Following up on previous OpEx post:

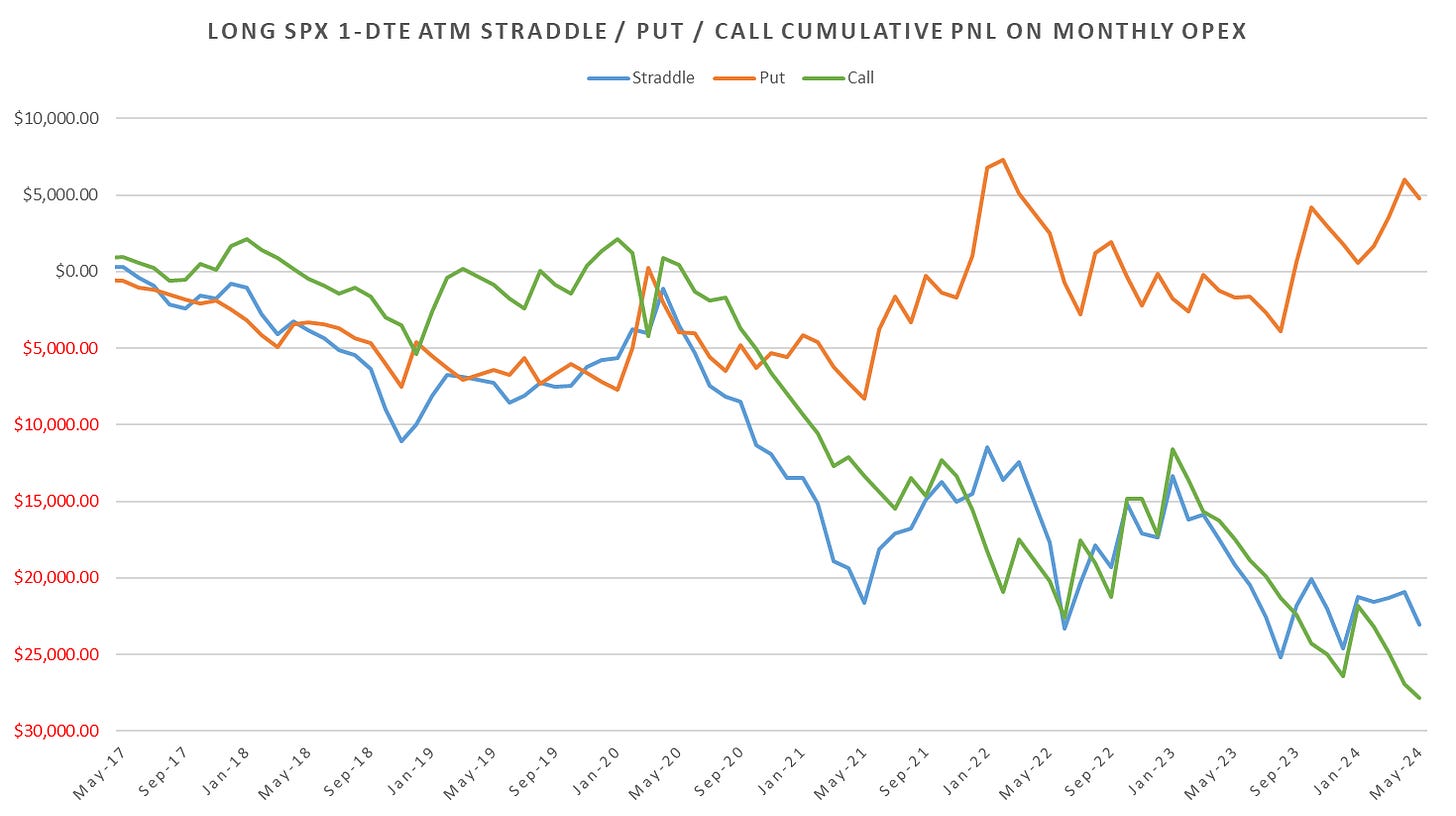

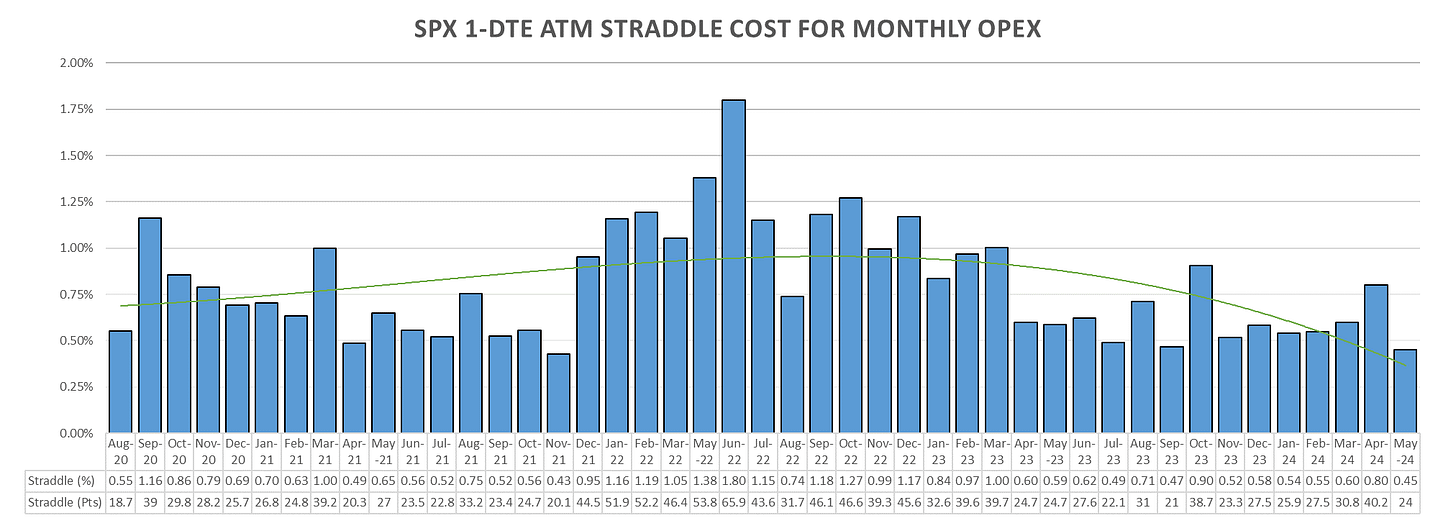

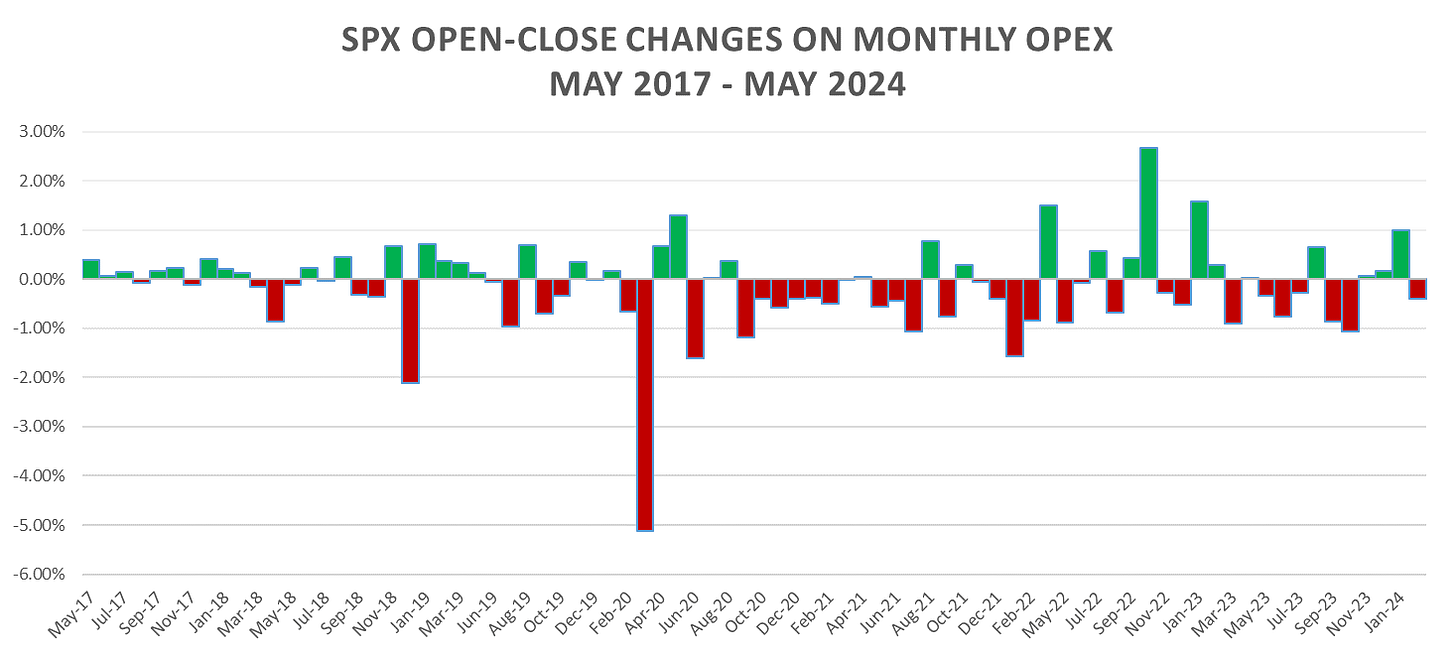

