Market Overview - June 2nd 2024

S&P Index Options & Volatility

Following up on last weeks overview:

SPX managed to dodge a 2% red week on Friday afternoon, closing down 50 bps on the week instead after a 150 bps rally on Friday close. Overall, SPX is stuck near 5300 since May 15th CPI data. We have FOMC rates decision on the 12th of June, with a bunch of data coming in between now and the meeting. Outside of data reactions, SPX remains pinned intraday. Implied vols jumped higher all week and remained firm on SPX bounces.

June VX roundtripped back to 13.6 (~flat w/w.) VX Carry system triggered cash into Wed/Thu but closed the week back short VX June on Friday close.

For details:

So, lets take a look at how realized volatility moved this week and how the strategies outlined in previous posts have done:

Realized Volatility Overview

Overnight performance took a hit this week with yields rallying into Wed/Thu data. Overall, still incredible 3.5 sharpe ytd on overnight performance.

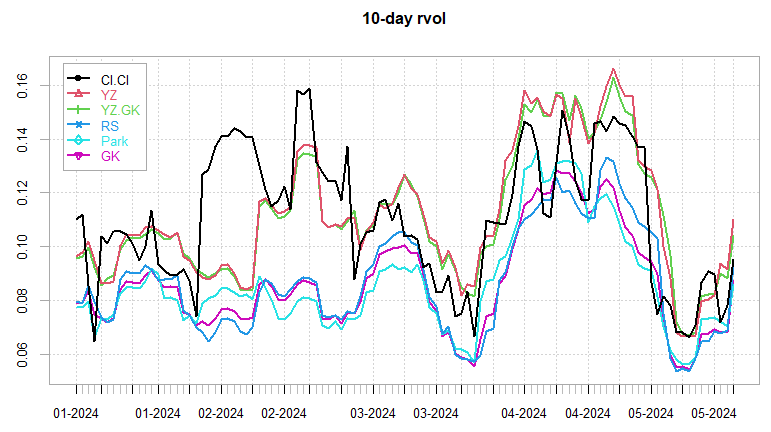

10-day vols perked up a bit but largely intraday rvol still sub 10 annualized. ‘Faster’ vols picking up triggered long straddles from Wed to Friday (also still long 1-Day straddle for Monday.)

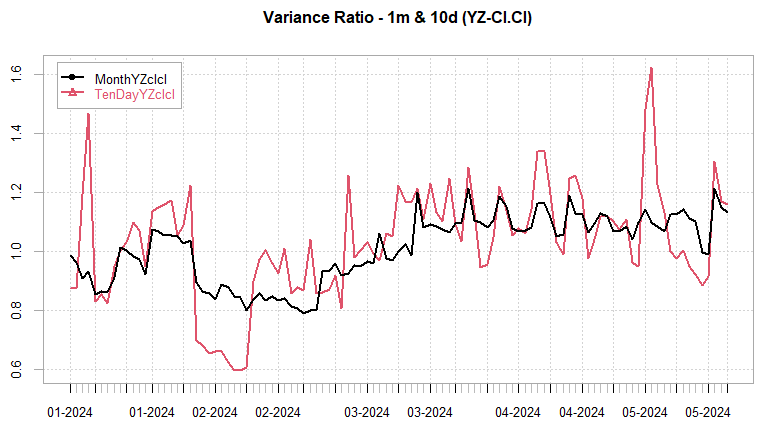

Intraday/Overnight vol continues to sort of move in tandem, so, VarRatios remain tight.

Unlike SPY, SVXY overnight perf beating overall daily returns so far YTD. Carry VX strats still underperforming heavily as risk remains purely hypothetical costing money for managed carry on whipsaws.

