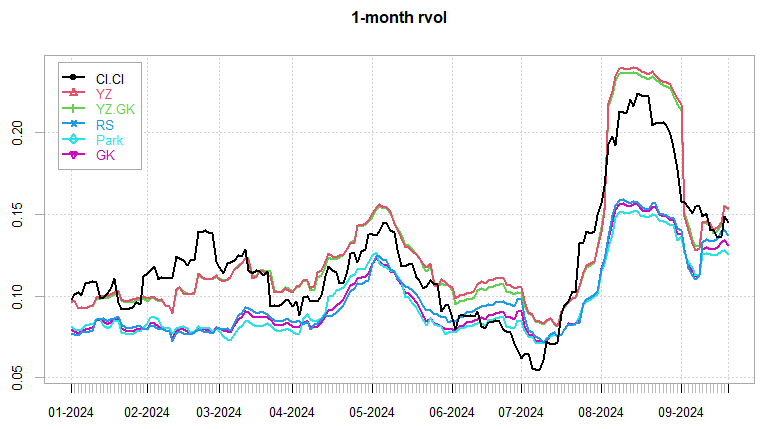

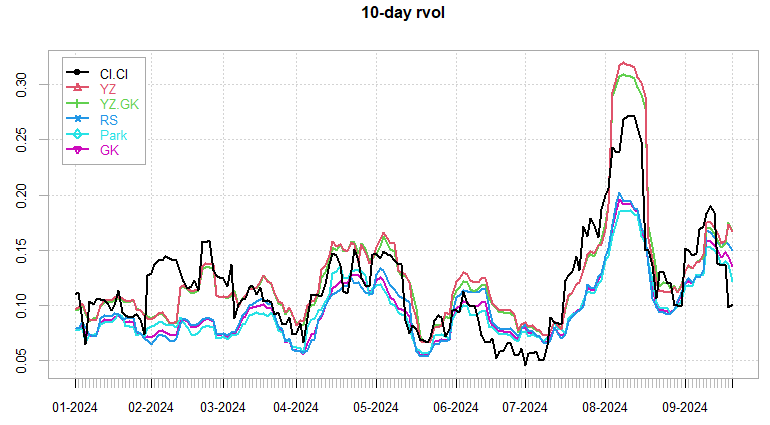

10-day rvol dropped down to post August lows on a cl-cl basis. Monthly vol lagging a bit due to the sharp upside rvol we’ve seen.

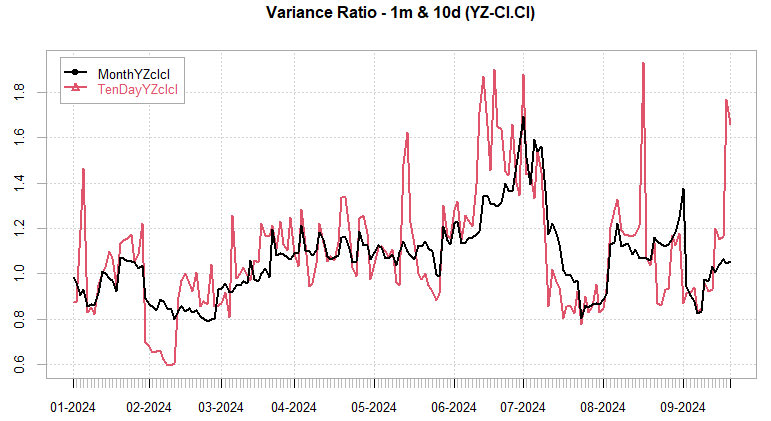

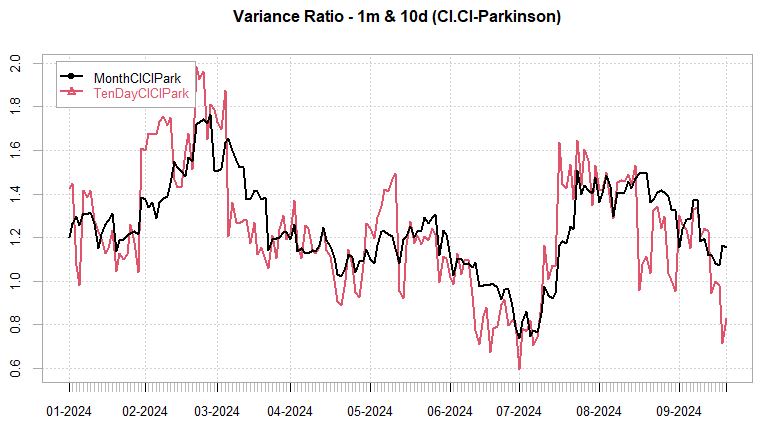

From the last weeks post: “Var Ratio’s showing a trending market right now, with strong continuation intraday. Not quite at the point to start betting on mean reversion intraday, although some short straddle trades showing up in the VarRatio systems.”