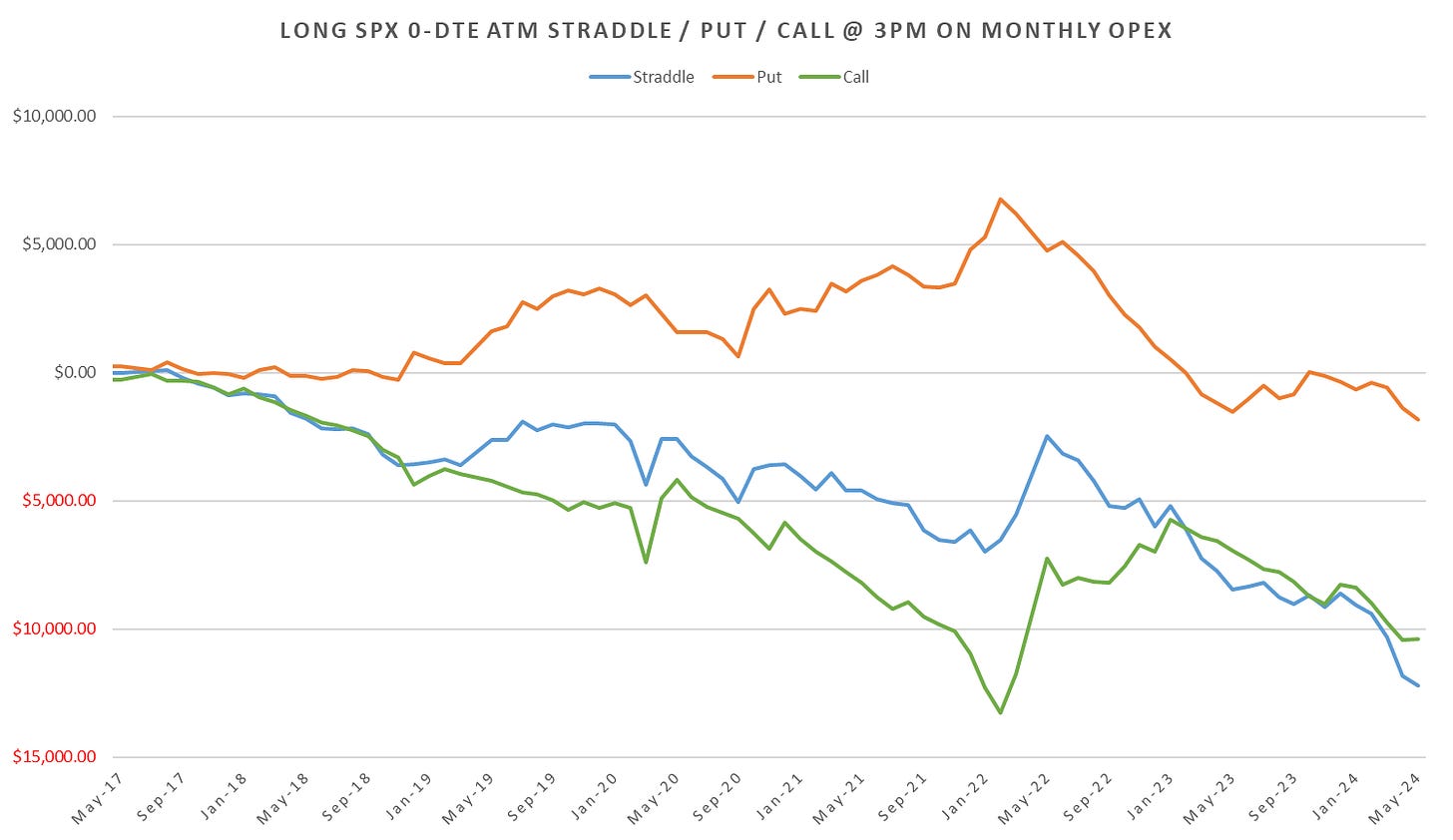

Since February ‘24 OpEx, bearish tendency continues, straddle costs for OpEx keep dropping (~50bps for tmrw.)

