Following up on last weeks overview:

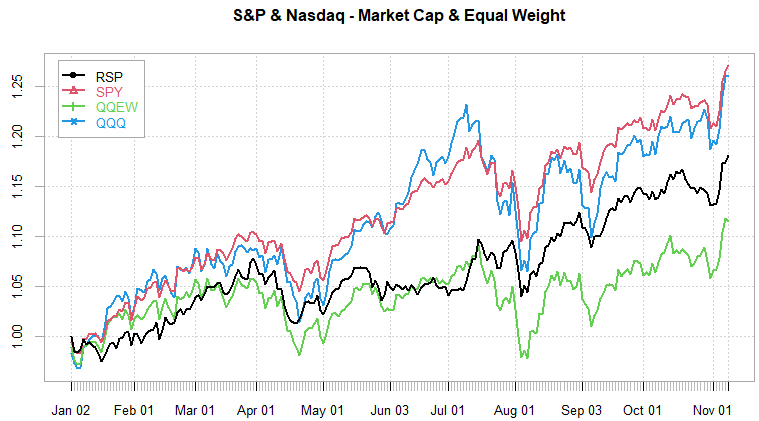

Markets continued to rally after Wednesday election results, broad indices climbing anywhere from 5% to 10% (RTY) in a few days. VIX had a 20% drop on the day, closing the week down 30%+ from last Friday. I’ll quote

for showing just how rare the 4pt vol crush was on Wednesday (from his latest note:Tuesday night’s events now look particularly intriguing. Once you account for non-expanding volatility regimes, losing more than 4 points in the VIX overnight is incredibly rare—it almost never happens.

In fact, it has occurred only six times in our dataset going back to 2000. And even more compelling, two of those occurrences happened this year, in 2024.

