Following up on last weeks overview:

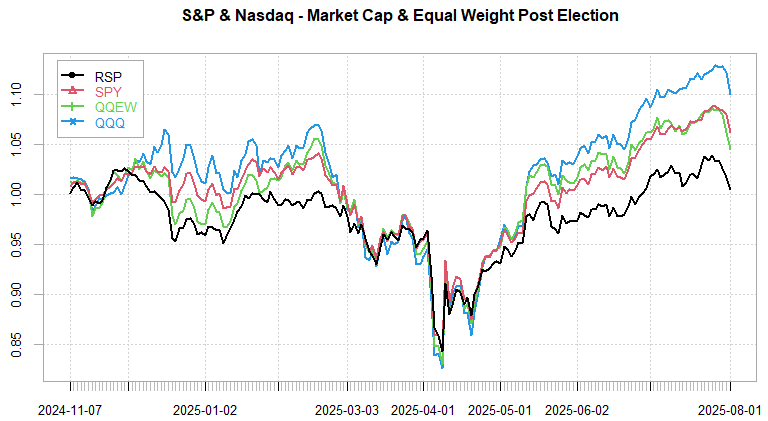

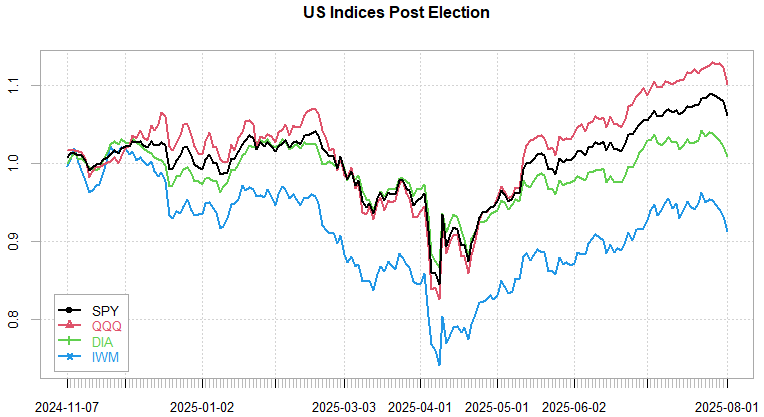

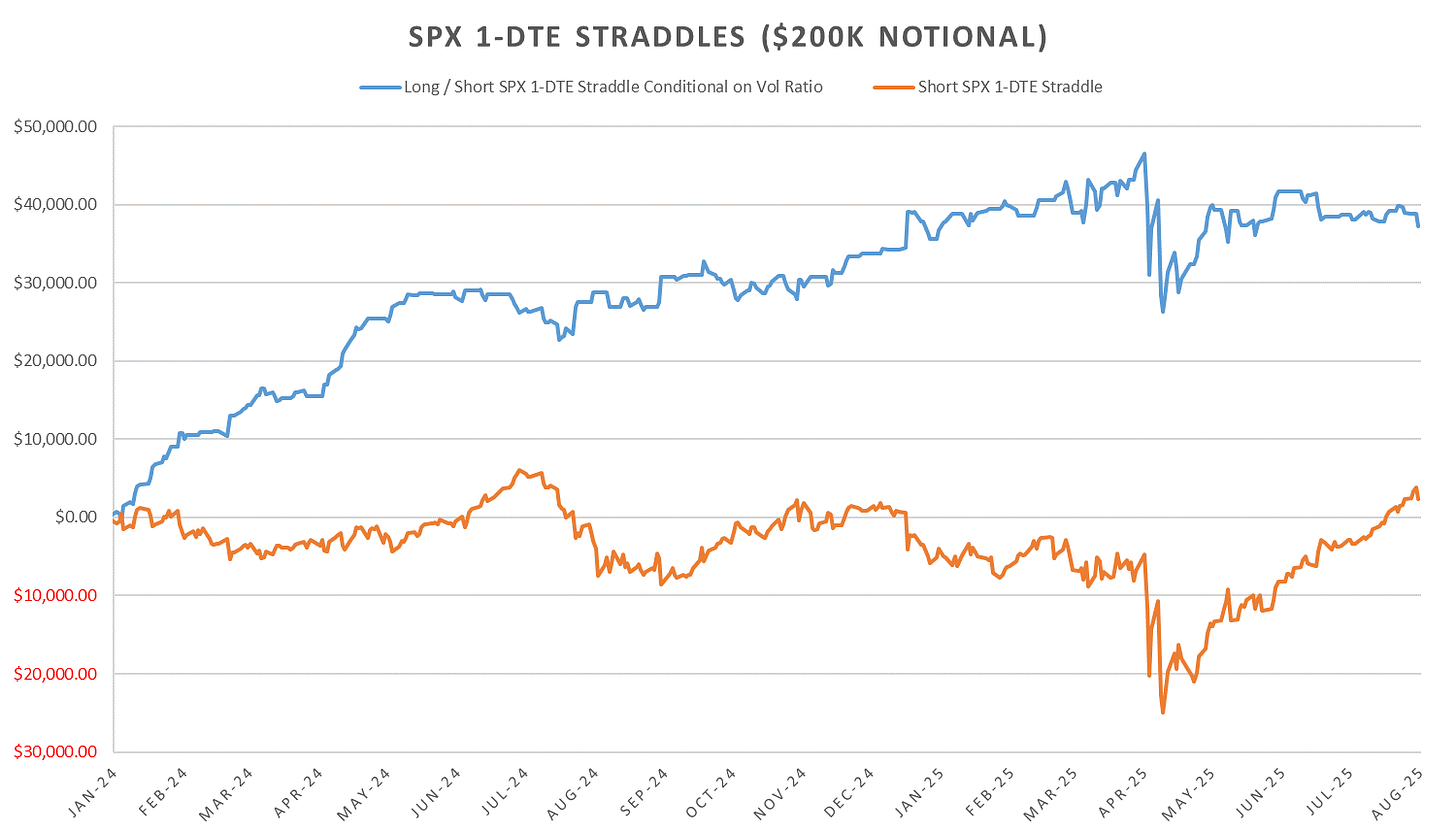

First sizable drop for indices since mid-May after FOMC reiterated inflation risks from tariffs. A miss on NFP print on Friday reignited recession concerns sending indices into ~2.5% drawdown by weekly close. Trump did not like the numbers on Friday so fired the lead official on economic data in the best traditions of … North Korea (and others..) Short dated vol on indices was already bid into data releases so net 1-DTE straddles ended up red on the week despite multiple 1%+ moves intraday. CPI comes out next week so we get a slight pause in econ data after last weeks packed release schedule.

