Following up on last weeks overview:

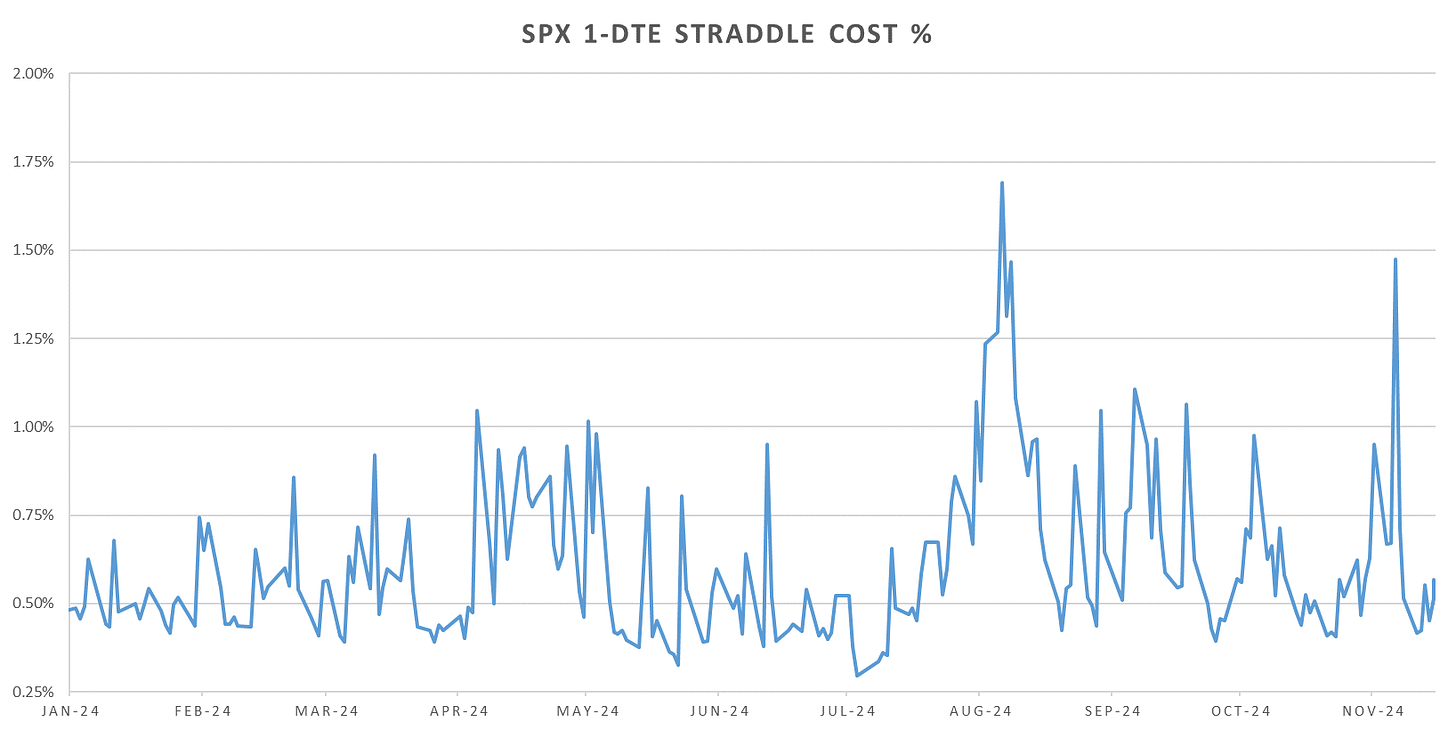

Markets briefly entered nirvana early last week with realized & implied short-dated volatility dropping to 1-year lows. 1-DTE SPX Straddles traded as low as 42bps Monday/Tuesday before the 3rd slightly elevated CPI print in a row & Powell’s ‘no rate cut’ comments spoiled the mood.