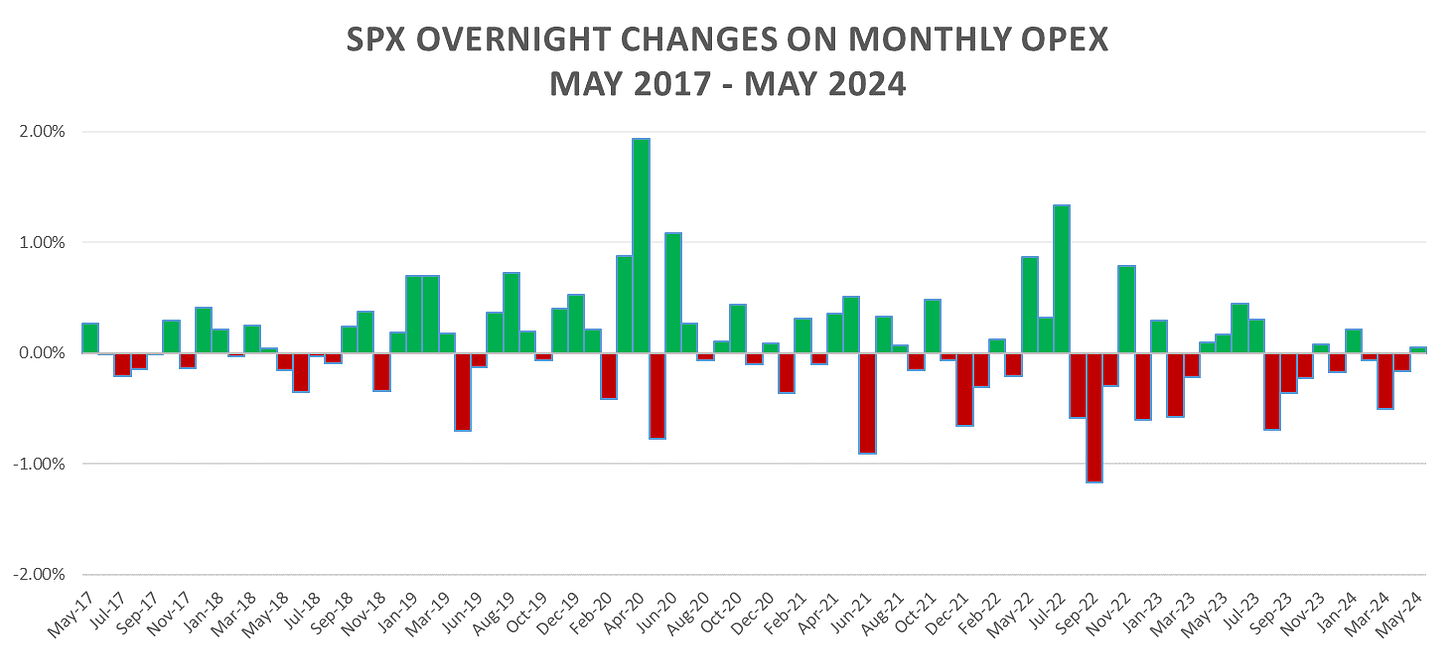

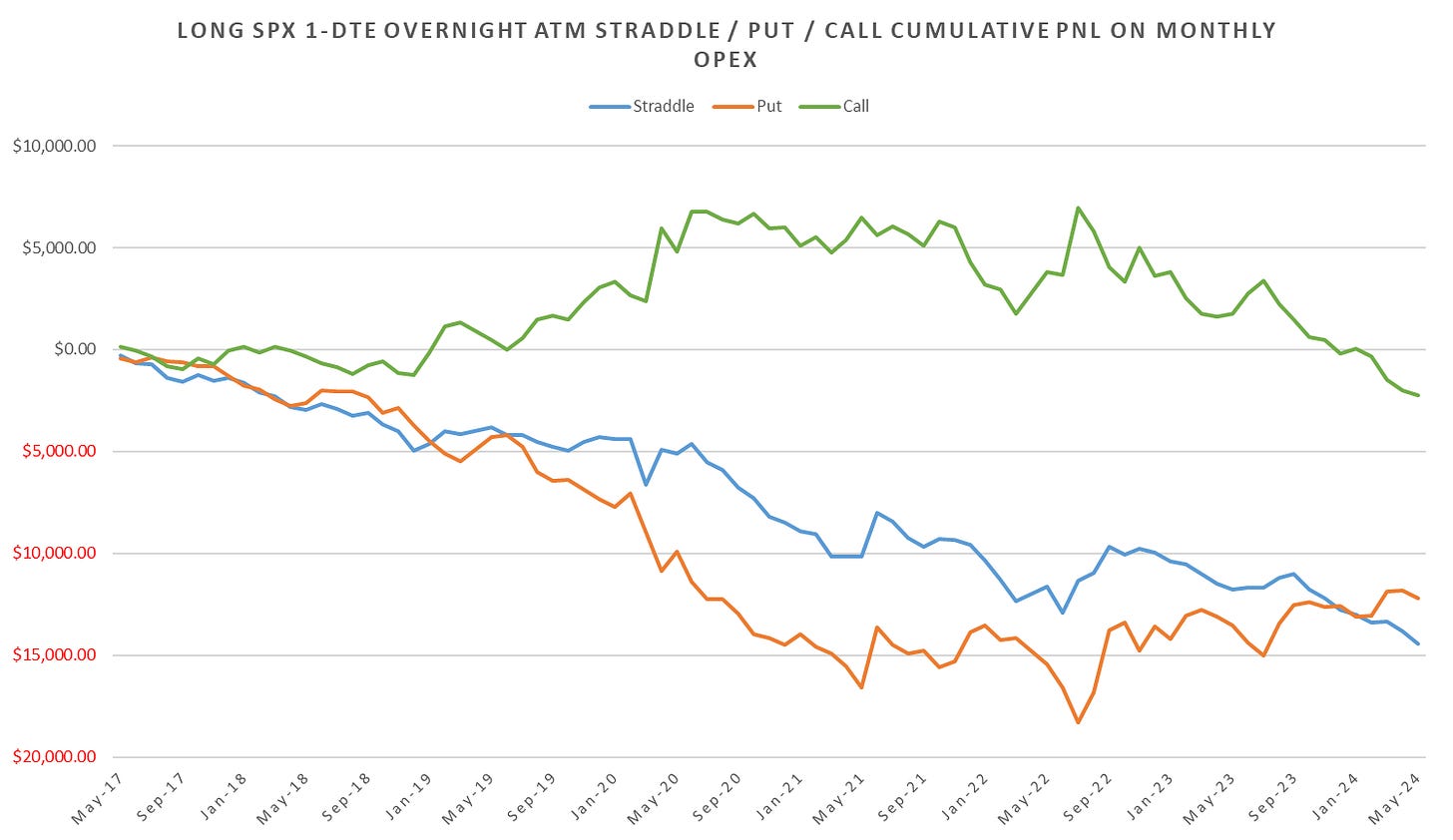

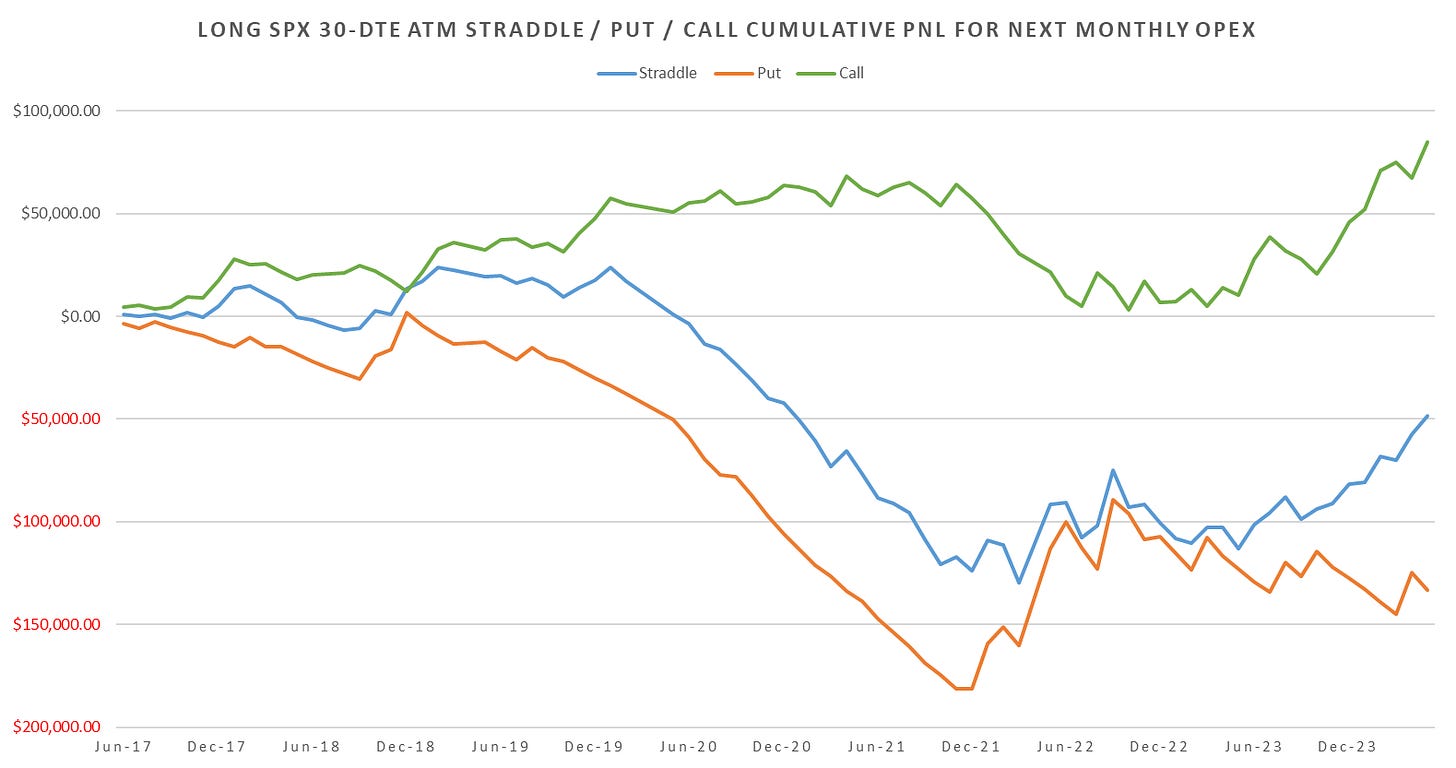

Unlike the overall pattern of overnight grind higher, OpEx morning settlement tends to bleed SPX overnight for the last few years:

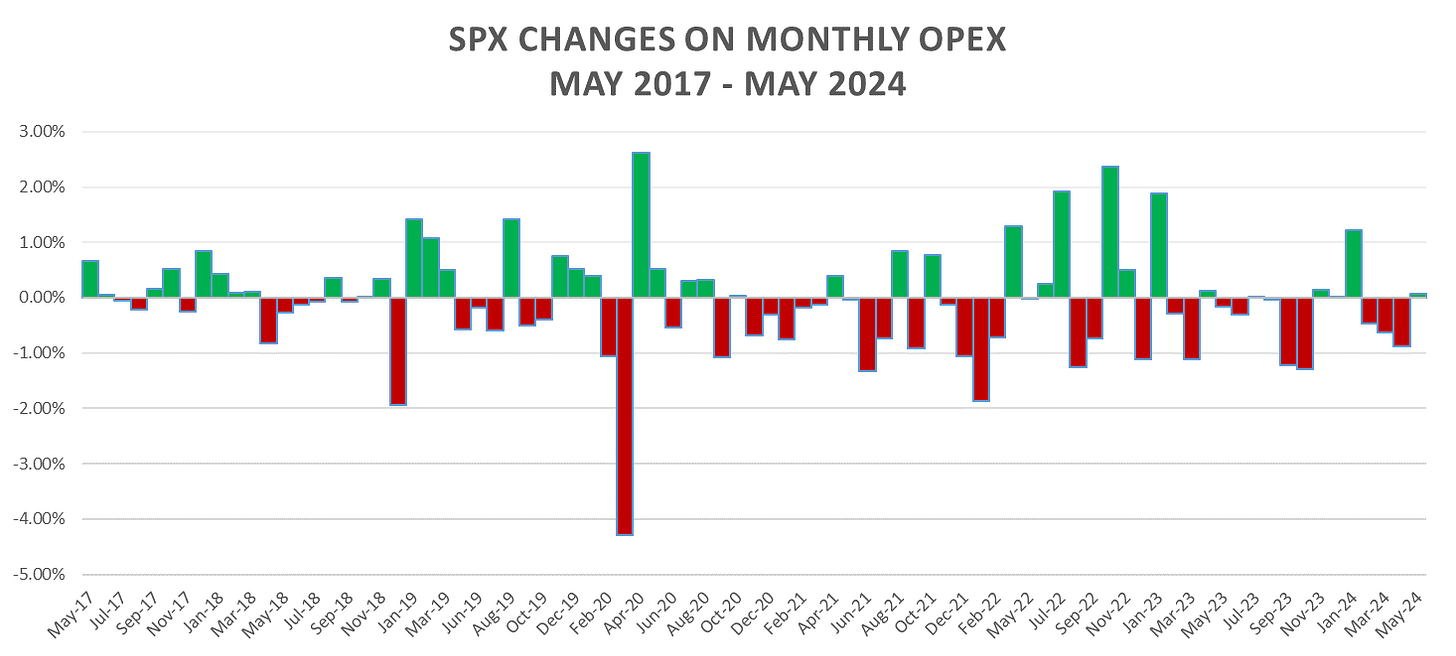

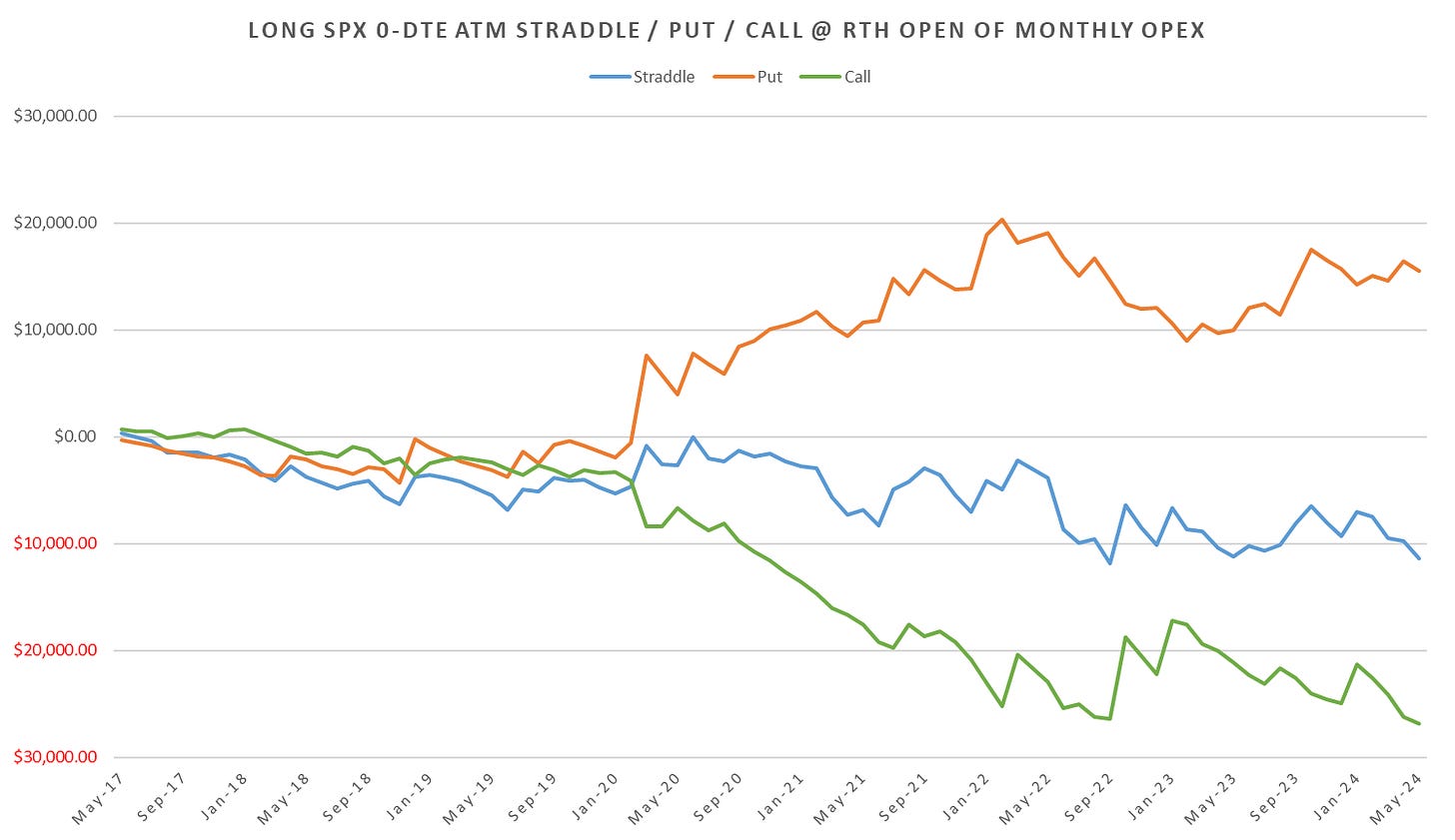

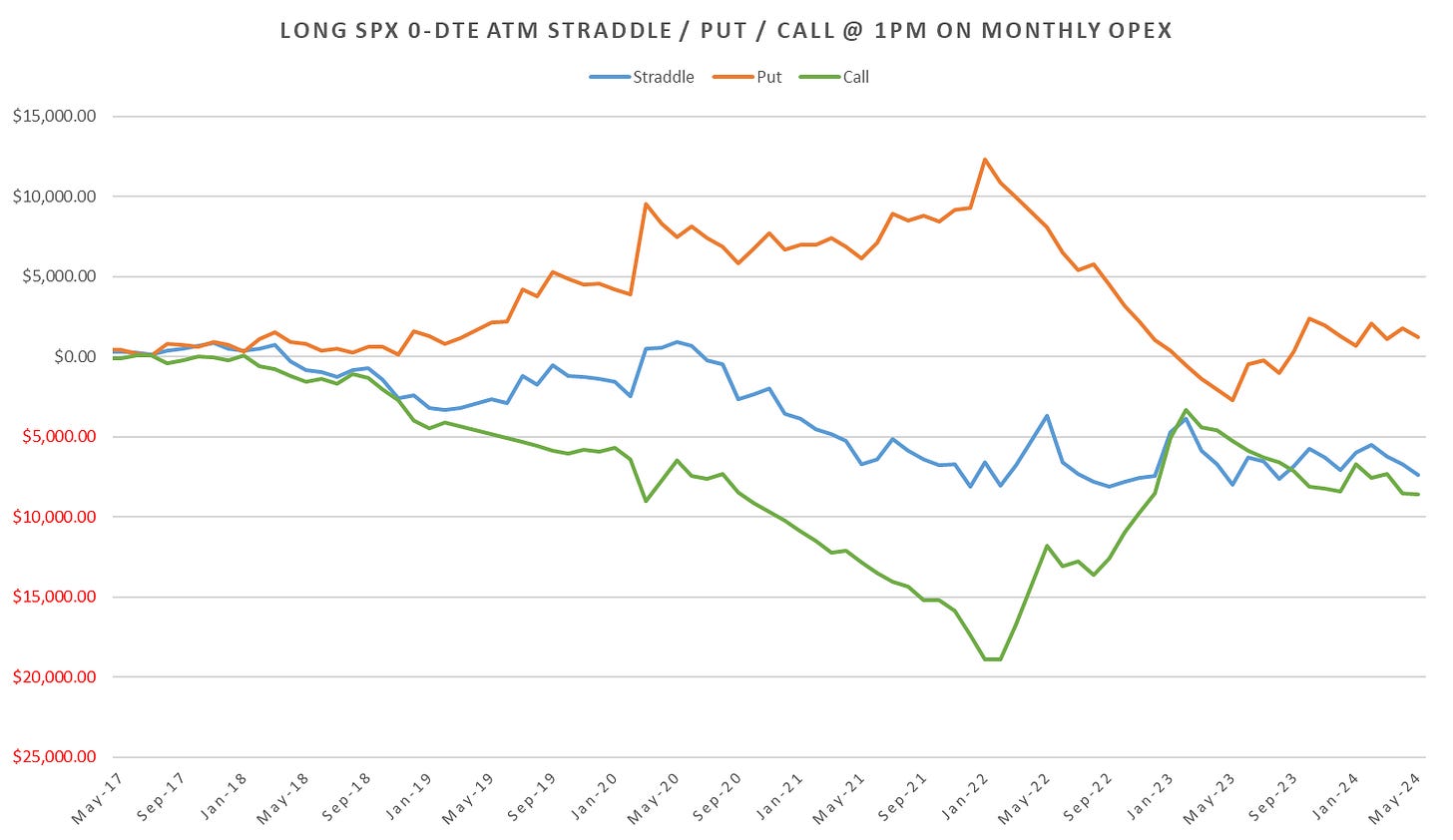

