Following up on last weeks overview:

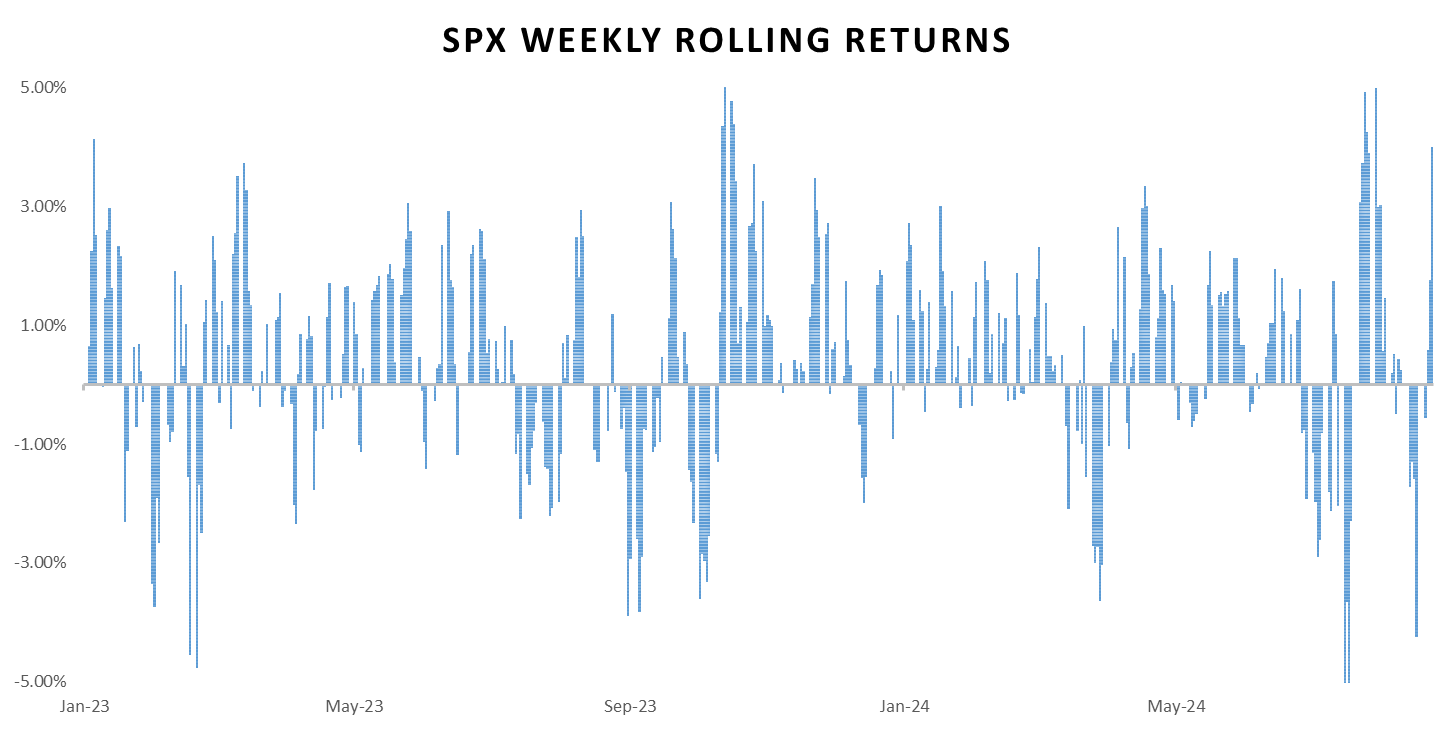

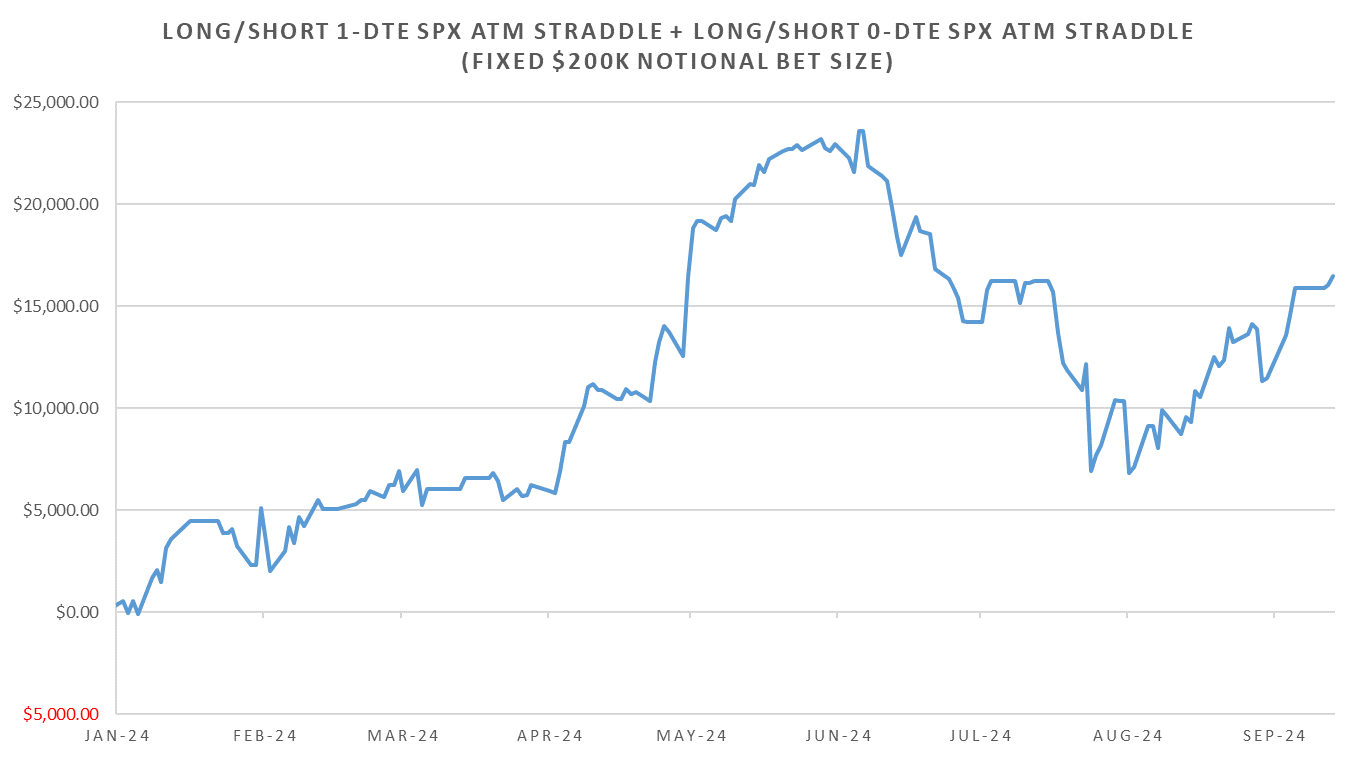

Previous week closed with the worst weekly return since the March 2023 SVB crash. As mentioned in previous post, the overreaction was driven by equity vol (which is rare.) By Friday this week, SPX has retraced the entire drop, closing flat relative to Tuesday Sep 3rd RTH open after putting in 5 green days in a row.