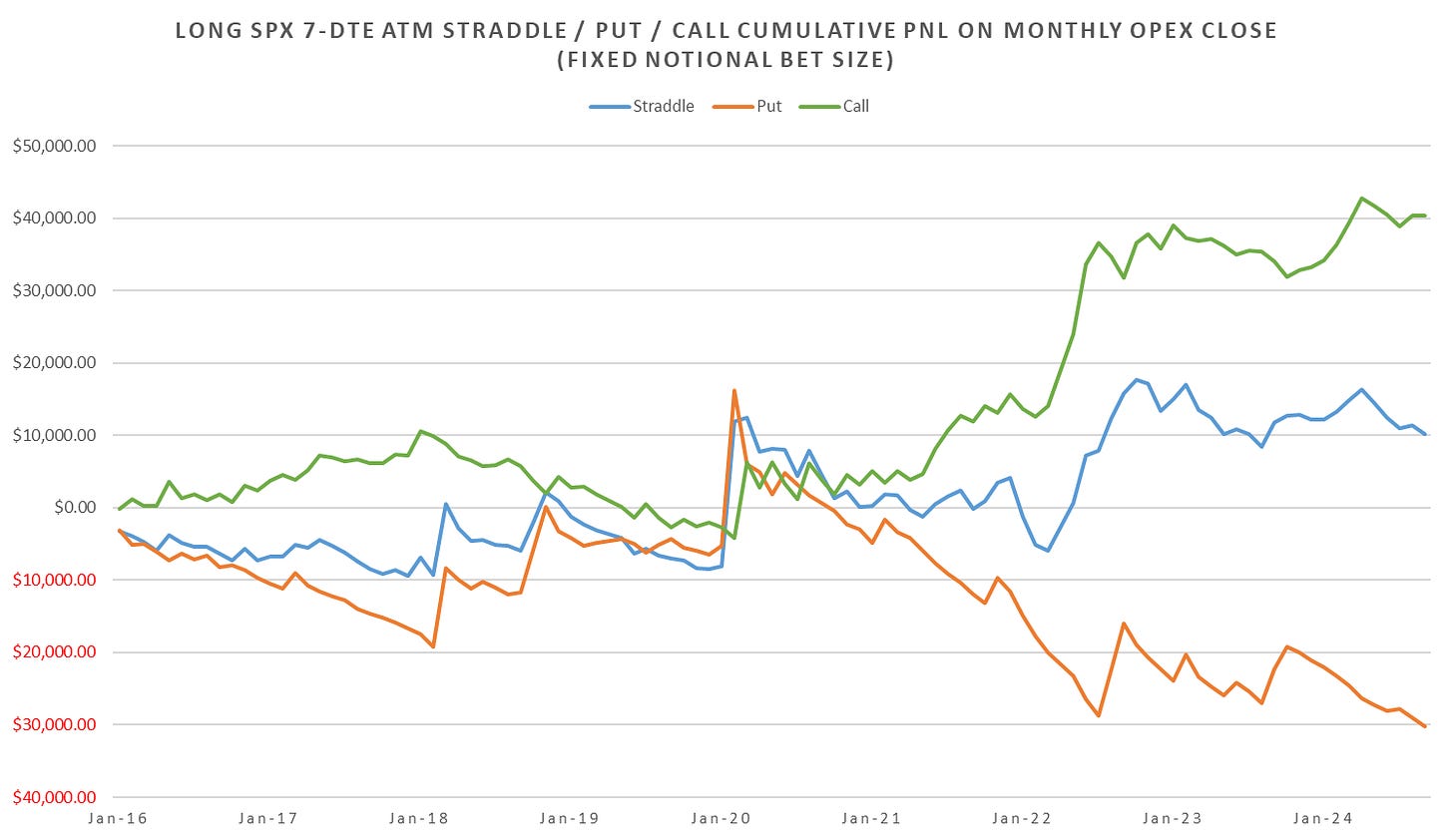

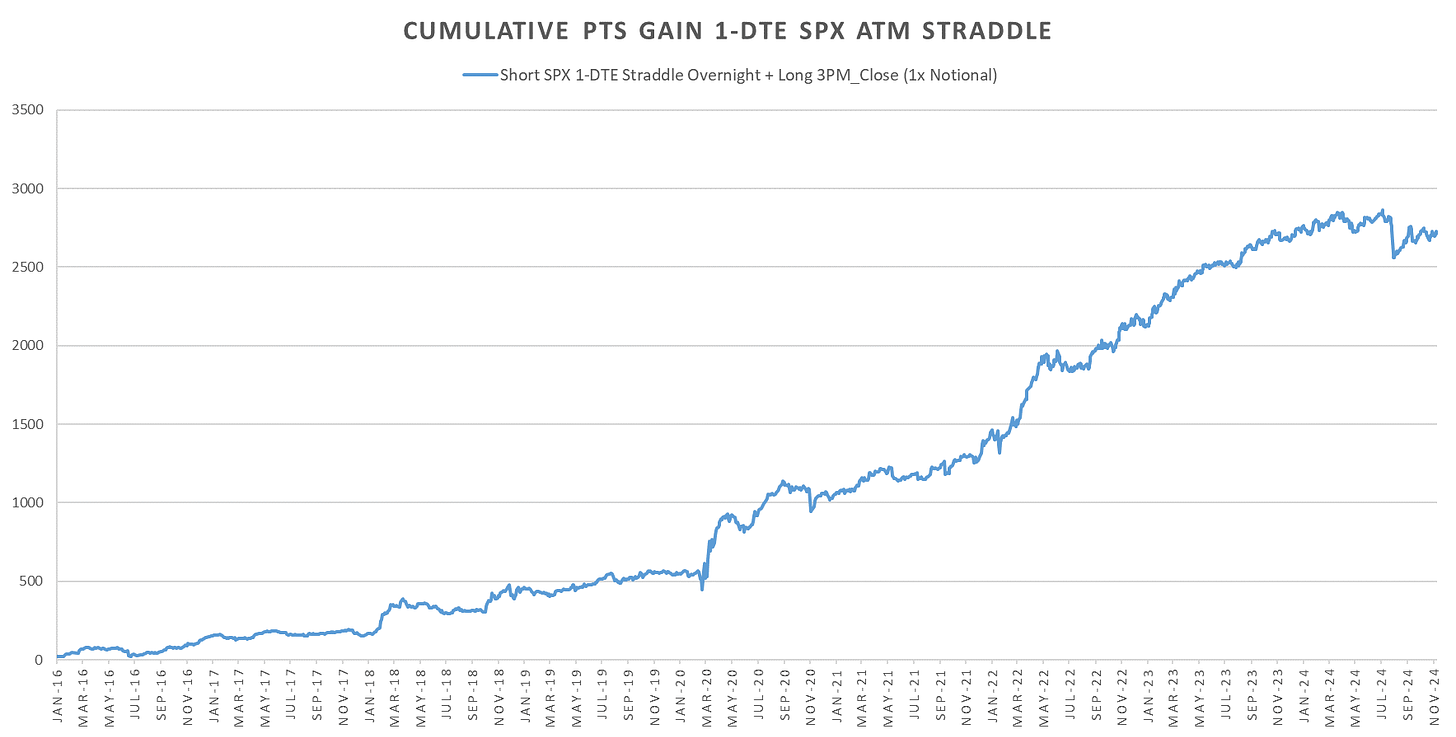

We’ve got the last of Mag7 earnings on Wed when NVDA reports. Reactions have been sluggish for earnings, overshadowed by the election rally in indices. The main story for me, personally is the horrible performance of short premium strategies across the board in the 2nd half of the year. For a record year like 2024 where indices are up 20-30% and realized volatility (outside Aug crash) hit some of the lowest levels in 2 decades, the short VX / short index option pnls have been extremely underwhelming.