Overall, intraday, slightly bearish lean throughout the day but moves have been extremely muted even into the close last year and a half.

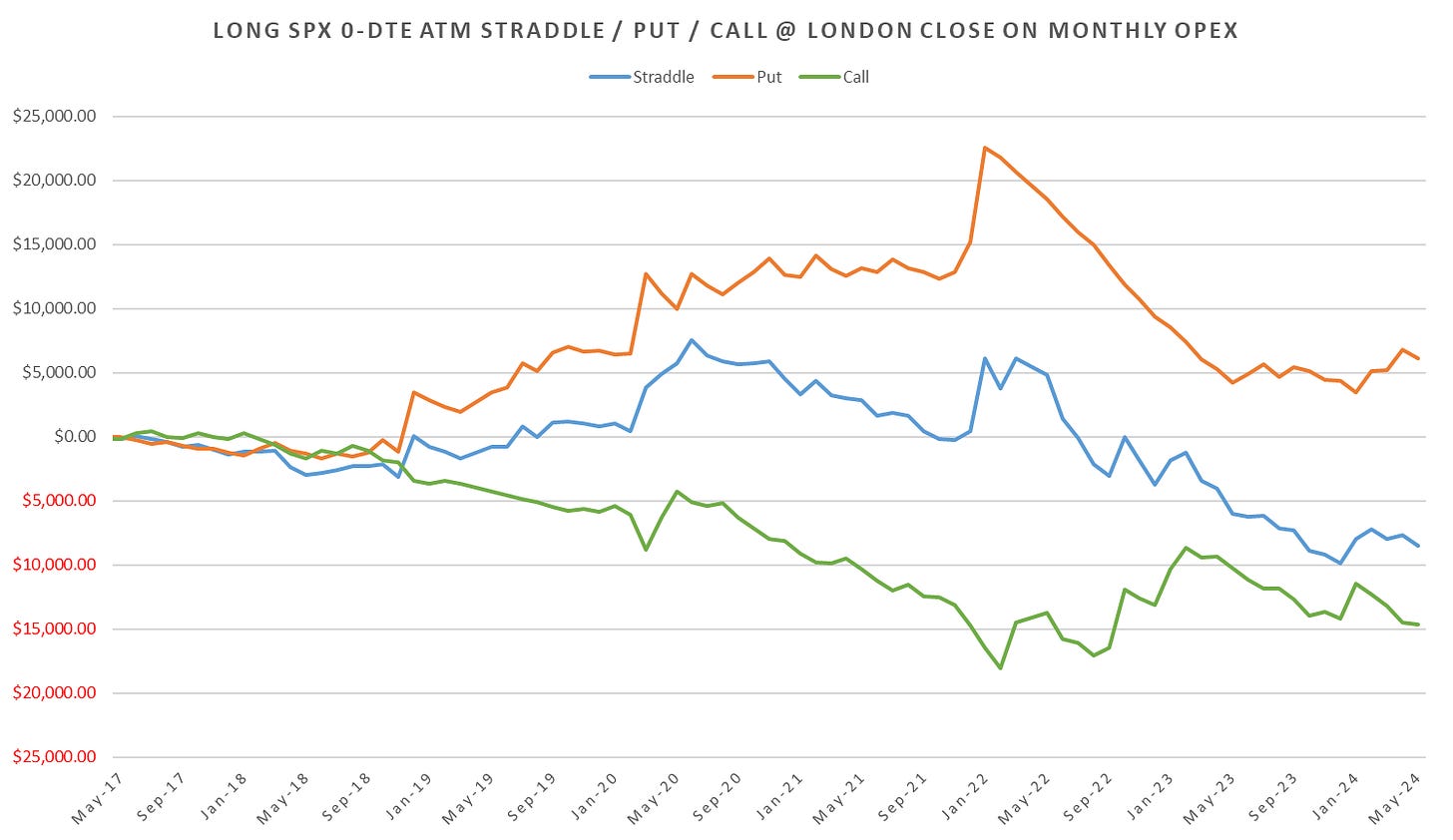

Post London Close, markets have not moved at all for a while now (between Feb 2022 and May 2023, puts have not paid once…) :

