Following up on last weeks overview:

Last week S&P closed down only 80bps on the week with the rotation trade from NQ into RTY continuing. S&P finally had its -2% move on the day on Wednesday, ending the 300+ day streak before ramping nearly 2% off lows the very next day.

Despite what feels like outrageous volatility (when compared against the last few months), 2Y and 5Y z-score implied vol lookbacks across assets haven’t even made it back to their average levels…

Of course, vol mode tends to be lower than average, still, as I’ve mentioned before, the true single stock volatility is greatly masked by low implied & realized correlations within the index. The performance of vol beta relative to index moves looks healthy, implying, at least in the short-term, we have probably seen the lows in correlations for the year (at least until Dec.)

1-DTE Straddle cost is back to highs of the year, took 2 weeks to go from 20 year lows in straddles to 1 year highs…

We have a loaded event week with FOMC & majority of MAG7 earnings coming out, I anticipate more mean reversion intraday than we’ve seen past few weeks but for the ranges to remain just as wide, further pushing pnl from scalping long straddle deltas intraday higher. Probably lasts for next 1-1.5 weeks after which earnings season will be over and we resume regular grind until elections. Few reasons why I expect scalping deltas against long straddles will continue to work in the short term,

Last couple of days we failed to make new lows and had decent retracement rallies

Downside momentum dropping, overall rvol still up

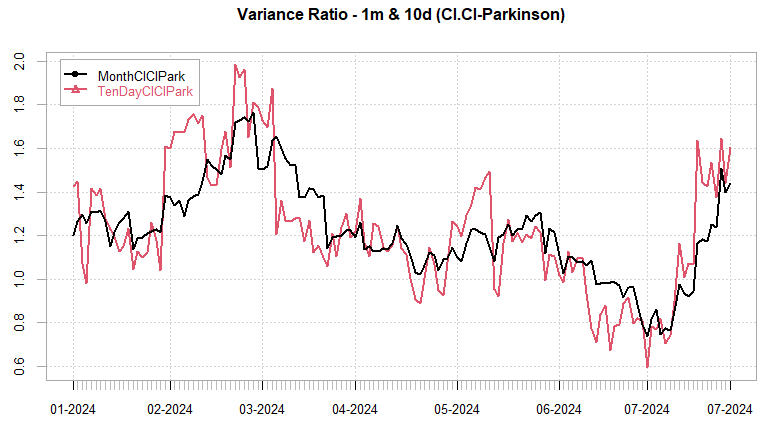

Historically, outside of periods with extreme momentum to the downside, ‘trending’ intraday behavior as measured by the ratio of op-cl rvol : intraday range tends to bottom around current levels (see VarRatio & Taleb ratio from last post)

Events this week should keep realized vol up until at least Friday, setting up a nice range to trade against long straddles that are still priced lower than in April (despite realized vol being higher)

Realized Volatility Overview

As mentioned on my Twitter account, entire drop (similar to April correction) so far happening intraday during US hours. S&P currently running a 3+ Sharpe for overnight performance ytd vs ~.75 for intraday.

10-day rvol jumped to 2024 highs as of Friday close. Expecting cl-cl vols to retrace while range based estimators play catchup this week.

Variance Ratio’s nearing lows (YZ - cl.cl) / highs (cl.cl - Park), as mentioned, looking for intraday mean reversion this week.

Intraday-Overnight divergence continues for VIX Futures, shorting VX30 intraday now down ~20% for the year, overnight up nearly 60% cumulatively…

