Market Overview - November 3rd 2024

S&P Index Options & Volatility

Following up on last weeks overview:

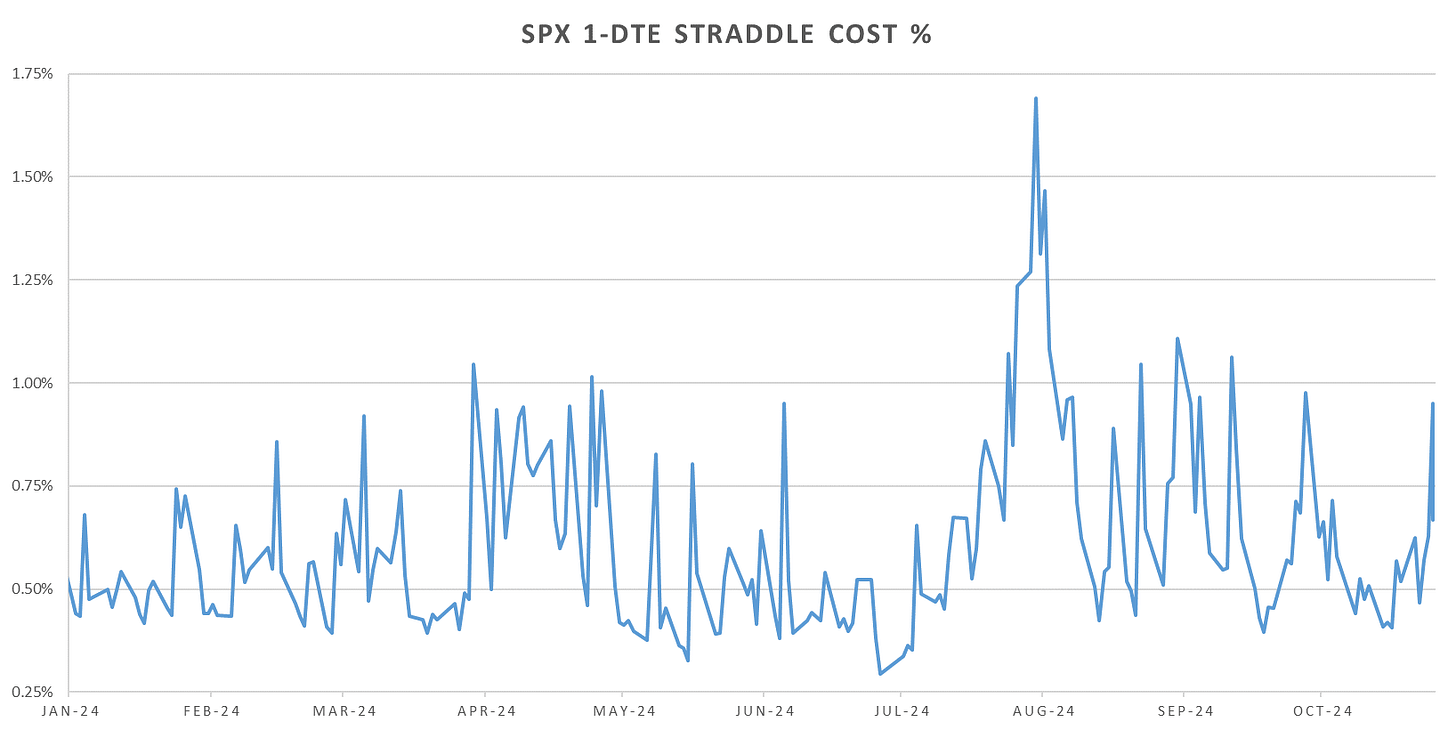

Markets had their first break lower (below 21-MA) on Thursday in almost 2 months. All Mag7 except NVDA have reported already and results have been mixed, AMZN & TSLA higher, rest lower. AMZN & TSLA fading a little bit last few days as market grapples with election outcomes. As expected, Wed SPX straddles trading ~190 bps, but that comes along with potential Middle East news as Iran gave notice that they will be closing airspace from Nov 4th - 6th over ‘gunfire’ (whatever that means.) Either way, plenty of volatility baked in already.

1-DTE SPX Straddles briefly spiked to near highs of the year on Wednesday close along with VIX trading at highs of the year (outside Aug crash.)