SPX ATM Straddle Performance

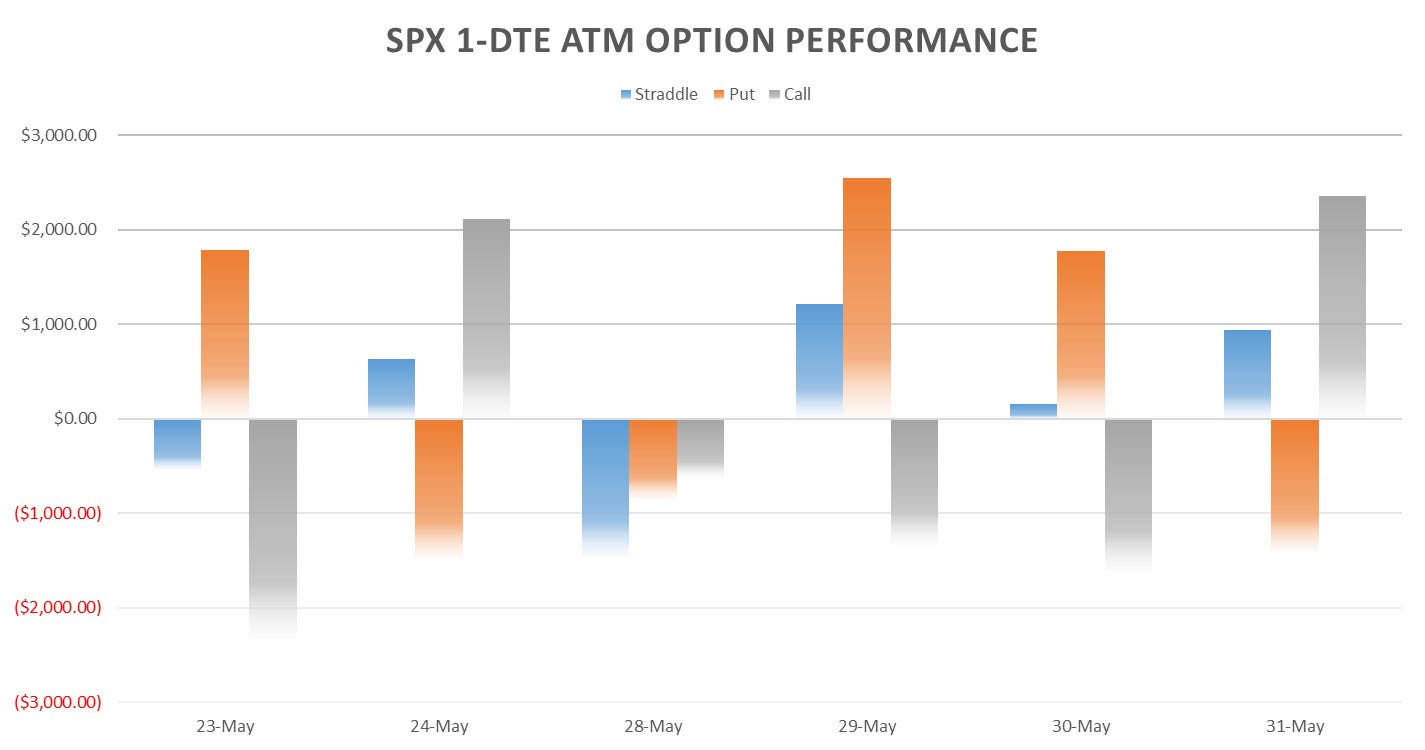

SPX 1-Day straddles up ~9 pts on the week vs SPX itself down ~24pts. Lots of trading action this week despite it being a short week.

RTH Open straddles down ~25pts though as all the action concentrated overnight on data jumps or towards eod.

Overnight straddles flat on the week.

10am setraddles down ~3pts, London close straddles up ~18pts (saved due to Fridays ramp) with the 1pm straddles netting ~56pts on the week (again thanks to Fridays eom rebalance.)

2pm straddles up 53pts on the week.

Had a look at performance of 25 delta strangle performance into eod, had a post a few months back about buying ~$1 options into eod:

Last hour ytd seems to be on a ‘lucky’ streak of large eod moves in either direction.

Variance Ratio Conditional Performance

From the following post:

Small up week for the long short 1-(0) dte straddles, Tuesday short 1-dte win, Wed 1-dte short loss, Thursday 1-DTE long win, RTH long loss, Friday long 1-DTE win. Overall I quite like the capture, there’s some sharp drawdowns if we look back, this is after all a ‘trend’ strategy inherently, so sharp drops don’t get captured well especially if there’s not enough warning in the ‘fast’ 10 day window… I tested the drawdowns on the var ratio system vs vx front month momentum system, signals from vx front month (which is faster than the var ratio system) shows a long vx fm trigger on majority of large losses in the long/short straddle system so something to look at later…

Have a good week!

For any1 interested, here are my May CPI estimates:

https://open.substack.com/pub/arkominaresearch/p/may-2024-cpi-estimate?r=1r1n6n&utm_campaign=post&utm_medium=web