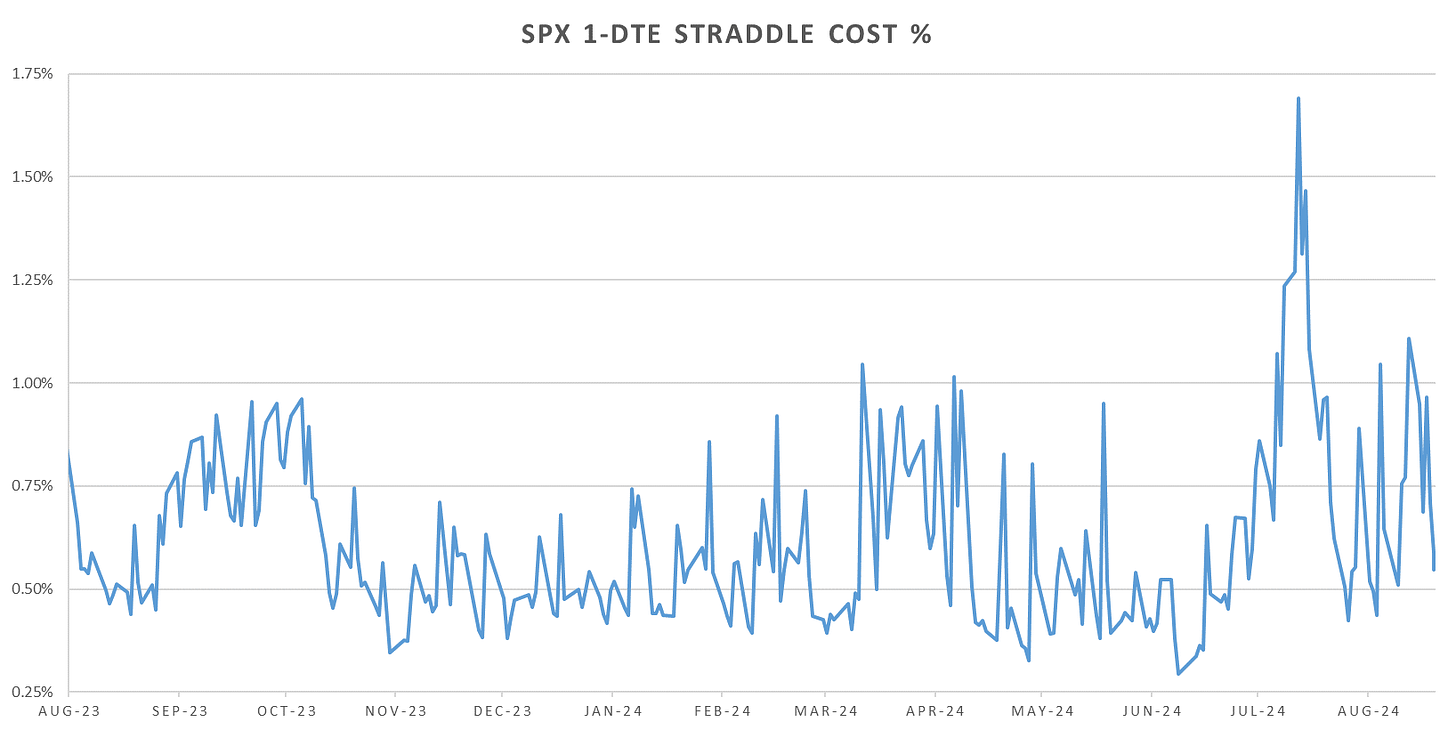

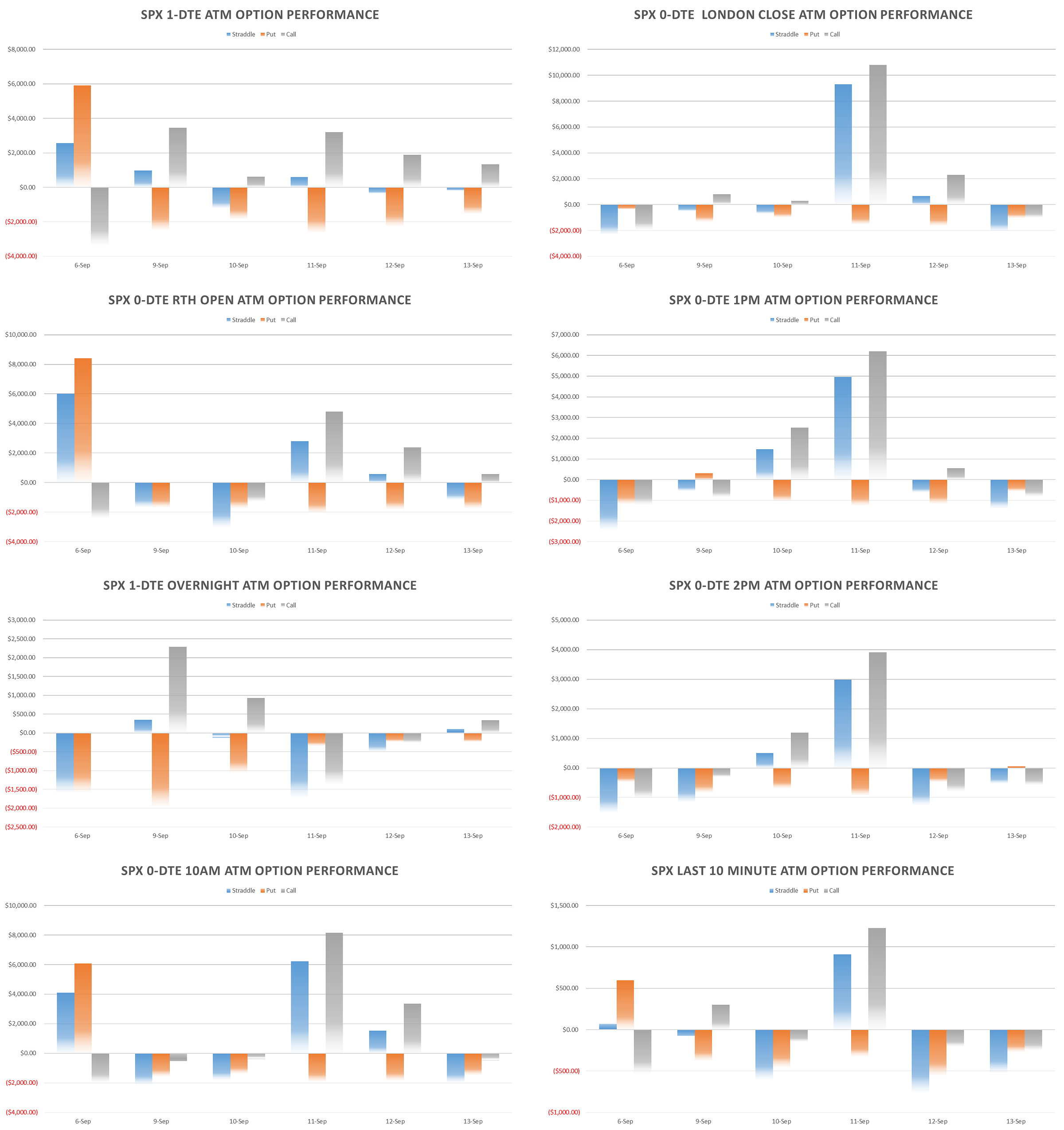

It was a wild week for 1-DTE options, over the last few weeks we’ve had 1-DTE straddles priced at 1-year highs & near 1 year lows (closing for the weekend at roughly modal price.)

