Market Overview - October 5th 2025

S&P Index Options & Volatility

Following up on last weeks overview:

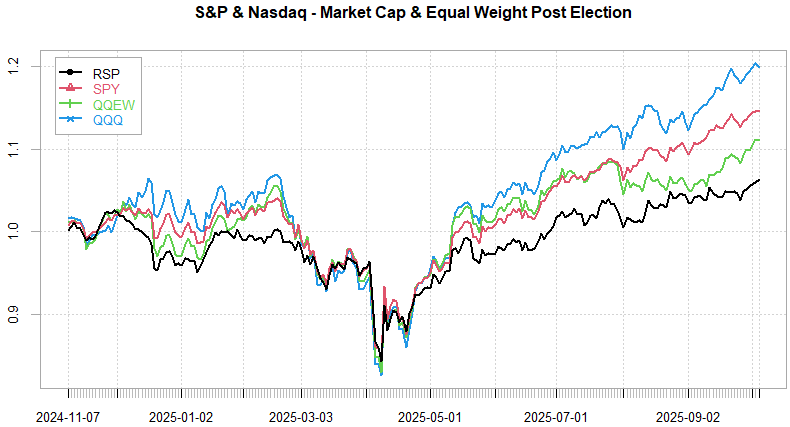

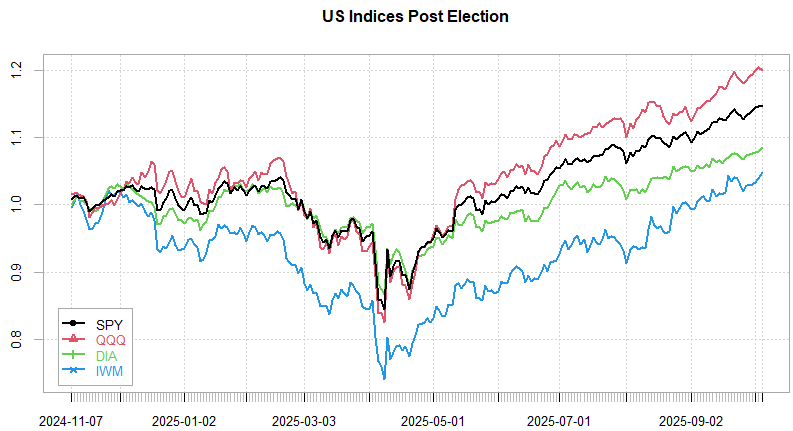

Markets once again briefly hit new ATH before fading a bit towards Friday close. The shutdown means we are not going to be getting as much new econ data coming out in the near term. We’ve got earnings season starting, albeit the ‘AI’ earnings are towards end of Oct (as well as FOMC) so there’s really not much going on for now… Powell will be speaking on Thursday but rate cuts odds are trading near 100% for Oct meeting by now with Fed unlikely to deviate from market expectations.

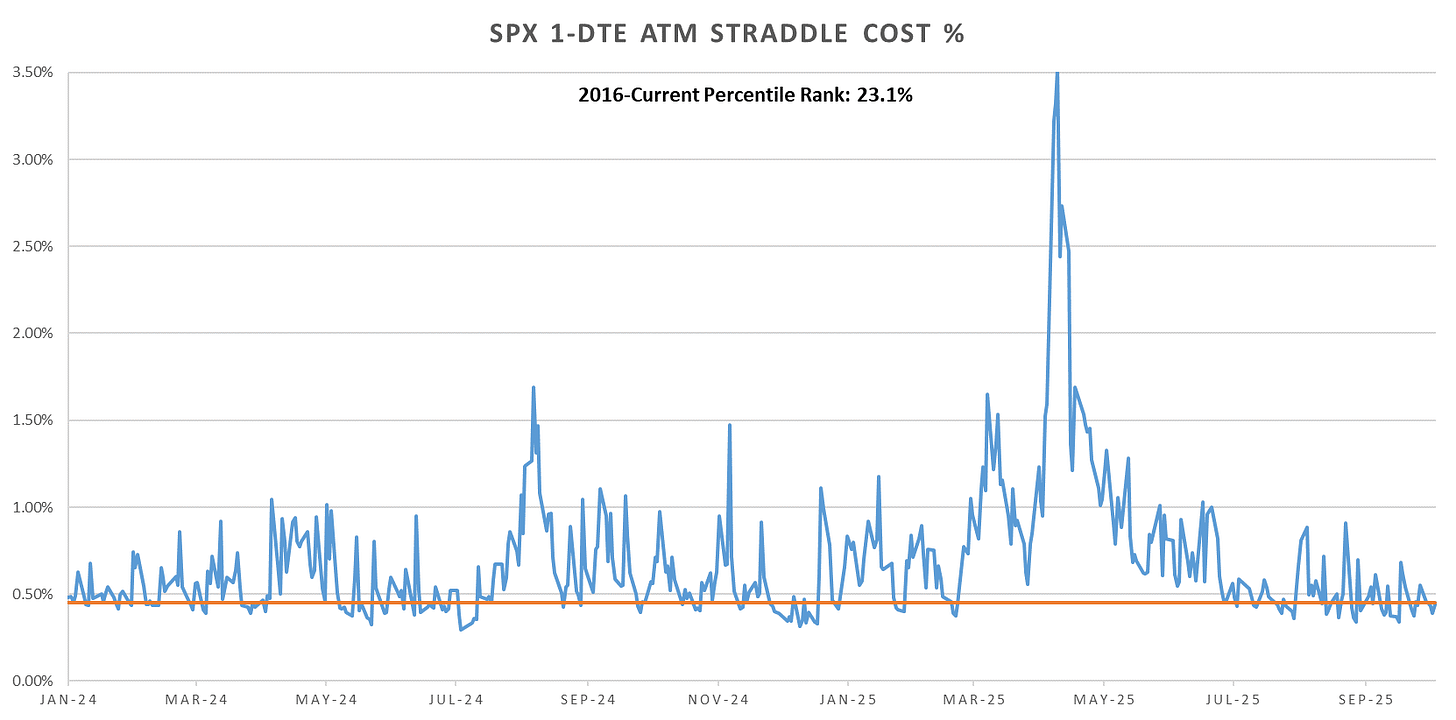

We’ve not seen a 1% 1-DTE spx straddle since that one day in June. Nothing new this week, just another low vol grind higher in indices even as commodities are going parabolic.