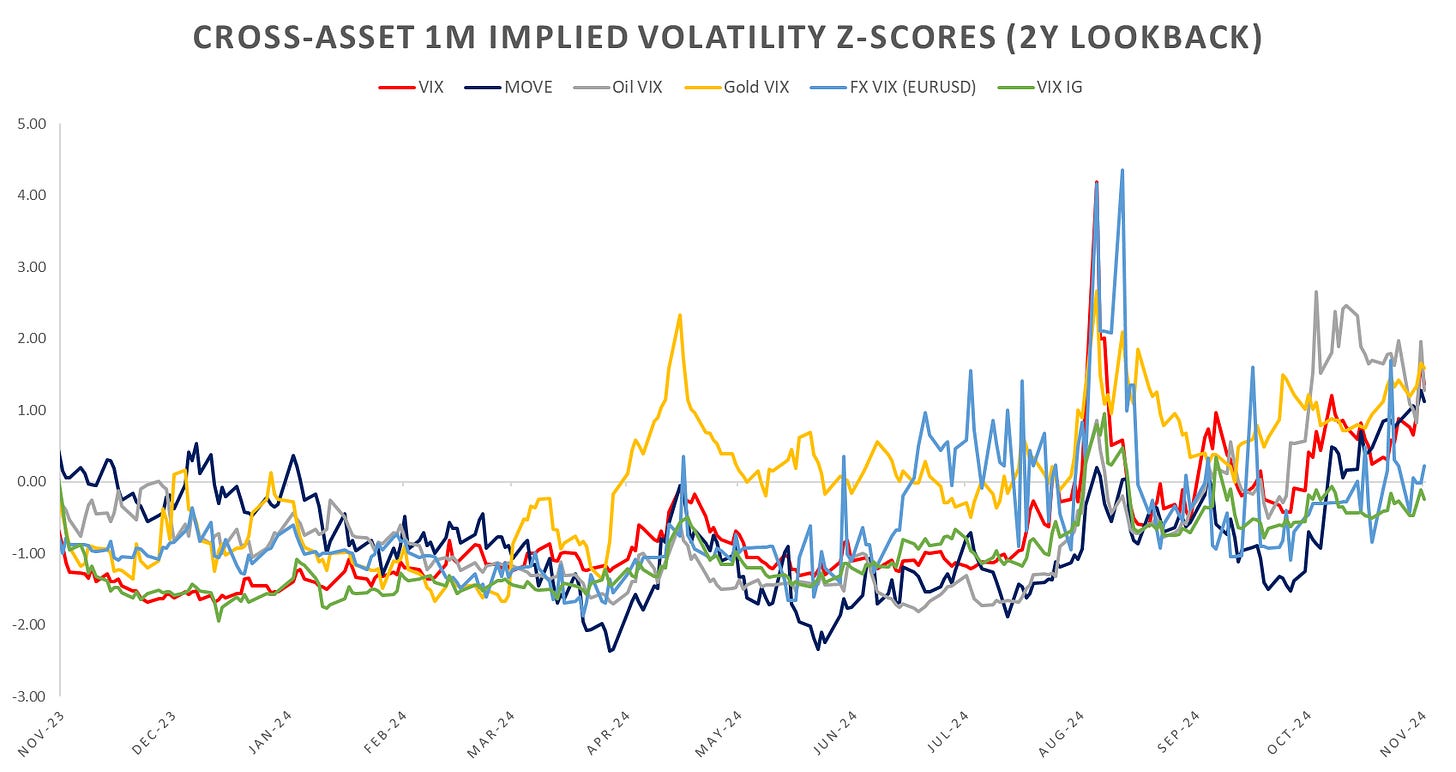

Almost all cross-asset implied vols trading above 2Y & 5Y averages. Realized cross-asset vol is trailing implieds, with VRP widening to top %-ile historically across assets. There is plenty of room for ivols to come down into year end, however, given the Middle East is unlikely to resolve any time soon I doubt we can see persistently low equity vol (and oil/fx/gold) even after election uncertainty is gone. ~15 VIX sounds fair given 3-4pt ME premium & the steep drop to negative in equity-oil correlations.

Looking at SPX skew, closed the week tiny bit flatter relative to last Friday. Not much change expected until election uncertainty resolves.