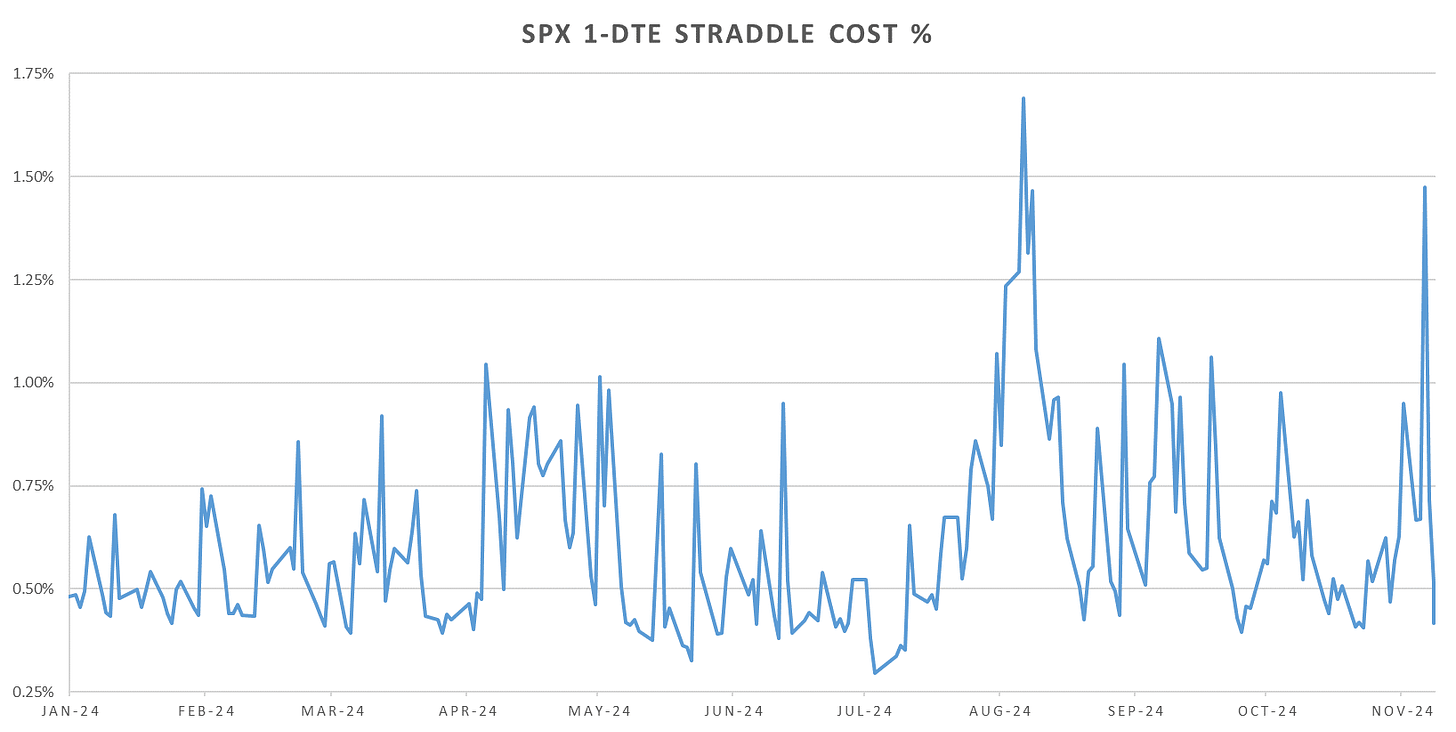

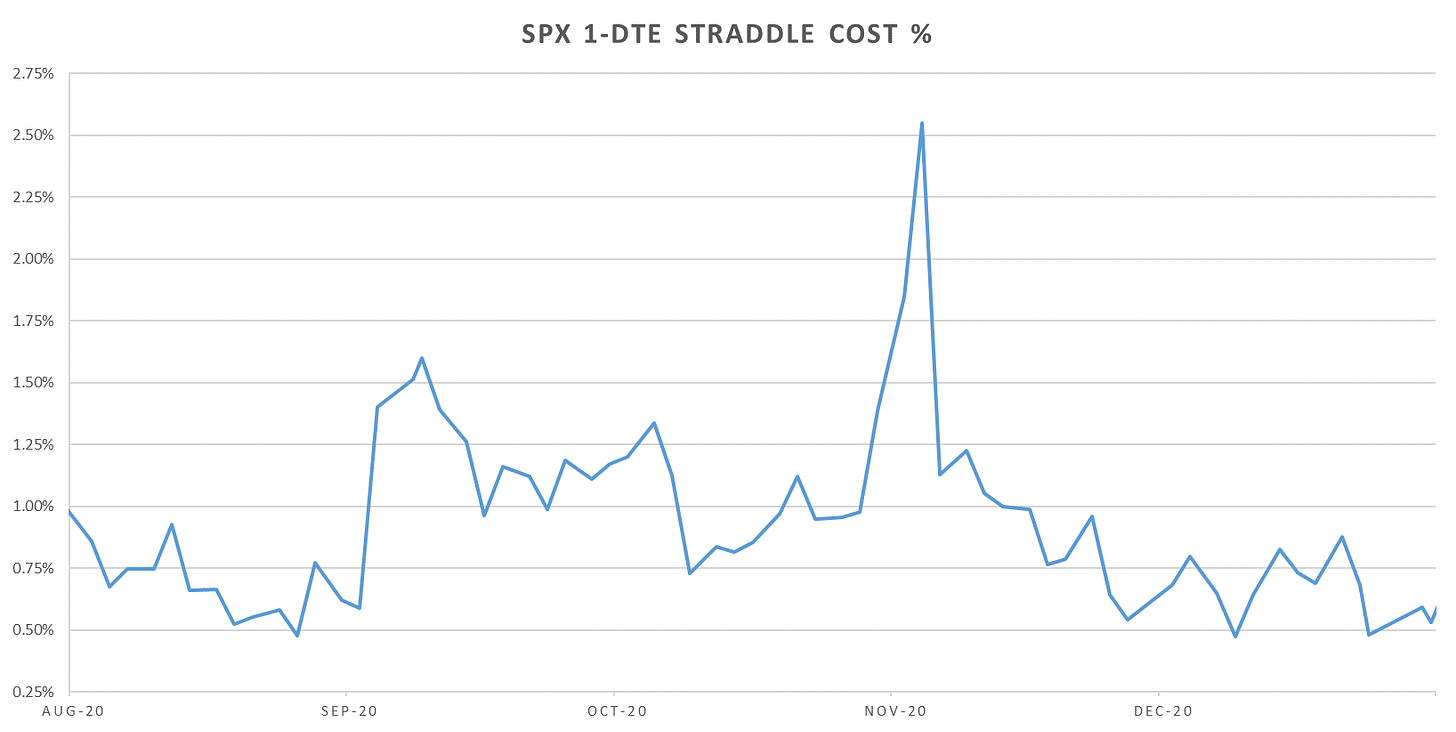

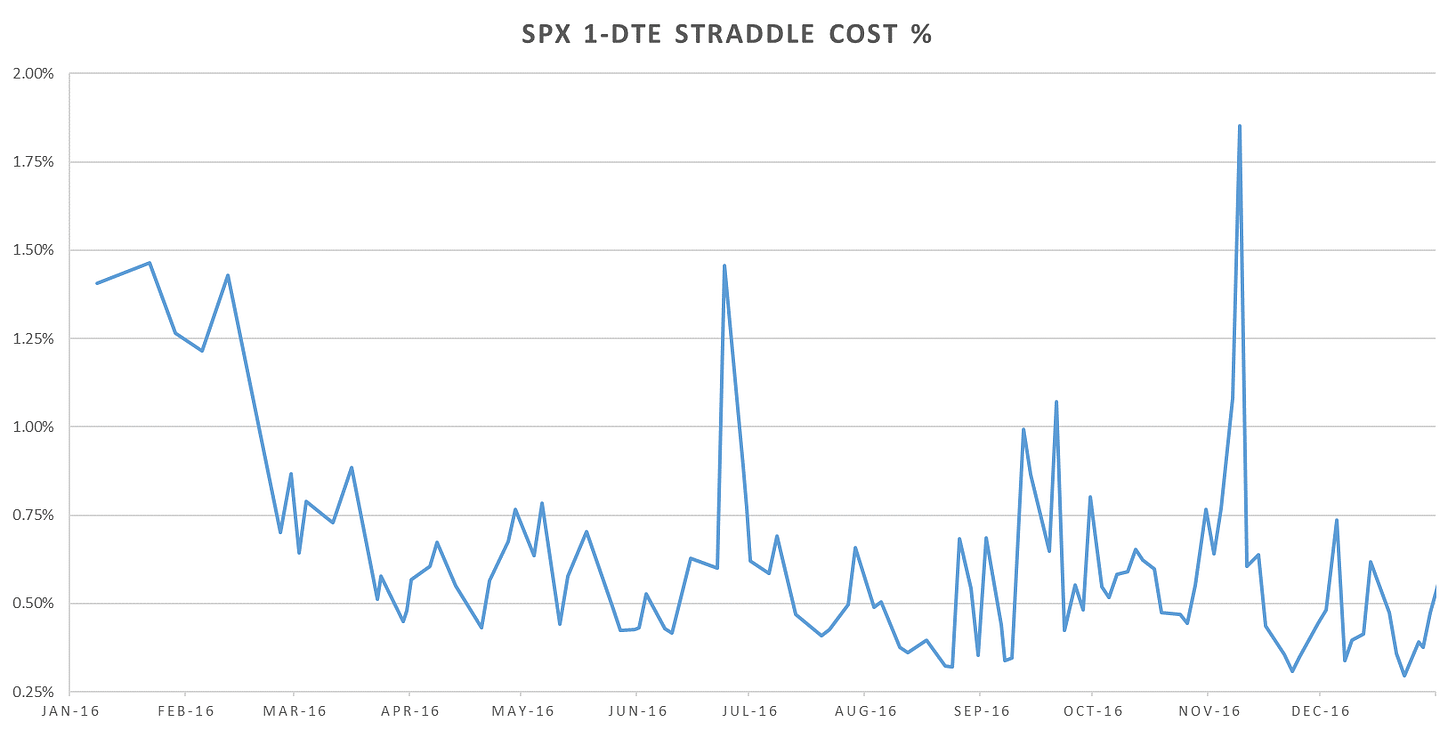

Looking at short dated straddles, very similar to 2016 in terms of drop-off for short dated vol. Both times, short dated vol went right to yearly lows and stayed there up until Thanksgiving. Both years saw some chop return into Dec, but the post election impulse can easily last couple of more weeks without seeing any significant downside, especially in these extremely ‘trendy’ markets.

