Market Overview - November 23rd 2025

S&P Index Options & Volatility

Following up on last weeks overview:

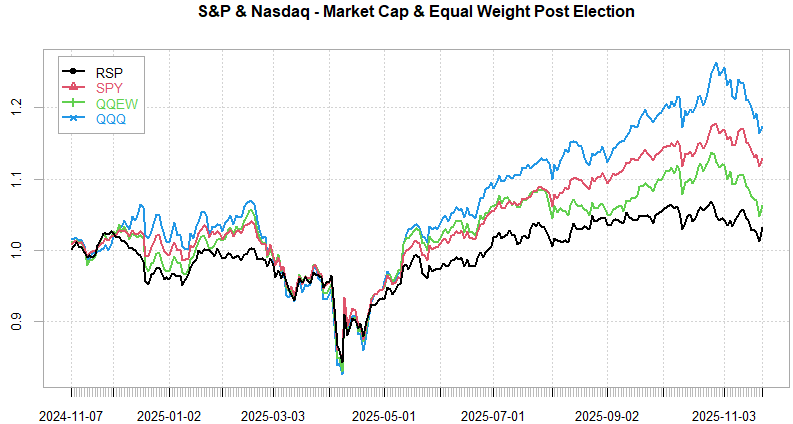

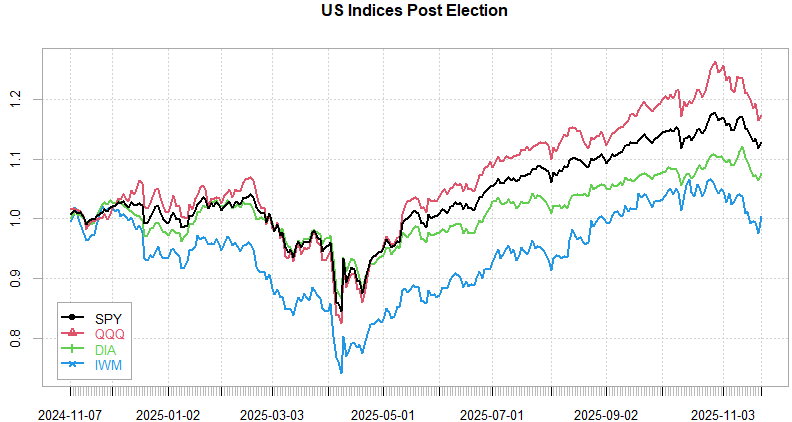

With only 3 full trading weeks remaining in 2025, we’re going into a historically positive period for equity markets. S&P ended the week once again bouncing off lows into Friday, touching ~5% dd from peak on Thursday. Main damage is coming from large cap tech, down ~11-12% as a basket from highs. VIX spiked near 30 on Thursday, running well ahead of realized vol. NVDA earnings came out strong, with Jensen, supposedly, in a leaked memo claimed NVDA is literally holding the planet together. Bessent earlier this weekend also mentioned that interest rate sensitive sectors are suffering, but, 2026 growth prospects looking ok… More of the same… narrow tech led rally with broader economy struggling. We are due for a slew of econ data releases throughout the week due to the backlog caused by the shutdown so despite it being a short week, should be plenty of action.

SPX weekend straddles priced just above 100bps, near highs of 2 year range. Trailing VRP ticking slightly higher as implied vol traded at a healthy premium over the last month.

