Following up on last weeks overview:

SPX finished the week 2.85% off its highs, its 2nd (!) largest corrections since the rally started in October… VIX Index promptly ramped ramped to 2024 highs, closing 16.51 on Friday evening. Needless to say this drop *feels* alot larger than it really is, given the record breaking low volatility environment we’ve been in for a few months now.

Despite the jump in vols this week, across assets, this move is barely visible on a 2Y and 5Y lookback window. Equity vol (even Russell VIX) is still near 2Y average.

1-DTE straddles are trading off lows, excluding events, Monday’s straddle went for ~70bps on Friday close, 20bps off the highest non-event straddle this year.

As I’ve mentioned a couple of posts before, 2nd part of the summer tends to bring higher average realized vol than the first half. Political headlines, MAG7 earnings next week as well as the upcoming FOMC meeting should keep short-term vol off the June/July lows. Correlations spiking last week shows a degree of deleveraging going on, hopefully resetting positioning for the rest of the year.

Week following OpEx, generally bullish, with straddles holding up well for the past 8 years. Currently at 8 month win streak (tiny loss in June, ~4pts.) The calendar straddle suggested last week closed on Friday for a ~22-24pt loss, saved by vol expansion for this weeks straddles. Last week’s straddle almost 3x’d by eow for a ~93pt loss, this weeks straddle up ~70-71pts on Friday close from trade inception.

Realized Volatility Overview

S&P giving up the gains from early July, still up 17% YTD (SPY) and 15.4% (SPX).

10-Day cl-cl vols jumping back to almost YTD highs. The moves last week had no retraces at all intraday and closed near lows almost every day. Would like to see downside retracing before a low (although it has barely ever bottomed slowly last few years… V-bounces every single time.)

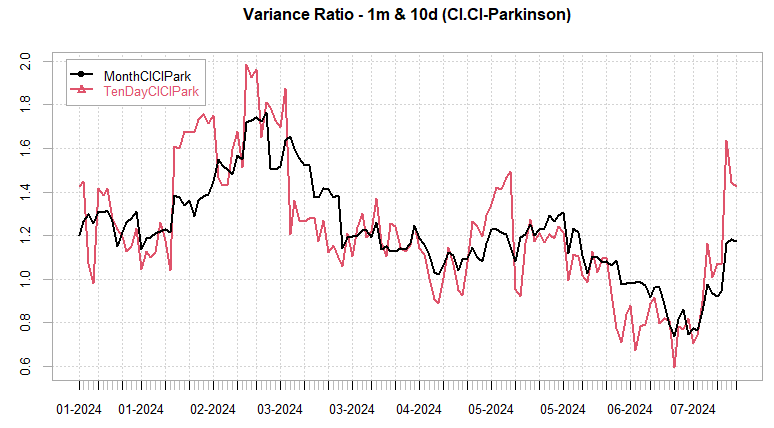

Very little intraday vol relative to cl-cl, so ratio’s spiking. Historically, should see intraday retraces start to occur. Variance Ratio system going into Monday short 1-DTE straddle and will short the RTH straddle as well…

SVXY giving back some of the gains since May this week. Notably, intraday, SVXY was down almost the entire year. Entirety of the gains came in overnight with overnight -1x VX30 up almost 40% YTD…

A couple of other years have seen intraday SVXY do nothing for majority of the year… namely one of the best years for the short VX trade, 2017, saw intraday SVXY go red ytd by end of August. At that point in time the difference was almost (!) 60% between the overnight return and intraday return…