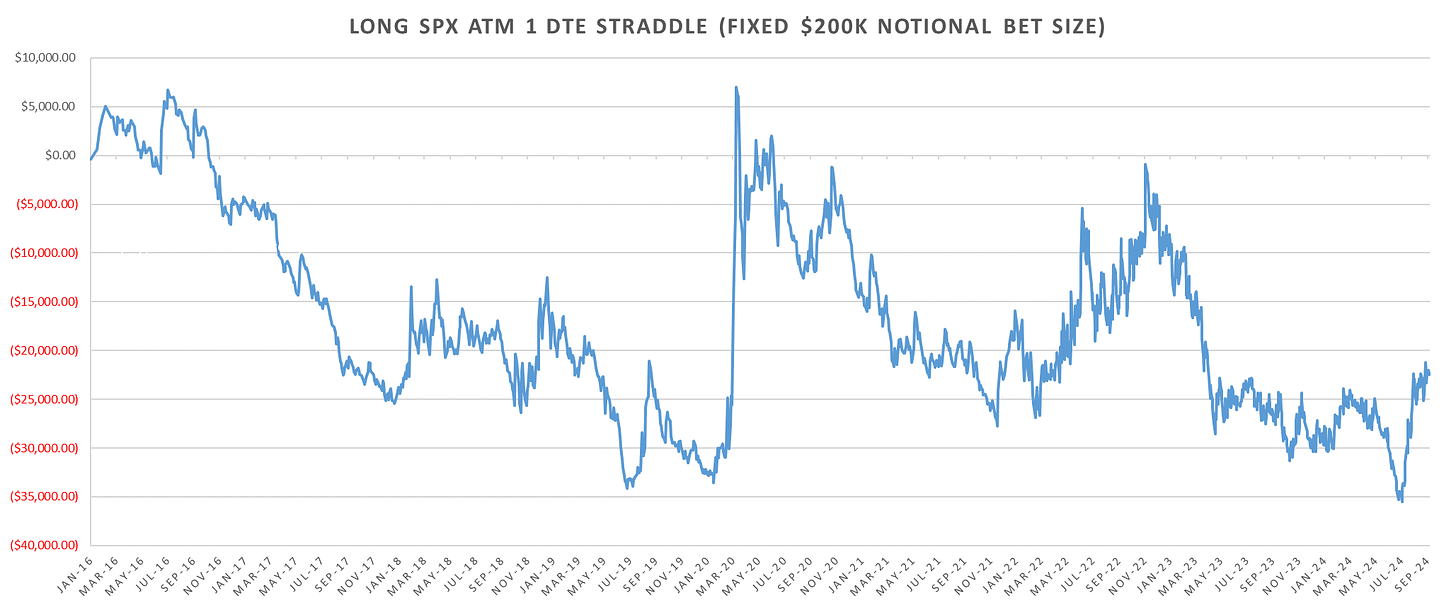

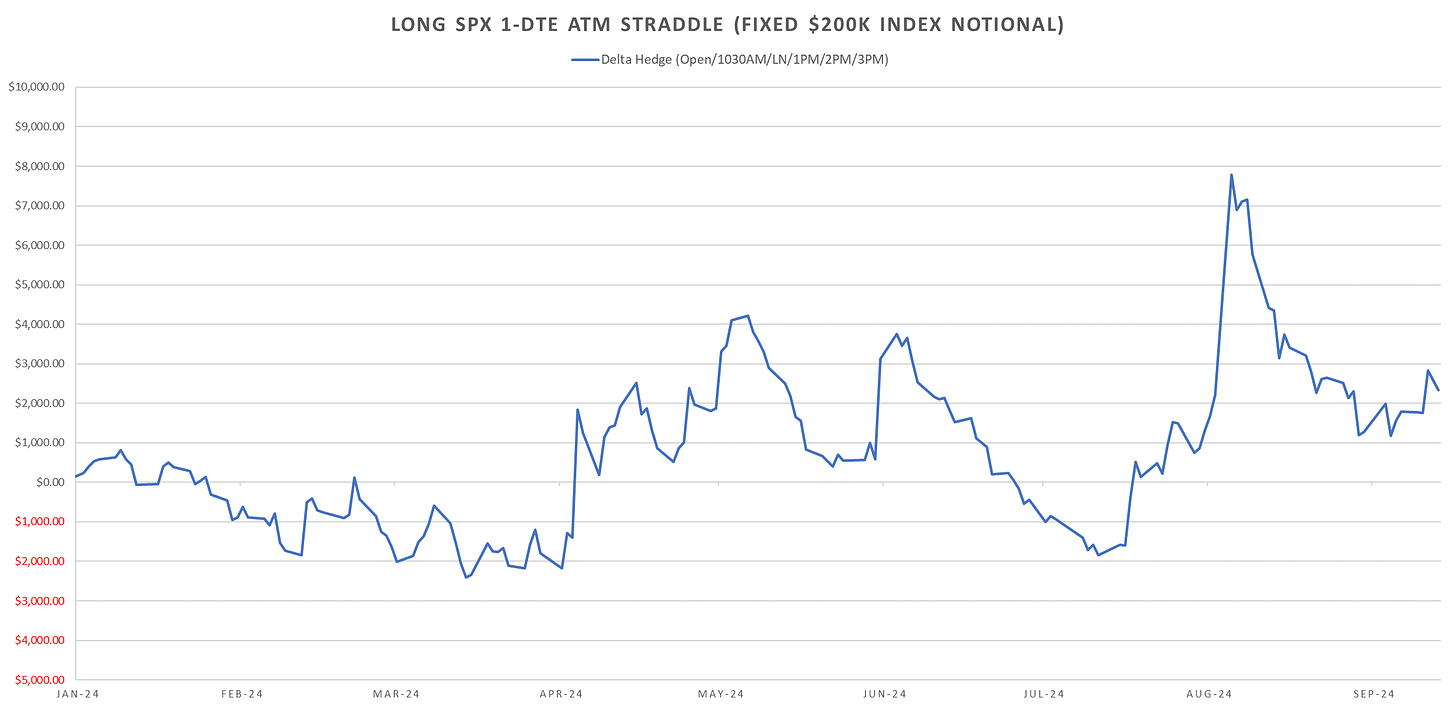

1-DTE rolling long straddle performance has not given up any gains since the BoJ vol spike. Erasing all losses since March 2023. We continue to realize volatility slightly above implied over the last month and a half.

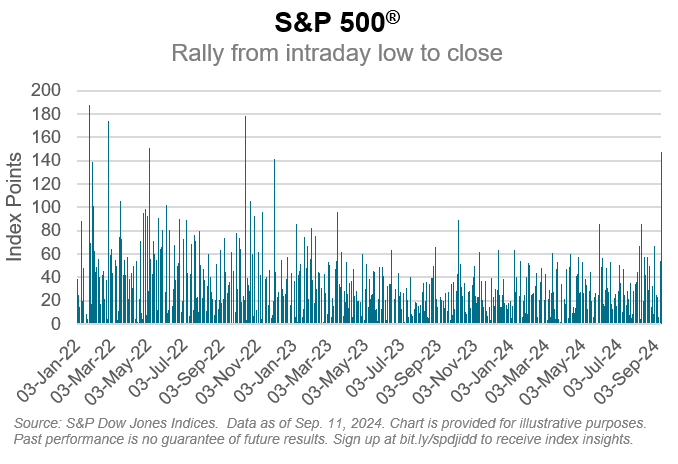

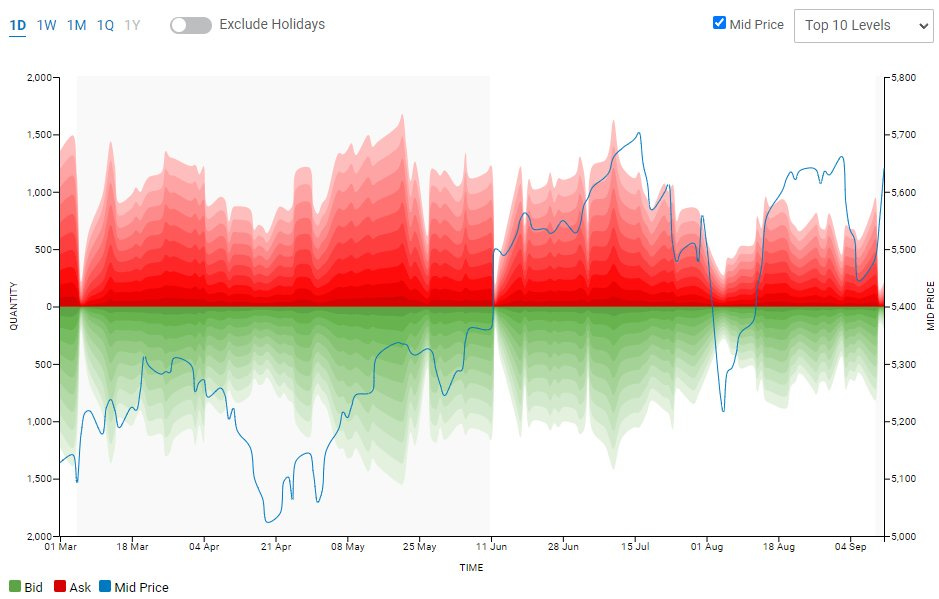

Wed CPI reaction saw one of the largest intraday market moves since 2022. Liquidity dropped off sharply towards eow as the roll to Dec contract started, nevertheless, might have contributed to the wide moves we saw after Wednesday CPI release.

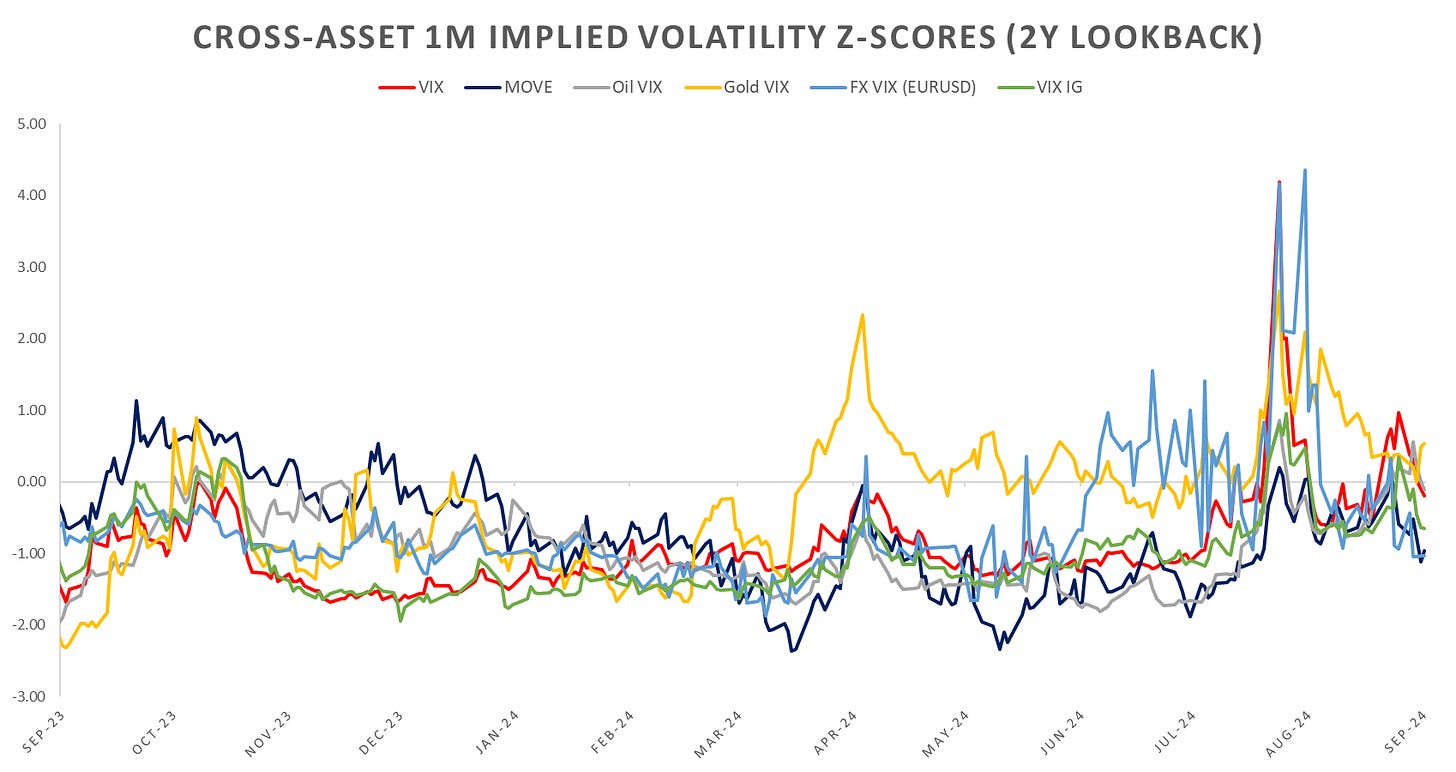

Looking at cross-asset vols, last week majority faded back below their 5Y & 2Y averages yet still remain well off July lows. I don’t see vols being week till after the November election.