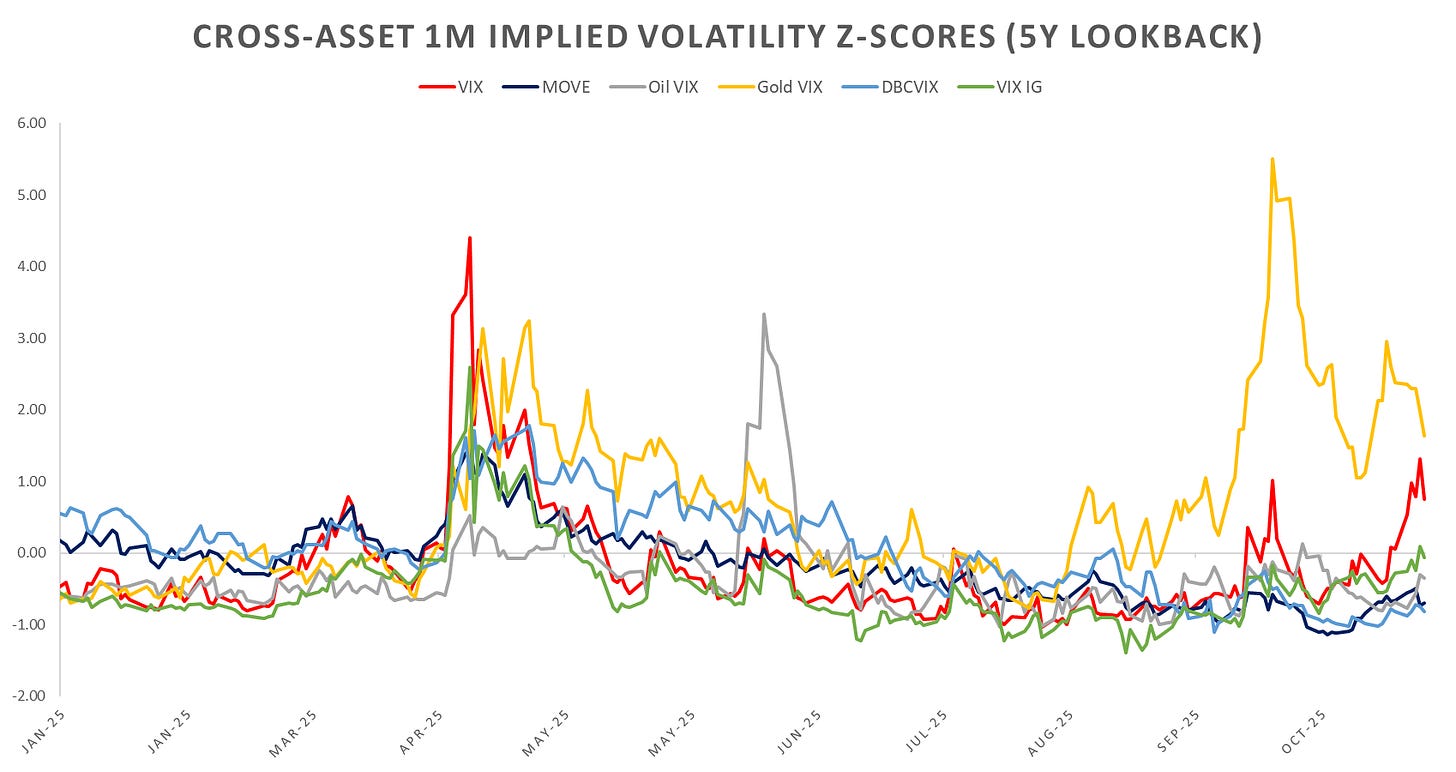

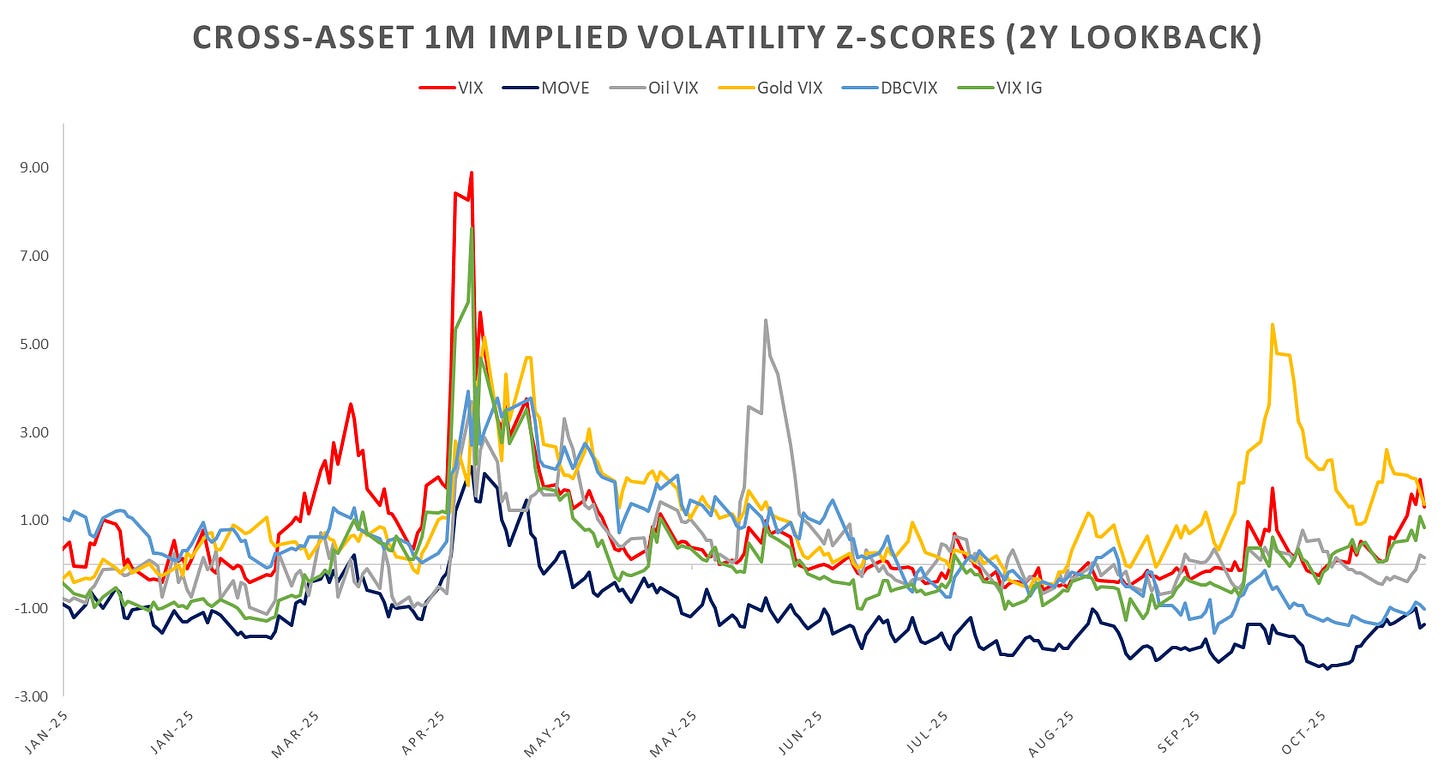

Cross asset vols higher across the board except for gold. Equity vol showing up as the clear outlier, highest on a relative basis.

SPX 25d skew back to Oct highs. Recent comments by fed / admin officials as well as lack of data for a fed that claims to be data dependent leading to increased uncertainty surrounding Dec rate cut odds.

Looking at intraday price action:

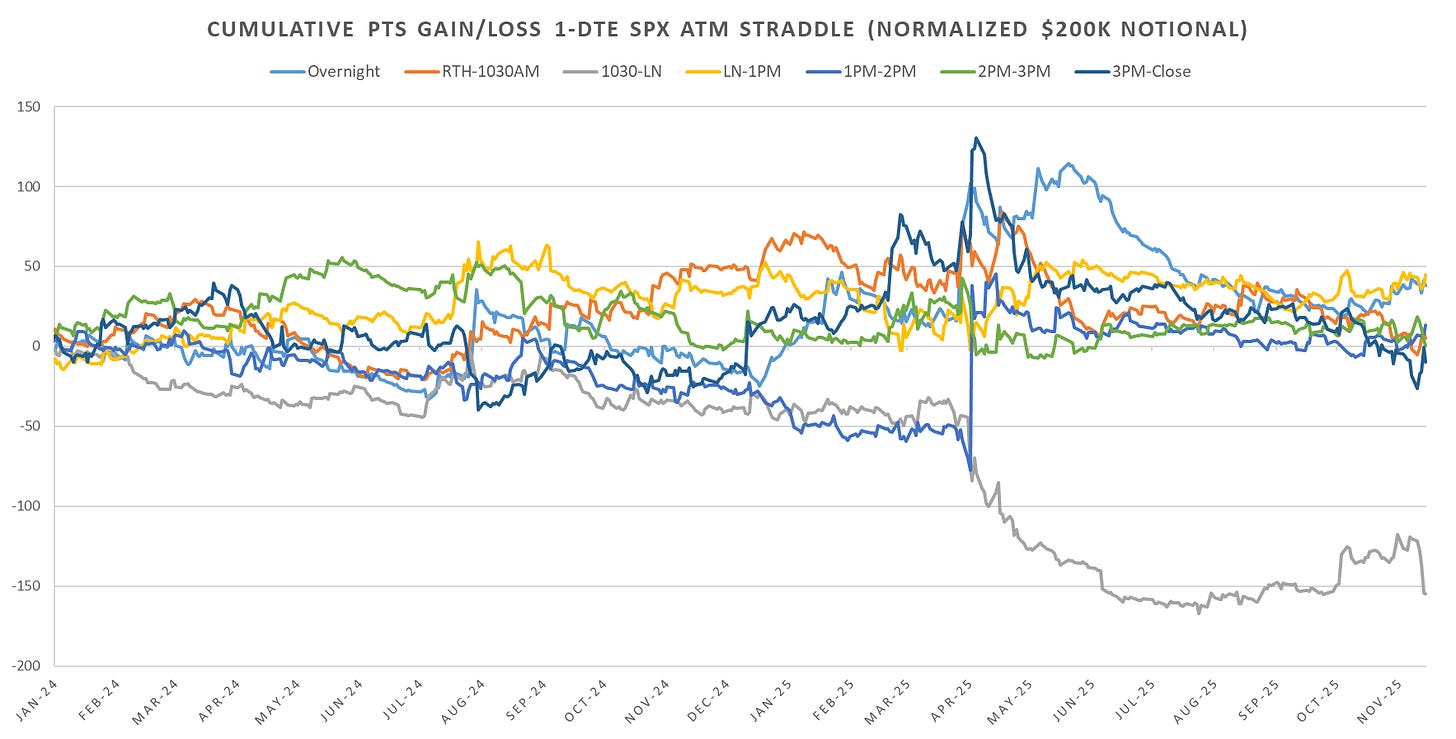

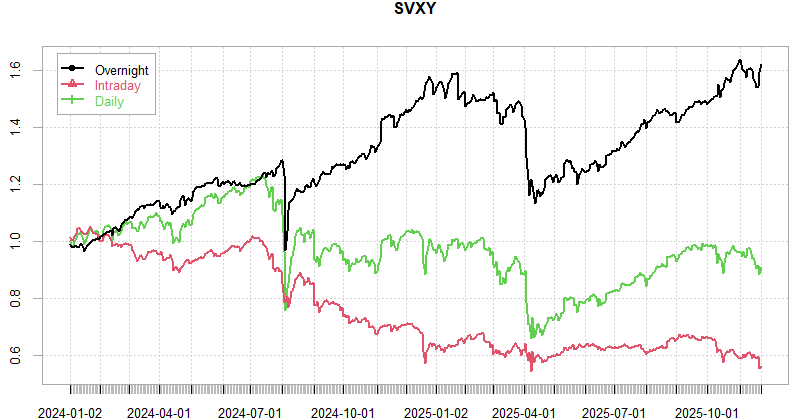

Large divergence last week between delta hedged / unhedged 1-DTE SPX straddles as majority of the vol realized intraday rather than cl-cl basis. Systematically selling unhedged 1-DTE straddles hit peak pnl for the year last week even as VIX hit nearly 30 & indices had 4%+ intraday reversals.

Huge reversal on Thursday knocking the pnl for 10:30am-11:30am mean reversion right back to lows. This reversion into 11:30am has been persistent right from Dec 2021 till now, accelerating heavily from April of this year.

Realized Volatility Overview

US RTH session performance down to ~end of April levels. 6 months of purely overnight gains.