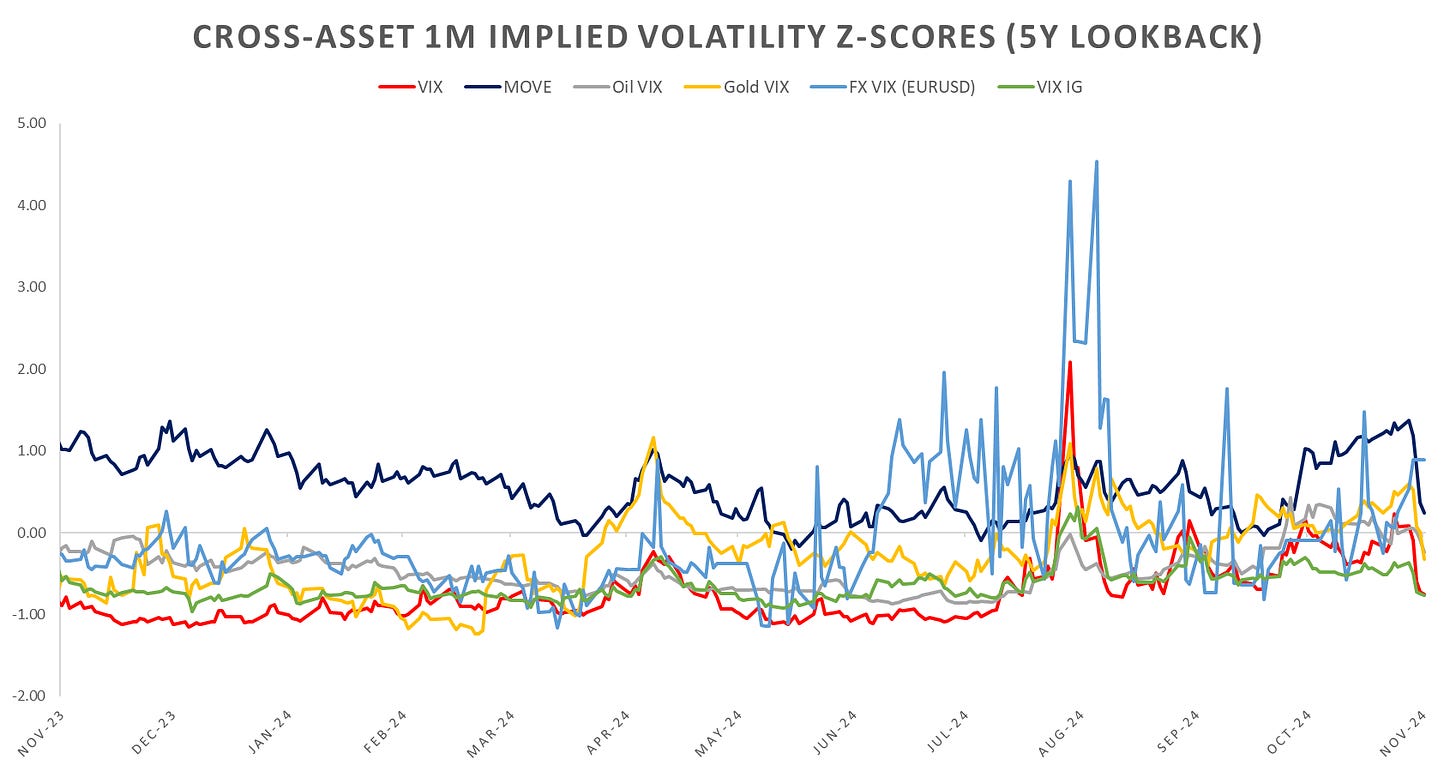

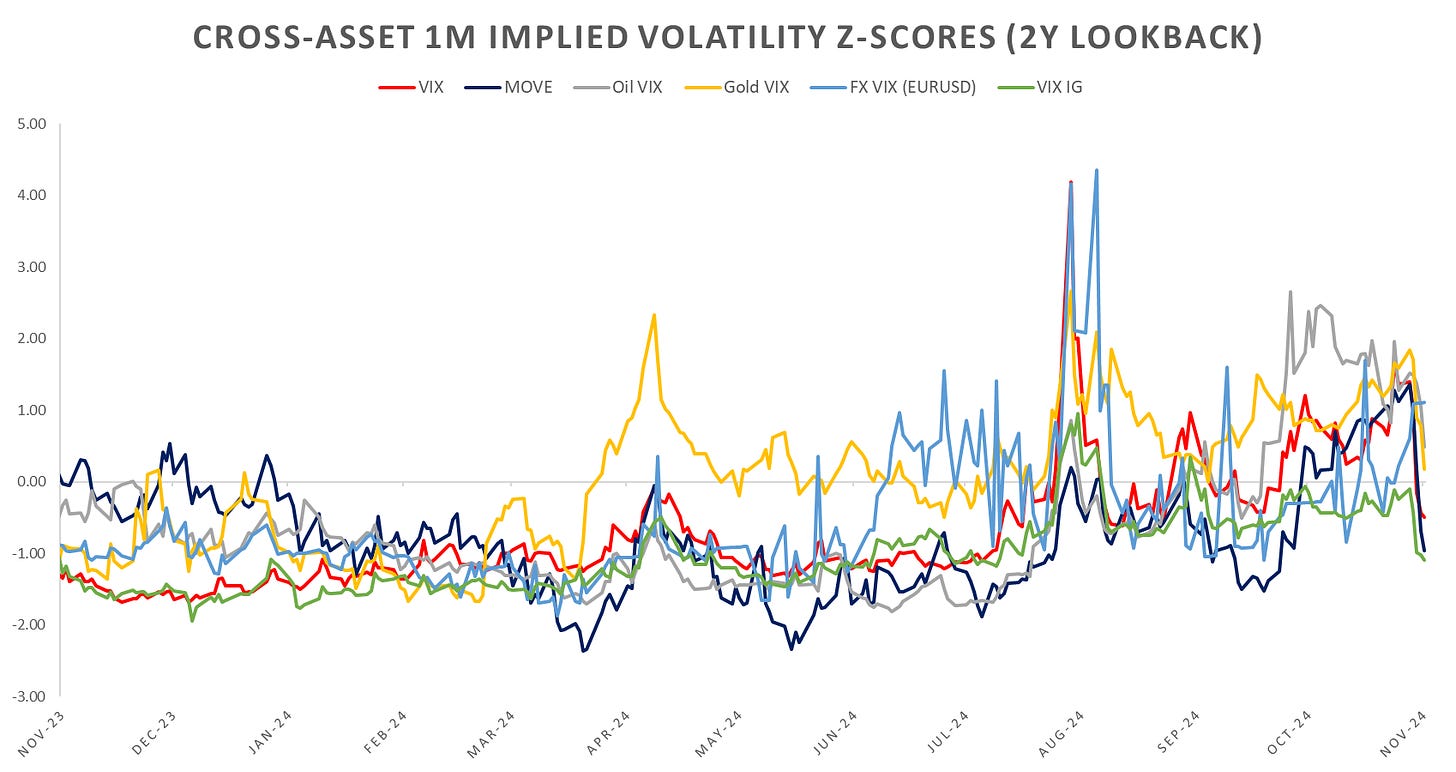

Looking at cross-asset implied vols, sharp drop-off across the board with bond vol experiencing the sharpest drop (despite 10y yields still near 4.5% albeit off highs into eow.) As mentioned in the last few posts, VIX sold off to ~15 to end the week, there is still demand for left tail for indices, with Israel/Iran & Ukraine war unresolved (and unlikely to be anytime soon.)