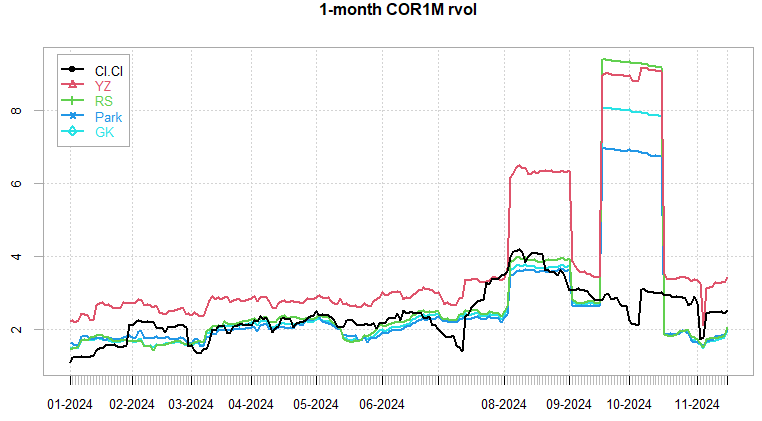

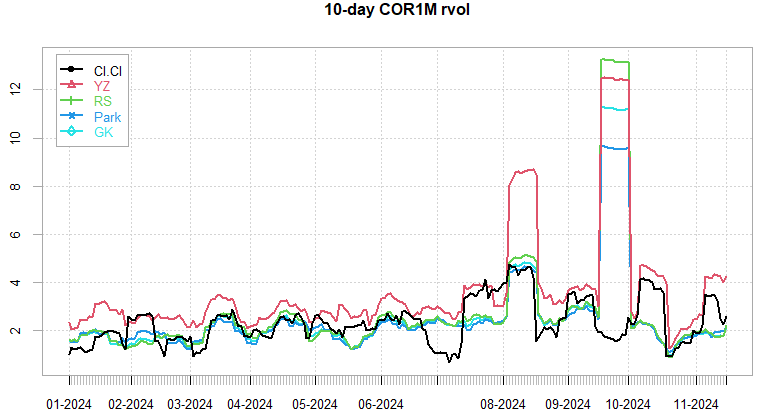

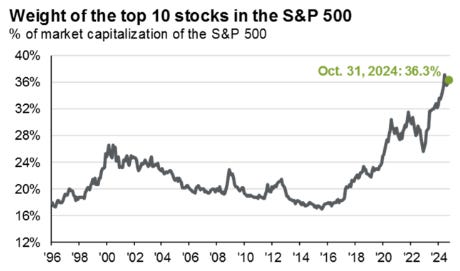

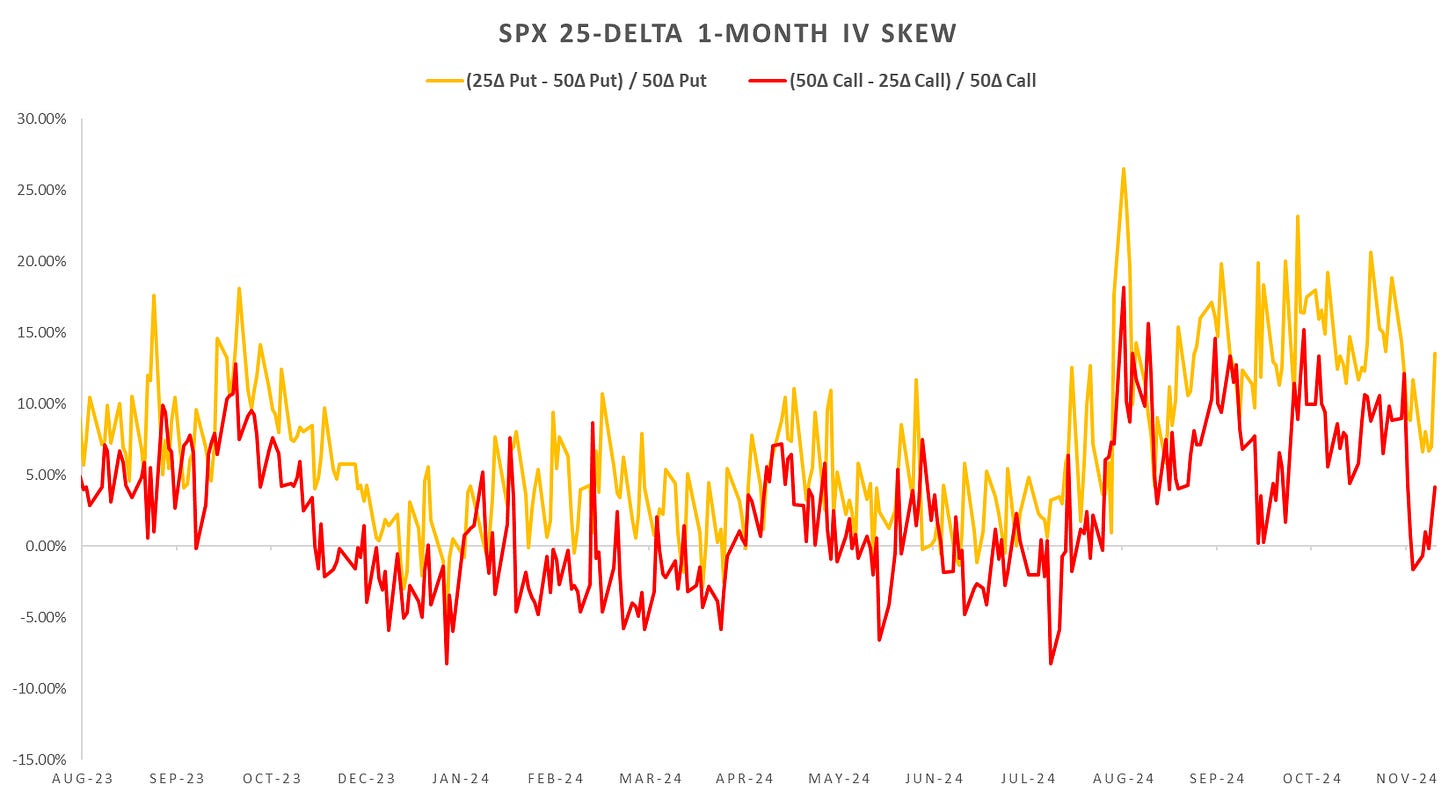

With Mag7 1M implied vols trading anywhere from 20-40 on a regular basis (compared to ~15 lows in 2017) the only thing keeping index vols low is the dispersion between tech & rest of indices (especially given the weight tech has right now.) Performance in short premium strategies dropped significantly after July, which coincided with the brief ‘dispersion unwind’. While index rvol has collapsed back to sub 10 in the previous few months, implied correlation rvol remains violent. This leads to extremely sharp re-pricings in VX & short dated vol. Unfortunately this isn’t just the case this year, since 2018, short premium strategies have underperformed. Persistence in low vol is much weaker than 2010-2017. I don’t see this environment changing until index weights normalize, the short vol trade is far off its ‘golden years’ lately…