Looking at intraday price action, from the following series of posts:

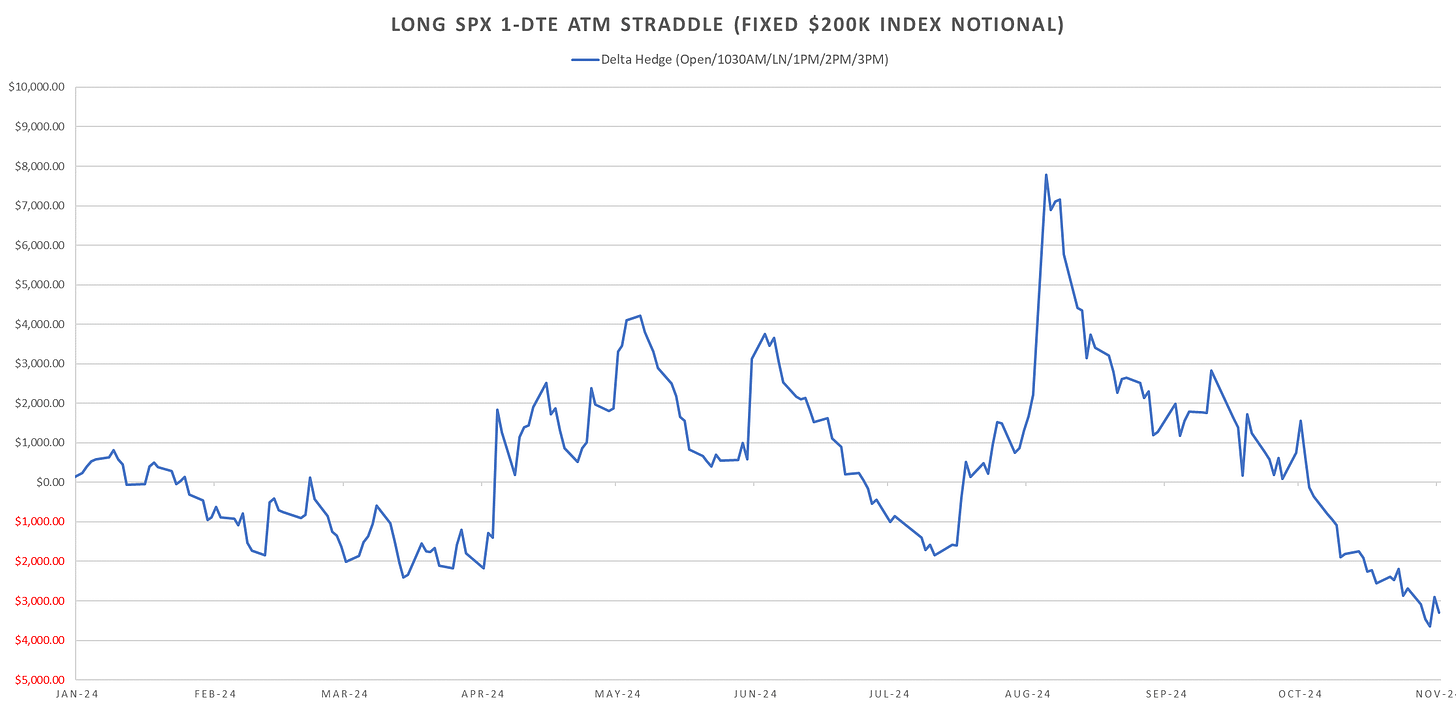

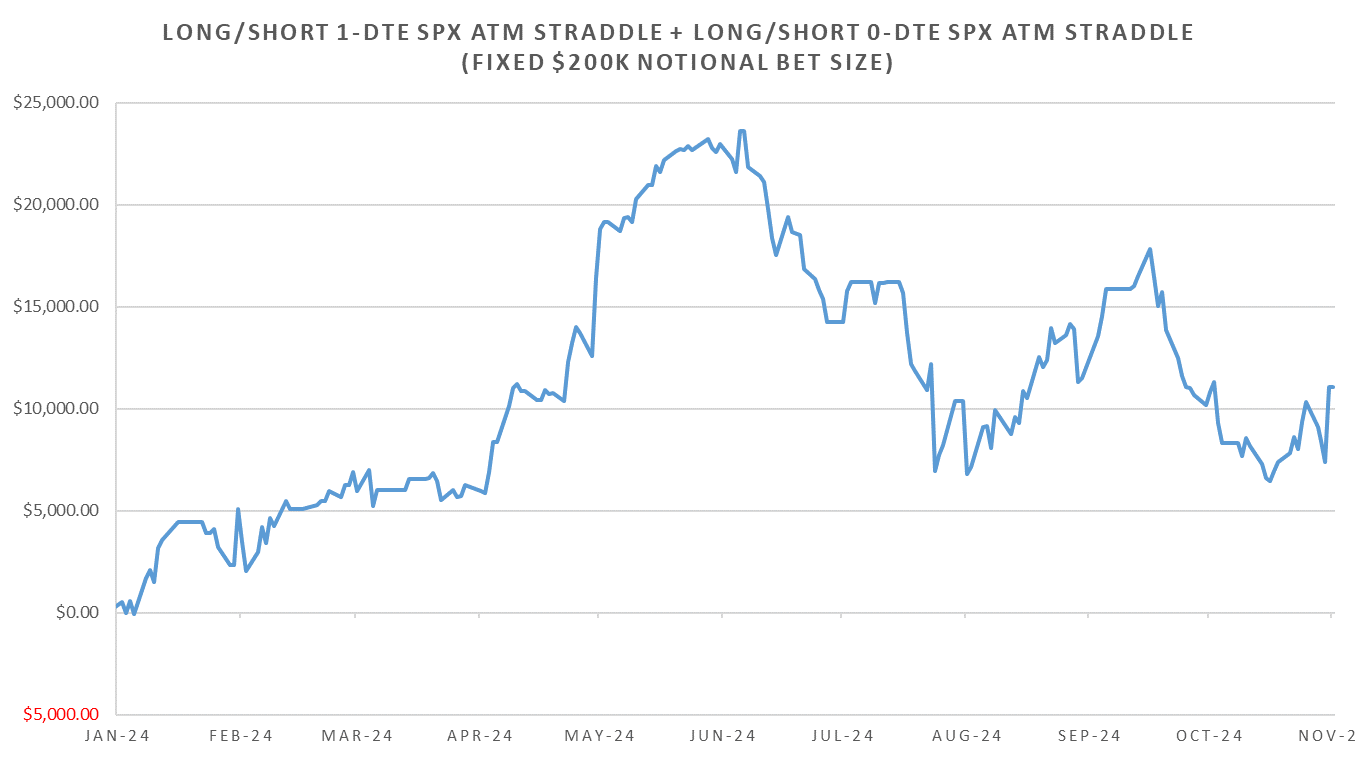

Long delta-hedged hourly 1-DTE SPX straddles continue to bleed since Aug. Short dated vols remain rich on the back of realized single stock correlations dropping to near lows of the year. Still mostly rotation under the hood between Mag7 & rest of market.

Mostly mean reverting market intraday since early Sept. Nothing too crazy just enough to keep indices pinned with average ranges.