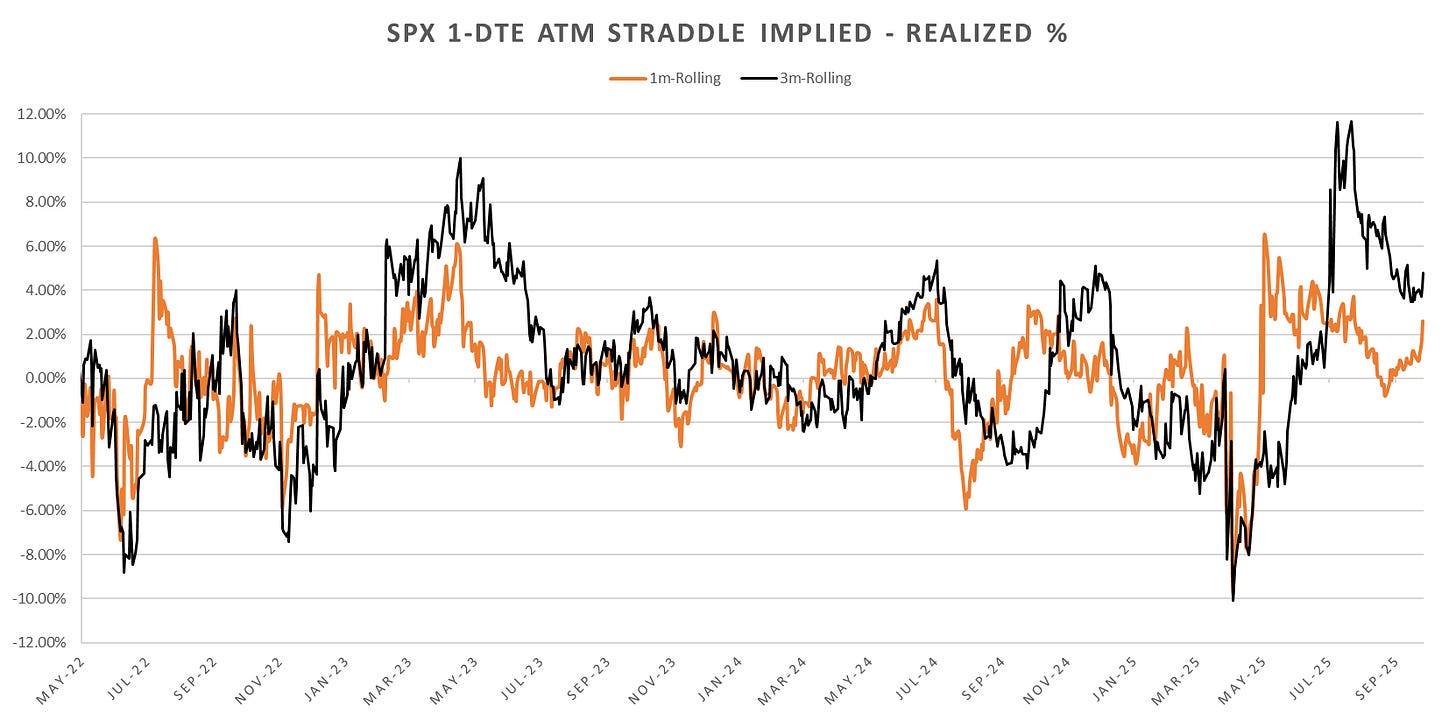

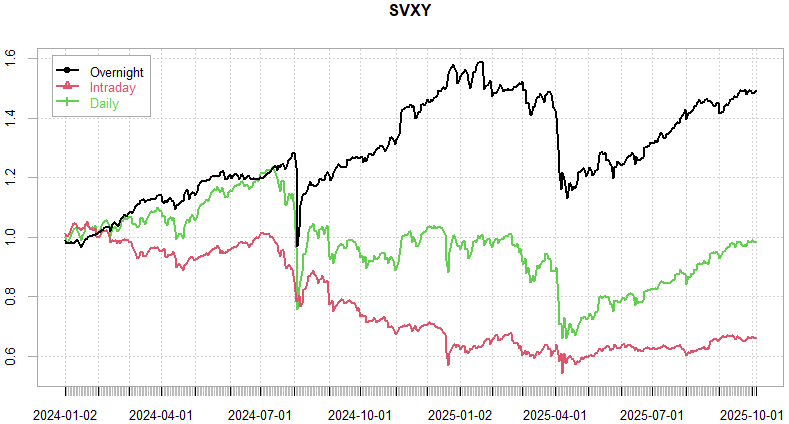

1-Day VRP picking back up in Sep, running near last 2 year highs so far despite the drop off in premiums.