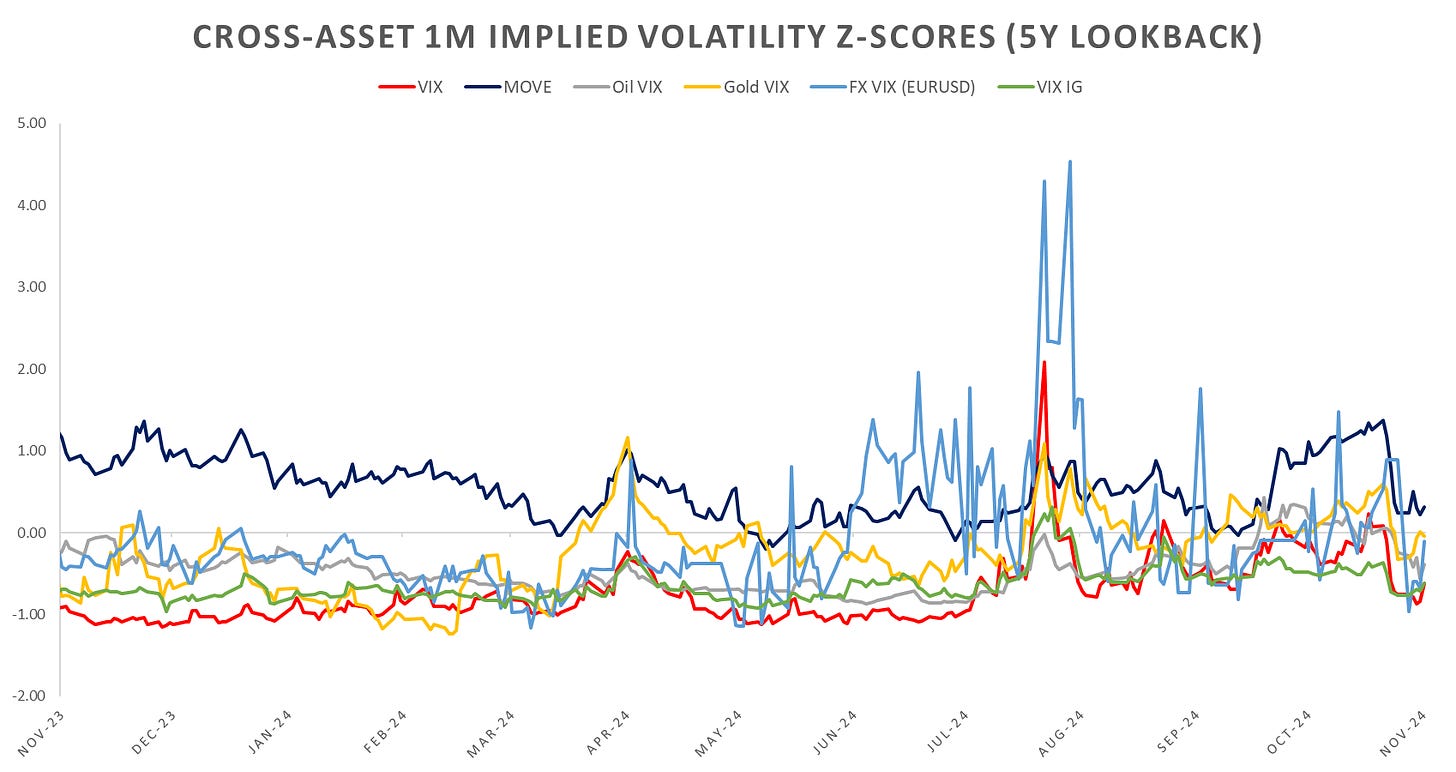

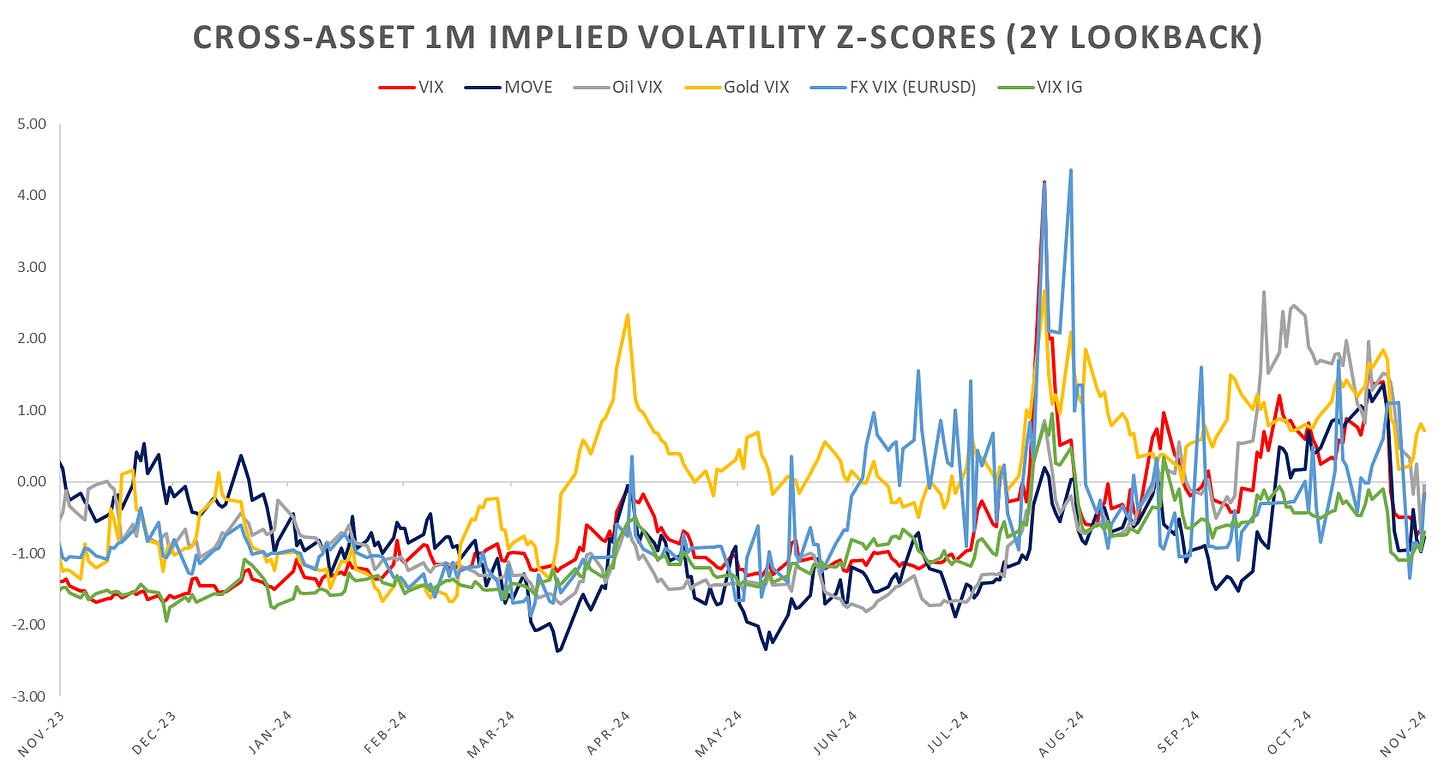

Despite the brief spike in vols after Powell’s comments, cross-asset vols remain below 2Y & 5Y averages. Only Gold & Oil still elevated on ME headlines. Credit vol sitting at 5Y lows.

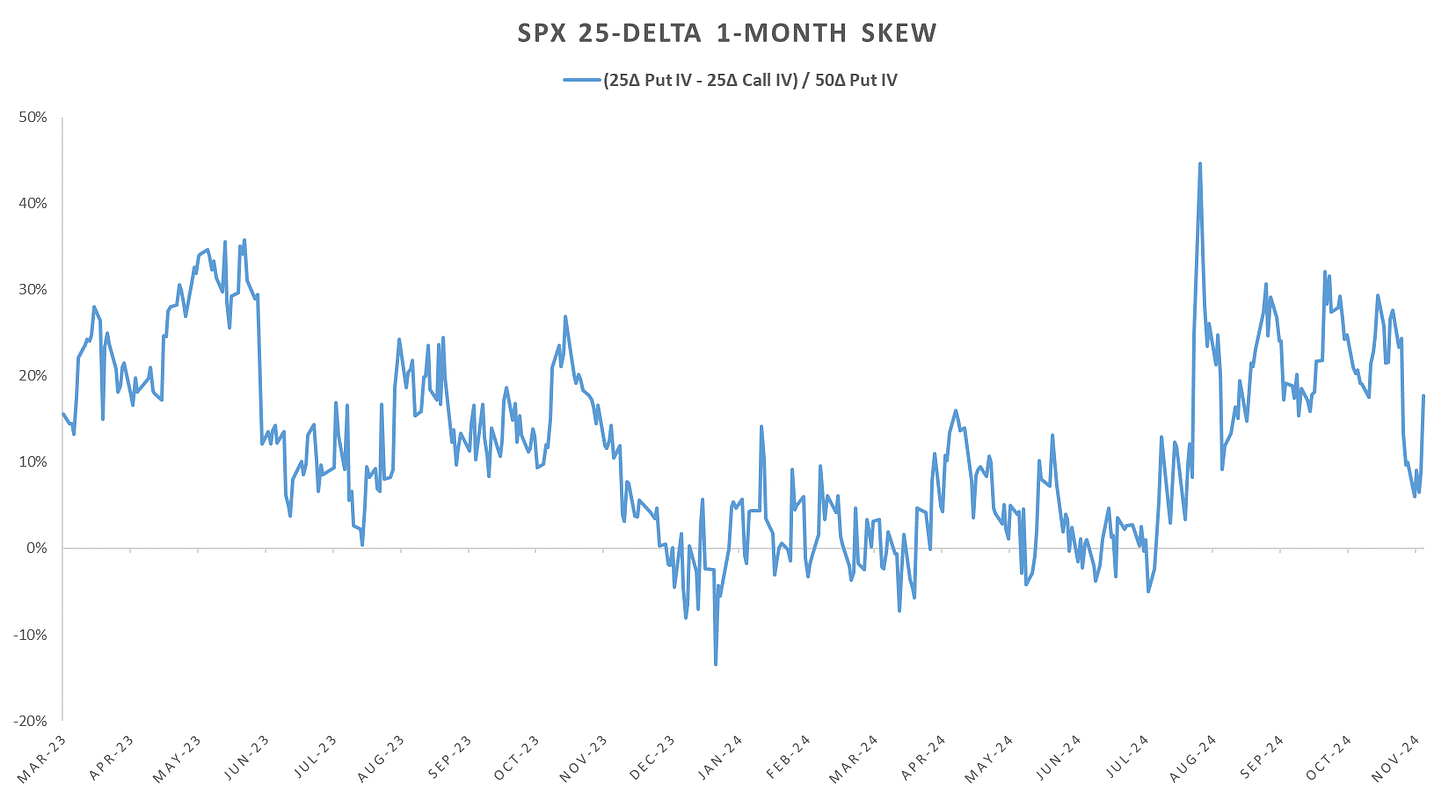

SPX skew bid once again on Friday, put skew barely retraced the Aug move after election vol unwind. December rate cut now under question after last weeks CPI print, with tailwinds for equities in the form of bullish seasonality into year end but slightly more hawkish than anticipated Fed. This new uncertainty should keep event/data premiums elevated into year end and cushion against selling thin short dated vol.