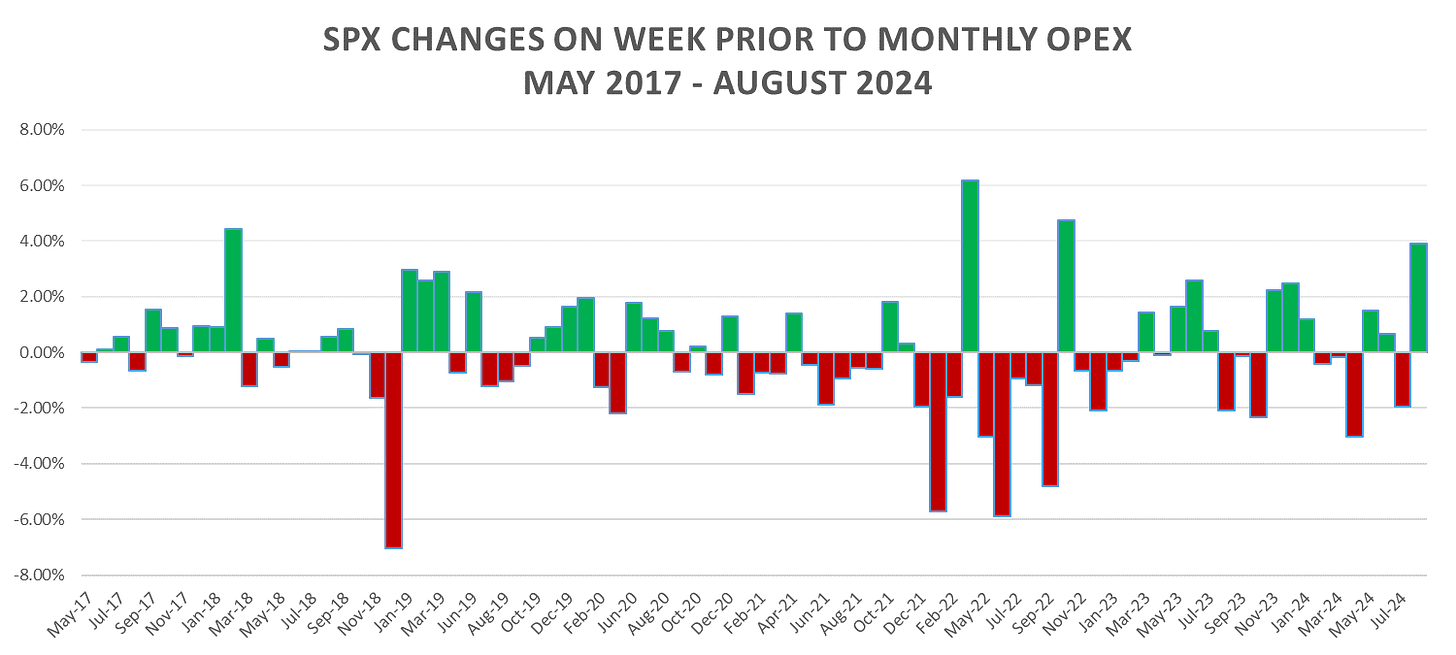

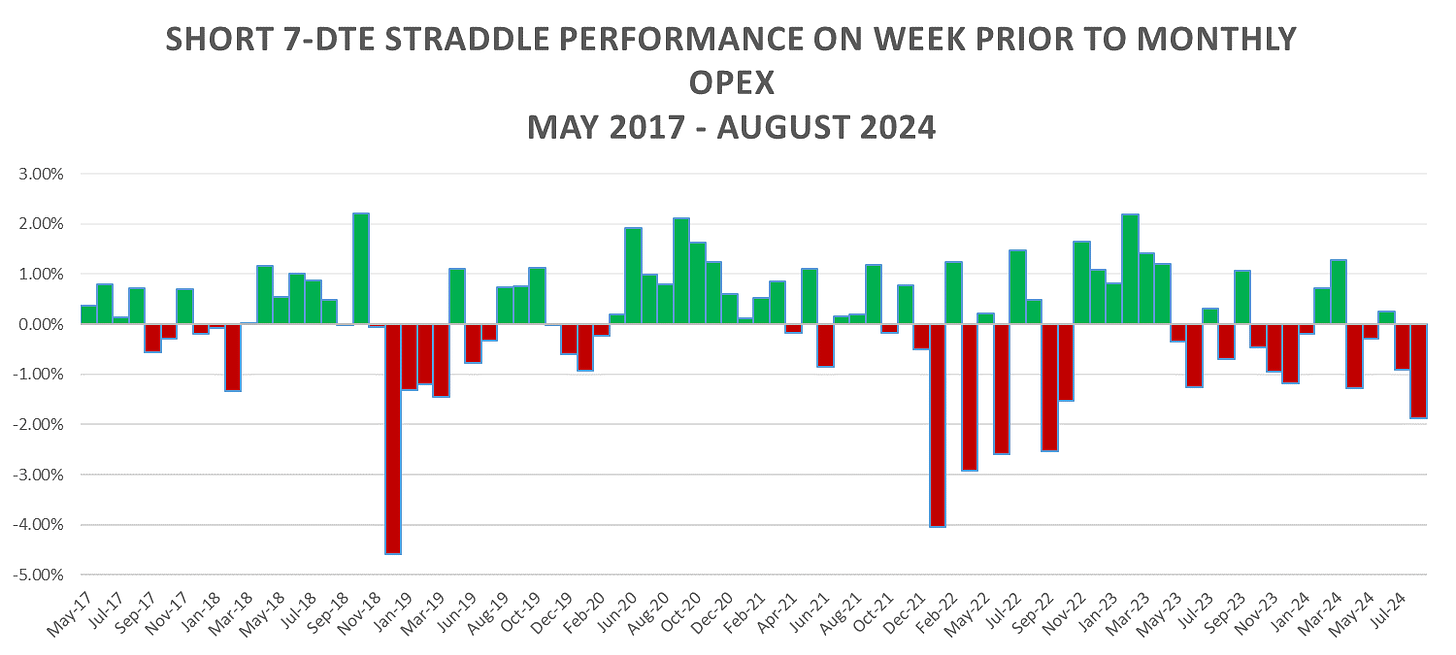

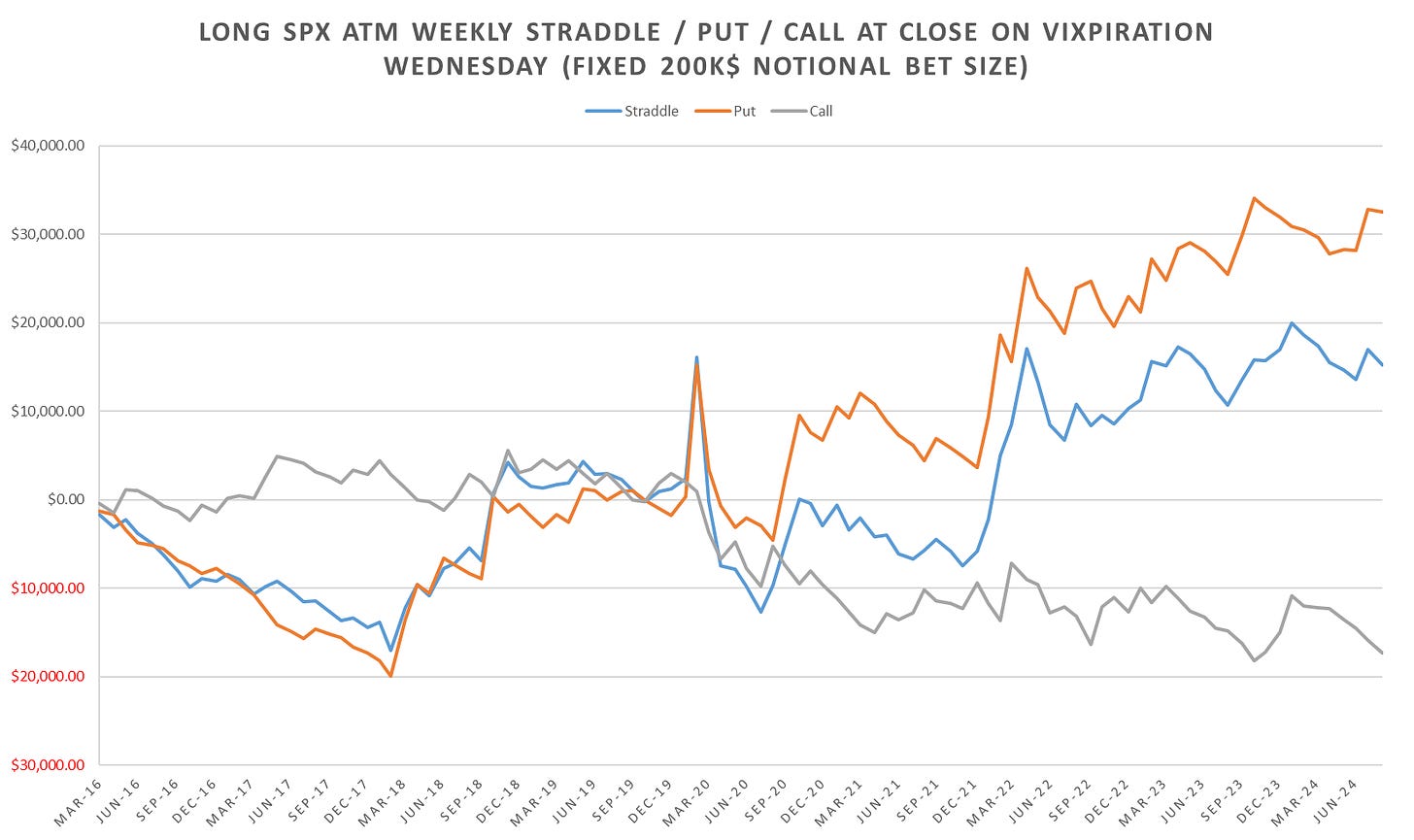

We are going into quarterly OpEx week on Monday, as mentioned previously, week going into OpEx has been decently volatile in both directions. Given the worst seasonality over the next few weeks I have a bit of a bearish lean but having long vol positions for this week should still do decently (especially given markets are clearly free to move on higher implieds and bid put / call skew.)

