Following up on last weeks overview:

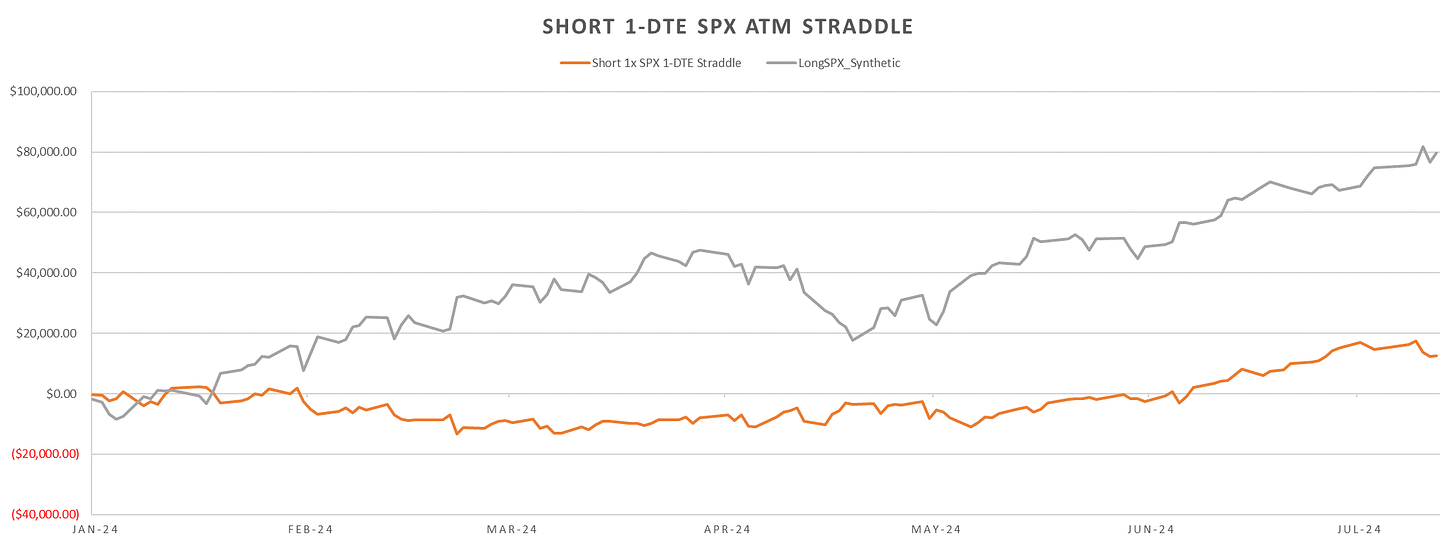

In the last post I highlighted the breakout in pnls for short straddles as vol collapsed to record lows. Well, we got quite a violent pickup in vol towards eow as the rotation within indices knocked down tech stocks (with RTY bid.) The main culprit in rvol pickup was a tiny spike in realized correlations. Despite the small move in correlations, long straddles have returned almost 3x breakeven on Wednesday. Intraday moves the last 4 days have moved multiple straddle breakevens in a matter of hours.

Source: CBOE

Despite 4 days of correlations spiking, implied vols have failed to adjust accordingly (small jump from <40bps straddles to ~42-43bps). As a result, intraday delta hedged straddles have performed quite well as indices finally able to move without low correlations keeping a lid on rvol. Notably, 1-DTE straddles continue to trade without any significant bumps in premium, implying the small spike in correlations is not expected to hold… as previously mentioned we continue to trade implied corrs < realized corrs for a few months now.