As of Tuesday, the mean reversion expectations were gone, now expecting trending price action intraday going forward. Last 10 days, highest mean reversion since July & mid August.

Inverse short-term VIX Futures indices continue to underperform ytd relative to how well equity indices are doing. I expect a lot of catchup post elections into year end…

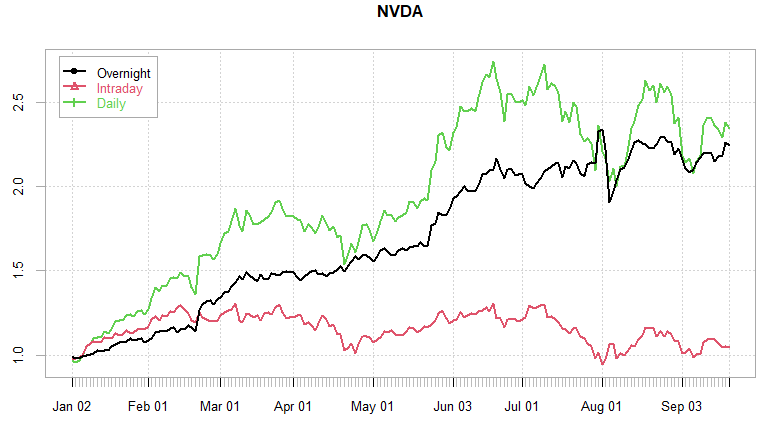

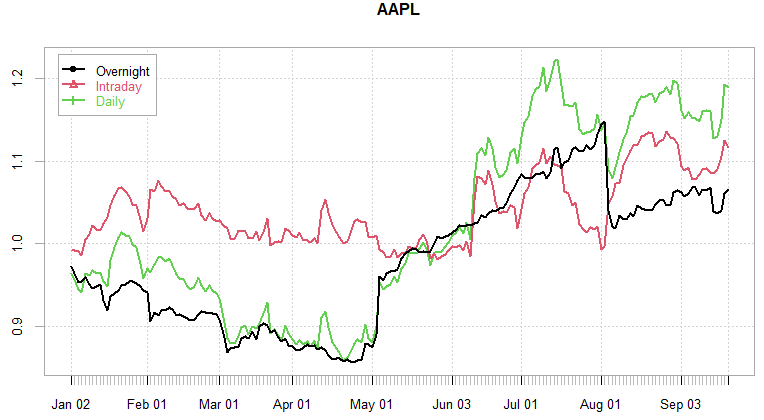

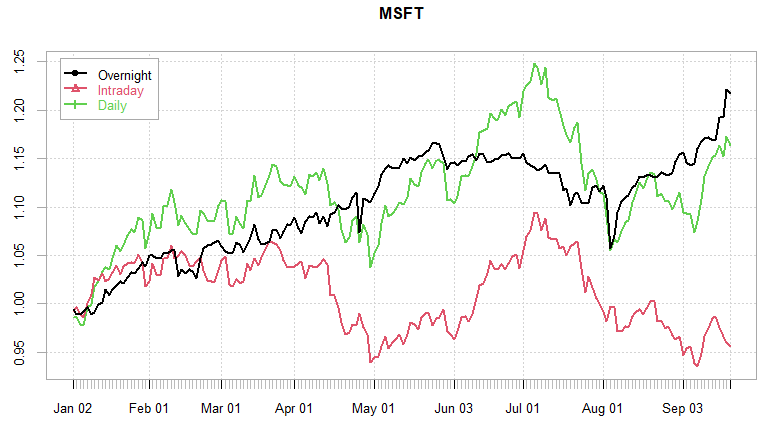

Had a look at NVDA/MSFT/AAPL performance YTD… 0% return intraday (AAPL slightly better), all the performance overnight… No wonder day trading is a losing proposition!