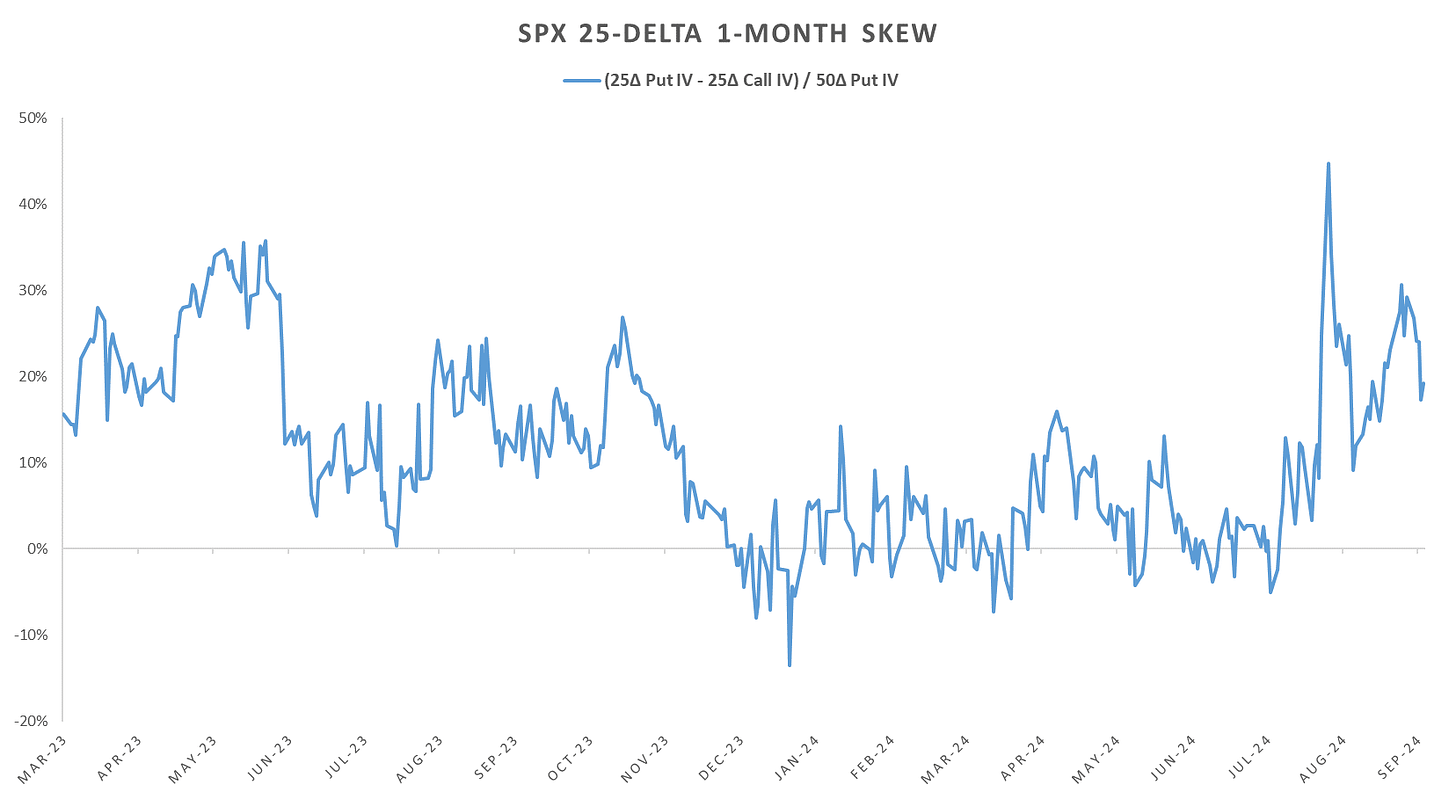

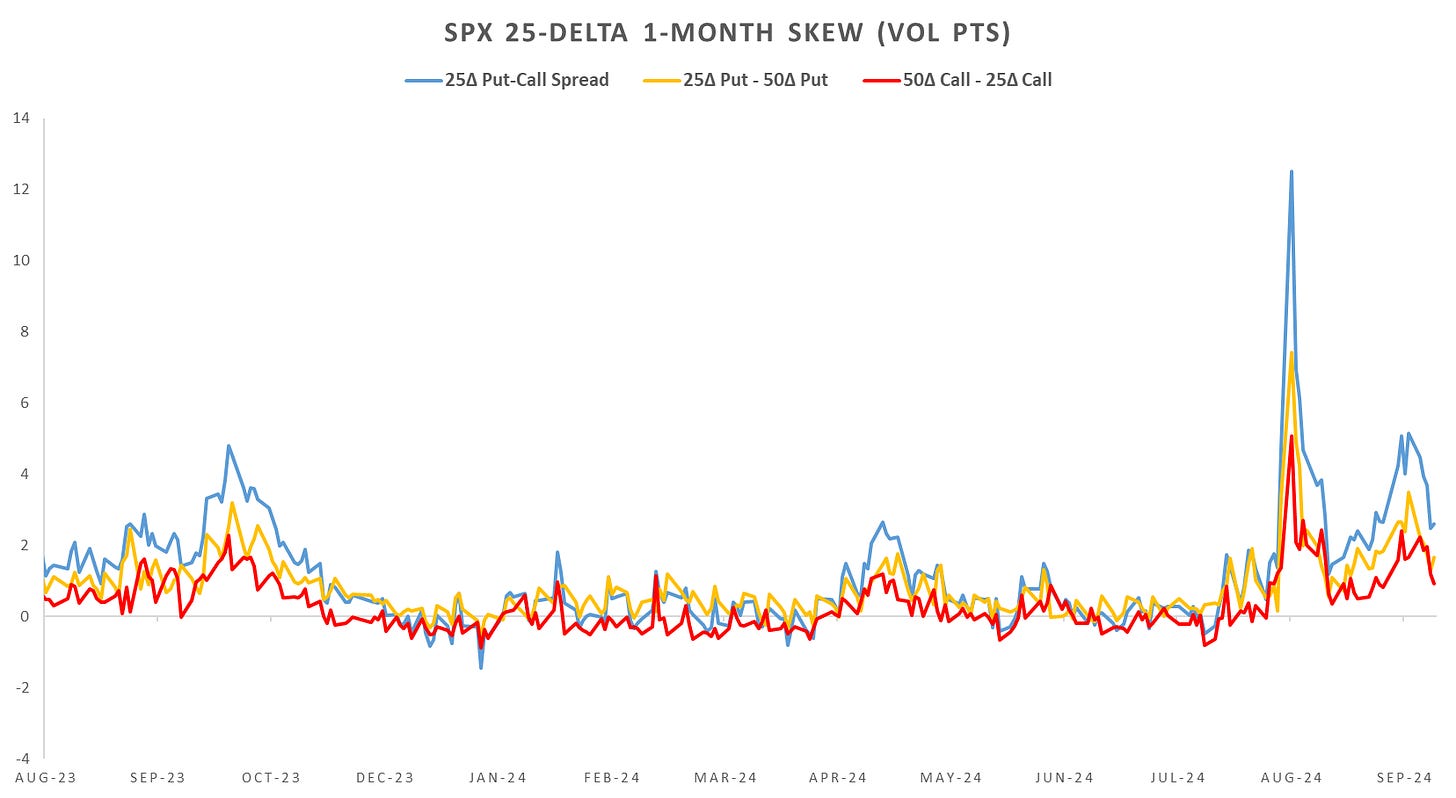

Looking at SPX skew, despite market being just 50pts away from a new ATH, put skew remains well bid (FOMC & election hedges I assume.) Put skew eased more last week than call skew but both remain at March 2023 levels.