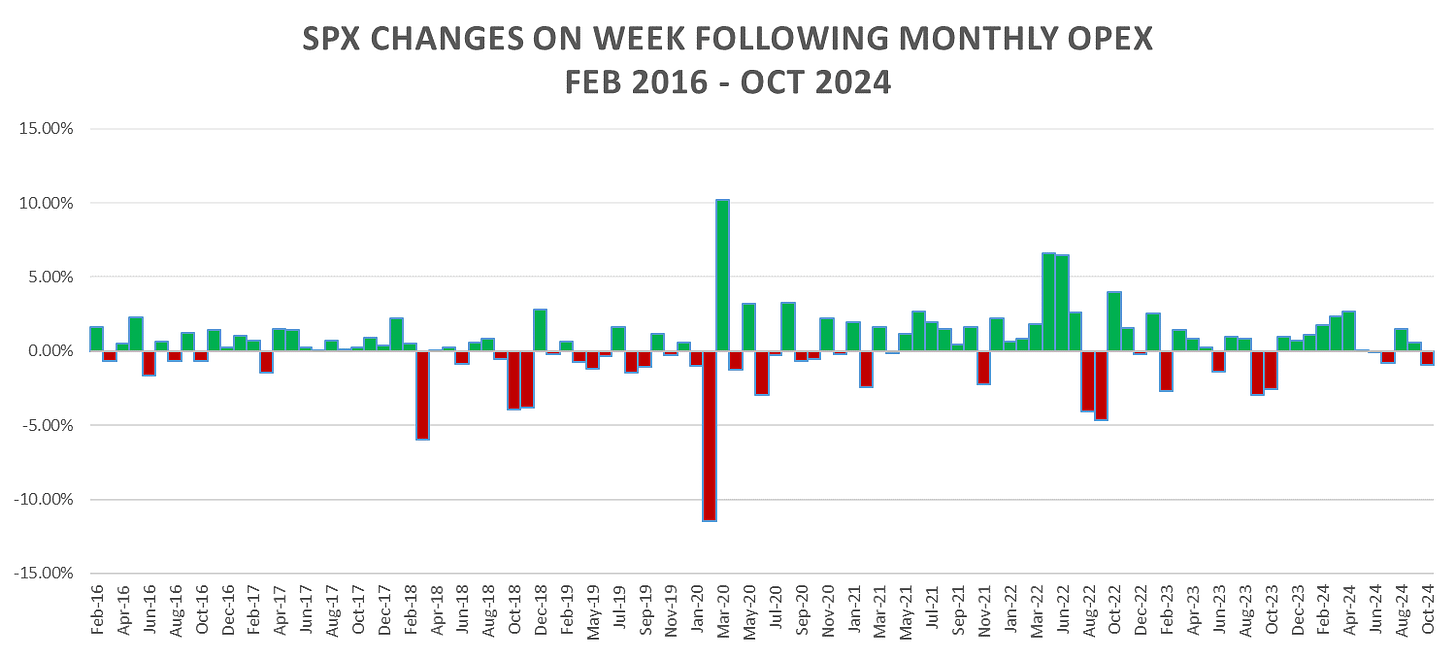

The post-OpEx seasonality alot more positive than the week prior to OpEx. I believe the dip into last week was slightly exaggerated with respect to VX/SPX beta, should see some relief come Monday. Indices retraced half the election rally gains and closed the week at previous highs.

Looking at intraday price action, from the following posts:

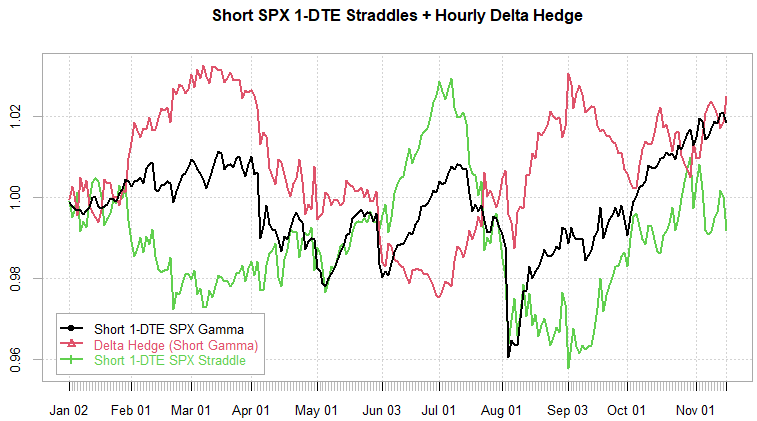

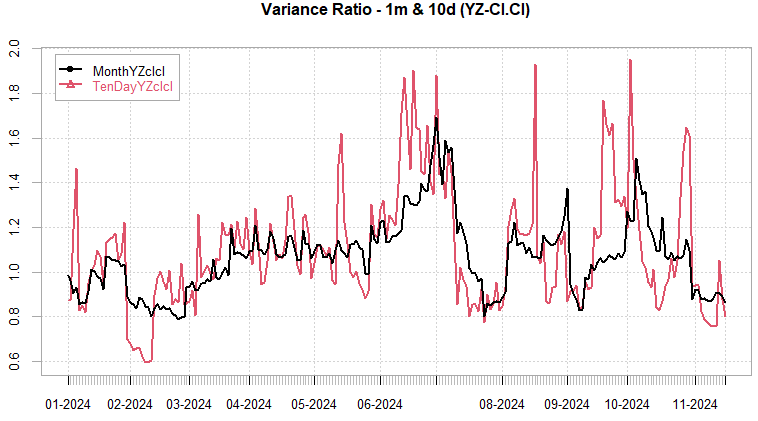

‘Tepid’ selling we saw Thursday/Friday barely made a dent in the post Aug short gamma rally. Intraday trend (Delta Hedge Short Gamma on chart) back to YTD highs, expecting mean reversion intraday next few weeks (more in VarRatio section.)