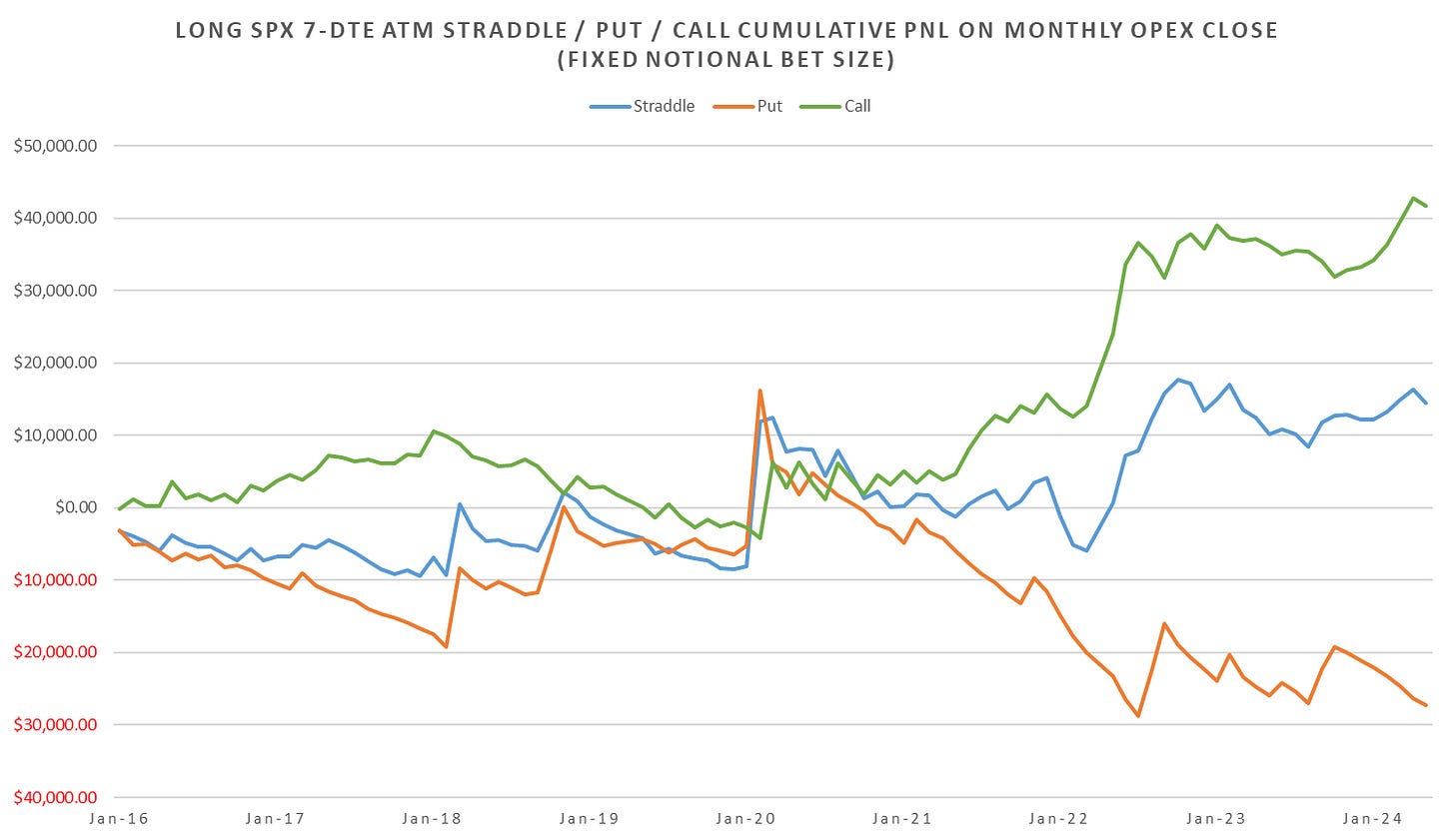

Looking at individual straddle legs, the short call leg is currently ~ -250pts ytd, with short put leg up ~382pts. Not only is it difficult to sell daily calls, but almost any period intraday (except a few hrs at the start of the trading day) selling calls is a losing proposition!

Realized Volatility Overview

S&P nearing +20% ytd as we trade through the summer… Even with rvol jumping, still can’t get S&P to close lower.