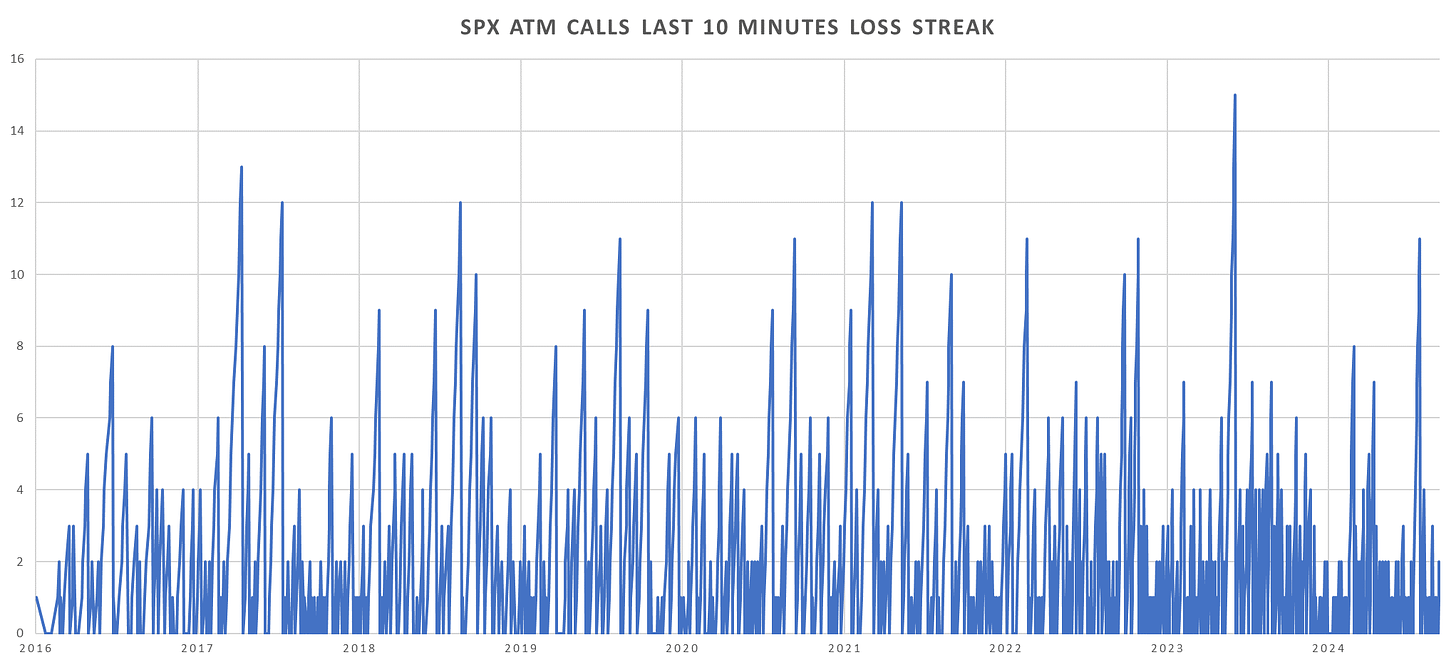

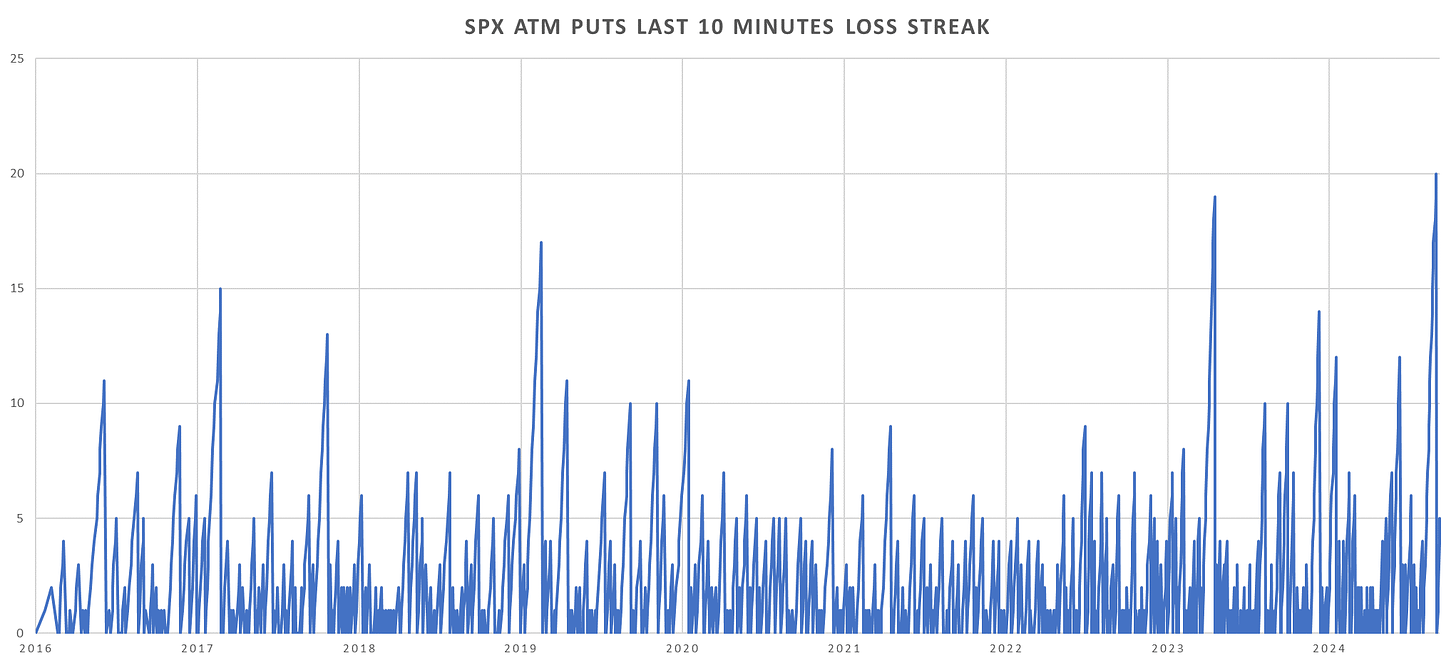

Post BoJ crash, market looks increasingly panicky to the upside. I highlighted the call loss streak going into end of July for the last 10 minutes. I am not sure if its any indication of large flows deleveraging into eod, but from August 6th to September 5th puts have lost !20 trading days in a row (with calls up ~42 pts in the meantime.) That’s the largest put loss streak since 2016… I would guess given the deleveraging that occurred around Aug 5th (from volatility triggers) there was the opposite panic to buy it back (exacerbated into eod.)

Looking at intraday price action, from the following posts:

and the newest post

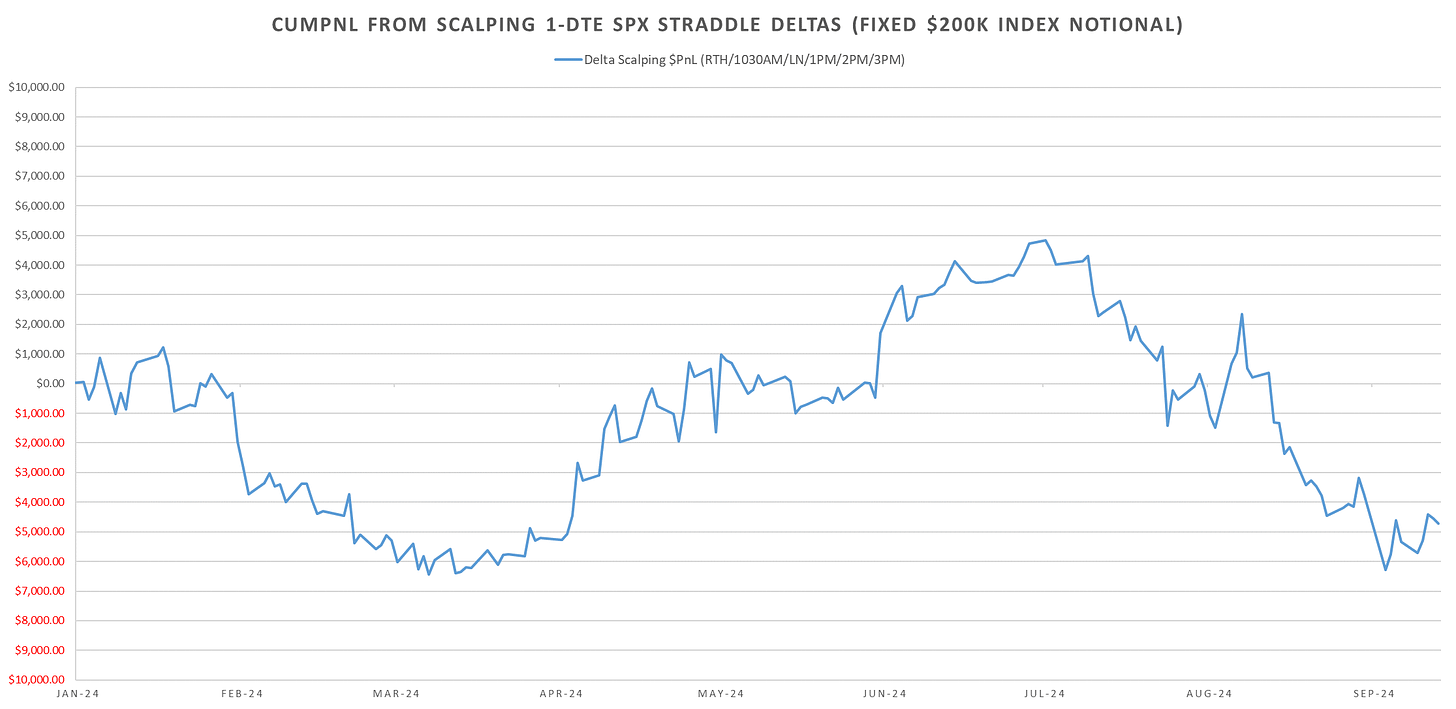

Long short dated gamma did ‘ok’ last week on the sharp intraday reversals & negative implied/realized vol spread. Both the delta scalping ended the week positive and the 1-DTE straddles did well.

This was a wild week with multiple outsized moves, yet long 1-day gamma still barely up on the week…