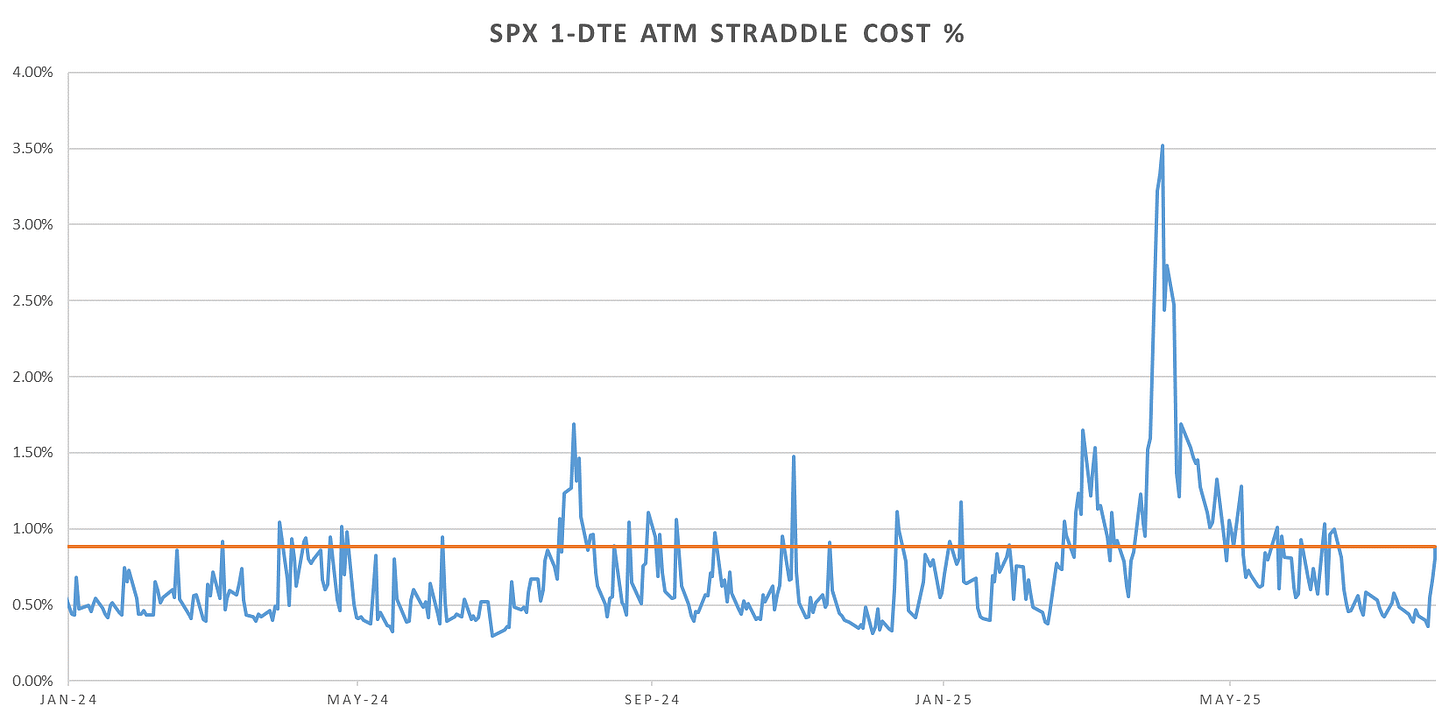

1-DTE SPX straddles back to range highs for last year and a half. VIX closed the week above 20 with a flat VX curve as markets stumbled.