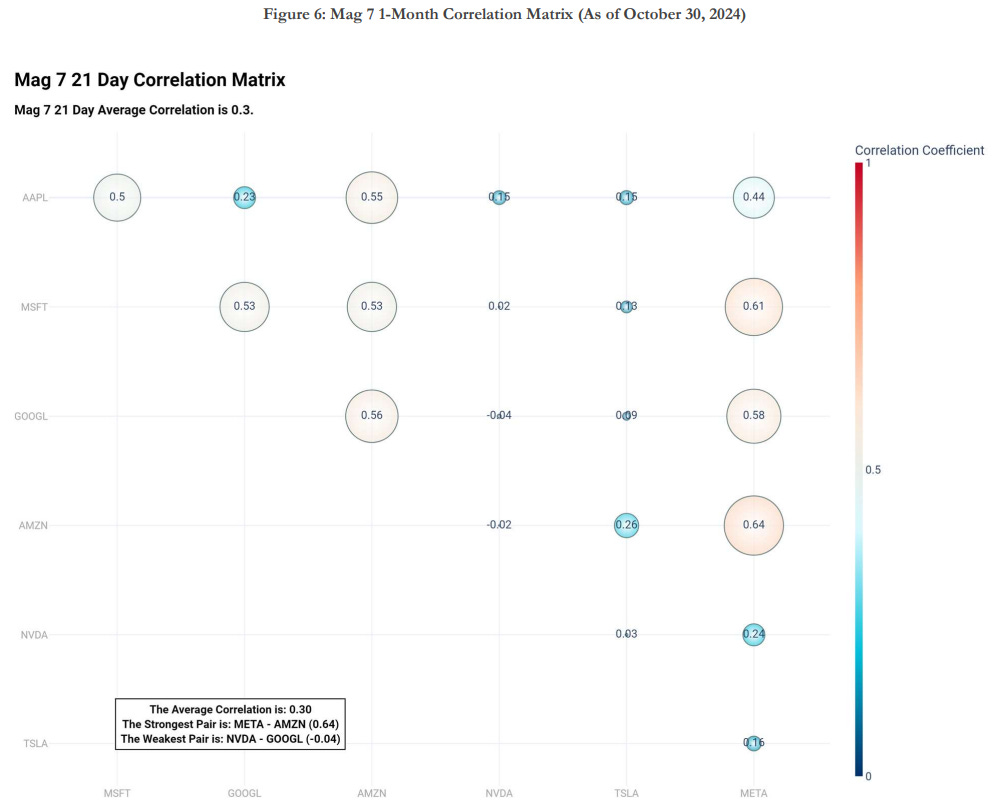

from TradeWell had an excellent summary of the correlation breaks between Mag7 components which led to pinning of the indices lately:Analytics Update - The Unpinning

NVDA living in its own world these days, uncorrelated even to the other Mag7 components… As previously mentioned in posts this year, the tail events we saw with respect to SPX / VX beta & the record short dated vol miss-pricings we’ve seen in Aug / Sep were primarily the result of these correlations suddenly repricing higher. We’ve got the most concentrated market in recent history, with index implied vol being kept in check by low correlations between sectors & within the Mag7 itself.

I first mentioned the breakdown of last 2-year trend of majority of the intraday vol being realized towards eod back in July/Aug. Thought we were back in that trend in Sept, however, the first half of the day has been the source of majority of the moves since late July. First hour of the day now the best performing period for the 1-dte long straddle trade with eod mean reversion likely (we used to accelerate into close in the direction of the intraday trend.)

Realized Volatility Overview

SPX almost flat now ytd during the US RTH session. I would expect the US session to come alive post US elections as uncertainty resolves.

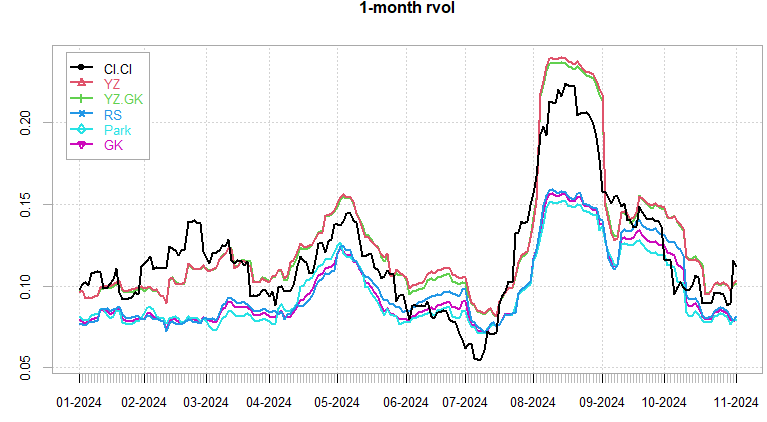

Rvol barely climbing above 10 on the Thursday drop. IV-HRV spread remains extreme across measuring frequencies.

Looking at the variance ratio’s, briefly hit ytd highs in mean reversion which was resolved on Thursdays cl-cl move. Back to ~avg going into the election.

One would NOT think inverse vol ETP’s would be red ytd given SPX & NDX are having their best year in decades yet here we are… Absolutely wild divergence between RTH session and Globex for VIX futures. Entire curve up to June 2025 above 19 right now, lots of cushion for a long swing into January (praying.)

SPX ATM Straddle Performance

Despite the large win on Thursday (~75pts) shorting 1-dte straddles still net up on the week (~20pts)… Long London close straddles winner last week as we reversed sharply lower after the US session open.

Calls have been punished harshly lately… longest losing streak since 2022. ~115 pts loss last 10 trading days, even the Mag7 earnings couldn’t keep indices up.

Variance Ratio Conditional Performance

From the following post:

Spent Mon-Wed last week longing straddles for 1-DTE leg & RTH session leg, cash on Friday. Short the US RTH session straddle for Monday. Small bounce so far, lets see how it closes the year.

VX Carry & SPX Overlay

From the following post:

VX system in cash for a while now, SPX overlay mainly triggering long straddles on the flattish term structure. Event vol screwing with the signals. In 2020 I jumped in too early in anticipation that 32-34 vx was decent enough premium, only to watch it go to 40… If pattern holds, should see short vol trigger next week or so and probably hold well into Jan-Feb at this point given entire term structure well into 2025 trading 19+.

Have a good week!