Close to close vol estimators jumping… but still below 10…

Last week I was expecting a drop in intraday rvol, clearly, the rotation to broader market proved that to be wrong. Indices managed to realize decent cl-cl moves, bringing the ratio’s back into neutral territory from long straddle bias. Monthly YZclcl ratio slightly too high to trigger short straddles but if the next few sessions we don’t see meaningful moves, should trigger back into short intraday / daily straddles.

As mentioned before, the VX carry trade doing a little bit of catchup over the summer months. Have not had an exit out of short VX since early May. August contract currently ~14.3, I expect it to come in lower as we approach the July FOMC meeting.

SPX ATM Straddle Performance

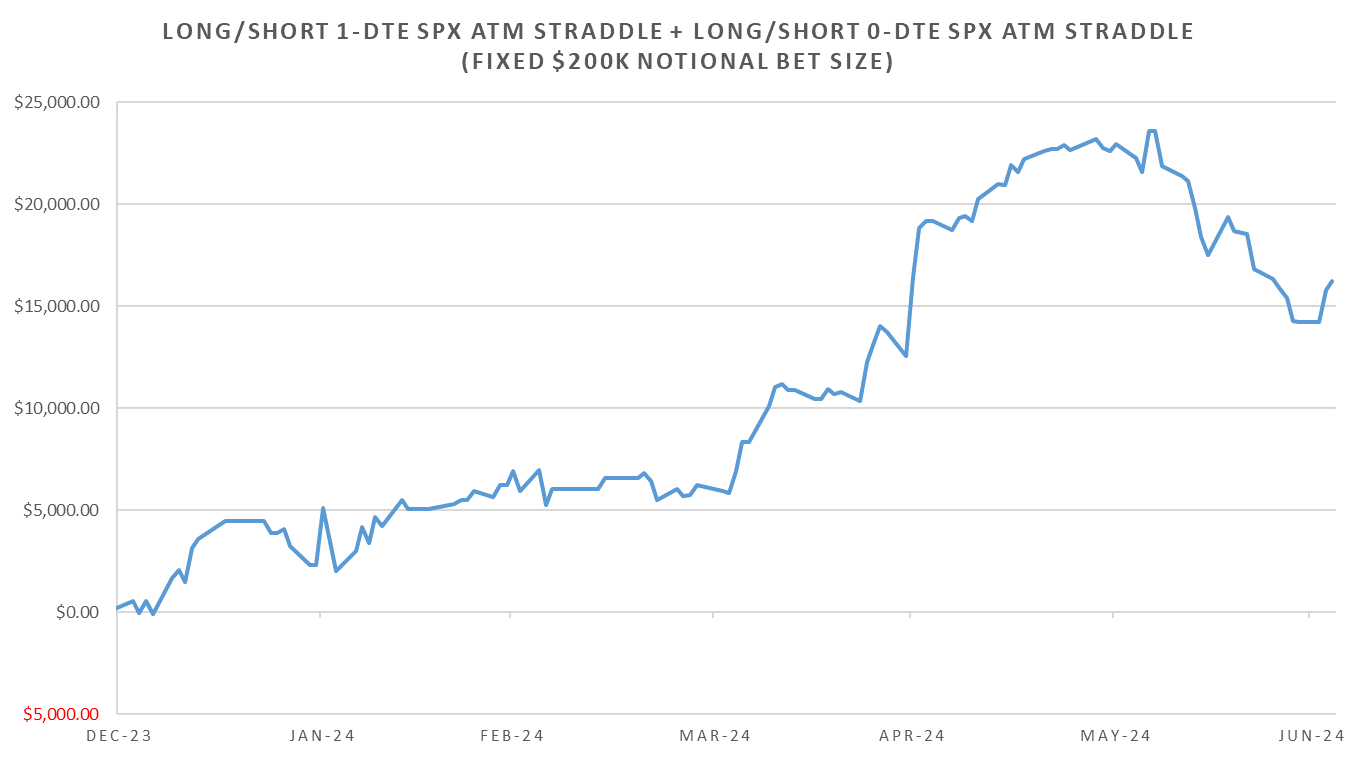

1-DTE Straddles up ~32pts over the last week and a half, mainly due to the large win on Wednesday as everything rallied into the cooling CPI number.