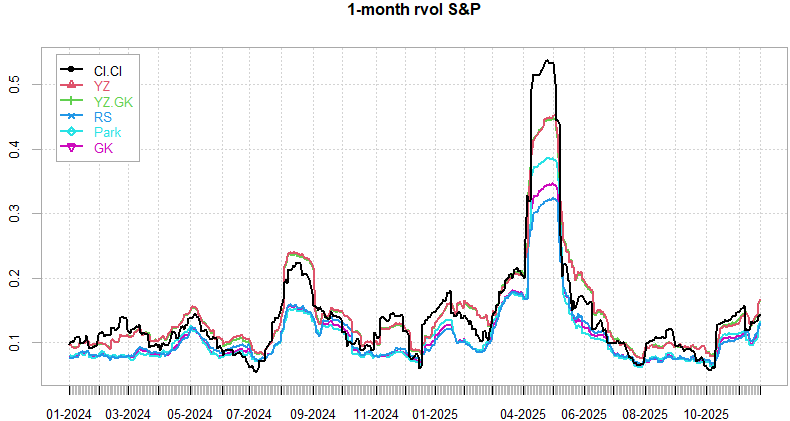

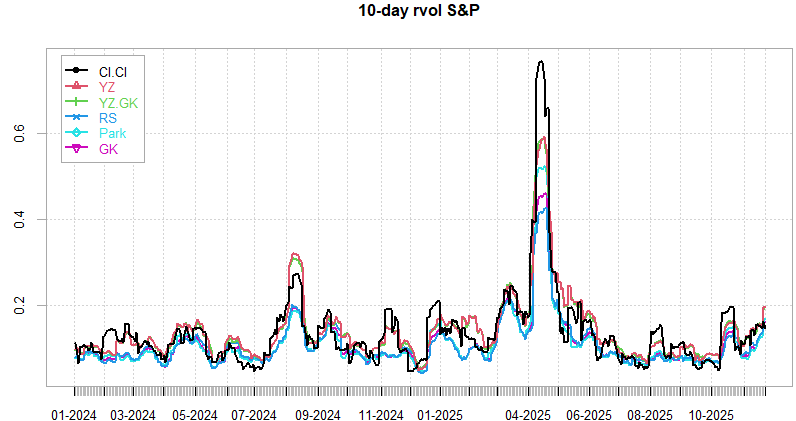

Intraday volatility measures popping above cl-cl as we’ve seen some major intraday reversals. Despite the elevated levels of vol, its largely been a slow rolling correction, Mag7 basket down ~11% over 4-5 weeks and not sharply keeping a lid on realized vol.

1m implied correlations spiked sharply last week as Mag7 sold off with the rest of the market. Short dated implied correlations bottomed ~6-7 on Oct 30th right before the first bulk of AI earnings and have been climbing steadily since. NVDA 1m vols trading ~10pts lower post earnings so far, with VIXEQ also dropping back into high 30’s. Given NVDA earnings did not disappoint, I assume we are heading back to single digit short dated correlations with the AI basket climbing back to highs into year end.

The pattern of overnight outperformance is more pronounced in VIX futures than the underlying indices. Short VX30 rolling performance now below April lows with overnight drops in VIX futures almost back to new highs.

Despite record levels of intraday volatility, 1-DTE straddles net down ~116pts over last 6 trading days. Biggest wins came from straddles opened early in the session (9:30am/10am) for 50/132pts, respectively.