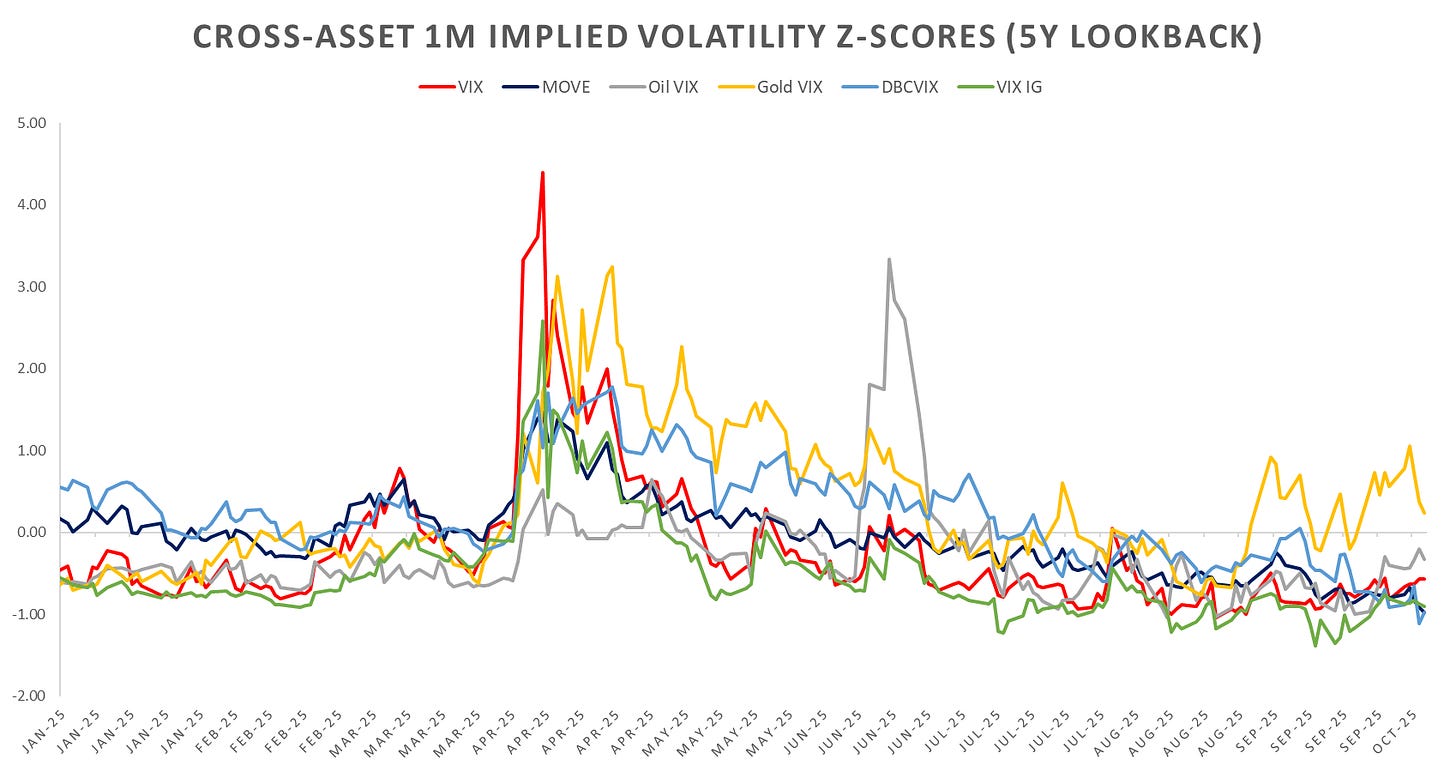

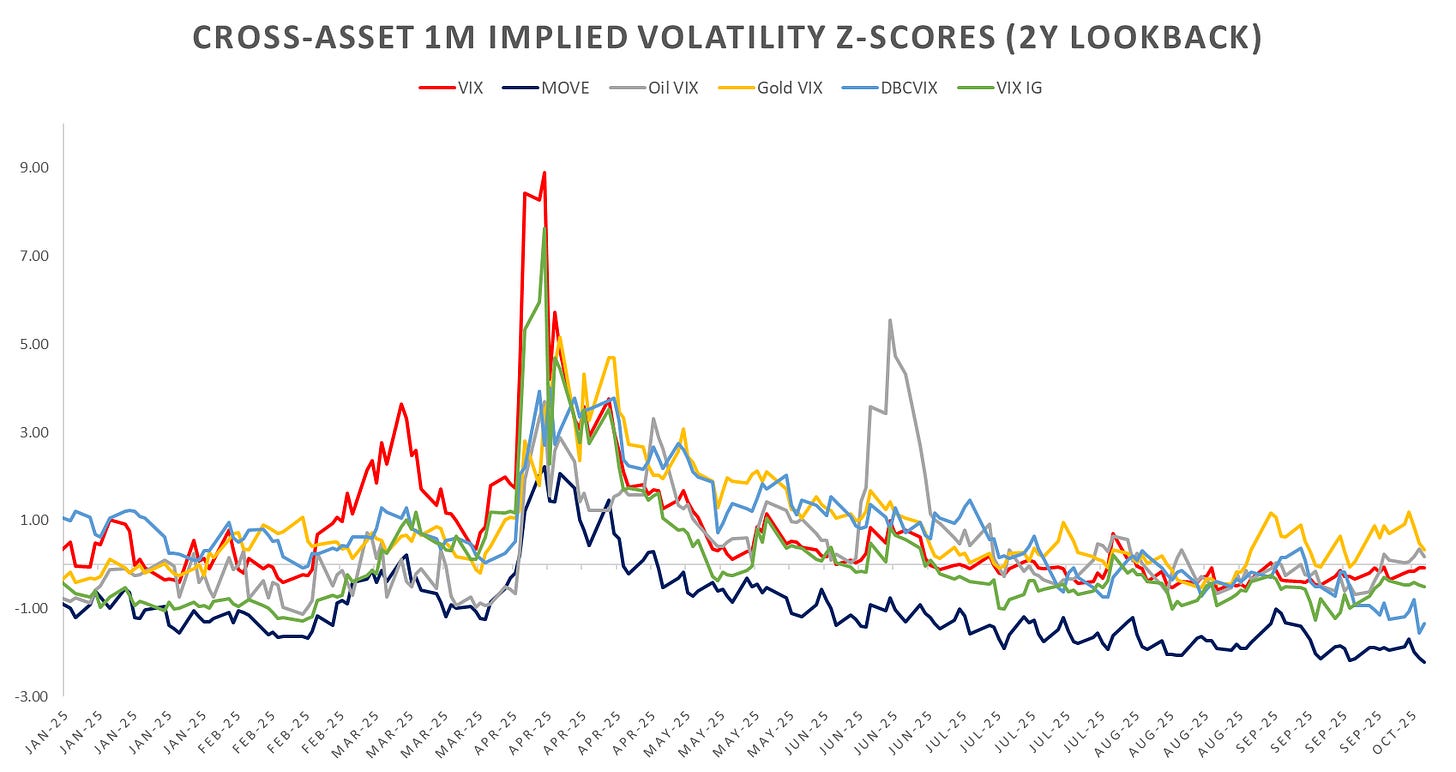

Looking at cross asset implied vol moves, some dispersion going on with equity/oil/gold implieds higher, fx/bonds lower.