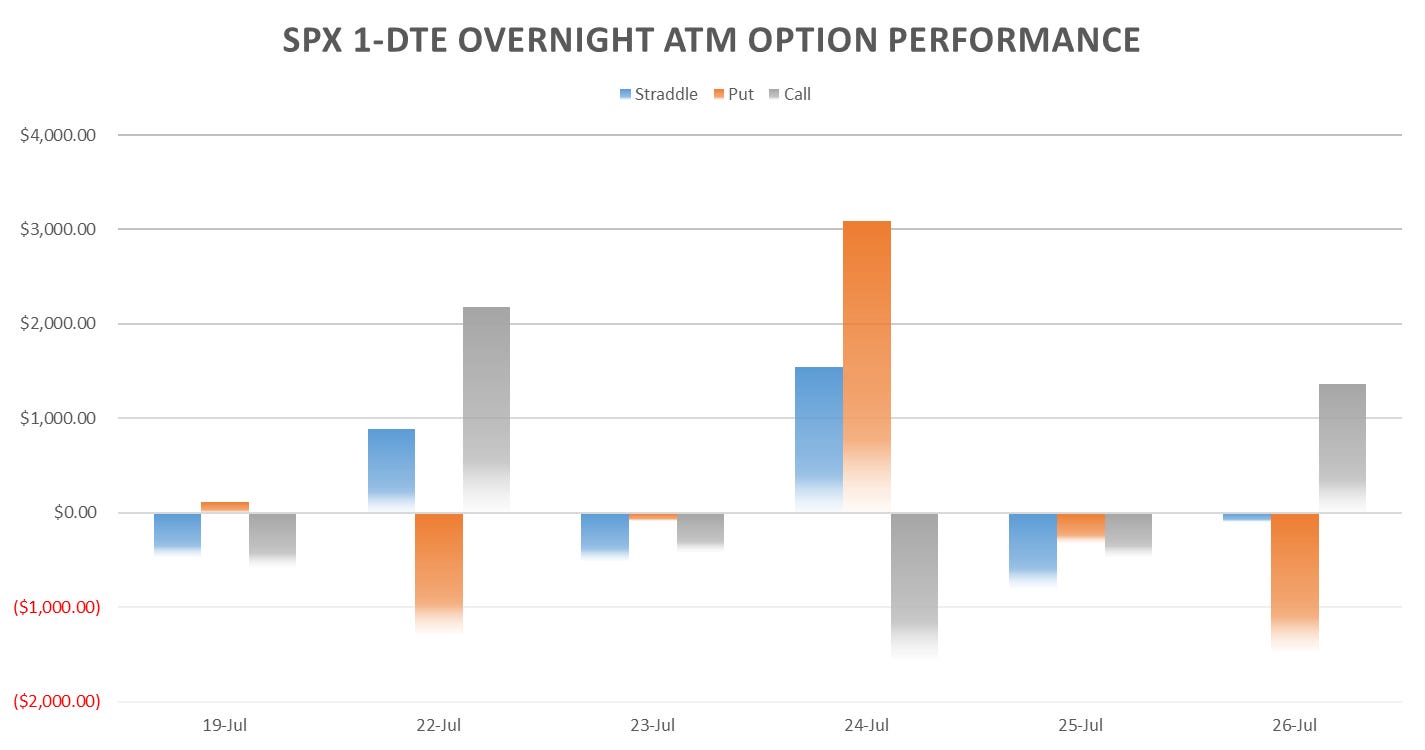

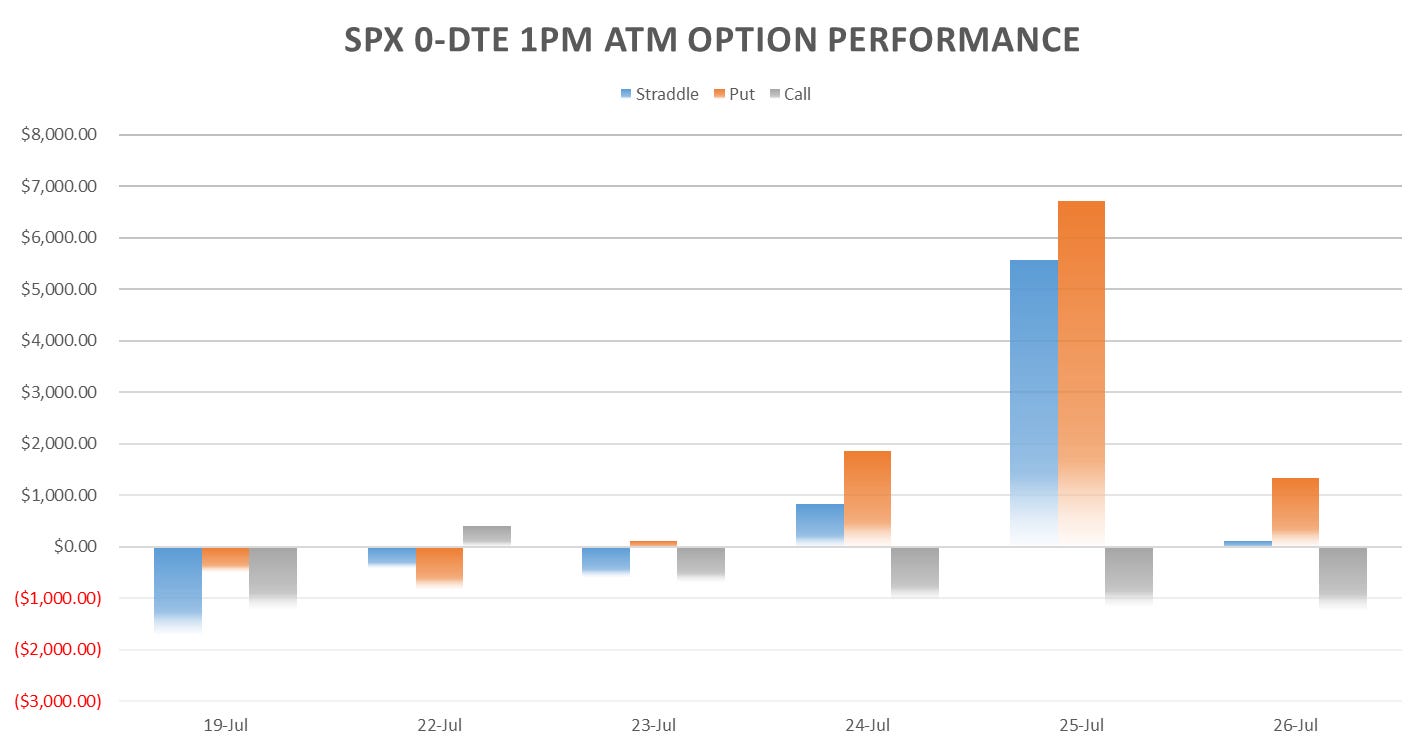

SPX ATM Straddle Performance

1-DTE structures almost all winners last week (calls only down net 2pts on the week)

Straddles from RTH open only up ~16pts vs 92pts for 1-DTE.

Overnight calls net up 10pts for the week (as mentioned entire correction happening during RTH…)

Markets faded the ramps in the afternoons late last week, expect dips bot, rips sold this week as well as we move through earnings & FOMC.

Vol picking up universally across the trading day last week, morning session & afternoon sessions saw straddles pay.

Notably last 10 mins, calls lost every single day for the last 6 days. The end of month rebalancing should be interesting to see given the historic rotation we had in July…

Eom trade coming up on Wednesday along with FOMC, check posts for details:

Variance Ratio Conditional Performance

From the following post:

3 wins, 1 loss this week on the system but the Wednesday loss was massive, taking pnl down to April levels… System short 1-dte straddle for Monday & short the RTH straddle at open.

VX Carry & SPX Overlay

No trades last week on VX carry or the SPX overlay, signals managed to dodge long straddle thresholds by a bit on Wed/Thu… Will see if something triggers by eow.

Have a good week!

what are the signals for the vx carry / spx overlay trade, if you don't mind explaining?

Geez!

That's a lot of Greek, (in a good way).

Someone (me) has a lot of catching up to do, starting to read "Trading Volatility" by Bennet this week.

Hopefully some more of this will make sense after that, thank you, good sir.