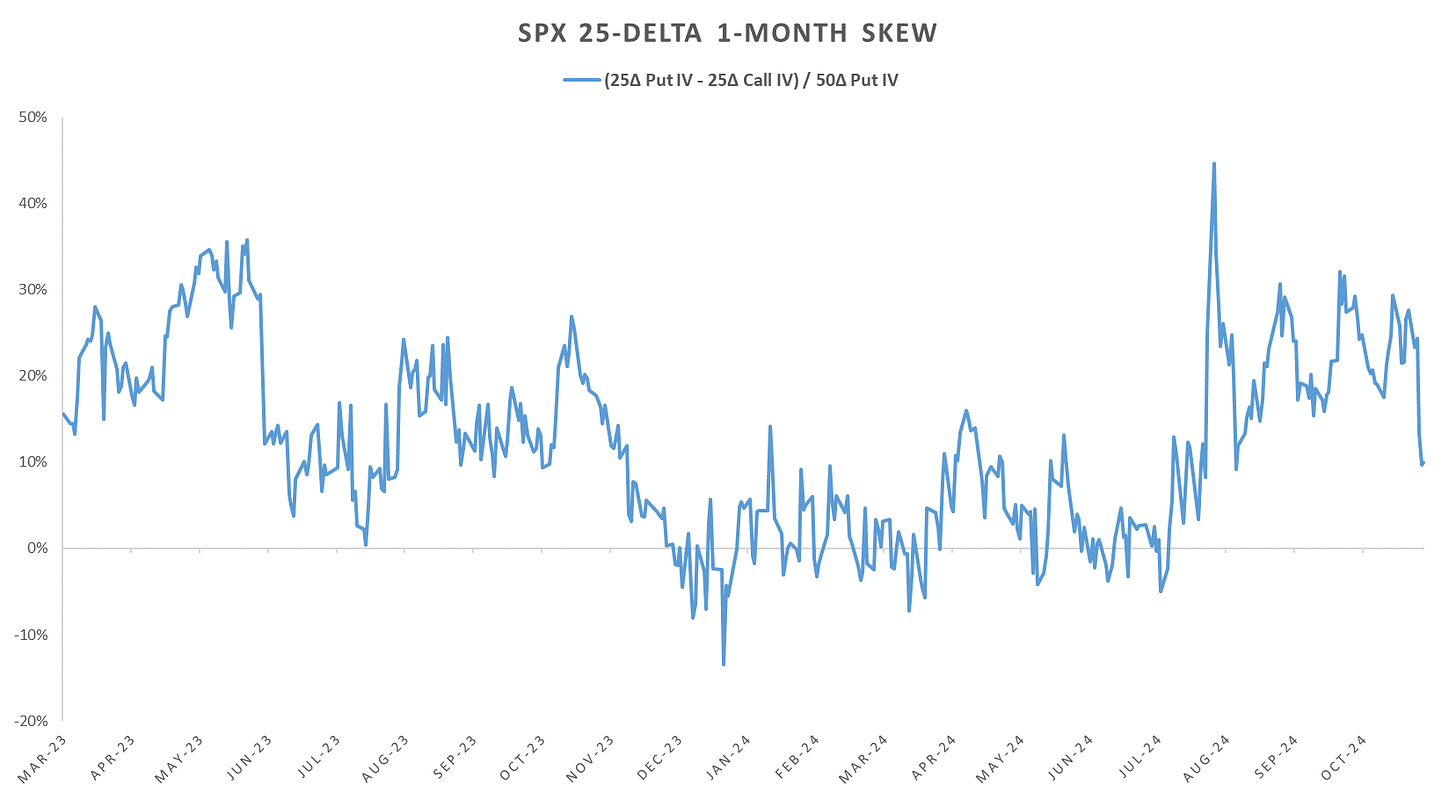

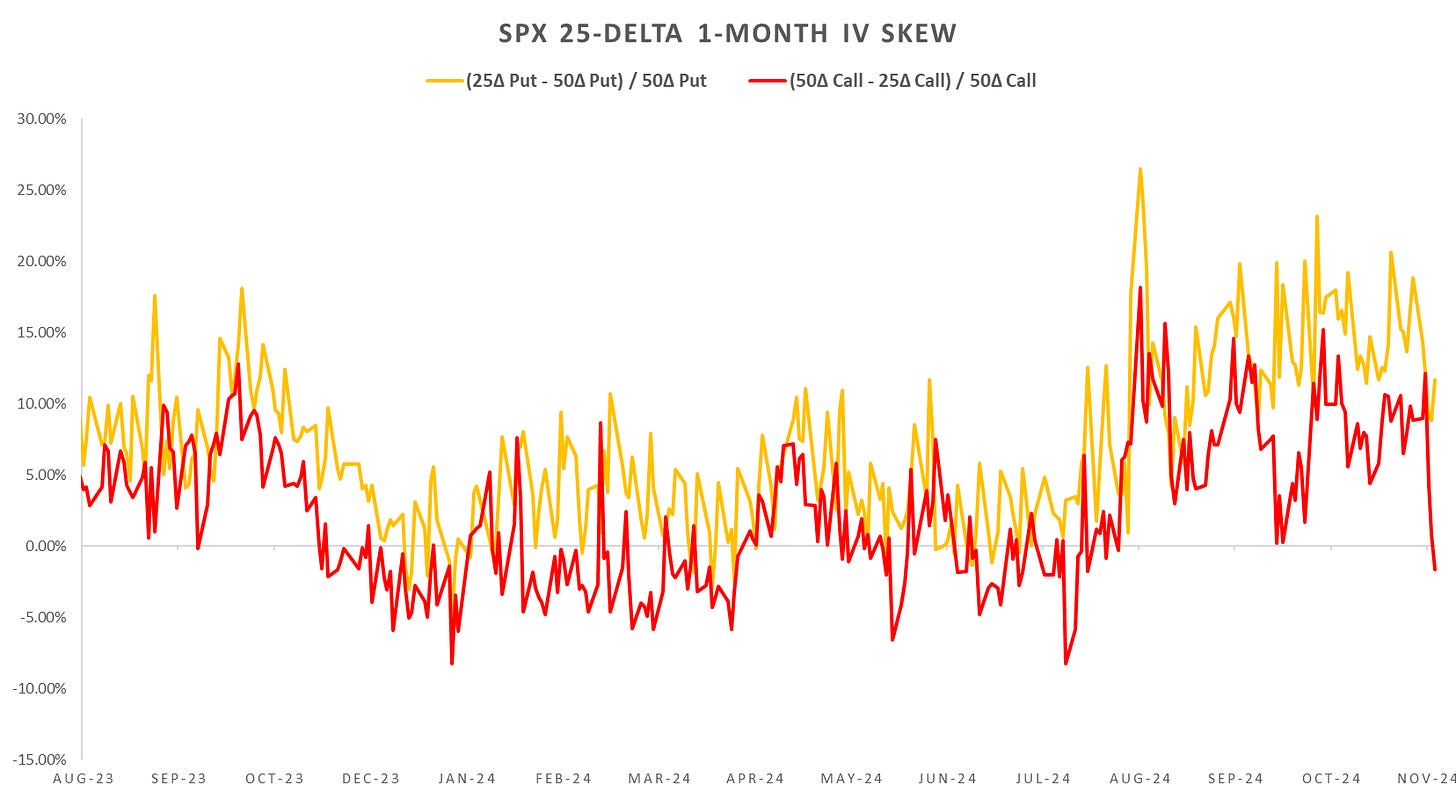

SPX skew eased slightly, with call skew back to near ytd lows. Long 25d calls delta hedged into eoy give a nice setup for both a panic chase into December as well as opportunity to scalp a short term retrace following strong rally in equities last week.