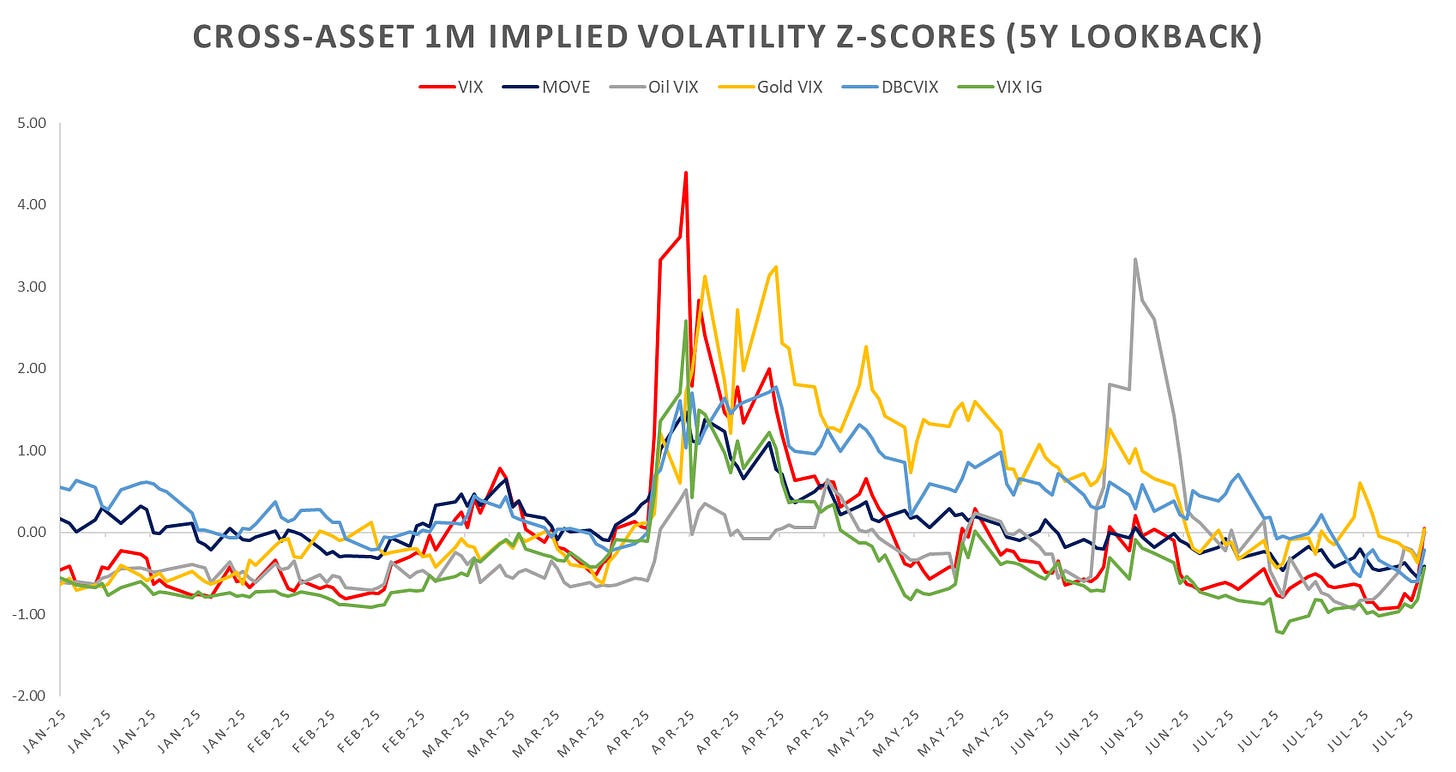

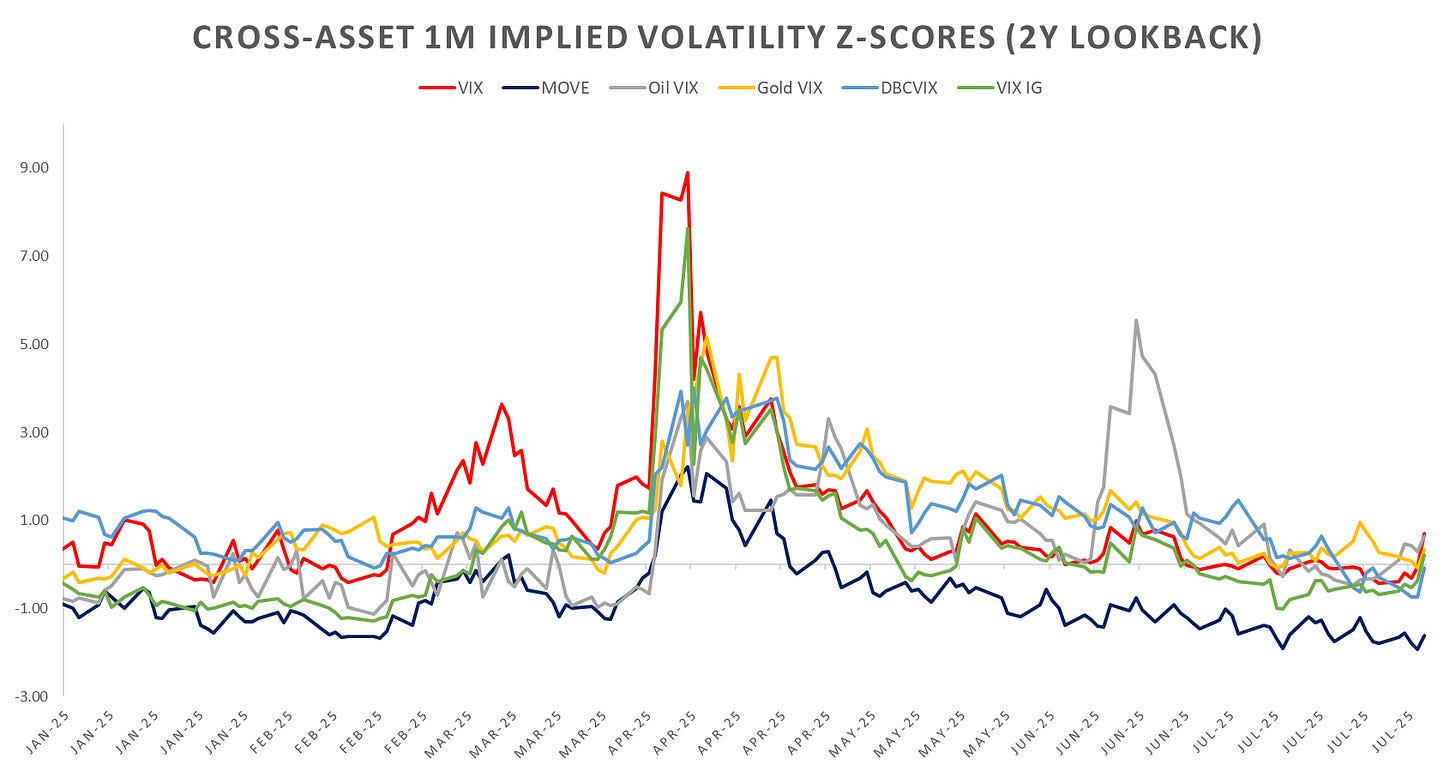

Cross-asset implied vols spiked on the week, led by equities (was relatively lowest last week.)