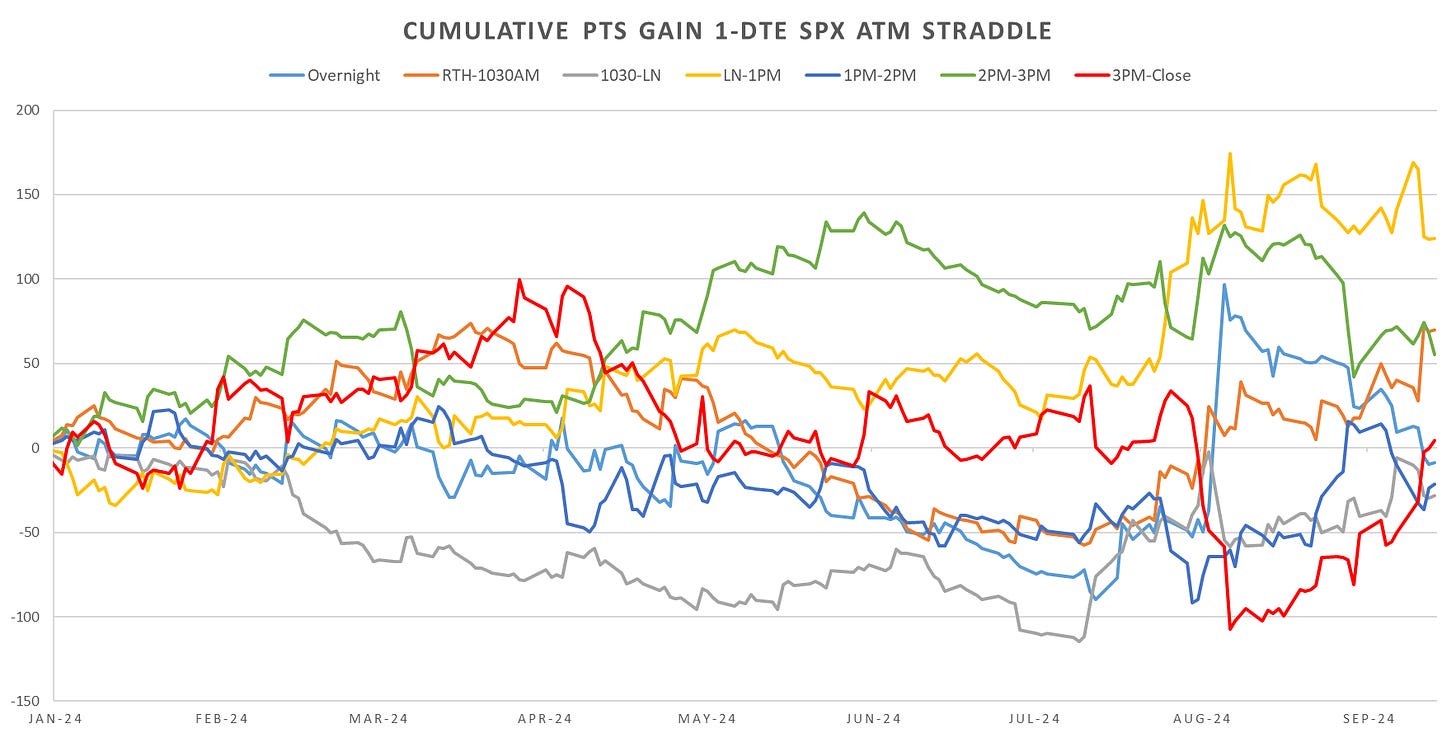

Looking at the 1-DTE straddle cross section, it looks like we are seeing the return of eod vol. 3pm-Close straddle performance back to positive on the year (although early morning straddle pnl not dropping off… will do a post on Monday/Tuesday on the conditional performance of long/short intraday straddles.)

From the last post:

“Was talking to a trader over the weekend, he mentioned “this market always gives you the urge to sell calls”, yet looking at data, its probably the worst possible thing to do across any duration…”

Would have been a pain this week… I continue to say shorting calls is almost more difficult than buying puts profitably. Across almost any frequency & using various conditions, short calls do NOT have an attractive pnl profile…

Realized Volatility Overview

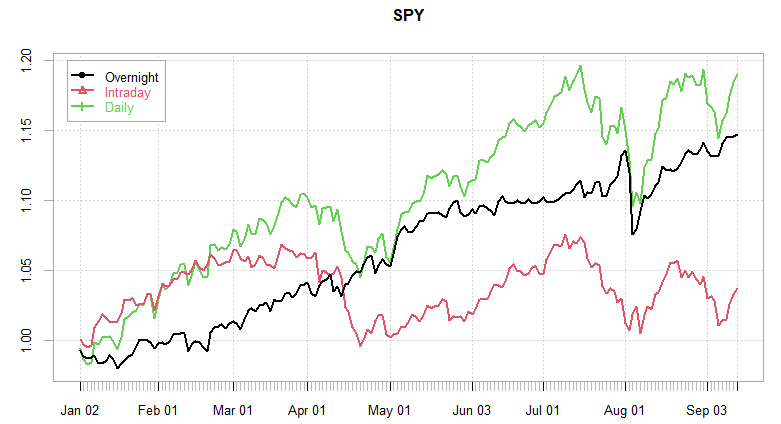

No surprise, overnight performance ignored the drop last week & continued to grind higher this week closing at new highs for the year on Friday. Intraday performance for SPY barely positive.

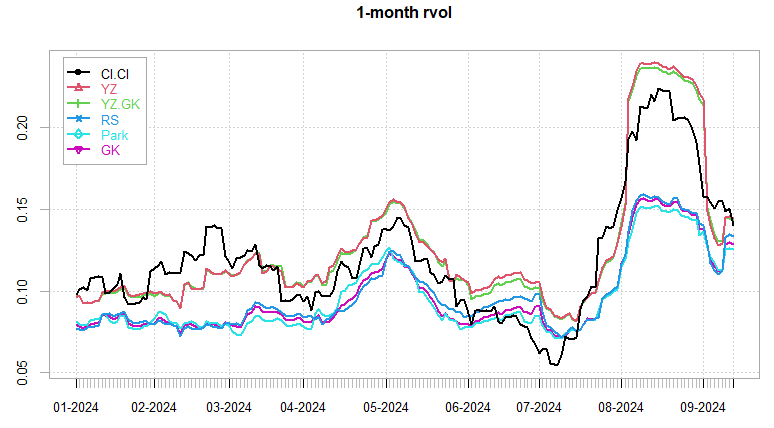

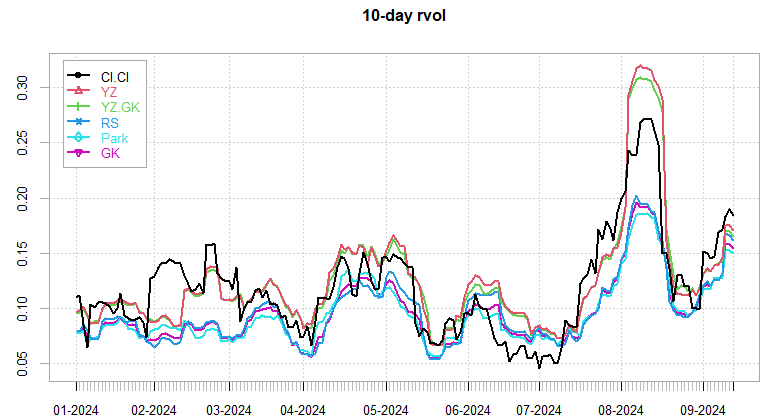

Both 10d & 21d rvols not giving up. 10-day vols closing near 2024 highs (outside BoJ spike.) VRP continues to be negative since mid July. We’ve talked about volatility triggers being a broad based positioning signal in almost every model out there. Perhaps, the wild moves we are seeing both up & down are a result of reduced participation on the back of rising rvol… The rising rvol → reduced liquidity → even higher rvol cycle in full effect here…

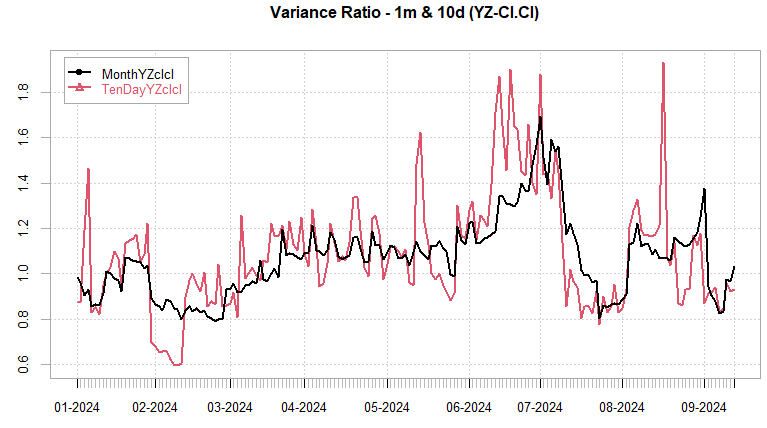

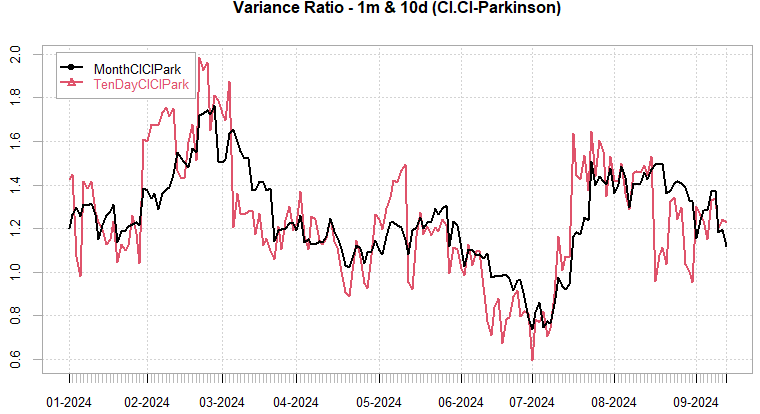

Var Ratio’s showing a trending market right now, with strong continuation intraday. Not quite at the point to start betting on mean reversion intraday, although some short straddle trades showing up in the VarRatio systems (lower in the post.)

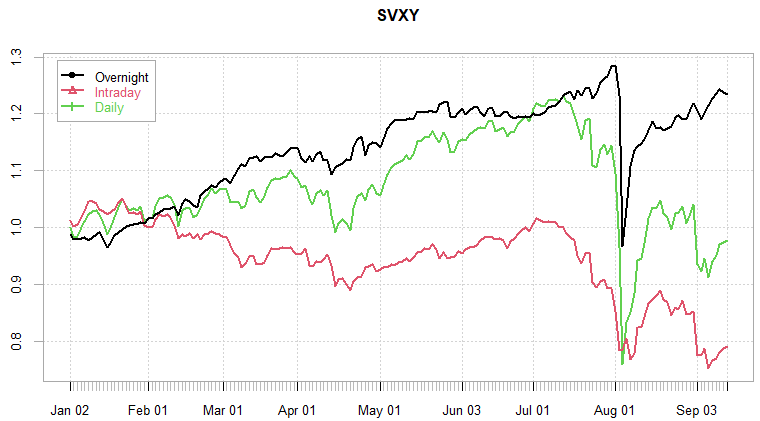

Largely similar picture to S&P from VIX-Futures. Intraday performance horrendous YTD, overnight performance almost back to YTD highs.