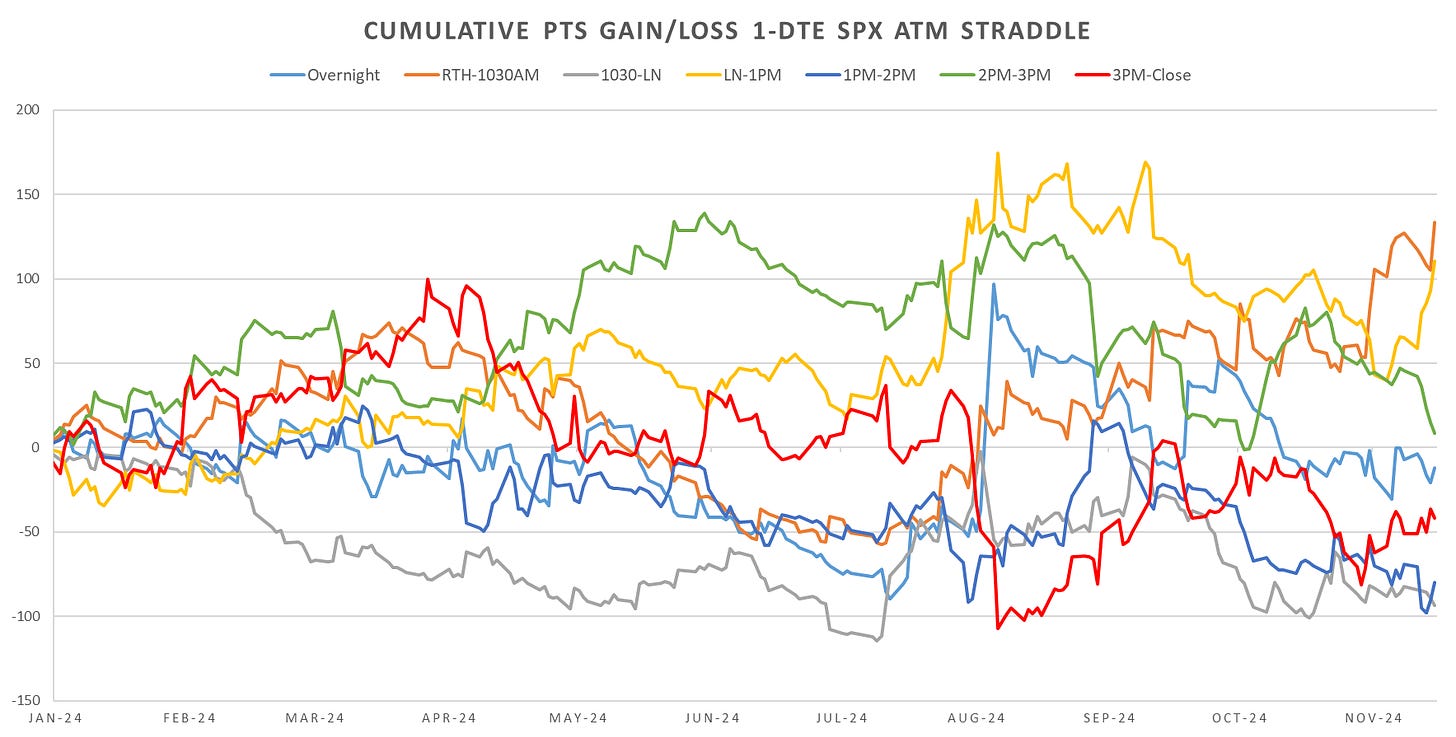

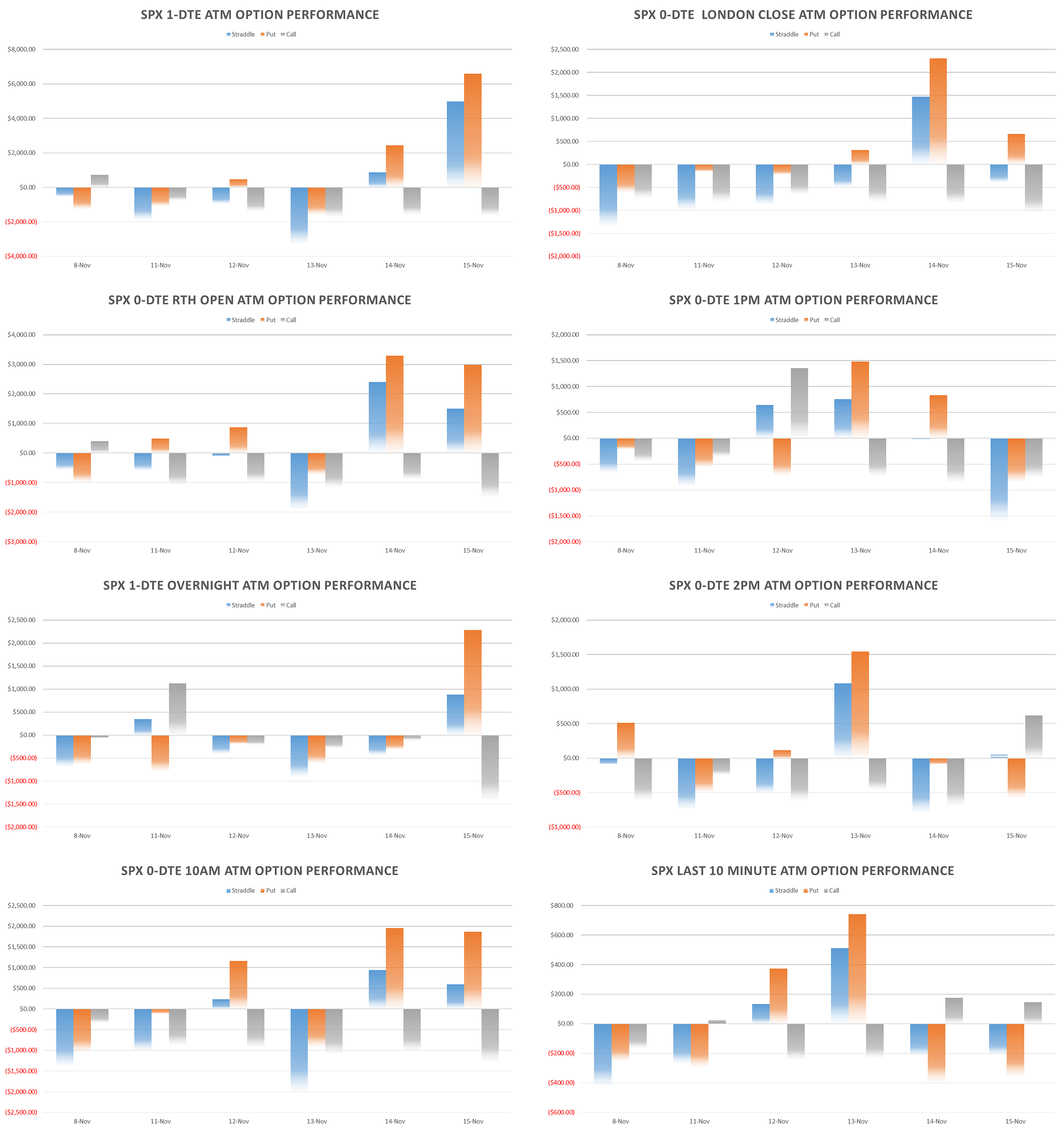

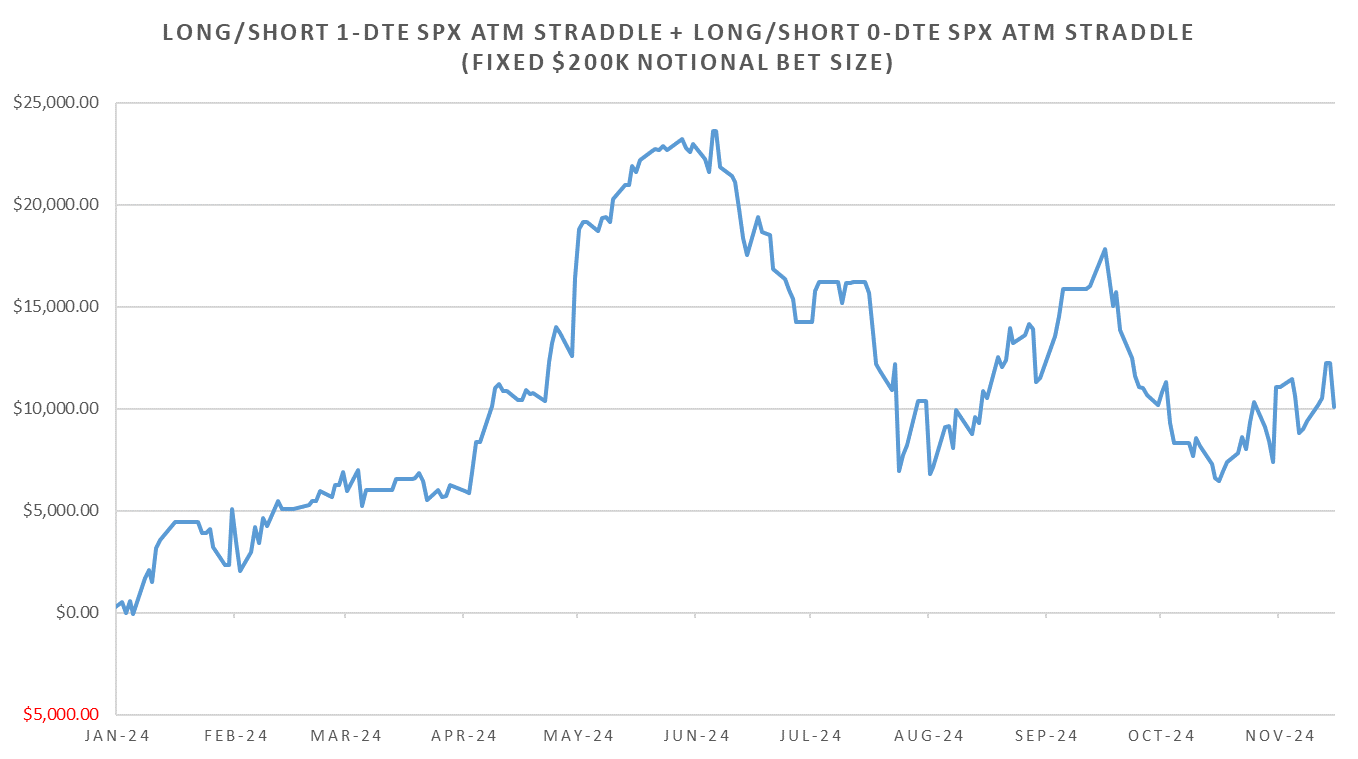

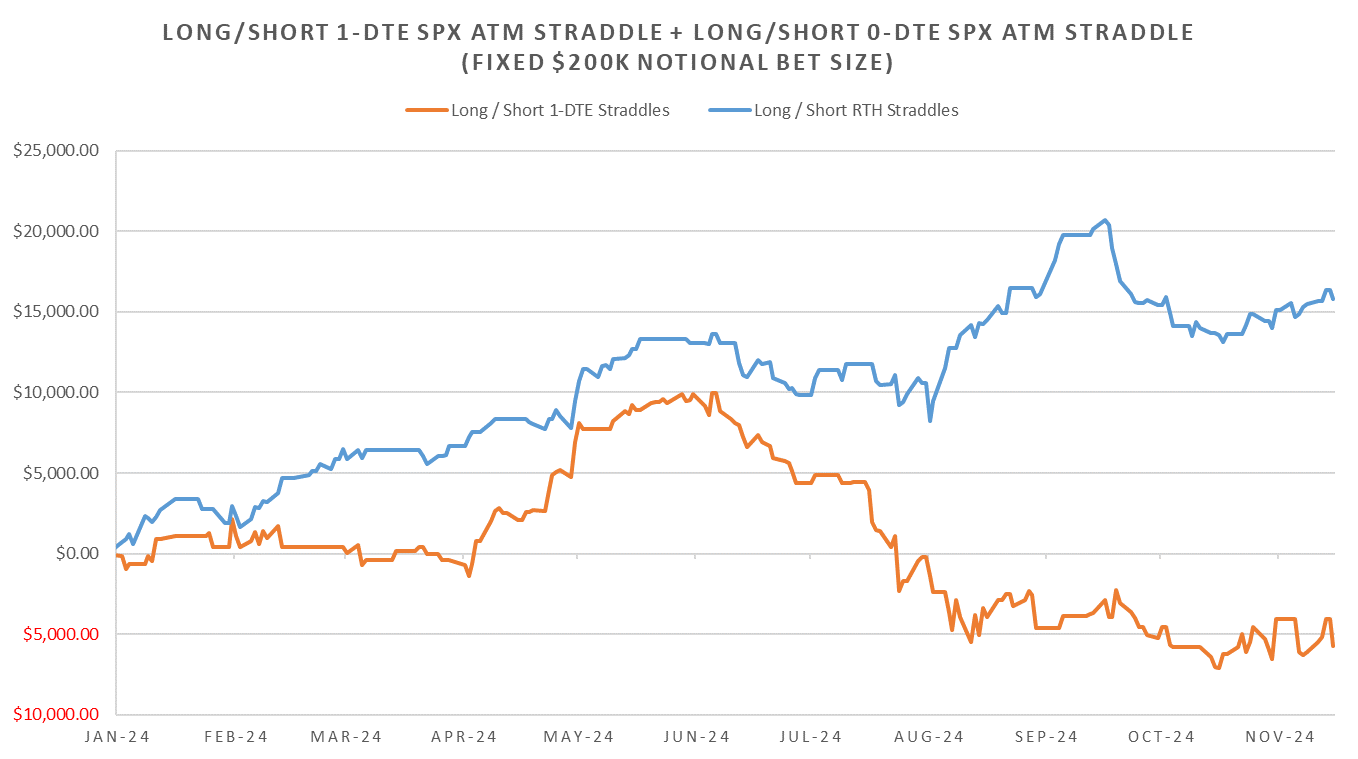

Looking at the 1-DTE SPX straddle cross-section, RTH-1030am & LN-1PM best performing periods YTD. Late day vol continues to disappoint, Aug shift in am/pm session vol, largest in last 8 years.