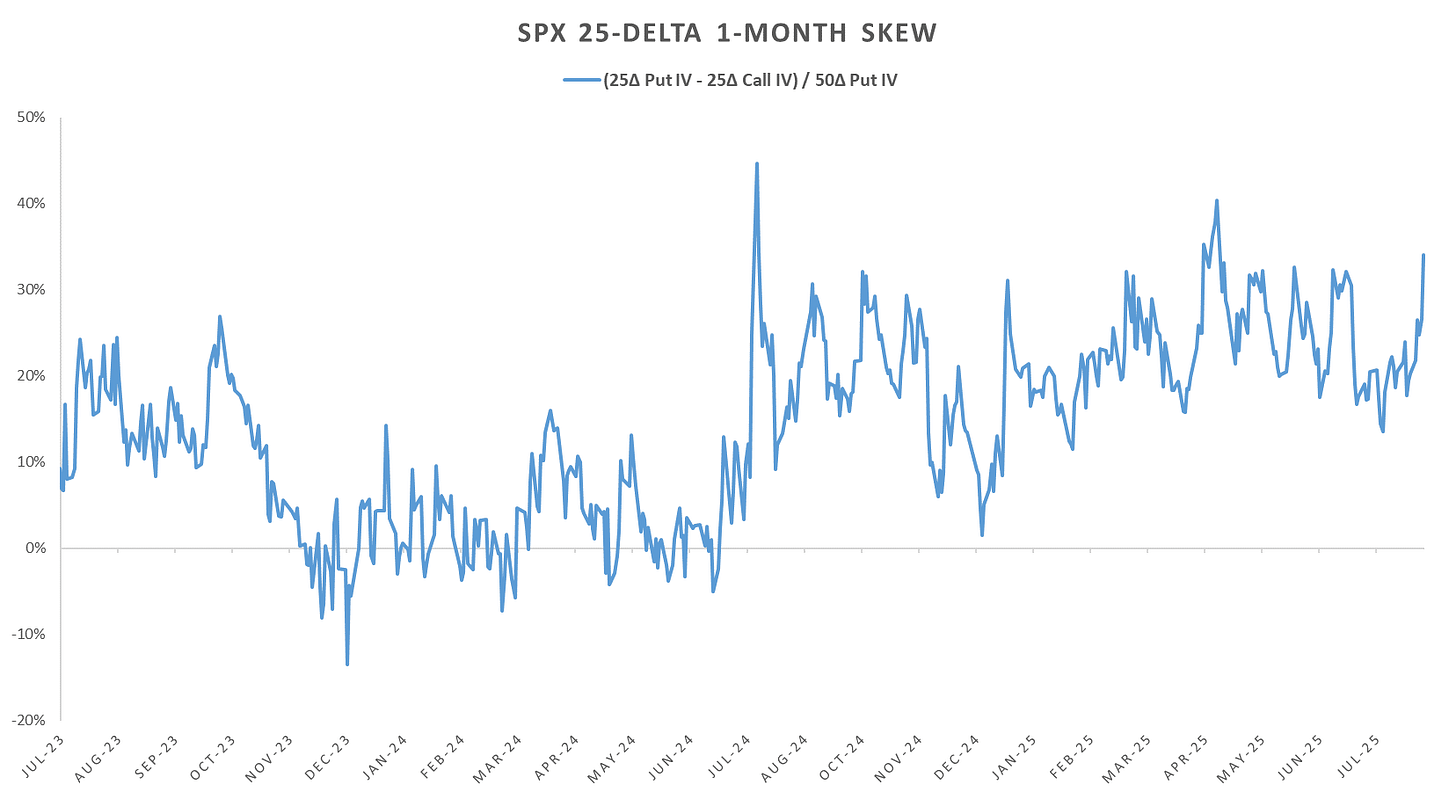

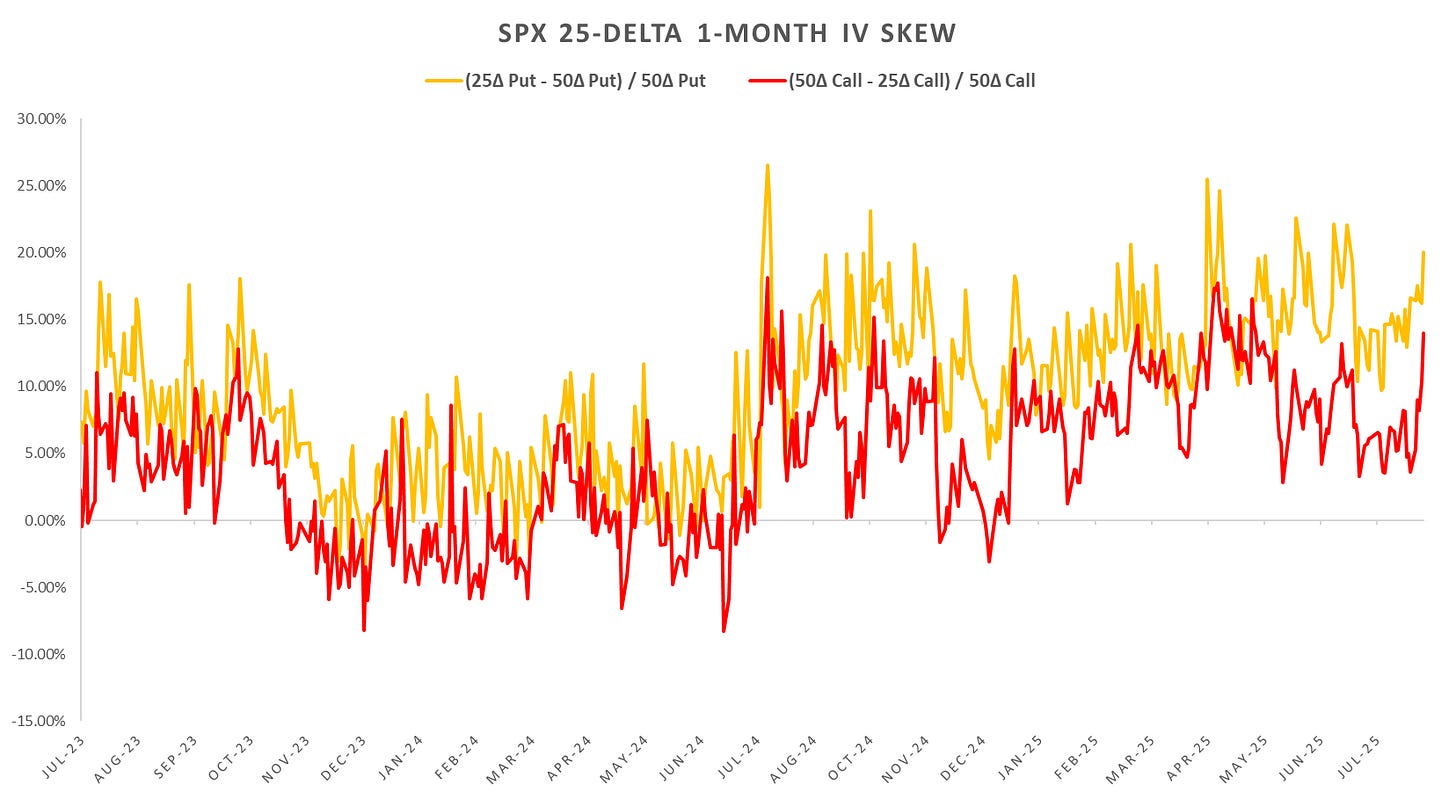

SPX 1m 25d skew steepest since April on the back of tariffs dropping again & recessionary econ data.

Looking at intraday price action:

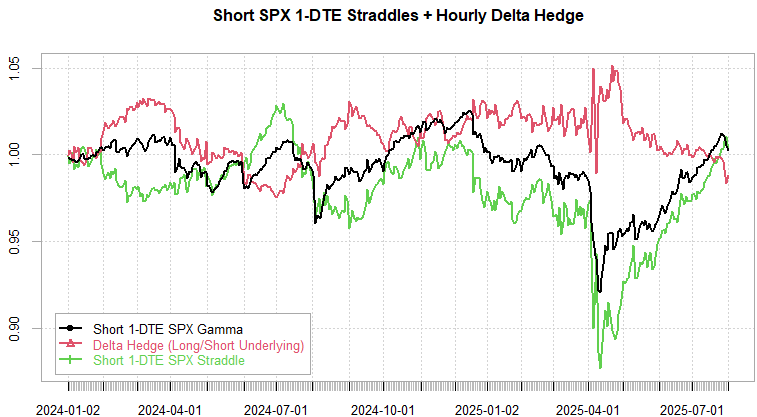

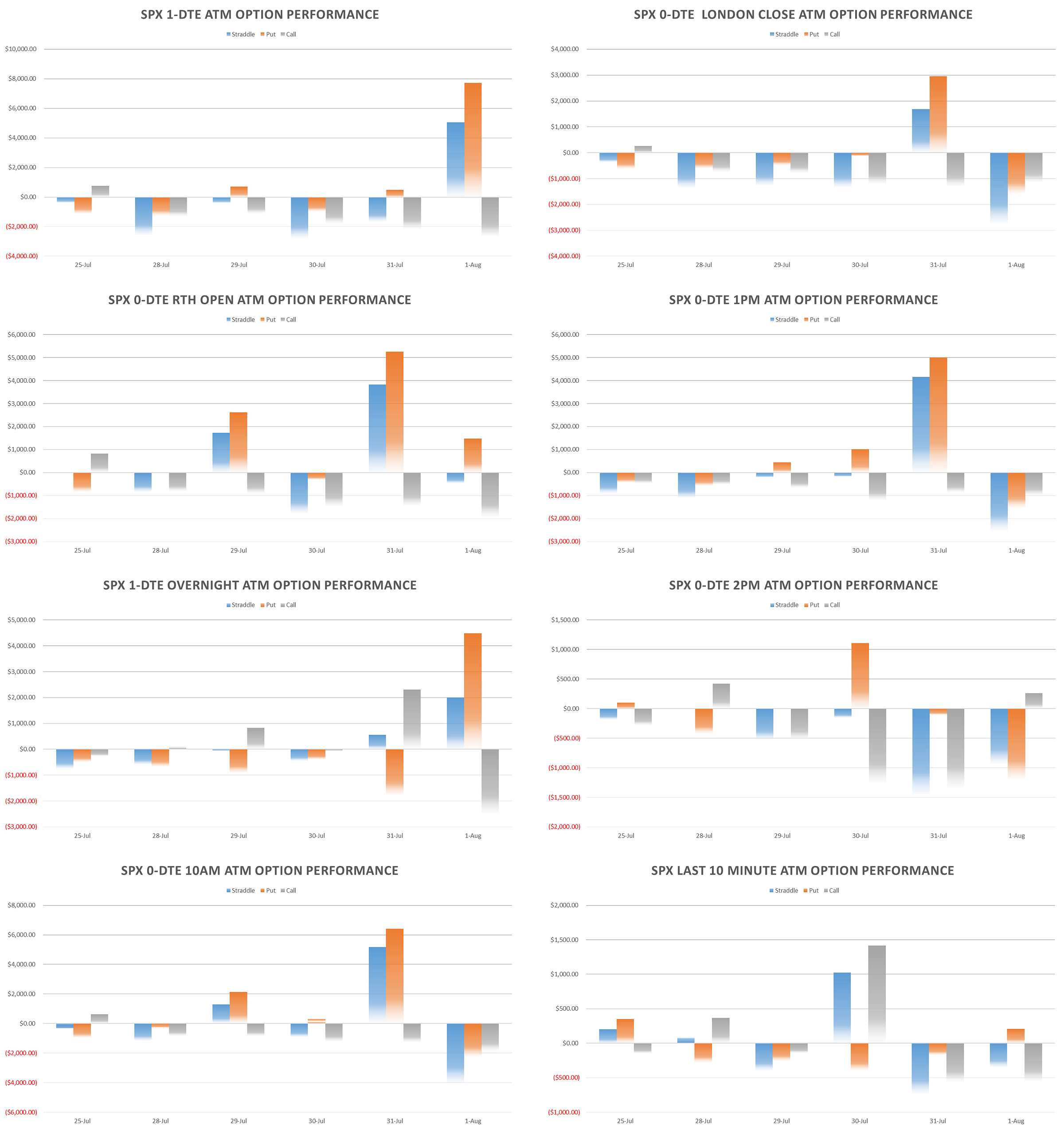

Short 1-DTE SPX delta hedged straddles down more than unhedged straddles last week as we had violent reversals from overnight earnings gap higher on Thursday. With short dated vol being already elevated into econ data releases, little damage to short straddles so far.