Looking at intraday price action, from the following posts:

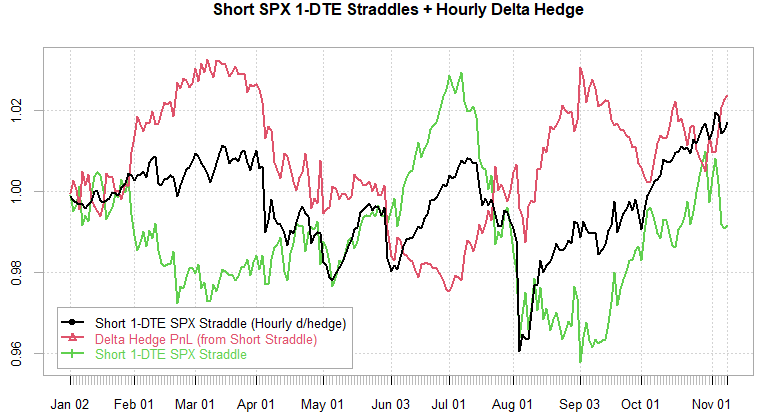

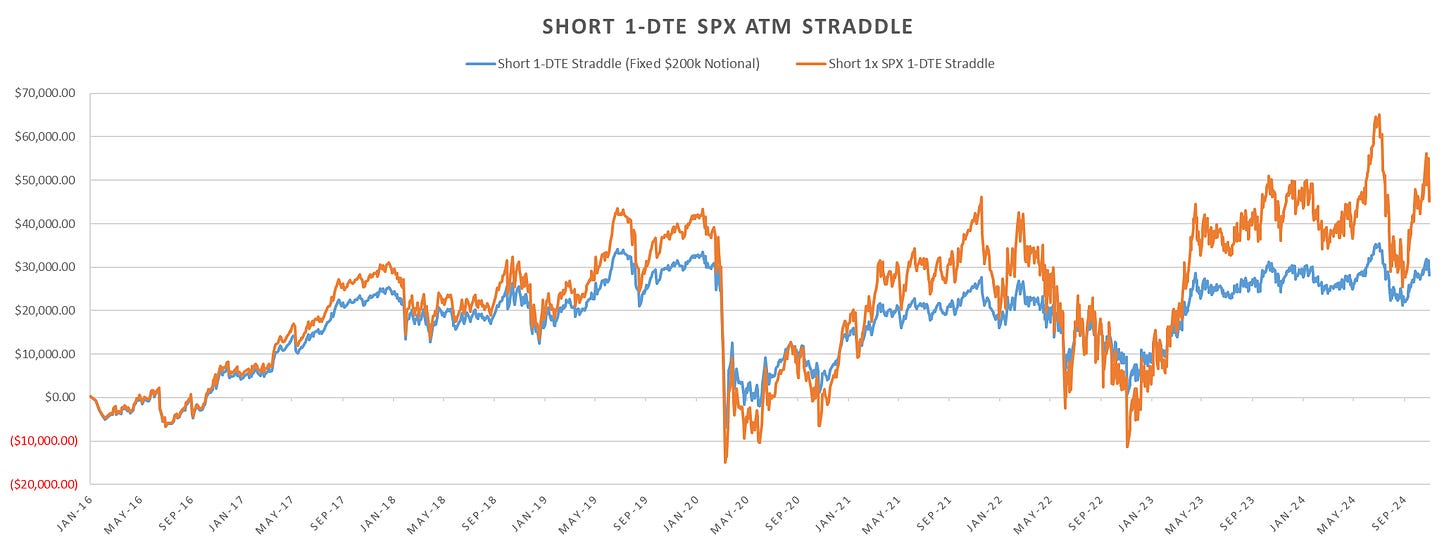

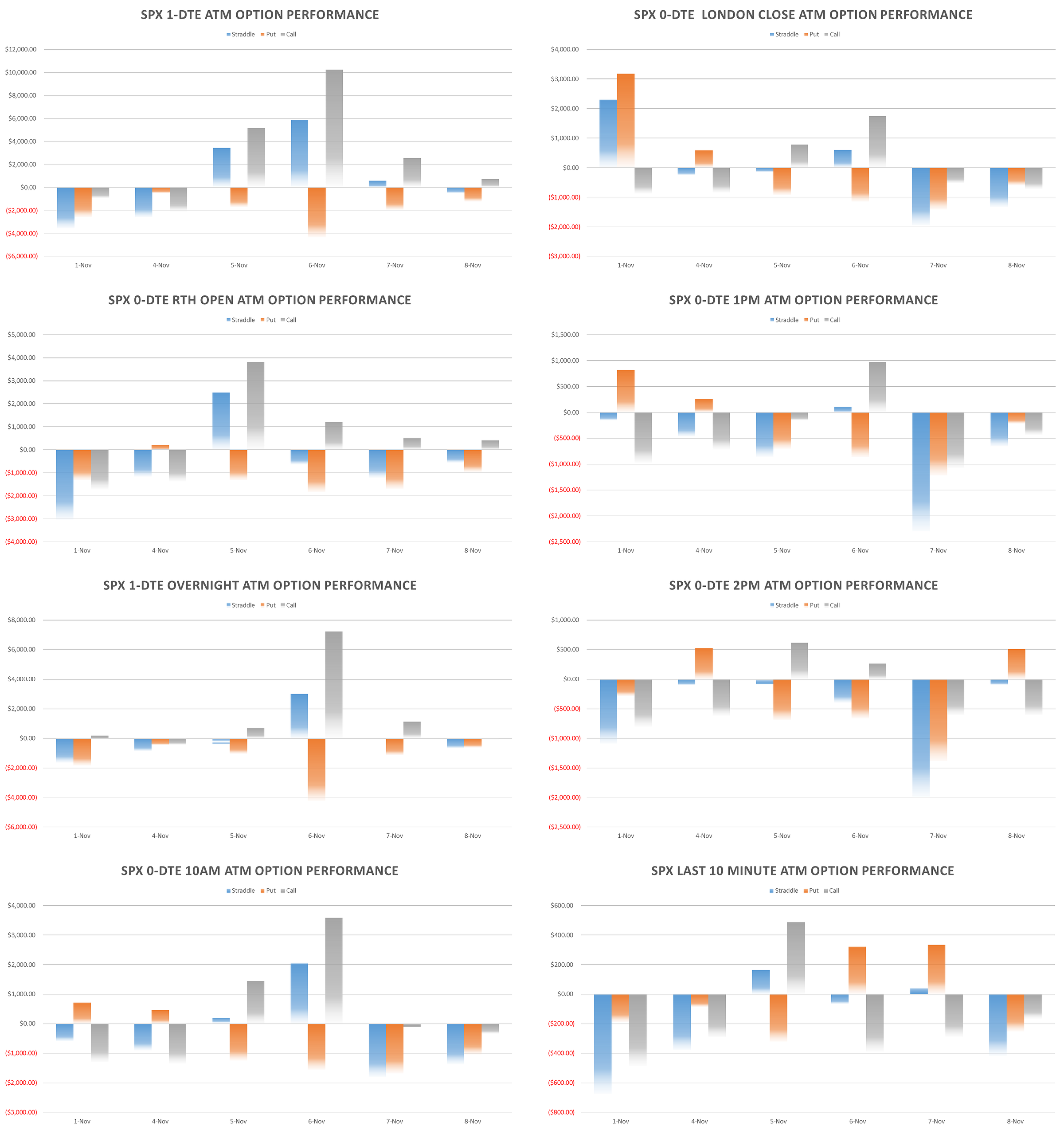

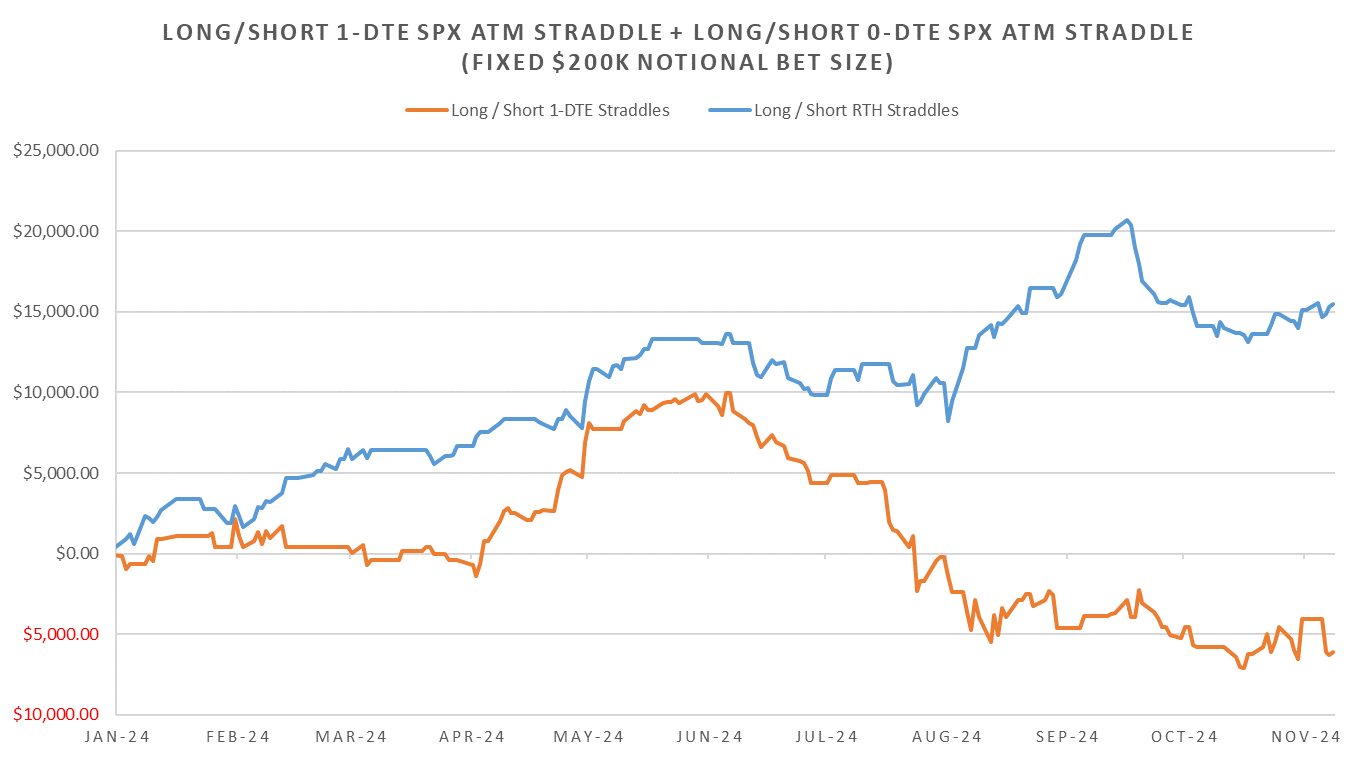

Despite the massive move in indices last week, shorting 1-dte straddle delta hedged hourly closed the week up, losses Wed/Thu, rest green. This continues to be the weakest year since 2021 for short 1-dte gamma.