Overnight / Intraday Index Performance

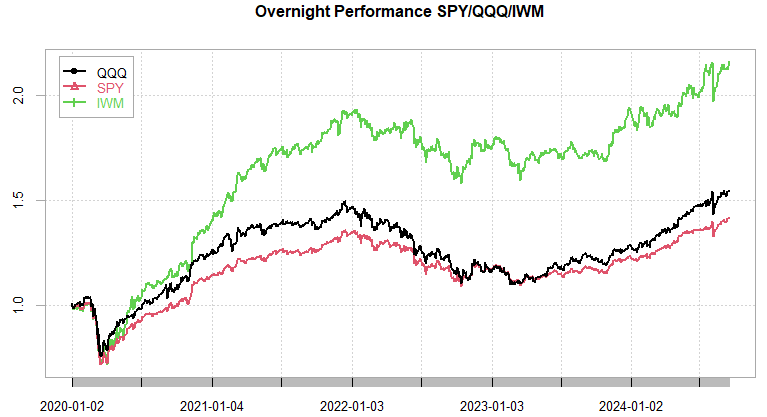

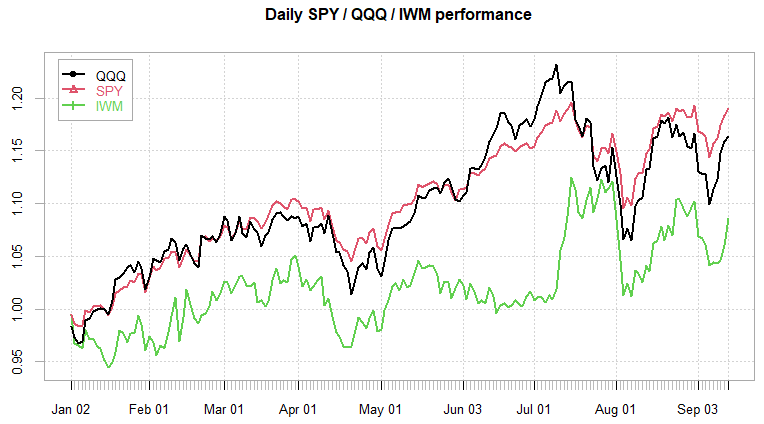

Had a look at the overnight/intraday effect in other indices. Curiously, IWM divergence is the sharpest over the last 5 years. IWM overnight returns almost double QQQ/SPY, with a -40% cumulative intraday return…

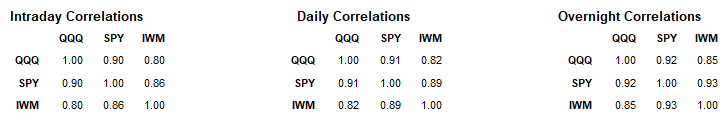

Looking at correlations, we see highest correlations across indices overnight, with lowest intraday.

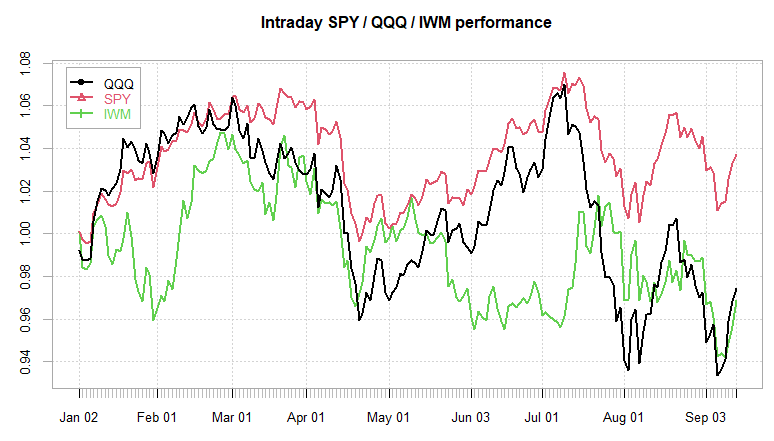

The overnight divergence decreased a bit in 2024 between IWM and other indices, with QQQ showing the sharpest divergence between overnight / intraday returns.

Will explore the overnight short straddle trades for IWM/QQQ relative to SPY in a post later this week.

SPX ATM Straddle Performance

Roughly flat straddle performance across the board last week. End of day vol picked up with morning session vol not easing. Only consistent trade was the overnight short straddle into an events / data releases. I expect vol to continue to perform into OpEx, especially with FOMC on Wednesday. Wednesday morning is also Vixpiration day, with quite positive forward weekly performance for long straddles (although slightly less exciting when vixpiration happens before OpEx.)

Variance Ratio Conditional Performance

From the following post:

Var Ratio systems continue to do well, although as mentioned in the last post, staying alot more in cash recently. Tiny wins on Thursday/Friday from short 1-Day and RTH straddles.

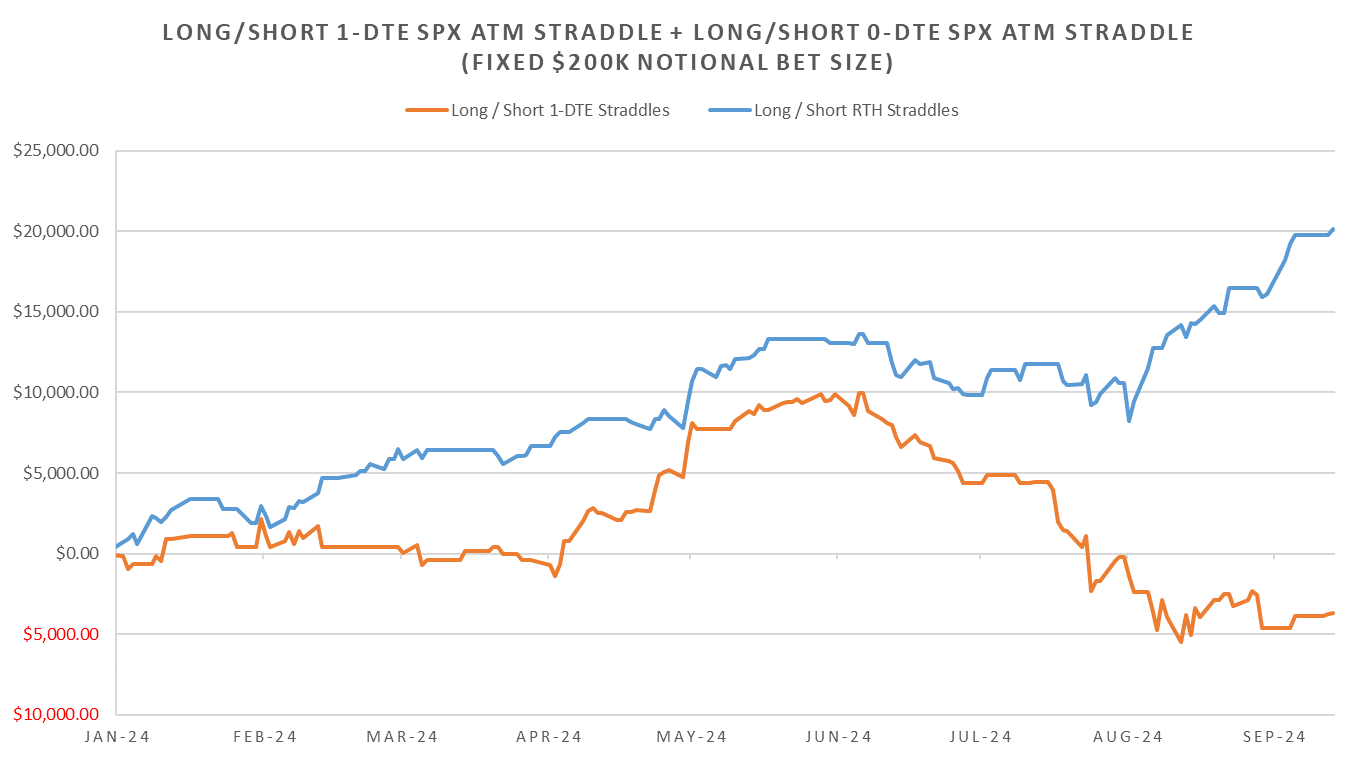

The RTH leg continues to post impressive performance, trading long/short RTH open straddles much better than the 1-DTE leg… I reckon that’s mostly due to the 1-DTE leg eating the overnight decay and getting hit with the intraday vol since July. Very curious if it navigates the next few months well given the chop we might see with the election headlines & autumn seasonality.

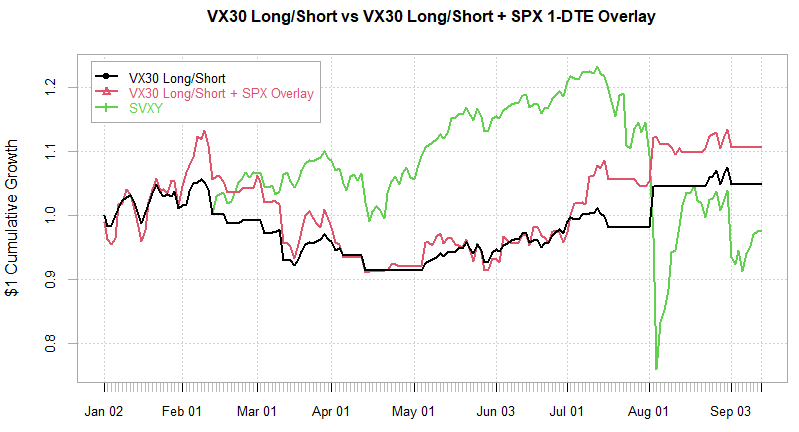

VX Carry & SPX Overlay

From the following post:

System has not traded largely since mid July (outside the VX Oct short into end of August with a flat exit at start of Sep.) This is expected given the negative VRP we are seeing and too high vol of vol relative to the potential carry. SPX overlay had small long straddle loss into Thursday, rest of the time just sat in cash. Big hopes on the post election crush to make the year!

Have a good week!