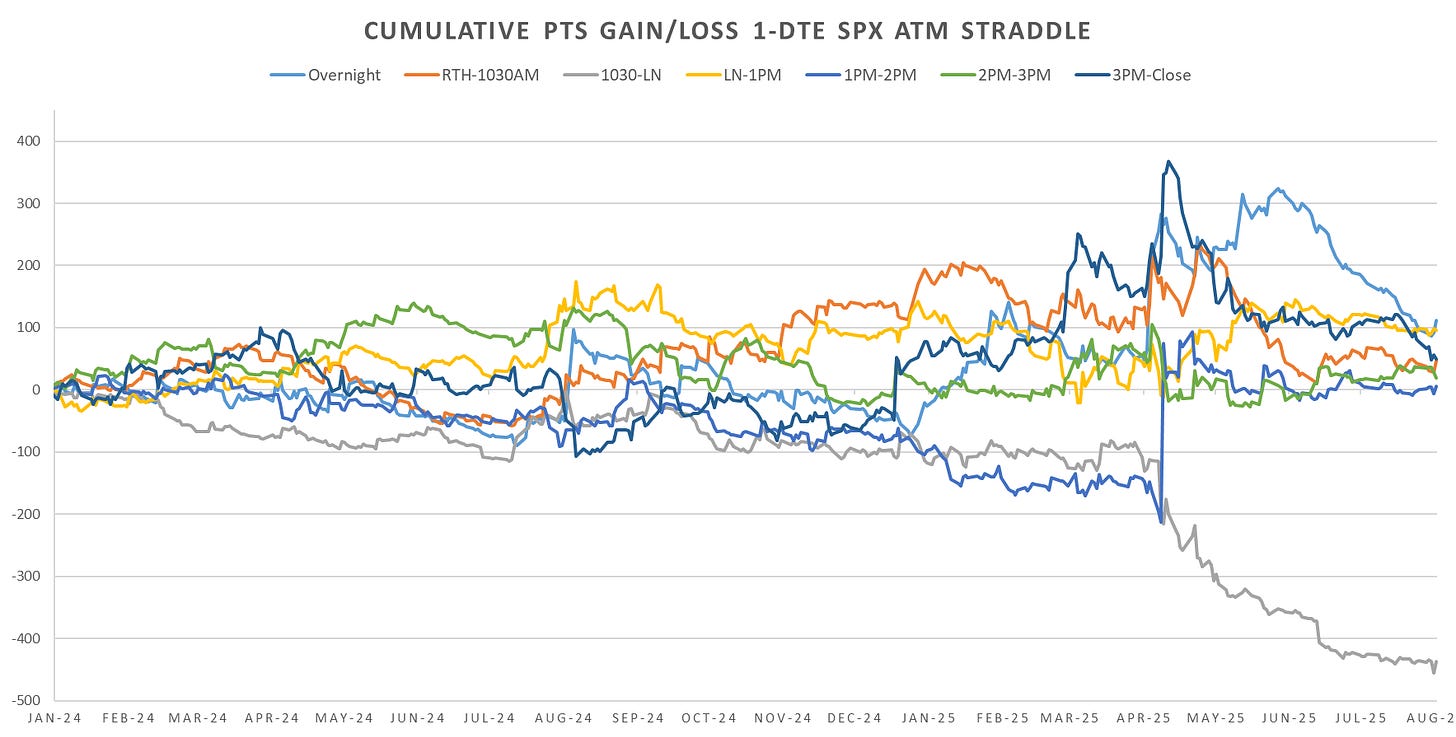

Cross section looks unchanged since April, overnight moves retraced by London close (11:30am).

Realized Volatility Overview

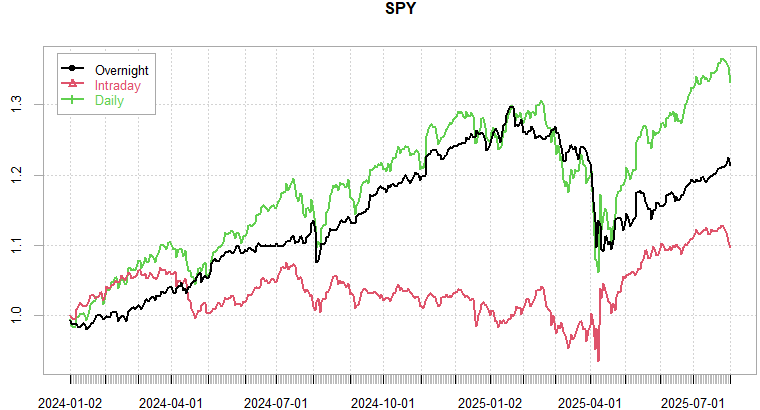

Mostly RTH session selling with Globex still up on the week.