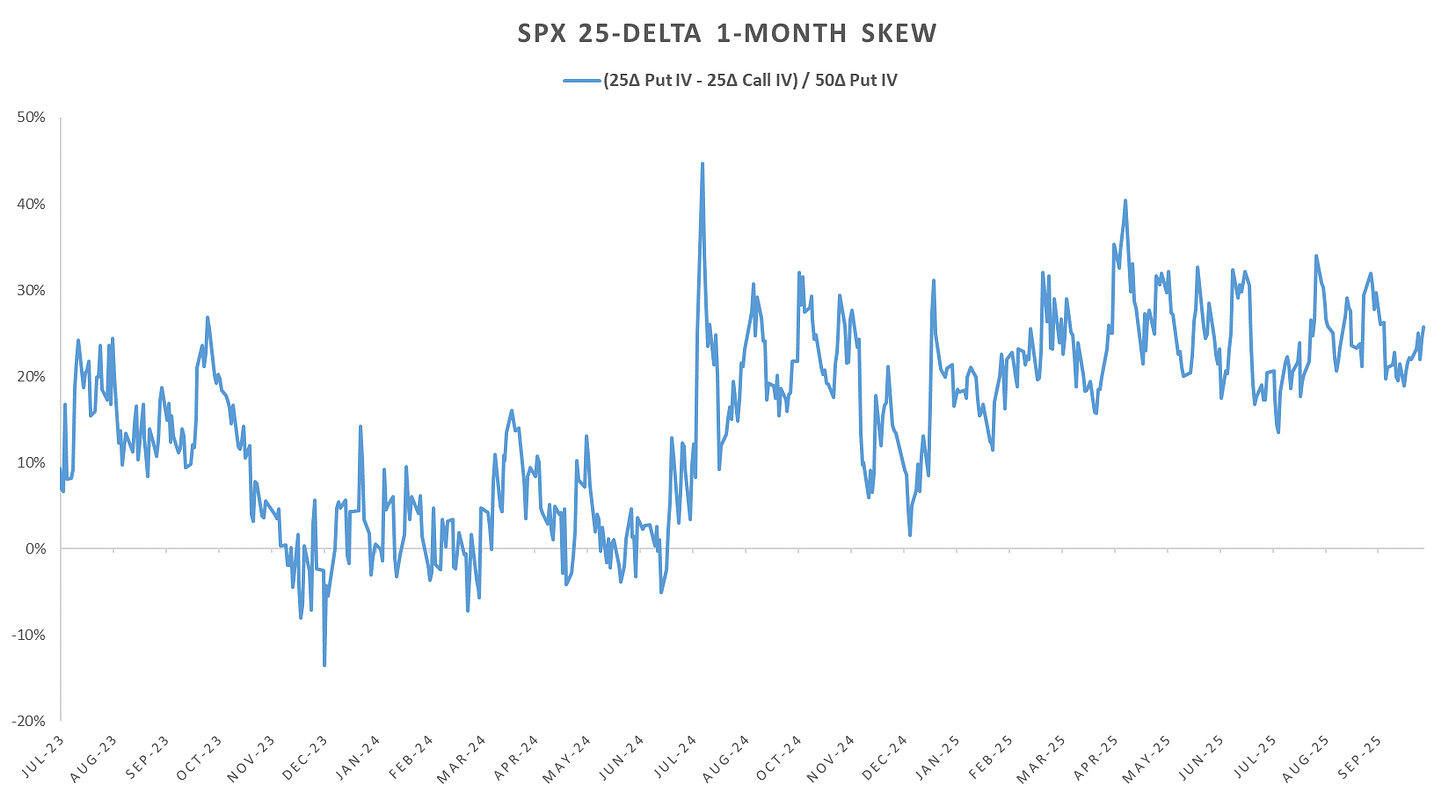

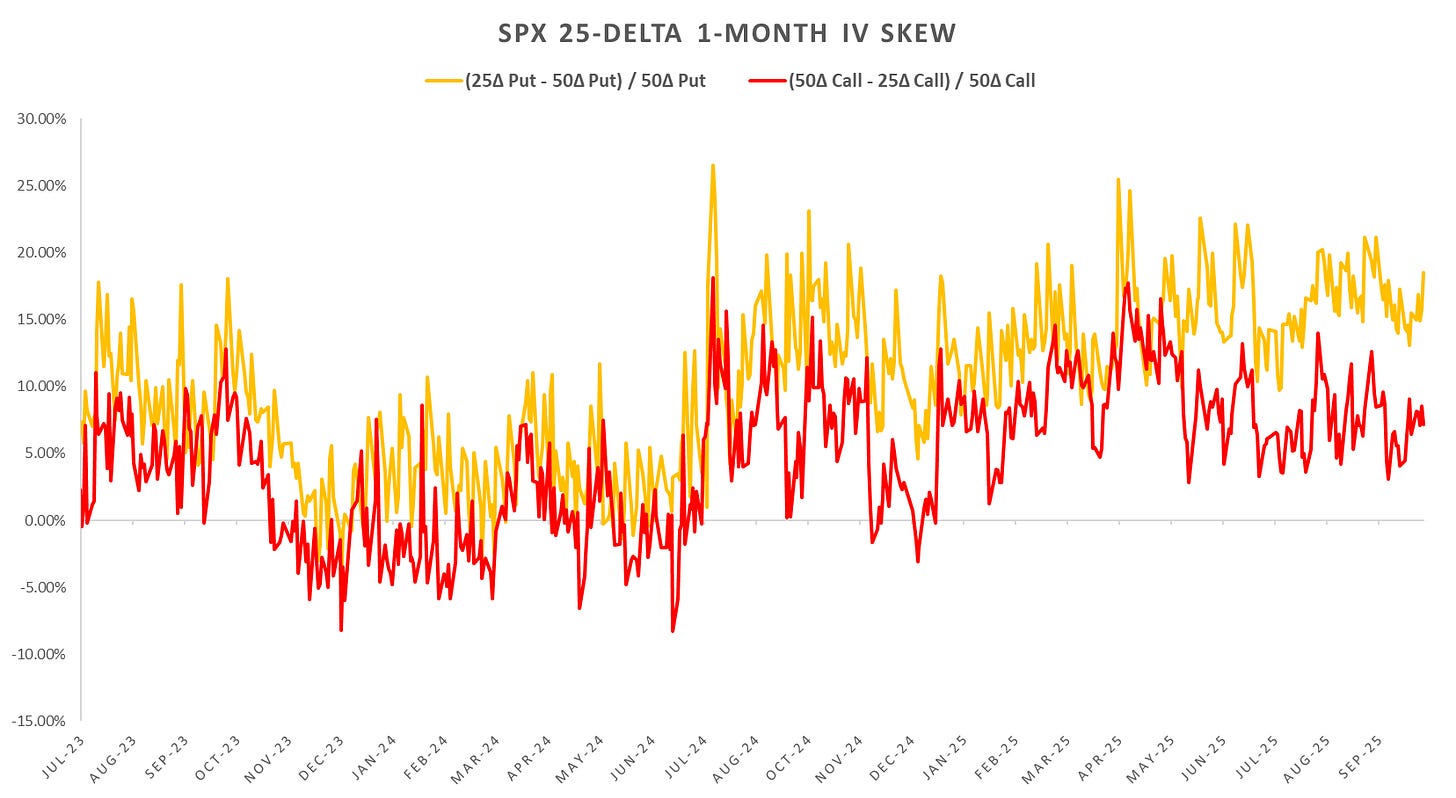

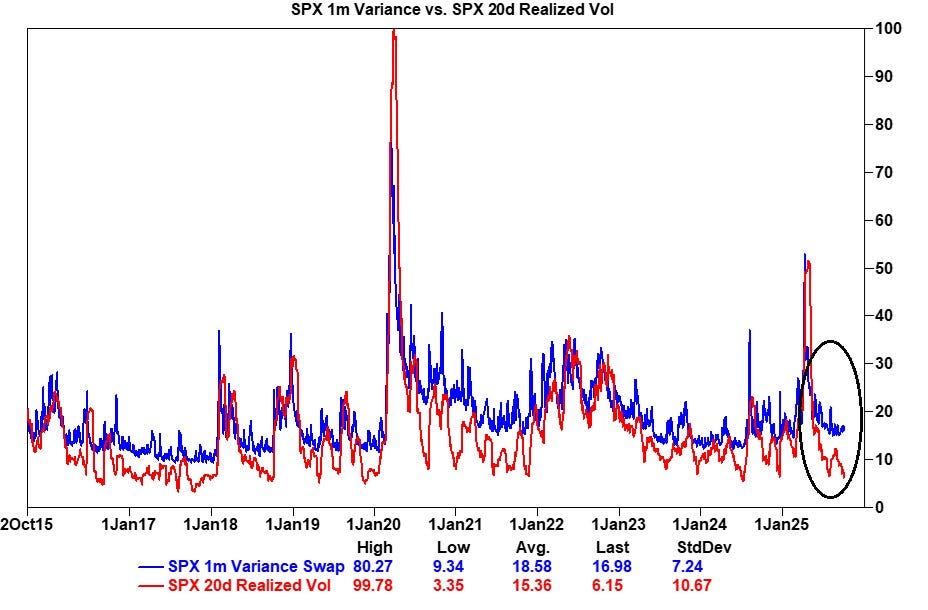

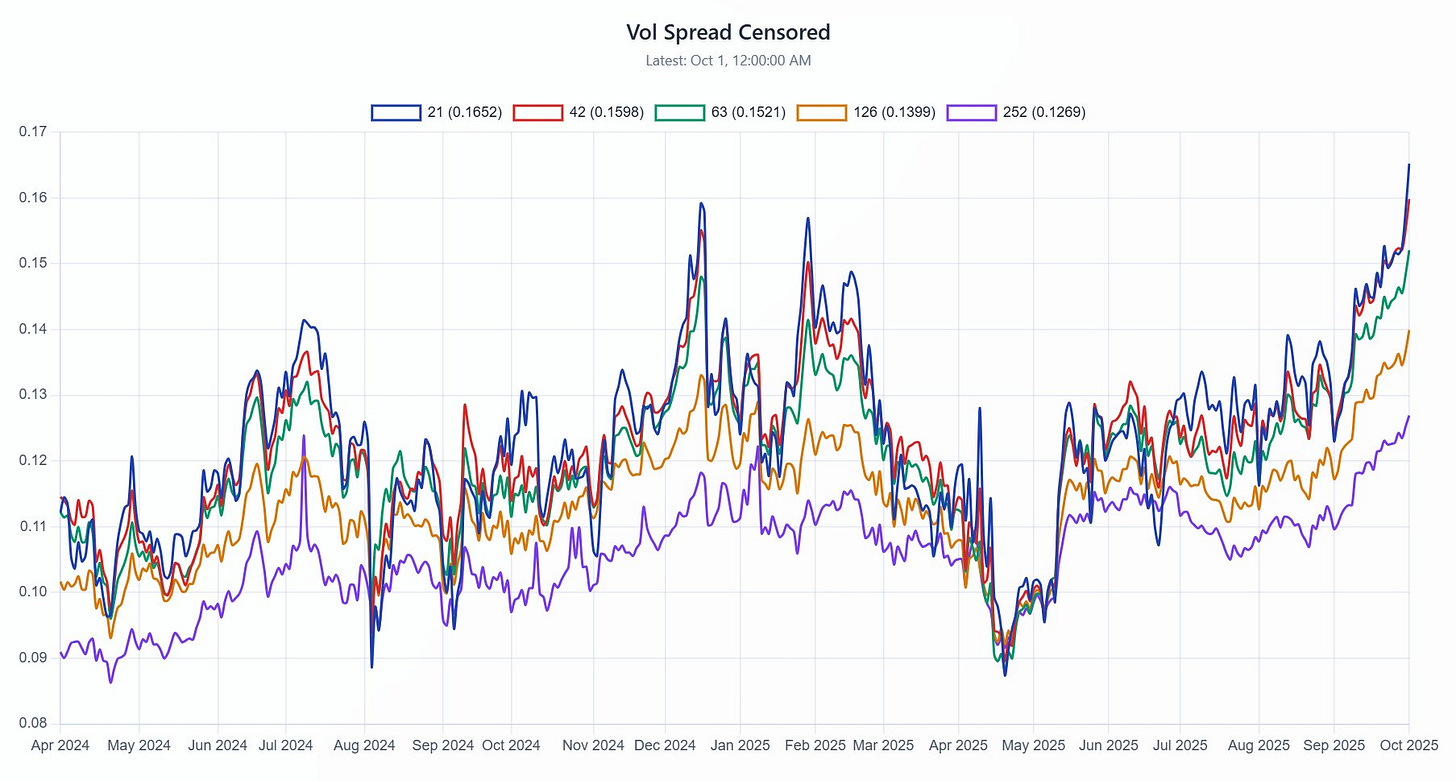

SPX skew steepened slightly last week despite the