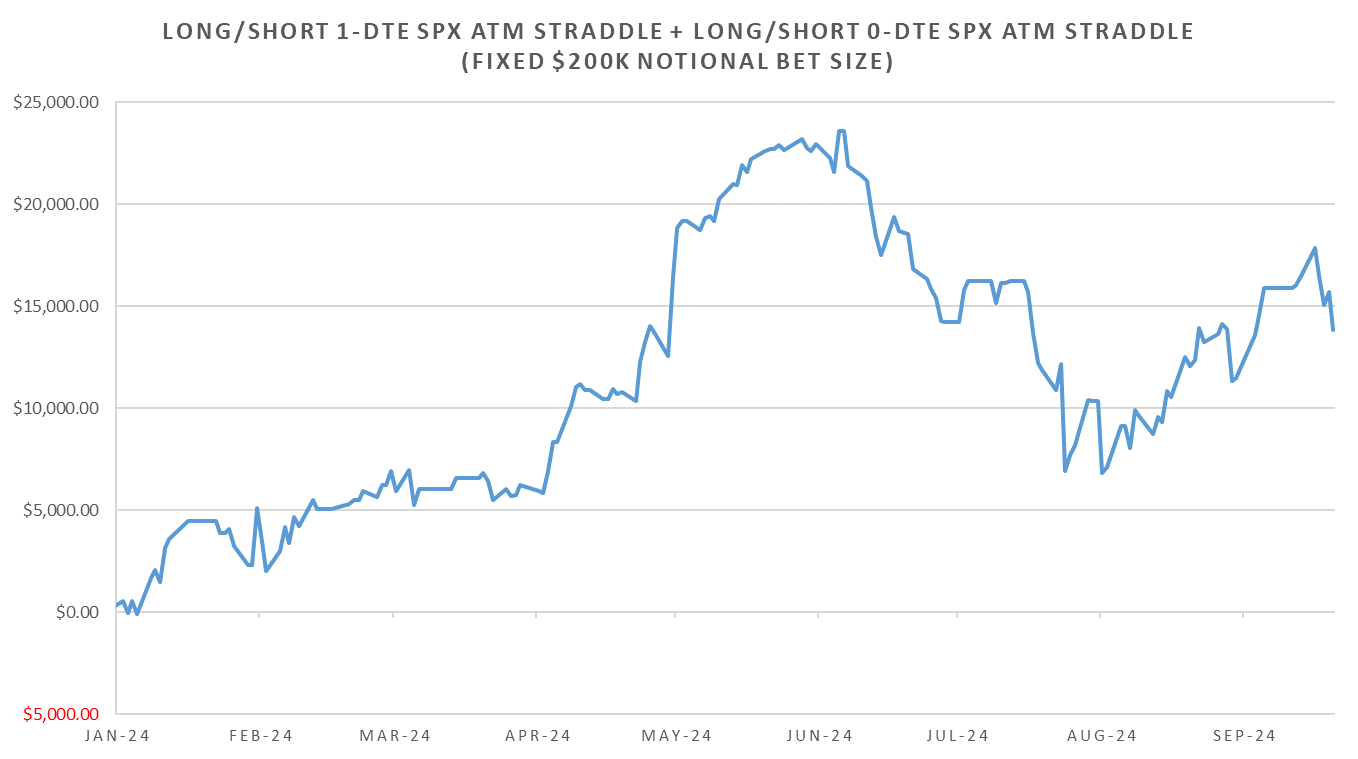

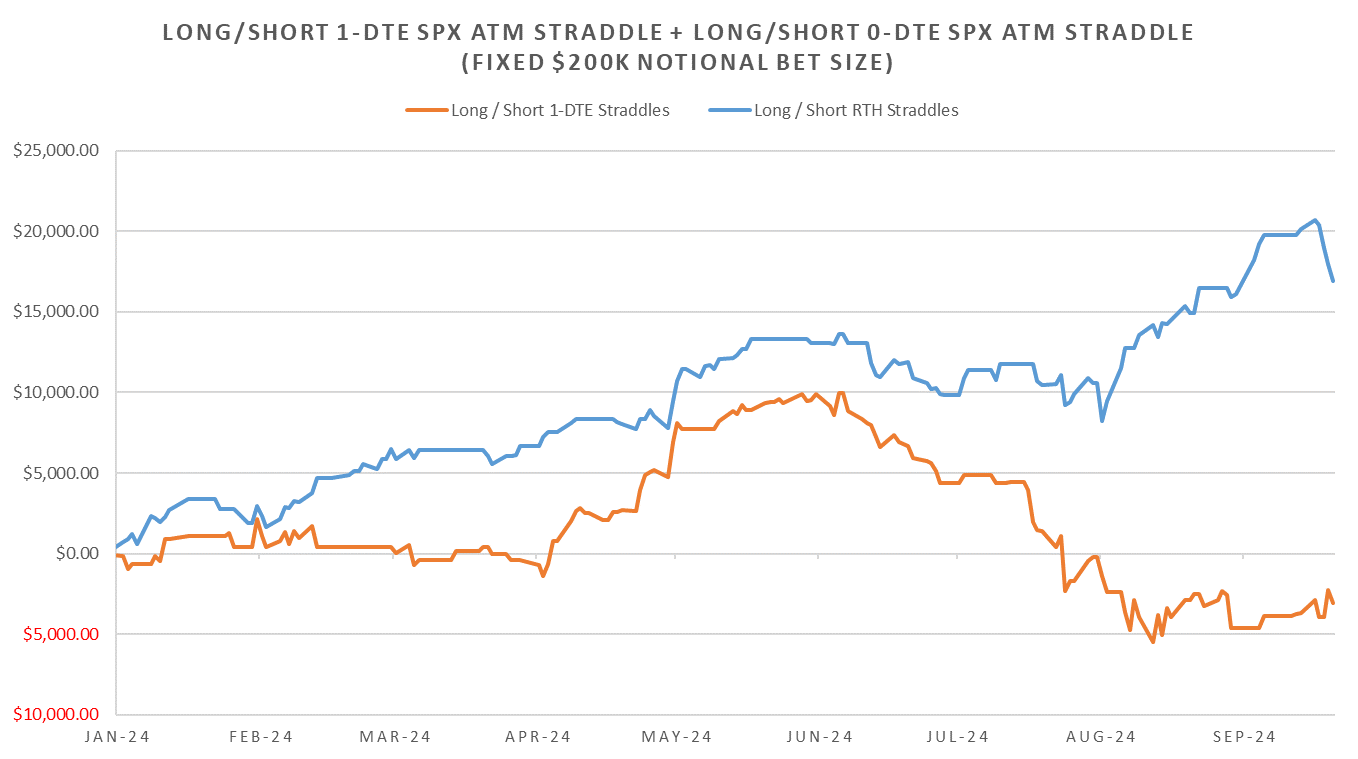

SPX ATM Straddle Performance

“A sea of red”… This was probably the worst week in years for 1-DTE long premium bets. Only holding overnight net up on the week, rest just destroyed. Weekly straddles did ok thanks to Thursday, outside of that, high mean reversion dampened the cl-cl rvol.

Variance Ratio Conditional Performance

From the following post:

VarRatio systems now expecting trending moves cl-cl. Last week finished on short straddle bets, however, starting Tuesday, all long trades throughout the week for 1-DTE and RTH legs… ouch