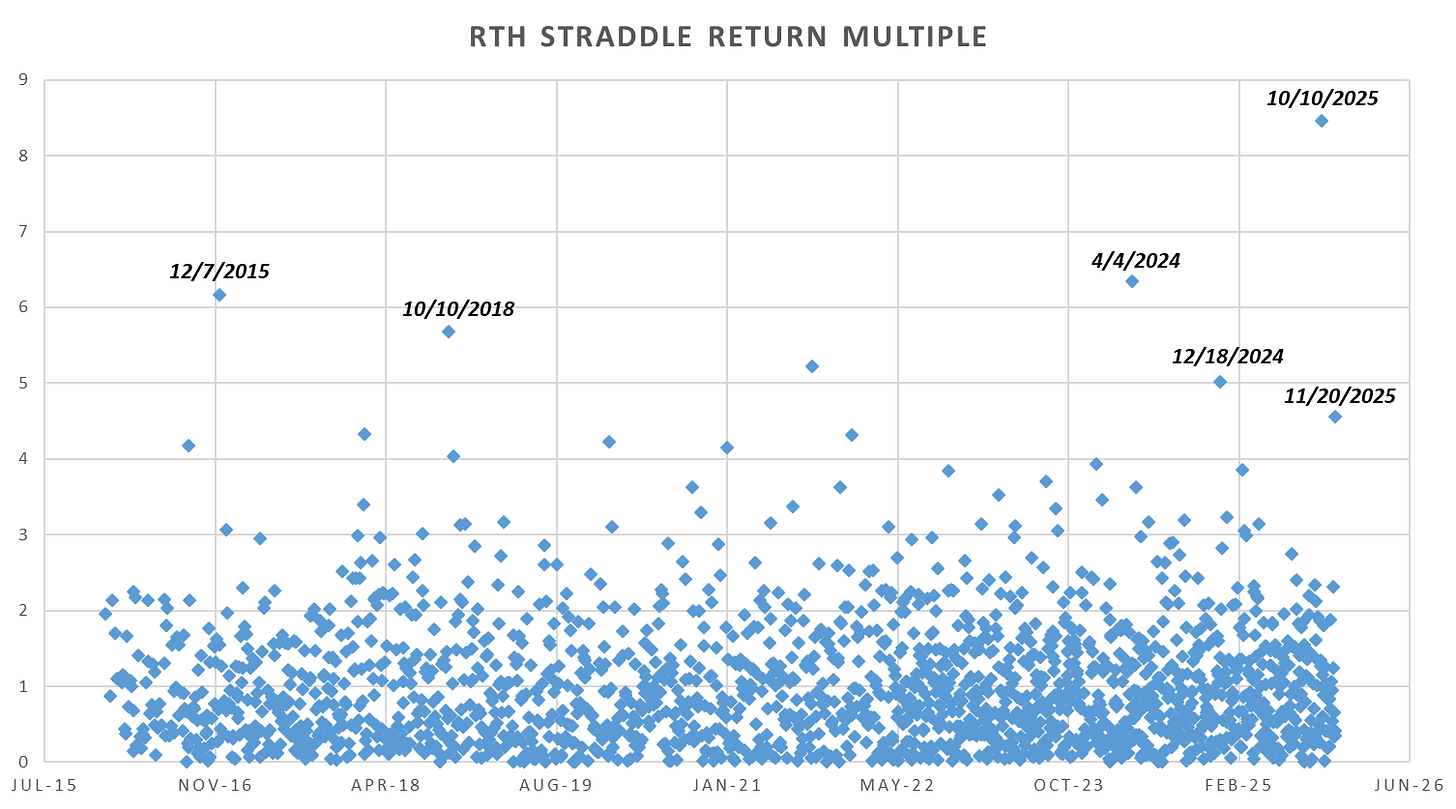

Last few years we’ve been seeing record multiples on short dated straddles. The cluster after 2023 likely as a result of Mag7 dominance and low implied correlations. Implied vol on index kept low but the blowouts in correlations when Mag7 sells off with broader index result in much wider swings than market anticipates.

Intraday Variance Ratio

From the following post:

Bias towards short straddles after a couple of extreme trend days last week. This is a holiday week so even with the data, I don’t think we see much follow through to the upside before FOMC even if we grind higher into the end of the week.

VX Carry & SPX Overlay

From the following post:

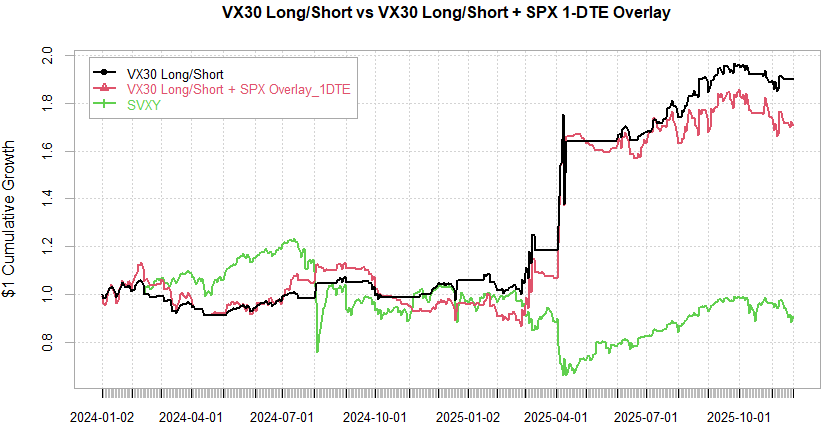

Even with the rally overnight last week and so far on Monday, cash signal sticky for the strategy. Dec VIX lowest point on the curve (as expected Dec contract always depressed) with the rest of the curve ~22 well into summer 2026. So far every early week rally has been sold into heavily last 3-4 weeks. I don’t see much juice in shorting VX here relative to short dated SPX straddles, considering VX is likely to stay bid at least until FOMC, while short dated straddles are getting a boost from slightly elevated short dated implied correlations.

As always don’t hesitate to reach out!

Have a great week!