move higher in indices. Markets seem to be literally ‘climbing a wall of worry’, with 1m vol trading at a record premium to realized vol:

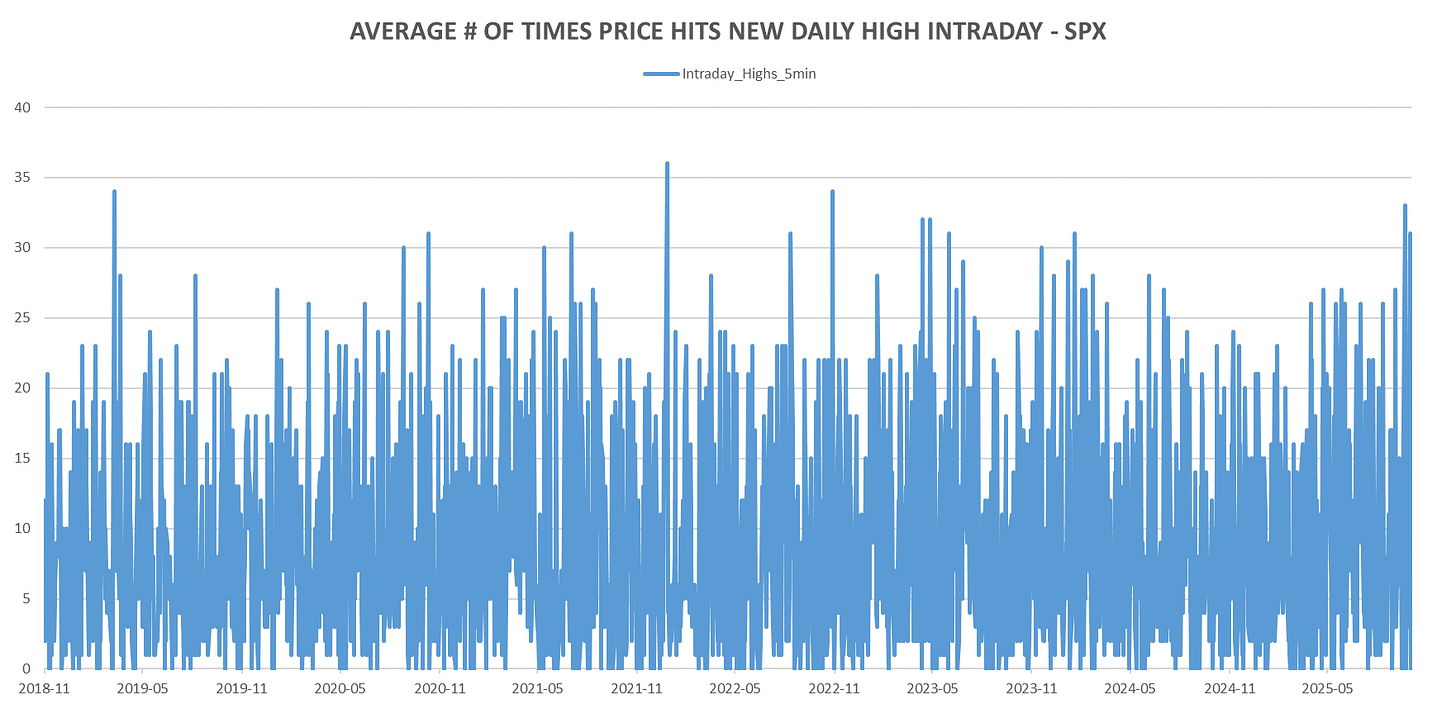

Looking at intraday price action:

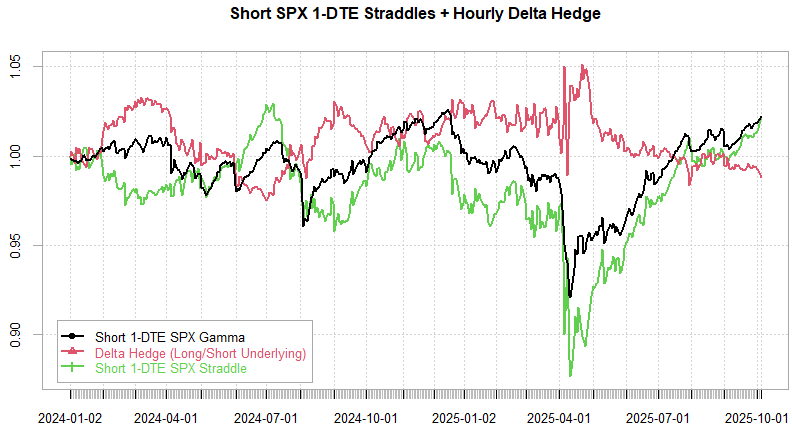

Systematically shorting 1-DTE SPX straddles (unhedged) puts in a new high this week, beating the previous peak in July 2024. Delta hedge component largely a drag since April spike as markets see absolutely no follow through to the downside and simply retrace any intraday dip by close.