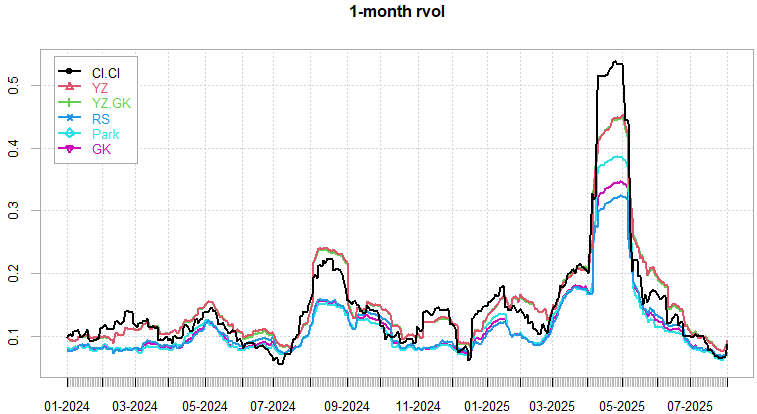

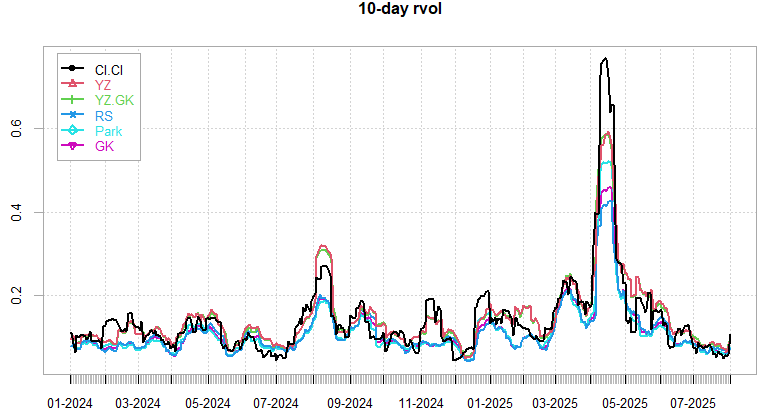

1m & 10d rvols still trading sub 10, barely noticeable. Decent VRP when looking at trailing realized vols, however, periods of low rvol last 5 years are extremely short (at least relative to what we saw in 2017…)

Spike in VIX driven entirely by spike in implied corrs (10 → 23) as component vol (VIXEQ) just back to last weeks levels before earnings started. Broad risk-off move last week (along with sharp drop in yields) suggests we are likely seeing Sep rate cut from Powell. Worst case will be rising CPI along with worsening jobs market (12th Aug CPI), so likely we churn this week before possibly moving lower again on the back of hotter CPI…

In just 2 days VX Aug up 3pts from the low 17 handle. Once again the extreme spread saw spot close the gap instead of futures.

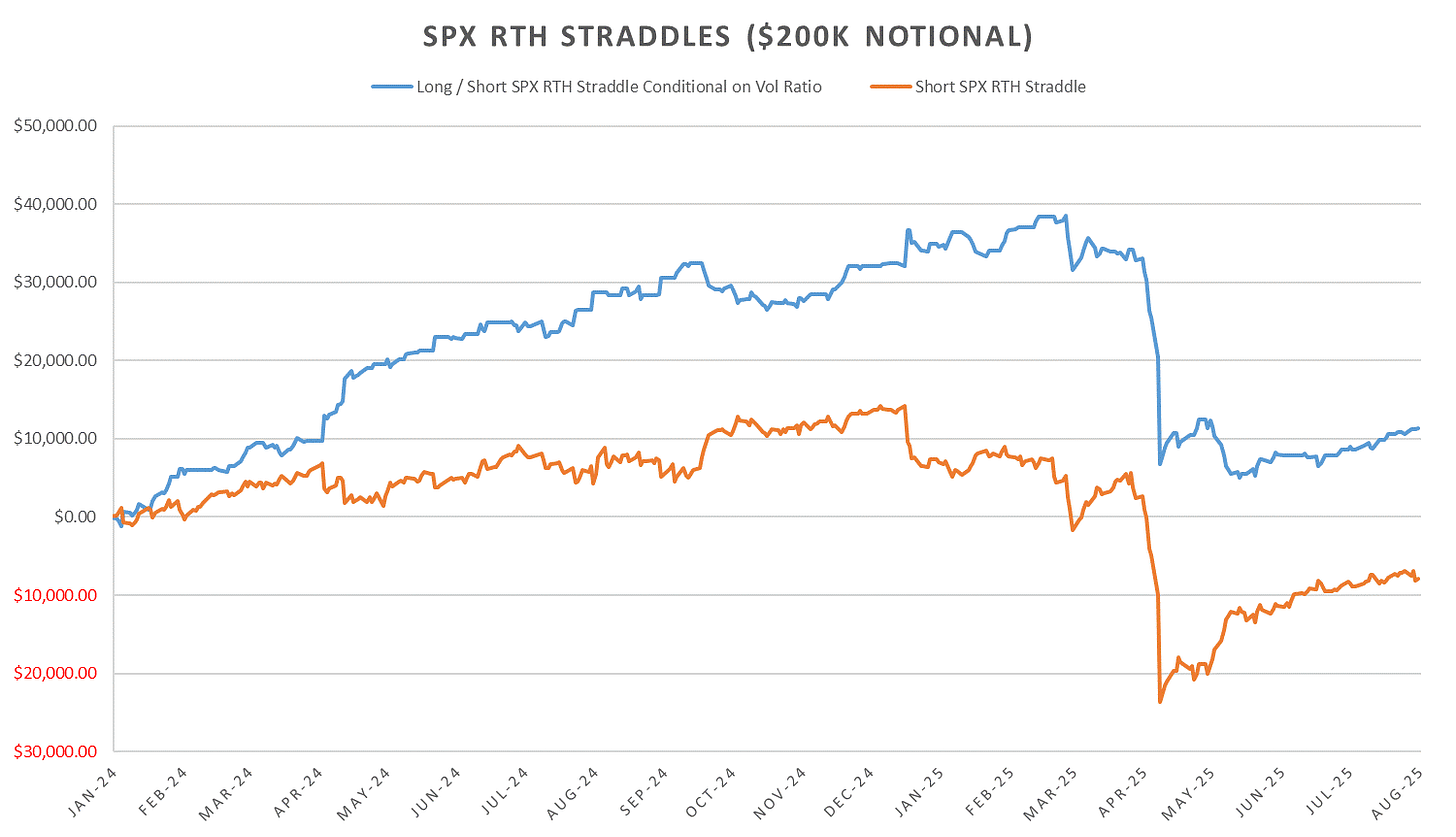

SPX ATM Straddle Performance

Despite the sharp move lower in indices, short 1-dte straddles up ~27pts for the previous 6 trading days. Eom long last 10 min straddle trade down ~7pts & last 2 hrs down ~14pts. Short london close (11:30am) - US close straddles up 53pts on the week, the biggest winner.