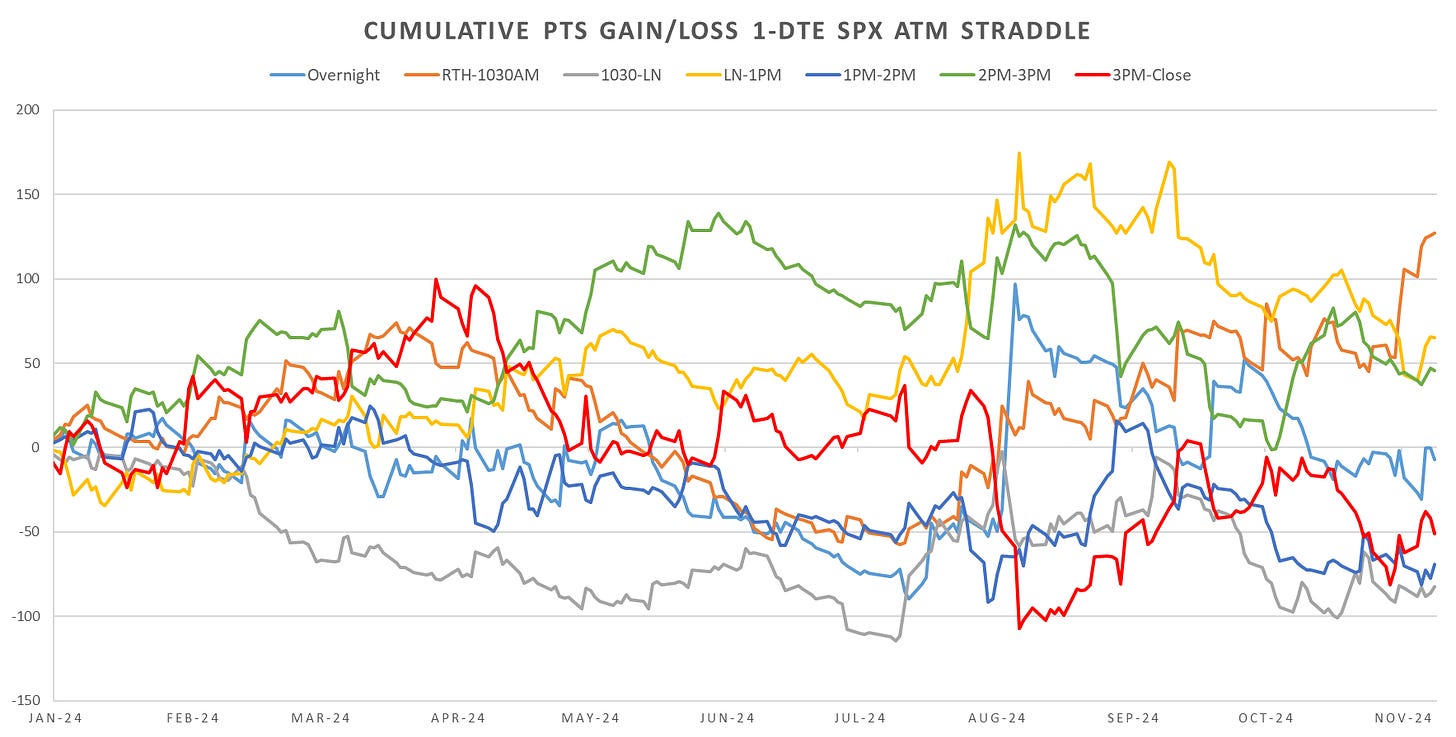

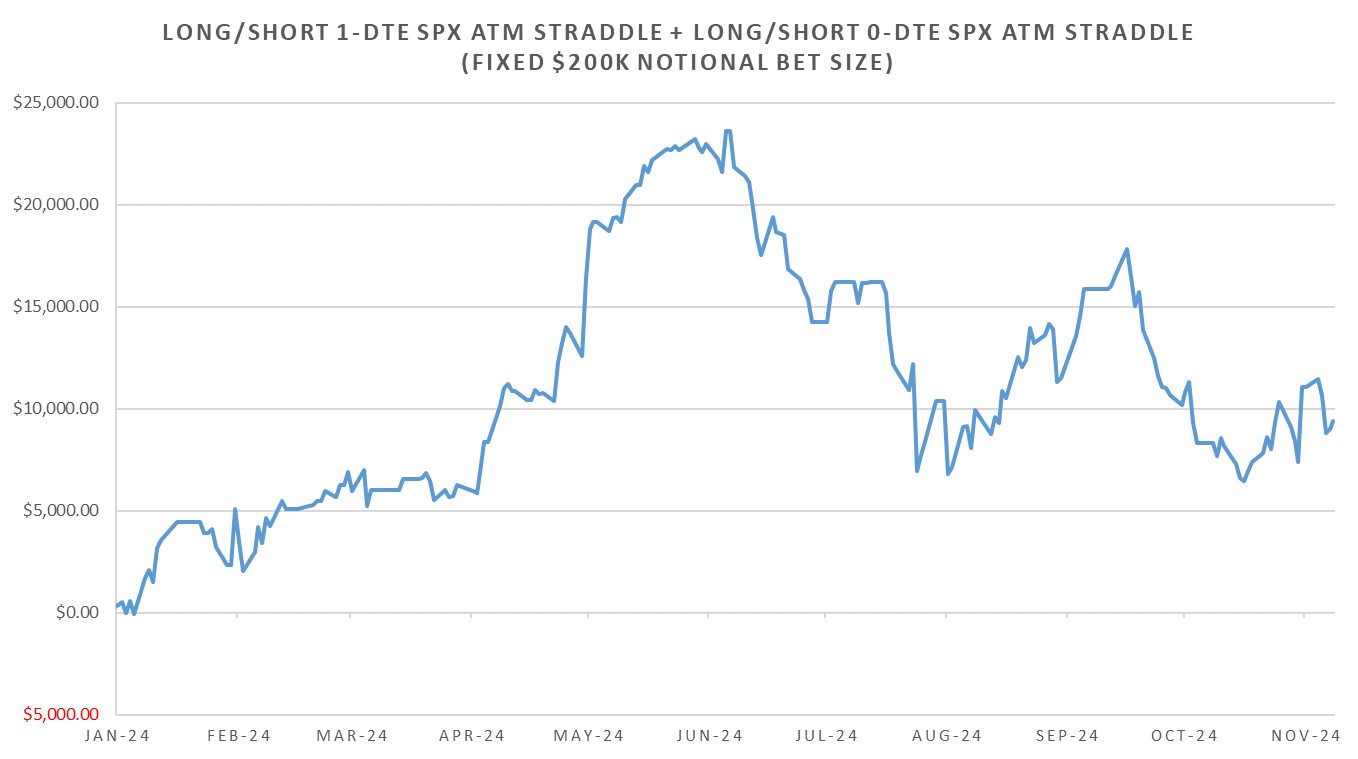

Cross-sectional performance for the 1-DTE straddle this year shows RTH-1030am outperforming since July. Majority of range expansion came in right after open, followed by the notorious mean reversion into London Close. Eod volatility outside the ‘end of month’ effect remains absent, as pointed out in the related post, the last hour was the biggest contributor to poor short straddle performance over the last 4 years (fixed notional short-1dte straddle pnl STILL below 2019 lows):

Realized Volatility Overview

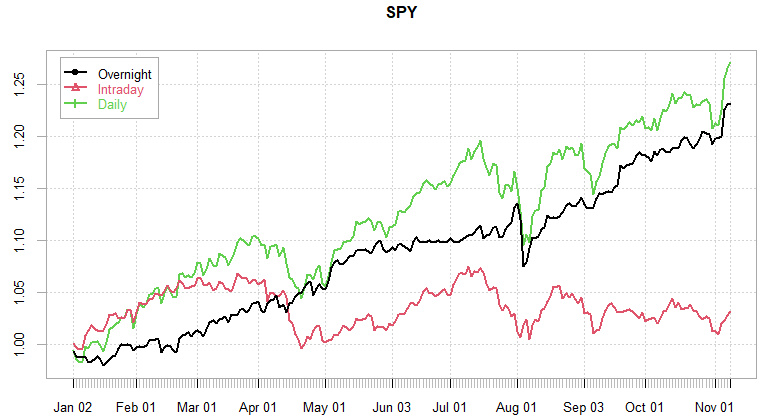

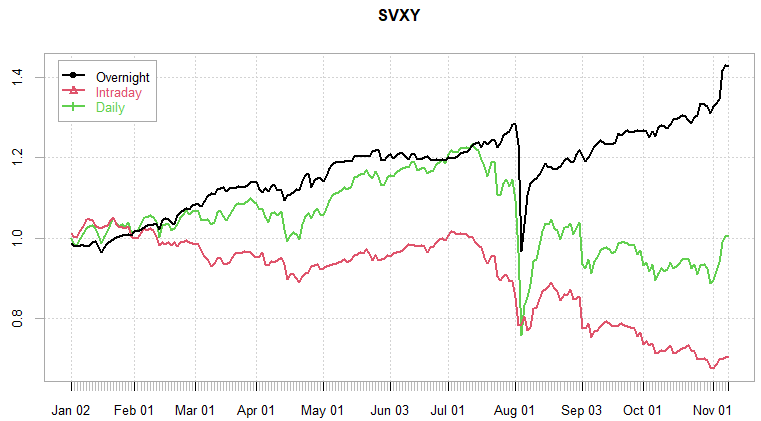

S&P going for a record large 1y gain of ~45%. Out of those 45% roughly 31% came overnight, with rth performance flat since Jan 10th 2024. This pattern holds for majority of Mag7 stocks & other indices, with the biggest rth/globex divergence in IWM.