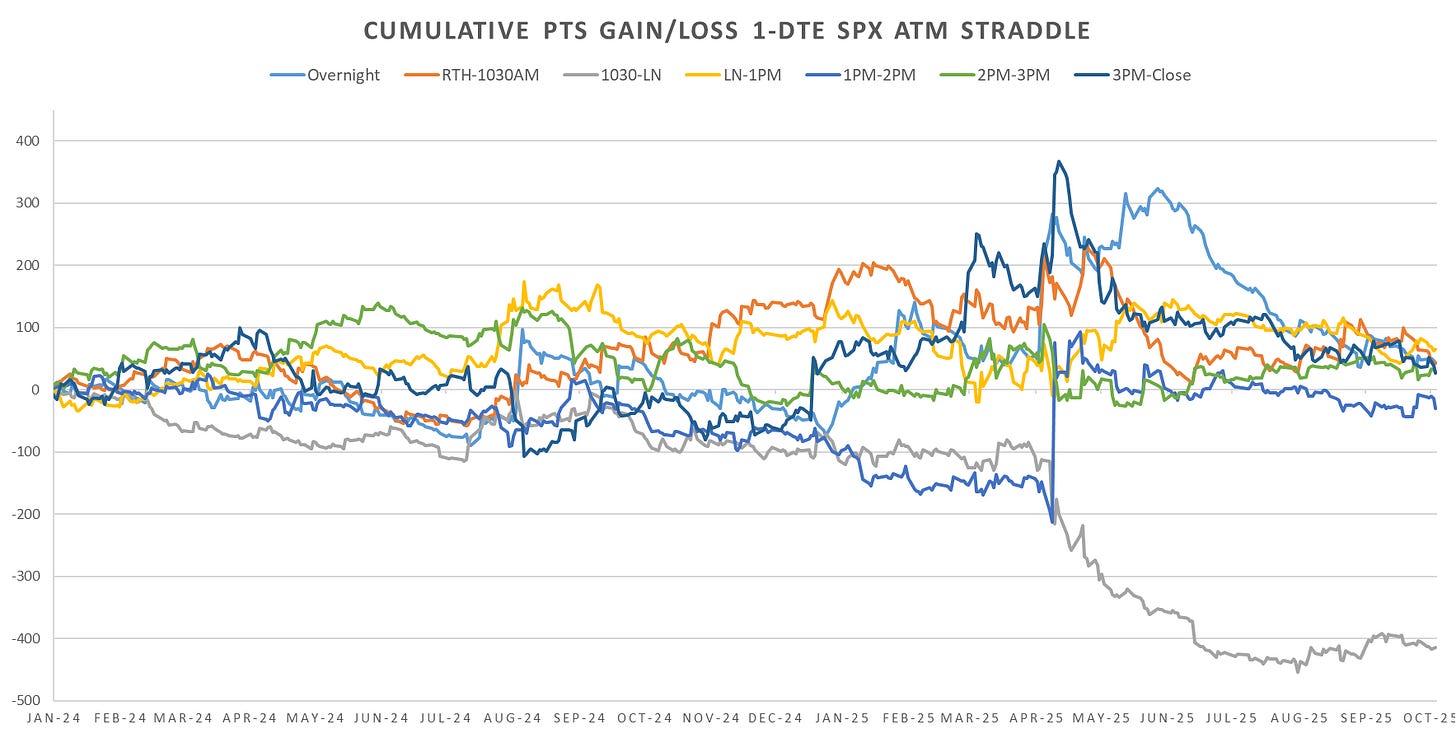

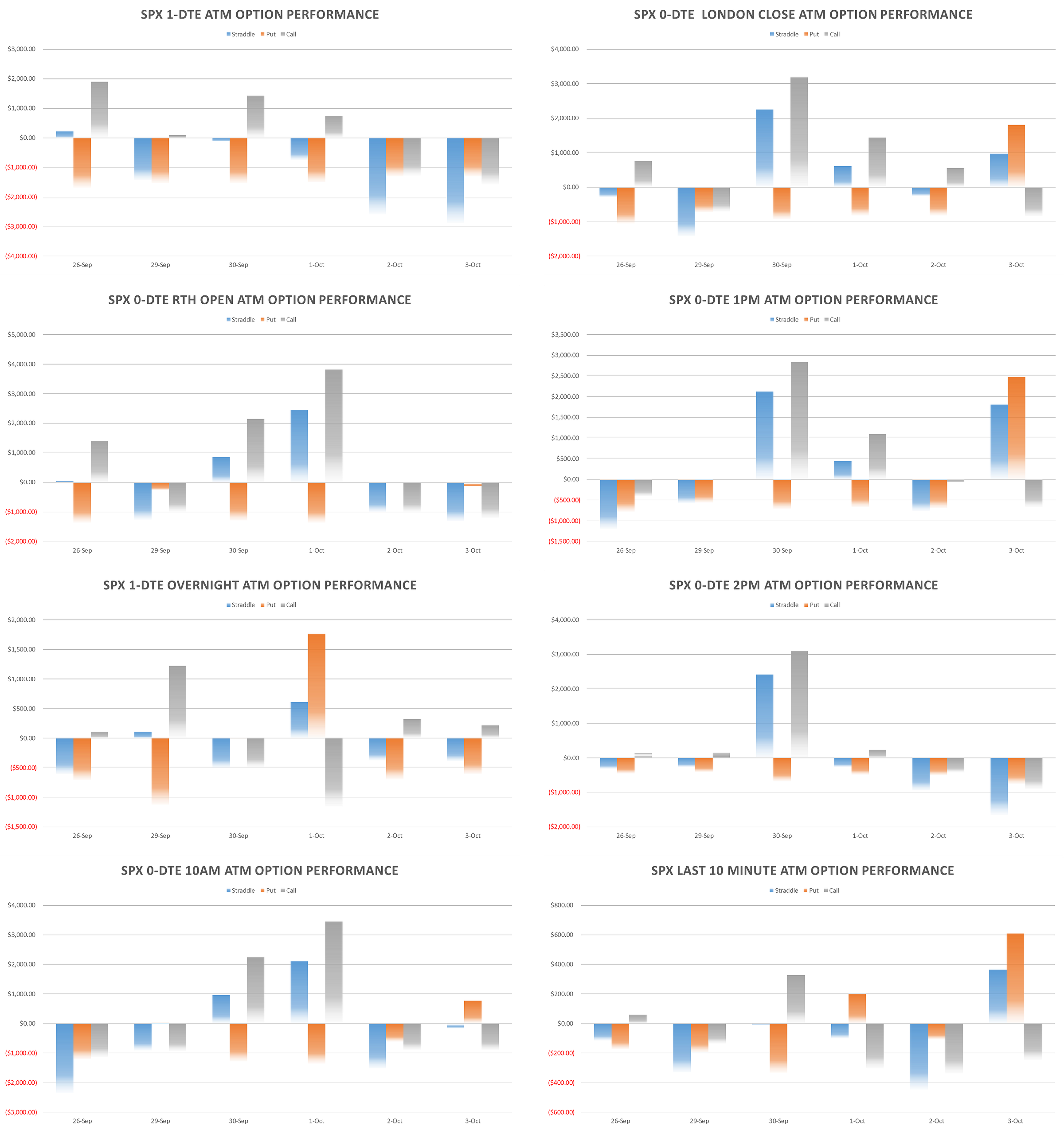

Looking at the intraday cross-section, much more uniform action than during Aug-June period.

Realized Volatility Overview

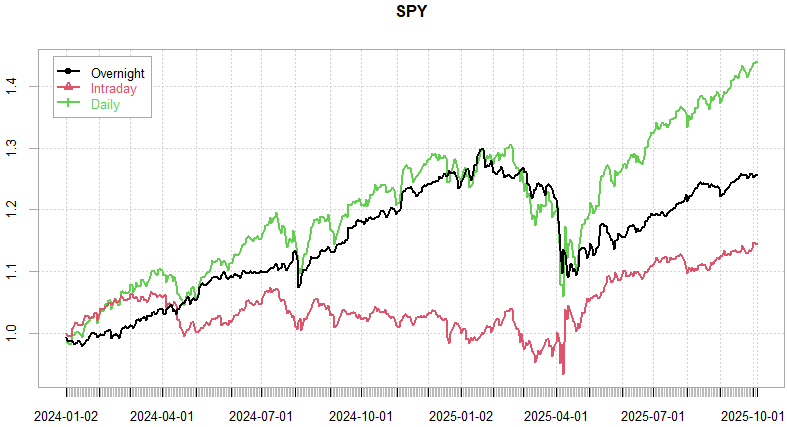

The run since April barely had a 2% drawdown on indices. Overnight/intraday blended & overwhelmingly bullish.

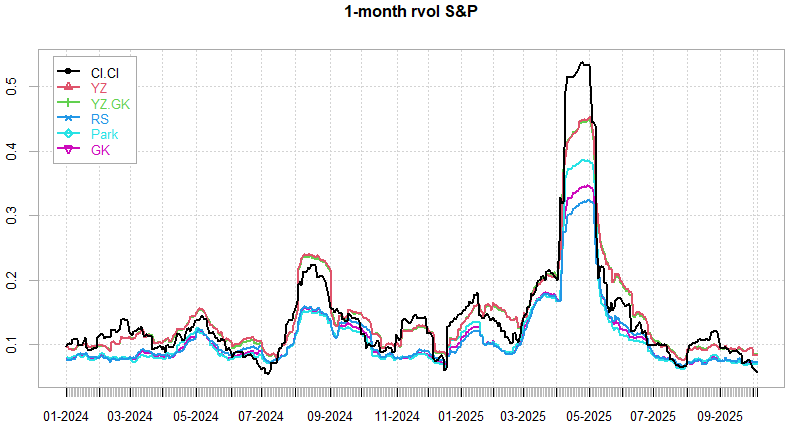

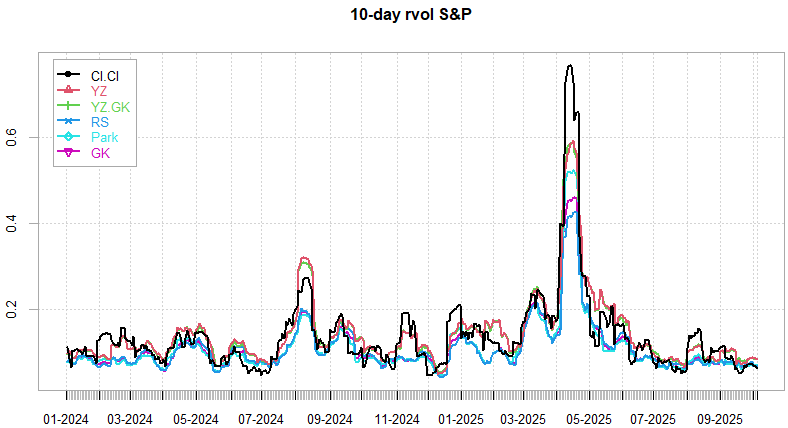

Rvol is looking like it wants to sit at 0 even for monthly lookback. Intraday rvol measures holding flat. Earlier in the summer we used to move at on morning data releases but the reactions got more and more muted towards autumn. Now with gov shutdown we don’t even have any intraweek catalysts to spur some movement.

Single stock vol has been ramping from early Sep, with VIXEQ up from 30 to 38. We’ve not seen VIX go higher as 1m implied correlations have broken summer lows now trading ~8-9%. Should we continue to pump on the ever dubious Mag7 CapEx commitments, July 2024 saw 1m icorrs trade down to 2-3%… which should give us VIX 12-13 again even with index component vols hitting 40’s.

Updated dispersion performance from Dominik, now well above July 2024 / Dec 2024 peaks.

VIX Futures stalling last week, no follow through on VX30 with SPX making new highs. Spread between spot/futures narrowed last week as well, now ~2.5pts with Nov / 3pts with Dec. Generally that’s very decent but keep in mind we will see vol explode on anything that triggers a high corr move lower.

SPX ATM Straddle Performance

SPX 1-DTE straddles net down ~75pts over last 6 trading days. US RTH 0-DTE straddles ~flat overall. 2nd half of the US session calls up ~45pts on a couple of big rallies of lows that we had early last week.