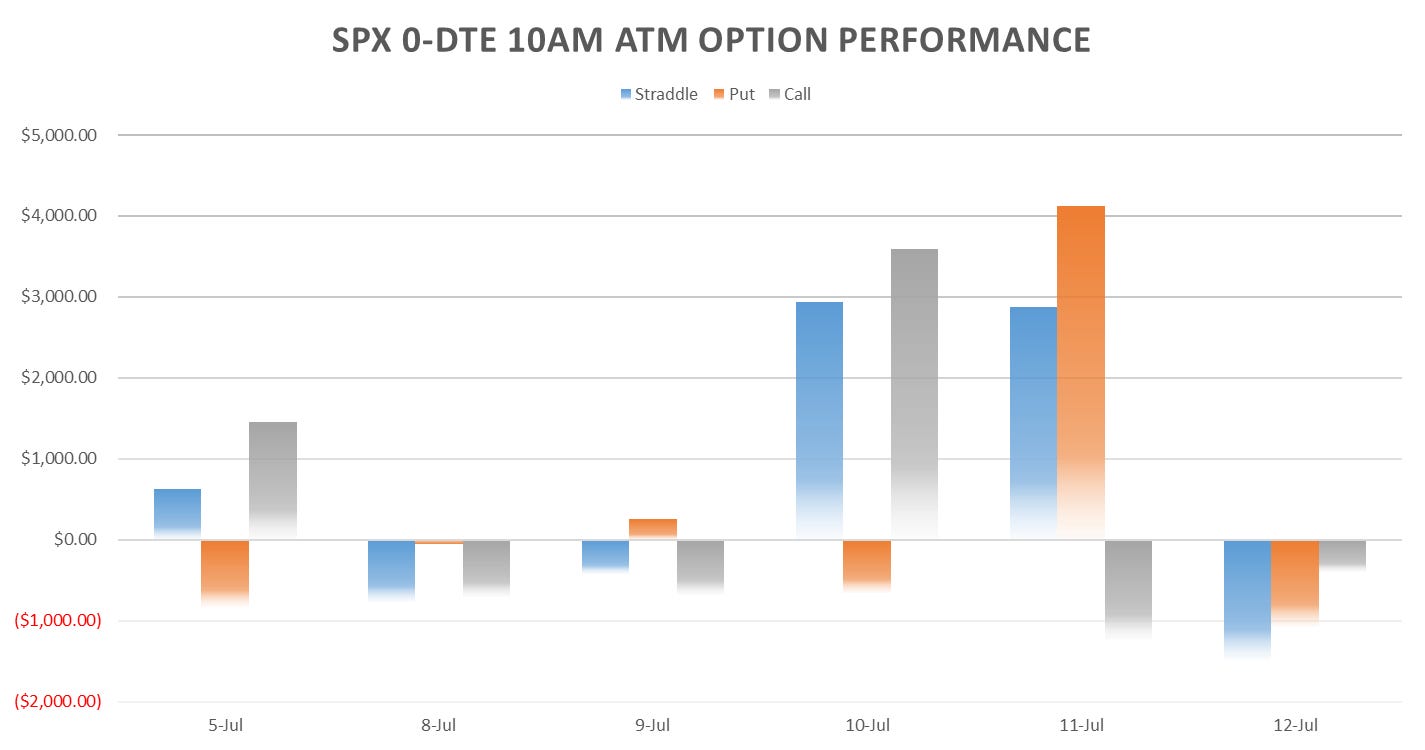

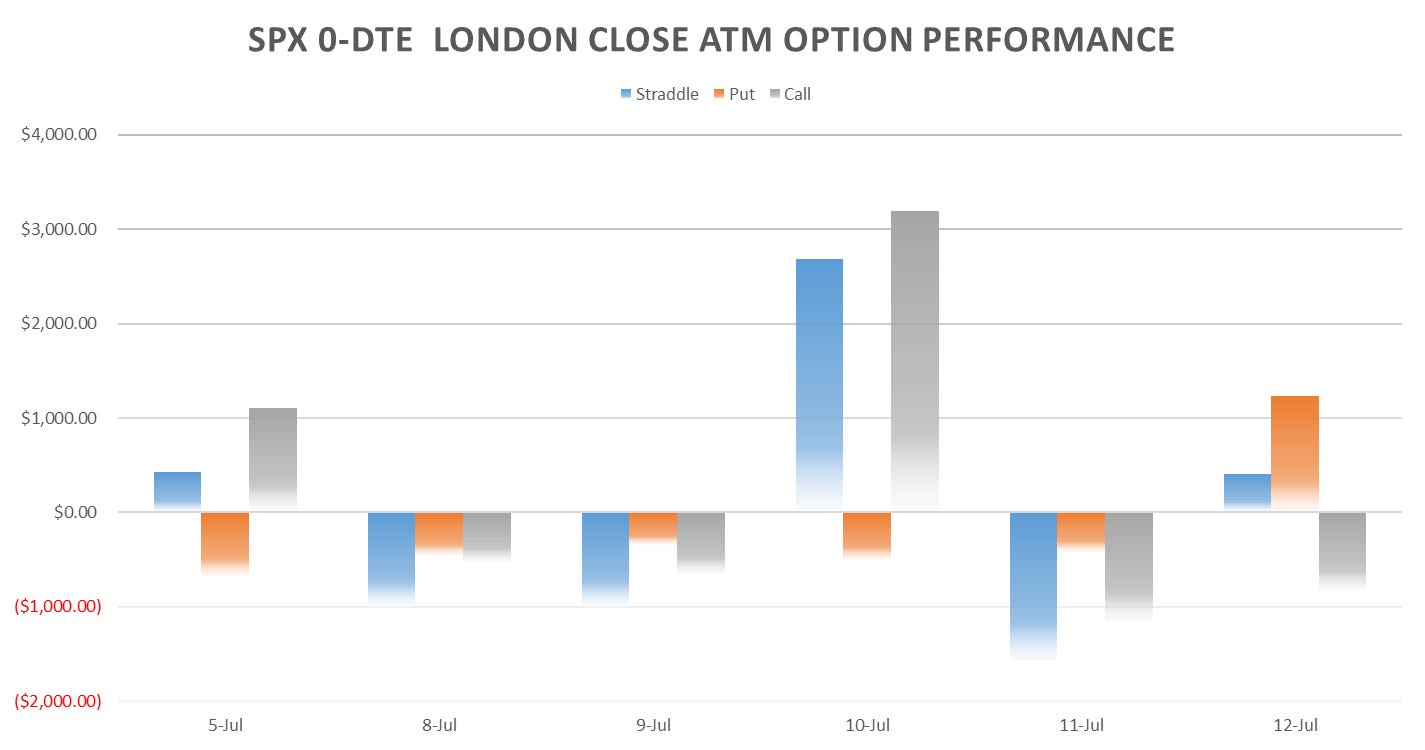

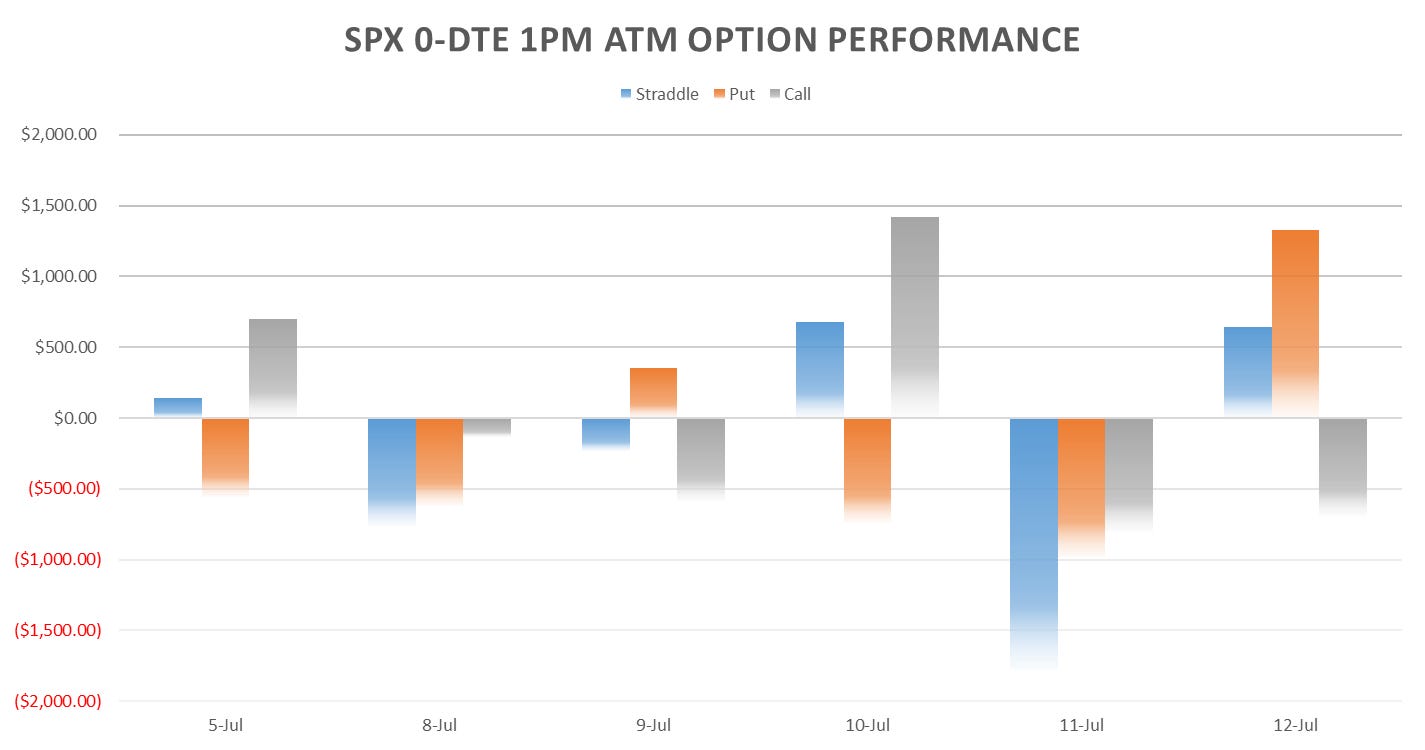

RTH Straddles winning on Wednesday & Thursday on the cl-cl move expansion.

Overnight straddles down 16pts, CPI premium was too rich, with subsequent move underpriced.

Intraday straddles performed well, strong intraday moves in both directions last week.

In a slight change of character, majority of moves realized between open and London close. EOD straddles net losers (2PM straddles saved by the big closing dump on Friday.)

Last 10 min trades flat w/w, larger moves started ~ 3:30pm instead of last 10 mins, premiums also held higher into eod (I assume on anticipation of large rebalancing flows.)

Variance Ratio Conditional Performance

From the following post:

Two winning trades, one losing trade since last week, net flat. Currently flat, will likely trigger short if we don’t realize a larger cl-cl move next few days. Daily straddle premiums remain slim (even with a couple of bps bump since lows) and near record lows despite correlations rising slightly. Ideally, daily straddles reprice slightly higher towards 45-50 bps with short signals triggering… Will see how rest of week goes.