SPX ATM Straddle Performance

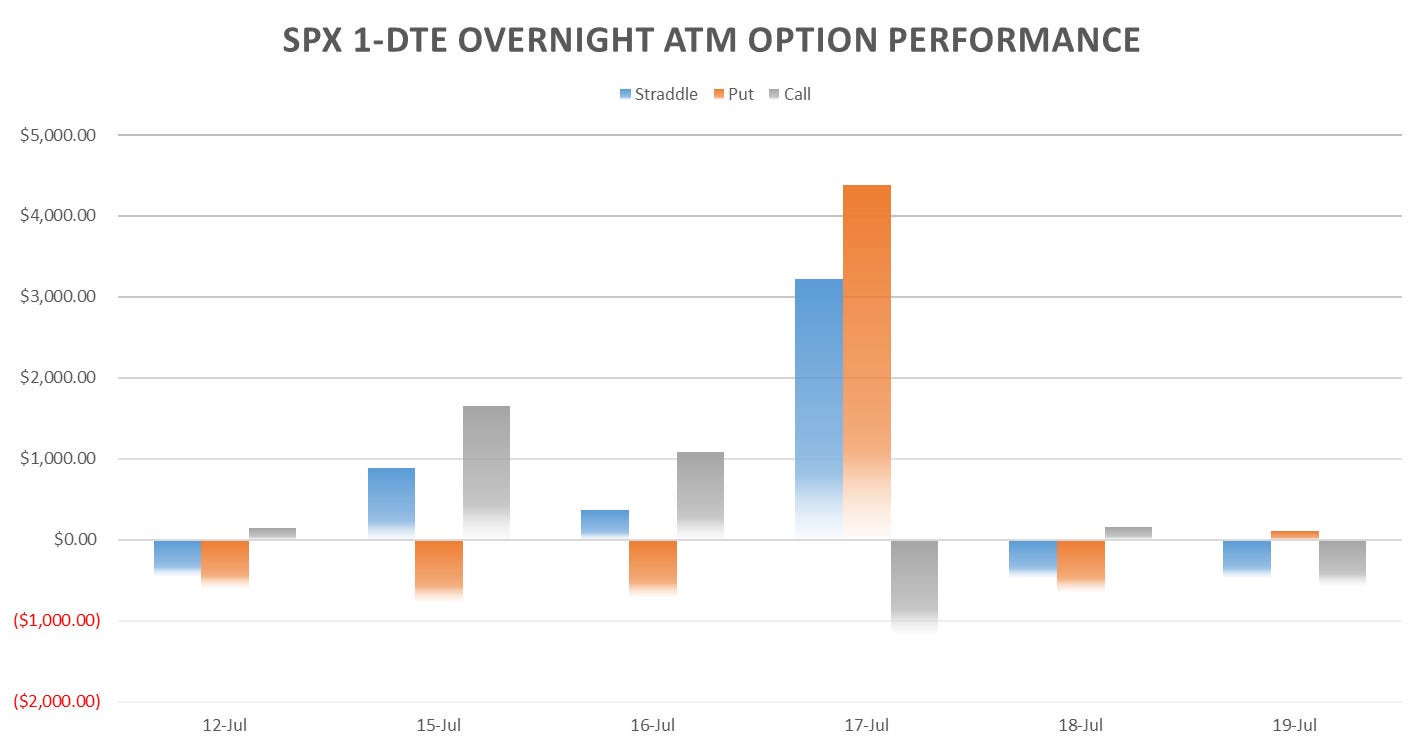

1-DTE Straddles on a 4 day win streak last week, up every single day.