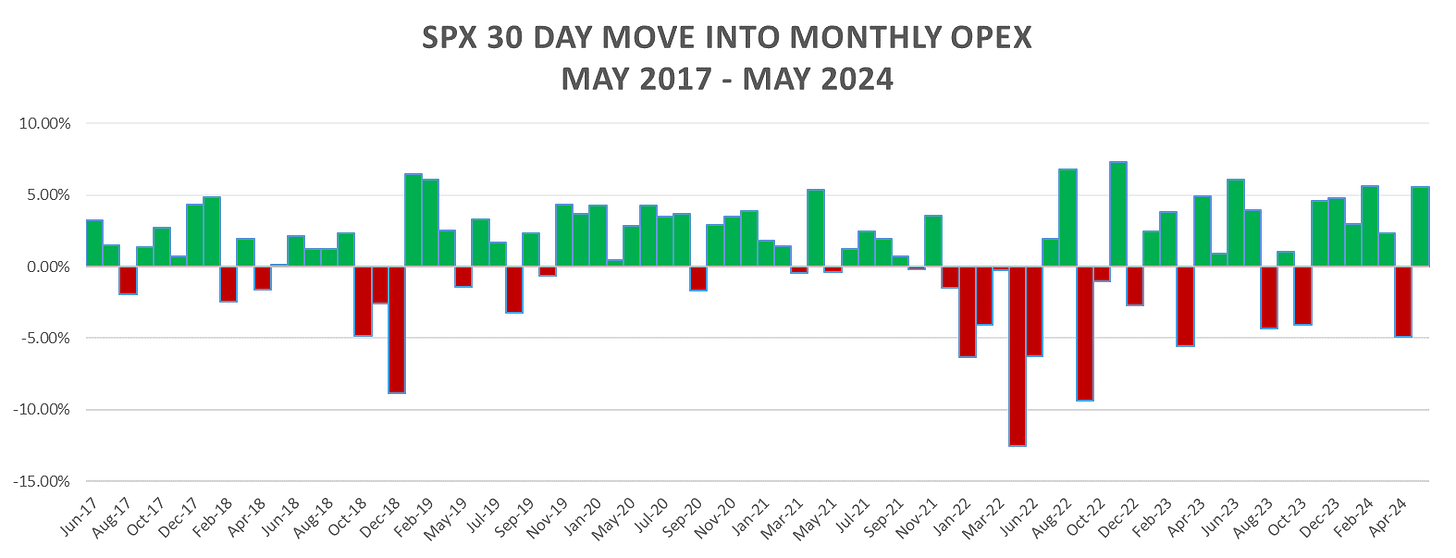

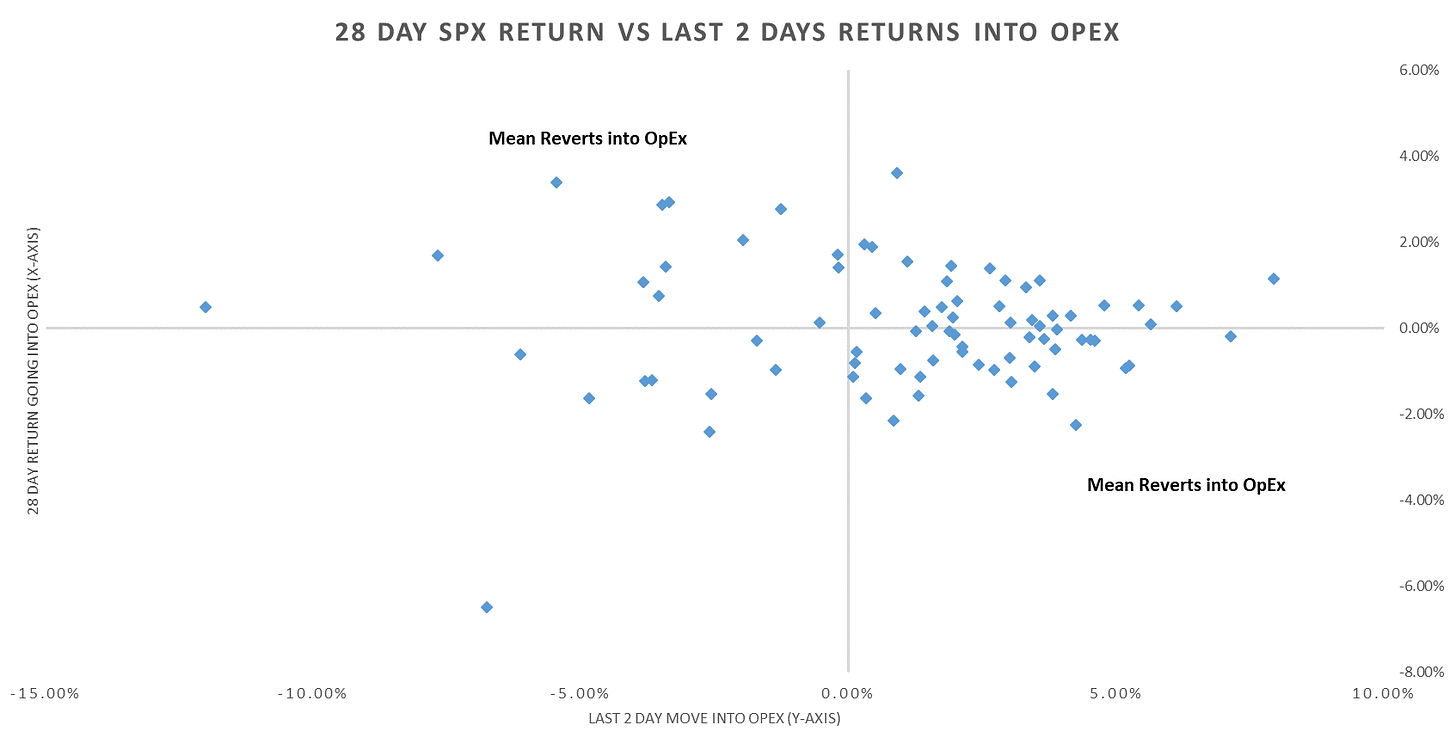

Had a look at monthly performance going into OpEx, if there is any impact on direction of last few days going into option expiry:

Plotting the 28 day return up to OpEx against the last 2 day returns, no clear pattern, some mean reversion, but, nothing major.