Liftin' 0-DTE's

Chasing the elusive 50x'er

After todays eod 30pt ramp left a few people pulling their hairs out for not buying 0-DTE calls into the close, with some claiming eod options trading ‘cheap’ when looking at win rates / returns, lets take a look at what the data shows.

We try to buy a call closest to 1$ (100$ bet size) premium, range in the data is 0.6$ - 1.4$ but on avg very close to 1$. We then look at various times in the last hour, first at 3pm, then 3:15pm, 3:30pm and lastly 3:40pm. Interestingly, cumulative pnls peak right when 0-DTE Tue/Thu expirations got introduced… Now that might be a story about how 0-DTE’s changed the game OR it could just be because you get an extra 2 days of decay… Although the returns from Oct 2023 bottom do have impressive consistency.

At 3pm, the b-s delta of the 1$ call is ~0.15-0.2, this increases to ~0.25-0.4 at 3:40pm. Overall, ~15% win rate lifting eod calls every day. Lots of things to look at (conditional entry on intraday + or - return to last hour, taking profits early and not holding till expiry, seasonality… etc) which we will be doing in a follow up post later this week! (including more exciting 0-DTE / vol stuff)

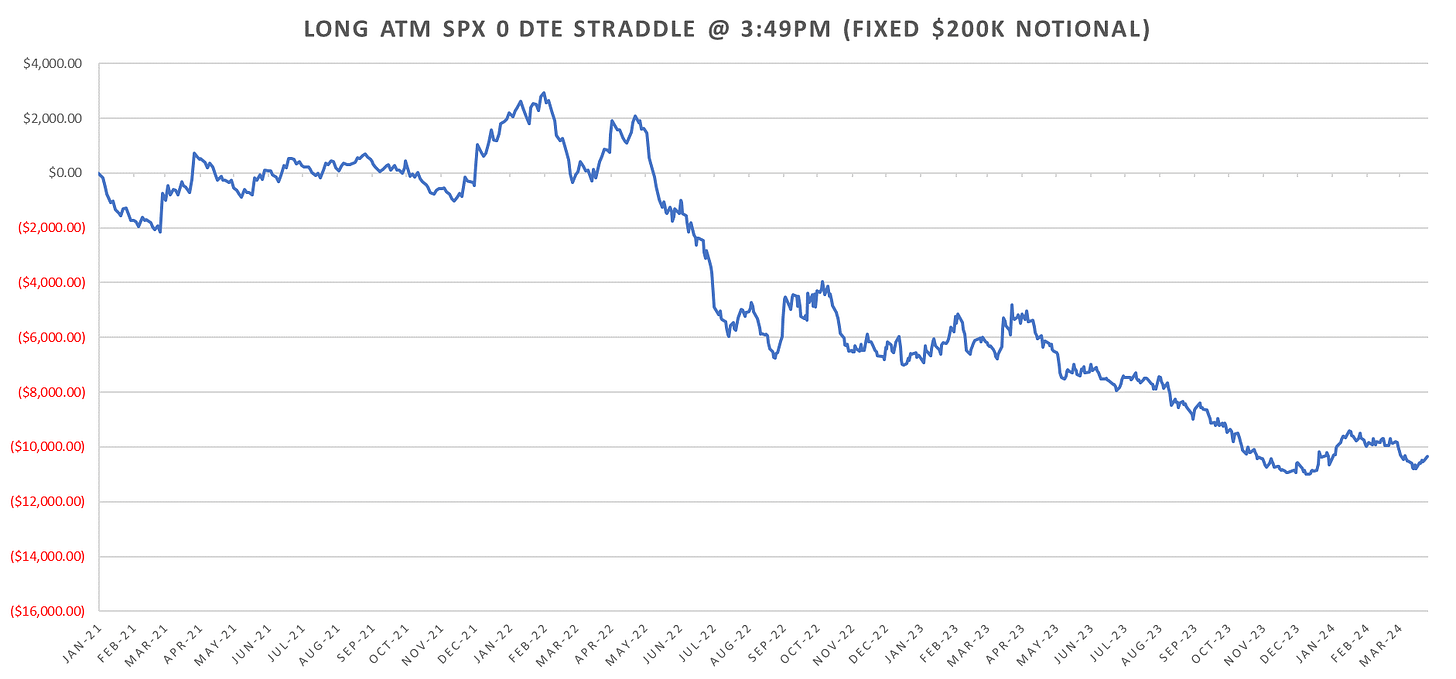

Bonus Chart: EOD Straddles