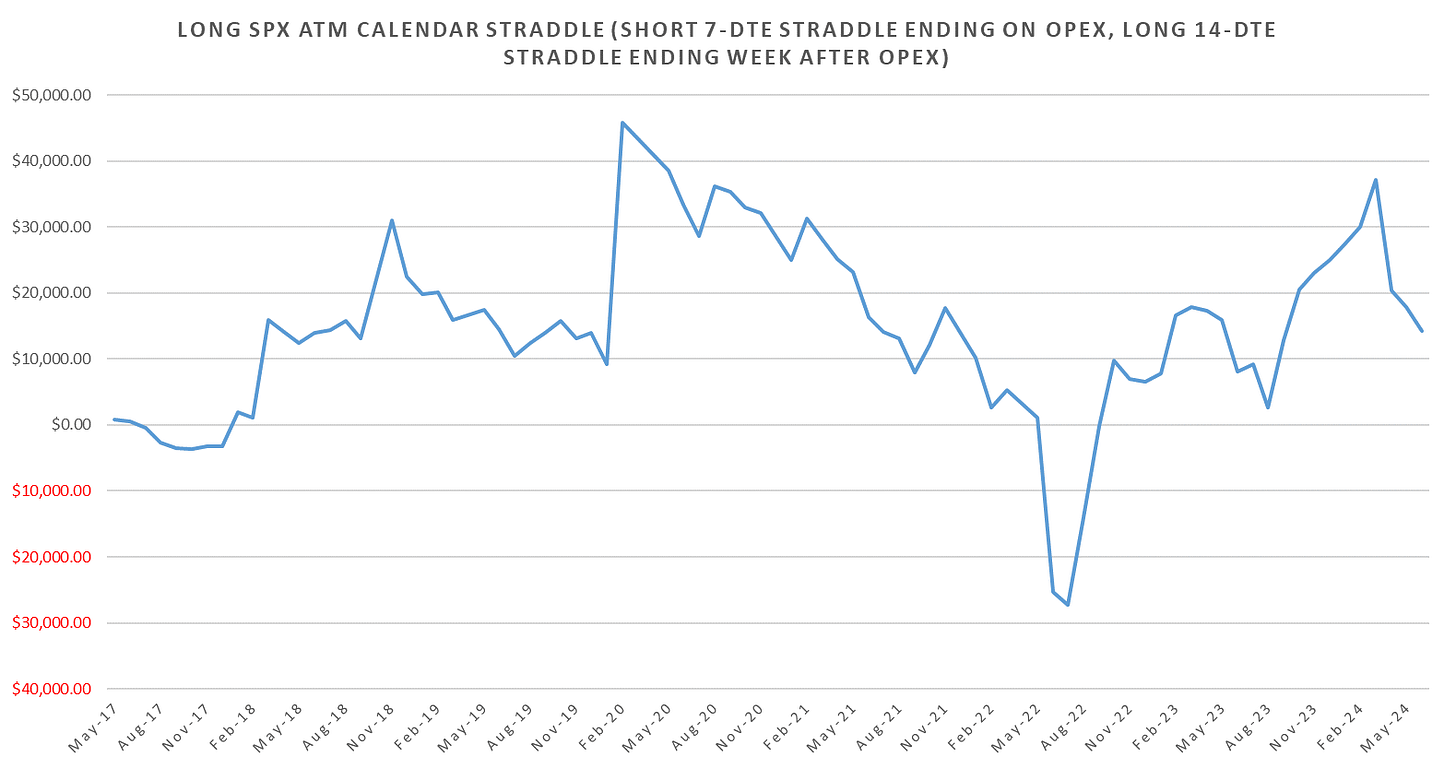

This week is OpEx week, outside of 2020 when premiums were a bit extreme, long straddles historically performed alright. Currently, eow SPX ATM Straddle is priced at ~94 bps. Given historically the move post OpEx week performs much better:

A decent play could be trading a calendar straddle, shorting this Fridays 5650 SPX straddle, long next Friday 5650 straddle for ~27-28 pts per calendar straddle:

2020-2022 horrific pnl, but largely I believe that was an overall odd period for a number of volatility seasonality patterns… It looks like since 2022, pnl more in line with pre-Covid period. Last 3 months losing trade… I like the blowoff top play into end of July FOMC though…