Realized Volatility Overview

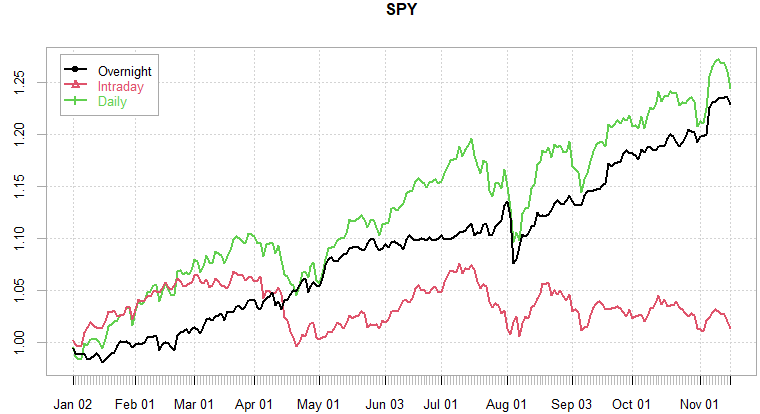

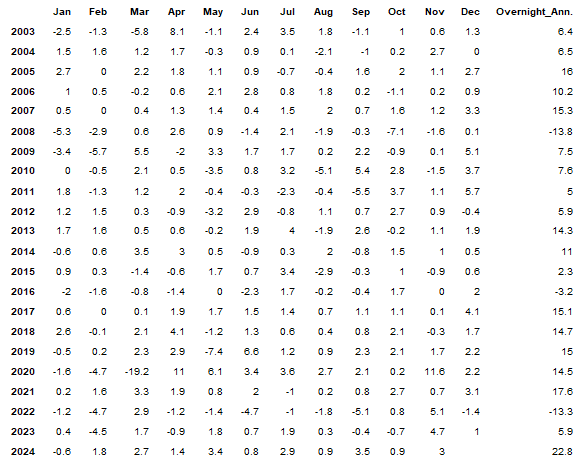

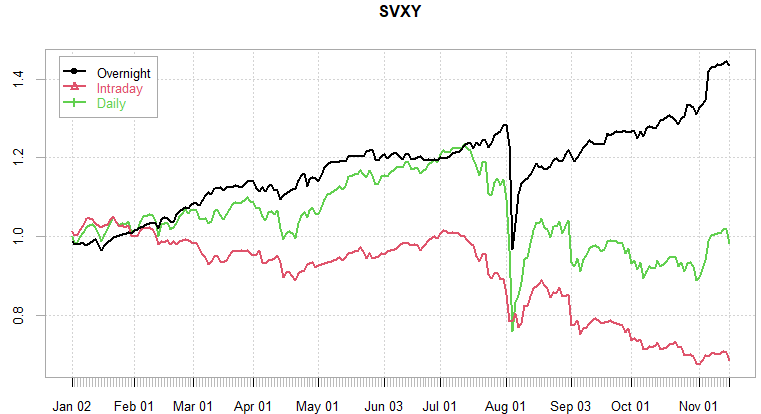

RTH S&P almost back to 0% gain on the year… Overnight ~50bps off its ytd highs. Single best year for overnight performance in 20 years for S&P.

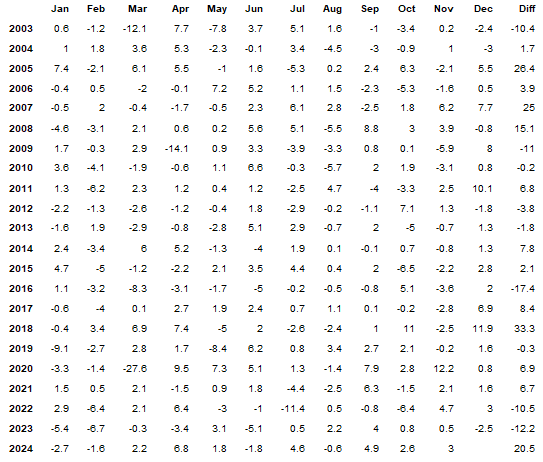

Not the best year in terms of outperformance (Diff+ = overnight outperformance):

2018 outperformance nearly 35% on the year…

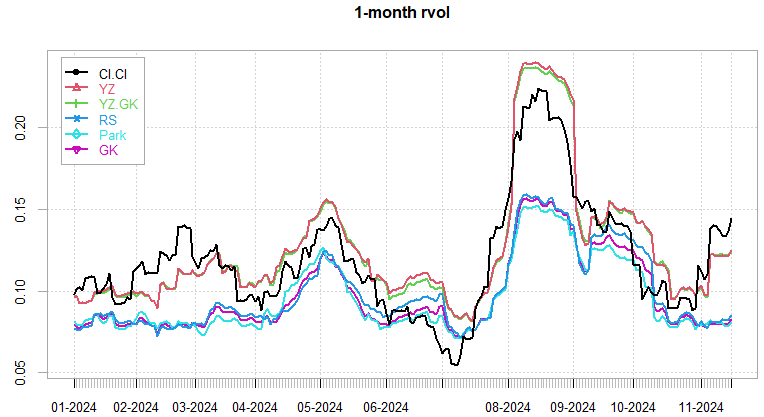

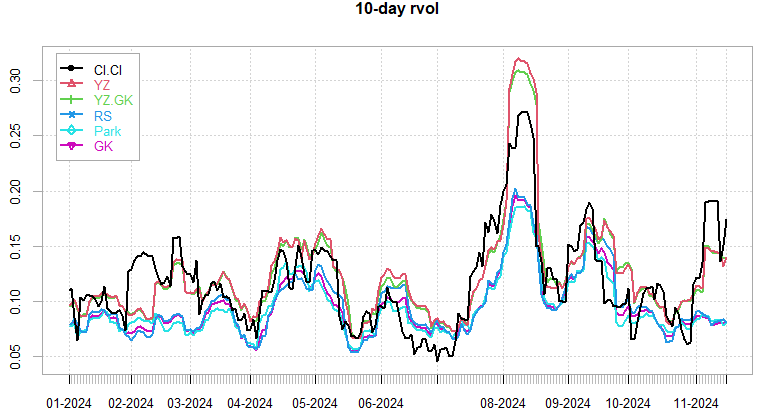

Realized vols perking up after the massive election rally & the eow drop. Note the massive divergence between range based intraday estimators and cl-cl vol. Rallies / drops extremely trendy.

As mentioned, expecting mean reversion to pick up, cl-cl changes lower near term. Not much data this week, NVDA earnings + jobs data Thursday main events. Don’t expect indices to move much outside of that.

VX continues to slide overnight & gets bid intraday. Almost linear performance since July, overnight VX30 ~80%+ short ytd on -1x lev.

SPX ATM Straddle Performance

Similar pattern to previous week for intraday long/short straddles. Post London close best win for short straddles, although entire week has been completely flat in terms of pnls, +-10pts across the board.

Variance Ratio Conditional Performance

From the following post:

Was leaning short all week for 1-DTE & RTH legs. Wins all week (cash Thursday), caught short straddles Friday… RTH leg still doing better, 1-DTE leg completely off this year since July (from the CORR1M rvol chart in the beginning, clearly optimization struggling here as have not seen flips this wild before.) Sudden index correlation flips hits hard on the short straddle side.

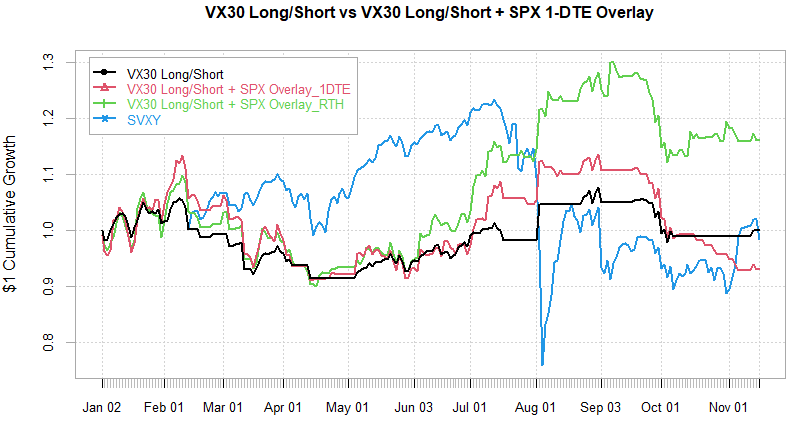

VX Carry & SPX Overlay

From the following post:

First trigger for short VX in a while on Tuesday/Wed, back to cash for Thursday & still cash for Monday. SPX Overlay mainly calls once this week but otherwise cash. Did not cover last week the RTH & Intraday option overlays, hopefully this week will have more time. Disappointing that no short VX triggers post election, but looking at SVXY performance, not missing out on much so far. Still some time to put in 10-15% into year end…

Always happy to hear comments/suggestions/questions so don’t hesitate to reach out!

Have a good week!

Tyvm for posting, ser.