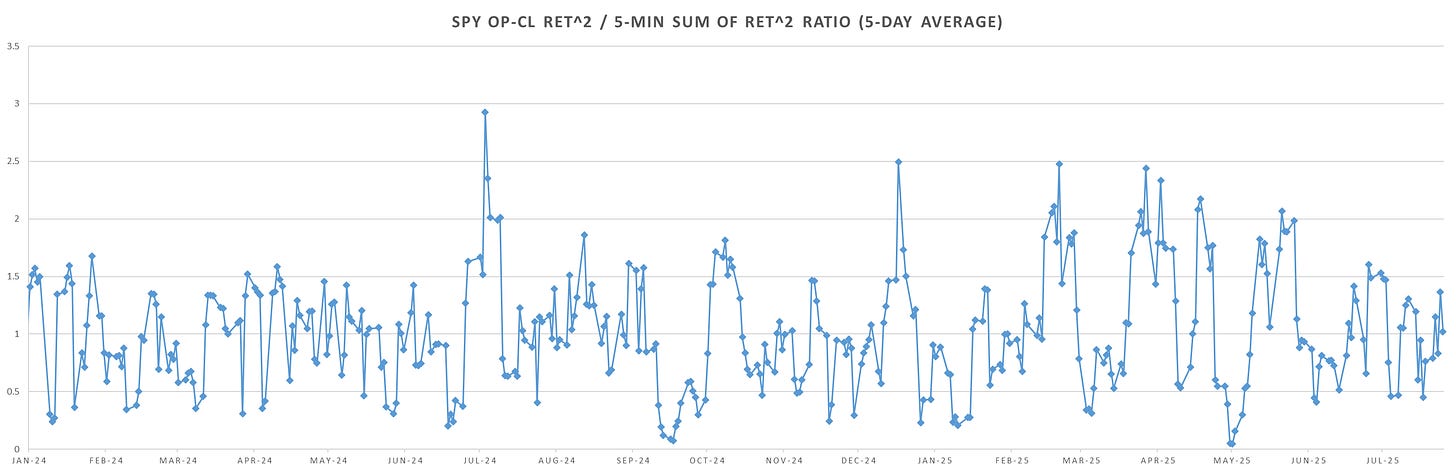

Intraday Variance Ratio

From the following post:

Last few weeks markets oscillating between strong intraday trend and strong mean reversion on a daily basis without any follow through for more than a day. No bias going into this week as Friday intraday saw little follow through of morning selling.

Little use tracking variance ratio since May as we mostly saw volatility (both implied & realized) collapse, leading to exceptional short straddle performance. Lack of extreme trend/mean reversion also apparent so no opportunity to fade.

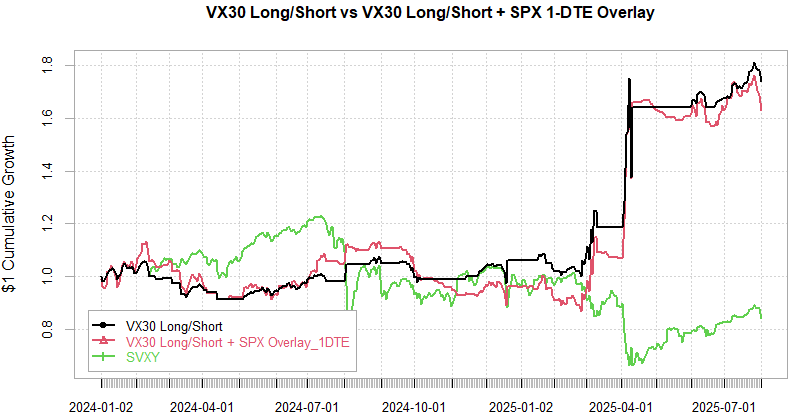

VX Carry & SPX Overlay

From the following post:

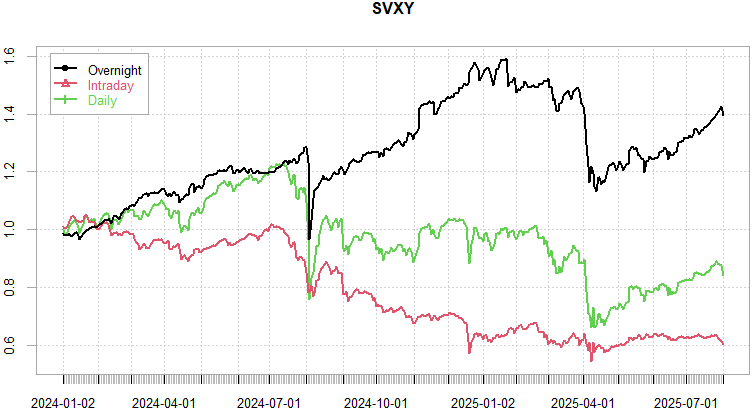

Short VX Aug triggered out pre-market Friday. Gave up a bit of July gains but not a bad exit. Possibly trigger a long VX Aug trade if we see some sharp downside momentum next few days on indices as VX curve already slightly inverted. VIX outperformed to the upside as fixed strike vols moved higher across the board & put skew got steeper. Seasonality wise, does not favor short vol runs from here till Nov/Dec…

As always, don’t hesitate to reach out,

Have a great week!

Curious what you're referring to with "VX curve already slightly inverted." Spot VIX getting above August VX last week?