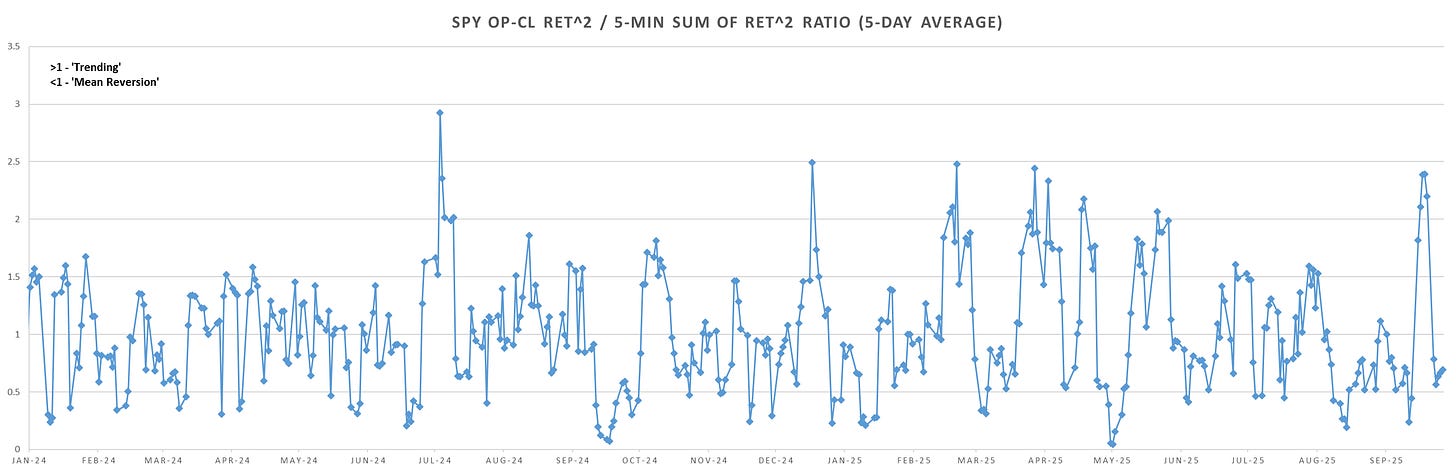

Intraday Variance Ratio

From the following post:

After a couple of very ‘trendy’ days towards end of Sep, we are now back to more mean reverting intraday price action late last week. Outside the couple of trendy days after OpEx & last day of the month, we’ve not been trending heavily at all. Bias is now again towards trendy price action going into this week.

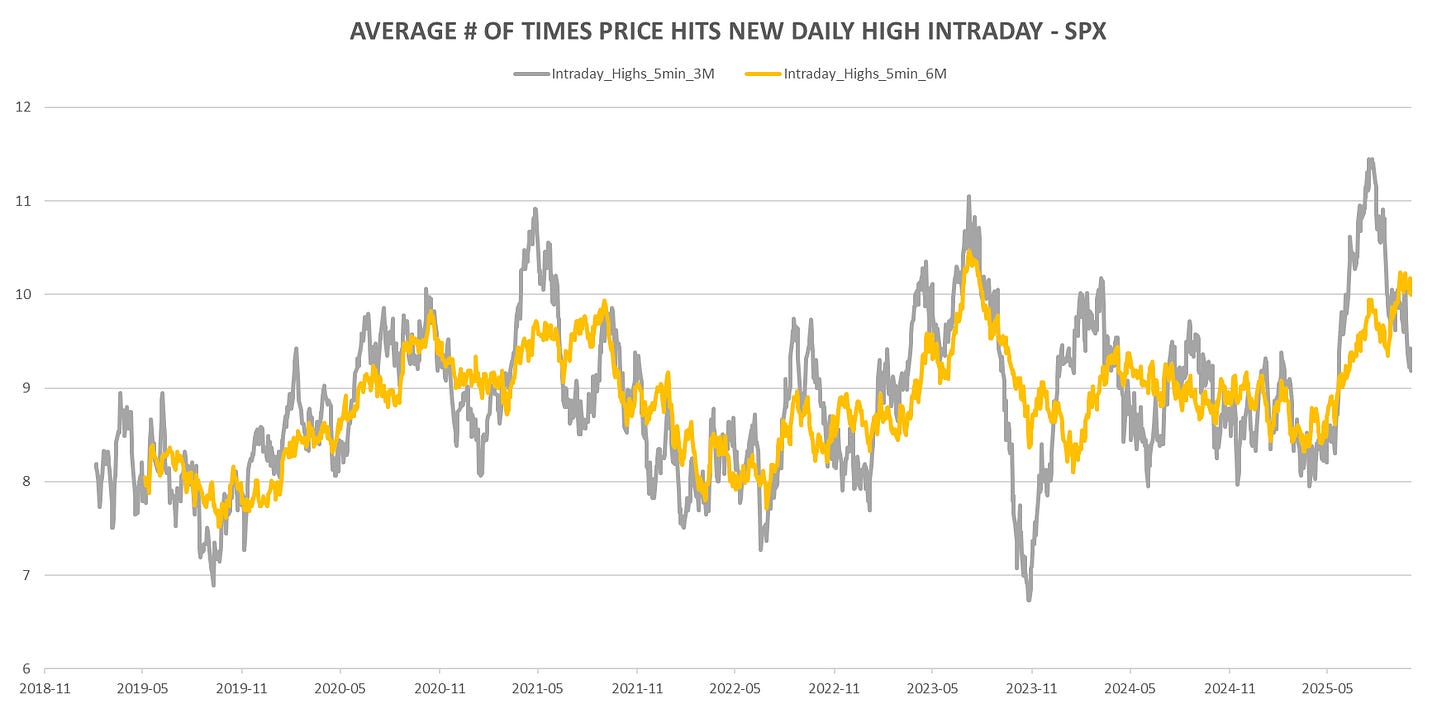

Last month, day after OpEx & last day of Sep saw some of the largest US RTH session buying strength since 2018… Looking at smoothed 3M & 6M numbers, looks like we passed the peak of buying strength already. In 2021 we’ve hit peak strength around the end of summer but indices only rolled over after new years.

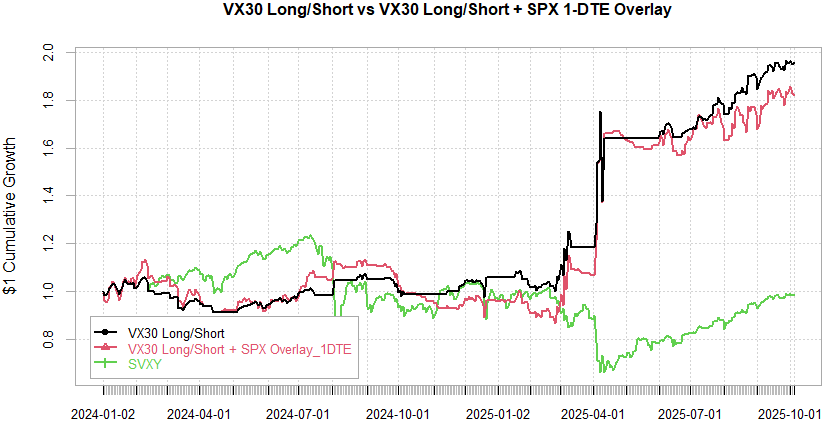

VX Carry & SPX Overlay

From the following post:

Still short the Oct VX, will roll on to Nov short in the middle of next week assuming markets continue to grind higher / churn. Not much to say… everyone sees this rally getting extended but we have the AI hopium behind it and some of the largest balance sheets that rival smaller countries GDP’s pledging trillions in capex over next few years…

As always, don’t hesitate to reach out if you have any question!

Have a great week!