Overall, 1-DTE legs flat on the week, the RTH leg losses on Wed & Fri with expectations for a trending move gone wrong. Still, positioned long RTH & 1-DTE straddles for Monday.

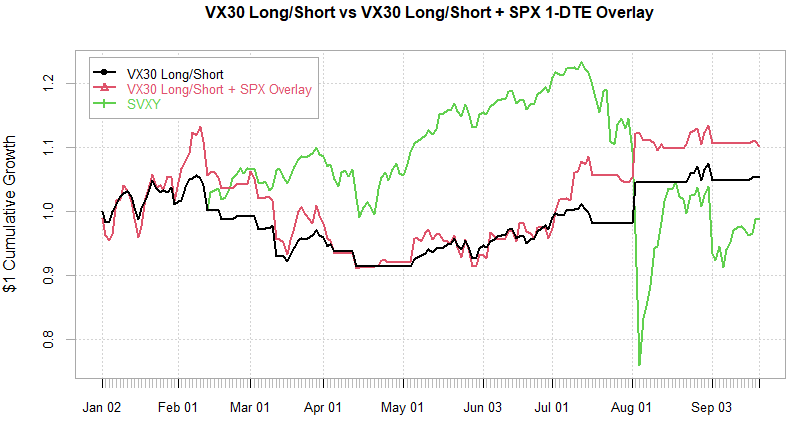

VX Carry & SPX Overlay

From the following post:

Short Oct VX triggered on Tuesday going into FOMC, whipsawed around flat twice. Going into this week short Oct VX from ~18.3. the SPX Overlay one trade last week (calls in Friday - loss.) Largely flat performance, gotta survive till November…

Have a good week!

A very insightful and broad perspective. Why though focus only ultra short-dated option vs. for instance monthlies? Cheers.