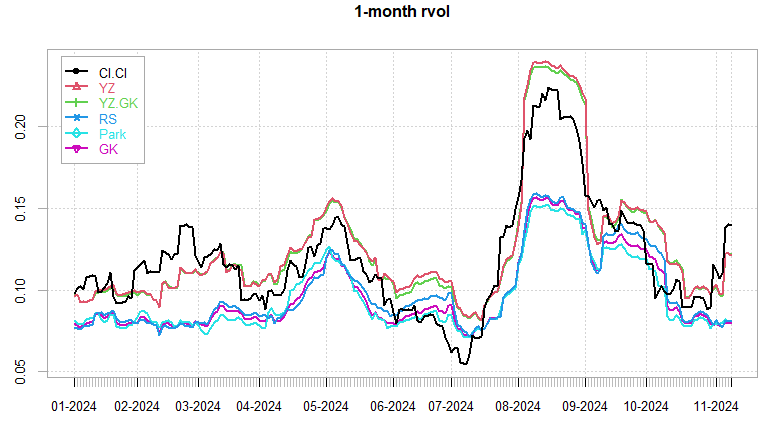

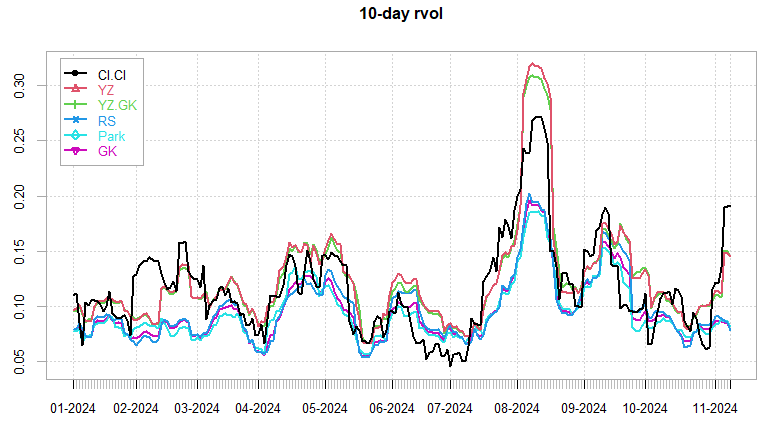

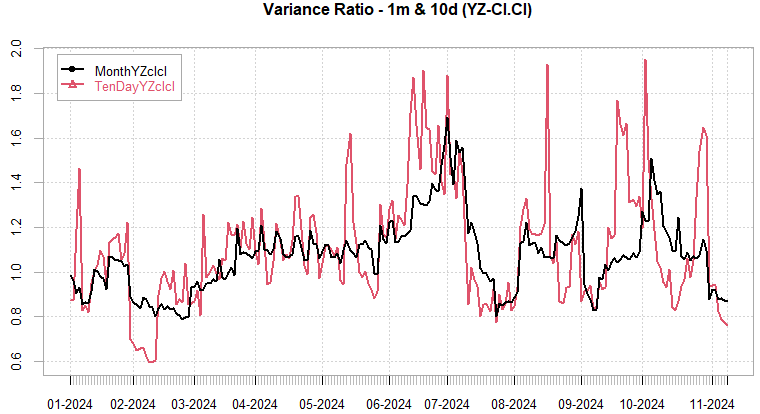

1m & 10d vols spiked on the ramp higher in indices. Note the divergence between cl-cl and range based vol estimators last week. Intraday action shows strong trend without any mean reversion, wait for cl-cl to catch down to range based estimators before playing for a retrace. Last 2 years these ramps have gone beyond reasonable, playing counter trend was extremely costly… If playing reversal use cheap calls (delta hedged.)

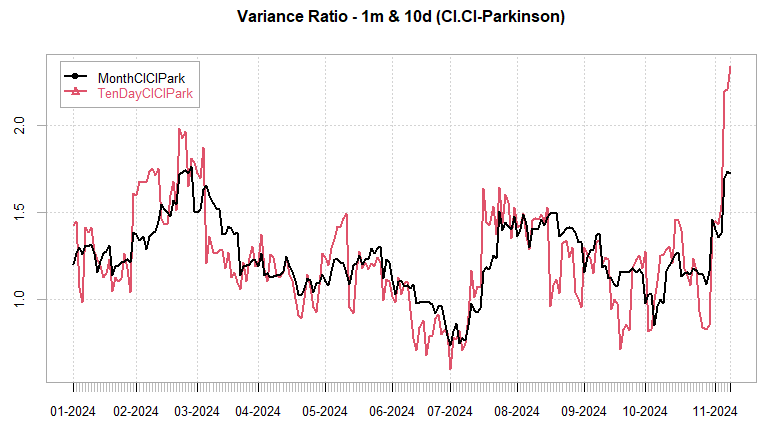

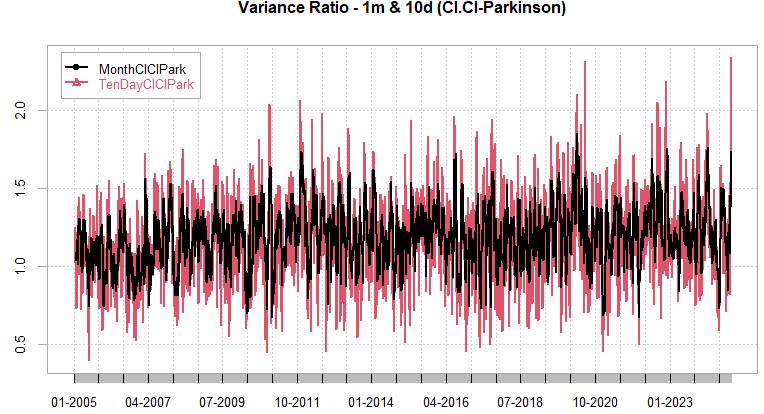

Looking at the variance ratios, massive spike in cl.cl - park ratio, historically, pays to short cl-cl vol in the near term until drops back to ~1.2.

This has been the strongest intraday trend in the last 20 years for SPX:

I’ve highlighted in other posts (Taleb Ratio) how the market is getting more and more lopsided (or efficient) intraday over the last decade. Blame algos or whatever but given the extremes we see rn, this is having an impact across strategies, with more and more flows reinforcing this intraday trend (will do a post on https://www.spglobal.com/spdji/en/indices/multi-asset/sp-500-dynamic-intraday-tca-index-usd-er/ this week).

Lastly, short VIX-Futures had a great week, unfortunately all of the drop happened overnight so if you waited for markets to open, as with the rest of the year, you got nothing…

SPX ATM Straddle Performance

You’d think short optionality would be obliterated this week given the massive index moves (and relatively in line / cheap implied vols), however, majority of the moves happened overnight, which leaves the 1-DTE straddles up ~67pts on the week with RTH Straddles down ~10pts. Even overnight straddles only up ~10pts given the premium on election night. Biggest winner on the short side, short the 1pm straddle for ~40pts this week. Although anything post london close did well on the short side as we barely moved into eod.

From the following post:

Down small on the week, bias now heavily short both RTH & 1-DTE legs (overall short cl-cl vol bias). RTH leg continues to do better than 1-DTE.

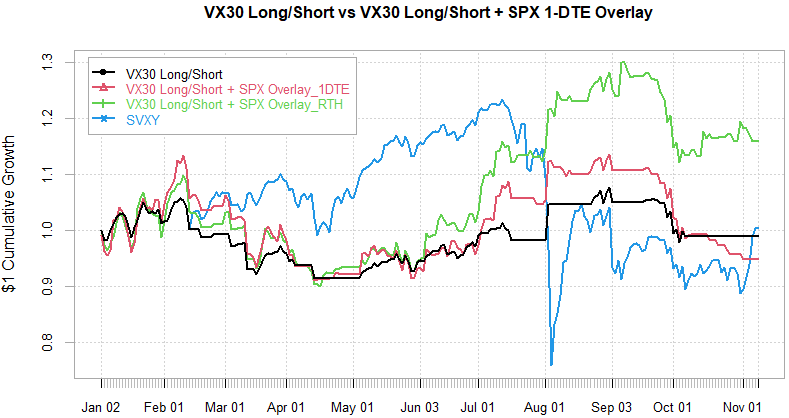

VX Carry & SPX Overlay

From the following post:

No trigger for short VX yet, likely comes next few days. Cash signals all week for SPX Overlay, likely start triggering call buys next few days unless market drops sharply (unlikely.) Added SPX Overlay pnl curve for RTH trades, will do a post on performance of RTH overlay using VXTS filter this week as well. Does not look good so far this year… better be one hell of a vol crush into year end to make up for the rest of the year…

Always happy to hear comments/suggestions so don’t hesitate to reach out!

Have a great week!

Thank you for the great overview!