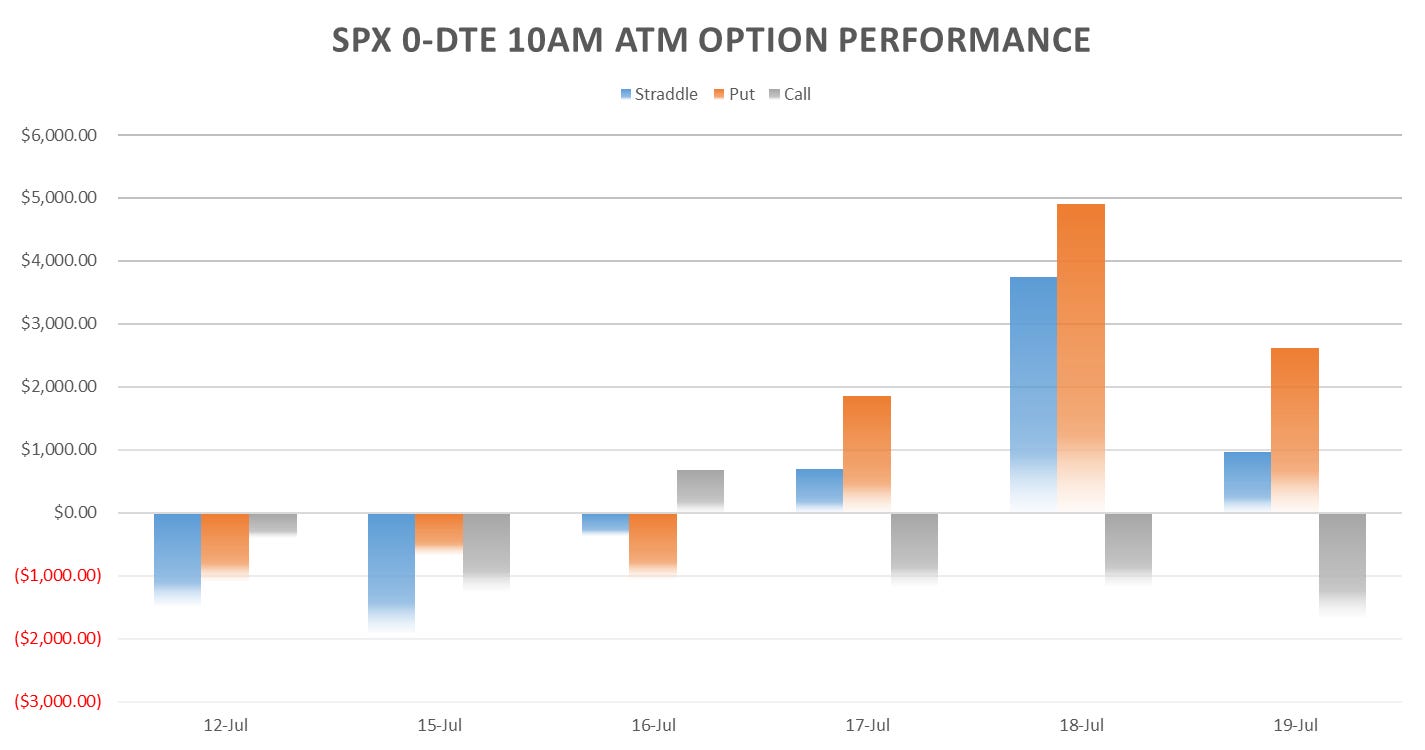

RTH straddles up ~15pts on the week, saved by Thursday/Friday moves lower after gap up.

Large win for overnight moves last week, ~30pts on Wednesday gap lower.

Stark contract between intraday rvol last week, unlike the usual pattern of EOD acceleration on trend, all 0-DTE straddles after London Close lost money every single day last week…

On the difference between single point of entry short straddles vs various time weighted schemes, check out the recent post:

Very little excitement with the last 10 minutes as well…

Variance Ratio Conditional Performance

From the following post:

The Variance Ratio systems that target daily vs intraday vol giving up majority of the gains since April. Also one of steepest drawdowns… Currently positioned short 1-DTE straddle & will short the RTH opening straddle as well.

VX Carry & SPX Overlay

From the following post:

System with SPX overlay managing to squeeze positive on the year last month and a half. Mainly on the back of long call trades throughout the last few months.

The VIX curve is firmly above 15 for all future expiries in 2024. The VX carry model (more below) got stopped out on Wednesday morning, annoying given my expectations for smooth sailing into FOMC. Performance YTD on VX carry is lackluster… despite record low rvol, jumpy spot/vol beta forces systems to de-risk into events, which prove to be 1 day vol bumps with no follow through. The biggest drop in vol this year came around a week after the April spike, which, due to smoothing, system was a bit slow to capture.

Despite large cost of carry due to tiny rvol and decent term structure, short term event bumps and sensitive spot/vol beta are hurting the short 30 day vx trade this year (SVXY / SVIX.) As a number of people have pointed out, the election ‘premium’ is also not something you can expect to collect in full as rvol is likely to increase going forward.

Have a good week!