Following up on lasts week overview:

Market ended this week flat, with rvol briefly dropping to near 30 year lows for a couple of days before a little pop on Thursday/Friday. VIX Futures largely unchanged over the week, with the roll lifting short VIX ETP’s just slightly positive for the week. VIX May futures settled at 12, the lowest VIX Futures settlement since 2017… only Sep 2018 and Dec 2019 settled a tiny bit lower (11.94 and 11.99.)

So, lets take a look at how things look ytd in terms of rvols and see how index option structures did this week:

Realized Volatility Overview

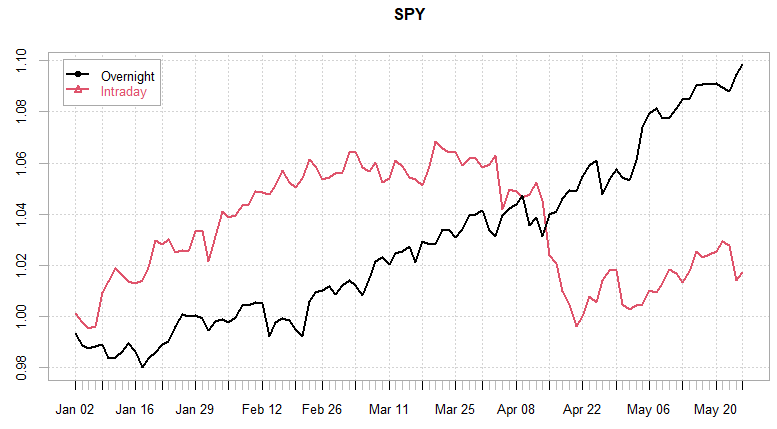

Overnight SPY grind continues to impress ytd… had a look at overnight performance going back to 2005, current ytd overnight sharpe sits at 3.7, only 2 years had higher overnight sharpe ratios… 2017 and 2005.

Interesting that 2005 and 2017 were both years AFTER the election year, so maybe we’ve got a fun Oct/Nov to look forward to…

Rvols crushed… but, as I mentioned on twitter, its low, it CAN be lower and its frequently here:

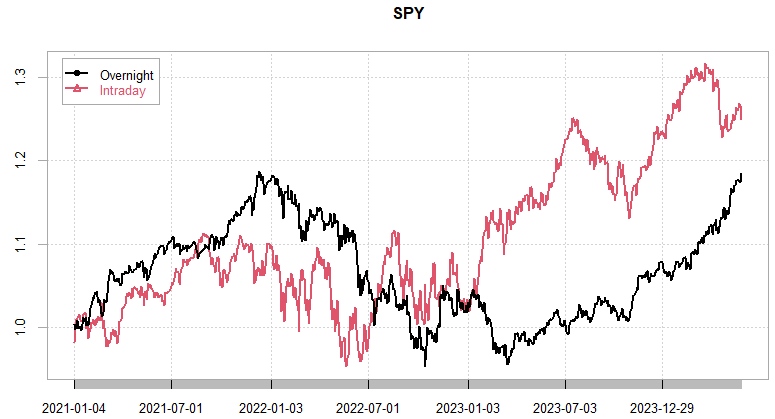

Looking at volatility estimator ratios, ‘faster’ ratios continue to drop, YZ-cl.cl drops below 1 for both monthly and 10-day periods as intraday vol completely evaporates with the only ‘movement’ being the overnight gap up or down on data / european & asian sessions…

Feb had a bigger difference between intraday/overnight vols as evident from charts above, with large gaps but tiny intraday rvol. Currently, even the gaps got alot smaller…

Had a look at SVXY overnight/intraday perf too…

Getting a feeling that the overnight/intraday difference might be more pronounced in a low rvol environment… Will have a look later.

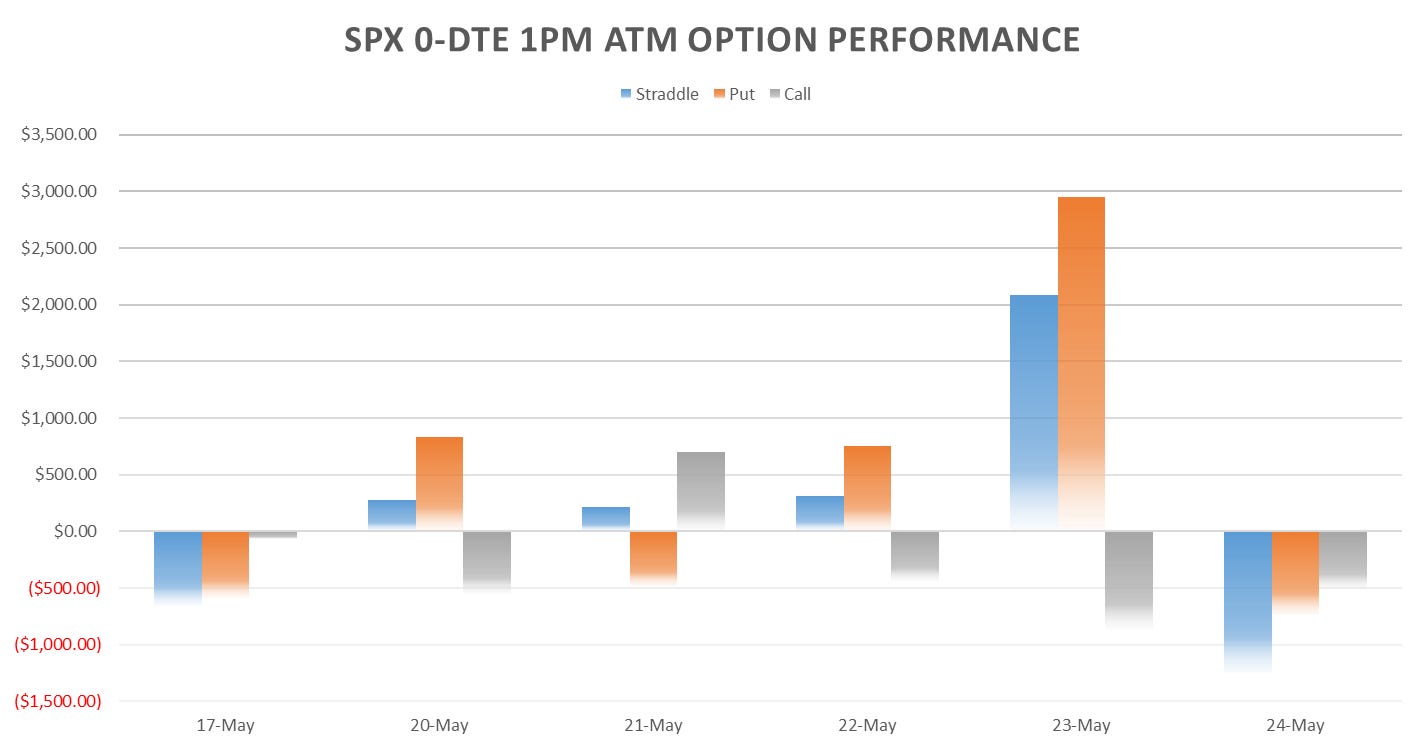

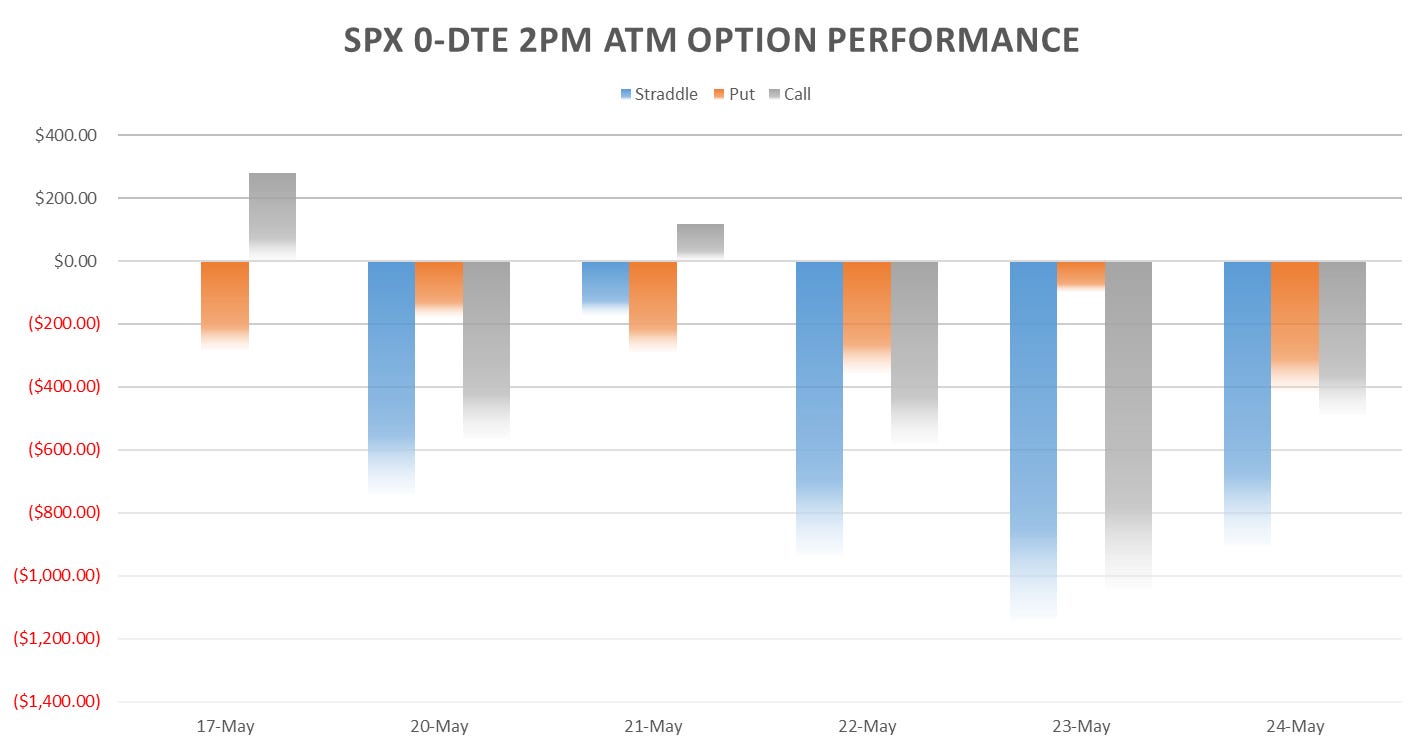

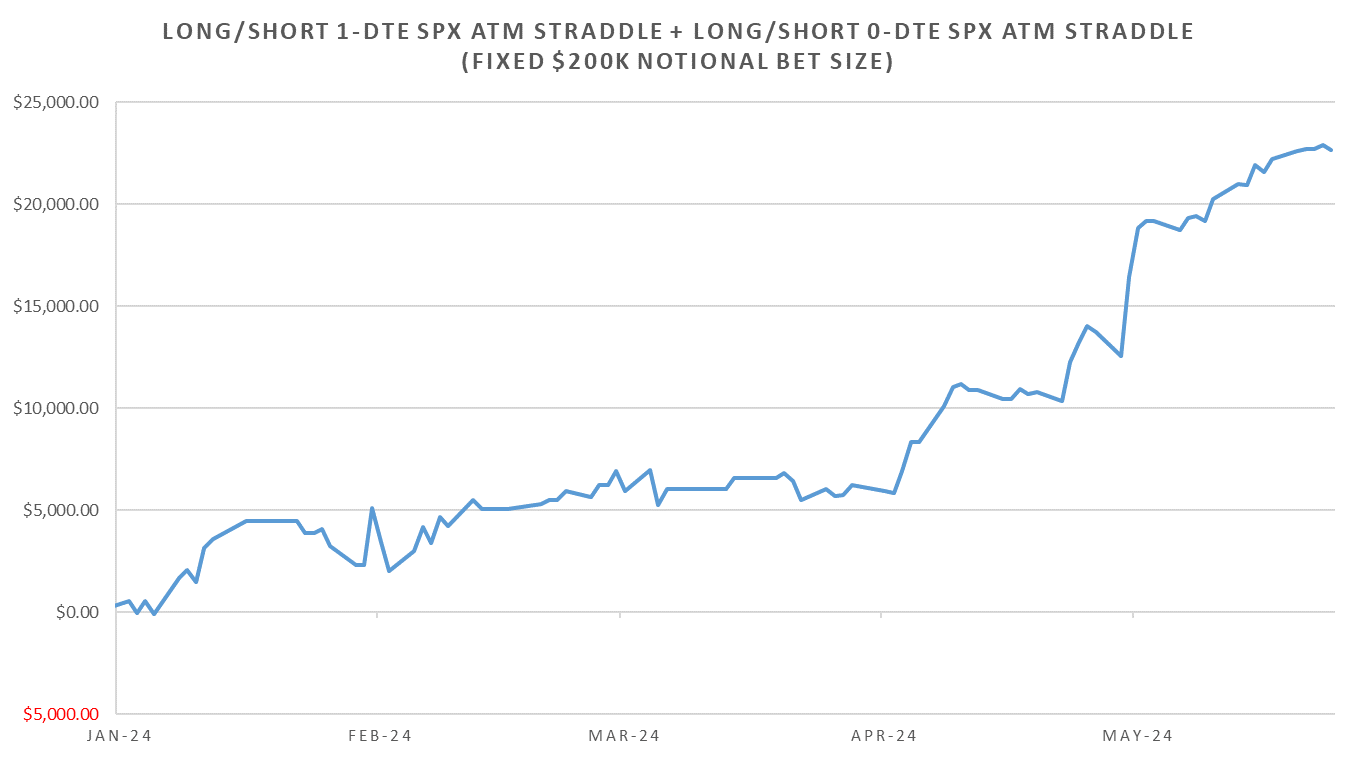

SPX ATM Straddle Performance

Over the week, 1-day SPX Straddles down ~12 pts, with the usual pattern of bleeding straddle / puts performing decently into Wed, with vol picking up into Friday lunch time (and then dies.)

RTH straddles up ~38pts on the week, saved by Thursdays sharp reversal…

Overnight Straddles down ~21pts on the week… even with Thursday post NVDA ramp and Friday gap up (just can’t win.)

Straddles opened early on in the day all net winners on the week by ~20pts… however, anything after 2pm got absolutely destroyed, down !39pts for straddles bought at 2pm into close… guess everyone can’t wait to leave and enjoy the weather…

Variance Ratio Conditional Performance

From the following post:

No long or short intraday trades from the systems this week… lucky, considering would have lost shorting rth straddles… Kept short 1-day straddles all week though…

Checked to see why no short rth straddle trades taken, largely due to loss of momentum (1m caught up to 10d) and the diff between overnight/intraday vols not being pronounced enough (all vol just died…)

Not much to say for other systems, VX system hasn’t triggered anything new, kept short VX June… Intraday momentum / mean reversion both bleeding as we have hardly moved anywhere (Thursday small win for momentum but not enough to overcome the decay over last 1.5 years in both factors.)

Have a good long weekend everyone!